Global Timing Belt Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

7.38 Billion

USD

10.12 Billion

2024

2032

USD

7.38 Billion

USD

10.12 Billion

2024

2032

| 2025 –2032 | |

| USD 7.38 Billion | |

| USD 10.12 Billion | |

|

|

|

|

Global Timing Belt Market Segmentation, By Drive Type (Dry Belts, Chain, and Belt in Oil), Component (Tensioner, Idler Pulleys, Timing Shield/Cover, and Sprocket), Vehicle Type (Passenger Vehicle and Commercial Vehicle), Distribution Channel (OEM and Aftermarket) - Industry Trends and Forecast to 2032

Timing Belt Market Size

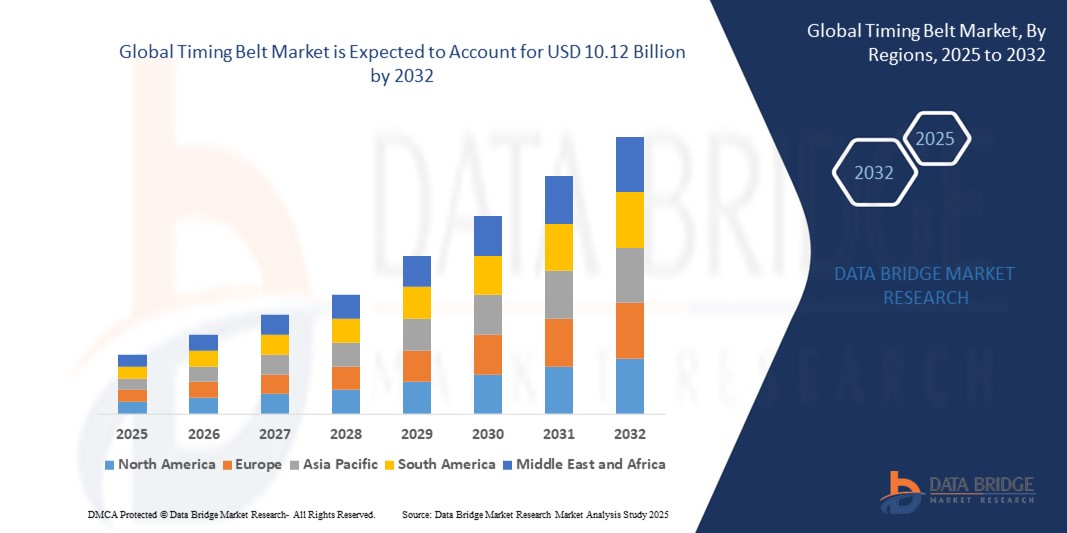

- The global timing belt market size was valued at USD 7.38 billion in 2024 and is expected to reach USD 10.12 billion by 2032, at a CAGR of 4.03% during the forecast period

- The market growth is largely fueled by the increasing demand for fuel-efficient, low-maintenance, and durable engine components across passenger and commercial vehicles. Improvements in engine technology and rising adoption of compact and hybrid engines are driving the need for high-performance timing belts

- Furthermore, expanding automotive production, particularly in emerging economies, coupled with the growing replacement and aftermarket demand, is supporting consistent growth. These factors are accelerating the adoption of advanced timing belt systems, thereby significantly boosting the market’s expansion

Timing Belt Market Analysis

- Timing belts are toothed belts used in internal combustion engines to synchronize the rotation of the crankshaft and camshaft, ensuring precise engine timing. They are critical for maintaining engine efficiency, reducing noise, and minimizing maintenance requirements in modern vehicles

- The escalating demand for timing belts is primarily driven by the need for reliable and durable engine components, the shift toward hybrid and fuel-efficient vehicles, and growing awareness among vehicle owners about preventive maintenance and long-term engine performance

- North America dominated the timing belt market in 2024, due to a robust automotive industry, high production of passenger vehicles, and strong demand for fuel-efficient engine components

- Asia-Pacific is expected to be the fastest growing region in the timing belt market during the forecast period due to rapid industrialization, rising disposable incomes, and surging vehicle production in China, India, and Japan

- Passenger vehicle segment dominated the market with a market share of 64.6% in 2024, due to the sheer volume of global passenger car production and the rising demand for fuel-efficient, low-maintenance engines. Timing belts are extensively used in compact and mid-segment cars due to their cost advantages, quieter performance, and extended replacement intervals, making them a preferred choice among consumers and OEMs. Increasing urbanization and rising middle-class ownership of cars in developing economies further fuel this dominance

Report Scope and Timing Belt Market Segmentation

|

Attributes |

Timing Belt Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Timing Belt Market Trends

