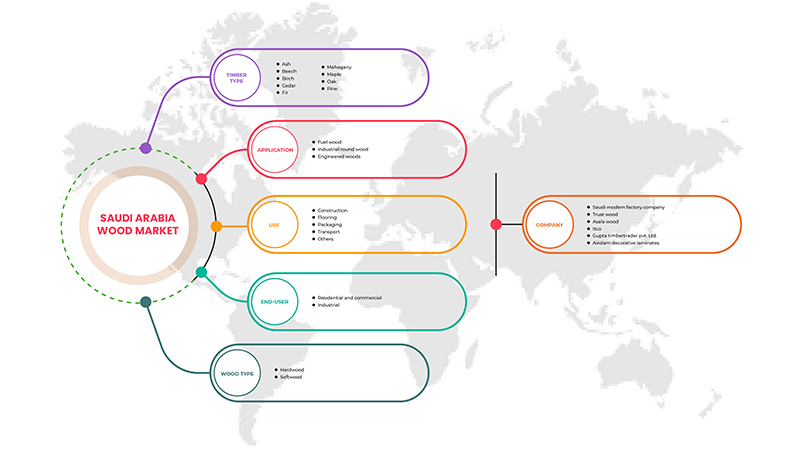

Saudi Arabia Wood Market, By Timber Type (Ash, Beech, Birch, Cedar, Fir, Mahogany, Maple, Oak, Pine), Application (Fuel Wood, Industrial Round Wood, Engineered Woods), Use (Construction, Flooring, Packaging, Transport, Others), End-User (Residential, Commercial, Industrial), Wood Type (Hardwood, Softwood), Industry Trends and Forecast to 2029.

Saudi Arabia Wood Market Analysis and Size

Rising commercial and residential building demand is an important driver for the Saudi Arabia wood market. In addition, the growing uses in packaging and transportation applications are accelerating market growth.

Data Bridge Market Research analyses that the Saudi Arabia wood market is expected to reach the value of USD 4,101.80 million by the year 2029, at a CAGR of 2.2% during the forecast period. Mahogany Accounts for the most prominent timber type segment.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Timber Type (Ash, Beech, Birch, Cedar, Fir, Mahogany, Maple, Oak, and Pine), Application (Fuel Wood, Industrial Round Wood, and Engineered Woods), Use (Construction, Flooring, Packaging, Transport, and others), End-User (Residential and commercial, and Industrial), Wood Type (Hardwood, and Softwood). |

|

Countries Covered |

Saudi Arabia |

|

Market Players Covered |

Saudi Modern Factory Company, Trust Wood, Asala Wood, ITCO, Gupta Timbertrader Pvt. Ltd., and Airolam decorative laminates. |

Market Definition

The wood industry is the industry concerned with forestry, logging, timber trade, and the production of primary forest products and wood products (for instance furniture) and secondary products such as wood pulp for the pulp and paper industry. Some of the largest producers are also among the biggest owners of timberland. The wood industry has historically been and continues to be an important sector in many economies. Wood is relatively light in weight and strong because wood's efficiency for structural purposes has qualities similar to steel. Wood is usually classified as either hardwood from broad-leafed trees, such as Beech and Oak, or softwood from conifers such as Pine and Fir. Because they're replaceable, fast-growing species like Pine trees tend to be more sustainable than slow-growing trees like Oak. Oak forests must be managed carefully to make them sustainable, grown, and harvested correctly, but it can be done.

Engineered wood is generally made from the same hardwoods and softwoods used to manufacture lumber but mixed with additives like adhesives. This type of wood often utilizes waste wood from sawmills and are treated through chemical or heat processes to produce wood that meets size requirements that are hard to find in nature. Engineered wood is used in various applications, from home construction to commercial buildings to industrial products. Saudi Arabia has introduced legal measures to protect its woodlands and forests, and these days more trees are planted than felled. It's great news for the future, with Saudi Arabia's forests actually growing instead of diminishing.

The Market Dynamics of the Saudi Arabia Wood Market Include:

Drivers

- Rising demand in commercial and residential building sectors

Wood and timber are currently commonly utilized in building materials and are quickly replacing concrete and steel as the material of choice due to their lower carbon footprint. Currently, the building sector accounts for 25% of Saudi Arabia's greenhouse gas emissions, and the industry thinks that green building construction may assist cut CO2 emissions and storing carbon. Wood is proven to have the requisite resilience, hardness, durability, and strength while delivering distinct advantages over steel and concrete in commercial, residential, and industrial structures. Timber allows architects and builders to create sustainable, economical, and ecologically friendly structures. For more ambitious projects, wood and lumber are used as building materials. It is a costly material for building construction, and furniture manufactures, such as doors, windows, cabinets, cupboards, shelves, tables, and many others. Timber is also extensively used as plywood (Plywood blocks and plywood boards) and raw wood. Heavy patterned doors and windows are composed of solid wood/timber for strength, toughness, and longevity. As a result of these characteristics and applications, Timber and wood have become major building materials.

