Global Ocular Pain Intracameral Treatment Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

22.33 Million

USD

36.15 Million

2024

2032

USD

22.33 Million

USD

36.15 Million

2024

2032

| 2025 –2032 | |

| USD 22.33 Million | |

| USD 36.15 Million | |

|

|

|

|

Global Ocular Pain Intracameral Treatment Market Segmentation, By Drug Class (NSAIDs, Corticosteroids, Local anesthetics, Antibiotics, Analgesic combinations, and Sustained-release implants), Clinical Indication (Post-operative ocular pain, Inflammatory condition, Corneal abrasion, Infectious pain, and neuropathic ocular pain), Delivery (Single-use vials, Pre-filled syringes, Biodegradable implants/depots, and nano-formulations), End User (Hospitals, Ambulatory Surgery Centers, Specialty eye clinics, and Office-based ophthalmic surgeons) Distribution Channel (Hospital procurement, Retail pharmacy, Direct sales to institutions, and Online)- Industry Trends and Forecast to 2032

Ocular Pain Intracameral Treatment Market Size

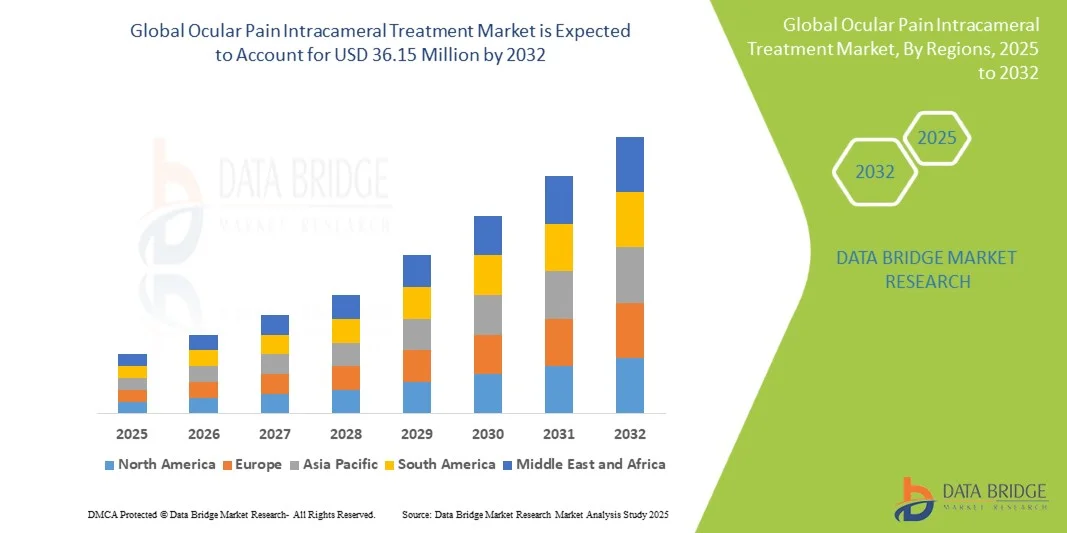

- The global ocular pain intracameral treatment market size was valued at USD 22.33 million in 2024 and is expected to reach USD 36.15 million by 2032, at a CAGR of 6.21% during the forecast period

- The market growth is largely driven by the increasing volume of ophthalmic surgeries, particularly cataract procedures, coupled with rising adoption of intracameral formulations that deliver targeted and sustained pain relief with fewer systemic side effects

- Furthermore, growing demand for safer, more effective, and patient-compliant solutions is positioning intracameral therapies as a preferred choice in post-operative ocular pain management. These factors together are accelerating the adoption of advanced ocular drug delivery, thereby significantly boosting the market’s expansion

Ocular Pain Intracameral Treatment Market Analysis

- Intracameral treatments, delivering drugs directly into the anterior chamber of the eye, are becoming increasingly important in post-operative ocular pain management due to their targeted efficacy, reduced systemic side effects, and ability to enhance patient comfort following ophthalmic procedures such as cataract surgery

- The rising demand for these therapies is primarily driven by the global increase in surgical volumes, growing preference for minimally invasive pain management solutions, and advancements in sustained-release formulations designed for longer therapeutic effect and fewer follow-up interventions

