Middle East And Africa Unmanned Aerial Vehicle Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.18 Billion

USD

7.11 Billion

2025

2033

USD

2.18 Billion

USD

7.11 Billion

2025

2033

| 2026 –2033 | |

| USD 2.18 Billion | |

| USD 7.11 Billion | |

|

|

|

|

Segmentação do mercado de veículos aéreos não tripulados (VANTs) no Oriente Médio e África, por tipo de produto (VANTs de asa rotativa, VANTs de asa fixa, VANTs híbridos, outros), por componente do sistema (plataforma, software e cibersegurança, enlace de dados, sistemas de lançamento e recuperação), por função (inteligência, vigilância e reconhecimento (ISR), mapeamento e levantamento topográfico, monitoramento e inspeção, entrega e logística, agricultura e agricultura de precisão, fotografia aérea, outros), por tipo de mobilidade (VANTs de asa rotativa, asa fixa, VANTs híbridos VTOL, helicópteros monorrotores, nanodrones/microdrones, outros), por usuário final (defesa e segurança, comercial, recreativo, civil, outros), por tipo de usuário (militar, operadores comerciais, governo e aplicação da lei, consumidor/entusiasta) e por canal de distribuição (indireto, direto) - Tendências e previsões do setor até 2033.

Tamanho do mercado de veículos aéreos não tripulados no Oriente Médio e na África

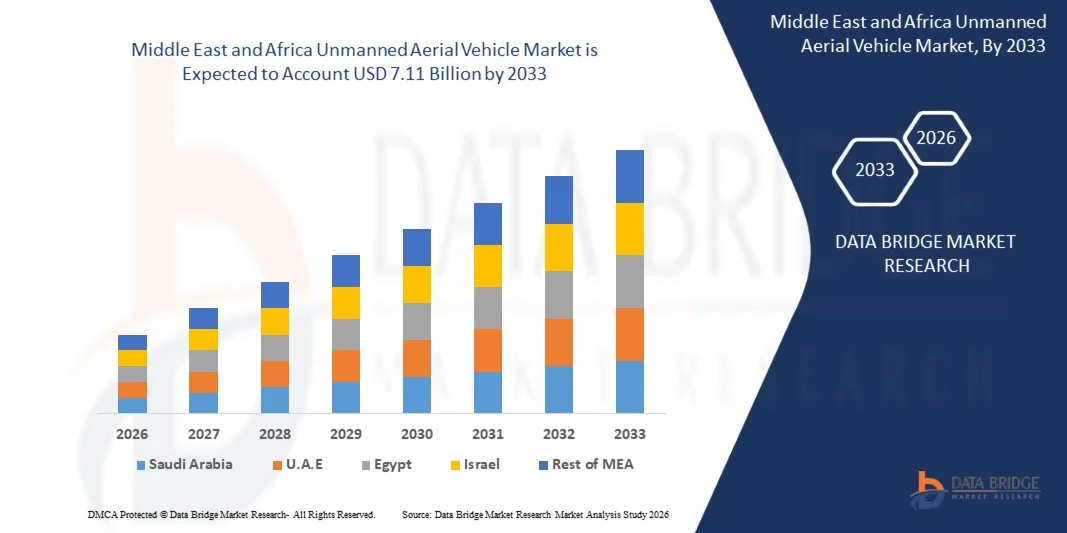

- O mercado de veículos aéreos não tripulados (VANTs) no Oriente Médio e na África deverá atingir US$ 7,11 bilhões em 2033, partindo de US$ 2,18 bilhões em 2025, crescendo a uma taxa composta anual (CAGR) de 16,1% no período de previsão de 2026 a 2033.

- O mercado de drones no Oriente Médio e na África está experimentando um rápido crescimento, impulsionado pela crescente adoção nos setores de defesa, agricultura, logística e indústria, com demanda cada vez maior por aplicações de vigilância, entrega e monitoramento.

- A integração de tecnologias avançadas de drones, incluindo navegação com inteligência artificial, sistemas de voo automatizados e análise de dados em tempo real, está acelerando a expansão do mercado, aprimorando a eficiência operacional e a precisão em diversas aplicações.

- Iniciativas governamentais, apoio regulatório e desenvolvimento de infraestrutura — como a modernização do espaço aéreo, políticas favoráveis a drones e investimentos em projetos de cidades inteligentes — estão impulsionando o crescimento do mercado e incentivando a implantação de drones tanto no setor privado quanto no comercial. A crescente tendência em direção a serviços de valor agregado, como soluções personalizadas de FIBC (Field Block Container), integração 3PL/4PL e armazenamento com temperatura controlada para produtos a granel sensíveis, está reforçando a posição da América do Norte como um mercado maduro com forte potencial de crescimento a longo prazo em soluções de embalagens a granel.

Análise do mercado de veículos aéreos não tripulados no Oriente Médio e na África

- O mercado de drones no Oriente Médio e na África abrange a produção, distribuição e uso de veículos aéreos não tripulados em setores como agricultura, logística, construção, defesa e aplicações industriais, impulsionado pela crescente demanda por soluções eficientes de monitoramento, entrega e coleta de dados.

- Israel domina o mercado, representando 28,47%, impulsionado pela rápida industrialização, iniciativas governamentais, crescente adoção de tecnologias de drones e expansão das atividades de comércio eletrônico e logística.

- Os drones de asa rotativa representam o maior segmento, detendo 53,78% da participação de mercado, devido à sua versatilidade, manobrabilidade e adequação para aplicações de vigilância, entrega e agricultura.

- A crescente adoção de tecnologias avançadas de drones, incluindo navegação com inteligência artificial, sistemas de voo automatizados e análise de dados em tempo real, está aprimorando a eficiência operacional e impulsionando a expansão do mercado nos setores comercial e industrial.

- Políticas governamentais favoráveis, desenvolvimento de infraestrutura e investimentos em projetos de cidades inteligentes estão impulsionando ainda mais o crescimento do mercado, incentivando a implantação de drones nos setores privado e comercial e fortalecendo o potencial de longo prazo do setor.

Escopo do relatório e segmentação do mercado de veículos aéreos não tripulados no Oriente Médio e na África

|

Atributos |

Análise do mercado de veículos aéreos não tripulados no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de informações de mercado como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado elaborado pela equipe da Data Bridge Market Research inclui análises aprofundadas de especialistas, análises de importação/exportação, análises de preços, análises de produção e consumo e análises PESTEL. |

Tendências do mercado de veículos aéreos não tripulados no Oriente Médio e na África

“ Integração com projetos de cidades inteligentes, automação de armazéns e logística de comércio eletrônico ”

- Os drones estão sendo utilizados para monitoramento de tráfego, planejamento urbano e segurança pública, aprimorando a tomada de decisões baseada em dados em iniciativas de cidades inteligentes.

- Os drones facilitam a gestão de inventário, o monitoramento de estoque em tempo real e o manuseio automatizado de materiais, melhorando a eficiência operacional em armazéns.

- Os drones são cada vez mais utilizados para entregas de última milha, processamento rápido de pedidos e otimização da cadeia de suprimentos, impulsionando o crescimento das plataformas de comércio eletrônico.