Rising Adoption of Hybrid and Fuel-Efficient Vehicles

- The timing belt market is benefitting from the rising adoption of hybrid and fuel-efficient vehicles, where optimized engine performance and lightweight design are increasingly prioritized. Timing belts support smoother engine operation, reduced friction, and higher efficiency, aligning well with evolving powertrain requirements

- For instance, Continental AG has developed advanced timing belt systems compatible with hybrid engines to improve fuel efficiency and durability. These solutions address OEM demands for lightweight and cost-effective components in electrified vehicle platforms

- The shift toward stricter emission standards is accelerating demand for timing belts as they facilitate better combustion control and reduced CO₂ emissions. This role is particularly crucial in compact hybrid vehicles, where efficiency gains directly impact market competitiveness

- In addition, the aftermarket segment is experiencing growth due to rising consumer focus on regular maintenance for hybrid and fuel-efficient vehicles. Timely belt replacement ensures consistent performance and extends the lifespan of advanced vehicles

- The combination of electrification, lightweighting, and efficiency regulations underscores the role of timing belts in meeting hybrid and eco-friendly mobility trends. This alignment is reinforcing their importance in the evolving automotive value chain despite technological competition

- Altogether, the approach of balancing durability with fuel efficiency is defining the shift in timing belt designs. Their growing integration in hybrid powertrains ensures they remain relevant in a market gradually transitioning toward greener automotive solutions

Timing Belt Market Dynamics

Driver

Growing Automotive Production and Replacement Demand

- The global expansion of automotive production is directly driving timing belt demand, with vehicles requiring these components either during OEM assembly or throughout their maintenance lifecycle. Higher ownership rates are reinforcing replacement demand, which remains a consistent revenue stream

- For instance, Gates Corporation, a leader in power transmission systems, supplies timing belts widely across OEM and aftermarket channels, emphasizing replacement schedules that ensure optimal vehicle performance. Their presence highlights the dual reliance on new production and aftermarket services

- Routine maintenance and the necessity of periodic belt replacement are sustaining demand in mature markets such as North America and Europe. At the same time, rising vehicle ownership in Asia-Pacific is boosting OEM requirements and creating new aftermarket opportunities

- In addition, commercial vehicles and light-duty trucks add to the replacement demand due to high engine usage and durability pressures. Timing belts remain critical to managing fleet maintenance and averting costly breakdowns

- Together, higher production volumes and regular replacement needs ensure timing belts remain integral to the automotive ecosystem. Their demand is sustained by vehicle lifecycle needs, reinforcing their central role in both OEM and aftermarket channels globally

Restraint/Challenge

Competition from Timing Chains and Alternative Drive Technologies

- The timing belt market faces growing challenges from increasing adoption of timing chains and alternative drive technologies. Timing chains, known for durability and lower maintenance frequency, are being preferred by several automakers in newer vehicle designs

- For instance, Toyota and BMW have expanded the use of timing chains in selected engines, citing advantages in durability and consumer appeal due to reduced replacement intervals compared to timing belts. This trend is reshaping market dynamics in some premium segments

- Hybrid powertrains and electric vehicles also present challenges, as alternative motor drive systems reduce or eliminate reliance on timing belts. This shift places long-term pressure on timing belt relevance in fully electrified mobility transitions

- In addition, consumer awareness of longevity benefits has tilted preferences toward timing chains in certain regions. Combined with OEM preferences for lower lifetime maintenance costs, this is impacting overall timing belt adoption trajectories

- Overcoming these challenges requires manufacturers to innovate by improving belt materials, enhancing resistance to wear, and marketing belts as lightweight and cost-effective alternatives. Sustained relevance will depend on balancing innovation with evolving drive technology trends in the automotive industry

Timing Belt Market Scope

The market is segmented on the basis of drive type, component, vehicle type, and distribution channel.

- By Drive Type

On the basis of drive type, the timing belt market is segmented into dry belts, chain, and belt in oil. The dry belts segment dominated the largest market revenue share in 2024, driven by its cost-effectiveness, lightweight construction, and widespread use in passenger cars. Dry belts are preferred by automakers for their quiet operation, low frictional losses, and extended replacement cycles, which enhance vehicle efficiency. Their compatibility with modern engines and increasing adoption in compact and mid-sized vehicles further strengthens their position in the market.

The belt in oil segment is anticipated to witness the fastest growth rate from 2025 to 2032, owing to its superior durability and ability to operate in high-performance environments. By being immersed in engine oil, these belts experience reduced wear, improved heat resistance, and enhanced service life compared to traditional dry belts. Automakers are increasingly integrating belt-in-oil systems to achieve better fuel efficiency and reduced emissions in compliance with global environmental regulations. Growing demand for advanced, long-lasting solutions in premium and performance vehicles is driving their adoption rapidly.