- North America dominated the ocular pain intracameral treatment market with the largest revenue share of 40.3% in 2024, supported by high cataract surgery rates, favorable reimbursement structures, and the presence of leading ophthalmic pharmaceutical and device companies, with the U.S. showing strong uptake of FDA-approved intracameral formulations

- Asia-Pacific is expected to be the fastest-growing region in the ocular pain intracameral treatment market during the forecast period, fueled by expanding healthcare infrastructure, a rapidly aging population, and increasing accessibility of advanced ophthalmic care in countries such as China and India

- Corticosteroid segment dominated the market with a share of 42% in 2024, driven by their proven anti-inflammatory and analgesic efficacy in post-operative settings, along with growing surgeon preference for controlled, single-dose administration during ocular surgery

Report Scope and Ocular Pain Intracameral Treatment Market Segmentation

|

Attributes |

Ocular Pain Intracameral Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ocular Pain Intracameral Treatment Market Trends

Advancement in Sustained-Release and Targeted Drug Delivery

- A significant and accelerating trend in the global ocular pain intracameral treatment market is the development of sustained-release and next-generation intracameral drug delivery systems, designed to improve patient compliance, surgical efficiency, and long-term therapeutic outcomes

- For instance, DEXTENZA (Ocular Therapeutix) provides a bioresorbable intracanalicular insert delivering dexamethasone for up to 30 days, eliminating the need for frequent post-operative eye drops. Similarly, emerging nanoparticle- and liposome-based intracameral formulations are being developed to enhance drug penetration and durability

- These innovative delivery systems not only improve efficacy but also minimize risks of dosing errors and reduce dependency on patient adherence to topical drop regimens, which has long been a challenge in post-surgical ocular pain management

- Sustained-release technologies are also enabling combination therapies, such as corticosteroid–antibiotic blends, that simplify treatment protocols and decrease the risk of infection or inflammation following cataract and refractive surgeries

- This trend towards more controlled, long-acting, and patient-friendly intracameral solutions is reshaping expectations for post-operative care in ophthalmology. Consequently, key players are investing in biodegradable implants, depot injections, and AI-assisted formulation research to enhance clinical decision-making and personalized treatment strategies

- The demand for advanced intracameral treatments that reduce follow-up care and provide superior patient outcomes is growing rapidly across hospitals, ambulatory surgery centers, and specialty clinics, driving strong innovation and adoption in the market

Ocular Pain Intracameral Treatment Market Dynamics

Driver

Rising Ophthalmic Surgical Volumes and Shift Toward Single-Dose Post-Operative Care

- The increasing prevalence of cataracts and other age-related eye disorders, coupled with the rising number of surgical interventions worldwide, is a major driver fueling demand for intracameral pain treatments

- For instance, cataract surgeries are projected to surpass 30 million annually worldwide by 2030, creating substantial opportunities for single-dose intracameral solutions that offer controlled analgesia and anti-inflammatory benefits

- Intracameral therapies align with the growing clinical preference for reducing reliance on post-operative topical drops, offering surgeons a reliable and time-efficient option that ensures consistent drug delivery at the point of care

- Furthermore, supportive regulatory pathways, coupled with favorable reimbursement in developed markets such as the U.S. and Europe, are reinforcing adoption and encouraging investments in novel formulations

- The convenience of one-time administration during surgery, improved patient adherence, and better clinical outcomes are key factors propelling adoption of intracameral therapies in ophthalmology worldwide

Restraint/Challenge

High Development Costs and Stringent Regulatory Approvals

- A significant challenge for the ocular pain intracameral treatment market lies in the high cost of research, clinical trials, and compliance with stringent regulatory standards governing intraocular therapies

- For instance, gaining FDA or EMA approval for intracameral drug delivery requires extensive safety and efficacy data due to the direct administration into the eye, raising entry barriers for smaller companies

- In addition, the premium pricing of advanced sustained-release implants and novel intracameral products compared to traditional topical drops can limit uptake, particularly in price-sensitive regions where healthcare budgets are constrained

- Adoption is further challenged by surgeon training requirements and potential concerns regarding intraocular complications if products are not administered correctly

- Overcoming these barriers through cost-effective innovations, wider education of ophthalmic professionals, and demonstrating long-term cost savings through reduced follow-up care and improved patient adherence will be vital for sustained market growth

Ocular Pain Intracameral Treatment Market Scope

The market is segmented on the basis of drug class, clinical indication, delivery, end user, and distribution channel.