Por exemplo,

- Em janeiro de 2025, os veículos aéreos não tripulados (VANTs) já fazem parte de sistemas de logística inteligentes que integram inteligência artificial (IA), redes 5G e robótica para tornar o transporte de cargas e as entregas mais rápidas e seguras, demonstrando como a tecnologia de VANTs está se tornando um componente essencial da infraestrutura logística de cidades inteligentes de próxima geração.

- Um recente panorama do setor destaca o rápido crescimento de soluções de entrega autônomas, incluindo sistemas de entrega por drones, à medida que o comércio eletrônico se expande, apontando para uma adoção logística mais ampla além dos métodos tradicionais.

Dinâmica do mercado de veículos aéreos não tripulados no Oriente Médio e na África

Motorista

“ Aumento das necessidades de modernização da defesa e de ISR (Inteligência, Vigilância e Reconhecimento) militar ”

- O setor de defesa do Oriente Médio e da África está passando por uma rápida aceleração na aquisição e integração operacional de veículos aéreos não tripulados (VANTs), impulsionada pela evolução e crescente complexidade das necessidades de inteligência, vigilância, reconhecimento (ISR) e proteção de forças. As forças armadas em todo o mundo estão priorizando os VANTs como ativos essenciais para uma série de missões, desde ISR persistente e vigilância de fronteiras até inteligência eletrônica (ELINT) e operações de ataque de precisão. À medida que as estratégias militares evoluem para enfrentar novas ameaças, há uma demanda crescente por plataformas de VANTs capazes de voos de longa duração, execução autônoma de missões e links de comunicação seguros para permitir a transferência de dados em tempo real.

- O crescente foco em UAVs (Veículos Aéreos Não Tripulados) nas iniciativas de modernização da defesa criou um ambiente dinâmico para que os fornecedores inovem, resultando em avanços na modularidade da plataforma, autonomia e subsistemas como propulsão, sensores e links de dados seguros. Em resposta a essa demanda, as empresas contratadas pela defesa estão investindo fortemente no desenvolvimento de soluções versáteis de UAVs que possam ser facilmente adaptadas a diversos perfis de missão, seja para ISR (Inteligência, Vigilância e Reconhecimento), apoio tático ou operações ofensivas.

- Essas inovações são impulsionadas pelas necessidades operacionais das forças armadas modernas, que exigem plataformas adaptáveis e multifuncionais capazes de operar em ambientes diversos e frequentemente hostis. À medida que os ministérios da defesa continuam a priorizar a integração de VANTs (Veículos Aéreos Não Tripulados) em suas estruturas de forças, esse ímpeto de aquisição não apenas influencia os investimentos dos fornecedores, mas também remodela as capacidades militares do Oriente Médio e da África, reforçando o papel dos VANTs como componentes centrais da guerra moderna.

Por exemplo

- Em setembro de 2023, de acordo com um artigo do Centro para Segurança e Tecnologias Emergentes, o Departamento de Defesa dos EUA anunciou a "Iniciativa Replicadora", com o objetivo de implantar rapidamente milhares de sistemas autônomos e não tripulados, incluindo drones aéreos, para combater ameaças emergentes por meio de processos acelerados de aquisição e implantação.

- Em fevereiro de 2024, um artigo publicado pela Crown afirmava que o Ministério da Defesa do Reino Unido reafirmou os sistemas não tripulados e autônomos como prioridades centrais em sua agenda de modernização da defesa, destacando a integração de UAVs para ISR (Inteligência, Vigilância e Reconhecimento), apoio a ataques e resiliência operacional nos domínios aéreo e terrestre.

- Em fevereiro de 2025, a Agência Europeia de Defesa (EDA) delineou os esforços multinacionais em curso para melhorar as capacidades de ISR (Inteligência, Vigilância e Reconhecimento) de aeronaves não tripuladas, apoiando a aquisição conjunta, a interoperabilidade e a harmonização de capacidades entre os Estados-Membros da UE.

Restrição/Desafio

“Falta de regulamentações harmonizadas no Oriente Médio e na África para operações com drones”

- A falta de regulamentações harmonizadas no Oriente Médio e na África para operações com veículos aéreos não tripulados (VANTs) representa um desafio significativo para o mercado de VANTs na região, uma vez que os marcos regulatórios variam muito entre os países e regiões.

- As autoridades de aviação civil aplicam regras diferentes para acesso ao espaço aéreo, licenciamento de pilotos, certificação de plataformas, proteção de dados e aprovações operacionais, como voos além da linha de visão visual (BVLOS). Essa fragmentação regulatória força os fabricantes e operadores de drones a personalizar plataformas, softwares e procedimentos operacionais para cada jurisdição, aumentando os custos de conformidade e prolongando o tempo de lançamento no mercado.

- Como resultado, as empresas enfrentam dificuldades para expandir as operações com drones internacionalmente, principalmente para serviços transfronteiriços como logística, mapeamento e inspeção de infraestrutura.

Por exemplo,

- No final de novembro de 2025, de acordo com uma publicação no LinkedIn, diversas autoridades locais na Índia (por exemplo, Mumbai, Uttarakhand e Varanasi) emitiram ordens temporárias de exclusão aérea para drones em torno de eventos e áreas aeroportuárias, com cada jurisdição estabelecendo diferentes restrições espaciais e temporais. Essa variedade de regras locais ilustra a fragmentação regulatória dentro de um mesmo país e representa um desafio para os operadores, que precisam lidar com diferentes requisitos regulatórios mesmo dentro de uma mesma nação.

- Em maio de 2025, segundo o Times of India, a polícia de Nashik, na Índia, declarou toda a cidade uma zona de exclusão aérea para drones, em meio a amplas preocupações com a segurança, apesar da existência simultânea de estruturas nacionais de espaço aéreo digital, como a Plataforma Digital Sky da Índia. A proibição local generalizada, que ia além das diretrizes nacionais para drones, causou desafios operacionais para operadores de drones civis e comerciais, que tiveram que solicitar permissão explícita para quaisquer voos durante o período de proibição.

Escopo do mercado de veículos aéreos não tripulados no Oriente Médio e na África

O mercado de veículos aéreos não tripulados (VANTs) no Oriente Médio e na África é categorizado em sete segmentos principais, com base em tipo de produto, componente, função, tipo de mobilidade, usuário final, tipo de usuário e canal de distribuição.

Por tipo de produto

Com base no tipo de produto, o mercado de veículos aéreos não tripulados (VANTs) no Oriente Médio e na África é segmentado em VANTs de asa rotativa, VANTs de asa fixa, VANTs híbridos e outros.

O segmento de drones de asa rotativa deverá dominar o mercado devido à sua versatilidade, manobrabilidade e facilidade de operação superiores em comparação com plataformas de asa fixa. Esses drones podem decolar e pousar verticalmente, pairar com precisão e operar com eficácia em ambientes confinados ou urbanos sem a necessidade de pistas de pouso. Tais capacidades os tornam ideais para aplicações como fotografia aérea, vigilância, inspeção de infraestrutura, mapeamento, agricultura e segurança pública. Os drones de asa rotativa também são amplamente adotados por agências militares e policiais para missões táticas e de inteligência de curto alcance. Além disso, os custos de aquisição mais baixos, a facilidade de implantação e os rápidos avanços tecnológicos em projetos multirrotores continuam a impulsionar sua ampla adoção no Oriente Médio e na África.

