北米の薬物補助治療 (MAT) 市場、タイプ別 (薬物療法と療法)、製品別 (ブプレノルフィンとナロキソン、ナルトレキソン、ブプレノルフィン、メタドン、ナロキソン、ジスルフィラム、アカンプロサート)、薬剤タイプ別 (ジェネリックとブランド)、剤形別 (即放性および徐放性)、投与経路別 (経口、非経口、その他)、人口タイプ別 (成人および 10 代)、エンドユーザー別 (リハビリテーション クリニック、病院、専門センター、在宅ケア、その他)、流通チャネル別 (病院薬局、直接入札、小売薬局、オンライン薬局、その他)、業界動向および 2029 年までの予測

市場分析と洞察

食品医薬品局 (FDA) は、ブプレノルフィン、メタドン、ナルトレキソンの 3 つの臨床薬を承認しました。薬物補助治療 (MAT) は、アルコール使用障害、オピオイド依存薬、オピオイド過剰摂取防止薬の治療に適用されます。アルコール使用障害 (AUD) は、社会的、職業的、または健康上の悪影響にもかかわらず、アルコール使用を中止する能力が低下していることを特徴とする病状です。アカンプロセート、ジスルフィラム、ナルトレキソンは、アルコール使用障害 (AUD) の治療に使用される最も一般的な薬です。オピオイド依存薬は、患者のオピオイド中毒を増加させます。ブプレノルフィン、メタドン、ナルトレキソンは、ヘロイン、モルヒネ、コデインなどの短時間作用型オピオイド、およびオキシコドンやヒドロコドンなどの半合成オピオイドに対するオピオイド使用障害の治療に使用されます。これらの MAT 薬は、数か月、数年、さらには一生にわたって安全です。