- By Drug Class

On the basis of drug class, the market is segmented into NSAIDs, corticosteroids, local anesthetics, antibiotics, analgesic combinations, and sustained-release implants. Corticosteroids dominated the market in 2024 with the largest revenue share of 42%, driven by their powerful anti-inflammatory and analgesic properties that make them highly effective in managing post-operative ocular pain. Their ability to reduce swelling, redness, and discomfort following cataract and other ocular surgeries has made them a preferred intracameral treatment option worldwide. Increasing approvals of novel corticosteroid formulations, including preservative-free and pre-filled delivery formats, further support their adoption. Hospitals and ambulatory surgery centers rely heavily on corticosteroids as the standard of care due to their predictable efficacy and favorable clinical outcomes. In addition, their wide availability and established inclusion in ophthalmic surgical protocols solidify their leadership in this segment.

Sustained-release implants are expected to witness the fastest CAGR during the forecast period, fueled by the rising demand for long-acting and minimally invasive pain control solutions. These implants reduce the need for repeated administrations, thereby improving patient compliance and treatment outcomes. Their innovative drug delivery mechanisms are being supported by increased R&D investment, making them attractive for chronic pain indications such as post-surgical recovery and neuropathic ocular pain. The potential for tailored release profiles also gives this segment a strong growth trajectory.

- By Clinical Indication

On the basis of clinical indication, the market is segmented into post-operative ocular pain, inflammatory condition, corneal abrasion, infectious pain, and neuropathic ocular pain. Post-operative ocular pain accounted for the largest market share in 2024, as cataract and refractive surgeries remain the most common ophthalmic procedures worldwide. The rise in surgical volumes globally, especially among the aging population, directly drives the demand for effective intracameral pain relief solutions. Intracameral treatments are preferred for providing localized and targeted relief, thereby minimizing systemic side effects. Growing adoption in ambulatory surgical centers further supports this segment’s dominance.

Neuropathic ocular pain is projected to grow at the fastest pace during the forecast period, driven by increasing recognition and diagnosis of complex ocular pain syndromes. Traditional topical therapies often fail to address neuropathic origins, creating strong demand for targeted intracameral approaches. The emergence of advanced drug formulations, coupled with ongoing clinical trials assessing novel therapies, is expanding opportunities in this area. Rising awareness among ophthalmologists about chronic neuropathic conditions adds further momentum to this growth.

- By Delivery

On the basis of delivery, the market is segmented into single-use vials, pre-filled syringes, biodegradable implants/depots, and nano-formulations. Pre-filled syringes dominated the market share in 2024 due to their convenience, reduced risk of contamination, and precise dosing benefits. Ophthalmologists increasingly prefer them for surgical procedures, as they save time in the operating room and improve patient safety. The widespread adoption across hospitals and specialty eye centers, along with compatibility with both NSAIDs and corticosteroids, reinforces their leading market position. In addition, regulatory approvals for multiple pre-filled formulations have expanded their clinical availability.

Nano-formulations are expected to be the fastest-growing delivery method during the forecast period, supported by advancements in nanotechnology and drug bioavailability. Nano-carriers enable enhanced drug penetration into ocular tissues, ensuring sustained release and improved therapeutic outcomes. Their potential to reduce dosing frequency and minimize side effects makes them highly attractive for long-term ocular pain management. Growing R&D partnerships between pharmaceutical companies and nanotech startups are accelerating commercialization in this segment.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgery centers, specialty eye clinics, and office-based ophthalmic surgeons. Hospitals held the largest market share in 2024, given their role as primary centers for ophthalmic surgeries such as cataract and glaucoma operations. The availability of advanced infrastructure, skilled ophthalmic surgeons, and bulk procurement capabilities drive the segment’s dominance. Hospitals also serve as key hubs for clinical trials, which further boosts access to innovative intracameral treatments. Their established reimbursement frameworks contribute significantly to patient adoption and overall demand.