Por componente do sistema

Com relação aos componentes do sistema, o mercado de veículos aéreos não tripulados (VANTs) do Oriente Médio e da África é segmentado em plataforma, software e cibersegurança, enlace de dados e sistemas de lançamento e recuperação.

Espera-se que o segmento de Plataformas domine o mercado, pois representa o sistema físico central que determina o desempenho, a capacidade e a adequação à missão. As plataformas de UAVs (Veículos Aéreos Não Tripulados) representam a maior parcela do custo total do sistema, abrangendo fuselagens, unidades de propulsão, sistemas de controle de voo e componentes estruturais. A crescente demanda das forças de defesa por UAVs táticos avançados, MALE (Médio, Longa, Longa e Longa Duração) e HALE (Alto, Longa e Longa Duração), juntamente com a crescente adoção comercial de drones multirrotores e de asa fixa, impulsiona significativamente as vendas de plataformas. Além disso, a expansão frequente da frota, os ciclos de substituição e a personalização para aplicações específicas, como vigilância, entrega e inspeção, reforçam ainda mais a liderança do segmento de plataformas no mercado.

• Por função

Com base na função, o mercado de veículos aéreos não tripulados (VANTs) no Oriente Médio e na África é segmentado em Inteligência, Vigilância e Reconhecimento (ISR), Mapeamento e Levantamento Topográfico, Monitoramento e Inspeção, Entrega e Logística, Agricultura e Agricultura de Precisão, Fotografia Aérea e Outros.

Espera-se que o segmento de Inteligência domine o mercado devido à crescente ênfase no Oriente Médio e na África em inteligência, vigilância e reconhecimento (ISR) em operações de defesa e segurança. Governos e forças militares dependem cada vez mais de drones para obter consciência situacional em tempo real, monitoramento de fronteiras, contraterrorismo e inteligência no campo de batalha, sem colocar vidas humanas em risco. Os sistemas de inteligência baseados em drones oferecem monitoramento contínuo, imagens de alta resolução e transmissão rápida de dados a custos operacionais mais baixos em comparação com aeronaves tripuladas. Além disso, o aumento das tensões geopolíticas, a guerra assimétrica e a integração de sensores avançados, análises baseadas em IA e sistemas de comunicação seguros estão fortalecendo ainda mais a demanda por soluções de drones focadas em inteligência em todo o mundo.

Por tipo de mobilidade

Com base no tipo de mobilidade, o mercado de veículos aéreos não tripulados (VANTs) do Oriente Médio e da África é segmentado em VANTs de asa rotativa, asa fixa, híbridos VTOL, helicópteros de rotor único, nanodrones/microdrones e outros.

Espera-se que o segmento de drones de asa rotativa domine o mercado devido à sua flexibilidade operacional superior e versatilidade em uma ampla gama de aplicações. Os drones de asa rotativa podem decolar e pousar verticalmente, pairar no ar e operar com eficácia em ambientes confinados ou urbanos, onde os drones de asa fixa têm limitações. Essas capacidades os tornam ideais para vigilância, inspeção, mapeamento, resposta a emergências e missões militares. Sua capacidade de transportar diversas cargas úteis, como câmeras, LiDAR, sensores e equipamentos de comunicação, aumenta ainda mais sua adoção. Além disso, a forte demanda dos setores de defesa, segurança pública, monitoramento de infraestrutura e fotografia comercial continua impulsionando a ampla implantação de drones de asa rotativa no Oriente Médio e na África.

Por usuário final

Com base no usuário final, o mercado de veículos aéreos não tripulados (VANTs) do Oriente Médio e da África é segmentado em Defesa e Segurança, Comercial, Recreativo, Civil e Outros.

Espera-se que o segmento de Defesa e Segurança domine o mercado devido aos investimentos militares contínuos no Oriente Médio e na África em plataformas de inteligência, vigilância, reconhecimento e prontas para combate. As forças armadas dependem cada vez mais de drones para monitoramento de fronteiras, detecção de ameaças, aquisição de alvos e ataques de precisão, pois reduzem o risco operacional para o pessoal e oferecem maior autonomia a custos mais baixos do que aeronaves tripuladas. O aumento das tensões geopolíticas, a guerra assimétrica e a necessidade de inteligência em tempo real no campo de batalha reforçam ainda mais a demanda. Além disso, os programas de drones para defesa se beneficiam de contratos de aquisição de longo prazo, atualizações contínuas e integrações de cargas úteis de alto valor agregado, resultando em uma contribuição de receita significativamente maior em comparação com as aplicações de drones comerciais e civis.

Por tipo de usuário

Com base no tipo de usuário, o mercado de veículos aéreos não tripulados (VANTs) do Oriente Médio e da África é segmentado em Militar, Operadores Comerciais, Governo e Forças da Lei, e Consumidores/Entusiastas.

Espera-se que o segmento militar domine o mercado devido aos gastos contínuos com defesa e à importância estratégica dos sistemas não tripulados na guerra moderna. As forças armadas dependem cada vez mais de drones para missões de inteligência, vigilância, reconhecimento, monitoramento de fronteiras e ataques de precisão, pois reduzem os riscos para o pessoal e aumentam a eficácia operacional. Os drones militares têm custos unitários significativamente mais altos e contratos de serviço de longo prazo em comparação com drones comerciais, contribuindo com mais receita por plataforma. As tensões geopolíticas contínuas, a modernização das forças de defesa, a demanda por drones de longa duração e capacidade de combate, e os investimentos em andamento em sistemas autônomos e com inteligência artificial reforçam ainda mais a posição de liderança do segmento militar no mercado de drones do Oriente Médio e da África.

Por canal de distribuição

Com base no canal de distribuição, o mercado de veículos aéreos não tripulados (VANTs) do Oriente Médio e da África é segmentado em indireto e direto.

Espera-se que o segmento indireto domine o mercado devido à sua capacidade de fornecer soluções abrangentes que vão além da fabricação de drones, incluindo software, análise de dados, manutenção, treinamento, integração e serviços gerenciados. Muitos usuários finais preferem soluções indiretas, pois elas reduzem a complexidade operacional, a carga regulatória e o investimento inicial de capital. Agências de defesa e empresas terceirizam cada vez mais as operações de UAVs, o processamento de dados e o gerenciamento de frotas para provedores de serviços especializados, a fim de aumentar a eficiência e se concentrar em suas atividades principais. Além disso, as receitas recorrentes de serviços, atualizações e contratos de longo prazo geram um valor maior e mais estável em comparação com as vendas únicas de hardware, fortalecendo a dominância do segmento indireto.

Análise Regional do Mercado de Veículos Aéreos Não Tripulados no Oriente Médio e África

- Israel é o maior mercado de drones, representando 28,40% da demanda do Oriente Médio e da África. Com uma taxa de crescimento anual composta (CAGR) projetada de 15,8%, o crescimento é impulsionado pela rápida industrialização, apoio governamental, expansão do comércio eletrônico e das operações logísticas, e crescente adoção de drones nos setores agrícola, de construção e de vigilância.