市場の定義

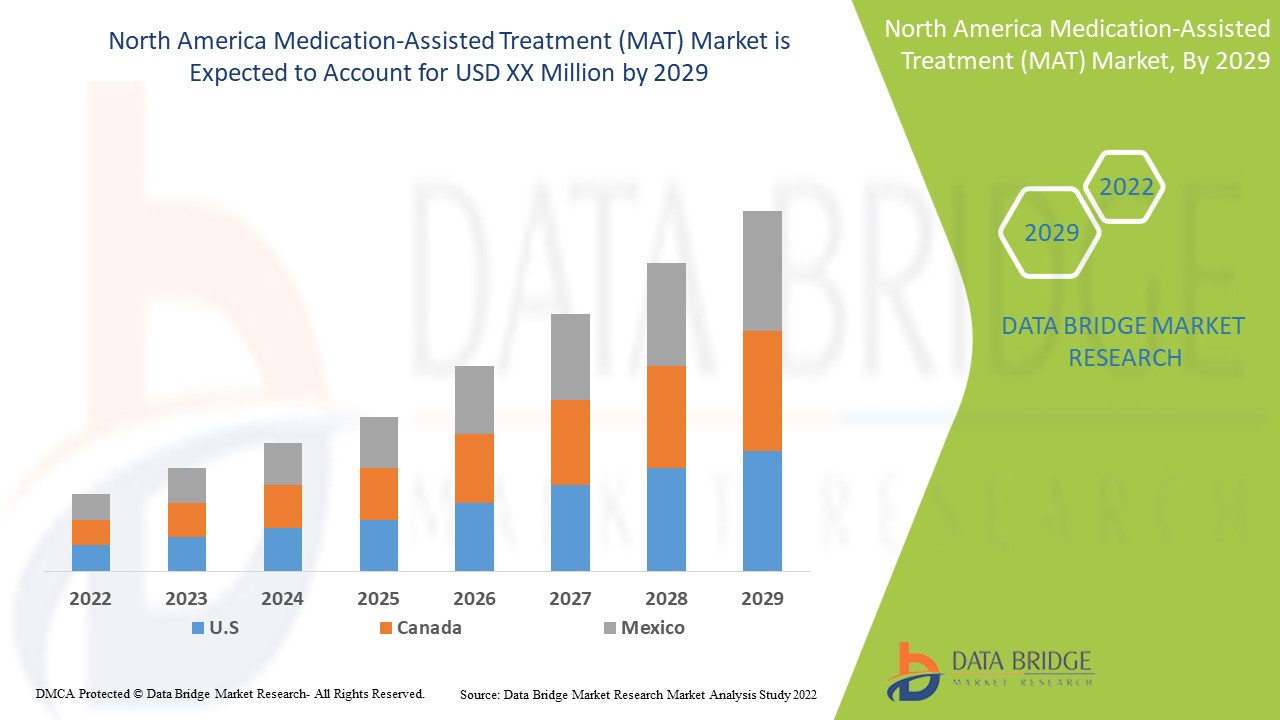

薬物補助治療(MAT)では、薬物をカウンセリングや行動療法と組み合わせて使用し、薬物使用障害を治療するための完全な患者アプローチを提供します。オピオイド過剰摂取防止薬として、過剰摂取の毒性効果を逆転させることでオピオイド過剰摂取を防ぐためにナロキソンが使用されます。世界保健機関(WHO)と薬物乱用・精神衛生局(SAMHSA)によると、ナロキソンは機能的な医療システムに不可欠であると考えられている多くの薬の1つです。北米の薬物補助治療は支持的であり、症状の重症度を軽減することを目的としています。データブリッジマーケットリサーチは、薬物補助(MAT)治療市場が2022年から2029年にかけて9.7%のCAGRで成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

タイプ別(医薬品と治療)、製品別(ブプレノルフィンとナロキソン、ナルトレキソン、ブプレノルフィン、メタドン、ナロキソン、ジスルフィラム、アカンプロサート)、薬剤タイプ別(ジェネリックとブランド)、剤形別(即放性および徐放性)、投与経路別(経口、非経口、その他)、対象者タイプ別(成人および10代)、エンドユーザー別(リハビリテーションクリニック、病院、専門センター、在宅ケア、その他)、流通チャネル別(病院薬局、直接入札、小売薬局、オンライン薬局、その他) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Indivior PLC、Orexo US Inc (Orexo AB の子会社)、Recovery Centers of America、Alkermes、Sun Pharmaceutical Industries Ltd.、Purdue Pharma LP、Taj Pharmaceuticals Limited、Lannett、Hikma Pharmaceuticals PLC、Pfizer Inc.、Pinnacle Treatment Center、American Addiction Centers、Adamis Pharmaceuticals Corporation、Glenmark Pharmaceutical Inc.、Viatris Inc.、Mallinckrodt、Alvogen、VistaPharm, Inc.、Teva Pharmaceutical Industries Ltd.、Dr. Reddy's Laboratories Ltd.、Amneal Pharmaceuticals LLC、Titan Pharmaceuticals, Inc. |

北米の薬物補助治療(MAT)市場の動向

ドライバー

- アルコール使用障害とオピオイド使用障害の発生率の上昇

アルコール使用障害 (AUD) は、社会的、職業的、または健康上の悪影響にもかかわらず、アルコールの使用を止めたり制御したりする能力が損なわれることを特徴とする病状です。アルコール乱用、アルコール依存、アルコール中毒と呼ばれる症状も含まれます。薬物補助治療 (MAT) は、カウンセリングや行動療法と組み合わせて薬物を使用することで、薬物使用障害を治療するための「患者全体」アプローチを提供します。MAT で使用される薬物は、米国食品医薬品局 (FDA) によって承認されており、MAT プログラムは臨床的に推進され、各患者のニーズに合わせて調整されます。

例えば、

- 2022年、世界保健機関(WHO)欧州地域のデータによると、アルコール依存症は年間100万人の死者を出している。

企業は絶えず研究開発活動に取り組んでいるため、アルコール使用障害やオピオイド使用障害の発生率に関する知識は、新しい解決策を見つけるのに役立ち、米国、ヨーロッパ、アジア太平洋地域などの国の市場プレーヤーとのより多くのコラボレーションやパートナーシップに役立ちます。これは、薬物補助治療(MAT)におけるジェネリック医薬品の開始に向けた研究開発関連の投資の増加を意味し、市場の成長を促進すると予想されます。

- 薬物補助治療(MAT)に対する政府による資金提供

Despite the established effectiveness of pharmacotherapies for treating opioid use and alcohol disorders, limitations to implementing medications for addiction treatment (MAT) by specialty treatment programs have been observed. Particular attention needs to be paid to specific sources for funding, organizational structure, and workforce resources, making a long-term investment that aligns the payment with the potential future beneficiaries.

