北米のタキサン市場、タイプ別(パクリタキセル、ドセタキセル、カバジタキセル)、薬剤タイプ(ジェネリック、ブランド)、製剤(リポソーム、ナノ粒子、ポリマーミセル、その他)、年齢層(成人、高齢者)、用途(乳がん、非小細胞肺がん、膵臓がん、卵巣がん、前立腺がん、その他)、エンドユーザー(病院、外来手術センター、専門クリニック、その他)流通チャネル(小売販売、直接入札) - 2029年までの業界動向と予測。

市場分析と洞察

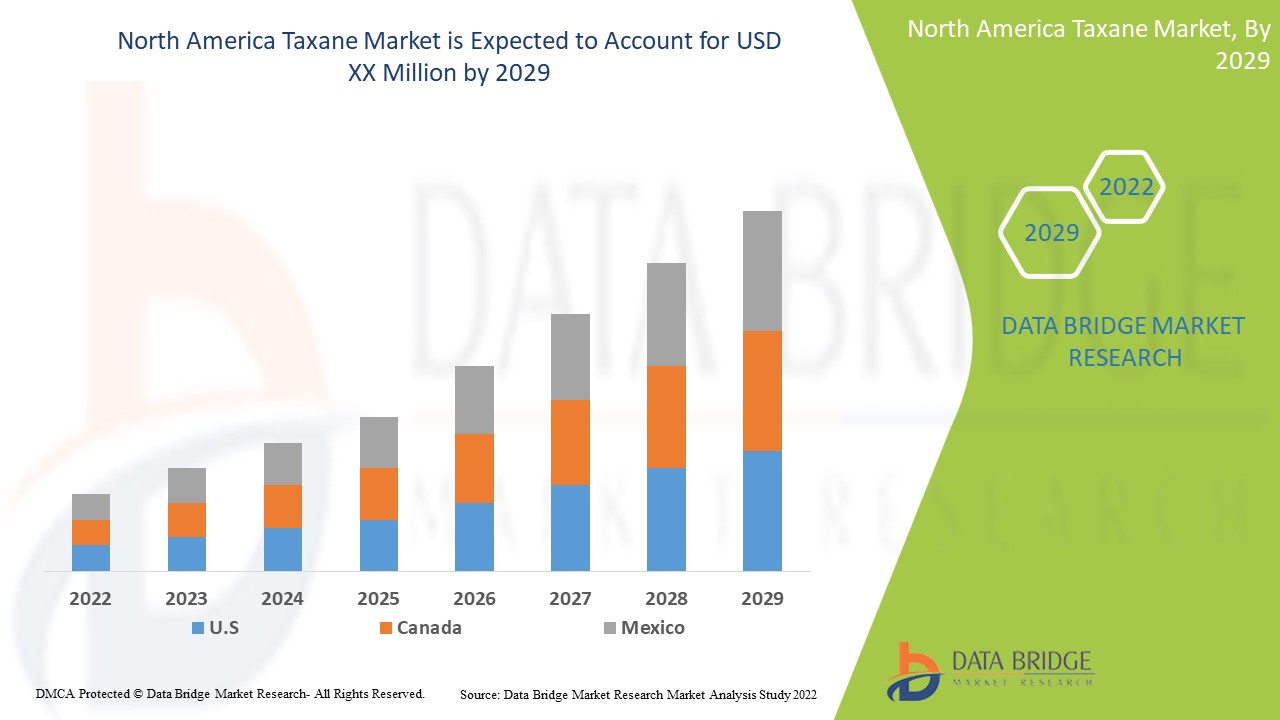

北米のタキサン市場は、2022年から2029年の予測期間に市場が成長すると予想されています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に7.7%のCAGRで成長すると分析しています。タキサン薬物治療の技術的進歩とコンピューター支援診断の応用の増加は、予測期間におけるタキサン市場の成長を促進する他の要因です。