- A região se beneficia da melhoria da infraestrutura, de políticas regulatórias favoráveis e do aumento do investimento em iniciativas de cidades inteligentes e tecnologia de drones. O crescimento das aplicações finais na agricultura, inspeção industrial e logística sustenta uma forte penetração de mercado e um potencial de crescimento a longo prazo no Oriente Médio e na África.

Análise Regional do Mercado de Veículos Aéreos Não Tripulados na Arábia Saudita

- Prevê-se que a Arábia Saudita cresça a uma notável taxa composta de crescimento anual (CAGR) de 16,6% durante o período de previsão, emergindo como um importante contribuinte para a expansão do mercado regional. Com uma participação de 21,38% no mercado regional, o Reino está fortalecendo rapidamente suas capacidades em veículos aéreos não tripulados (VANTs), apoiado por um forte incentivo governamental no âmbito da Visão 2030, que visa diversificar a economia, localizar a produção de defesa e aprimorar a segurança nacional. Investimentos significativos em sistemas avançados de vigilância, desenvolvimento de infraestrutura inteligente e segurança de fronteiras estão impulsionando a crescente adoção de tecnologias de VANTs tanto em aplicações de defesa quanto civis. Além disso, parcerias com fabricantes globais de defesa e o foco crescente na produção nacional estão acelerando o avanço tecnológico. Esses fatores, em conjunto, posicionam a Arábia Saudita como um mercado de VANTs de rápido crescimento e estrategicamente importante na região.

Análise Regional do Mercado de Veículos Aéreos Não Tripulados nos Emirados Árabes Unidos

- Prevê-se que os Emirados Árabes Unidos registrem a maior taxa de crescimento anual composta (CAGR) de 16,8% até 2033, consolidando sua posição como um dos principais mercados em crescimento na região. Detendo uma participação de 17,29% no mercado regional, o país está adotando agressivamente a tecnologia de drones em uma ampla gama de aplicações, incluindo logística, segurança, desenvolvimento de cidades inteligentes e planejamento urbano. Iniciativas governamentais de apoio a sistemas autônomos, juntamente com marcos regulatórios progressivos, estão permitindo a rápida integração de drones em operações comerciais e do setor público. Além disso, parcerias estratégicas com fabricantes globais de drones e drones estão acelerando a transferência de tecnologia e o desenvolvimento de capacidades locais. Investimentos robustos em inovação, infraestrutura e soluções avançadas de mobilidade continuam impulsionando a rápida expansão do mercado de drones nos Emirados Árabes Unidos.

Análise Regional do Mercado de Veículos Aéreos Não Tripulados na África do Sul

- A África do Sul mantém uma taxa de crescimento anual composta (CAGR) saudável de 15,7% durante o período de previsão, refletindo um crescimento constante e sustentável em seu mercado de drones. Com uma participação de 9,64% no mercado regional, a expansão do país é impulsionada principalmente pela crescente adoção de drones em setores-chave como agricultura, mineração e monitoramento ambiental. Os drones são cada vez mais utilizados para vigilância de plantações, agricultura de precisão, inspeção de minas e avaliação de terras, ajudando as organizações a melhorar a eficiência operacional, reduzir custos e aumentar a segurança. A crescente conscientização sobre os benefícios da tecnologia de drones, juntamente com a maior clareza regulatória e acessibilidade tecnológica, está impulsionando ainda mais o desenvolvimento do mercado. Esses fatores, em conjunto, contribuem para a posição consistente e cada vez mais sólida da África do Sul no cenário regional de drones.

Participação de mercado de veículos aéreos não tripulados no Oriente Médio e na África

O setor de Veículos Aéreos Não Tripulados é liderado principalmente por empresas consolidadas, incluindo:

- DJI (China)

- Northrop Grumman Corporation (EUA)

- Lockheed Martin Corporation (EUA)

- General Atomics Aeronautical Systems (EUA)

- BAE Systems (Reino Unido)

- Grupo Thales (França)

- Leonardo SPA (Itália)

- Teledyne FLIR LLC (EUA)

- Insitu (uma empresa Boeing) (EUA)

- Robótica Autel (China)

- Ehang Holdings (China)

- Parrot SA (França)

Últimos desenvolvimentos no mercado de veículos aéreos não tripulados no Oriente Médio e na África

- Em novembro de 2025, a BAE Systems e a Turkish Aerospace assinaram um Memorando de Entendimento para formar uma aliança estratégica focada no desenvolvimento de sistemas aéreos não tripulados. A colaboração reúne a expertise da BAE Systems em aeronaves de combate da FalconWorks e as comprovadas capacidades da Turkish Aerospace em UAS (Sistemas Aéreos Não Tripulados) para explorar conjuntamente a inovação, acelerar o desenvolvimento e desbloquear novas oportunidades de mercado no Oriente Médio e na África por meio de soluções economicamente viáveis.

- Em julho de 2025, a BAE Systems demonstrou com sucesso uma capacidade de ataque de baixo custo, lançando munições guiadas com precisão a partir de um sistema aéreo não tripulado multirrotor durante testes nos EUA. Utilizando uma plataforma TRV-150 equipada com APKWS®, os testes destruíram alvos aéreos e terrestres, apresentando uma solução UAS multifuncional e acessível para operações modernas em campo de batalha.

- Em dezembro de 2025, na I/ITSEC 2025, a Thales apresentou uma nova capacidade de treinamento com drones que integra drones em simulações militares reais. Compatível com diversos tipos de drones, o sistema permite treinamento realista tanto para cenários com drones aliados quanto inimigos. Ele aprimora a prontidão operacional ao simular a neutralização de drones, o uso de munições de ataque de precisão e fornece análises baseadas em dados, preparando as forças armadas para as ameaças aéreas em constante evolução no campo de batalha moderno.

- Em junho de 2025, a Leonardo e a Baykar estabeleceram uma joint venture 50/50, a LBA Systems, com sede na Itália, para desenvolver tecnologias não tripuladas. Anunciada no Paris Airshow 2025, a parceria combina as plataformas avançadas de UAS da Baykar com a expertise da Leonardo em eletrônica, certificação e sistemas multidomínio, visando projetar, produzir e manter conjuntamente sistemas aéreos não tripulados de última geração para os mercados europeu, do Oriente Médio e da África.

