North America Dental Radiology Equipment Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

1.20 Billion

USD

2.54 Billion

2024

2032

USD

1.20 Billion

USD

2.54 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 2.54 Billion | |

|

|

|

|

North America Dental Radiology Equipment Market Segmentation By Type (Diagnostic Dental Equipment), End-User (Hospitals, Diagnostic Centers, Dental Clinics)- Industry Trends and Forecast to 2032

Dental Radiology Equipment Market Size

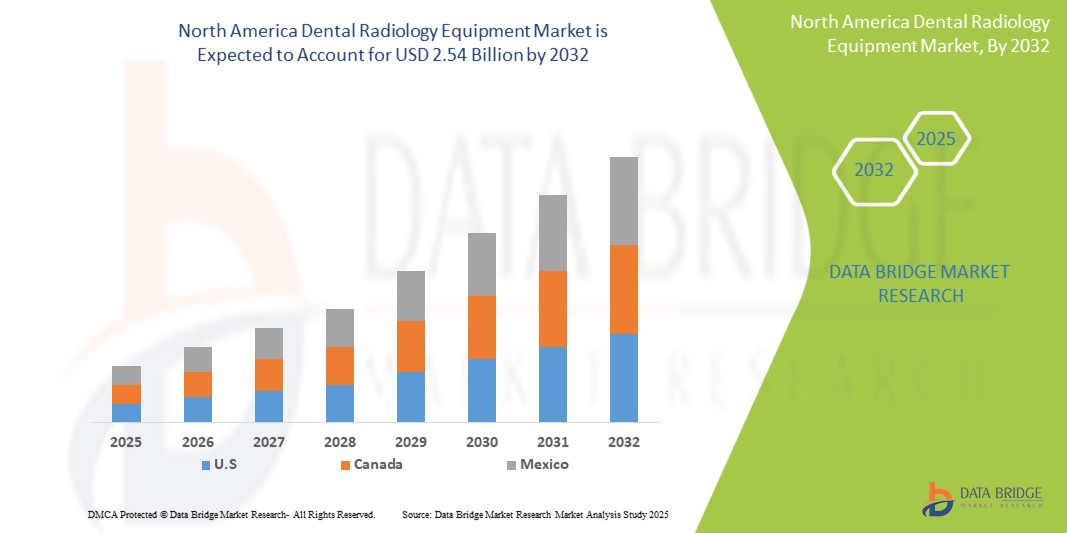

- The North America Dental Radiology Equipment Market was valued atUSD1.20 Billionin 2024and is expected to reachUSD2.54 Billionby 2032,at aCAGR of 7.1%during the forecast period

- The North America Dental Radiology Equipment Market is primarily driven by several key factors. These include the increasing prevalence of dental disorders, such as dental caries, periodontal disease, and oral cancers, which are fueling demand for advanced diagnostic imaging.

North America Dental Radiology Equipment Market Analysis

- Dental radiology equipment plays a critical role in diagnosing a wide range of oral health conditions, including dental caries, periodontal disease, impacted teeth, jaw disorders, and oral cancers. These imaging systems—including intraoral X-rays, extraoral panoramic and cephalometric systems, and advanced 3D imaging technologies such as cone beam computed tomography (CBCT)—enable accurate visualization of dental structures, aiding in effective treatment planning and improved patient outcomes. These tools are widely adopted across dental clinics, hospitals, diagnostic centers, and academic institutions.

- The demand for dental radiology equipment in North America is primarily driven by a rising incidence of dental diseases, increasing awareness of preventive dental care, and a growing elderly population that requires frequent dental evaluations. Additionally, the growing emphasis on cosmetic dentistry and orthodontics, where precise imaging is crucial, is significantly boosting the uptake of dental imaging solutions.

- North America is a leading region in the global dental radiology equipment market, supported by a well-developed healthcare infrastructure, early adoption of advanced technologies, and favorable reimbursement policies. The United States holds a dominant share, driven by a high number of dental professionals, growing dental insurance coverage, and strong investment in digital health and imaging innovations.

- The North American dental radiology equipment market is also shaped by regulatory approvals, including FDA clearances for novel and safer imaging systems. Furthermore, rising healthcare spending, increasing demand for chairside imaging solutions, and advancements in AI-based diagnostics and image-guided surgeries are enhancing diagnostic capabilities. The market is also witnessing increased adoption of mobile and handheld X-ray devices, particularly in remote or mobile dental care settings. Overall, the focus on personalized and precision dentistry is driving the adoption of innovative radiology equipment across the region

Report ScopeDental Radiology EquipmentMarket Segmentation

|

Attributes |

Dental Radiology EquipmentKeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Radiology Equipment Market Trends

“Digital Imaging and 3D Radiology Innovation”

- Advancements in dental imaging—such as cone-beam computed tomography (CBCT), digital panoramic and cephalometric systems—are revolutionizing diagnostics by delivering faster, clearer, and more accurate imaging. These technologies support enhanced visualization of oral structures, enabling better treatment planning in implantology, orthodontics, endodontics, and oral surgery.

