North America Wound Closure Devices Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

15.18 Billion

USD

26.45 Billion

2024

2032

USD

15.18 Billion

USD

26.45 Billion

2024

2032

| 2025 –2032 | |

| USD 15.18 Billion | |

| USD 26.45 Billion | |

|

|

|

|

North America Wound Closure Devices Market, By Device (Adhesives, Staples, Sutures, Mechanical Devices), Application (Burns, Ulcer, Surgical Wounds, Pressure Ulcers, Diabetic Ulcers, Arterial Ulcers), Type of Wound (Acute Wound, Chronic Wound), End User (Hospitals, Community Healthcare Service Providers, Ambulatory Surgical Centers, Home Care), Country (U.S., Canada, Mexico) Industry Trends and Forecast to 2032.

Wound Closure Devices Market Size

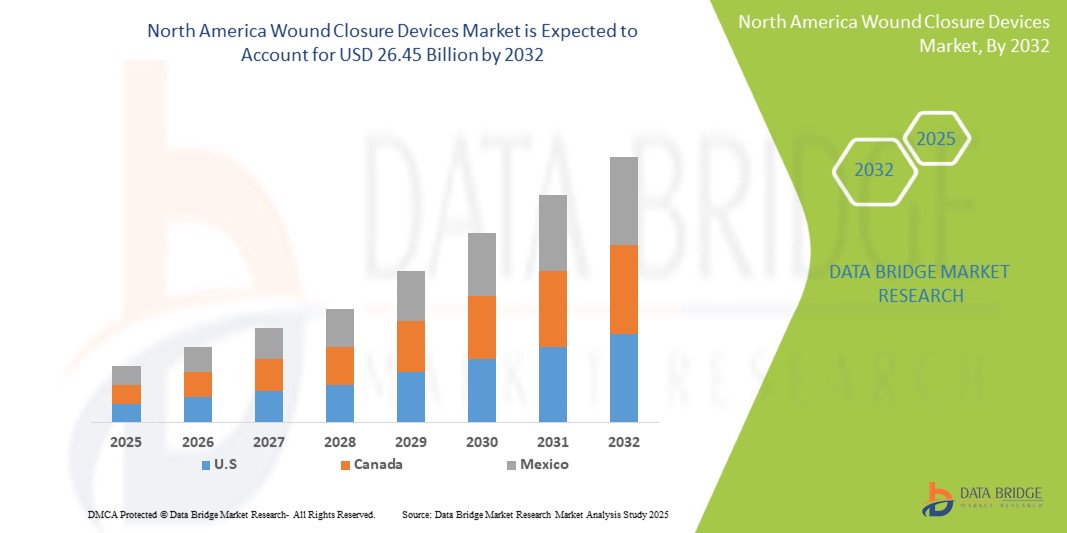

- The North America Wound Closure Devices Market size was valued atUSD 15.18 Billion in 2024and is expected to reachUSD 26.45 Billion by 2032, at aCAGR of 6.49%during the forecast period

- This growth is driven by factors such as the rising number of surgical procedures, increasing incidence of chronic wounds, and technological advancements in wound closure devices.

Wound Closure Devices Market Analysis

- Active wound care products play a critical role in enhancing the wound healing process by supporting cellular activity and tissue regeneration, particularly in chronic and non-healing wounds

- The demand for these products is driven by the increasing prevalence of chronic wounds, growing geriatric population, and rising awareness about advanced wound management solutions

- U.S. is expected to dominate the Active and Advanced Wound Care market due to its strong healthcare infrastructure, high healthcare expenditure, and increasing adoption of innovative wound care therapies

- U.S. is also projected to be the fastest-growing market during the forecast period due to the surge in diabetic foot ulcers, supportive reimbursement policies, and growing investments in wound care R&D

- The Advanced Dressings segment is expected to lead the market with a significant share due to their effectiveness in moisture retention, infection prevention, and acceleration of the healing process in complex wounds

Report Scope andWound Closure Devices Market Segmentation

|

Attributes |

Wound Closure Devices KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wound Closure Devices Market Trends

“Rising Prevalence of Chronic and Surgical Wounds”

- The increasing incidence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, is driving demand for effective closure devices to accelerate healing, minimize infection risk, and reduce hospital stays, especially among the aging population.

- Surgical procedures are rising due to a growing elderly population and lifestyle-related diseases. Post-surgical wound management is critical, and advanced closure devices are essential to support quick recovery and minimize complications like infections and dehiscence.

- Patients suffering from obesity or compromised immune systems face more complications in wound healing. This necessitates innovative closure solutions that offer superior sealing, minimal trauma, and improved outcomes, thereby fueling the adoption of advanced wound closure devices.

Wound Closure Devices Market Dynamics

Driver

Technological Advancements in Closure Techniques

- Emerging technologies such as absorbable staples, bioengineered adhesives, and antimicrobial sutures provide efficient, less invasive wound closure options. These innovations enhance clinical outcomes and patient comfort, encouraging wider use in both hospitals and outpatient settings.

- The integration of wound closure devices with digital monitoring tools enables real-time assessment of healing progress. This improves treatment strategies, reduces readmissions, and supports better decision-making among healthcare professionals, promoting adoption across North America.

- Minimally invasive surgical procedures are increasingly popular, necessitating equally advanced wound closure devices. These tools allow quicker recovery times, reduced scarring, and better cosmetic results, meeting rising patient and provider expectations for high-quality care.

For Instance,

Emerging technologies in wound closure, such as absorbable staples, bioengineered adhesives, and antimicrobial sutures, provide efficient, less invasive options, enhancing clinical outcomes and patient comfort. The integration of digital monitoring tools allows real-time healing assessments, promoting better decision-making and adoption of advanced closure devices in minimally invasive surgeries across North America.

