Global Monitoring Tools Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

33.12 Billion

USD

140.52 Billion

2024

2032

USD

33.12 Billion

USD

140.52 Billion

2024

2032

| 2025 –2032 | |

| USD 33.12 Billion | |

| USD 140.52 Billion | |

|

|

|

|

Global Monitoring Tools Market Segmentation, By Component (Software and Services), Deployment (Cloud and On-premises), Type (Infrastructure Monitoring Tools, Application Performance Monitoring Tools, Security Monitoring Tools, and End-user Experience Monitoring Tools), Vertical (BFSI, Retail & e-commerce, Healthcare, IT & Telecom, Media & Entertainment, Manufacturing, and Others) - Industry Trends and Forecast to 2032

Monitoring Tools Market Size

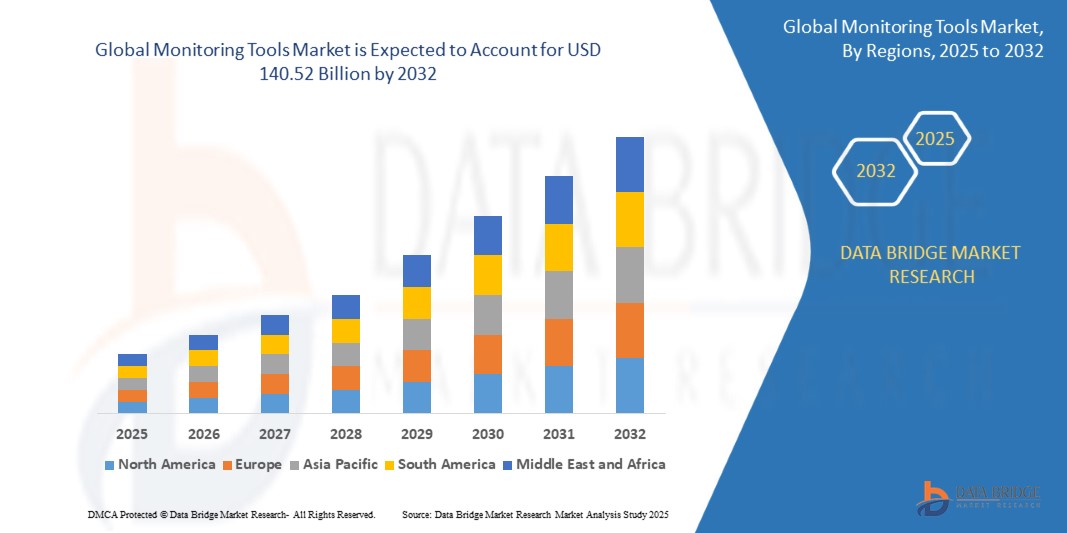

- The global monitoring tools market size was valued at USD 33.12 billion in 2024 and is expected to reach USD 140.52 billion by 2032, at a CAGR of 19.80% during the forecast period

- The market growth is largely fueled by the increasing reliance on IT infrastructure and cloud-based systems across enterprises, driving the need for efficient monitoring and performance management solutions

- Furthermore, rising demand for real-time visibility, predictive analytics, and proactive issue resolution is prompting organizations to adopt advanced monitoring tools, enhancing operational efficiency and minimizing downtime

Monitoring Tools Market Analysis

- Monitoring tools are software solutions designed to track, analyze, and optimize the performance, availability, and security of IT systems, networks, applications, and cloud environments

- The growing adoption of digital transformation initiatives, coupled with the need for seamless IT operations, robust cybersecurity, and regulatory compliance, is driving the widespread deployment of monitoring solutions across enterprises

- North America dominated the monitoring tools market with a share of 37.5% in 2024, due to the rising demand for real-time IT monitoring, cloud adoption, and digital transformation initiatives across enterprises

- Asia-Pacific is expected to be the fastest growing region in the monitoring tools market during the forecast period due to rapid digital transformation, cloud adoption, and IT modernization initiatives across countries such as China, Japan, and India

