Europe Laboratory Hoods And Enclosure Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

168.86 Million

USD

265.70 Million

2025

2033

USD

168.86 Million

USD

265.70 Million

2025

2033

| 2026 –2033 | |

| USD 168.86 Million | |

| USD 265.70 Million | |

|

|

|

|

Europe Laboratory Hoods and Enclosure Market, By Product (Ventilated Balance Enclosures (VBEs), Biological Safety Cabinets, Laminar Flow Cabinets, Enclosures, Hoods, and Others), Modularity (Benchtop and Portable), Material (PVC, Stainless Steel, and Others), End User (Pharmaceutical Companies, Research Institutes, Academic Centers and Others), Country (Germany, U.K., France, Italy, Spain, Switzerland, Netherlands, Belgium, Russia, Turkey and Rest of Europe) Industry Trends and Forecast to 2028.

Market Analysis and Insights: Europe Laboratory Hoods and Enclosure Market

Market Analysis and Insights: Europe Laboratory Hoods and Enclosure Market

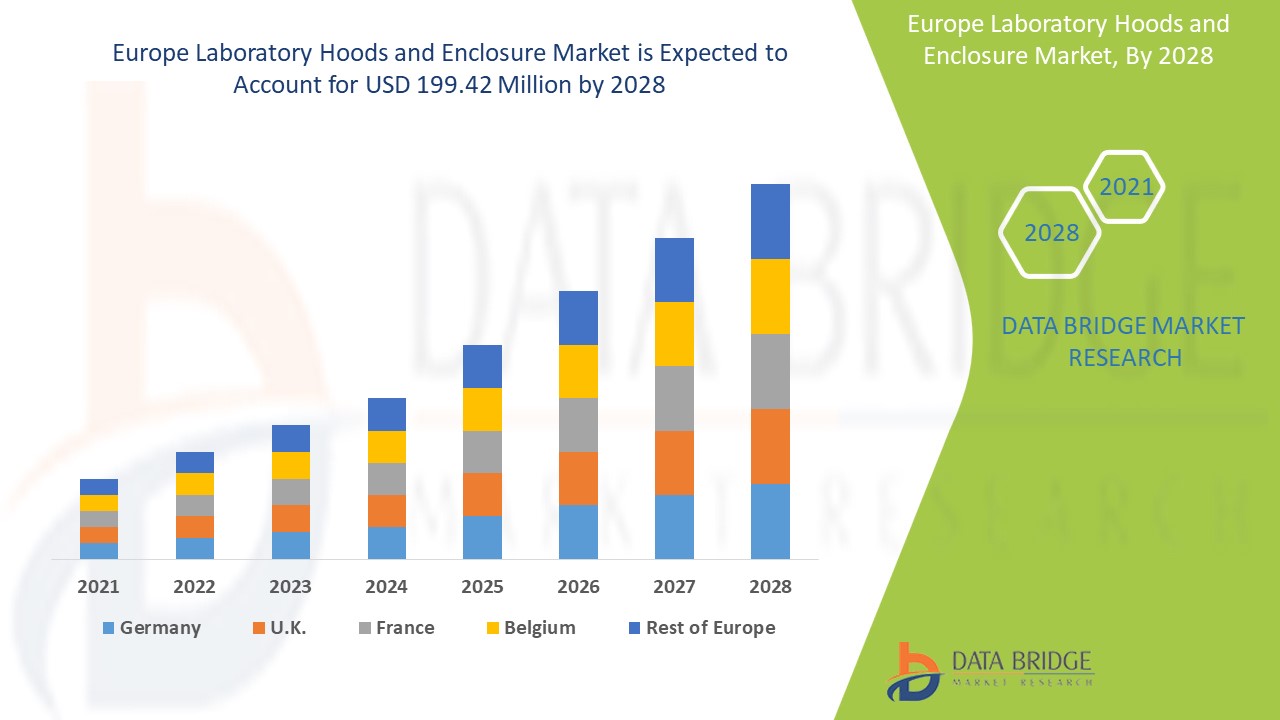

Europe laboratory hoods and enclosure market is expected to grow in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.7% in the forecast period of 2021 to 2028 and is expected to reach USD 199.42 million by 2028. The rising prevalence of chronic diseases demands advanced laboratory hoods and enclosure solutions and services, thus driving the Europe laboratory hoods and enclosure market growth.