- Em junho de 2025, a Leonardo e a Baykar estabeleceram uma joint venture 50/50, a LBA Systems, com sede na Itália, para desenvolver tecnologias não tripuladas. Anunciada no Paris Airshow 2025, a parceria combina as plataformas avançadas de UAS da Baykar com a expertise da Leonardo em eletrônica, certificação e sistemas multidomínio, visando projetar, produzir e manter conjuntamente sistemas aéreos não tripulados de última geração para os mercados europeu, do Oriente Médio e da África.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 OVERVIEW

4.2.2 LOGISTIC COST SCENARIO

4.2.2.1 INBOUND LOGISTICS FOR COMPONENTS AND SUBSYSTEMS

4.2.2.2 DOMESTIC DISTRIBUTION AND SYSTEM DEPLOYMENT

4.2.2.3 EXPORT LOGISTICS AND MIDDLE EAST AND AFRICA DEPLOYMENT

4.2.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

4.2.3.1 SPECIALIZED HANDLING AND SECURITY

4.2.3.2 SUPPLY CHAIN COORDINATION AND NETWORK DESIGN

4.2.3.3 REGULATORY COMPLIANCE AND EXPORT MANAGEMENT

4.2.3.4 RISK MITIGATION AND SUPPLY CHAIN RESILIENCE

4.2.3.5 SUPPORT FOR AFTERMARKET AND CUSTOMER SERVICE

4.2.4 CONCLUSION

4.3 VALUE CHAIN ANALYSIS

4.3.1 RAW MATERIAL AND COMPONENT SUPPLIERS: ENABLING PERFORMANCE AND RELIABILITY

4.3.2 TECHNOLOGY AND SOFTWARE PROVIDERS: POWERING AUTONOMY AND INTELLIGENCE

4.3.3 MANUFACTURERS AND FORMULATORS: CONVERTING DATA INTO CUSTOMIZED PRODUCTS

4.3.4 MANUFACTURERS AND SYSTEM INTEGRATORS: CONVERTING TECHNOLOGY INTO MISSION-READY UAVS

4.3.5 GROUND CONTROL, SUPPORT EQUIPMENT, AND PAYLOAD PROVIDERS: EXPANDING OPERATIONAL CAPABILITY

4.3.6 END USERS AND SERVICE OPERATORS: DRIVING DEMAND THROUGH MISSION REQUIREMENTS

4.3.7 REGULATORY AUTHORITIES AND STANDARDS BODIES

4.3.8 SUSTAINABILITY AND INNOVATION DRIVERS

4.4 VENDOR SELECTION CRITERIA

4.4.1 TECHNICAL CAPABILITY & PRODUCT PERFORMANCE

4.4.2 MANUFACTURING & INTEGRATION CAPABILITIES

4.4.3 SUPPLY CHAIN RELIABILITY & AFTER‑SALES SUPPORT

4.4.4 COST & COMMERCIAL COMPETITIVENESS

4.4.5 REGULATORY, SAFETY & SUSTAINABILITY PRACTICES

4.4.6 COLLABORATION, INNOVATION & PROGRAM FLEXIBILITY

4.5 TECHNOLOGICAL ADVANCEMENTS

4.5.1 ADVANCED SENSORS AND IMAGING SYSTEMS

4.5.2 ARTIFICIAL INTELLIGENCE (AI) AND AUTONOMOUS NAVIGATION

4.5.3 EXTENDED FLIGHT TIME AND BATTERY TECHNOLOGY

4.5.4 LIGHTWEIGHT AND ADVANCED MATERIALS

4.5.5 ANTI-COLLISION AND OBSTACLE AVOIDANCE SYSTEMS

4.5.6 MODULAR PAYLOAD SYSTEMS

4.6 COMPANY EVALUATION QUADRANT

4.7 BRAND OUTLOOK

4.7.1 BRAND COMPARATIVE ANALYSIS

4.7.2 COMPANY VS BRAND OVERVIEW

4.8 CONSUMER BUYING BEHAVIOUR

4.8.1 GROUP 1 DEFENSE & MILITARY USERS

4.8.2 GROUP 2 GOVERNMENT & PUBLIC SAFETY AGENCIES

4.8.3 GROUP 3 COMMERCIAL & ENTERPRISE USERS

4.8.4 GROUP 4 INDUSTRIAL INSPECTION & ENERGY SECTOR USERS

4.8.5 GROUP 5 AGRICULTURE & ENVIRONMENTAL MONITORING USERS

4.8.6 GROUP 6 CONSUMER & PROSUMER USERS

4.9 COST ANALYSIS BREAKDOWN

4.9.1 HARDWARE COSTS

4.9.2 R&D, SOFTWARE, SENSORS, AND IP COSTS

4.9.3 MANUFACTURING, CONTRACT ASSEMBLY, AND PROCUREMENT

4.9.4 TESTING, CERTIFICATION, AND REGULATORY COMPLIANCE

4.9.5 LOGISTICS, DISTRIBUTION, SALES & MARKETING

4.9.6 AFTER-SALES, SUSTAINMENT, TRAINING, AND DATA SERVICES

4.1 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.1.1 JOINT VENTURES

4.10.1.2 MERGERS AND ACQUISITIONS

4.10.1.3 LICENSING AND STRATEGIC PARTNERSHIPS

4.10.2 TECHNOLOGY COLLABORATIONS

4.10.3 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.4 STAGE OF DEVELOPMENT

4.10.5 TIMELINES AND MILESTONES

4.10.6 INNOVATION STRATEGIES AND METHODOLOGIES

4.10.7 RISK ASSESSMENT AND MITIGATION

4.10.8 FUTURE OUTLOOK

4.11 PRICING ANALYSIS

4.11.1 PRICING BY UAV TYPE

4.11.2 PRICING BY APPLICATION

4.11.3 COST STRUCTURE DRIVERS

4.11.4 REGIONAL PRICING VARIATIONS

4.11.5 IMPACT OF TARIFFS AND LOCALIZATION

4.11.6 PRICING MODELS AND COMMERCIAL STRATEGIES

4.11.7 PRICING TREND AND FUTURE OUTLOOK

4.12 PROFIT MARGIN SCENARIO

4.12.1 MILITARY SEGMENT

4.12.2 COMMERCIAL SEGMENT

4.12.3 REGIONAL VARIATIONS

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING DEFENSE MODERNIZATION AND MILITARY ISR (INTELLIGENCE, SURVEILLANCE, RECONNAISSANCE) REQUIREMENTS

7.1.2 RISING ADOPTION OF UAVS FOR BORDER SECURITY AND HOMELAND SURVEILLANCE

7.1.3 GROWING COMMERCIAL USE IN AGRICULTURE, INFRASTRUCTURE INSPECTION, MINING, AND CONSTRUCTION

7.1.4 EXPANSION OF UAV APPLICATIONS IN LOGISTICS AND LAST-MILE DELIVERY

7.2 RESTRAINTS

7.2.1 STRINGENT AIRSPACE REGULATIONS AND COMPLEX CERTIFICATION PROCESSES

7.2.2 LIMITED BATTERY LIFE AND PAYLOAD CAPACITY

7.3 OPPORTUNITIES

7.3.1 INCREASING DEMAND FOR UAVS IN DISASTER MANAGEMENT AND EMERGENCY RESPONSE

7.3.2 EXPANSION OF UAV-BASED MAPPING, SURVEYING, AND AERIAL IMAGING SERVICES

7.3.3 INTEGRATION OF UAVS WITH 5G, SATELLITE COMMUNICATIONS, AND CLOUD PLATFORMS

7.4 CHALLENGES

7.4.1 LACK OF HARMONIZED MIDDLE EAST AND AFRICA REGULATIONS FOR UAV OPERATIONS

7.4.2 SAFE INTEGRATION INTO CIVILIAN AIR TRAFFIC MANAGEMENT SYSTEMS

8 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 ROTARY-WING UAVS

8.3 FIXED-WING UAVS

8.4 HYBRID UAVS

8.5 OTHERS

8.6 MIDDLE EAST AND AFRICA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 MULTI-ROTOR (QUADCOPTER, HEXACOPTER, ETC.)