- Software segment dominated the market with a market share of 76.5% in 2024, due to its critical role in automating monitoring, data collection, and analytics across complex IT environments. Organizations increasingly rely on monitoring software to detect anomalies, optimize system performance, and ensure seamless operations across cloud, on-premises, and hybrid infrastructures. The segment benefits from continuous technological advancements, such as AI-based analytics, predictive insights, and real-time dashboards, which enhance operational efficiency and decision-making. The growing need for robust visibility and control over IT assets reinforces the dominance of the software segment

Report Scope and Monitoring Tools Market Segmentation

|

Attributes |

Monitoring Tools Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Monitoring Tools Market Trends

Increasing Adoption of AI-Driven Monitoring Solutions

- The monitoring tools market is experiencing significant momentum as enterprises increasingly adopt AI-driven solutions that provide predictive analytics, anomaly detection, and automated issue resolution. AI integration enables IT teams to address performance challenges proactively, reducing downtime and improving user experiences

- For instance, Datadog has enhanced its platform with AI-powered monitoring features that detect irregularities in cloud workloads and applications in real-time. These capabilities help organizations prevent critical failures and maintain service availability across complex infrastructures

- The rising complexity of IT environments, spanning cloud, hybrid, and on-premise deployments, has created the need for intelligence-driven monitoring. AI algorithms provide actionable insights from large datasets, enabling organizations to optimize infrastructure performance and resource utilization effectively

- In addition, AI-driven monitoring supports automation in incident management by reducing manual intervention. Digital operations teams can leverage predictive alerts and root cause analysis to minimize resolution times and ensure business continuity across mission-critical operations

- The ability to integrate monitoring with DevOps and continuous delivery pipelines is also expanding adoption. By enhancing productivity and enabling intelligent system reliability, AI-driven monitoring tools are becoming an essential part of digital transformation processes

- Altogether, the trend toward AI-powered monitoring is redefining IT operations management, positioning these tools as vital for resilience, scalability, and performance optimization in increasingly digital and interconnected environments

Monitoring Tools Market Dynamics

Driver

Growing Demand for Real-Time IT Performance Insights

- Enterprises are placing greater emphasis on real-time visibility into IT performance to improve operational continuity and user satisfaction. Monitoring tools are crucial in providing immediate insights into infrastructure, applications, and networks for faster response and enhanced efficiency

- For instance, New Relic has positioned itself as a leader in real-time observability by offering analytics tools that track system health, application performance, and user experiences. Their solutions enable businesses to identify problems proactively, saving time and reducing system risks

- The rise of digital-native businesses and application-centric enterprises has increased demand for continuous monitoring to avoid downtime. Real-time insights support agile operations, enabling companies to adapt quickly to performance fluctuations or service bottlenecks

- In addition, organizations are moving toward strategic reliance on big data and analytics platforms, which amplify the demand for tools that provide instant, actionable intelligence. By correlating live IT metrics, businesses can improve decision-making and customer engagement simultaneously

- The focus on operational agility and uninterrupted service delivery demonstrates why real-time IT insights remain a central driver of monitoring tool adoption. This trend is expected to strengthen further as enterprises expand their digital infrastructure across regions and industries

Restraint/Challenge

Complexity in Integrating Multi-Cloud Environments

- The widespread adoption of multi-cloud ecosystems is creating integration challenges for monitoring tools, adding complexity to visibility and control. Enterprises face difficulties in unifying monitoring across diverse service providers, architectures, and applications, resulting in fragmented performance data

- For instance, Splunk users in multi-cloud setups have reported challenges integrating data from AWS, Azure, and Google Cloud simultaneously due to varied APIs and vendor-specific architectures. This complicates monitoring consistency and raises operational burdens for IT teams

- The lack of standardized frameworks across different cloud providers adds further pressure, making it difficult to consolidate monitoring dashboards and achieve comprehensive system observability. This often results in performance blind spots and inefficiencies in issue resolution

- In addition, cross-cloud security, data transfer latency, and differing compliance standards contribute to integration hurdles. These challenges delay troubleshooting efforts and limit enterprises from achieving the full benefits of monitoring investments in hybrid or multi-cloud deployments

- Addressing these constraints requires monitoring platforms with enhanced interoperability, API-driven integrations, and unified observability solutions. Overcoming multi-cloud complexity will be essential for ensuring scalability, performance reliability, and efficiency in the monitoring tools market

Monitoring Tools Market Scope

The market is segmented on the basis of component, deployment, type, and vertical.