- Growing uses in packaging and transportation applications

Wood and timber play an important part in packing and shipping. Wooden packaging has been utilized since ancient times for its great strength and inexpensive cost... In the past, few other materials surpassed wood in terms of packing. However, rising awareness of sustainable growth and environmental preservation aided in reintroducing wood as the primary packaging material. Compared to other materials, the wooden packaging is said to be more stable and ecologically friendly. These materials are long-lasting, renewable, environmentally benign, suitable for heavy objects, and stackable. Wooden packaging material is best suited for sectors dealing with heavy-weight items. It is regarded as the most cost-effective packaging solution due to its great strength and cheap cost.

- Rising importance of light wood material

As sustainable timber, light wood is a potential alternative for building homes, decorations, furniture, exterior design, and products such as paper, picture frames, shelves, cabinets, wardrobes, garden fences, planter boxes, and others. Its key benefit over hardwood is its lightweight and low density. Similarly, light wood species may develop quickly while producing high-quality timber. Lightwood has the potential to be a game changer in the building sector. Because these species grow quickly, one can obtain quickly, high-quality, and sustainable wood and other wood products. As a high-quality timber building material, light wood may give a strategic advantage as a timber business and has a distinctive standing in technical wood goods and modern mass timber construction. Using wood to its full potential allows one to enhance the impact of climate advantages such as CO2 sequestration (forest carbon stock), CO2 storage (carbon in materials), the substitution of high-emission products, and recycling (end of life cycle).

Opportunities

- The thriving commercial sectors are paving the path for wood plastic composites (WPC)

In recent years, Saudi Arabia has seen tremendous expansion in commercial areas such as offices, retail, industrial, healthcare, leisure, and others. To begin with, utilizing actual wood necessitates the removal of trees, which play a critical role in lowering CO2 emissions. Wood is also heavier than plastic, so delivering and transporting genuine wood is more expensive, requiring more fuel and leaving a larger carbon impact. Despite its numerous benefits, it has some detrimental environmental consequences. As people became more concerned about the environment and realized the worth of trees, they began to prefer alternatives to wood. This is where wood plastic composite (WPC) comes in, an excellent replacement for wood with similar qualities and strong environmental advantages.

- Rising investment in R&D and various projects

Saudi Arabia is investing in R&D to diversify its economy. The research, development, and innovation sector aim to boost the kingdom's competitiveness. The RDI plans rely significantly on open innovation and science, including establishing special programs through the center for special residents that will draw experts from across the world and make migration to the kingdom simple. Changes in the Kingdom's long-term plans are driving the Saudi economy, particularly with a growing population that is more accustomed to a digitalized economy. The most crucial is the forward-thinking atmosphere provided by Saudi Vision 2030, a strategy framework initially announced in 2016 to reduce the country's reliance on oil earnings by growing domestic consumption and supporting private-sector development. The government is committed to diversifying its revenue sources away from oil. As a result, it aids in the transition away from plastics and toward wood and timber material items.

Restraints/Challenges

- Availability of substitutes such as plastics and metal products

Engineers have long used wood, metal, and concrete to construct numerous constructions. Timber walks were employed in forest preserves, and park authorities frequently acquired metal seating. Wood was also employed by manufacturers for cribbing. Engineers developed recycled plastic lumber, which is more environmentally friendly, more durable, and less expensive than wood. Although metal, concrete, and wood have several advantages, many people are moving away from wood in a variety of building projects in order to aid the earth's earth and preserve our natural resources. Steel construction is out of reach for clients on a limited budget due to the high costs of manufacture, shipment, and installation. While concrete is a long-lasting and low-maintenance material, there are alternative materials on the market, such as plastic lumber, that fit the bill and the project better. Metal (expense, fire danger, corrosion), concrete (time, contraction), and lumber all have drawbacks (shrinking, swelling, deterioration, health hazard).

- Potential direct and indirect impact of climate change on the timber industry

Forest wood has been a vital necessity for humanity since the dawn of civilization and remains the primary supply for many applications in our daily lives. Trees serve to sustain the water cycle and provide habitat for species. The Saudi Arabia’s impact of both direct and indirect climate change has hampered the expansion of wood production. The largest loss of forest related to climate is forest fire, which kills many trees each year. This is caused by severe summer and winter temperatures. Nature sparked the fire, which resulted in a massive loss of forest cover.

