Global Construction And Demolition Waste Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

139.08 Billion

USD

169.45 Billion

2024

2032

USD

139.08 Billion

USD

169.45 Billion

2024

2032

| 2025 –2032 | |

| USD 139.08 Billion | |

| USD 169.45 Billion | |

|

|

|

|

Global Construction and Demolition Waste Market Segmentation, By Type (Sand, Soil and Gravel, Concrete, Bricks and Masonry, Wood, and Metal), Source (Residential, Commercial, Industrial, and Municipal), Materials (Soil, Sand, Gravel, Concrete, Bricks, Masonry, Wood, Metal, and Others), Services (Collection, Transportation, and Disposal) - Industry Trends and Forecast to 2032

Construction and Demolition Waste Market Analysis

The construction and demolition (C&D) waste market is experiencing significant growth due to the rising demand for sustainable waste management solutions. As urbanization and industrialization accelerate globally, particularly in regions such as Asia-Pacific and North America, the volume of C&D waste continues to rise, leading to an increased need for effective disposal and recycling services. Advanced technologies, including automated sorting systems and material recovery facilities, are being integrated into waste management processes to improve efficiency and reduce landfill use. Innovations such as robotics and AI-driven systems for waste sorting have enhanced the recycling rates of valuable materials such as wood, metals, and concrete, further driving market expansion. In addition, government regulations encouraging recycling and sustainability in the construction sector are contributing to market growth. Companies are adopting green building practices, focusing on reducing construction waste, and improving waste-to-energy conversion methods. Veolia, SUEZ, and Metso are among the key players in this market, investing in research and development to bring more efficient and environmentally friendly waste management solutions. As demand for construction and demolition projects grows, the market is expected to evolve with increased emphasis on recycling, reuse, and the adoption of circular economy principles.

Construction and Demolition Waste Market Size

The global construction and demolition waste market size was valued at USD 139.08 billion in 2024 and is projected to reach USD 169.45 billion by 2032, with a CAGR of 2.50% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Construction and Demolition Waste Market Trends

“Increasing Adoption of Recycling Technologies”

A key trend driving the construction and demolition waste market is the increasing adoption of recycling technologies aimed at reducing landfill use and promoting a circular economy. As urbanization accelerates, the volume of construction and demolition waste has surged, leading to a greater focus on waste diversion and the reuse of materials. Innovations such as automated sorting systems and robotic sorting technologies are improving the efficiency of separating reusable materials such as metals, wood, and concrete. For instance, SUEZ has implemented advanced recycling technologies in its waste management facilities, significantly increasing the recovery rate of materials from C&D waste. This trend is further supported by stringent regulations that mandate higher recycling rates and sustainable construction practices. With a growing emphasis on reducing environmental impact, the market is witnessing a shift toward resource recovery rather than traditional disposal methods, driving the demand for more efficient and eco-friendly waste management solutions in the C&D industry.

Report Scope and Construction and Demolition Waste Market Segmentation

|

Attributes |

Construction and Demolition Waste Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Veolia (France), SUEZ (France), ECO WISE (India), CDE Group (U.K.), NSWAI (India), Saahas Waste Management Private Limited (India), Ramky Group (India), Infrastructure Leasing & Financial Services Limited (India), Duromech (India), SHANGHAI ZENITH MINERAL CO., LTD. (China), GFL Environmental Inc. (Canada), Metso (Finland), Cleanaway (Australia), REMONDIS SE and CO. KG (Germany), BINGO INDUSTRIES (Australia), J.J. Richards & Sons Pty Ltd (India), and Fortum (Finland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Construction and Demolition Waste Market Definition

Construction and Demolition (C&D) waste refers to the materials and by-products generated during the construction, renovation, and demolition of buildings, infrastructure, and other structures. This waste typically includes items such as concrete, wood, metals, bricks, glass, plastics, and drywall, along with debris from excavation, roads, and infrastructure projects.

Construction and Demolition Waste Market Dynamics

Drivers

- Rising Construction Activities Globally

The rising construction activities globally are a major driver of the construction and demolition waste market. As urbanization accelerates, particularly in developing regions such as Asia-Pacific, there is a substantial increase in infrastructure development, residential, and commercial projects. For instance, China alone is expected to invest over USD 13 trillion in infrastructure development by 2030, significantly contributing to the generation of C&D waste. In addition, in North America, a strong recovery in the construction sector post-pandemic has led to a surge in construction and renovation projects, further driving the need for efficient waste management. With more construction activities, the demand for proper waste disposal and recycling services intensifies, making C&D waste management an essential component in meeting the growing environmental and regulatory standards for sustainable development. This rise in construction activities directly correlates to the increasing demand for innovative waste management solutions, thus fueling market growth.

