Global Agricultural Rodenticides Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

5.40 Billion

USD

8.41 Billion

2021

2029

USD

5.40 Billion

USD

8.41 Billion

2021

2029

| 2022 –2029 | |

| USD 5.40 Billion | |

| USD 8.41 Billion | |

|

|

|

|

Global Agricultural Rodenticides Market, By Type (Non-Anticoagulants, Anticoagulants), First-generation (Anticoagulants, Chlorophacinone, Diphacinone, Coumatetrayl and Warfarin), Second-Generation (Anticoagulants Brodifacoum, Bromadiolone, Difenacoum, Difethialone and Flocoumafone), Application (Pellets, Sprays and Powders) – Industry Trends and Forecast to 2029.

Market Analysis and Size

Rodenticides are used to control rodents of all kinds in any environment. Rodenticides are acute poisons, anticoagulants, and bio agents that, if used wrongly, can kill humans, domestic animals, and wildlife. Rodents are only a nuisance when there is a delicious food supply nearby. A multi-pronged approach that incorporates chemical, baiting, trapping, barrier fencing, habitat alteration, ultrasonic devices, repellents, and biological control, all linked with land management methods, is the most effective way to tackle rodent problems.

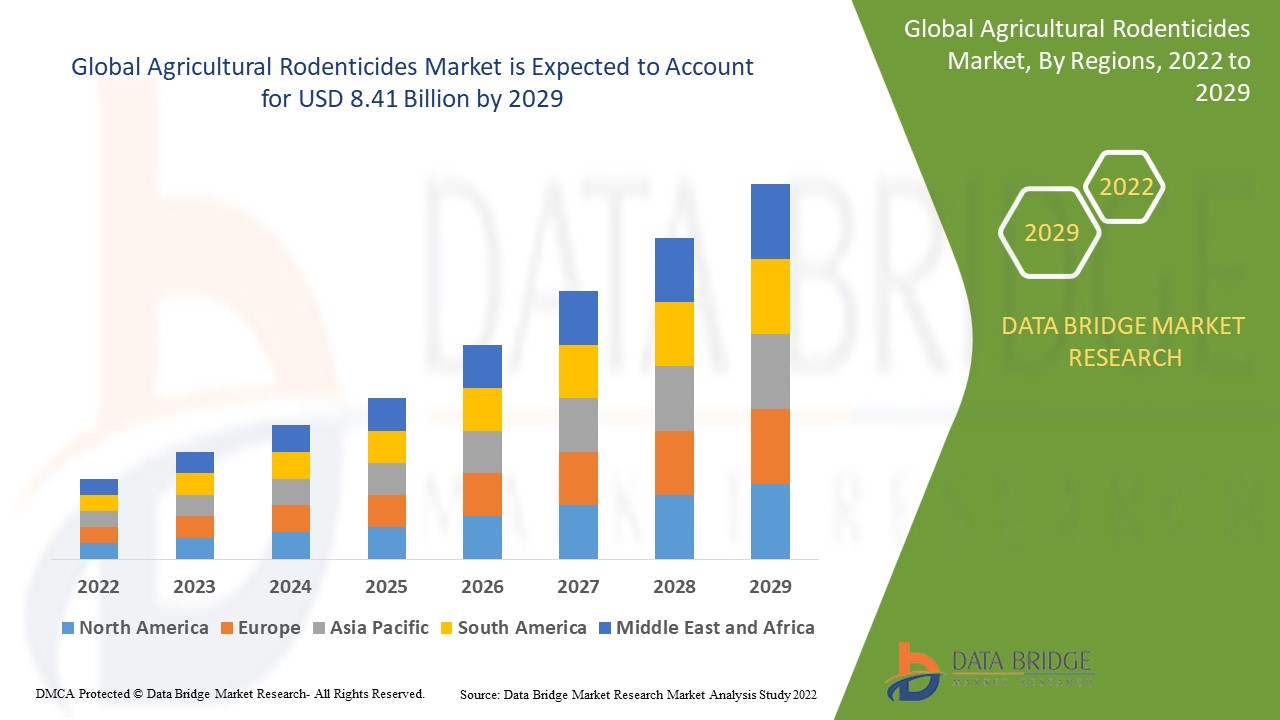

Data Bridge Market Research analyses that the agricultural rodenticides market was valued at USD 5.4 billion in 2021 is expected to reach the value of USD 8.41 billion by 2029, at a CAGR of 5.70% during the forecast period of 2022-2029.The market report curated by Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, technological advancements and patent analysis.

Market Definition

Rodenticides are pesticides that are used to kill mice and other rodents such as rats, chipmunks, squirrels, porcupines and others. Rodenticides provide critical services to both residential and commercial customers and the public and private sectors. Its primary function is to maintain hygiene and eliminate pests that wreak havoc on the commercial and public sectors.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Non-Anticoagulants, Anticoagulants), First-generation (Anticoagulants, Chlorophacinone, Diphacinone, Coumatetrayl and Warfarin), Second-Generation (Anticoagulants Brodifacoum, Bromadiolone, Difenacoum, Difethialone and Flocoumafone), Application (Pellets, Sprays and Powders) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

PelGar International (U.K), Bayer AG (Germany), Liphatech Inc. (U.S), BASF SE (Germany), Syngenta Crop Protection AG (Switzerland), Rentokil Initial Plc (U.K), Anticimex (Sweden), The Terminix International Company Limited (U.S), Liphatech Inc (U.S), Neogen Corporation (U.S), Bell Laboratories Inc (U.S), Ecolab Inc (U.S), Rollins Inc (U.S), Abell Pest Control (Canada), Futura Germany (Germany), SenesTech, Inc. (U.S), Impex Europa S.L (Spain) |

|

Opportunities |

|

Agricultural Rodenticides Market Dynamics

Drivers

- Rising concerns about food waste

Due to increased demand for food grains and farmer concerns about food waste, the market is expanding. Rodenticides are primarily used in agricultural fields, greenhouses, and warehouses.

