Global Enterprise Collaboration Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

53.93 Billion

USD

132.64 Billion

2024

2032

USD

53.93 Billion

USD

132.64 Billion

2024

2032

| 2025 –2032 | |

| USD 53.93 Billion | |

| USD 132.64 Billion | |

|

|

|

|

Global Enterprise Collaboration Market Segmentation, By Component (Solutions, Services), Deployment Type (On-Premises, Cloud, Hybrid), Application (Unified Communication, Project Management and Workflow Automation, Document Sharing and Management, Enterprise Social Collaboration, Others), End User (IT and Telecommunication, BFSI, Retail and E-Commerce, Healthcare, Manufacturing, Government, Others) - Industry Trends and Forecast to 2032

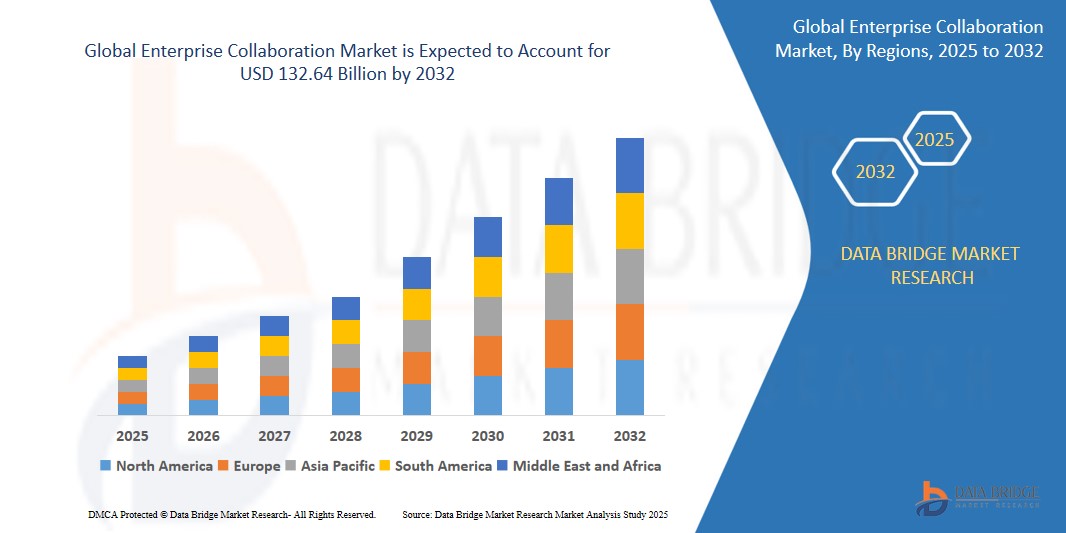

Enterprise Collaboration Market Size

- The global Enterprise Collaboration market size was valued atUSD 53.93 billion in 2024and is expected to reachUSD 132.64 billion by 2032, at aCAGR of 12.1% duringthe forecast period

- This growth is driven by the increasing adoption of cloud-based collaboration tools, the rise of remote and hybrid work models, and the integration of AI to enhance productivity and communication.

Enterprise Collaboration Market Analysis

- The Enterprise Collaboration market encompasses solutions and services that facilitate seamless communication, file sharing, project management, and real-time collaboration among employees within and across organizations, including tools like unified communication platforms, enterprise social networks, and video conferencing systems.

- The demand for enterprise collaboration solutions is significantly driven by the global shift to remote work, with 80% of enterprises adopting collaboration tools by 2024, and the need for real-time communication, with 65% of businesses prioritizing instant feedback mechanisms.

- North America is expected to dominate the Enterprise Collaboration market due to its advanced IT infrastructure, early adoption of 5G, and presence of key vendors like Microsoft and Cisco, holding a 40% market share in 2024.,

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid digital transformation, smartphone penetration, and increasing investments in collaboration tools in countries like China and India.

- The Solutions segment is expected to dominate the market with a market share of60.0%in 2025 due to the critical role of unified communication, project management, and document sharing platforms in enhancing workforce productivity.

Report Scope and Enterprise Collaboration Market Segmentation

|

Attributes |

Enterprise Collaboration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Enterprise Collaboration Market Trends

“Advancements in IoT and AI for Real-Time Data Analytics”

- A prominent trend in the Enterprise Collaboration market is the integration of AI and automation, enabling features like intelligent task prioritization, automated meeting summaries, and predictive analytics, which improve productivity by up to 25% in enterprises.

- These advancements are supported by cloud-based platforms, with 70% of organizations adopting cloud collaboration tools by 2024, offering scalability and real-time data syncing.

- For instance, in September 2024, DingTalk launched DingTalk 365, a subscription service with AI-powered tools like virtual assistants and automated replies to enhance workplace collaboration.

- This trend is driving demand for innovative, AI-driven collaboration solutions that streamline workflows and enhance communication.

