北米の熱収縮チューブ市場、タイプ別(シングルウォールとデュアルウォール)、製品タイプ(スプール、プレカット長さ、その他)、電圧(低、中、高)、収縮率(2:01、3:01、4:01、6:01、その他)、材質(ポリオレフィン、パーフルオロアルコキシアルカン(PFA)、 ポリテトラフルオロ エチレン(PTFE)、エチレンテトラフルオロエチレン(ETFE)、フッ素化エチレンプロピレン(FEP)、ポリエーテルエーテルケトン(PEEK)など)、エンドユーザー(公共事業、ITおよび通信、自動車、電子機器、航空宇宙、ヘルスケア、石油およびガス、海洋、食品および飲料、建設、化学、その他)業界動向および2030年までの予測。

北米の熱収縮チューブ市場の分析と規模

世界中で発電能力が増大したことで、北米の熱収縮チューブ市場が成長しています。しかし、既存の送電線や変電所を既存の回廊に沿ってアップグレードすることは、コスト効率の高い方法で送電能力を増大させることができます。既存の送電線を再配線することで送電能力を増大させることができます (より高い電流を流せる複合導体などの材料を使用)。これらの材料は現在入手可能ですが、新しい材料を再配線するために使用中の送電線を撤去することが難しいため、広くは使用されていません。さらに、気象条件が良好な場合、すべての架空送電線は公称定格よりも高い電流を流すことができ、継続的に調整できるリアルタイム定格により、利用可能な容量が増大します。

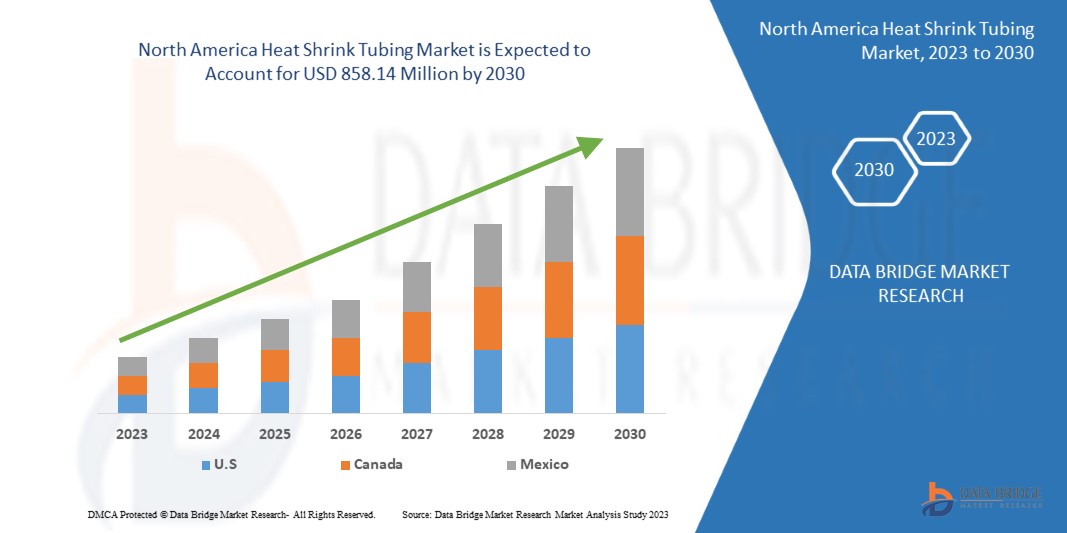

Data Bridge Market Research の分析によると、北米の熱収縮チューブ市場は 2023 年から 2030 年の予測期間に 6.2% の CAGR で成長し、2030 年までに 8 億 5,814 万米ドルに達すると予想されています。北米の熱収縮チューブ市場レポートでは、価格分析、特許分析、技術の進歩についても包括的に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (カスタマイズ可能 2015-2020) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