- AI-powered dental radiology solutions are improving image analysis, diagnosis accuracy, and clinical decision-making. AI tools are being integrated into radiology software to automate the detection of dental anomalies, caries, bone loss, and more, streamlining the workflow for dental practitioners.

- For instance, the U.S. has seen a surge in the adoption of digital radiography and CBCT systems, fueled by the shift towards paperless workflows, integration with electronic health records (EHRs), and demand for high-resolution imaging in minimally invasive procedures.

- This combination reduced diagnostic time, improved accuracy in implant and orthodontic planning, and streamlined clinical workflows, leading to better patient outcomes and more informed treatment decisions.

Dental Radiology Equipment Market Dynamics

Driver

“High Adoption of Advanced Dental Imaging Technologies”

- The North America Dental Radiology Equipment Market is experiencing significant growth due to the widespread adoption of advanced imaging modalities, particularly digital and 3D imaging systems, for enhanced diagnostic accuracy and treatment planning in dental care.

- Technological innovations such as cone-beam computed tomography (CBCT), digital panoramic and cephalometric imaging, and intraoral sensors are revolutionizing dental diagnostics by offering high-resolution, real-time imaging with reduced radiation exposure.

- Government initiatives in the U.S. and Canada aimed at improving oral health infrastructure and increasing access to advanced dental care are fueling the demand for modern radiology equipment in both public and private dental facilities.

- The integration of imaging technologies into electronic health records (EHR), along with the rising use of AI-based diagnostic tools in dentistry, is improving diagnostic speed, efficiency, and accuracy, thereby driving market growth.

For instance,

- According to the American Dental Association (ADA), CBCT systems have become a preferred modality in implant planning and complex endodontic procedures due to their 3D visualization capabilities.

- In January 2024, Dentsply Sirona announced the launch of a next-generation digital imaging suite in North America, offering faster image processing, enhanced clarity, and seamless integration with CAD/CAM systems

- The ongoing shift toward digital dentistry, supported by investments in clinic modernization and dental IT infrastructure, is further accelerating the adoption of state-of-the-art radiology equipment across North America.

Opportunity

“Integration of Dental Imaging into Digital and Decentralized Care Models”

- The growing transition toward digital and decentralized dental care delivery in North America is opening new opportunities for the adoption of portable, cloud-connected, and AI-integrated dental radiology equipment.

- Demand is rising for advanced imaging solutions that can be seamlessly used in mobile dental units, community health centers, and outpatient settings—enabling broader access to quality dental diagnostics, especially in rural and underserved regions.

- The expansion of teledentistry platforms is also driving the need for digital radiology equipment capable of generating and sharing high-resolution images in real-time, improving remote consultations and treatment planning.

For instance,

- In February 2024, the Canadian Dental Association highlighted the growing use of mobile CBCT and portable intraoral imaging devices to support oral health outreach programs in remote communities.

- Companies such as Planmeca and Carestream Dental have launched compact and wireless imaging systems designed for use in decentralized settings, enhancing diagnostic flexibility and efficiency

- This trend is further bolstered by healthcare providers’ growing focus on same-day diagnostics and treatment workflows, particularly in orthodontics, implantology, and emergency dental care.

- Additionally, the rising availability of cloud-based image storage and analysis tools is fostering the development of integrated radiology platforms, enabling multi-site practices to centralize and streamline imaging data.

Restraint/Challenge

“High Equipment Costs and Regulatory Compliance Barriers”

- One of the major challenges in the North America Dental Radiology Equipment Market is the high cost of advanced imaging systems, such as cone-beam computed tomography (CBCT), panoramic X-ray machines, and digital intraoral scanners. These technologies require significant capital investment, ongoing maintenance, and staff training—posing financial strain on small dental practices and community clinics.

- The stringent regulatory approval processes enforced by agencies like the U.S. Food and Drug Administration (FDA) and Health Canada further add to the complexity and cost of launching new dental radiology devices. These requirements demand extensive clinical validation, safety assessments, and quality certifications.

For instance,

- According to a 2024 analysis by the Dental Trade Alliance (DTA), the average upfront cost of installing a CBCT machine in a private dental clinic can range from USD 100,000 to USD 200,000, making it less accessible for solo practitioners and rural care providers.

- Additionally, compliance with evolving data privacy regulations, such as HIPAA and PHIPA, adds another layer of complexity for digital imaging systems that store or transmit patient data

- These financial and regulatory hurdles can delay product adoption, especially among smaller dental operators, and limit access to modern imaging technologies in less urbanized regions.

- Furthermore, the high pace of technological innovation can lead to faster equipment obsolescence, deterring investment and contributing to disparities in imaging capabilities across the region

Dental Radiology Equipment Market Scope

The market is segmented on the basis, type, end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

ByEnd User |

|

In 2025, the Diagnostic is projected to dominate the market with a largest share in type segment.