Enterprise Collaboration Market Dynamics

Driver

“Rise of Remote and Hybrid Work Models”

- The global shift to remote and hybrid work models, with 60% of organizations adopting flexible work policies by 2024, and the increasing demand for real-time collaboration tools are significantly contributing to the Enterprise Collaboration market growth.

- These solutions enable seamless communication, file sharing, and project management across distributed teams, improving operational efficiency by 20%.

For instance,

- In February 2024, Tata Communications collaborated with Microsoft to integrate voice calling on Microsoft Teams, enhancing workforce efficiency for Indian enterprises.

- As enterprises prioritize workforce connectivity, the demand for collaboration tools continues to rise, ensuring business continuity and productivity.

Opportunity

“Adoption of Collaboration Tools by SMEs”

- Small and medium-sized enterprises (SMEs) are increasingly adopting cost-effective, cloud-based collaboration tools, enabling them to compete with larger organizations, with SMEs projected to grow at the fastest CAGR from 2025 to 2032.

- These tools offer scalable solutions for communication, task management, and document sharing, boosting productivity without significant infrastructure costs.

For instance,

- in 2024, SMEs in retail adopted platforms like Slack and Zoom, increasing team efficiency by 15%.

- This opportunity drives market growth by expanding the accessibility of collaboration technologies to smaller businesses.

Restraint/Challenge

“Security Concerns and Integration Complexity”

- Security concerns, with 45% of enterprises reporting data breaches in cloud-based collaboration platforms in 2024, and integration complexity with existing systems, with 50% of firms facing compatibility issues, pose significant barriers to the Enterprise Collaboration market.

- These issues require robust cybersecurity measures and simplified integration frameworks, increasing deployment costs for organizations.

For instance,

- in 2024, 30% of mid-sized firms cited security concerns as a barrier to adopting cloud collaboration tools

- These challenges can hinder market growth, necessitating secure and interoperable solutions.

Enterprise Collaboration Market Scope

The market is segmented on the basis of component, deployment type, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Type |

|

|

By Application |

|

|

By End User |

|

In 2025, the Solutions segment is projected to dominate the market with the largest share in the component segment.

The Solutions segment is expected to dominate the Enterprise Collaboration market with the largest share of 60.0% in 2025 due to the essential role of unified communication, project management, and document sharing platforms in enabling seamless collaboration across enterprises.

“North America Holds the Largest Share in the Enterprise Collaboration Market”

- North America dominates the Enterprise Collaboration market, driven by its advanced IT infrastructure, early adoption of 5G, and presence of key vendors like Microsoft, Cisco, and IBM, with a 40% market share in 2024.,

- The U.S. holds a significant share, valued at USD 21.6 billion in 2024, due to high demand for cloud-based solutions and collaborations like Tata Communications-Microsoft in 2024.

- The region’s focus on digital transformation and robust adoption of collaboration tools in BFSI and IT sectors further strengthens the market.

- In addition, high demand for real-time communication tools, with 70% of U.S. enterprises using platforms like Microsoft Teams, fuels market expansion.

“Asia-Pacific is Projected to Register the Highest CAGR in the Enterprise Collaboration Market”

- The Asia-Pacific region is expected to witness the highest growth rate, driven by rapid digital transformation, increasing smartphone penetration, and growing adoption of collaboration tools in countries like China, India, and Japan.

- China, with a projected market value of USD 15 billion by 2032, remains a key market due to its focus on enterprise digitalization and remote work adoption.

- India is projected to grow at a CAGR of 14.0% due to affordable cloud solutions and expanding IT infrastructure.

- The expanding presence of global vendors and government support for digital initiatives further contribute to market growth.

Enterprise Collaboration Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Microsoft Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Slack Technologies, LLC (U.S.)

- IBM Corporation (U.S.)

- Adobe Inc. (U.S.)

- SAP SE (Germany)

- Huawei Technologies Co., Ltd. (China)

- Atlassian Corporation Plc (Australia)

- Zoom Video Communications, Inc. (U.S.)

- Wrike, Inc. (U.S.)

Latest Developments in Global Enterprise Collaboration Market

- October 2024: Miro launched Innovation Workspace, an AI-powered platform designed to foster team collaboration throughout the entire process, from brainstorming to execution. This tool leverages AI to streamline workflows, making collaboration more efficient and impactful for teams.

- September 2024: DingTalk introduced DingTalk 365, a subscription-based service featuring AI tools such as virtual assistants and automated replies. This service is aimed at improving workplace collaboration by automating routine tasks and enhancing team communication and efficiency.

- February 2024: Tata Communications partnered with Microsoft to integrate voice calling into Microsoft Teams, enhancing workforce productivity and collaboration for Indian enterprises. This integration allows for seamless communication within the Teams platform, improving efficiency across organizations.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.