タイプ (シングルウォールとデュアルウォール)、製品タイプ (スプール、プレカット長さ、その他)、電圧 (低、中、高)、収縮率 (2:01、3:01、4:01、6:01、その他)、材質 (ポリオレフィン、パーフルオロアルコキシアルカン (PFA)、ポリテトラフルオロエチレン (PTFE)、エチレンテトラフルオロエチレン (ETFE)、フッ素化エチレンプロピレン (FEP)、ポリエーテルエーテルケトン (PEEK)、その他)、エンドユーザー (公共事業、IT および通信、自動車、電子機器、航空宇宙、ヘルスケア、石油およびガス、海洋、食品および飲料、建設、化学、その他) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

ABB(スイス)、住友電気工業株式会社(日本)、TE Connectivity(スイス)、Thermosleeve USA(米国)、Techflex, Inc.(米国)、Dasheng Group(中国)、Shenzhen Woer Heat - Shrinkable Material Co., Ltd.(中国)、Huizhou Guanghai Electronic Insulation Materials Co.,Ltd.(中国)、Panduit(米国)、HellermannTyton(ドイツ)、Alpha Wire(米国)、3M(米国)、SHAWCOR(カナダ)、Zeus Industrial Products, Inc.(米国)、Molex(米国)、PEXCO(米国)、Prysmain Group(イタリア)、GREMCO GmbH(ドイツ)、Qualtek Electronics Corp.(米国)、Hilltop(英国)、Dunbar Products, LLC.(米国)、cygia、Changyuan Electronics(Dongguan)Co., Ltd.(中国)など |

市場の定義

熱収縮チューブは、電気工事の接続部、ジョイント、端子を備えた撚り線導体に耐摩耗性と環境保護性を提供し、電線を絶縁するために使用されます。一般に、収縮温度が低いチューブは収縮が速くなります。熱収縮チューブを電線アレイや電気部品に巻き付けると、機器の輪郭に合わせて放射状に収縮し、保護層を形成します。

さらに、これらのチューブは、パーフルオロアルコキシアルカン (PFA)、ポリテトラフルオロエチレン (PTFE)、フッ素化エチレンプロピレン (FEP) などのさまざまな材料を使用して熱収縮チューブを製造します。さまざまな材料を使用した熱収縮チューブは、個々のワイヤをカバーしたり、アレイ全体を包んだりすることで、摩耗、低衝撃、切断、湿気、ほこりに対するさまざまな保護機能を備えています。さらに、材料は、電子機器、自動車、航空宇宙などの最終用途に基づいて決定されます。プラスチック製造業者は、熱可塑性チューブを押し出して熱収縮チューブを作成することから始めます。熱収縮チューブの材料は、目的の用途によって異なります。

北米の熱収縮チューブ市場の動向

このセクションでは、市場の推進要因、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

ドライバー

- 地域全体の熱収縮チューブ市場における送電・配電システムの支援と拡大における政府の役割

The role of electric power transmission and distribution (T&D) plays an important link between generating stations and customers. Growing loads and stress created by the aging equipment and increasing the risk of widespread blackouts are a few of the factors which help generates the need for heat shrink tubes. Electricity delivery that is both dependable and cost-effective is critical in today's society. The U.S. transmission and distribution (T&D) is comprised of numerous economic drivers, organizational structures, technologies, and forms of regulatory oversight. Federal and municipal governments and state and customer-owned cooperatives are all part of these systems. However, about 80 percent of power transactions occur on lines owned by investor-owned regulated utilities (IOUs). These fully integrated utilities own both the generating plants and the transmission and distribution systems that deliver their customers' power. This was among the dominant model in the past but deregulation in some states has transformed the industry. Transmission, generation, and distribution may be handled by different entities in deregulated areas.