- Stringent rules and regulations regarding the timber

Saudi Arabia's forests are threatened by a harsh environment characterized by low fluctuating rainfall, severe drought, high temperatures, and human effects such as urban and agricultural development, as well as fuel wood harvesting. A scarcity of competent forestry professionals in comparison to what is necessary to carry out the activities required to sustainably manage the resources exacerbates the mix of natural and manmade causes. In response to these causes, the Saudi government has undertaken and/or supported a number of institutional and/or legislative efforts, as well as a number of programs, to reduce forest degradation and maintain, extend, and develop existing forests.

- Shrinking of the forests causes wide-reaching problems

Deforestation entails chopping down trees to a considerable amount, whether they are forests, barren ground, or trees one passes on their walk to school every day. Natural forests are being destroyed to cultivate the land, create houses and industries, log, clear land for livestock grazing, extract oil, mine, build dams, or acquire wood for furniture and fuel. The loss of forest cover impacts biodiversity, which in turn threatens people's lives. Forest shrinkage causes widespread issues such as soil erosion, less crops, floods, water cycle disturbance, greenhouse gas emissions, climate changes, and biodiversity loss.

For Instance,

- In 2021, according to Timber Exchange due to increasing demand in Riyadh, Jeddah, Dammam, and Khobar, Saudi Arabia requires one million additional houses over the next ten years. The demand will create 628,000 units, with Riyadh accounting for 48 percent of the units.

Saudi Arabia Wood Market Scope

The Saudi Arabia wood market is segmented on the basis of timber type, application, use, end-user, and wood type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Timber Type

- Ash

- Beech

- Birch

- Cedar

- Fir

- Mahogany

- Maple

- Oak

- Pine

On the basis of timber type, Saudi Arabia wood market is classified into ash, beech, birch, cedar, fir, mahogany, maple, oak, and pine.

Application

- Fuel Wood

- Industrial Round Wood

- Engineered Woods

On the basis of application, Saudi Arabia wood market is classified into fuel wood, industrial round wood, and engineered woods.

Use

- Construction

- Flooring

- Packaging

- Transport

- Others

On the basis of use, Saudi Arabia wood market is classified into construction, flooring, packaging, transport, and others.

End Use

- Residential and commercial

- Industrial

On the basis of end-use, Saudi Arabia wood market is classified into residential and commercial, and industrial.

Wood Type

- Hardwood

- Softwood

On the basis of wood type, Saudi Arabia wood market is classified into hardwood, and softwood.

Competitive Landscape and Saudi Arabia Wood Share Analysis

The Saudi Arabia wood market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Saudi Arabia presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Saudi Arabia wood market.

Some of the major market players engaged in the Saudi Arabia wood market are Saudi Modern Factory Company, Trust Wood, Asala Wood, ITCO, Gupta Timbertrader Pvt. Ltd., and Airolam decorative laminates.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SAUDI ARABIA WOOD MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 WOOD TYPE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SAUDI ARABIA WOOD AND TIMBER MARKET, PESTEL ANALYSIS

