Global Aquafeed Additives Market, By Ingredient (Soybean, Fishmeal, Corn, Fish Oil, Additive, Others), Additive (Amino Acids, Vitamins & Minerals, Probiotics & Prebiotics, Enzymes, Antibiotics, Antioxidants, Others), Species (Fish, Crustaceans, Mollusks, Others), Form (Dry Form, Wet Form, Moist Form), Lifecycle (Grower Feed, Finisher Feed, Starter Feed, Brooder Feed – Industry Trends and Forecast to 2029.

Aquafeed Additives Market Analysis and Size

Aquaculture is farming fish or water species in ponds, recirculating tanks, and other similar environments. Aquaculture has a long history dating back to the ancient era, and the aquaculture industry has seen many recent developments. Aquaculture practices began in 1990 when the construction of concrete tanks for fish farming began and the production expanded to meet market demand. Aquafeed additives are being introduced to provide the necessary nutritional feeds.

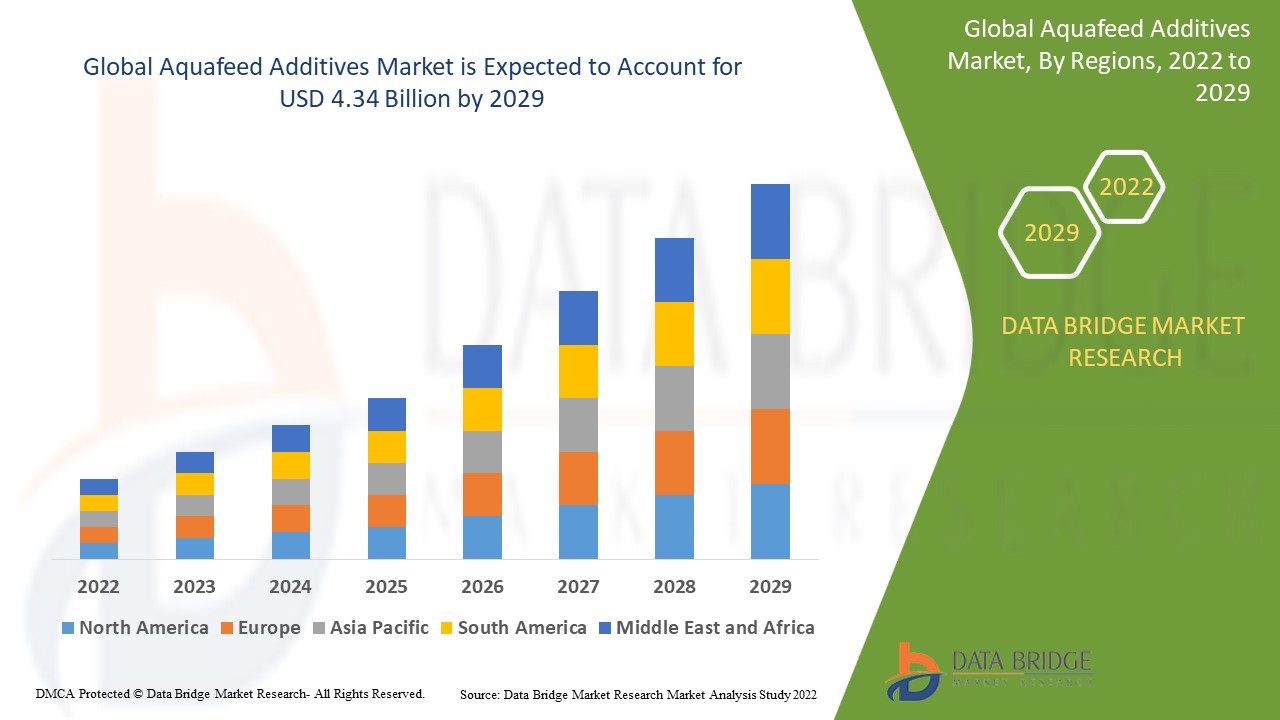

Data Bridge Market Research analyses that the aquafeed additives market which was growing at a value of 3.15 billion in 2021 and is expected to reach the value of USD 4.34 billion by 2029, at a CAGR of 4.1% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and consumer behaviour.