- Increase in the Capacity for Power Generation Across the Globe

A two-step process is used to create heat shrink tubing. The first step is standard extrusion followed by a secondary process that makes the tubing heat-shrinkable. Although this secondary process's specifics are kept confidential, heat and force are used to expand the tubing's diameter. While still expanded, the tubing is cooled to room temperature. If the tubing is rigid, it is going to shrink down to its original size. The up-gradation of transmission lines and substations along existing corridors is a cost-effective way to increase transmission capacity. Existing lines can be reconducted to increase transmission capacity (using materials such as composite conductors that can carry higher currents).

Opportunity

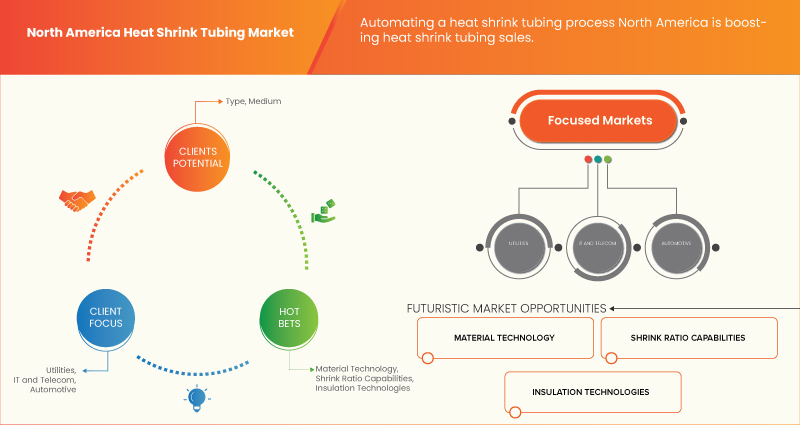

- Wide Adoption of Heat Shrink Tubes in Various Industries

AI The heat shrink tubing products are made from uniquely formulated materials that have been enhanced by radiation cross-linking, a technology with product design that provides a repeatable, reliable, and shrink-to-fit installation compatible with many manufacturing processes. These products are in service throughout the world in automotive, telecommunications, power distribution, aerospace, defense, industrial and commercial applications. The tubing application in under bonnet cable protection, hoses, brake pipes, air conditioning, diesel injection clusters, connectors, inline splice, wire bundles, ring terminals, seat belt stalks, gas springs, antennas, and others are further enhancing the application capabilities in the automobile industry. The tubing products are made from uniquely formulated materials that have been enhanced by radiation cross-linking, a technology. The easy-to-use products provide cost-effective, proven solutions in various automotive applications, from sealing and protecting electrical splices to providing mechanical protection for fluid management systems in harsh surroundings.

Restraints/Challenges

- Government Regulation On the Emission of Toxic Gases

The environmental significance of rapid industrialization has brought about uncountable air, land, and water resource sites being contaminated with toxic materials and other pollutants, threatening humans and ecosystems with serious health risks. More extensive and intensive use of materials and energy has created cumulative pressures on the quality of local, regional, and North America ecosystems. Before there was a concerted effort to restrict the impact of pollution, environmental management extended little beyond laissez-faire tolerance, tempered by the disposal of wastes to avoid disruptive local nuisance conceived of in a short-term perspective. The need for remediation was recognized by exception in instances where damage was determined to be unacceptable. As the pace of industrial activity intensified and the understanding of cumulative effects grew, a pollution control paradigm became the dominant method of environmental management.

- Rising Prices of Raw Materials for Tubing

The price fluctuations affect the cable, wire, and connectivity products and materials being purchased or affect the outlook on budget projections in procurement, finance, supply chain management, or product development. Thanks to rising industrial production and aggressive sustainable energy initiatives, China is the world's largest consumer of copper. Europe, the U.S., and China pursue aggressive renewable energy initiatives to sustain greener economies and copper's high thermal and electric conductivity will help them get there. The largest copper-producing countries such as Chile, Peru, China, and the United States are struggling to meet the high demand for countries to meet their green economic initiative, contributing to the price of copper skyrocketing. There is also speculation that as the U.S. dollar weakens against other North America currencies, there will be more opportunities for users of other currencies to increase their purchasing power with copper and other commodities.

