Global Cell And Tissue Culture Media Reagents And Buffers Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.72 Billion

USD

7.80 Billion

2025

2033

USD

3.72 Billion

USD

7.80 Billion

2025

2033

| 2026 –2033 | |

| USD 3.72 Billion | |

| USD 7.80 Billion | |

|

|

|

|

Global Cell & Tissue Culture Media Reagents & Buffers Market Segmentation, By Product Type (Cell Culture Media, Reagents & Supplements, Buffers, Serum & Serum Alternatives), Application (Biopharmaceutical Production, Drug Discovery & Development, Academic & Research Institutes, Clinical Diagnostics, and Regenerative Medicine )- Industry Trends and Forecast to 2033

Cell and Tissue Culture Media Reagents and Buffers Market Size

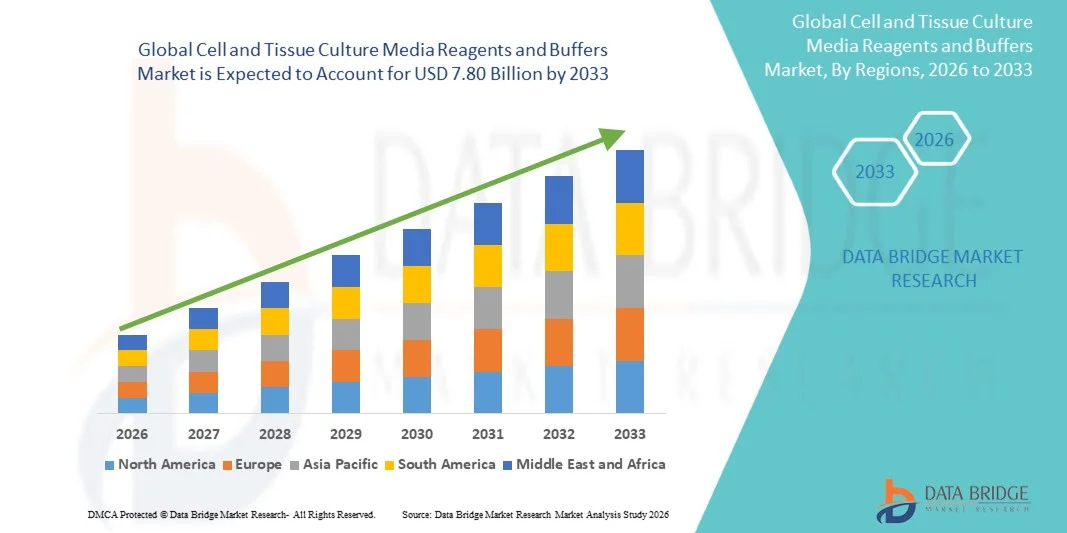

- The Cell and Tissue Culture Media Reagents and Buffers Market size was valued at USD 3.72 billion in 2025 and is expected to reach USD 7.80 billion by 2033, at a CAGR of 9.70% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced biopharmaceutical manufacturing and the rapid expansion of cell-based research across academic and industrial laboratories

- Furthermore, rising demand for high-quality, standardized culture media, reagents, and buffers to support complex cell therapy development, regenerative medicine, and biologics production is driving market expansion

Cell and Tissue Culture Media Reagents and Buffers Market Analysis

- Cell culture media, reagents, and buffers are essential components in cell and tissue culture workflows, enabling growth, maintenance, and analysis of cells across research and biomanufacturing applications

- The escalating demand for cell and tissue culture media reagents and buffers is primarily fueled by rapid growth in biologics manufacturing, increasing adoption of cell and gene therapies, and expanding research activities in regenerative medicine and oncology

- North America dominated the cell and tissue culture media reagents and buffers market with the largest revenue share of 38.5% in 2025, driven by strong presence of major biopharmaceutical companies, advanced research infrastructure, high R&D spending, and extensive adoption of innovative cell culture technologies

- Asia-Pacific is expected to be the fastest growing region in the cell and tissue culture media reagents and buffers market during the forecast period, with a projected CAGR of 12.8%, due to increasing investments in biotechnology, expanding CRO/CDMO services, and growing adoption of advanced cell therapy research in countries such as China and India

