Global Trade Management Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

4.10 Billion

USD

8.20 Billion

2024

2032

USD

4.10 Billion

USD

8.20 Billion

2024

2032

| 2025 –2032 | |

| USD 4.10 Billion | |

| USD 8.20 Billion | |

|

|

|

|

Global Trade Management Market Segmentation, By Component (Solutions, Services), Deployment Model (0n-Premises, Cloud), Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), End User (Transportation and Logistics, Government and Public, Healthcare and Life Sciences, Aerospace and Defense, Manufacturing, Consumer Goods and Retail, Energy and Utilities, Others)- Industry Trends and Forecast to 2032

Trade Management Market Size

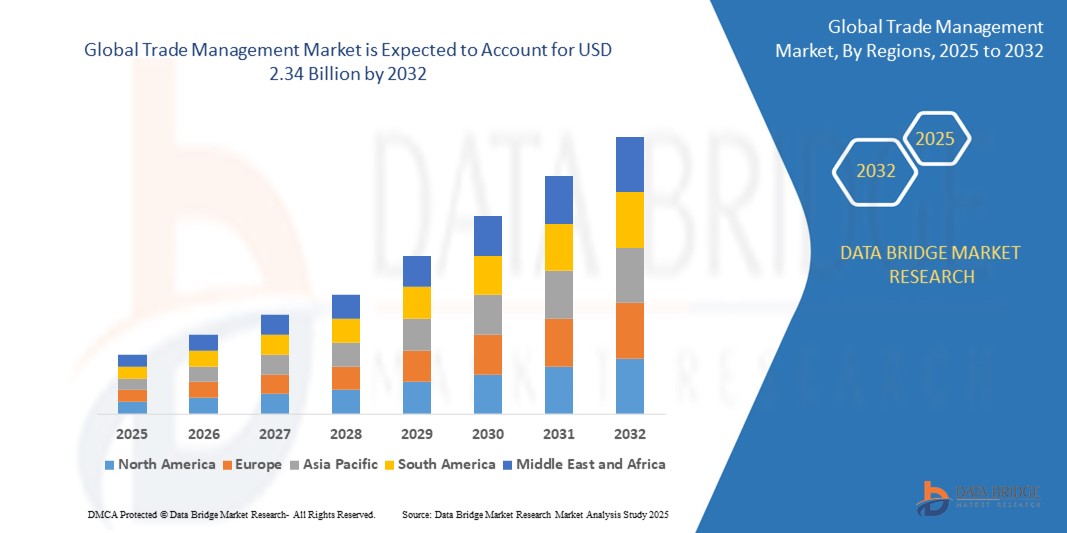

- The Global Trade Management market size was valued atUSD 1.20 billion in 2024and is expected to reachUSD 2.34 billion by 2032, at aCAGR of 8.71%during the forecast period

- This growth is driven by factors such as the rapidly increasing investments in global logistics infrastructures across the world

Trade Management Market Analysis

- Trade management is basically a process of managing the trade in such a way that it make the most of the profit and lessen the risk of the suppliers and the buyers concerned in the trade process

- The trade management also helps in automating the procedures related to regulatory compliance, customs, global logistics and trade financing and helps in managing the global trade resourceful

- North America leads the global trade management market, driven by the presence of a highly developed logistics sector, advanced IT infrastructure, and strong regulatory frameworks governing international trade and customs compliance

- The Asia-Pacific region is expected to witness the fastest growth in the global trade management market, supported by expanding cross-border trade, the rise of e-commerce, and government-led trade facilitation initiatives

- The services segment is expected to dominate the global trade management market in 2025 due to the increasing need for expert guidance, system integration, and support in navigating complex international trade regulations. As businesses expand across borders, they rely heavily on managed services and consulting to ensure compliance, reduce risk, and streamline their trade operations

Report Scope and Trade Management Market Segmentation

|

Attributes |

Trade Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Trade Management Market Trends

“Integration of AI, Blockchain, and Automation in Trade Compliance”

- A significant trend shaping the global trade management market is the growing integration of artificial intelligence (AI), blockchain, and robotic process automation (RPA) into global trade operations.

- These technologies are revolutionizing trade workflows by automating manual compliance checks, predicting disruptions, and providing secure, transparent tracking of shipments across international borders.