Recent Developments

- In April 2023, TE Connectivity announced the new EV Single Wall (EVSW) tubing specifically designed for high voltage applications and safely insulating and protecting conductive components and cables. This product is a single wall tube with the prime focus of providing electrical insulation and protection for high-voltage components in electric vehicles. This will help the company to diversify its product portfolio and meets the unique challenges of EV applications.

- In February 2023, Molex released a miniaturization report, stating expert insights and innovations in product design engineering and leading-edge connectivity. Through this miniaturization, the company has increased the effectiveness of products and their safety too. This development enhanced the company’s product line and it made a positive impact on the growth of the North America heat shrink tubing market.

North America Heat Shrink Tubing Market Scope

The North America heat shrink tubing market Scope is segmented into six notable segments based on the type, product type, material, voltage, shrink ratio, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Single Wall

- Dual Wall

On the basis of type, the North America heat shrink tubing market is segmented into single wall and dual wall.

Product Type

- Spools

- Pre-Cut Lengths

- Others

On the basis of product type, the North America heat shrink tubing market is segmented into spools, pre-cut lengths, and others.

Voltage

- Low

- Medium

- High

On the basis of voltage, the North America heat shrink tubing market is segmented into low, medium, and high.

Shrink Ratio

- 2:01

- 3:01

- 4:01

- 6:01

- Others

On the basis of shrink ratio, the North America heat shrink tubing market is segmented into 2:01, 3:01, 4:01, 6:01, and others.

Material

- Polyolefin

- Per Fluoroalkoxy Alkane (PFA)

- Poly Tetra Fluoro Ethylene (PTFE)

- Ethylene Tetra Fluoro Ethylene (ETFE)

- Fluorinated Ethylene Propylene (FEP)

- Polyether Ether Ketone (PEEK)

- Others

On the basis of material, the North America heat shrink tubing market is segmented into polyolefin, per fluoroalkoxy alkane (PFA), poly tetra fluoro ethylene (PTFE), ethylene tetra fluoro ethylene (ETFE), fluorinated ethylene propylene (FEP), polyether ether ketone (PEEK), and others.

End User

- Utilities

- IT and Telecommunication

- Automotive

- Electronics

- Aerospace

- Healthcare

- Oil and Gas

- Marine

- Food and Beverages

- Construction

- Chemical

- Others

On the basis of application, the North America heat shrink tubing market is segmented into utilities, it and telecommunication, automotive, electronics, aerospace, healthcare, oil and gas, marine, food and beverages, construction, chemical, and others.

North America Heat Shrink Tubing Market Regional Analysis/Insights

The North America heat shrink tubing market is analysed, and market size insights and trends are provided by type, product type, voltage, shrink ratio, material, and end user as referenced above.

The countries covered in the North America heat shrink tubing market report are U.S., Canada, and Mexico.

The U.S. dominates in the North America region owing to the region's advanced software sector.

The region section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and North America Heat Shrink Tubing Market Share Analysis

North America heat shrink tubing market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the North America heat shrink tubing market.

北米の熱収縮チューブ市場で活動している主要企業には、ABB(スイス)、住友電気工業(日本)、TE Connectivity(スイス)、Thermosleeve USA(米国)、Techflex, Inc.(米国)、Dasheng Group(中国)、Shenzhen Woer Heat - Shrinkable Material Co., Ltd.(中国)、Huizhou Guanghai Electronic Insulation Materials Co.,Ltd.(中国)、Panduit(米国)、HellermannTyton(ドイツ)、Alpha Wire(米国)、3M(米国)、SHAWCOR(カナダ)、Zeus Industrial Products, Inc.(米国)、Molex(米国)、PEXCO(米国)、Prysmain Group(イタリア)、GREMCO GmbH(ドイツ)、Qualtek Electronics Corp.(米国)、Hilltop(英国)、Dunbar Products, LLCなどがあります。 (米国)、cygia、Changyuan Electronics (Dongguan) Co., Ltd. (中国) など。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA HEAT SHRINK TUBING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ROLE OF THE GOVERNMENT IN SUPPORTING AND EXPANSION OF TRANSMISSION & DISTRIBUTION SYSTEMS IN THE HEAT SHRINK TUBING MARKET ACROSS THE REGION