• By Component

On the basis of component, the monitoring tools market is segmented into software and services. The software segment dominated the largest market revenue share of 76.5% in 2024, driven by its critical role in automating monitoring, data collection, and analytics across complex IT environments. Organizations increasingly rely on monitoring software to detect anomalies, optimize system performance, and ensure seamless operations across cloud, on-premises, and hybrid infrastructures. The segment benefits from continuous technological advancements, such as AI-based analytics, predictive insights, and real-time dashboards, which enhance operational efficiency and decision-making. The growing need for robust visibility and control over IT assets reinforces the dominance of the software segment.

The services segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for managed monitoring services, consulting, and implementation support. Organizations with limited in-house IT expertise prefer outsourcing monitoring services for scalable, cost-effective solutions. Services also offer continuous updates, security patches, and customization to meet dynamic business requirements, making them increasingly popular across industries seeking reliable performance management solutions.

• By Deployment

On the basis of deployment, the monitoring tools market is segmented into cloud and on-premises. The cloud segment dominated the largest market revenue share in 2024, driven by its scalability, flexibility, and ability to provide real-time monitoring across distributed infrastructures. Cloud-based monitoring tools enable seamless remote access, centralized dashboards, and integration with existing IT ecosystems, supporting organizations in reducing operational complexity. The adoption of cloud-native applications, virtualization, and hybrid environments further reinforces the preference for cloud deployment, especially among enterprises aiming to enhance agility and reduce infrastructure costs.

The on-premises segment is expected to witness the fastest growth from 2025 to 2032, fueled by regulatory compliance requirements, data privacy concerns, and the need for highly customized monitoring solutions. Many large enterprises and critical sectors, such as BFSI and healthcare, prefer on-premises deployment to maintain control over sensitive data and integrate monitoring tools with legacy systems. On-premises solutions also offer robust security, low-latency performance, and customization options, driving increased adoption in targeted enterprise environments.

• By Type

On the basis of type, the monitoring tools market is segmented into infrastructure monitoring tools, application performance monitoring tools, security monitoring tools, and end-user experience monitoring tools. The infrastructure monitoring tools segment dominated the largest market revenue share in 2024, driven by the need for continuous oversight of servers, networks, databases, and IT infrastructure components. Organizations prioritize infrastructure monitoring to ensure system availability, prevent downtime, optimize resource utilization, and maintain operational continuity. Growing IT complexity, rising adoption of cloud and hybrid environments, and the integration of AI-driven analytics further reinforce the segment’s leadership in the market.

The application performance monitoring tools segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing reliance on digital applications, mobile services, and SaaS platforms. Businesses require real-time insights into application performance, user experience, and error detection to enhance productivity and customer satisfaction. The proliferation of web and mobile applications, combined with advanced analytics and automation, makes application performance monitoring a rapidly expanding segment across multiple industry verticals.

• By Vertical

On the basis of vertical, the monitoring tools market is segmented into BFSI, retail & e-commerce, healthcare, IT & telecom, media & entertainment, manufacturing, and others. The BFSI vertical dominated the largest market revenue share in 2024, driven by the critical need for secure, highly available IT infrastructure to support banking, insurance, and financial services operations. BFSI organizations prioritize monitoring tools to ensure system reliability, regulatory compliance, fraud prevention, and seamless customer experience. High-value transactions, digital banking adoption, and increasing cyberthreats further reinforce BFSI’s leadership in the regional and global monitoring tools market.

The retail & e-commerce vertical is expected to witness the fastest growth from 2025 to 2032, fueled by the surge in online shopping, omnichannel retailing, and demand for uninterrupted digital services. Retailers increasingly adopt monitoring tools to track website performance, optimize supply chains, detect anomalies, and enhance end-user experience. The growing reliance on cloud platforms, mobile applications, and personalized digital services drives the accelerated adoption of monitoring solutions in the retail and e-commerce sector.