Opportunity

“Rising Ambulatory Surgical Centers (ASCs) and Homecare Trends”

- With the shift toward cost-effective healthcare, Ambulatory Surgical Centers are on the rise. These facilities favor wound closure solutions that are quick to apply, easy to monitor, and adaptable to same-day procedures, offering growth potential for manufacturers.

- The expansion of home healthcare services allows for increased use of user-friendly wound closure devices. Devices like skin adhesives and adhesive strips, which require minimal medical supervision, are in demand among homecare patients across North America.

- Remote patient monitoring combined with easy-to-use closure technologies creates an opportunity for manufacturers to develop smart, self-applicable closure systems. These innovations align with the growing preference for decentralized and patient-centric healthcare delivery models.

For Instance,

- The rise of Ambulatory Surgical Centers (ASCs) is driving demand for quick and adaptable wound closure solutions suited for same-day procedures, presenting growth opportunities for manufacturers. Concurrently, home healthcare services favor user-friendly devices, like skin adhesives, while remote monitoring promotes the development of smart, self-applicable systems, aligning with decentralized healthcare trends.

Restraint/Challenge

“Regulatory Hurdles and Reimbursement Constraints”

- Strict regulatory pathways for approval of wound closure devices in the U.S. and Canada can delay market entry. Developers face rigorous testing and documentation requirements, increasing time-to-market and development costs.

- Reimbursement limitations for newer wound closure technologies restrict hospital and clinic adoption. Without adequate insurance coverage, healthcare providers may be reluctant to switch from traditional methods, hindering widespread deployment of innovative solutions.

- Navigating varying state-level reimbursement rules in the U.S. adds complexity for manufacturers. Inconsistent policies between regions impact market penetration and create operational challenges, especially for small and mid-sized device developers.

For Instance,

- Strict regulatory pathways in the U.S. and Canada delay market entry for wound closure devices due to rigorous testing and documentation requirements. Additionally, reimbursement limitations hinder the adoption of innovative technologies in hospitals and clinics. Varying state-level reimbursement rules further complicate market penetration for small and mid-sized manufacturers, impacting growth.

Wound Closure Devices Market Scope

The market is segmented on the basis By Device, Application, Type of Wound, End User.

|

Segmentation |

Sub-Segmentation |

|

By Device |

|

|

Application |

|

|

Type of Wound

|

|

|

End User |

|

In 2025, theAdhesives is projected to dominate the market with a largest share in application segment

The Adhesives segment is expected to dominate the Wound Closure Devices market with the largest share of 48.38% in 2024 due to increasing demand for non-invasive, easy-to-use wound closure solutions. As a critical component in both surgical and trauma care, advancements in adhesive strength, flexibility, and biocompatibility have significantly improved clinical outcomes and patient comfort. The rising volume of surgical procedures, growing preference for minimally invasive techniques, and increasing healthcare awareness further contribute to the segment’s market dominance.

TheStaples is expected to account for the largest share during the forecast period in technology market

In 2025, the Staples segment is expected to dominate the Wound Closure Devices market with the largest market share of 48.38% due to their efficiency, speed of application, and effectiveness in closing large or complex wounds. As a vital component in surgical wound management, advancements in stapler design, material safety, and precision delivery systems have improved procedural outcomes and reduced operative time. The increasing number of surgical interventions, rising demand for reliable closure methods, and growing adoption of technology-driven surgical tools further contribute to the segment’s market dominance.

Wound Closure Devices Market Regional Analysis

“U.S Holds the Largest Share and highest CAGR in theWound Closure DevicesMarket”

- U.S. dominates and highest CAGR the Wound Closure Devices market, driven by advanced healthcare infrastructure, high volume of surgical procedures, and strong presence of key market players

- The U.S. holds a significant share due to increased demand for minimally invasive wound closure solutions, rising incidence of chronic wounds, and growing preference for faster recovery options

- The availability of well-established reimbursement policies and growing investments in surgical innovation by leading medical device companies further strengthen the market

- In addition, the increasing shift toward outpatient surgeries, integration of smart wound care technologies, and the rising elderly population are fueling market expansion across the region

Wound Closure Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- 3M (U.S.)

- Smith+Nephew (U.K.)

- B. Braun SE (Germany)

- Stryker (U.S.)

- Baxter (U.S.)

- Boston Scientific Corporation (U.S.)

- Frankenman International Ltd. (China)

- CooperSurgical Inc. (U.S.)

- Intuitive Surgical (U.S.)

- MANI, INC. (Japan)

- Artivion, Inc. (U.S.)

- CP Medical (Riverpoint Medical) (U.S.)

- CONMED Corporation (U.S.)

- Genesis Medtech (Singapore)

- Cardinal Health, Inc. (U.S.)

- Essity AB (Sweden)

- Medline Industries, LP (U.S.)

Latest Developments in North America Wound Closure Devices Market

- In June 2021, Ethicon Plus sutures were the first to be approved for use in the NHS by NICE Medical Technologies Guidance as they have been demonstrated to lower the possibility of surgical site infections (SSIs) by over 30%.

- In November 2020, Trubarb, a knotless tissue closure device launched by Healthium, is an efficacious triangular end stopper that removes the need for knotting as compared to a normal suture.

- In March 2020, LiquiBand Plus, developed by Advanced Medical Solutions Limited, was approved by the FDA to heal readily approximated skin margins of wounds after surgical incisions.

- In February 2020, Wego-Stainless Steel suture was approved by the FDA for applications such as abdominal wound closure, hernia repair, and sternal closure by Foosin Medical Supplies Inc., Ltd

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.