5.1.2 INCREASE IN THE CAPACITY FOR POWER GENERATION ACROSS THE GLOBE

5.1.3 RISING USAGE OF PRODUCTS WITH ADVANCED INFRASTRUCTURE AND TECHNOLOGY

5.1.4 INCREASING PENETRATION OF ELECTRIC VEHICLES

5.2 RESTRAINTS

5.2.1 GOVERNMENT REGULATION ON THE EMISSION OF TOXIC GASES

5.2.2 PRODUCTION CHALLENGES IN THE LEAST DEVELOPED COUNTRIES

5.2.3 INVOLVEMENT OF PLASTIC HAS A DIRECT IMPACT ON THE COST AS WELL AS THE ENVIRONMENT

5.3 OPPORTUNITIES

5.3.1 WIDE ADOPTION OF HEAT SHRINK TUBES IN VARIOUS INDUSTRIES

5.3.2 EASY PRODUCTION OF THE HEAT-SHRINKABLE TUBING

5.3.3 AUTOMATING A HEAT SHRINK TUBING PROCESS

5.4 CHALLENGES

5.4.1 RISING PRICES OF RAW MATERIALS FOR TUBING

5.4.2 POOR INSTALLATION OF HEAT-SHRINK TUBES

5.4.3 AVAILABILITY OF ALTERNATIVE AND INEXPENSIVE PRODUCTS IN THE MARKET

6 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY TYPE

6.1 OVERVIEW

6.2 SINGLE WALL

6.3 DUAL WALL

7 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SPOOLS

7.3 PRE-CUT LENGTH

7.4 OTHERS

8 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY VOLTAGE

8.1 OVERVIEW

8.2 LOW

8.3 MEDIUM

8.4 HIGH

9 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 POLYOLEFIN

9.3 PERFLUOROALKOXY ALKANES (PFA)

9.4 POLYTETRAFLUOROETHYLENE (PTFE)

9.5 FLUORINATED ETHYLENE PROPYLENE (FEP)

9.6 ETHYLENE TETRAFLUOROETHYLENE (ETFE)

9.7 POLYETHER ETHER KETONE (PEEK)

9.8 OTHERS

10 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO

10.1 OVERVIEW

10.2 12/30/1899 2:01:00 AM

10.3 12/30/1899 3:01:00 AM

10.4 12/30/1899 4:01:00 AM

10.5 12/30/1899 6:01:00 AM

10.6 OTHERS

11 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY END-USER

11.1 OVERVIEW

11.2 UTILITIES

11.3 IT AND TELECOMMUNICATION

11.4 AUTOMOTIVE

11.5 ELECTRONICS

11.5.1 COMMERCIAL/INDUSTRIAL

11.5.2 CONSUMER PRODUCT

11.6 AEROSPACE

11.7 HEALTHCARE

11.8 OIL AND GAS

11.9 MARINE

11.1 FOOD AND BEVERAGES

11.11 CONSTRUCTION

11.11.1 COMMERCIAL

11.11.2 RESIDENTIAL

11.12 CHEMICAL

11.13 OTHERS

12 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA HEAT SHRINK TUBING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 TE CONNECTIVITY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 SUMITOMO ELECTRIC INDUSTRIES, LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 MOLEX