- The Cell Culture Media segment dominated the market with the largest revenue share of 42.5% in 2025, supported by increasing adoption of cell-based research and growing demand for high-quality media for cell growth and proliferation

Report Scope and Cell and Tissue Culture Media Reagents and Buffers Market Segmentation

|

Attributes |

Cell and Tissue Culture Media Reagents and Buffers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cell and Tissue Culture Media Reagents and Buffers Market Trends

“Enhanced Focus on Advanced Cell and Tissue Culture Media Formulations”

- A major and accelerating trend in the Cell and Tissue Culture Media Reagents and Buffers Market is the increasing focus on advanced and customized media formulations designed for specific cell types, such as stem cells, primary cells, and biologics-producing cell lines. This trend is driven by the need for improved cell growth, enhanced productivity, and consistent experimental outcomes

- For instance, many leading manufacturers are now offering chemically defined, serum-free media specifically optimized for stem cell expansion, as well as media formulations tailored for CAR-T cell therapy manufacturing, ensuring higher reproducibility and regulatory compliance

- The shift towards serum-free and xeno-free media is driven by safety concerns and regulatory expectations, especially in biopharmaceutical production. These formulations reduce the risk of contamination and variability, supporting more predictable cell culture performance

- In addition, the demand for media with enhanced stability, longer shelf life, and reduced batch-to-batch variability is rising as manufacturers seek to improve manufacturing efficiency and product quality

- This trend is also supported by increased adoption of advanced cell culture systems such as 3D cell culture, organoids, and bioreactors, which require specialized media and buffers to support complex cell growth conditions

- As biopharma and research organizations continue to pursue more sophisticated therapies, the need for tailored and high-performance culture media is expected to further accelerate market growth

Cell and Tissue Culture Media Reagents and Buffers Market Dynamics

Driver

“Rising Demand from Biopharmaceutical and Cell Therapy Manufacturing”

- The increasing development and commercialization of cell and gene therapies, including CAR-T, stem cell therapies, and regenerative medicine products, are major drivers for the Cell and Tissue Culture Media Reagents and Buffers market

- For instance, Lonza expanded its cell therapy media production capacity to support growing demand from cell therapy developers, especially for GMP-grade media used in clinical manufacturing

- As these therapies progress through clinical and commercial stages, there is strong demand for high-quality, scalable media and buffer solutions that support large-scale manufacturing

- Moreover, the expanding biopharmaceutical pipeline and increasing investments in biologics production are driving higher demand for media that supports high cell density and productivity, ensuring cost-effective manufacturing

- In addition, the rise in research activities and clinical trials focusing on complex biologics and personalized medicine is further propelling demand for specialized culture media

- The need for reproducible and regulatory-compliant media solutions is increasing as manufacturers seek consistent results across batches, driving market growth

Restraint/Challenge

“High Costs and Stringent Regulatory Compliance”

- The high cost of advanced cell culture media, particularly chemically defined and serum-free formulations, can limit adoption in cost-sensitive research settings and small-scale laboratories

- For instance, the high price of GMP-grade media used in clinical manufacturing often restricts its use to large-scale biopharma players, limiting accessibility for smaller biotech startups

- Many specialized media and buffer products require high-quality raw materials and complex manufacturing processes, increasing overall production costs and pricing

- Stringent regulatory requirements for media used in clinical manufacturing and biologics production pose challenges for manufacturers, who must maintain strict quality control and documentation to meet compliance standards

- In addition, the high cost of development and validation for new media formulations can delay product launches and restrict market entry for smaller players

- Ensuring consistent performance across different batches remains a challenge, particularly in complex media systems, which can impact reproducibility and confidence among end-users

- Overcoming these cost and compliance barriers will be critical for broader market adoption and sustained growth

Cell and Tissue Culture Media Reagents and Buffers Market Scope

The market is segmented on the basis of product type and application.