しかし、この薬剤のコストの高さと、血栓、白血球減少症、アレルギー、下痢、体重減少などの副作用が市場の成長を抑制します。主要な市場プレーヤーによるパートナーシップや買収などの戦略的提携の採用は、タキサン市場の成長の機会となります。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

タイプ別(パクリタキセル、ドセタキセル、カバジタキセル)、薬剤タイプ別(ブランドおよびジェネリック)、製剤別(タキサンを含むリポソームおよびポリマーミセル、タキサンのハイドロゲル製剤、ナノ粒子製剤など)、年齢層別(成人および高齢者)、用途別(卵巣がん、乳がん、前立腺がん、非小細胞肺がんなど)、エンドユーザー別(病院、外来手術センター、専門クリニックなど)、流通チャネル別(直接入札、小売販売) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Viatris Inc.、Sandoz International GmbH(ノバルティスの1部門)、sanofi-aventis US LLC、Hikma Pharmaceuticals PLC、Pfizer Inc.、Dr. Reddy's Laboratories Ltd.、Taxane Healthcare、Bristol-Myers Squibb Company、Fresenius Kabi AG(Fresenius SE & Co. KGaAの子会社)、SAMYANG HOLDINGS CORPORATION.、Luye Pharma Group、Elevar Therapeutics、Huiang Pharmaceutical Co Ltd.、Shenzhen Main Luck Phar maceuticals Inc.、Accord Healthcare、Torrent Pharmaceuticals Ltd.、Panacea Biotec、RPG Life Sciences Limited.、Aureate Healthcare、Samarth Life Sciences Pvt. Ltd.、Cipla Inc.、Hetero Healthcare Limited.、AqVida GmbH、Ingenus Pharmaceuticals, LLCなど。 |

タキサン市場の定義

タキサンまたはタキソイドは、有糸分裂阻害剤としての独自の作用機序を持つ、密接に関連した抗腫瘍剤のグループであり、卵巣がん、乳がん、肺がん、食道がん、前立腺がん、膀胱がん、頭頸部がんの治療に広く使用されています。臨床で使用されているタキサンは、パクリタキセル (タキソール: 1992)、ドセタキセル (タキソテール: 1996)、カバジタキセル (ジェブタナ: 2010) の 3 つです。タキサンは、微小管の機能を妨げ、有糸分裂の変化と細胞死を引き起こす抗がん剤です。パクリタキセル (タキソール) は、成長速度の遅い小さな常緑針葉樹であるイチイの木から最初に単離されました。パクリタキセルは当初不足していたため、ヨーロッパイチイの葉から抽出したパクリタキセルの半合成類似体であるドセタキセル (タキソテール) が開発されました。ドセタキセルはパクリタキセルと化学的に 2 か所異なり、より水溶性になっています。カバジタキセルも天然タキソイドの半合成類似体であり、ドセタキセル耐性の一般的な媒介物である P 糖タンパク質に対する親和性がないことを利用して開発されました。

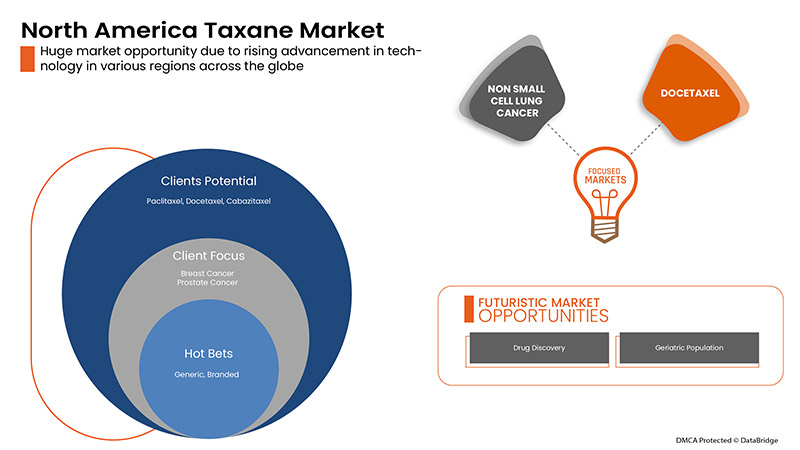

さらに、慢性疾患の罹患率の上昇、がんの罹患率の急増、医療インフラへの投資の増加により、タキサン薬の使用が増加しています。タキサン市場の需要が増加するこれらの要因により、主要な市場プレーヤーは、製品の発売、買収、戦略、契約を通じて、より新しい技術と戦略を実装するよう促されています。