Monitoring Tools Market Regional Analysis

- North America dominated the monitoring tools market with the largest revenue share of 37.5% in 2024, driven by the rising demand for real-time IT monitoring, cloud adoption, and digital transformation initiatives across enterprises

- Organizations in the region prioritize operational efficiency, performance optimization, and security compliance, making monitoring tools essential for IT infrastructure, applications, and end-user experience management

- The market growth is further supported by the presence of advanced technology providers, high IT spending, and a strong focus on automation and AI-driven analytics. This widespread adoption establishes monitoring tools as a critical solution across BFSI, IT & telecom, and e-commerce sectors

U.S. Monitoring Tools Market Insight

The U.S. monitoring tools market captured the largest revenue share within North America in 2024, fueled by the rapid adoption of cloud services, hybrid IT environments, and AI-enabled monitoring solutions. Enterprises increasingly seek proactive performance insights, predictive maintenance, and security monitoring to minimize downtime and optimize digital operations. The growing reliance on SaaS applications, data centers, and remote workforce management further drives market expansion. Integration with AI, machine learning, and automation platforms enhances operational efficiency, making the U.S. a key market for sophisticated monitoring solutions.

Europe Monitoring Tools Market Insight

The Europe monitoring tools market is projected to expand steadily during the forecast period, driven by increasing investments in IT infrastructure modernization, cloud migration, and cybersecurity. Enterprises across BFSI, healthcare, and manufacturing sectors are prioritizing proactive monitoring to enhance operational efficiency and minimize system disruptions. The region also benefits from regulatory compliance requirements, such as GDPR, which encourage organizations to implement robust monitoring solutions. Growing awareness of digital transformation benefits and the demand for real-time analytics are fostering market adoption across Western and Central Europe.

U.K. Monitoring Tools Market Insight

The U.K. monitoring tools market is anticipated to grow at a notable CAGR during the forecast period, driven by the expanding adoption of cloud computing, enterprise mobility, and digital business operations. Organizations increasingly implement monitoring tools to ensure application performance, infrastructure stability, and security compliance. The strong presence of IT service providers, coupled with the growing demand for managed services and SaaS applications, further boosts market growth. Increased reliance on e-commerce, BFSI, and retail sectors for uninterrupted digital services strengthens the adoption of monitoring solutions in the U.K.

Germany Monitoring Tools Market Insight

The Germany monitoring tools market is expected to expand at a significant CAGR during the forecast period, driven by the need for advanced IT performance management, robust cybersecurity, and compliance adherence. Germany’s strong industrial and manufacturing base, along with its emphasis on digitalization and Industry 4.0 initiatives, fuels the demand for infrastructure and application monitoring tools. Enterprises are increasingly integrating monitoring solutions with AI-driven analytics and automation to optimize operations and enhance system reliability. The market growth is further supported by the adoption of cloud, hybrid deployments, and the integration of monitoring solutions into smart enterprise ecosystems.

Asia-Pacific Monitoring Tools Market Insight

The Asia-Pacific monitoring tools market is poised to grow at the fastest CAGR during the forecast period, driven by rapid digital transformation, cloud adoption, and IT modernization initiatives across countries such as China, Japan, and India. Enterprises are increasingly deploying monitoring tools to manage complex IT infrastructures, optimize application performance, and ensure end-user satisfaction. Government initiatives supporting digitalization, the expansion of data centers, and rising cloud service penetration are accelerating market growth. The region is also witnessing increased investment from global technology providers, making monitoring solutions more accessible and affordable for a broad range of enterprises.

Japan Monitoring Tools Market Insight

The Japan monitoring tools market is gaining momentum due to the country’s technologically advanced ecosystem, high enterprise IT spending, and emphasis on operational efficiency. Enterprises prioritize infrastructure, application, and security monitoring to ensure uninterrupted operations, particularly in finance, telecom, and manufacturing sectors. The growing adoption of AI, IoT, and cloud technologies further drives demand for intelligent monitoring solutions. In addition, Japan’s focus on innovation, automation, and seamless end-user experience is fostering the rapid deployment of monitoring tools across corporate and industrial applications.