• By Product Type

On the basis of product type, the Cell and Tissue Culture Media Reagents and Buffers market is segmented into Cell Culture Media, Reagents and Supplements, Buffers, Serum and Serum Alternatives. The Cell Culture Media segment dominated the market with the largest revenue share of 42.5% in 2025, supported by increasing adoption of cell-based research and growing demand for high-quality media for cell growth and proliferation. The segment benefits from continuous advancements in media formulations for mammalian cells, stem cells, and specialized cell lines. Strong demand from biopharmaceutical manufacturing and academic research institutions further reinforces its leadership. In addition, the rising trend of biologics production and cell therapy development is driving higher consumption of cell culture media. The segment remains dominant due to its essential role in all cell culture workflows and high usage across multiple applications.

The Reagents and Supplements segment is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, driven by rising demand for specialized reagents such as growth factors, cytokines, and supplements required for advanced cell culture and bioprocessing. Increased adoption of 3D cell culture, organoids, and stem cell research is accelerating the need for advanced supplements. Growth in drug discovery and development activities is also boosting the demand for high-quality reagents. The segment’s rapid growth is supported by continuous innovation and increasing funding for cell-based research.

• By Application

On the basis of application, the Cell and Tissue Culture Media Reagents and Buffers market is segmented into Biopharmaceutical Production, Drug Discovery and Development, Academic and Research Institutes, Clinical Diagnostics, and Regenerative Medicine. The Biopharmaceutical Production segment accounted for the largest market revenue share of 39.8% in 2025, driven by increasing production of monoclonal antibodies, vaccines, and cell-based therapies. Growing biologics manufacturing and expansion of contract manufacturing organizations (CMOs) are significantly boosting demand. Stringent regulatory standards and need for high-quality media and buffers in large-scale production further support segment dominance. Rising investments in biologics and continuous expansion of production capacities globally continue to drive growth.

The Regenerative Medicine segment is expected to witness the fastest CAGR of 23.5% from 2026 to 2033, due to increasing research and commercialization of cell therapy and tissue engineering. Growing prevalence of chronic diseases and demand for personalized treatments is accelerating adoption of regenerative medicine. Increasing number of clinical trials and funding for stem cell research are also driving demand for specialized media and supplements. The segment’s growth is supported by expanding applications in tissue regeneration and cell-based therapies.

Cell and Tissue Culture Media Reagents and Buffers Market Regional Analysis

- North America dominated the cell and tissue culture media reagents and buffers market with the largest revenue share of 38.5% in 2025, driven by the strong presence of major biopharmaceutical companies, advanced research infrastructure, high R&D spending, and extensive adoption of innovative cell culture technologies

- The region’s leadership is supported by a high number of clinical trials, increasing demand for biologics and cell therapies, and strong government and private funding for biotechnology research

- The U.S. is the key contributor, owing to its well-established biotech ecosystem, robust manufacturing capabilities, and high adoption of serum-free and chemically defined media for large-scale production

U.S. Cell and Tissue Culture Media Reagents and Buffers Market Insight

The U.S. cell and tissue culture media reagents and buffers market captured the largest revenue share in 2025, driven by the rapid growth in biopharmaceutical production, increasing investments in cell and gene therapy research, and high adoption of advanced culture media and reagents. The U.S. market benefits from strong biotechnology infrastructure, leading academic institutions, and major CRO/CDMO services. Continuous innovations in serum-free media, xeno-free reagents, and automated cell culture systems further boost demand across research and manufacturing sectors.

Europe Cell and Tissue Culture Media Reagents and Buffers Market Insight

The Europe cell and tissue culture media reagents and buffers market is expected to grow steadily due to rising investment in biopharmaceutical research, increasing demand for biologics manufacturing, and strong presence of leading biotech companies in Germany, UK, and France. Growth is also supported by favorable regulatory policies, increased government funding for cell therapy research, and rising adoption of advanced culture media technologies in academic and industrial research.

U.K. Cell and Tissue Culture Media Reagents and Buffers Market Insight

The U.K. cell and tissue culture media reagents and buffers market is anticipated to grow at a significant CAGR due to increased cell therapy research, expansion of biopharmaceutical manufacturing, and strong academic research collaborations. The U.K. benefits from strong government support, high number of biotech startups, and growing demand for specialized culture media and reagents in drug discovery and clinical research.