タキサン市場の動向

ドライバー

- がんの発症率の上昇

がんは米国および世界中で社会に大きな影響を与えています。がんの統計は、大勢の人々に何が起きているかを示し、がんが社会に及ぼす負担を時系列で示します。がん治療に使用される抗有糸分裂剤タキソールは、細胞分裂を停止してがん細胞の増殖を阻止し、細胞死をもたらします。

国立がん研究所 (NCI) によると、資金援助を受けた臨床試験で、進行性卵巣がん患者の 30 % がタキサン治療に良好な反応を示したことがわかった。臨床診療では、タキサンは現在、転移性乳がんの標準治療となっている。今日、タキソールは世界保健機関の必須医薬品モデル リストに掲載されており、がん細胞を殺す細胞毒性薬である。タキソールは、乳がん、卵巣がん、非小細胞肺がん、膵臓がん、およびエイズ関連のカポジ肉腫の治療に用いられる。

- 政府による資金援助と研究開発への投資

オピオイド使用とアルコール障害の治療における薬物療法の有効性は確立されているものの、専門治療プログラムによるタキサンの実施には限界があることが観察されています。資金、組織構造、労働力のリソースの特定のソースに一定の注意を払い、支払いを将来の潜在的な受益者に合わせる長期的な投資を行う必要があります。医薬品開発の持続可能性、生産性、患者への影響に関する問題は、これまでも、そしてこれからも、単なる業界の産物ではありません。

The funding by the government would result in the patient's safety, cost-savings. In addition, hospitals and healthcare agencies would administer this treatment at a lower price through collaboration with government organizations. Hence the advancements in research and development activities and funding by the government are expected to drive the market growth.

Restraint

-

Side effects of drugs incurred with the taxane drugs

Taxanes belong to a class of diterpenes. Taxane drugs (paclitaxel and docetaxel) are used as chemotherapeutic agents. Due to ongoing clinical trials, research studies, type of cancer, type of treatment plan, and drug dosage, the present high cost is expected to show a descending trend in the future. Taxane drugs are most effective for treating breast and prostate cancer. However, certain side effects have been reported. The adverse complications or side effects reported would lead to a decline in sales of the taxane drugs, which would limit the sales of the drugs. In addition, it would affect the reliability of manufacturers involved in this market and hence be expected to restrain the market growth.

Opportunity

-

Strategic initiative by market players

The demand for taxane market has increased in the U.S. and Europe owing to the timely treatment of alcohol and opioid disorders. These favorable factors enhance the need for taxane, and to achieve the market demand, minor and major market players are utilizing various strategies.

The major players are also trying to devise specific strategies, such as product launches, acquisitions, approvals, expansions, and partnerships, to ensure the smooth running of the business, avoid risks, and increase the long-term growth in the sales of the market.

These strategic initiatives by the market players, including acquisition, conferences, and focused segment product launches, are helping the companies grow and improve the company's product portfolios, ultimately leading to more revenue generation. Hence, these strategic initiatives by the market players provide an opportunity to help in future growth and drive market growth.

Challenge

- The lack of skilled professionals required for taxane drug treatment

The lack or shortage of skilled expertise would challenge the pace of recovery and growth in one place. Often the unemployed people in one place have skills that are in short supply elsewhere. Moreover, rapid technological advancement in this field also leads to a lack of expertise.

Physician supply is a term used to describe the number of trained physicians working in a healthcare system or labor market. It is dependent on the number of graduates and the retention rates of the profession. The physician shortage is a growing concern in many countries around the world.

