Asia Pacific Artificial Blood Substitutes Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

13.18 Billion

USD

75.10 Billion

2025

2033

USD

13.18 Billion

USD

75.10 Billion

2025

2033

| 2026 –2033 | |

| USD 13.18 Billion | |

| USD 75.10 Billion | |

|

|

|

|

Asia-Pacific Artificial Blood Substitutes Market, By Product Type (Perflurocarbon (PFCs) and Hemoglobin-Based Oxygen Carries (HBOCs)), Source (Human Blood, Animal Blood, Microorganism Based Recombinant HB, Synthetic Polymers and Stem Cells), Application (Cardiovascular Diseases, Malignant Neoplasma, Injuries, Neonatal Conditions, Organ Transplant and Maternal Condition), End User (Hospital & Clinics, Blood Banks and Others), Country (U.S., Mexico, France, Russia, Netherlands, Rest of Europe, China, Rest of Asia-Pacific, South Africa, and Rest of Middle East and Africa) Industry Trends and Forecast To 2028.

Market Analysis and Insights: Asia-Pacific Artificial Blood Substitutes Market

Market Analysis and Insights: Asia-Pacific Artificial Blood Substitutes Market

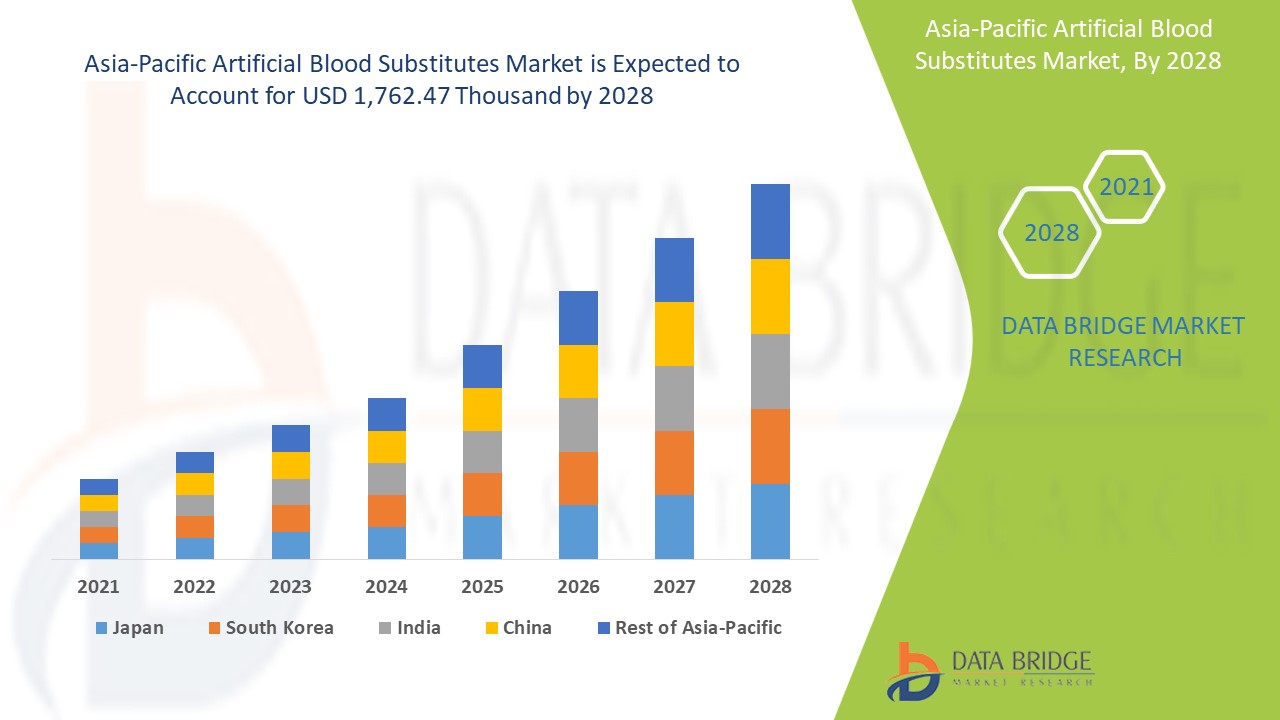

The artificial blood substitutes market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 24.3% in the forecast period of 2021 to 2028 and is expected to reach USD 1,762.47 thousand by 2028. Limited availability of fresh blood and its short life span coupled with increasing demand for blood transfusion and increased funding, for the development of blood substitutes acts as driver for the artificial blood substitutes market growth.