4.1.1 OVERVIEW

4.1.2 POLITICAL FACTORS

4.1.3 ENVIRONMENTAL FACTORS

4.1.4 SOCIAL FACTORS

4.1.5 TECHNOLOGICAL FACTORS

4.1.6 ECONOMICAL FACTORS

4.1.7 LEGAL FACTORS

4.1.8 CONCLUSION

4.2 ILLEGAL WOOD IMPORTS FROM INDONESIA

4.3 CERTIFICATION

4.4 COMPLETE LIFE CYCLE OF WOOD AND TIMBER

4.5 LEGAL AND ILLEGAL IMPORT OF WOOD AND TIMBER INTO SAUDI ARABIA MARKET

4.6 SUSTAINABILITY FOR WOOD AND TIMBER

4.7 SUSTAINABILITY OF WOOD

4.8 TRANSPORT AND CUSTOM DETAILS OF TIMBER AND WOOD

4.9 REGULATION AND STANDARDS FOR WOOD AND TIMBER

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND IN COMMERCIAL AND RESIDENTIAL BUILDING SECTORS

5.1.2 GROWING USES IN PACKAGING AND TRANSPORTATION APPLICATIONS

5.1.3 RISING IMPORTANCE OF LIGHT WOOD MATERIAL

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF SUBSTITUTES SUCH AS PLASTICS AND METAL PRODUCTS

5.2.2 POTENTIAL DIRECT AND INDIRECT IMPACT OF CLIMATE CHANGE ON THE TIMBER INDUSTRY

5.3 OPPORTUNITIES

5.3.1 THE THRIVING COMMERCIAL SECTORS ARE PAVING THE PATH FOR WOOD PLASTIC COMPOSITES (WPC)

5.3.2 RISING INVESTMENT IN R&D AND VARIOUS PROJECTS

5.4 CHALLENGES

5.4.1 STRINGENT RULES AND REGULATIONS REGARDING THE TIMBER

5.4.2 SHRINKING OF THE FORESTS CAUSES WIDE-REACHING PROBLEMS

6 SAUDI ARABIA WOOD MARKET, BY TIMBER TYPE

6.1 OVERVIEW

6.2 MAHOGANY

6.3 OAK

6.4 ASH

6.5 BEECH

6.6 BIRCH

6.7 CEDAR

6.8 FIR

6.9 MAPLE

6.1 PINE

7 SAUDI ARABIA WOOD MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 INDUSTRIAL ROUND WOOD

7.3 ENGINEERED WOODS

7.3.1 CROSS-LAMINATED TIMBER (CLT)

7.3.2 ORIENTED STRAND BOARDS (OSB)

7.3.3 GLULAM (GLUED LAMINATED TIMBER)

7.3.4 LAMINATED VENEER LUMBER (LVL)

7.3.5 I-BEAMS, PLYWOOD

7.3.6 OTHERS

7.4 FUEL WOOD

8 SAUDI ARABIA WOOD MARKET, BY USE

8.1 OVERVIEW

8.2 CONSTRUCTION

8.3 FLOORING

8.4 PACKAGING

8.5 TRANSPORT

8.6 OTHERS

9 SAUDI ARABIA WOOD MARKET, BY END USER

9.1 OVERVIEW

9.2 RESIDENTIAL AND COMMERCIAL

9.3 INDUSTRIAL

10 SAUDI ARABIA WOOD MARKET, BY WOOD TYPE

10.1 OVERVIEW

10.2 HARDWOOD

10.3 SOFTWOOD

11 SAUDI ARABIA WOOD MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

11.2 CERTIFICATION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ITCO

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 GUPTA TIMBERTRADER PVT. LTD.

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 ASALA WOOD

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 SAUDI MODERN FACTORY COMPANY

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENT

13.5 TRUST WOOD

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 AIROLAM DECORATIVE LAMINATES

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

표 목록

TABLE 1 IMPORT DATA OF BITUMEN AND WOOD, NATURAL; BITUMINOUS OR OIL-SHALE AND TAR SANDS; WOODITES AND WOODIC; HS CODE – 2714 (USD MILLION)

TABLE 2 EXPORT DATA OF BITUMEN AND WOOD, NATURAL; BITUMINOUS OR OIL-SHALE AND TAR SANDS; WOODITES AND WOODIC; HS CODE – 2714 (USD MILLION)

TABLE 3 SAUDI ARABIA WOOD MARKET, BY TIMBER TYPE, 2020-2029 (USD MILLION)

TABLE 4 SAUDI ARABIA WOOD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 SAUDI ARABIA ENGINEERED WOODS IN WOOD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 SAUDI ARABIA WOOD MARKET, BY USE, 2020-2029 (USD MILLION)

TABLE 7 SAUDI ARABIA WOOD MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 8 SAUDI ARABIA WOOD MARKET, BY WOOD TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 SAUDI ARABIA WOOD MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA WOOD MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA WOOD MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA WOOD MARKET: SAUDI ARABIA MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA WOOD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA WOOD MARKET: THE WOOD TYPE LIFE LINE CURVE

FIGURE 7 SAUDI ARABIA WOOD MARKET: MULTIVARIATE MODELLING

FIGURE 8 SAUDI ARABIA WOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SAUDI ARABIA WOOD MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SAUDI ARABIA WOOD MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 SAUDI ARABIA WOOD MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 SAUDI ARABIA WOOD MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 SAUDI ARABIA WOOD MARKET: SEGMENTATION

FIGURE 14 RISING DEMAND IN COMMERCIAL AND RESIDENTIAL BUILDING SECTORS IS EXPECTED TO DRIVE SAUDI ARABIA WOOD MARKET IN THE FORECAST PERIOD

FIGURE 15 INDUSTRIAL ROUND WOOD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA WOOD MARKET IN 2022 & 2029

FIGURE 16 SAUDI ARABIA WOOD AND TIMBER MARKET: PESTEL ANALYSIS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF SAUDI ARABIA WOOD MARKET

FIGURE 18 SAUDI ARABIA WOOD MARKET: BY TIMBER TYPE, 2021

FIGURE 19 SAUDI ARABIA WOOD MARKET: BY APPLICATION, 2021

FIGURE 20 SAUDI ARABIA WOOD MARKET: BY USE, 2021

FIGURE 21 SAUDI ARABIA WOOD MARKET: BY END USER, 2021

FIGURE 22 SAUDI ARABIA WOOD MARKET: BY WOOD TYPE, 2021

FIGURE 23 SAUDI ARABIA WOOD MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.