- Various applications of rodent control products

Growing consumer awareness of food safety and animal health, as well as increased demand for animal protein, an increase in the animal population, and the incredible benefits of enzymes, will all help to propel the market forward.

The market is projected to be impacted by increased demand for food grains and crop protection. As the use of various rodent control chemicals in industrial, residential, and commercial settings has grown, so has the prevalence of diseases like lassa fever, plague, and hantavirus. As a result of the rising demand in major cities around the world, manufacturers are working on new goods to efficiently regulate population.

The increased demand for enzymes in the pharmaceutical industry to synthesize intermediates in active pharmaceutical ingredient (API) production for effective medications is expected to drive the enzymes market forward. Similarly, the ability of an enzyme to convert complex molecules to simpler molecules (starch to glucose) in food and beverage companies, removal of fats and oil stains in the detergent industry, bioethanol for biofuel production, and improved bleaching properties in the paper and pulp industries are expected to drive enzyme demand in the coming years.

Opportunity

The entertainment industry, warehouses, construction companies, foodservice segment, pharmaceutical companies, and hospitality industry all play a significant role in increasing demand for pest control products and services, particularly for rodents. Economic losses caused by pests such as rodents have an impact on the tourism industry. The expansion of the hospitality and entertainment sectors in urban areas, driven by consumers' high purchasing power, has increased demand for rodent control products.

Restraints

Rodenticides are subject to registration in various countries by health, environmental, and pest control agencies. Governments assess pesticide purchase, registration, formulation, application, and disposal policies. The nature of government policies influences rodenticide demand and prices. According to Rentokil, the use of rodenticides as control and prevention methods has been restricted in many European and North American countries.

This agricultural rodenticides market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the agricultural rodenticides market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Agricultural Rodenticides Market

Syngenta AG, Bayer AG, BASF SE, UPL Ltd, Rentokil Initial plc, Ecolab Inc, and Rollins Inc are among the market's major product manufacturers and service providers. These companies have manufacturing and service facilities in Asia Pacific, Europe, North America, South America, and the rest of the world. COVID-19 has had an impact on their businesses to some extent. Though the pandemic has impacted their businesses, there has been no significant impact on their rodenticides' global operations and supply chain. Several player manufacturing facilities are still in process. The service providers provide rodent control services while adhering to safety and sanitation protocols.

Recent Development

- Rentokil Initial Plc acquired Florida Pest Control (US) in November 2019, a pest control service provider for commercial and residential customers. This acquisition would allow the company to broaden its product offerings in North America.

- Bayer and AlphaBio Control (UK) agreed in June 2019 to grant Bayer the exclusive right to market Flipper, an innovative biological pest control product developed by AlphaBio.

- BASF SE introduced Selontra rodent bait, a soft bait formulation based on the active ingredient cholecalciferol, for rodent control in the US market in April 2018. The product has a high efficacy in controlling rodent infestations in just seven days.

Global Agricultural Rodenticides Market Scope

The agricultural rodenticides market is segmented on the basis of type, first-generation, second-generation and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Non-anticoagulants

- Anticoagulants

On the basis of type, the agricultural rodenticides market is segmented into non-anticoagulants, Anticoagulants.

First generation

- Anticoagulants

- Chlorophacinone

- Diphacinone

- Coumatetrayl

- Warfarin

- Others

On the basis of first-generation, the agricultural rodenticides market is segmented into anticoagulants, chlorophacinone, diphacinone, coumatetrayl and warfarin.

Second generation

- Anticoagulants

- Brodifacoum

- Bromadiolone

- Difenacoum

- Difethialone

- Flocoumafone.

- Dry

On the basis of second-generation, the agricultural rodenticides market is segmented into anticoagulants brodifacoum, bromadiolone, difenacoum, difethialone and flocoumafone dry.

Applications

- Pellets

- Sprays

- Powders

Based on application, the agricultural rodenticides market is segmented into pellets, sprays and powders.

Agricultural Rodenticides Market Regional Analysis/Insights

The agricultural rodenticides market is analysed and market size insights and trends are provided by country, type, first-generation, second-generation and application as referenced above.

The countries covered in the agricultural rodenticides market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominated the global rodenticides market, with the United States accounting for the majority share. The growing population of rodents is expected to drive the growth of the rodenticides industry by increasing the number of rodent control products and services. Furthermore, the presence of major manufacturers in the region contributes to market growth. During the forecast period, Asia-Pacific is expected to grow at the fastest CAGR, with China accounting for most rodenticide sales. The rising demand for rodenticides in this region has been fuelled by an increase in rat infestations in agriculture and warehouses.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Agricultural Rodenticides Market Share Analysis

The agricultural rodenticides market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to agricultural rodenticides market.

Some of the major players operating in the agricultural rodenticides market are:

- PelGar International (U.K)

- Bayer AG (Germany)

- Liphatech Inc. (U.S)

- BASF SE (Germany)

- Syngenta Crop Protection AG (Switzerland)

- Rentokil Initial Plc (U.K)

- Anticimex (Sweden)

- The Terminix International Company Limited (U.S)

- Liphatech Inc (U.S)

- Neogen Corporation (U.S)

- Bell Laboratories Inc (U.S)

- Ecolab Inc (U.S)

- Rollins Inc (U.S)

- Abell Pest Control (Canada)

- Futura Germany (Germany)

- SenesTech, Inc. (U.S)

- Impex Europa S.L (Spain)

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.