For instance,

- In January 2021, according to the Federal Register of Government, The Rural Community Development Initiative Grants (RCDI) provided funding to intermediary organizations that deliver financial and technical assistance to recipients to help meet the needs of their communities in eligible rural areas

The funding by the government would result in the patient's safety and cost savings. In addition, hospitals and healthcare agencies would administer this treatment at a lower price through collaboration with government organizations. Hence the advancements in research and development activities and funding by the government are expected to drive the market growth.

Opportunity

- Rise In Healthcare Expenditure

Moreover, the rise in the research and development activities and increasing investments by government and private organizations will boost new opportunities for the market's growth rate.

For instance,

- In February 2021, according to Health Care Price Index (HCPI), the total U.S. healthcare budget had increased by 3.4%. The increase in growth states the federal government spending decreased significantly in the previous year from USD 287,000 million in 2020 to USD 170,000 million in 2021

Growing healthcare expenditure is also beneficial for further economic development and growth of the healthcare sector. In addition, the increase in disposable income of the population is a favourable factor. The above are expected to create lucrative opportunities for the medication-assisted treatment (MAT) market.

Restraint/Challenge

- Side Effects Of Drugs Used In Medication-Assisted Treatment (MAT)

Medication-assisted treatment (MAT) involves using medications collated with counselling and behavioral therapies to provide a "whole-patient" approach as part of the comprehensive treatment strategy. Therefore, the present high cost is expected to show a descending trend. MAT is most effective for treating alcohol and opioid use disorders. However, specific side effects have been reported.

For instance,

- Methadone and buprenorphine, the generic medications, are chemically similar to opioids, so their side effects can be similar too. These may include constipation, drowsiness, and dizziness. Some people may experience more severe side effects

The adverse complications reported would lead to a decline in sales of the medicated opioid dependency medications, which would limit the sales of the medicines. In addition, it would affect the reliability of manufacturers involved in this market and hence be expected to restrain the market growth.

The medication-assisted treatment (MAT) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on Medication-assisted (MAT) treatment market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Covid-19 Impact on the Medication-Assisted (MAT) Treatment Market

During the pandemic, medication-assisted treatment remarkably reduces mortality and morbidity of patients with COVID-19. Further large-scale studies are needed to approve these results. A protocol for medication-assisted treatment in COVID-19 infection should be defined to achieve the best possible clinical outcomes. Clinical trials were conducted during Covid-19 Medication for opioid use disorder (MOUD) services are key to addressing the opioid crisis, and COVID-19 has significantly impacted MOUD delivery.

Recent Development

- In April 2021, Adamis Pharmaceuticals Corporation with USWM announced the launch and availability of a high-dose ZIMHI injectable naloxone product to help combat opioid overdose deaths. The launch is expected to increase the product segment revenue, which will boost the market growth, and ZIMHI being made available at a discounted rate for first responders and community health organizations

North America Medication-Assisted Treatment (MAT) Market Scope

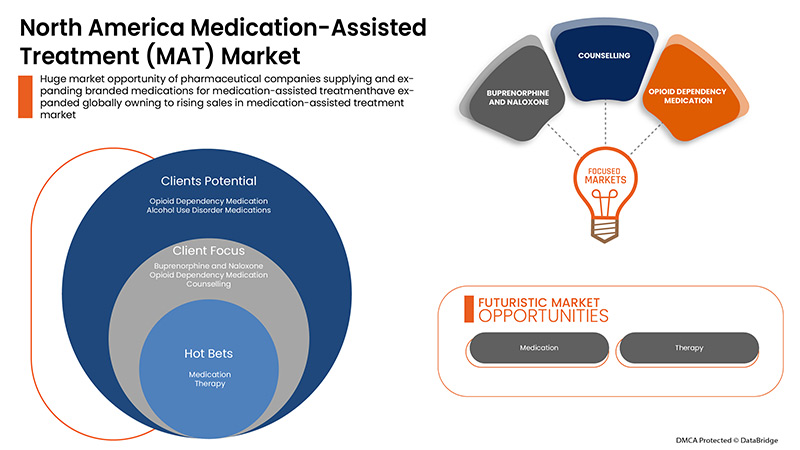

The medication-assisted (MAT) treatment market is segmented on the basis of eight segments: type, products, drug type, and dosage form, route of administration, population type, end user and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Medication

- Therapy

On the basis of type the North America medication-assisted treatment (MAT) market is segmented into medication and therapy.