- By Component

On the basis of component, the timing belt market is segmented into tensioner, idler pulleys, timing shield/cover, and sprocket. The tensioner segment held the largest market revenue share in 2024, as it plays a critical role in maintaining optimal belt tension and ensuring smooth engine operation. Demand for tensioners is consistently high due to their necessity in extending belt life, reducing vibrations, and preventing slippage in combustion engines. With rising production of passenger and commercial vehicles worldwide, tensioners remain a vital component supporting engine reliability.

The idler pulleys segment is projected to register the fastest CAGR from 2025 to 2032, supported by their growing use in high-performance engines requiring precise alignment and load distribution. Idler pulleys are integral to enhancing timing belt efficiency by reducing friction and maintaining balance across the system. Increasing consumer demand for high-power output vehicles and the growing adoption of advanced pulley materials, such as thermoplastics and high-strength composites, are contributing to their accelerated market growth.

- By Vehicle Type

On the basis of vehicle type, the timing belt market is segmented into passenger vehicles and commercial vehicles. Passenger vehicles dominated the market revenue share of 64.6% in 2024, attributed to the sheer volume of global passenger car production and the rising demand for fuel-efficient, low-maintenance engines. Timing belts are extensively used in compact and mid-segment cars due to their cost advantages, quieter performance, and extended replacement intervals, making them a preferred choice among consumers and OEMs. Increasing urbanization and rising middle-class ownership of cars in developing economies further fuel this dominance.

Commercial vehicles are expected to witness the fastest growth rate from 2025 to 2032, propelled by the expansion of logistics, construction, and heavy-duty transportation industries worldwide. Timing belts in commercial vehicles are increasingly being engineered to withstand high loads and extended operational hours, driving their adoption in trucks, buses, and vans. The ongoing electrification of commercial fleets is also supporting innovation in belt systems compatible with hybrid and fuel-efficient engines, thereby boosting market growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the timing belt market is segmented into OEM and aftermarket. The OEM segment accounted for the largest market revenue share in 2024, driven by strong partnerships between timing belt manufacturers and global automotive companies. Automakers prefer sourcing directly from OEM suppliers to ensure consistent quality, compliance with technical standards, and optimized integration into engine systems. The rising demand for new passenger and commercial vehicles worldwide continues to strengthen OEM dominance.

The aftermarket segment is forecasted to grow at the fastest pace from 2025 to 2032, supported by the growing vehicle parc and increasing need for belt replacements due to wear and tear. Consumers often turn to aftermarket solutions for cost-effective replacements and a wide variety of options across brands and performance levels. The rising average age of vehicles, especially in emerging economies, coupled with consumer awareness of preventive maintenance, is accelerating demand for aftermarket timing belts and related components.

Timing Belt Market Regional Analysis

- North America dominated the timing belt market with the largest revenue share in 2024, driven by a robust automotive industry, high production of passenger vehicles, and strong demand for fuel-efficient engine components

- Consumers in the region prioritize performance, durability, and low-maintenance solutions, making timing belts a preferred choice in modern vehicle designs

- This dominance is further reinforced by advanced R&D capabilities, established automotive OEMs, and a strong aftermarket presence, which ensure widespread adoption and replacement demand across both passenger and commercial vehicles

U.S. Timing Belt Market Insight

The U.S. timing belt market captured the largest revenue share in 2024 within North America, fueled by the country’s extensive automobile production and the significant size of its vehicle parc. Rising consumer preference for quiet, efficient, and cost-effective timing systems is driving adoption. A mature aftermarket network and the increasing average age of vehicles are accelerating replacement demand. Moreover, the U.S. market benefits from continuous technological upgrades by OEMs and component suppliers, ensuring sustained growth in both new vehicle integration and aftermarket sales.

Europe Timing Belt Market Insight

The Europe timing belt market is projected to expand at a substantial CAGR throughout the forecast period, primarily supported by stringent emission regulations and the region’s strong focus on fuel-efficient engine designs. The shift toward lightweight and durable belt technologies is encouraging adoption across passenger cars and light commercial vehicles. Rising demand for low-noise and long-life timing belts is also strengthening the market. Europe’s strong automotive base, particularly in Germany, Italy, and France, further contributes to consistent market growth.

U.K. Timing Belt Market Insight

The U.K. timing belt market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a combination of rising vehicle ownership and steady demand for aftermarket replacements. The country’s large base of passenger cars, coupled with increasing consumer awareness of preventive maintenance, supports consistent replacement cycles. The transition toward smaller, fuel-efficient engines in the U.K. automotive sector is also fostering greater adoption of timing belts over chains.