The digital X-ray systems in the diagnostic segment are expected to dominate the North America Dental Radiology Equipment Market with the largest share of 46.22% in 2025 due to the high growth of high-resolution, real-time imaging, which significantly enhances diagnostic accuracy and workflow efficiency in dental practices. Digital X-ray systems offer numerous advantages over conventional film-based systems, including faster image acquisition, lower radiation exposure, easy image storage and sharing, and integration with electronic health records (EHRs).

The Dental Clinics is expected to account for the largest share during the forecast period in end user market

In 2025, the dental clinics segment is expected to dominate the market with the largest market share of 54.56% due to its high prevalence and demand for precision. This is attributed to the high volume of outpatient dental procedures, ranging from routine check-ups to orthodontic and endodontic treatments that require precise radiographic evaluation. The growing number of independent and group dental practices, along with rising investments in in-office imaging capabilities, is driving the adoption of compact and user-friendly radiology equipment. Dental clinics are increasingly transitioning to digital and 3D imaging solutions to improve diagnostic precision, reduce turnaround time, and enhance patient engagement.

Dental Radiology Equipment Market Regional Analysis

“U.S. is the Dominant Country in the Dental Radiology Equipment Market”

- The United States dominates the North America Dental Radiology Equipment Market, accounting for the largest share due to its advanced healthcare infrastructure, widespread adoption of digital dentistry, and significant investments in dental technology and research.

- The increasing prevalence of oral health conditions, including periodontal diseases, dental caries, and the growing elderly population, is driving demand for accurate diagnostic tools and imaging solutions in the U.S. The adoption of digital X-ray systems, cone beam computed tomography (CBCT), and 3D imaging has become the norm in both private dental practices and hospital-based dental departments.

- The presence of key industry players, such as Carestream Health, Planmeca, and Sirona Dental Systems, contributes to the region's technological leadership. These companies offer innovative and user-friendly imaging systems designed to enhance diagnostic accuracy and improve patient outcomes.

- Government-backed initiatives and programs aimed at improving oral health awareness and prevention in the U.S. further solidify the country's leadership position in the North American dental radiology equipment market. Additionally, favorable insurance reimbursement policies for advanced imaging techniques are fostering widespread adoption of these technologies.

“Canada is Projected to Register the Highest Growth Rate”

- Canada is expected to register the fastest growth in the North America Dental Radiology Equipment Market. The country's universal healthcare system and increasing focus on preventative care are driving adoption of advanced dental imaging systems.

- Strategic government investments in healthcare infrastructure, particularly oral health initiatives and disease prevention programs, are accelerating the adoption of digital radiology solutions across the country. Additionally, public awareness of the importance of regular dental screenings and diagnostics is contributing to the rising demand for high-quality imaging technologies.

- The growth of dental service organizations (DSOs), which are expanding their presence across the Canadian provinces, is driving the demand for state-of-the-art radiology equipment that supports efficient patient care and high-volume diagnostics. Moreover, collaborations between academic research centers, dental schools, and biotech firms are helping to further the adoption of advanced imaging technologies, especially for orthodontics, implantology, and oral surgery.

- Increased focus on personalized dental care and the adoption of 3D imaging for treatment planning are also accelerating growth in the Canadian dental radiology market

Dental Radiology Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Dentsply Sirona Inc. (U.S.)

- Carestream Dental LLC (U.S.)

- Envista Holdings Corporation (U.S.)

- Midmark Corporation (U.S.)

- Planmeca USA Inc. (Finland)

- Vatech America, Inc (South Korea)

- Acteon Group (France)

- Owandy Radiology Inc (France)

- LED Dental Inc. (U.S.)

- PreXion Inc (Japan)

Latest Developments in Global Dental Radiology Equipment Market

- In August 2024, Carestream Health introduced an innovative digital radiology system designed to offer high-resolution imaging with lower radiation exposure. The system is equipped with advanced sensor technology and user-friendly interfaces, enabling faster imaging and improved patient comfort.

- In July 2024, Planmeca introduced an upgraded Cone Beam Computed Tomography (CBCT) system that combines high-definition 3D imaging with enhanced software tools for treatment planning and surgical guidance. This new system offers superior image quality with reduced exposure to radiation, providing optimal imaging for implantology, orthodontics, and oral surgery

- In May 2024, Sirona Dental Systems launched a revolutionary intraoral X-ray system, which offers improved image resolution and quicker diagnostic workflows. This system features a compact design with wireless capabilities, making it ideal for smaller dental practices and clinics with limited space.

- In April 2024, Vatech launched a portable dental radiography solution aimed at improving dental access in rural and underserved regions. The compact, battery-operated system is designed for mobile dental units and emergency settings, providing high-quality images on-site with reduced radiation exposure.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.