8.6.2 SINGLE ROTOR

8.7 MIDDLE EAST AND AFRICA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

8.7.1 REMOTE PILOTED

8.7.2 AUTONOMOUS

8.8 MIDDLE EAST AND AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 CONVENTIONAL FIXED-WING

8.8.2 HYBRID FIXED-WING

8.9 MIDDLE EAST AND AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

8.9.1 MEDIUM RANGE

8.9.2 LONG RANGE

8.9.3 SHORT RANGE

8.1 MIDDLE EAST AND AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

8.10.1 REMOTE PILOTED

8.10.2 AUTONOMOUS

8.11 MIDDLE EAST AND AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.11.1 VTOL (VERTICAL TAKE-OFF AND LANDING)

8.11.2 TILT-WING

8.12 MIDDLE EAST AND AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

8.12.1 DEFENSE VTOL

8.12.2 COMMERCIAL VTOL

8.12.3 OTHERS

8.13 MIDDLE EAST AND AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

8.13.1 REMOTE PILOTED

8.13.2 AUTONOMOUS

8.14 MIDDLE EAST AND AFRICA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 NORTH AMERICA

8.14.3 EUROPE

8.14.4 MIDDLE EAST AND AFRICA

8.14.5 SOUTH AMERICA

8.15 MIDDLE EAST AND AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.15.1 ASIA-PACIFIC

8.15.2 NORTH AMERICA

8.15.3 EUROPE

8.15.4 MIDDLE EAST AND AFRICA

8.15.5 SOUTH AMERICA

8.16 MIDDLE EAST AND AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA-PACIFIC

8.16.2 NORTH AMERICA

8.16.3 EUROPE

8.16.4 MIDDLE EAST AND AFRICA

8.16.5 SOUTH AMERICA

8.17 MIDDLE EAST AND AFRICA OTHERS UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.17.1 ASIA-PACIFIC

8.17.2 NORTH AMERICA

8.17.3 EUROPE

8.17.4 MIDDLE EAST AND AFRICA

8.17.5 SOUTH AMERICA

9 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT

9.1 OVERVIEW

9.2 PLATFORM

9.3 SOFTWARE & CYBERSECURITY

9.4 DATA LINK

9.5 LAUNCH & RECOVERY SYSTEMS

9.6 MIDDLE EAST AND AFRICA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.6.1 AVIONICS

9.6.2 AIRFRAME

9.6.3 PROPULSION SYSTEM

9.6.4 GROUND CONTROL STATION

9.7 MIDDLE EAST AND AFRICA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.7.1 FLIGHT CONTROL SYSTEMS

9.7.2 SENSORS & PAYLOADS

9.7.3 NAVIGATION SYSTEMS

9.7.4 COMMUNICATION SYSTEMS

9.8 MIDDLE EAST AND AFRICA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.8.1 IMAGING PAYLOAD

9.8.2 LIDAR/RADAR MODULES

9.8.3 HYPERSPECTRAL SENSORS

9.9 MIDDLE EAST AND AFRICA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA-PACIFIC

9.9.2 NORTH AMERICA

9.9.3 EUROPE

9.9.4 MIDDLE EAST AND AFRICA

9.9.5 SOUTH AMERICA

9.1 MIDDLE EAST AND AFRICA SOFTWARE & CYBERSECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.10.1 ASIA-PACIFIC

9.10.2 NORTH AMERICA

9.10.3 EUROPE

9.10.4 MIDDLE EAST AND AFRICA

9.10.5 SOUTH AMERICA

9.11 MIDDLE EAST AND AFRICA DATA LINK IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA-PACIFIC

9.11.2 NORTH AMERICA

9.11.3 EUROPE

9.11.4 MIDDLE EAST AND AFRICA

9.11.5 SOUTH AMERICA

9.12 MIDDLE EAST AND AFRICA LAUNCH & RECOVERY SYSTEMS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.12.1 ASIA-PACIFIC

9.12.2 NORTH AMERICA

9.12.3 EUROPE

9.12.4 MIDDLE EAST AND AFRICA

9.12.5 SOUTH AMERICA

10 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

10.3 MAPPING & SURVEYING

10.4 MONITORING & INSPECTION

10.5 DELIVERY & LOGISTICS

10.6 AGRICULTURE & PRECISION FARMING

10.7 AERIAL PHOTOGRAPHY

10.8 OTHERS

10.9 MIDDLE EAST AND AFRICA INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR) IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 MIDDLE EAST AND AFRICA

10.9.5 SOUTH AMERICA

10.1 MIDDLE EAST AND AFRICA MAPPING & SURVEYING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.10.1 ASIA-PACIFIC

10.10.2 NORTH AMERICA

10.10.3 EUROPE

10.10.4 MIDDLE EAST AND AFRICA

10.10.5 SOUTH AMERICA

10.11 MIDDLE EAST AND AFRICA MONITORING & INSPECTION IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.11.1 ASIA-PACIFIC

10.11.2 NORTH AMERICA

10.11.3 EUROPE

10.11.4 MIDDLE EAST AND AFRICA

10.11.5 SOUTH AMERICA

10.12 MIDDLE EAST AND AFRICA DELIVERY & LOGISTICS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 MIDDLE EAST AND AFRICA

10.12.5 SOUTH AMERICA

10.13 MIDDLE EAST AND AFRICA AGRICULTURE & PRECISION FARMING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.13.1 ASIA-PACIFIC

10.13.2 NORTH AMERICA

10.13.3 EUROPE

10.13.4 MIDDLE EAST AND AFRICA

10.13.5 SOUTH AMERICA

10.14 MIDDLE EAST AND AFRICA AERIAL PHOTOGRAPHY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.14.1 ASIA-PACIFIC

10.14.2 NORTH AMERICA

10.14.3 EUROPE

10.14.4 MIDDLE EAST AND AFRICA

10.14.5 SOUTH AMERICA

10.15 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.15.1 ASIA-PACIFIC

10.15.2 NORTH AMERICA

10.15.3 EUROPE

10.15.4 MIDDLE EAST AND AFRICA

10.15.5 SOUTH AMERICA

11 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE

11.1 OVERVIEW

11.2 ROTARY-WING

11.3 FIXED-WING

11.4 HYBRID VTOL

11.5 SINGLE-ROTOR HELICOPTER UAVS

11.6 NANO / MICRO DRONES

11.7 OTHERS

11.8 MIDDLE EAST AND AFRICA ROTARY-WING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.8.1 ASIA-PACIFIC

11.8.2 NORTH AMERICA

11.8.3 EUROPE

11.8.4 MIDDLE EAST AND AFRICA

11.8.5 SOUTH AMERICA

11.9 MIDDLE EAST AND AFRICA FIXED-WING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.9.1 ASIA-PACIFIC

11.9.2 NORTH AMERICA

11.9.3 EUROPE

11.9.4 MIDDLE EAST AND AFRICA

11.9.5 SOUTH AMERICA

11.1 MIDDLE EAST AND AFRICA HYBRID VTOL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA-PACIFIC

11.10.2 NORTH AMERICA

11.10.3 EUROPE

11.10.4 MIDDLE EAST AND AFRICA

11.10.5 SOUTH AMERICA

11.11 MIDDLE EAST AND AFRICA SINGLE-ROTOR HELICOPTER UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.11.1 ASIA-PACIFIC