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 ABB

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 PRYSMIAN GROUP

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 3M

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ALPHA WIRE

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 CHANGYUAN ELECTRONICS (DONGGUAN) CO., LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 DASHENG GROUP

15.9.1 COMPANY SNAPSHOT

15.9.2 COMPANY PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DUNBAR PRODUCTS, LLC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 GREMCO GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HELLERMANNTYTON

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 HILLTOP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO., LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 PANDUIT

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 PEXCO

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 QUALTEK ELECTRONICS CORP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SHAWCOR

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TECHFLEX, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 THERMOSLEEVE USA

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 ZEUS INDUSTRIAL PRODUCTS, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SINGLE WALL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA DUAL WALL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA SPOOLS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA PRE-CUT LENGTH IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA LOW IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MEDIUM IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA HIGH IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA POLYOLEFIN IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA PERFLUOROALKOXY ALKANES (PFA) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA POLYTETRAFLUOROETHYLENE (PTFE) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FLUORINATED ETHYLENE PROPYLENE (FEP) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA ETHYLENE TETRAFLUOROETHYLENE (ETFE) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA POLYETHERETHERKETONE (PEEK) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA 2:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA 3:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA 4:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA 6:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA UTILITIES IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA IT AND TELECOMMUNICATION IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA AUTOMOTIVE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA AEROSPACE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA HEALTHCARE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA OIL AND GAS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA MARINE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA FOOD AND BEVERAGES IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA CHEMICAL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.S. HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 53 U.S. HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 54 U.S. HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 55 U.S. HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 56 U.S. ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.S. CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 CANADA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 60 CANADA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 61 CANADA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 62 CANADA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 63 CANADA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 64 CANADA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 CANADA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 MEXICO HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 MEXICO HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 69 MEXICO HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 70 MEXICO HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 71 MEXICO HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 72 MEXICO ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 MEXICO CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEAT SHRINK TUBING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEAT SHRINK TUBING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEAT SHRINK TUBING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEAT SHRINK TUBING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEAT SHRINK TUBING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEAT SHRINK TUBING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA HEAT SHRINK TUBING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA HEAT SHRINK TUBING MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA HEAT SHRINK TUBING MARKET: TYPE TIMELINE CURVE

FIGURE 11 NORTH AMERICA HEAT SHRINK TUBING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 12 NORTH AMERICA HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 13 INCREASE IN THE CAPACITY FOR POWER GENERATION ACROSS THE GLOBE IS EXPECTED TO DRIVE THE NORTH AMERICA HEAT SHRINK TUBING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 THE SINGLE WALL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEAT SHRINK TUBING MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA HEAT SHRINK TUBING MARKET

FIGURE 16 GOVERNMENT INITIATIVES TO ENHANCE POWER TRANSMISSION

FIGURE 17 GENERATION OF RENEWABLE ELECTRICITY

FIGURE 18 ELECTRICITY GENERATION IN VARIOUS COUNTRIES

FIGURE 19 NORTH AMERICA SALES VOLUME OF ELECTRIC VEHICLES

FIGURE 20 MANUFACTURING PROCESS FOR HEAT SHRINK TUBING

FIGURE 21 SILVER PRICING (SEPTEMBER 2022 TO MARCH 2023)

FIGURE 22 ALTERNATIVES FOR HEAT SHRINK TUBING

FIGURE 23 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY TYPE, 2022

FIGURE 24 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY PRODUCT TYPE, 2022

FIGURE 25 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY VOLTAGE, 2022

FIGURE 26 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY MATERIAL, 2022

FIGURE 27 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY SHRINK RATIO, 2022

FIGURE 28 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY END-USER, 2022

FIGURE 29 NORTH AMERICA HEAT SHRINK TUBING MARKET: SNAPSHOT (2022)

FIGURE 30 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY COUNTRY (2022)

FIGURE 31 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY TYPE (2023-2030)

FIGURE 34 NORTH AMERICA HEAT SHRINK TUBING MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。