Ambulatory Surgery Centers (ASCs) are projected to record the fastest CAGR during the forecast period, due to the global shift toward outpatient surgical care. ASCs offer cost-effective, high-quality surgical interventions and are increasingly being equipped with advanced ocular surgical tools. Their growing preference among patients for quick recovery and lower costs makes them a strong growth driver. Expanding ophthalmic procedure volumes in ASCs, particularly in North America and Asia-Pacific, further strengthen their future potential.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital procurement, retail pharmacy, direct sales to institutions, and online. Hospital procurement dominated the market in 2024, driven by the bulk purchasing of intracameral treatments for surgical use. Hospitals prefer centralized procurement to ensure consistent supply for high-volume procedures such as cataract surgeries. Strong vendor-hospital partnerships and favorable pricing agreements also support this segment’s leading position. In addition, hospitals act as gatekeepers for introducing new drug formulations, ensuring rapid adoption of innovative treatments.

Online distribution is anticipated to grow at the fastest rate during the forecast period, spurred by the digitalization of healthcare procurement and rising comfort with e-pharmacy platforms. Online channels provide accessibility, transparency in pricing, and efficient delivery of specialty formulations. This trend is particularly evident in emerging economies where healthcare providers and clinics rely on digital platforms to source advanced ophthalmic treatments. Supportive regulatory frameworks for online drug sales further accelerate this growth.

Ocular Pain Intracameral Treatment Market Regional Analysis

- North America dominated the ocular pain intracameral treatment market with the largest revenue share of 40.3% in 2024, supported by high cataract surgery rates, favorable reimbursement structures, and the presence of leading ophthalmic pharmaceutical and device companies, with the U.S. showing strong uptake of FDA-approved intracameral formulations

- Patients and healthcare providers in the region value the efficacy, precision, and safety of intracameral corticosteroids and NSAIDs, which offer superior post-operative pain and inflammation management compared to conventional topical drops

- This adoption is further supported by the presence of leading pharmaceutical innovators, established ophthalmic surgery networks, and increasing demand for single-use, preservative-free, and sustained-release formulations

U.S. Ocular Pain Intracameral Treatment Market Insight

The U.S. ocular pain intracameral treatment market captured the largest revenue share of 79% in 2024 within North America, fueled by the high number of cataract surgeries performed annually and the growing shift toward intracameral corticosteroids and NSAIDs for post-operative pain relief. Surgeons and patients increasingly favor single-dose, preservative-free solutions that reduce the dependency on multiple topical drops, improving compliance and outcomes. Robust FDA approvals and strong R&D pipelines from key ophthalmic companies further strengthen the U.S. position. In addition, the rising elderly population, coupled with established reimbursement frameworks, continues to propel market growth.

Europe Ocular Pain Intracameral Treatment Market Insight

The Europe ocular pain intracameral treatment market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent healthcare standards, strong surgical infrastructure, and the growing demand for efficient post-operative care. European patients and physicians are increasingly drawn to sustained-release and combination therapies that provide long-lasting relief from ocular pain and inflammation. With cataract procedures being fully covered under many public health systems, adoption of intracameral treatments is steadily increasing. Furthermore, ongoing clinical trials and regulatory harmonization across the EU are fostering greater innovation and uptake.

U.K. Ocular Pain Intracameral Treatment Market Insight

The U.K. ocular pain intracameral treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the National Health Service’s (NHS) focus on optimizing surgical efficiency and reducing post-operative complications. Rising concerns over medication adherence have encouraged surgeons to shift toward single-dose intracameral therapies that simplify post-surgical recovery. In addition, the country’s emphasis on innovation in ophthalmology, alongside patient demand for faster recovery and reduced drop burden, supports continued expansion of this segment.

Germany Ocular Pain Intracameral Treatment Market Insight

The Germany ocular pain intracameral treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of ocular health, advanced surgical infrastructure, and strong adoption of cutting-edge ophthalmic treatments. German hospitals and specialty eye clinics are increasingly embracing intracameral corticosteroids and sustained-release depots for their proven efficacy in post-cataract surgery pain management. The country’s strong pharmaceutical research ecosystem and emphasis on quality standards also encourage the integration of innovative, eco-conscious drug delivery solutions that align with patient safety and sustainability expectations.