Germany Timing Belt Market Insight

The Germany timing belt market is expected to expand at a considerable CAGR, fueled by its position as one of Europe’s largest automotive manufacturing hubs. German automakers’ emphasis on precision engineering and advanced materials directly influences demand for durable, high-performance timing belts. In addition, Germany’s growing adoption of hybrid and fuel-efficient vehicle platforms is stimulating innovation in timing belt technology. The country’s strong aftermarket and export-oriented auto sector reinforce its leading role in Europe.

Asia-Pacific Timing Belt Market Insight

The Asia-Pacific timing belt market is poised to grow at the fastest CAGR during 2025–2032, driven by rapid industrialization, rising disposable incomes, and surging vehicle production in China, India, and Japan. Expanding middle-class ownership of cars and the rising preference for cost-effective, fuel-efficient vehicles are accelerating market demand. The region’s role as a global manufacturing hub for automotive components ensures affordability and widespread availability, further broadening market adoption across both OEM and aftermarket channels.

Japan Timing Belt Market Insight

The Japan timing belt market is gaining traction due to the country’s advanced automotive sector, strong culture of innovation, and emphasis on energy efficiency. Japanese automakers are increasingly deploying timing belts in hybrid and compact vehicle models to achieve fuel economy and low emissions. Growing consumer demand for quieter and smoother engine performance is also fueling adoption. With a mature but technologically advanced market, Japan continues to influence innovation and global trends in timing belt applications.

China Timing Belt Market Insight

The China timing belt market accounted for the largest share in Asia-Pacific in 2024, supported by massive vehicle production, rapid urbanization, and the expanding middle class. Timing belts are widely adopted in passenger and commercial vehicles due to their cost-effectiveness and compatibility with small, efficient engines. China’s strong domestic supply chain and extensive aftermarket network enhance availability and affordability. Government support for automotive manufacturing and the push for fuel-efficient mobility solutions are key growth accelerators in the Chinese market.

Timing Belt Market Share

The timing belt industry is primarily led by well-established companies, including:

- B&B Manufacturing (U.S.)

- ContiTech (U.S.)

- The Carlstar Group (U.S.)

- Gates Corporation (U.S.)

- J.K. Fenner Limited (India)

- ACDelco (U.S.)

- Federal-Mogul Motorparts Corporation (U.S.)

- Bando USA (U.S.)

- Dayco (U.S.)

- Ningbo Beidi Synchronous Belt (China)

- Goodyear SKF (U.S.)

- Ningbo Fulong Synchronous Belt (China)

- MAHLE Aftermarket (Germany)

- Tsubaki (Japan)

- Continental (Germany)

- IWIS Motorsysteme (Germany)

- SKF (Sweden)

- BorgWarner (U.S.)

- Tsubakimoto Chain (Japan)

Latest Developments in Global Timing Belt Market

- In June 2025, Dayco introduced its revolutionary Integrated Belt-Drive Transmission (iBTS) at Eurobike in Frankfurt. This innovative system combines a specially designed belt profile with sprockets of identical width, delivering highly efficient power transfer to the wheel. The iBTS is engineered for e-bike applications, offering enhanced durability and performance. This launch underscores Dayco's commitment to advancing drivetrain technologies in the electric mobility sector and positions the company as a leader in high-performance, sustainable belt drive solutions

- In April 2025, Gates Corporation expanded its product offerings by introducing Timing Chain Kits to the aftermarket. This development allows independent distributors to supply original equipment-quality timing solutions for all types of drive systems. The inclusion of these kits strengthens Gates’ presence in the aftermarket sector, providing customers with reliable and comprehensive timing solutions and ensuring continued demand for Gates products in vehicle maintenance and replacement cycles

- In February 2025, Continental commenced the expansion of its plant in San Luis Potosí, Mexico, by constructing a new 2,400-square-meter facility. This expansion incorporates advanced manufacturing technologies to optimize production efficiency, improve component durability, and reduce operational costs. The investment strengthens Continental’s manufacturing capabilities in North America, enabling it to better serve the automotive sector and meet the growing demand for high-quality timing belts and related components

- In January 2025, Dayco completed the acquisition of Sati S.p.A., an Italian manufacturer specializing in automotive timing belts. This acquisition allows Dayco to expand its European footprint and product portfolio, combining Sati’s manufacturing expertise with Dayco’s global distribution network. The move strengthens Dayco’s competitive position in the European market, enhances its OEM relationships, and ensures a broader range of high-quality timing belt solutions for both passenger and commercial vehicles

- In June 2024, Dayco entered into a strategic partnership with a leading European e-bike drive manufacturer to develop advanced timing belts for e-bike applications. This collaboration aims to replace traditional gear-driven systems with durable, low-maintenance belt drive solutions. By targeting the growing e-bike market, Dayco can leverage the trend toward sustainable mobility while increasing its market share in electric mobility component

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.