- Rising Adoption of Construction and Demolition (C&D) Waste Recycling in Urban Areas

The rising adoption of construction and demolition (C&D) waste recycling in urban areas is a key driver of the market. As cities expand and undergo redevelopment, the volume of C&D waste generated has increased significantly. For instance, in New York City, over 10 million tons of C&D debris are produced annually, with a growing focus on diverting waste from landfills through recycling initiatives. Urban areas are also implementing stricter waste management regulations, encouraging the recycling of materials such as concrete, steel, wood, and bricks, which can be reused in new construction projects. In Europe, the EU Circular Economy Action Plan aims for a 70% recycling rate for C&D waste by 2025, pushing cities to adopt advanced waste processing technologies. This shift towards sustainable practices and resource recovery in urban development is reducing environmental impact and creating significant market demand for innovative waste management solutions, driving the growth of the C&D waste market.

Opportunities

- Growing Smart Cities in Urban Areas

Growing smart cities in urban areas presents a significant market opportunity for the construction and demolition waste industry. As governments around the world invest in developing smart cities, there is a growing focus on sustainable construction practices, including the efficient management and recycling of C&D waste. For instance, in India, the government’s Smart Cities Mission aims to develop 100 smart cities, incorporating sustainable urban infrastructure and waste management solutions to reduce environmental impact. These initiatives are driving the demand for advanced waste processing technologies that can handle large volumes of C&D waste efficiently. As smart cities prioritize resource recovery, green building materials, and eco-friendly waste disposal, there is a rising need for innovative recycling solutions. This shift creates substantial opportunities for companies providing C&D waste management and recycling services, positioning them to meet the growing demand for sustainable urban development.

- Increasing Technological Advancements in Sustainable Recycling

New technological advancements in sustainable recycling are creating significant market opportunities within the construction and demolition waste sector. Innovations such as automated sorting systems, AI-driven recycling technologies, and robotic sorting are transforming how C&D waste is processed, allowing for more efficient material recovery and reducing environmental impact. For instance, Veolia has implemented advanced material recovery facilities (MRFs) that use robotics to sort and recycle construction debris, enhancing recycling rates and cutting down waste sent to landfills. In addition, technologies such as 3D printing are enabling the use of recycled construction materials to produce new building components, further promoting sustainability in construction. These advancements are improving efficiency and reducing costs and aligning with increasing regulations aimed at reducing waste and promoting a circular economy. As demand for eco-friendly practices grows, companies that invest in these cutting-edge recycling technologies are well-positioned to capitalize on the expanding market for sustainable waste management solutions in construction and demolition.

Restraints/Challenges

- High Disposal Costs

High disposal costs are a significant challenge in the construction and demolition (C&D) waste market, particularly in regions where disposal facilities are scarce or not easily accessible. For instance, in rural or remote areas of Africa and Asia, the cost of transporting C&D waste to authorized disposal sites can be prohibitively high, leading construction companies to either delay waste removal or resort to illegal dumping. In India, regions with limited waste management infrastructure have seen an increase in unauthorized waste disposal practices, contributing to environmental pollution and health risks. The rising fuel costs and logistical challenges further exacerbate these issues, making it difficult for smaller companies to manage waste effectively. As a result, many construction firms face higher operational costs and delays in their projects, which ultimately reduces the overall efficiency of waste management in the industry. This issue underscores the need for better waste management infrastructure and more cost-effective solutions, posing a barrier to the growth of the C&D waste recycling market.

- Limited Recycling Capacity

Limited recycling capacity remains a major challenge in the construction and demolition (C&D) waste market, as many regions still lack the necessary infrastructure to efficiently process and recycle C&D materials. While advancements in recycling technologies, such as robotic sorting and automated material recovery systems, are improving recycling rates in some areas, the absence of adequate recycling plants in numerous developing countries hampers progress. For instance, in parts of Latin America and sub-Saharan Africa, where there is limited access to modern recycling facilities, much of the C&D waste ends up in landfills rather than being repurposed into usable materials such as recycled concrete, wood, and metals. This reduces the potential for material recovery and increases the environmental footprint of the construction industry. The gap in recycling infrastructure makes it difficult for companies to comply with growing sustainability regulations and capitalize on the growing demand for eco-friendly construction materials. As a result, the market for C&D waste recycling is constrained, presenting a significant challenge to industry growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Construction and Demolition Waste Market Scope

The market is segmented on the basis of type, source, material, and service. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Sand

