Global Medical Nonwovens Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

18.61 Billion

USD

28.35 Billion

2024

2032

USD

18.61 Billion

USD

28.35 Billion

2024

2032

| 2025 –2032 | |

| USD 18.61 Billion | |

| USD 28.35 Billion | |

|

|

|

|

Global Medical Nonwoven Market Segmentation, By Type (Spunbond, Spun-melt-spun (SMS), Drylaid, Wetlaid, Meltblown, Others), Product Type (Hygiene Technology, Apparel Products), Usability (Disposable, Reusable), Distribution Channel (Direct Tenders, Retail), End-User (Hospitals, Clinics, Home Healthcare, Laboratory, Ambulatory Surgical Centres, Others) – Industry Trends and Forecast to 2031.

Medical Nonwoven Market Size

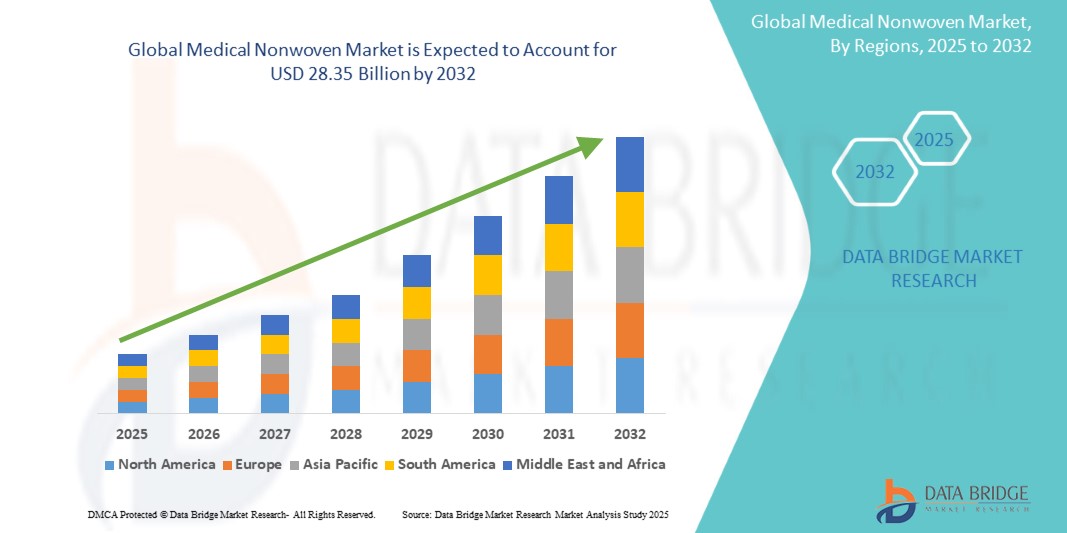

- The global medical nonwoven market size was valued at USD 18.61 billion in 2024 and is expected to reach USD 28.35 billion by 2032, at a CAGR of 5.40% during the forecast period

- This growth is driven by increasing prevalence of hospital acquired infections (HAIs)

Medical Nonwoven Market Analysis

- Medical Nonwoven materials play a crucial role in healthcare environments by preventing and reducinghealthcare-associated infections (HAIs)through effective sterilization, disinfection, and containment solutions. These materials are used in a wide range of medical applications such assurgical gowns, drapes, wound care products, and sterilization wraps

- The demand for Medical Nonwoven materials is growing rapidly, driven by the increasing prevalence of HAIs, a rising number of surgical procedures, and hospital admissions. In addition, stringent regulations on hygiene, infection control, and disinfection protocols across healthcare settings are further boosting market growth

- North America is expected to dominate the medical nonwoven market with the largest market share of 37.22%, supported by the presence of major manufacturers, rising demand for disposable medical products, and stringent infection control regulations enforced by healthcare authorities

- Asia-Pacific is projected to register the highest growth rate in the medical nonwoven market during the forecast period, due to population growth, rising healthcare needs, and increasing demand for infection prevention in healthcare settings

- The disposable segment is expected to dominate the usability segment with the largest market share of 77.89%, due to high demand for single-use medical products such as surgical drapes, gowns, masks, and wound dressings to prevent cross-contamination