- For instance, In February 2025, Maersk and IBM expanded their blockchain-powered platform TradeLens across major European ports, enabling automated data sharing and real-time tracking of container movements, which significantly reduced clearance times and improved customs compliance accuracy.

- Additionally, AI-powered analytics platforms are being used to optimize tariff classification, screen for trade embargoes, and improve supply chain forecasting — ultimately enhancing operational efficiency and compliance accuracy.

Trade Management Market Dynamics

Driver

“Global Expansion of E-Commerce and Cross-Border Trade”

- The rapid growth of e-commerce and cross-border digital marketplaces is a major driver fueling the demand for global trade management solutions. As businesses reach new international customers, the need for efficient, scalable, and automated trade operations is becoming critical.

- Online retailers and direct-to-consumer brands must navigate complex global shipping logistics, import/export compliance, and country-specific tax and duty structures — challenges that trade management platforms are designed to solve.

- The rise in small parcel shipments, multi-modal transportation, and drop-shipping models is further driving the need for centralized, cloud-based trade systems to manage documentation, customs declarations, and trade compliance.

For instance,

- March 2025, Swap, an AI-powered e-commerce logistics startup, secured $40 million in Series B funding to enhance its platform. The investment aims to streamline cross-border shipping, order tracking, return management, and inventory forecasting for direct-to-consumer brands. Swap's AI-driven tools assist brands in managing demand and improving operational efficiency, positioning them as a key player in the cross-border e-commerce logistics space.

- The continuous expansion of global e-commerce is expected to further boost the adoption of trade management systems that offer faster customs clearance, streamlined logistics, and end-to-end supply chain visibility.

Opportunity

“Digitalization of Customs and Trade Facilitation Initiatives”

- The ongoing digital transformation of customs operations and government-led trade facilitation programs present a major opportunity for the global trade management market

- Many countries are adopting electronic single window systems, digitized customs procedures, and API-based trade submission platforms to reduce bureaucracy and improve efficiency in cross-border trade

- These initiatives are creating demand for trade management software that can seamlessly connect with government portals, automate regulatory filings, and track trade documents electronically

For instance,

- In 2025, the World Trade Organization reported that over 70 countries had implemented digital single window systems, significantly reducing the time and cost of international shipments

- Vendors offering solutions that align with these digital trade infrastructure upgrades especially with built-in compliance and e-filing capabilities are well-positioned to capitalize on this opportunity in both developed and emerging markets.

Restraint/Challenge

“High Implementation Costs and Integration Challenges”

- One of the major restraints hindering the growth of the trade management market is the high initial cost and complexity involved in implementing and integrating these systems with existing enterprise resource planning (ERP) and logistics solutions.

- Many organizations, especially SMEs, struggle with the financial and technical burden of upgrading their trade systems to meet international compliance standards.

- Additionally, interoperability issues between legacy systems and new cloud-based trade platforms can lead to delays, data silos, and inefficiencies during the migration process.

For instance,

- in May 2024, the UK government's initiative to develop a post-Brexit border system encountered significant delays and IT issues, causing project costs to rise to at least $6 billion USD. The program faced technological challenges, unrealistic timelines, and a lack of integrated planning across governmental departments. USD 127 million contract awarded to Deloitte to deliver the first part of the USD 349 million Single Trade Window program was several months behind schedule due to system compatibility issues and lack of internal IT support.

- These challenges can slow adoption, particularly in developing economies or among smaller enterprises with limited budgets and digital maturity, thereby restraining market expansion in certain segments

Trade Management Market Scope

The market is segmented on the basis deployment, type, application, enterprise type, industry .

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Model |

|

|

By Organization Size

|

|

|

By End User

|

|

In 2025, the services is projected to dominate the market with a largest share in component segment

The services segment is expected to dominate the global trade management market in 2025 due to the increasing need for expert guidance, system integration, and support in navigating complex international trade regulations. As businesses expand across borders, they rely heavily on managed services and consulting to ensure compliance, reduce risk, and streamline their trade operations.