Artificial blood substitutes are also known as oxygen therapeutics or haemoglobin-based oxygen carriers. It is used to mimic the function of biological blood and to offer a substitute to blood transfusion. Artificial blood are used as a solution to replace transfusion of banked red blood cells and are designed to overcome the limitations such as shortage of blood sonor, high risk contamination, requirement of cross matching. The allogenic blood transfusions has multiple risks and can cause infectious transmission, transfusion reactions, transfusion related acute lung injury, delayed postoperative wound healing, immunomodulation and potential risk of cancer recurrence. It offers the promise of new and important life-saving medical treatments.

Artificial blood are produced from sources such as animal blood, human blood, microorganisms recombinant Hb, stem cells and others. Artificial blood also offers several advantages over the human blood as it belongs to universal blood group and can be given to the patients regardless of their blood type. Also artificial blood substitutes don’t produce any immulogical reactions. Also, artificial blood substitute eliminates the risk of infectious diseases or contamination during transfusion and offers extended shelf life in comparision to the human blood as it can be stored for 3 years at room temperature or more while the human blood shelf life is short for 42 days. Artificial blood can be used for emergency situations and can be stored easily also is the perfect option for the patients who doesn’t accept blood from donors due to their religious beliefs.

Limited availability of fresh blood and its short life span coupled with increasing demand for blood transfusion and increased funding for development of blood substitutes are the key factors driving the Asia-Pacific artificial blood substitutes market. However, the high cost production of artificial blood as well as stringent rules laid down by governmental bodies for approval of blood substitute products may hamper the growth of the artificial blood substitutes market. Also, rising awareness regarding the advantages offered by artificial blood and rising demand for artificial blood coupled with insufficient number of blood donor and growing number of research and development on artificial blood will create huge opportunities for the Asia-Pacific artificial blood substitutes market. The in availability of artificial blood products, extended clinical trials and side effects associated with artificial blood will create a huge challenge for the Asia-Pacific artificial blood substitutes market.

The artificial blood substitutes market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the artificial blood substitutes market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Artificial blood substitutes Market Scope and Market Size