11.11.2 NORTH AMERICA

11.11.3 EUROPE

11.11.4 MIDDLE EAST AND AFRICA

11.11.5 SOUTH AMERICA

11.12 MIDDLE EAST AND AFRICA NANO / MICRO DRONES IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA-PACIFIC

11.12.2 NORTH AMERICA

11.12.3 EUROPE

11.12.4 MIDDLE EAST AND AFRICA

11.12.5 SOUTH AMERICA

11.13 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.13.1 ASIA-PACIFIC

11.13.2 NORTH AMERICA

11.13.3 EUROPE

11.13.4 MIDDLE EAST AND AFRICA

11.13.5 SOUTH AMERICA

12 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY END USER

12.1 OVERVIEW

12.2 DEFENSE & SECURITY

12.3 COMMERCIAL

12.4 RECREATIONAL

12.5 CIVIL

12.6 OTHERS

12.7 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

12.7.1 DEFENSE & SECURITY

12.7.2 COMMERCIAL

12.7.3 RECREATIONAL

12.7.4 CIVIL

12.7.5 OTHERS

12.8 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.8.1 COMBAT OPERATIONS

12.8.2 BORDER PATROL

12.8.3 SEARCH & RESCUE

12.9 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.9.1 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.9.2 MONITORING & INSPECTION

12.9.3 DELIVERY & LOGISTICS

12.9.4 MAPPING & SURVEYING

12.9.5 AERIAL PHOTOGRAPHY

12.9.6 AGRICULTURE & PRECISION FARMING

12.9.7 OTHERS

12.1 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.10.1 AERIAL PHOTOGRAPHY

12.10.2 MAPPING & SURVEYING

12.10.3 AGRICULTURE & PRECISION FARMING

12.10.4 MONITORING & INSPECTION

12.10.5 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.10.6 DELIVERY & LOGISTICS

12.10.7 OTHERS

12.11 MIDDLE EAST AND AFRICA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.11.1 AERIAL PHOTOGRAPHY

12.11.2 MAPPING & SURVEYING

12.11.3 MONITORING & INSPECTION

12.11.4 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.11.5 DELIVERY & LOGISTICS

12.11.6 AGRICULTURE & PRECISION FARMING

12.11.7 OTHERS

12.12 MIDDLE EAST AND AFRICA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.12.1 ENVIRONMENTAL MONITORING

12.12.2 DISASTER MANAGEMENT

12.12.3 RESEARCH AND EDUCATION

12.13 MIDDLE EAST AND AFRICA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.13.1 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.13.2 MAPPING & SURVEYING

12.13.3 DELIVERY & LOGISTICS

12.13.4 AGRICULTURE & PRECISION FARMING

12.13.5 AERIAL PHOTOGRAPHY

12.13.6 MONITORING & INSPECTION

12.13.7 OTHERS

12.14 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

12.14.1 AERIAL PHOTOGRAPHY

12.14.2 MAPPING & SURVEYING

12.14.3 MONITORING & INSPECTION

12.14.4 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

12.14.5 DELIVERY & LOGISTICS

12.14.6 AGRICULTURE & PRECISION FARMING

12.14.7 OTHERS

12.15 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.15.1 ASIA-PACIFIC

12.15.2 NORTH AMERICA

12.15.3 EUROPE

12.15.4 MIDDLE EAST AND AFRICA

12.15.5 SOUTH AMERICA

12.16 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.16.1 ASIA-PACIFIC

12.16.2 NORTH AMERICA

12.16.3 EUROPE

12.16.4 MIDDLE EAST AND AFRICA

12.16.5 SOUTH AMERICA

12.17 MIDDLE EAST AND AFRICA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.17.1 ASIA-PACIFIC

12.17.2 NORTH AMERICA

12.17.3 EUROPE

12.17.4 MIDDLE EAST AND AFRICA

12.17.5 SOUTH AMERICA

12.18 MIDDLE EAST AND AFRICA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.18.1 ASIA-PACIFIC

12.18.2 NORTH AMERICA

12.18.3 EUROPE

12.18.4 MIDDLE EAST AND AFRICA

12.18.5 SOUTH AMERICA

12.19 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.19.1 ASIA-PACIFIC

12.19.2 NORTH AMERICA

12.19.3 EUROPE

12.19.4 MIDDLE EAST AND AFRICA

12.19.5 SOUTH AMERICA

13 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE

13.1 OVERVIEW

13.2 MILITARY

13.3 COMMERCIAL OPERATORS

13.4 GOVERNMENT & LAW ENFORCEMENT

13.5 CONSUMER / ENTHUSIAST

13.6 MIDDLE EAST AND AFRICA MILITARY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.6.1 ASIA-PACIFIC

13.6.2 NORTH AMERICA

13.6.3 EUROPE

13.6.4 MIDDLE EAST AND AFRICA

13.6.5 SOUTH AMERICA

13.7 MIDDLE EAST AND AFRICA COMMERCIAL OPERATORS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.7.1 ASIA-PACIFIC

13.7.2 NORTH AMERICA

13.7.3 EUROPE

13.7.4 MIDDLE EAST AND AFRICA

13.7.5 SOUTH AMERICA

13.8 MIDDLE EAST AND AFRICA GOVERNMENT & LAW ENFORCEMENT IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.8.1 ASIA-PACIFIC

13.8.2 NORTH AMERICA

13.8.3 EUROPE

13.8.4 MIDDLE EAST AND AFRICA

13.8.5 SOUTH AMERICA

13.9 MIDDLE EAST AND AFRICA CONSUMER / ENTHUSIAST IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.9.1 ASIA-PACIFIC

13.9.2 NORTH AMERICA

13.9.3 EUROPE

13.9.4 MIDDLE EAST AND AFRICA

13.9.5 SOUTH AMERICA

14 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 INDIRECT

14.3 DIRECT

14.4 MIDDLE EAST AND AFRICA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

14.4.1 DISTRIBUTORS & AUTHORIZED DEALERS

14.4.2 SYSTEM INTEGRATORS

14.4.3 VALUE-ADDED RESELLERS (VARS)

14.5 MIDDLE EAST AND AFRICA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.5.1 ASIA-PACIFIC

14.5.2 NORTH AMERICA

14.5.3 EUROPE

14.5.4 MIDDLE EAST AND AFRICA

14.5.5 SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA DIRECTOR IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.6.1 ASIA-PACIFIC

14.6.2 NORTH AMERICA

14.6.3 EUROPE

14.6.4 MIDDLE EAST AND AFRICA

14.6.5 SOUTH AMERICA

15 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY REGION

15.1 MIDDLE EAST AND AFRICA

15.1.1 ISRAEL

15.1.2 SAUDI ARABIA

15.1.3 UNITED ARAB EMIRATES

15.1.4 SOUTH AFRICA

15.1.5 EGYPT

15.1.6 QATAR

15.1.7 KUWAIT

15.1.8 OMAN

15.1.9 REST OF MIDDLE EAST & AFRICA

16 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET

16.1 COMPANY SHARE ANALYSIS: GLOBAL

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 DJI

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 NORTHROP GRUMMAN

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 LOCKHEED MARTIN CORPORATION

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENT

18.4 GENERAL ATOMICS

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 BAE SYSTEMS

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 ACTION DRONE, INC.

