Global Construction Paints And Coatings Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

241.65 Billion

USD

348.41 Billion

2025

2033

USD

241.65 Billion

USD

348.41 Billion

2025

2033

| 2026 –2033 | |

| USD 241.65 Billion | |

| USD 348.41 Billion | |

|

|

|

|

Global Construction Paints and Coatings Market Segmentation, By Resin Type (Epoxy, Acrylic, Polyurethane, and Others), Product Type (Powder Coatings, Waterborne Coatings, Solvent-borne Coatings, and Others), Application (Residential, Commercial, and Industrial)- Industry Trends and Forecast to 2033

Construction Paints and Coatings Market Size

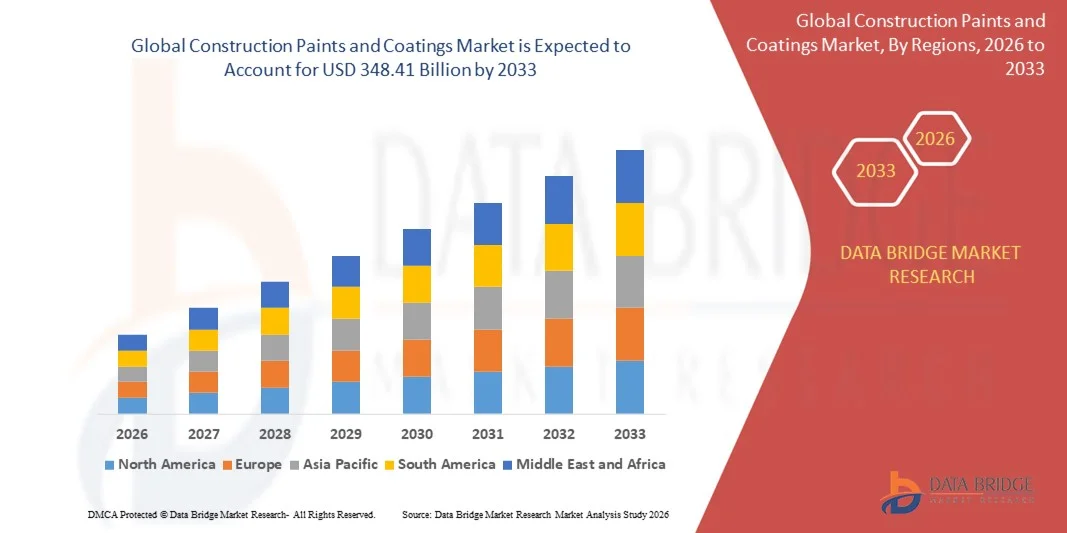

- The global construction paints and coatings market size was valued at USD 241.65 billion in 2025 and is expected to reach USD 348.41 billion by 2033, at a CAGR of 4.68% during the forecast period

- The market growth is largely fuelled by the increasing demand for residential and commercial infrastructure, rapid urbanization, and the adoption of eco-friendly and durable coating solutions

- Rising renovation and refurbishment activities across developed and emerging economies are contributing to market expansion

Construction Paints and Coatings Market Analysis

- The market is witnessing significant innovation in low-VOC, waterborne, and high-performance coatings, aligning with environmental regulations and sustainability trends

- Increasing construction activities, particularly in Asia-Pacific and North America, coupled with rising demand for premium and decorative coatings, are supporting steady market growth

- North America dominated the construction paints and coatings market with the largest revenue share in 2025, driven by increasing construction and renovation activities, rising urbanization, and high demand for eco-friendly and durable coating solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global construction paints and coatings market, driven by rising construction activities, increasing disposable incomes, and the growing adoption of innovative and decorative coating solutions

- The acrylic segment held the largest market revenue share in 2025, driven by its versatility, cost-effectiveness, and suitability for both interior and exterior applications. Acrylic-based coatings offer excellent weather resistance, color retention, and ease of application, making them a preferred choice for residential and commercial projects

Report Scope and Construction Paints and Coatings Market Segmentation

|

Attributes |

Construction Paints and Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Construction Paints and Coatings Market Trends

Rising Demand for Durable, Eco-Friendly, and Decorative Coatings

- The growing focus on sustainable, long-lasting, and aesthetically appealing coatings is significantly shaping the construction paints and coatings market, as consumers and contractors increasingly prefer products that offer protection, longevity, and environmental compliance. Advanced coatings are gaining traction due to their ability to provide weather resistance, corrosion protection, and enhanced finish without compromising environmental standards. This trend strengthens their adoption across residential, commercial, and industrial construction projects, encouraging manufacturers to innovate with new formulations that meet evolving consumer and regulatory demands

- Increasing awareness around environmental regulations, energy efficiency, and building sustainability has accelerated the demand for low-VOC, waterborne, and high-performance coatings. Architects, contractors, and building owners are actively seeking products that comply with green building standards, prompting brands to prioritize eco-friendly production processes and certifications. This has also led to collaborations between raw material suppliers and coating manufacturers to enhance functional and sustainable benefits