Asia-Pacific Ocular Pain Intracameral Treatment Market Insight

The Asia-Pacific ocular pain intracameral treatment market is poised to grow at the fastest CAGR of 23.5% during the forecast period of 2025 to 2032, driven by the surge in cataract and refractive surgeries across China, India, and Japan. Rising healthcare expenditure, government initiatives for improving eye care access, and growing awareness of modern ocular pain therapies are boosting adoption. Furthermore, the region is emerging as a hub for clinical trials and cost-effective manufacturing of intracameral formulations, which increases accessibility and affordability for a wider patient base. The combination of demographic growth and surgical demand makes APAC a critical growth frontier.

Japan Ocular Pain Intracameral Treatment Market Insight

The Japan ocular pain intracameral treatment market is gaining momentum due to the country’s rapidly aging population and advanced medical technology ecosystem. Japanese surgeons are early adopters of sustained-release corticosteroid implants and nano-formulation drug delivery, which improve patient adherence and reduce complications. The cultural emphasis on precision medicine and integration of new therapies into existing surgical workflows supports strong adoption. Moreover, the demand for minimally invasive and highly effective ocular pain relief aligns with Japan’s push toward innovative ophthalmic solutions.

India Ocular Pain Intracameral Treatment Market Insight

The India ocular pain intracameral treatment market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s high burden of cataracts, expanding middle-class population, and growing access to affordable eye care. India is witnessing a significant rise in cataract surgery volumes through public health campaigns and private ophthalmic chains, driving adoption of intracameral pain management solutions. The availability of cost-effective formulations, domestic manufacturing capabilities, and government-led vision care initiatives are accelerating growth. In addition, increasing awareness among surgeons and patients about the advantages of single-use and sustained-release options is boosting market penetration.

Ocular Pain Intracameral Treatment Market Share

The Ocular Pain Intracameral Treatment industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- Alcon Inc. (Switzerland)

- Bausch & Lomb (Canada)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Sun Pharmaceutical Industries Ltd. (India)

- Ocular Therapeutix, Inc. (U.S.)

- EyePoint Pharmaceuticals, Inc. (U.S.)

- Aerie Pharmaceuticals, Inc. (U.S.)

- Clearside Biomedical (U.S.)

- Nicox (France)

- Harrow, Inc. (U.S.)

- Laboratoires Théa (France)

- Kowa Company, Ltd. (Japan)

- Mitotech S.A. (Luxembourg)

- Graybug Vision, Inc. (U.S.)

- Kala Pharmaceuticals, Inc. (U.S.)

- Formosa Pharmaceuticals, Inc. (Taiwan)

- IVERIC bio, Inc. (U.S.)

What are the Recent Developments in Ocular Pain Intracameral Treatment Market?

- In April 2025, the FDA expanded approval of Dextenza (dexamethasone ophthalmic insert) to include pediatric patients for the treatment of ocular pain and inflammation following ophthalmic surgery. This marks the first time the insert has been approved for children, providing a sustained-release corticosteroid option that reduces reliance on topical eye drops

- In January 2025, Glaukos Corporation announced commercial launch preparations for iDose® TR, its long-duration intracameral implant delivering travoprost for continuous therapy. The implant, designed for sustained release, represents a key innovation in ocular drug delivery for conditions requiring long-term treatment, including postoperative pain management overlap in some cases

- In September 2024, CRSToday highlighted the rising adoption of intracameral antibiotics in high-volume cataract surgery settings to reduce postoperative infection risks. The report emphasized operational efficiencies and the growing clinical consensus supporting intracameral drug delivery for safer surgical outcomes, with implications for ocular pain management strategies

- In December 2023, EuroTimes reported on a “new era” of ophthalmic drug delivery, with innovations such as intracameral NSAIDs, corticosteroids, and sustained-release implants transforming cataract surgery pain and inflammation management. The article noted increasing clinical adoption of intracameral therapies to replace multiple post-operative topical drops, improving compliance and patient outcomes

- In October 2021, the FDA approved a supplemental indication for Dextenza to treat ocular itching associated with allergic conjunctivitis, expanding its use beyond post-surgical pain and inflammation. This approval reinforced the role of sustained-release intracameral corticosteroid inserts as versatile tools in ocular pain and allergy management

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.