- Soil and Gravel

- Concrete

- Bricks and Masonry

- Wood

- Metal

Source

- Residential

- Commercial

- Industrial

- Municipal

Material

- Soil, Sand, & Gravel

- Concrete

- Bricks & Masonry

- Wood

- Metal

- Others

Service

- Collection

- Transportation

- Disposal

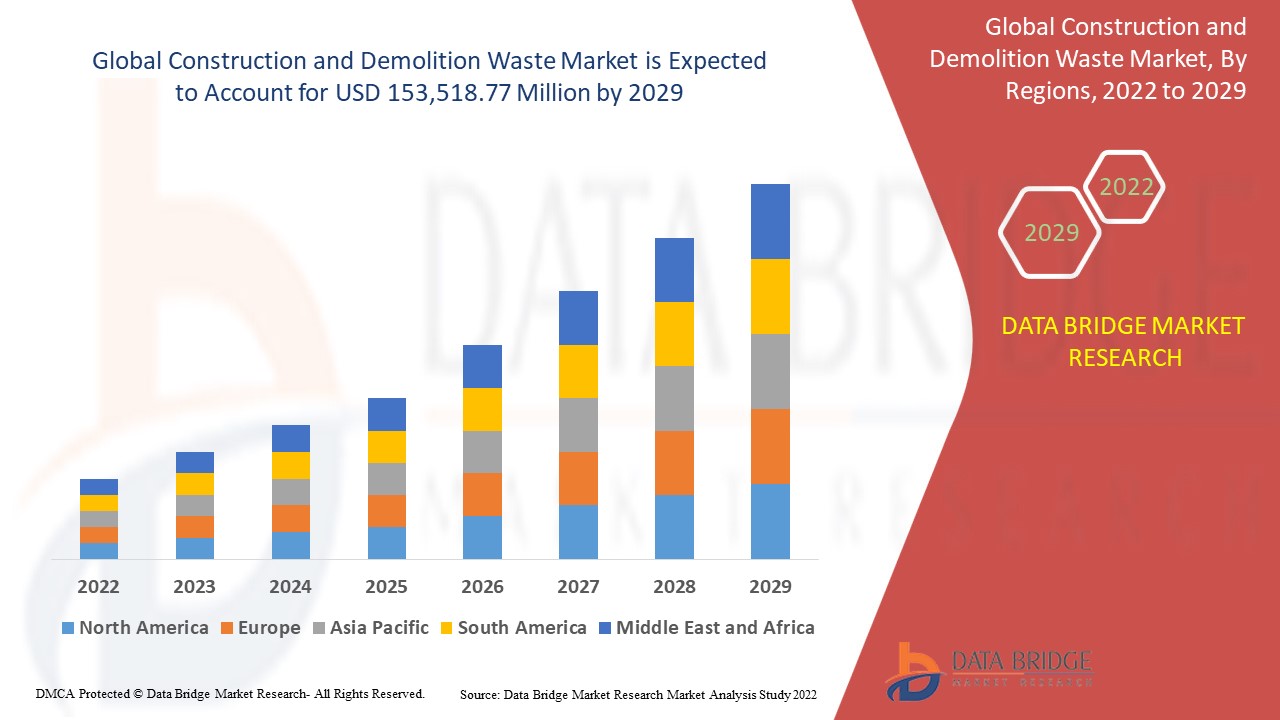

Construction and Demolition Waste Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, source, material, and service as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to dominate the construction and demolition waste market in terms of market share and revenue during the forecast period. This dominance is driven by the growing demand for construction and demolition waste management solutions, fueled by rapid urbanization and infrastructure development in the region. In addition, stringent regulations regarding waste disposal and sustainability are encouraging businesses to adopt advanced recycling and waste management practices. The increasing number of construction projects and renovations further propels the demand for efficient waste disposal and recycling services in North America.

Asia-Pacific is expected to be the fastest-growing market for construction and demolition waste due to rapid industrialization, a growing population, and increasing urbanization. As more cities expand and infrastructure projects intensify, the demand for efficient waste management solutions is surging. The region's expanding construction sector, coupled with government initiatives aimed at promoting sustainability, further accelerates the need for waste recycling and disposal services. With these factors combined, Asia-Pacific is poised to witness significant growth in the construction and demolition waste market over the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Construction and Demolition Waste Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Construction and Demolition Waste Market Leaders Operating in the Market Are:

- Veolia (France)

- SUEZ (France)

- ECO WISE (India)

- CDE Group (U.K.)

- NSWAI (India)

- Saahas Waste Management Private Limited (India)

- Ramky Group (India)

- Infrastructure Leasing & Financial Services Limited (India)

- Duromech (India)

- SHANGHAI ZENITH MINERAL CO., LTD. (China)

- GFL Environmental Inc. (Canada)

- Metso (Finland)

- Cleanaway (Australia)

- REMONDIS SE and CO. KG (Germany)

- BINGO INDUSTRIES (Australia)

- J.J. Richards & Sons Pty Ltd (India)

- Fortum (Finland)

Latest Developments in Construction and Demolition Waste Market

- In March 2023, Frontier Waste Solutions, a waste disposal and recycling company based in the U.S., announced the acquisition of Absolute Waste Services Inc. (AWS), expanding its customer base for commercial, residential, and roll-off waste collection services

- In March 2023, WM, a comprehensive waste management service provider, completed the acquisition of Specialized Environmental Technologies, Inc., enhancing its service offerings in the environmental sector

- In March 2023, Kinderhook Industries LLC's portfolio company, Capital Waste Services, finalized the acquisition of Sandlands, a U.S.-based company specializing in construction and demolition landfill operations

- In October 2022, Wiltshire Heavy Building Materials (Wiltshire), a company focused on recycling construction and demolition waste, was acquired by Holcim, a leading provider of concrete, cement, and aggregates across Europe

- In February 2022, SSN Innovative Infra LLP, an infrastructure-related company based in Pune, India, commissioned a construction and demolition waste management processing plant in Maharashtra, promoting eco-friendly disposal practices in the region

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.