- Sustainability and regulatory trends are influencing purchasing decisions, with manufacturers emphasizing eco-certifications, low-emission formulations, and transparent sourcing of raw materials. These factors are helping brands differentiate products in a competitive market and build consumer trust, while also driving the adoption of LEED-compliant and environmentally responsible coatings. Companies are increasingly using marketing campaigns to highlight these benefits to reinforce brand positioning and appeal to conscious consumers

- For instance, in 2024, Sherwin-Williams in the U.S. and AkzoNobel in the Netherlands expanded their product portfolios by introducing low-VOC, durable, and decorative coatings for residential and commercial projects. These launches were in response to rising consumer preference for sustainable and high-performance paints, with distribution across retail, specialty, and professional channels. The products were also marketed as environmentally responsible choices, enhancing brand loyalty and repeat purchases among target audiences

- While demand for eco-friendly and high-performance coatings is growing, sustained market expansion depends on continuous R&D, cost-effective production, and maintaining functional performance comparable to conventional coatings. Manufacturers are also focusing on improving scalability, supply chain reliability, and developing innovative solutions that balance cost, quality, and sustainability for broader adoption

Construction Paints and Coatings Market Dynamics

Driver

Rising Preference for Durable, Sustainable, and Decorative Coatings

- Increasing consumer and contractor demand for environmentally friendly, long-lasting, and visually appealing coatings is a major driver for the construction paints and coatings market. Manufacturers are increasingly replacing conventional solvent-based coatings with low-VOC and waterborne alternatives to meet regulatory and sustainability requirements, improve product appeal, and enhance building performance

- Expanding applications in residential, commercial, and industrial construction are influencing market growth. Advanced coatings help enhance durability, weather resistance, and aesthetic appeal while maintaining compliance with environmental standards, enabling manufacturers to meet customer expectations for high-quality, sustainable offerings. The increasing focus on green buildings globally further reinforces this trend

- Paint and coating manufacturers are actively promoting eco-friendly and high-performance formulations through product innovation, marketing campaigns, and industry certifications. These efforts are supported by the growing consumer preference for sustainable and energy-efficient building solutions, and they also encourage partnerships between raw material suppliers and brands to improve performance and reduce environmental footprint

- For instance, in 2023, PPG Industries in the U.S. and Asian Paints in India reported increased incorporation of low-VOC and durable coatings in residential and commercial projects. This expansion followed higher demand for sustainable, long-lasting, and decorative coatings, driving repeat purchases and product differentiation. Both companies also highlighted eco-certifications and compliance in marketing campaigns to strengthen consumer trust and brand loyalty

- Although rising sustainability and durability trends support growth, wider adoption depends on cost optimization, raw material availability, and scalable production processes. Investment in supply chain efficiency, sustainable sourcing, and advanced formulation technology will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

Higher Cost And Regulatory Compliance Requirements

- The relatively higher cost of eco-friendly and high-performance coatings compared to conventional alternatives remains a key challenge, limiting adoption among price-sensitive consumers and contractors. Higher raw material costs and complex formulation processes contribute to elevated pricing. In addition, stringent regulatory compliance requirements can further impact production costs and market penetration

- Consumer and contractor awareness of sustainable and high-performance coatings remains uneven, particularly in developing markets where environmental regulations are still emerging. Limited understanding of functional and environmental benefits restricts adoption across certain construction projects. This also leads to slower innovation uptake in emerging economies where educational initiatives on eco-friendly coatings are minimal

- Supply chain and distribution challenges also impact market growth, as sustainable coatings require sourcing from certified suppliers and adherence to quality and environmental standards. Logistical complexities, shorter shelf life of some advanced coatings, and temperature-sensitive storage increase operational costs. Companies must invest in proper handling, storage, and transport networks to maintain product integrity

- For instance, in 2024, distributors in Southeast Asia supplying low-VOC and waterborne coatings to commercial and residential contractors reported slower uptake due to higher prices and limited awareness of benefits compared to conventional paints. Certification compliance and cold storage requirements were additional barriers. These factors also prompted some retailers to limit shelf space for premium coatings, affecting visibility and sales

- Overcoming these challenges will require cost-efficient production, expanded distribution networks, and focused educational initiatives for contractors and consumers. Collaboration with retailers, builders, and certification bodies can help unlock the long-term growth potential of the global construction paints and coatings market. Furthermore, developing cost-competitive formulations and strengthening marketing strategies around functional and sustainability benefits will be essential for widespread adoption

Construction Paints and Coatings Market Scope

The construction paints and coatings market is segmented on the basis of resin type, product type, and application.

- By Resin Type

On the basis of resin type, the construction paints and coatings market is segmented into epoxy, acrylic, polyurethane, and others. The acrylic segment held the largest market revenue share in 2025, driven by its versatility, cost-effectiveness, and suitability for both interior and exterior applications. Acrylic-based coatings offer excellent weather resistance, color retention, and ease of application, making them a preferred choice for residential and commercial projects.