Report Scope andMedical Nonwoven Market Segmentation

|

Attributes |

Medical Nonwoven KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Nonwoven Market Trends

“Growing Integration of Eco-Friendly Materials in Medical Nonwovens”

- A key trend in the medical nonwoven market is the increasing integration of eco-friendly materials such as biodegradable and recyclable fibers in medical products. These materials are becoming popular due to their reduced environmental impact and increased focus on sustainability in healthcare practices

- Healthcare providers are adopting these environmentally conscious alternatives in products such as surgical gowns, drapes, and wound care dressings to comply with sustainable policies and reduce medical waste

- The use of non-toxic, eco-friendly materials ensures that medical nonwovens meet both hygiene and environmental standards without compromising on performance

- For instance, in 2023, Suominen Corporation launched a new line of eco-friendly medical nonwoven fabrics made from biodegradable fibers aimed at reducing the environmental footprint of surgical gowns and drapes

- This trend is reshaping the industry by driving manufacturers to innovate sustainable solutions, contributing to a cleaner healthcare environment while addressing the rising demand for green products

Medical Nonwoven Market Dynamics

Driver

“Technological Advancements in Nonwoven Manufacturing Processes”

- Technological advancements in the manufacturing processes of medical nonwoven materials are significantly driving market growth. Innovations such as spunbond, meltblown, and SMS (spun-melt-spun) processes are improving product efficiency, quality, and cost-effectiveness

- These advancements enable manufacturers to produce medical nonwovens that offer superior durability, high absorption rates, and effective barrier properties, which are essential for preventing infections in healthcare settings

- Improved production techniques also reduce lead times and costs, making medical nonwovens more accessible to hospitals and healthcare institutions worldwide

- For instance, in 2023, Berry Global Inc. unveiled a new meltblown technology that improves the filtration capabilities of medical nonwoven fabrics, particularly in face masks and respirators

- The continued development of manufacturing technology is propelling market expansion by meeting the rising demand for high-performance medical nonwoven products

Opportunity

“Expansion in Emerging Markets Due to Healthcare Improvements”

- Emerging markets, especially in Asia-Pacific, Latin America, and the Middle East, present significant growth opportunities for the medical nonwoven market as these regions invest heavily in improving healthcare infrastructure

- The increasing number of healthcare facilities, a growing aging population, and rising awareness of healthcare-associated infections (HAIs) are driving demand for sterilization and infection prevention products

- Manufacturers are focusing on expanding their distribution networks to these regions, offering affordable medical nonwoven solutions that meet the growing healthcare needs

- For instance, in 2023, Freudenberg SE expanded its production capabilities in India to cater to the increasing demand for medical nonwoven products such as surgical drapes and wound care dressings

- This market expansion is expected to accelerate the adoption of medical nonwoven solutions in areas with previously limited access to advanced healthcare technologies

Restraint/Challenge

“Challenges in Standardization and Regulatory Compliance”

- One of the key challenges in the medical nonwoven market is the inconsistency in regulatory standards and the complexity of complying with different healthcare regulations across regions. These inconsistencies can slow product approval processes and increase operational costs for manufacturers

- Different countries have varying standards for product performance, sterilization, and infection control, which creates barriers to entry for new companies and complicates the distribution of medical nonwoven products globally

- Furthermore, the lack of universal guidelines for some nonwoven materials may result in discrepancies in product quality, affecting their effectiveness in infection prevention

- For instance, in 2023, Kimberly-Clark Corporation faced delays in obtaining approval for its new line of surgical gowns in several European markets due to differing sterilization requirements

- Overcoming these regulatory hurdles is essential for global market growth, as standardization and compliance will enable easier access to a broader range of healthcare providers

Medical Nonwoven Market Scope

The market is segmented on the basis of type, product type, usability, distribution channel, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product Type |

|

|

By Usability |

|

|

By Distribution Channel |

|

|

By End-User |

|

In 2025, the disposable is projected to dominate the market with a largest share in usability segment

The disposable segment is expected to dominate the medical nonwoven market with the largest market share of 77.89% in 2025 due to high demand for single-use medical products such as surgical drapes, gowns, masks, and wound dressings to prevent cross-contamination.