Products

- Buprenorphine and Naloxone

- Naltrexone

- Buprenorphine

- Methadone

- Naloxone

- Disulfiram

- Acamprosate

On the basis of products, the North America medication-assisted treatment (MAT) market is segmented into buprenorphine and naloxone, naltrexone, buprenorphine, methadone, naloxone, disulfiram and acamprosate.

Drug Type

- Generics

- Branded

On the basis of drug type, the North America medication-assisted treatment (MAT) market is segmented into generics and branded.

Dosage Form

- Immediate Release

- Extended Release

On the basis of dosage form, the North America medication-assisted treatment (MAT) market is segmented into immediate release and extended release.

Route of Administration

- Oral

- Parenteral

- Others

On the basis of route of administration, the North America medication-assisted treatment (MAT) market is segmented into oral, parenteral and others.

Population Type

- Adults

- Teenage

On the basis of population type, the North America medication-assisted treatment (MAT) market is segmented into adults and teenage.

End User

- Rehabilitation Clinics

- Hospitals

- Specialty Centers

- Homecare

- Others

On the basis of end user, the North America medication-assisted treatment (MAT) market is segmented into rehabilitation clinics, hospitals, speciality centers, homecare and others.

Distribution Channel

- Hospital Pharmacy

- Direct Tender

- Retail Pharmacy

- Online Pharmacy

- Others

On the basis of distribution channel, the North America medication-assisted treatment (MAT) market is segmented into hospital pharmacy, direct tender, retail pharmacy, online pharmacy and others.

Medication-Assisted (MAT) Treatment Market Regional Analysis/Insights

The North America medication-assisted treatment (MAT) market is analysed and market size insights and trends are provided by regions, product type, type, application, workflow, end user and distribution channel as referenced above.

The countries covered in the medication-assisted (MAT) treatment market report are U.S., Canada and Mexico.

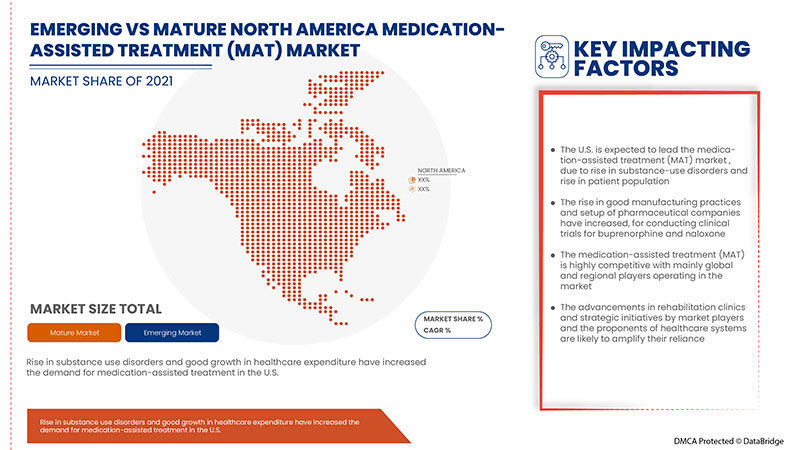

The U.S. is expected to dominate the market due to a rise in opioid dependency on medication, healthcare expenditure, and pharmaceutical companies.

The country section of the report also provides individual market impacting factors and domestic regulation changes that impact the current and future market trends. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Medication-Assisted (MAT) Treatment Market Share Analysis

北米の薬物補助治療 (MAT) 市場の競争状況は、競合他社の詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性が含まれます。提供されている上記のデータ ポイントは、薬物補助治療 (MAT) 市場への会社の重点にのみ関連しています。

薬物補助(MAT)治療市場で活動している主な企業としては、Indivior PLC、Orexo US Inc(Orexo AB の子会社)、Recovery Centers of America、Alkermes、Sun Pharmaceutical Industries Ltd.、Purdue Pharma LP、Taj Pharmaceuticals Limited、Lannett、Hikma Pharmaceuticals PLC、Pfizer Inc.、Pinnacle Treatment Center、American Addiction Centers、Adamis Pharmaceuticals Corporation、Glenmark Pharmaceutical Inc.、Viatris Inc.、Mallinckrodt、Alvogen、VistaPharm, Inc.、Amneal Pharmaceuticals LLC、Titan Pharmaceuticals, Inc. などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 EPIDEMIOLOGY