The polyurethane segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its superior durability, chemical resistance, and high-performance properties. Polyurethane coatings are particularly popular in industrial and high-traffic applications, providing long-lasting protection and reducing maintenance costs over time.

- By Product Type

On the basis of product type, the market is segmented into powder coatings, waterborne coatings, solvent-borne coatings, and others. The waterborne coatings segment accounted for the largest share in 2025 due to increasing environmental regulations and the shift toward low-VOC, eco-friendly products. Waterborne coatings are widely adopted in residential and commercial construction for their reduced environmental impact and safer application.

The powder coatings segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for durable, energy-efficient, and decorative finishing solutions in industrial and commercial construction. Powder coatings provide high-quality finishes, minimal waste, and superior corrosion resistance, enhancing long-term asset value.

- By Application

On the basis of application, the market is segmented into residential, commercial, and industrial. The residential segment held the largest market revenue share in 2025, supported by growing construction activities, renovation projects, and increasing consumer preference for high-quality and aesthetically appealing coatings.

The industrial segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising adoption of advanced coatings for machinery, infrastructure, and high-performance building components. Industrial coatings enhance durability, protect against harsh environments, and reduce maintenance costs, making them essential for modern infrastructure development.

Construction Paints and Coatings Market Regional Analysis

- North America dominated the construction paints and coatings market with the largest revenue share in 2025, driven by increasing construction and renovation activities, rising urbanization, and high demand for eco-friendly and durable coating solutions

- Consumers and contractors in the region value high-performance, low-VOC, and waterborne coatings for their aesthetic appeal, durability, and compliance with environmental regulations

- The widespread adoption is further supported by strong residential and commercial construction projects, rising disposable incomes, and awareness of sustainable building materials, establishing construction paints and coatings as a critical component in infrastructure development

U.S. Construction Paints and Coatings Market Insight

The U.S. construction paints and coatings market captured the largest revenue share in 2025 within North America, fueled by increasing investments in residential and commercial infrastructure. Demand for advanced coating solutions, such as waterborne and powder coatings, is rising due to environmental regulations and the need for long-lasting protective finishes. Growth is further supported by technological advancements, product innovations, and the preference for decorative and sustainable coatings across residential, commercial, and industrial applications.

Europe Construction Paints and Coatings Market Insight

The Europe construction paints and coatings market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental regulations, increasing refurbishment projects, and demand for energy-efficient and decorative coatings. European consumers and businesses are increasingly adopting low-VOC, waterborne, and eco-friendly coatings, contributing to growth across residential, commercial, and industrial sectors.

U.K. Construction Paints and Coatings Market Insight

The U.K. construction paints and coatings market is expected to witness significant growth from 2026 to 2033, driven by rising construction activities, sustainability initiatives, and demand for high-performance decorative and protective coatings. Renovation and retrofit projects, coupled with growing awareness of green building standards, are further propelling market expansion.

Germany Construction Paints and Coatings Market Insight

The Germany construction paints and coatings market is expected to grow steadily from 2026 to 2033, fueled by strong industrial and commercial construction sectors, innovation in functional and durable coatings, and a focus on environmental compliance. The adoption of advanced coating technologies, such as polyurethane and epoxy systems, is supporting growth in residential, commercial, and industrial applications.

Asia-Pacific Construction Paints and Coatings Market Insight

The Asia-Pacific construction paints and coatings market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, infrastructure development, and increasing construction activities in countries such as China, India, and Japan. The region’s expanding residential, commercial, and industrial projects, along with rising awareness of sustainable and decorative coatings, are significantly contributing to market expansion.

China Construction Paints and Coatings Market Insight

The China construction paints and coatings market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to booming residential and commercial construction, rapid urbanization, and growing demand for premium, sustainable, and decorative coatings. The government’s push for energy-efficient and environmentally friendly building materials, along with strong domestic manufacturers, is driving market growth across residential, commercial, and industrial applications.

Construction Paints and Coatings Market Share

The Construction Paints and Coatings industry is primarily led by well-established companies, including:

• PPG Industries (U.S.)

• Sherwin-Williams Company (U.S.)

• AkzoNobel N.V. (Netherlands)

• BASF SE (Germany)

• RPM International Inc. (U.S.)

• Asian Paints Ltd. (India)

• Kansai Paint Co., Ltd. (Japan)

• Nippon Paint Holdings Co., Ltd. (Japan)

• Axalta Coating Systems Ltd. (U.S.)

• Jotun Group (Norway)

• Berger Paints India Ltd. (India)

• Masco Corporation (U.S.)

• Hempel A/S (Denmark)

• Sherwin-Williams Powder Coatings (U.S.)

• Benjamin Moore & Co. (U.S.)

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.