The cloud is expected to account for the largest share during the forecast period in deployment model segment

The cloud segment is expected to dominate the global trade management market in 2025, driven by its scalability, cost-efficiency, and ease of access across geographically dispersed operations. As global trade becomes more complex and dynamic, enterprises are increasingly shifting to cloud-based platforms to gain real-time visibility, automate compliance tasks, and quickly adapt to regulatory changes.

Trade Management Market Regional Analysis

“North America Holds the Largest Share in the Trade Management Market”

- North America leads the global trade management market, driven by the presence of a highly developed logistics sector, advanced IT infrastructure, and strong regulatory frameworks governing international trade and customs compliance.

- The United States dominates the regional market due to the high volume of imports and exports, stringent trade regulations such as the U.S. Export Administration Regulations (EAR), and increasing adoption of automation in trade compliance and supply chain processes.

- Additionally, ongoing investments in digitization, trade finance technologies, and the integration of AI and blockchain in customs and compliance workflows are further supporting the growth of the trade management market in North America.

“Asia-Pacific is Projected to Register the Highest CAGR in the Trade Management Market”

- The Asia-Pacific region is expected to witness the fastest growth in the global trade management market, supported by expanding cross-border trade, the rise of e-commerce, and government-led trade facilitation initiatives.

- Major economies such as China, India, Japan, and South Korea are contributing significantly to market growth due to large-scale manufacturing activities and increasing demand for transparent and efficient export-import processes.

- China’s Belt and Road Initiative, along with India’s push toward paperless trade and customs automation under the National Trade Facilitation Action Plan, are creating favorable conditions for the adoption of advanced trade management solutions.

- The region is also witnessing increased participation in free trade agreements (FTAs), prompting businesses to invest in trade compliance tools that ensure alignment with varying international regulations, reduce risk, and optimize global operations.

Trade Management Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Oracle (U.S.)

- Infor (U.S.)

- Expeditors (U.S.)

- CargoWise (Australia)

- Bolero International (U.K.)

- Thomson Reuters (U.S.)

- Livingston International (Canada)

- Aptean (U.S.)

- SAP (Germany)

- Noatum Logistics (Spain)

- E2open (U.S.)

- Descartes (Canada)

- Bamboo Rose (U.S.)

- Shipsy (India)

- AEB (Germany)

- 3rdwave (Canada)

- QAD Precision (U.S.)

- Webb Fontaine (UAE)

Latest Developments in Global Trade Management Market

- In September 2024, Bamboo Rose acquired Foresight Retail, a SaaS-based planning company, to enhance its Product Lifecycle Management (PLM) capabilities. This acquisition integrates bidirectional data movement and workflows, including Planning, PLM, Supplier Relationship Management, Sourcing/Costing, and Order Management, into Bamboo Rose's platform. The move aims to redefine the traditional definition of PLM and offer a more integrated solution for retailers and brands.

- In 2024, Shipsy was recognized as a Niche Player in the Gartner Magic Quadrant for Transport Management Systems. The company has enhanced its global presence by establishing regional headquarters in the Netherlands, UAE, Saudi Arabia, and Indonesia. Shipsy focuses on developing AI powered solutions, including an AI co-pilot named LIA, intelligent route optimization, AI driven allocation engine, advanced analytics, automated multi-carrier management, and freight procurement. These innovations aim to streamline logistics operations and improve supply chain efficiency

- In January 2024, Noatum completed the acquisition of Sese Auto Logistics, the Finished Vehicles Logistics (FVL) business of Grupo Logistico Sese, for EUR 81 million. This acquisition enhances Noatum's position in the European automotive logistics market, providing comprehensive solutions across the entire logistics value chain. The integration of Sese Auto Logistics is expected to contribute significantly to Noatum's growth in the automotive sector.

- In December 2024, Aptean received the Top Software & Technology Solutions award from Food Logistics and Supply & Demand Chain Executive. The award recognizes Aptean's AI powered Food & Beverage ERP solution, which enhances supply chain visibility and offers industry specific insights, metrics, and KPIs. This recognition underscores Aptean's commitment to innovation and its dedication to delivering solutions that empower customers to thrive in the supply chain space.

- In July 2024, SAP launched an updated Trade Management Software featuring enhanced compliance capabilities and AI-driven analytics to improve global trade operations and risk management. This move aligns with SAP's strategy to address increasing complexities in global trade compliance and technological advancements.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.