The World Health Organization (WHO) estimated a global shortage of 4.3 million physicians, nurses, and other health professionals. Despite the strong evidence for the effectiveness of drugs in reducing morbidity and mortality, increasing treatment retention, and improving well-being for individuals with taxane, numerous barriers prevent broader access to taxane drug-based treatment.

Moreover, technological advancement is another aspect that leads to the increased demand for skilled professionals. Neurologists report significant unmet supportive care needs and barriers in their centers, with only a small minority rating themselves as competently providing supportive care. There is an urgent need for the education of professionals for the treatment of dementia and procuring available supportive care resources. Lack of trained and experienced professionals and persistent skill gaps limit the employability prospects and access to quality jobs. Therefore, it is apparent that the availability of professionals with adequate skills is challenging the market growth.

Post COVID-19 Impact on Taxane Market

COVID-19 has resulted in a substantial increase in demand for medical supplies from healthcare professionals and the general public for precautionary measures. Manufacturers of these items have an opportunity to take advantage of the increased demand for medical supplies by ensuring a steady supply of personal protective equipment on the market. COVID-19 is anticipated to have a big impact on the taxane market.

Recent Developments

- In November 2022, Viatris Inc. and Biocon Biologics Ltd. announced the U.S. launch of interchangeable biosimilars SEMGLEE (insulin glargine-yfgn) injection, a branded product, and Insulin Glargine (insulin glargine-yfgn) injection, an unbranded product, to help control high blood sugar in adult and pediatric patients with type 1 diabetes and adults with type 2 diabetes. Both biosimilar products are available in vial and prefilled pen presentations and are interchangeable for the reference brand, LANTUS (insulin glargine), allowing for substitution at the pharmacy counter. Viatris is committed to improving patient access to sustainable, quality and more affordable healthcare. This has helped the company to grow their product portfolio.

- In May 2022, Sandoz, a global leader in generic and biosimilar medicines, announced the U.S. launch of its generic pirfenidone, the first AB-rated (fully substitutable) equivalent to Genentech’s Esbriet, to treat patients with idiopathic pulmonary fibrosis (IPF). This prescription oral medicine is immediately available to patients via specialty pharmacies, with a $0 co-pay program for eligible patients. Sandoz is putting patients first by expanding access to generic pirfenidone for those with this rare disease, who will benefit from a more affordable, yet equally effective treatment. This has helped the company to grow its market position and business.

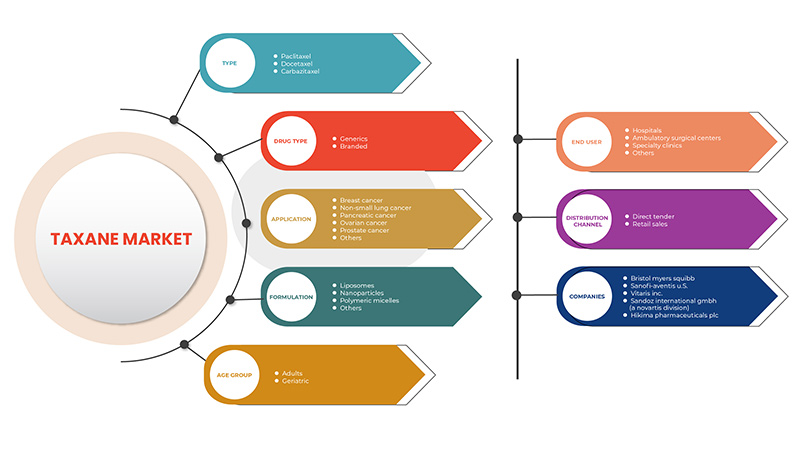

Taxane Scope and Market Size

Taxane market is segmented based on type, drug type, formulation, age group, application, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the Difference in your target markets.

By Type

- Paclitaxel

- Docetaxel

- Cabazitaxel

On the basis of type, the North America taxane market is segmented into paclitaxel, docetaxel and cabazitaxel.

By Application

- Ovarian Cancer

- Breast Cancer

- Prostate Cancer

- Non-small Cell Lung Cancer

- Other

On the basis of application, the North America taxane market is segmented into ovarian cancer, breast cancer, prostate cancer, non-small cell lung cancer and others.