4.2 PESTEL

4.3 PORTER'S FIVE FORCES MODEL

4.4 ANNUAL INCIDENCE OF SUBJECTS ENTERING MEDICATION-ASSISTED TREATMENT IN ALCOHOL, OPIOID USE DISORDER, AND OPIOID OVERDOSE PREVENTION (2021)

4.5 ANNUAL NUMBER OF TREATMENTS WITH CLONIDINE AND WITH LOFEXIDINE IN OPIOID USE DISORDER AND OPIOID OVERDOSE PREVENTION (2021)

4.6 ANNUAL INCIDENCE OF INDIVIDUALS RE-ENTERING MEDICATION-ASSISTED TREATMENT. FOR EXAMPLE, SOMEONE MAY DROP OUT OF TREATMENT AND RESTART TREATMENT LATER (2021)

4.7 ANNUAL USE OF NALTREXONE INJECTION AS PART OF TREATMENT FOR THE INITIAL WITHDRAWAL FROM OPIOIDS, AND ANNUAL MAINTENANCE THERAPY USING NALTREXONE INJECTION (2021)

4.8 PIPELINE ANALYSIS FOR MEDICATION-ASSISTED TREATMENT (MAT) MARKET

5 NORTH AMERICA MEDICATION-ASSISTED TREATMENT MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE IN INCIDENCE OF ALCOHOL USE DISORDER AND OPIOID USE DISORDERS

6.1.2 THE FUNDING BY THE GOVERNMENT FOR MEDICATION-ASSISTED TREATMENT (MAT)

6.1.3 THE RISE IN THE POPULATION RECEIVING MEDICATION-ASSISTED TREATMENT (MAT) AND MEDICATION-ASSISTED AWARENESS PROGRAMMESMEDICATION-ASSISTED TREATMENT (MAT)

6.1.4 USE OF REIMBURSEMENT FOR MEDICATION-ASSISTED TREATMENT (MAT)

6.2 RESTRAINTS

6.2.1 SIDE EFFECTS OF DRUGS USED IN MEDICATION-ASSISTED TREATMENT (MAT)

6.2.2 ETHICAL ISSUES RELATED TO USE OF MEDICATION-ASSISTED TREATMENTMEDICATION-ASSISTED TREATMENT (MAT)

6.2.3 RISE IN PRODUCT RECALLS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

6.3.2 RISE IN HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 THE LACK OF SKILLED PROFESSIONALS, REQUIRED FOR MEDICATION-ASSISTED TREATMENT