China Monitoring Tools Market Insight

The China monitoring tools market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid IT infrastructure expansion, digital transformation across enterprises, and the rise of cloud and hybrid IT deployments. Organizations are increasingly investing in monitoring tools to manage complex IT environments, optimize performance, and maintain security compliance. Strong domestic technology providers, growing adoption of SaaS platforms, and government support for smart infrastructure initiatives further propel the market. The affordability and accessibility of monitoring solutions, combined with increasing enterprise awareness, are key factors driving China’s leadership in the regional monitoring tools market.

Monitoring Tools Market Share

The monitoring tools industry is primarily led by well-established companies, including:

- Microsoft (U.S.)

- Google (U.S.)

- AWS (U.S.)

- IBM (U.S.)

- Cisco (U.S.)

- Dynatrace (U.S.)

- Splunk (U.S.)

- New Relic (U.S.)

- Logic Monitor (U.S.)

- Paessler AG (Germany)

- Netreo (U.S.)

- ManageEngine (U.S.)

- Idera (U.S.)

- Sematext (U.S.)

- Datadog (U.S.)

- Icinga (Germany)

- Nagios (U.S.)

- Zabbix (Latvia)

- Sentry (U.S.)

- UptimeRobot (Malta)

- Atera (Israel)

- Better Stack (Czech Republic)

- Sumo Logic (U.S.)

- Checkmk (Germany)

- Exporise (U.S.)

- ITRS (U.K.)

- Riverbed Technology (U.S.)

- Nlyte Software (U.S.)

Latest Developments in Monitoring Tools Market

- In June 2025, Ultrahuman launched a home device for environmental health monitoring, extending AI-driven observability into the consumer wellness segment. This development represents a major expansion of the monitoring tools market beyond enterprise IT, demonstrating how real-time data collection and AI analytics can empower individuals to track environmental and health metrics. It opens new avenues for consumer-focused monitoring solutions, encourages integration with smart home and wearable devices, and highlights the potential for cross-industry applications of AI observability. The move also indicates growing convergence between IT monitoring technologies and personal wellness management, expanding the market’s reach

- In April 2025, Dynatrace signed a multi-year collaboration with AWS to enhance AI-powered cloud monitoring and real-time performance assessments. This partnership strengthens cloud observability solutions by combining Dynatrace’s AI-driven insights with AWS’s scalable cloud infrastructure. Enterprises gain more accurate anomaly detection, predictive analytics, and faster troubleshooting capabilities, improving operational efficiency and reducing downtime. The collaboration also accelerates adoption of cloud-native monitoring solutions, reinforcing the trend of integrated AI and cloud services in the monitoring tools market and enabling organizations to optimize complex hybrid and multi-cloud environments

- In March 2025, Cisco finalized its USD 28 billion acquisition of Splunk, aiming to integrate observability and security at planet-scale. This strategic move allows Cisco to provide end-to-end solutions that combine performance monitoring with threat detection, addressing growing enterprise needs for unified visibility across IT and security landscapes. The acquisition drives market consolidation, accelerates innovation in AI-enabled monitoring platforms, and positions Cisco as a key player in large-scale observability. Enterprises benefit from streamlined workflows, improved incident response, and comprehensive analytics, further emphasizing the importance of integrated monitoring and security solutions

- In February 2025, BMC Software acquired Netreo to incorporate full-stack observability into its Helix platform, leveraging OpenTelemetry for enhanced infrastructure and application visibility. This development strengthens BMC’s portfolio by enabling proactive monitoring of IT systems, predictive problem resolution, and better resource optimization. It also highlights the market’s increasing focus on open standards and interoperability, which simplify integration with existing enterprise systems. By offering full-stack monitoring, BMC addresses the growing demand for comprehensive observability, operational efficiency, and real-time insights across hybrid IT environments

- In January 2025, New Relic introduced advanced AI-driven predictive analytics for application performance monitoring, allowing enterprises to anticipate system bottlenecks and automate remediation processes. This innovation enhances operational agility, reduces downtime, and improves user experience across digital platforms. By leveraging AI to proactively manage application performance, New Relic reinforces the market trend of intelligent, autonomous monitoring solutions. It also encourages broader adoption of predictive analytics in both cloud-native and on-premises environments, highlighting the increasing role of AI in transforming monitoring tools into strategic business enablers

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.