The spunbond is expected to account for the largest share during the forecast period in type segment

In 2025, the surgical instruments segment is expected to dominate the market with the largest market share of 55.41% due to its durability, breathability, and versatility, making it suitable for various medical applications. Its adaptability allows for use in products that require both strength and comfort, essential qualities in medical environments.

Medical Nonwoven Market Regional Analysis

“North America Holds the Largest Share in the Medical Nonwoven Market”

- North America is expected to dominate the global medical nonwoven market with the largest market share of 37.22%, supported by the presence of major manufacturers, rising demand for disposable medical products, and stringent infection control regulations enforced by healthcare authorities

- The U.S. dominates the region due to high healthcare spending, increasing surgical procedures, and widespread adoption of disposable medical supplies such as gowns, drapes, and face masks

- Ongoing developments in hospital infrastructure, rising awareness about cross-contamination, and favorable policies for using single-use medical textiles are expected to maintain North America's dominance in the forecast period

“Asia-Pacific is Projected to Register the HighestCAGR in the Medical Nonwoven Market”

- Asia-Pacific is projected to experience the highest growth rate in the medical nonwoven market, driven by population growth, rising healthcare needs, and increasing demand for infection prevention in healthcare settings

- Countries such as China, India, and Japan are contributing significantly due to large-scale healthcare investments, local manufacturing of disposable medical products, and supportive government healthcare programs

- Japan, known for its advanced healthcare standards, is incorporating innovative nonwoven technologies, while China and India are investing heavily in healthcare modernization, leading to strong market expansion across the region

Medical Nonwoven Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Ahlstrom(Finland)

- Berry Global Inc. (U.S.)

- Magnera (U.S.)

- DuPont(U.S.)

- Lydall, Inc. (U.S.)

- Fitesa SA(Brazil)

- TWE GmbH & Co. KG (Germany)

- PFNonwovens Holding s.r.o. (Czech Republic)

- Kraton Corporation (U.S.)

- Owens & Minor (U.S.)

- PFNonwovens a.s. (Czech Republic)

- Freudenberg SE (Germany)

- Dynarex Corporation (U.S.)

- Suominen Corporation (Finland)

- Fibertex Nonwovens A/S (Denmark)

- KCWW (U.S.)

- ABENA A/S (Denmark)

- Asahi Kasei Corporation (Japan)

Latest Developments in Global Medical Nonwoven Market

- In August 2024, Manjushree Spntek introduced a specialized range of hybrid nonwovens for chemotherapy gowns, utilizing Hightex monolithic hybrid nonwoven technology. These materials combine a polymer-based continuous fiber web with thermoplastic reinforcement to ensure high-level protection against chemicals and hazardous drugs, while maintaining wearer comfort during medical procedures. This innovation significantly improves safety and comfort for healthcare professionals handling high-risk medications

- In August 2023, Ahlstrom, recognized for its advanced medical textiles, launched the Reliance Fusion Sterilization Wrap. Designed to enhance performance in Central Sterile Services Departments (CSSDs), this product addresses issues related to wet packs and helps improve overall sterilization efficiency. This product strengthens Ahlstrom’s position in the infection control segment of medical nonwovens

- In July 2023, Freudenberg Performance Materials unveiled new wound care solutions, including an elastic version of its flexible superabsorbers. These are tailored for modern wound dressings, offering increased patient comfort and longer wear times, which help reduce the frequency of dressing changes. This launch supports improved patient outcomes and efficiency in wound management

- In May 2022, Winner Medical debuted a range of advanced wound care products in France, including transparent film dressing, bordered silicone foam dressing with SAF, an Antibiosis Series, and the new CMC dressing. The CMC dressing features a composition of gelling fiber, non-woven fabric, and polyester reinforcing thread. These innovations reflect Winner Medical’s focus on high-performance wound care solutions

- In February 2022, Kimberly-Clark Corporation finalized the acquisition of a majority stake in Thinx, Inc., a leader in reusable period and incontinence products. This move is intended to diversify Kimberly-Clark's product line and meet growing consumer demand for sustainable hygiene solutions. The acquisition strengthens Kimberly-Clark's presence in the reusable personal care segment

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.