By Drug Type

- Generics

- Branded

On the basis of drug type, the North America taxane market is segmented into branded and generics.

By Formulation

- Liposomes

- Nanoparticles

- Polymeric Micelles

- Others

On the basis of formulation, the North America taxane market is segmented into liposomes, nanoparticles, polymeric micelles and others.

By Age Group

- Adult

- Geriatric

On the basis of age group, the North America taxane market is segmented into adults and geriatric.

By End User

- Hospitals

- Ambulatory surgical centers

- Specialty clinics

- Others

On the basis of end user, the North America taxane market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and others.

By Distribution Channel

- Direct tender

- Retail Sales

On the basis of distribution channel, the North America taxane market is segmented into direct tender, retail sales.

North America Taxane Market Regional Analysis

The taxane market is analyzed and market size information is provided by type, drug type, formulation, age group, application, end user and distribution channel.

The countries covered in the taxane market report are U.S., Canada, Mexico.

In 2022, U.S. is dominating due to the presence of key market players along the largest consumer market with high GDP. U.S is expected to grow due to rise in technological advancement in drug treatments.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Taxane market also provides you with detailed market analysis for every country growth in healthcare industry. Moreover, it provides detailed information regarding healthcare services and treatments, impact of regulatory scenarios, and trending parameters regarding Taxane Market.

Competitive Landscape and Taxane Market Share Analysis

タキサン市場の競争状況は、競合他社ごとに詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と幅、アプリケーションの優位性、技術ライフライン曲線が含まれます。提供されている上記のデータ ポイントは、タキサン薬に関連する会社の焦点にのみ関連しています。

タキサン市場を扱っている主要企業としては、Viatris Inc.、Sandoz International GmbH (A Novartis Division)、sanofi-aventis US LLC、Hikma Pharmaceuticals PLC、Pfizer Inc.、Dr. Reddy's Laboratories Ltd.、Taxane Healthcare、Bristol-Myers Squibb Company、Fresenius Kabi AG (Fresenius SE & Co. KGaA の子会社)、SAMYANG HOLDINGS CORPORATION.、Luye Pharma Group、Elevar Therapeutics、Huiang Pharmaceutical Co Ltd.、Shenzhen Main Luck Phar maceuticals Inc.、Accord Healthcare、Torrent Pharmaceuticals Ltd.、Panacea Biotec、RPG Life Sciences Limited.、Aureate Healthcare、Samarth Life Sciences Pvt. Ltd.、Cipla Inc.、Hetero Healthcare Limited.、AqVida GmbH、Ingenus Pharmaceuticals, LLC などがあります。

主要な市場プレーヤーによる合併、買収、合意などの戦略的提携により、タキサン系医薬品の成長がさらに加速すると期待されています。

市場プレーヤーによるコラボレーション、製品の発売、事業拡大、賞や表彰、合弁事業、その他の戦略は、タキサン市場における企業の足跡を強化し、組織の利益成長にも利益をもたらします。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、北米と地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TAXANE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL_ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 INDUSTRIAL INSIGHTS

6.1 CONCLUSION

7 NORTH AMERICA TAXANE MARKET: REGULATIONS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 THE RISE IN INCIDENCE OF CANCER