6.4.2 STRINGENT REGULATIONS

6.4.3 DISCONTINUATION OF MEDICATION-ASSISTED TREATMENT (MAT)

7 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE

7.1 OVERVIEW

7.2 MEDICATION

7.2.1 OPIOID DEPENDENCY MEDICATION

7.2.1.1 BUPRENORPHINE AND NALOXONE

7.2.1.2 BUPRENORPHINE

7.2.1.3 METHADONE

7.2.1.4 NALTREXONE

7.2.2 ALCOHOL USE DISORDER MEDICATIONS

7.2.2.1 NALTREXONE

7.2.2.2 DISULFIRAM

7.2.2.3 ACAMPROSATE

7.2.3 OPIOID OVERDOSE PREVENTION MEDICATION

7.2.3.1 NALOXONE

7.3 THERAPY

7.3.1 BEHAVIORAL THERAPY

7.3.2 EDUCATIONAL THERAPY

7.3.3 COUNSELLING

7.3.4 VOCATIONAL THERAPY

7.3.5 OTHERS

8 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS

8.1 OVERVIEW

8.2 BUPRENORPHINE AND NALOXONE

8.3 NALTREXONE

8.4 BUPRENORPHINE

8.5 METHADONE

8.6 NALOXONE

8.7 DISULFIRAM

8.8 ACAMPROSATE

9 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE

9.1 OVERVIEW

9.2 GENERICS

9.3 BRANDED

9.3.1 SUBOXONE

9.3.2 VIVITROL

9.3.3 BUTRANS

9.3.4 ZUBSOLV

9.3.5 PROBUPHINE

9.3.6 OTHERS

10 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM

10.1 OVERVIEW

10.2 IMMEDIATE RELEASE

10.3 EXTENDED RELEASE

11 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.2.1 TABLET

11.2.2 SUBLINGUAL FILM

11.2.3 OTHERS

11.3 PARENTERAL

11.3.1 SOLUTION

11.3.2 SUSPENSION

11.4 OTHERS

12 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE

12.1 OVERVIEW

12.2 ADULTS

12.3 TEENAGE

13 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER

13.1 OVERVIEW

13.2 REHABILITATION CLINICS

13.3 HOSPITALS

13.4 SPECIALTY CENTERS

13.5 HOMECARE

13.6 OTHERS

14 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 HOSPITAL PHARMACY

14.3 DIRECT TENDER

14.4 RETAIL PHARMACY

14.5 ONLINE PHARMACY

14.6 OTHERS

15 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 TEVA PHARMACEUTICAL INDUSTRIES LTD. (2021)

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 INDIVOR PLC (2021)

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 VIATRIS INC (2021)

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 SUN PHARMACEUTICAL INDUSTRIES LTD (2021)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 ALKERMES (2021)

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 PURDUE PHARMA L.P. (2021)

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 PFIZER (2021)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 GLENMARK PHARMACEUTICAL INC (2021)

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 DR. REDDY’S LABORATORIES LTD (2021)

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 ALVOGEN (2021)

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 ADAMIS PHARMACEUTICALS CORPORATION (2021)

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 ACCORD HEALTHCARE (A SUBSIDIARY OF INTAS PHARMACEUTICALS)

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 AMNEAL PHARMACEUTICALS LLC (2021)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 AMERICAN ADDICTION CENTERS (2021)

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 HIKMA PHARMACEUTICALS PLC (2021)

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 LANNETT (2021)

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENT

18.17 MALLINCKRODT (2021)

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 OREXO US INC (A SUBSIDIARY OF OREXO, INC) (2021)

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

18.19 PINNACLE TREATMENT CENTERS

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 RECOVERY CENTERS OF AMERICA

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 TAJ PHARMACEUTICALS LIMITED

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

18.22 TITAN PHARMACEUTICALS (2021)

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 VISTAPHARM, INC (A SUBSIDIARY OF VERTICE PHARMA, LLC. (2021))

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BUPRENORPHINE AND NALOXONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA NALTREXONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BUPRENORPHINE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA METHADONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA NALOXONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA DISULFIRAM IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ACAMPROSATE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA GENERICS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA IMMEDIATE RELEASE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA EXTENDED RELEASE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ADULTS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA TEENAGE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA REHABILITATION CLINICS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA HOSPITALS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SPECIALTY CENTERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA HOMECARE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HOSPITAL PHARMACY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA DIRECT TENDER IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA RETAIL PHARMACY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA ONLINE PHARMACY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 69 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 72 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 73 U.S. ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 74 U.S. PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 75 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 77 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CANADA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 85 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 86 CANADA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 88 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 89 CANADA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 90 CANADA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 91 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 92 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MEXICO OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 MEXICO ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 MEXICO OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 MEXICO THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 101 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 102 MEXICO BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 104 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 105 MEXICO ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 106 MEXICO PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 107 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 109 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED INCIDENCE OF ALCOHOL USE DISORDERS AND RISE IN PRODUCT APPROVALS IS EXPECTED TO DRIVE NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET FROM 2022 TO 2029

FIGURE 13 TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET FROM 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET

FIGURE 15 INCIDENCE OF ALCOHOL CONSUMPTION IN 2019

FIGURE 16 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, 2021

FIGURE 17 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, 2021

FIGURE 21 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 24 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, 2021

FIGURE 25 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, 2021

FIGURE 29 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, 2022-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 32 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 33 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 36 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, 2021

FIGURE 37 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, 2022-2029 (USD MILLION)

FIGURE 38 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, CAGR (2022-2029)

FIGURE 39 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, LIFELINE CURVE

FIGURE 40 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, 2021

FIGURE 41 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 42 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 43 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, LIFELINE CURVE

FIGURE 44 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 45 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 46 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 47 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 48 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: SNAPSHOT (2021)

FIGURE 49 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY COUNTRY (2021)

FIGURE 50 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE (2022-2029)

FIGURE 53 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。