Artificial blood substitutes Market Scope and Market Size

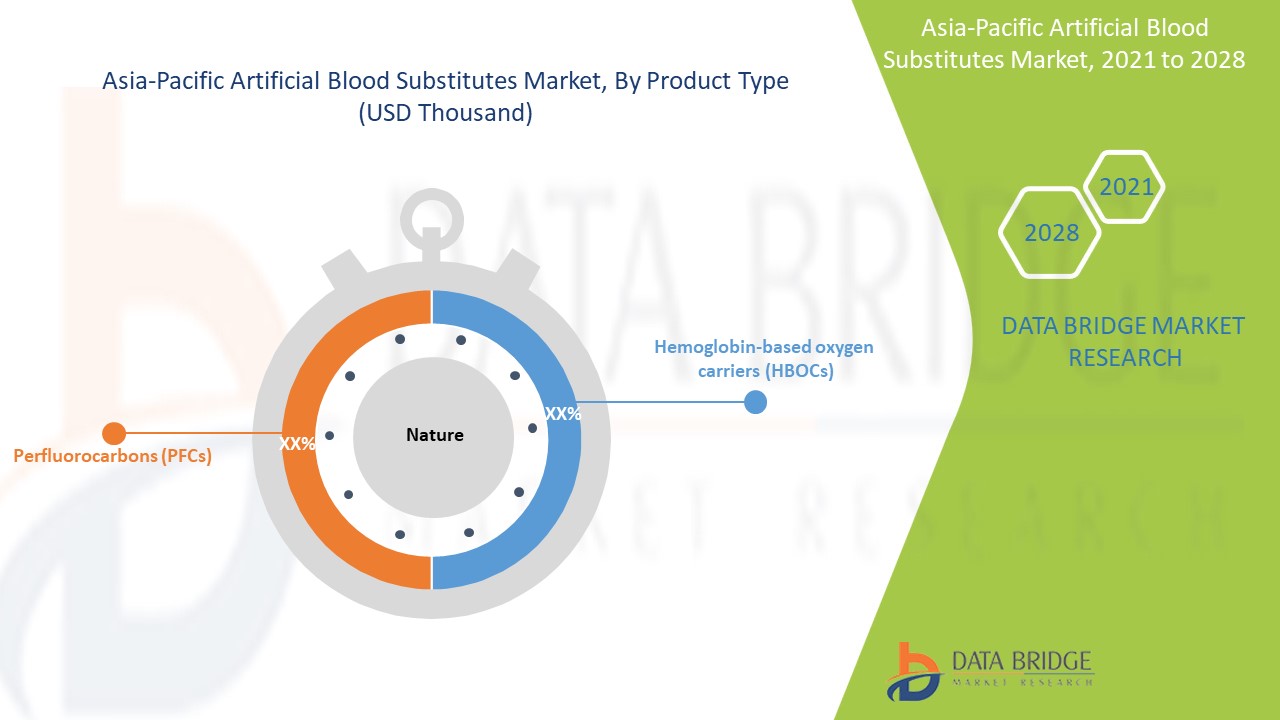

The artificial blood substitutes market is segmented on the based on the product type, source, application and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product type, the Asia-Pacific artificial blood substitutes market is segmented into perfluorocarbon (PFCs) and hemoglobin-based oxygen carries (HBOCs). Perfluorocarbon (PFCs) is further segmented into perftoran. Hemoglobin-based oxygen carries (HBOCs) is further segmented into oxyglobin and hemopure. In 2021, the hemoglobin-based oxygen carries (HBOCs) segment is expected to dominate the artificial blood substitutes market due to rising demand for blood sustitutes which eliminates the blood typing and to overcome the shortage of human blood.

- On the basis of source, the Asia-Pacific artificial blood substitutes market is segmented into human blood, animal blood, microorganism based recombinant HB, synthetic polymers and stem cells. In 2021, the animal blood segment is expected to dominate the artificial blood substitutes market due to availability of ample amount of source to produce artificial blood.

- On the basis of application, the Asia-Pacific artificial blood substitutes market is segmented into cardiovascular diseases, malignant neoplasma, injuries, neonatal conditions, organ transplant and maternal condition. In 2021, the injuries segment is expected to dominate the artificial blood substitutes market due to rising incidence of injuries, road accidents and others and high demand for artificial blood to treat them.

- On the basis of end user, the Asia-Pacific artificial blood substitutes market is segmented into hospital & clinics, blood banks and others. In 2021, the hospital & clinics segment is expected to dominate the artificial blood substitutes market due to rising number of patients with various illness and growing need for blood.

Artificial blood substitutes Market Country Level Analysis

The artificial blood substitutes market is analyzed and market size information is provided by the country, product type, source, application and end user as referenced above.

The countries covered in the artificial blood substitutes market report are the China, rest of Asia-Pacific.

Product type segment in China country is expected to grow with the highest growth rate in the forecast period of 2021 to 2028 because of increase in demand for blood transfusion with rising number of patients. The product type segment in Rest of Asia-Pacific is dominating market owing to limited availability of human blood to treat rising number of patients.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Growing Strategic Activities by Major Market Players to Enhance the Awareness for Artificial blood substitutes, is Boosting the Market Growth of Artificial blood substitutes market.

The artificial blood substitutes market also provides you with detailed market analysis for every country growth in particular market. Additionally, it provides the detail information regarding the market players’ strategy and their geographical presence. The data is available for historic period 2010 to 2019.

Competitive Landscape and Artificial blood substitutes Market Share Analysis

Artificial blood substitutes market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to artificial blood substitutes market.

The major companies which are dealing in the artificial blood substitutes are HEMARINA, Hemoglobin Oxygen Therapeutics LLC, KaloCyte, Inc., LLC “Visusmed”, European Medicines Agency, OPK Biotech LLC, NuvOx Pharma, Prolong Pharmaceuticals, LLC, Boston Therapeutics, Inc., Aurum Biosciences, OXYVITA Inc., NanoBlood LLC among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many expansion and funding are also initiated by the companies’ worldwide which are also accelerating the artificial blood substitutes market.

For instance,

- In November 2020, Hemarina published a scientific report for anti-inflammatory and antibacterial property of M 101, an oxygen transporter for the treatment of periodontitis. This study has validated the quality of M 101 molecolue, which is derived from haemoglobin of the marine lugworm.

- In June 2020, KaloCyte, Inc. received a USD 300k funding from University System of Maryland (USM) Momentum Fund for developing ErythroMer, a synthetic, bio-inspired red blood substitute. This funding has helped the company in developing the ErythroMer at much faster pace.

- In May 2020, KaloCyte, Inc. awarded by the National Institutes of Health (NIH) a USD 373,000 Small Buisness Innovation Resaerch (SBIR) Phase I grant. This grant helped the company in advancing KaloCyte product to preclinical safety and efficacy testing in anticipation of human trails.

Collaboration, business expansion, award and recognition, joint ventures and other strategies by the market player is enhancing the company footprints in the artificial blood substitutes market which also provides the benefit for organization’s profit growth.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.