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 AEROVIRONMENT, INC

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 AIROBOTICS LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 AUTEL ROBOTICS

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 EHANG

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 ELBIT SYSTEMS LTD.

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 HOLY STONE

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 INSITU (SUBSIDIARY OF THE BOEING COMPANY)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENT

18.15 LEONARDO S.P.A.

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 MICRODRONES

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 PARROT DRONES SAS

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 QUANTUM-SYSTEMS GMBH

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 SKYDIO, INC.

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 TELEDYNE FLIR DEFENSE INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 TERRA DRONE CORP.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 THALES

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENT

18.23 WINGCOPTER

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 YUNEEC

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 ZIPLINE

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tabela

TABLE 1 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA OTHERS UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA SOFTWARE & CYBERSECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA DATA LINK IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA LAUNCH & RECOVERY SYSTEMS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR) IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA MAPPING & SURVEYING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA MONITORING & INSPECTION IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA DELIVERY & LOGISTICS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA AGRICULTURE & PRECISION FARMING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA AERIAL PHOTOGRAPHY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA ROTARY-WING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA FIXED-WING IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA HYBRID VTOL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA SINGLE-ROTOR HELICOPTER UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA NANO / MICRO DRONES IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 39 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA MILITARY IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA COMMERCIAL OPERATORS IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA GOVERNMENT & LAW ENFORCEMENT IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA CONSUMER / ENTHUSIAST IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA DIRECTOR IN UNMANNED AERIAL VEHICLE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY COUNTRY, 2018-2033 (USD UNITS)

TABLE 62 MIDDLE EAST AND AFRICA

TABLE 63 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 80 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 ISRAEL UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 ISRAEL ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 ISRAEL ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 93 ISRAEL FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 ISRAEL FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 95 ISRAEL FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 96 ISRAEL HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 ISRAEL HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 98 ISRAEL HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 99 ISRAEL UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 100 ISRAEL PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 ISRAEL AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 ISRAEL SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 ISRAEL UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 104 ISRAEL UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 ISRAEL UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 106 ISRAEL UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 107 ISRAEL DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 ISRAEL DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 109 ISRAEL COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 110 ISRAEL RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 111 ISRAEL CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 ISRAEL CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 113 ISRAEL OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 114 ISRAEL UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 ISRAEL UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 116 ISRAEL INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 SAUDI ARABIA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 SAUDI ARABIA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 SAUDI ARABIA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 120 SAUDI ARABIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 SAUDI ARABIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 122 SAUDI ARABIA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 123 SAUDI ARABIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 SAUDI ARABIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 125 SAUDI ARABIA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 126 SAUDI ARABIA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 127 SAUDI ARABIA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 SAUDI ARABIA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 SAUDI ARABIA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 SAUDI ARABIA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 131 SAUDI ARABIA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 SAUDI ARABIA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 133 SAUDI ARABIA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 134 SAUDI ARABIA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 SAUDI ARABIA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 136 SAUDI ARABIA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 137 SAUDI ARABIA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 138 SAUDI ARABIA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 SAUDI ARABIA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 140 SAUDI ARABIA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 141 SAUDI ARABIA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 SAUDI ARABIA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 143 SAUDI ARABIA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 UNITED ARAB EMIRATES UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 UNITED ARAB EMIRATES ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 UNITED ARAB EMIRATES ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 147 UNITED ARAB EMIRATES FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 UNITED ARAB EMIRATES FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 149 UNITED ARAB EMIRATES FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 150 UNITED ARAB EMIRATES HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 UNITED ARAB EMIRATES HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 152 UNITED ARAB EMIRATES HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 153 UNITED ARAB EMIRATES UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 154 UNITED ARAB EMIRATES PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 UNITED ARAB EMIRATES AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 UNITED ARAB EMIRATES SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 UNITED ARAB EMIRATES UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 158 UNITED ARAB EMIRATES UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 UNITED ARAB EMIRATES UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 160 UNITED ARAB EMIRATES UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 161 UNITED ARAB EMIRATES DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 UNITED ARAB EMIRATES DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 163 UNITED ARAB EMIRATES COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 164 UNITED ARAB EMIRATES RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 165 UNITED ARAB EMIRATES CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 UNITED ARAB EMIRATES CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 167 UNITED ARAB EMIRATES OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 168 UNITED ARAB EMIRATES UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 UNITED ARAB EMIRATES UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 170 UNITED ARAB EMIRATES INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 SOUTH AFRICA UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 SOUTH AFRICA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 SOUTH AFRICA ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 174 SOUTH AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 SOUTH AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 176 SOUTH AFRICA FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 177 SOUTH AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 SOUTH AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 179 SOUTH AFRICA HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 180 SOUTH AFRICA UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 181 SOUTH AFRICA PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 SOUTH AFRICA AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 SOUTH AFRICA SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 SOUTH AFRICA UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 185 SOUTH AFRICA UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 SOUTH AFRICA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 187 SOUTH AFRICA UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 188 SOUTH AFRICA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 SOUTH AFRICA DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 190 SOUTH AFRICA COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 191 SOUTH AFRICA RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 192 SOUTH AFRICA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 SOUTH AFRICA CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 194 SOUTH AFRICA OTHERS IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 195 SOUTH AFRICA UNMANNED AERIAL VEHICLE MARKET, BY USER TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 SOUTH AFRICA UNMANNED AERIAL VEHICLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 197 SOUTH AFRICA INDIRECT IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 EGYPT UNMANNED AERIAL VEHICLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 EGYPT ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 EGYPT ROTARY-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 201 EGYPT FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 EGYPT FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION RANGE, 2018-2033 (USD THOUSAND)

TABLE 203 EGYPT FIXED-WING UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 204 EGYPT HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 EGYPT HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY APPLICATION MODE, 2018-2033 (USD THOUSAND)

TABLE 206 EGYPT HYBRID UAVS IN UNMANNED AERIAL VEHICLE MARKET, BY OPERATION MODE, 2018-2033 (USD THOUSAND)

TABLE 207 EGYPT UNMANNED AERIAL VEHICLE MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 208 EGYPT PLATFORM IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 EGYPT AVIONICS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 EGYPT SENSORS & PAYLOADS IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 EGYPT UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 212 EGYPT UNMANNED AERIAL VEHICLE MARKET, BY MOBILITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 EGYPT UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 214 EGYPT UNMANNED AERIAL VEHICLE MARKET, BY END USER, 2018-2033 (USD UNITS)

TABLE 215 EGYPT DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 EGYPT DEFENSE & SECURITY IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 217 EGYPT COMMERCIAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 218 EGYPT RECREATIONAL IN UNMANNED AERIAL VEHICLE MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 219 EGYPT CIVIL IN UNMANNED AERIAL VEHICLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)