8.1.2 THE FUNDING BY THE GOVERNMENT AND INVESTMENT IN RESEARCH AND DEVELOPMENT

8.1.3 RISE IN PIPELINE OR CLINICAL TRIALS OF TAXANE TREATMENTS

8.1.4 USE OF REIMBURSEMENT FOR TAXANE

8.2 RESTRAINTS

8.2.1 SIDE EFFECTS OF DRUGS INCURRED WITH THE TAXANE DRUGS

8.2.2 ETHICAL ISSUES RELATED TO THE USE OF TAXANE TREATMENT

8.2.3 RISE IN PRODUCT RECALLS

8.3 OPPORTUNITIES

8.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

8.3.2 RISE IN HEALTHCARE EXPENDITURE

8.4 CHALLENGES

8.4.1 THE LACK OF SKILLED PROFESSIONALS REQUIRED FOR TAXANE DRUG TREATMENT

8.4.2 STRINGENT GOVERNMENT REGULATIONS ON TAXANE DRUG TREATMENT

9 NORTH AMERICA TAXANE MARKET, BY TYPE

9.1 OVERVIEW

9.2 PACLITAXEL

9.2.1 BY TYPE

9.2.1.1 SEMI-SYNTHETIC

9.2.1.2 NATURAL

9.2.2 BY STRENGTH

9.2.2.1 100MG

9.2.2.2 200MG

9.2.2.3 250MG

9.2.2.4 30MG

9.2.2.5 260MG

9.2.2.6 300MG

9.3 DOCETAXEL

9.3.1 120MG

9.3.2 80MG

9.3.3 20MG

9.3.4 40MG

9.3.5 60MG

9.4 CABAZITAXEL

9.4.1 60MG

10 NORTH AMERICA TAXANE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BREAST CANCER

10.3 NON-SMALL CELL LUNG CANCER

10.4 PANCREATIC CANCER

10.5 OVARIAN CANCER

10.6 PROSTATE CANCER

10.7 OTHERS

11 NORTH AMERICA TAXANE MARKET, BY DRUG TYPE

11.1 OVERVIEW

11.2 GENERICS

11.3 BRANDED

12 NORTH AMERICA TAXANE MARKET, BY FORMULATION

12.1 OVERVIEW

12.2 LIPOSOMES

12.3 NANOPARTICLES

12.4 POLYMERIC MICELLES

12.5 OTHERS

13 NORTH AMERICA TAXANE MARKET, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULT

13.2.1 FEMALE

13.2.2 MALE

13.3 GERIATRIC

13.3.1 FEMALE

13.3.2 MALE

14 NORTH AMERICA TAXANE MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 AMBULATORY SURGICAL CENTERS

14.4 SPECIALTY CLINICS

14.5 OTHERS

15 NORTH AMERICA TAXANE MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL SALES

15.2.1 HOSPITAL PHARMACY

15.2.2 RETAIL PHARMACY

15.2.3 ONLINE PHARMACY

15.3 DIRECT TENDER

16 NORTH AMERICA TAXANE MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA TAXANE MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 BRISTOL-MYERS SQUIBB COMPANY

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 SANOFI-AVENTIS U.S. LLC

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 VIATRIS INC.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 SANDOZ INTERNATIONAL GMBH (A NOVARTIS DIVISION)

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 FRESENIUS KABI AG (SUBSIDIARY OF FRESENIUS SE & CO. KGAA )

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 HIKMA PHARMACEUTICALS PLC

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 ACCORD HEALTHCARE

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 AQVIDA GMBH

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 AUREATE HEALTHCARE

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 CIPLA INC.

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENTS

19.11 DR. REDDY’S LABORATORIES LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 ELEVAR THERAPEUTICS

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENTS

19.13 HETERO HEALTHCARE LIMITED.

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 HUIANG PHARMACEUTICAL CO LTD

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 INGENUS PHARMACEUTICALS, LLC

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 LUYE PHARMA GROUP

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENTS

19.17 PANACEA BIOTEC

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 PFIZER INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENTS

19.19 RPG LIFE SCIENCES LIMITED

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENTS

19.2 SAMARTH LIFE SCIENCES PVT. LTD.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENTS

19.21 SAMYANG HOLDINGS CORPORATION.

19.21.1 COMPANY SNAPSHOT

19.21.2 REVENUE ANALYSIS

19.21.3 PRODUCT PORTFOLIO

19.21.4 RECENT DEVELOPMENTS

19.22 SHENZHEN MAIN LUCK PHAR MACEUTICALS INC.

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENTS

19.23 TORRENT PHARMACEUTICALS LTD

19.23.1 COMPANY SNAPSHOT

19.23.2 REVENUE ANALYSIS

19.23.3 PRODUCT PORTFOLIO

19.23.4 RECENT DEVELOPMENTS

19.24 TAXANE HEALTHCARE

19.24.1 COMPANY SNAPSHOT

19.24.2 PRODUCT PORTFOLIO

19.24.3 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA PACLITAXEL IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA DOCETAXEL IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CABAZITAXEL IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BREAST CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA NON-SMALL LUNG CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PANCREATIC CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OVARIAN CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PROSTATE CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OTHERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA GENERICS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA BRANDED IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA LIPOSOMES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA NANOPARTICLES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA POLYMERIC MICELLES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA OTHERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ADULT IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA GERIATRIC IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HOSPITALS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SPECIALTY CLINICS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA RETAIL SALES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA DIRECT TENDER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA TAXANE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA CARBAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 U.S. TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 U.S. TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 58 U.S. PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 59 U.S. DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 60 U.S. CARBAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 61 U.S. TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 62 U.S. ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 63 U.S. GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 64 U.S. TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 U.S. TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 U.S. RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 CANADA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 CANADA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CANADA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 CANADA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 71 CANADA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 72 CANADA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 73 CANADA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 74 CANADA CARBAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 75 CANADA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 76 CANADA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 77 CANADA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 78 CANADA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 CANADA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 CANADA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 81 MEXICO TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 MEXICO PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 MEXICO TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 MEXICO TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 85 MEXICO TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 86 MEXICO PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 87 MEXICO DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 88 MEXICO CARBAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 89 MEXICO TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 90 MEXICO ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 91 MEXICO GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 92 MEXICO TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 MEXICO TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 MEXICO RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA TAXANE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TAXANE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TAXANE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TAXANE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TAXANE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TAXANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TAXANE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA TAXANE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TAXANE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA TAXANE MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA TAXANE MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASING INVESTMENT FOR HEALTHCARE INFRASTRUCTURE IS EXPECTED TO DRIVE THE NORTH AMERICA TAXANE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TAXANE MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TAXANE MARKET

FIGURE 15 INCIDENCE OF BREAST CANCER IN 2020

FIGURE 16 NORTH AMERICA TAXANE MARKET: BY TYPE, 2021

FIGURE 17 NORTH AMERICA TAXANE MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA TAXANE MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA TAXANE MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA TAXANE MARKET: BY APPLICATION, 2021

FIGURE 21 NORTH AMERICA TAXANE MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA TAXANE MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA TAXANE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 24 NORTH AMERICA TAXANE MARKET: BY DRUG TYPE, 2021

FIGURE 25 NORTH AMERICA TAXANE MARKET: BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA TAXANE MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA TAXANE MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA TAXANE MARKET: BY FORMULATION, 2021

FIGURE 29 NORTH AMERICA TAXANE MARKET: BY FORMULATION, 2022-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA TAXANE MARKET: BY FORMULATION, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA TAXANE MARKET: BY FORMULATION, LIFELINE CURVE

FIGURE 32 NORTH AMERICA TAXANE MARKET: BY AGE GROUP, 2021

FIGURE 33 NORTH AMERICA TAXANE MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA TAXANE MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA TAXANE MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 36 NORTH AMERICA TAXANE MARKET: BY END USER, 2021

FIGURE 37 NORTH AMERICA TAXANE MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 38 NORTH AMERICA TAXANE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 NORTH AMERICA TAXANE MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 NORTH AMERICA TAXANE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 NORTH AMERICA TAXANE MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 NORTH AMERICA TAXANE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 NORTH AMERICA TAXANE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 NORTH AMERICA TAXANE MARKET: SNAPSHOT (2021)

FIGURE 45 NORTH AMERICA TAXANE MARKET: BY COUNTRY (2021)

FIGURE 46 NORTH AMERICA TAXANE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 NORTH AMERICA TAXANE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 NORTH AMERICA TAXANE MARKET: BY TYPE (2022-2029)

FIGURE 49 NORTH AMERICA TAXANE MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。