Germany Cell and Tissue Culture Media Reagents and Buffers Market Insight

Germany’s cell and tissue culture media reagents and buffers market is expected to expand significantly due to growing investments in biotech and cell therapy, high manufacturing capabilities, and strong demand for advanced cell culture media. Germany is witnessing increased adoption of serum-free media, GMP-grade reagents, and automation in biopharma production and research.

Asia-Pacific Cell and Tissue Culture Media Reagents and Buffers Market Insight

The Asia-Pacific cell and tissue culture media reagents and buffers market is poised to grow at the fastest CAGR of 12.8% during 2026–2033, driven by increasing investments in biotechnology, expanding CRO/CDMO services, and growing adoption of advanced cell therapy research in countries such as China and India. Rising government support, growing biopharma manufacturing, and rapid expansion of research institutes accelerate market growth.

Japan Cell and Tissue Culture Media Reagents and Buffers Market Insight

Japan’s cell and tissue culture media reagents and buffers market is growing due to high investments in regenerative medicine and cell therapy, strong research collaborations, and growing demand for specialized media for stem cell research and clinical applications.

China Cell and Tissue Culture Media Reagents and Buffers Market Insight

China cell and tissue culture media reagents and buffers market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid growth in biopharmaceutical manufacturing, expansion of cell therapy research, and strong domestic production of culture media and reagents. China’s increasing focus on biotech innovation and large-scale cell therapy production supports strong market growth.

Cell and Tissue Culture Media Reagents and Buffers Market Share

The Cell and Tissue Culture Media Reagents and Buffers industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Merck KGaA (Germany)

- Corning Incorporated (U.S.)

- Lonza Group AG (Switzerland)

- Sartorius AG (Germany)

- GE Healthcare Life Sciences (U.S.)

- Danaher Corporation (U.S.)

- Bio-Techne Corporation (U.S.)

- STEMCELL Technologies (Canada)

- Avantor, Inc. (U.S.)

- Fujifilm Wako Pure Chemical Corporation (Japan)

- Takara Bio Inc. (Japan)

- HiMedia Laboratories (India)

- PromoCell GmbH (Germany)

- PanReac AppliChem (Spain)

- Cytiva (U.S.)

- Miltenyi Biotec (Germany)

- PromoCell GmbH (Germany)

- Axygen Scientific (U.S.)

- Biocon (India)

Latest Developments in Cell and Tissue Culture Media Reagents and Buffers Market

- In April 2022, Captivate Bio expanded its cell culture solutions portfolio by introducing new classical media products and custom media manufacturing services, including the CET Cocktail kit aimed at improving workflows for human pluripotent stem cells (hPSC), addressing researcher demand for reliable defined media options

- In July 2023, Sartorius AG officially opened a new 21,500-square-foot cell culture media manufacturing facility at its Yauco, Puerto Rico site, enhancing production capacity for media and reagents critical to biopharmaceutical and vaccine development

- In July 2023, Lonza launched the TheraPRO CHO Media System, a new cell culture media platform designed to simplify processes and optimize protein production in GS-CHO cell lines, supporting therapeutic protein manufacturing workflows

- In September 2024, Merck KGaA (operating as MilliporeSigma in the U.S.) achieved the industry-first EXCiPACT cGMP certification for its cell culture media manufacturing processes at multiple global sites, reinforcing quality and safety standards for media used in biopharmaceutical production

- In November 2024, Fujifilm Irvine Scientific opened a new innovation center in the Netherlands focused on customizing culture media formulations for European cell therapy clients, expanding the company’s global media development and supply capabilities

- In January 2025, PromoCell entered into a multi-year distribution agreement with VWR International to broaden access to primary human cells and culture reagents across Europe, enhancing reagent availability and support for research laboratories

- In March 2025, Thermo Fisher Scientific announced a strategic collaboration with Lonza to co-develop cell culture media and feeds for large-scale biopharmaceutical production, aimed at improving media availability and process scalability for global biologics manufacturers

- In May 2025, Fujifilm Irvine Scientific launched a new chemically defined, serum-free culture medium specifically formulated for pluripotent stem cell maintenance and differentiation, addressing rising demand in cell therapy workflows

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.