Fume hoods are ventilated enclosures that remove hazardous chemical fumes, particulates, and volatile vapors from the laboratory, providing personnel protection and prevent them from inhalation or absorption of hazardous chemicals and other health problems. The fume hood limits the exposure to hazardous or toxic fumes, vapors, or dust by safely removing these substances from the immediate working environment. It also serves to protect the sample from the external environment. Biological safety cabinets (or biosafety cabinets) utilize HEPA filters to provide environmental, personnel, and product protection. They capture the impure fumes and recirculate or exhaust filtered air to protect the environment and personnel while doing sample preparation and experimentation. A ventilated enclosure is any site-fabricated chemical hood designed to contain processes, such as scale-up or pilot plant equipment. Ventilated balance enclosures are used in laboratories to weigh toxic particulates. These devices are installed with different specifications for face velocity than the standard laboratory chemical hood. They are well suited for locating sensitive balances that might be disturbed if placed in a laboratory chemical hood.

Moreover, the increasing prevalence of infectious diseases worldwide has further propelled the demand for laboratory hoods and enclosures. The increasing prevalence of LAIs is likely to fuel the growth of the Europe laboratory hoods and enclosure market to prevent spreading infections while performing research and development and sample preparation across the globe. The key market players invest extensively in research and development to launch new products and services, which acts as an opportunity for growth. However, the high cost of laboratory hoods and enclosures and environmental side effects and limitations associated with the use of them act as a restraint for its growth in the market.

Manufacturers are increasing their focus toward research and development activities to provide strategic solutions for emerging diseases, increasing the application of hoods and enclosures. In addition, the rising prevalence of infectious diseases such as COVID-19 increases the demand for laboratory hoods and enclosures. These factors are expected to propel market growth. The stringent regulation policy acts as a major challenge in the growth of the market.

The Europe laboratory hoods and enclosure market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the Europe laboratory hoods and enclosure market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Europe Laboratory Hoods and Enclosure Market Scope and Market Size

Europe Laboratory Hoods and Enclosure Market Scope and Market Size

Europe laboratory hoods and enclosure market is segmented based on the product, modularity, material, and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product, the Europe laboratory hoods and enclosure market is segmented into Ventilated Balance Enclosures (VBEs), biological safety cabinets, laminar flow cabinets, enclosures, hoods, and others. In 2021, the hoods segment is expected to dominate the Europe laboratory hoods and enclosure market as it provides enormous beneficial factors during research activities.

- On the basis of modularity, the Europe laboratory hoods and enclosure market is segmented into benchtop and portable. In 2021, the benchtop segment is expected to dominate the Europe laboratory hoods and enclosure market due to its increasing demand across Europe.

- On the basis of material, the Europe laboratory hoods and enclosure market is segmented into PVC, stainless steel, and others. In 2021, the stainless steel segment is expected to dominate the Europe laboratory hoods and enclosure market due to its rigidity and strength.

- On the basis of end user, the Europe laboratory hoods and enclosure market is segmented into pharmaceutical companies, research institutes, academic centers, and others. In 2021, the pharmaceutical companies segment in the end user is expected to dominate the market due to the growing research and development activities.

Europe Laboratory Hoods and Enclosure Market Country Level Analysis

Europe laboratory hoods and enclosure market is analyzed, and market size information is provided by the country, product, modularity, material, and end user as referenced above.

The countries covered in the Europe laboratory hoods and enclosure market report are Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Turkey, Austria, Ireland, and the Rest of Europe. Germany is dominating country in the European region due to technological advancements.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of European brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growing Strategic Activities by Major Market Players to Enhance the Awareness for Laboratory Hoods and Enclosure is Boosting the Market Growth of Europe Laboratory Hoods and Enclosure Market

Europe laboratory hoods and enclosure market also provide you with detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategy and their geographical presence. The data is available for the historical period 2010 to 2019.

Competitive Landscape and Europe Laboratory Hoods and Enclosure Market Share Analysis

Europe laboratory hoods and enclosure market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the Europe laboratory hoods and enclosure market.

The major companies dealing in the Europe laboratory hoods and enclosure are Thermo Fisher Scientific Inc., WALDNER Holding GmbH & Co. KG, Köttermann GmbH, Bigneat Ltd., Esco Micro Pte. Ltd., Monmouth Scientific Limited, and Kewaunee International Group, among others, domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many contracts and agreements are also initiated by the companies worldwide, which also accelerates the Europe laboratory hoods and enclosure market.

For instance,

- In August 2021, Bigneat Ltd. was acquired entirely by Caron Products and Services. The combination of our strong European network and Caron’s market leadership in the U.S. provides immediate opportunities to both businesses to better serve our customers

- In April 2018, Thermo Fisher Scientific Inc. announced its first Cloud-Enabled HeraSafe 2030i Biological Safety Cabinet to address the need for uncompromised contamination control, seamless workflow connectivity, and enhanced ease of use in cell culture laboratories. This has helped the company to accelerate growth in lab equipment and thereby sustaining footprints in the market

Collaboration, product launch, business expansion, award and recognition, joint ventures, and other strategies by the market player enhance the company's footprints in the Europe laboratory hoods and enclosure market, which also benefits the organization’s profit growth.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.