Market Definition

Aquafeed additives comprise compounded meals made from raw materials such as sunflower, corn, soybean, fish meal, and fish oil. The name implies that the feed is intended for consumption by aquatic species such as fish, shrimp, and crustaceans. These have high nutritional content and a variety of growth-promoting properties.

Aquafeed Additives Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Ingredient (Soybean, Fishmeal, Corn, Fish Oil, Additive, Others), Additive (Amino Acids, Vitamins & Minerals, Probiotics & Prebiotics, Enzymes, Antibiotics, Antioxidants, Others), Species (Fish, Crustaceans, Mollusks, Others), Form (Dry Form, Wet Form, Moist Form), Lifecycle (Grower Feed, Finisher Feed, Starter Feed, Brooder Feed) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Global (APAC) in the Global (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

The Hershey Company (U.S.), Perfetti Van Melle Group B.V. (Italy), Mondelez International, Inc (U.S.), Lotte Corporation (Japan), The PUR Company Inc. (Canada), Mars Incorporated (U.S.), Health Made Easy Group (U.K.), Ferndale Confectionery Pty Ltd (Australia), Ferrero SpA (Italy), Verve, Inc. (U.S.), Kraft Foods Inc (U.S.), Haribo GmbH & Co. Kg (Germany), The Wm. Wrigley Jr. Company (U.S.), Topps Company Inc. (U.S.), Simply Gum Inc. (U.S.) |

|

Opportunities |

|

Aquafeed Additives Market Dynamics

Drivers

- Rising fish farming activities in the region

Rising fish farming activities around the world as well as increased spending on research and development activities are driving the growth of the aquafeed additives market. Rising need and demand for compounded meals to maintain aquatic species health as well as growing awareness about Aquafeed additives are some other market growth determinants.

Aquaculture as a form of livelihood

Global fish and aquaculture production has increased as a result of population growth, rising incomes in developing countries, and urbanisation. The increasing consumption of seafood at the expense of staple foods is positively related to income and consumption of animal protein. Global consumption of fish is increasing faster than the growing global population owing to rising incomes and urbanisation. Fisheries and aquaculture are becoming a primary source of protein, foreign exchange, livelihoods, and population well-being worldwide.

Opportunity

Manufacturers' increased emphasis on innovative product offerings combined with increased restrictions on animal-based food products will create even more lucrative growth opportunities for the aquafeed additives market.

Restraints

However, fluctuations in raw material prices will be a major impediment to the growth of the Aquafeed additives market. The government's stringent regulations on product approvals will further slow the growth rate of the Aquafeed additives market.

This aquafeed additives market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the aquafeed additives market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Aquafeed Additives Market

The COVID-19 pandemic has slowed operations, resulting in staff shortages and new sanitary guidelines for fisheries and processing. Many countries consider the marine ingredients industry to be an essential part of the food supply chain, which explains why fishing and reduction operations have continued almost everywhere. Feed companies have ensured that farmers have the supplies they need to protect the health and welfare of their animals while also maintaining farm production levels. Growing fish demand has increased export-oriented aquaculture and the adoption of 'Scientific Aquaculture Management Practices' (SAMP).

Recent Development

- Skretting, a Nutreco company, will launch a new starter and grower feed for rainbow trout in December 2021, dubbed Nutra Sprint and Celero, respectively, to assist farms in reaching their full potential. Validation trials for the launched product revealed growth increases of up to 8% and an 8% decrease in Feed Conversion Ratio.

- In September 2021, Cargill announced a multi-year agreement with The Conservation Fund's Freshwater Institute to develop, evaluate, and improve feeds for the land-based aquaculture industry. The Institute can provide Cargill nutritionists and researchers with experience in recirculating aquaculture systems. The collaboration will improve land-based aquaculture's environmental and economic performance by developing and testing feeds specifically for recirculating aquaculture systems.

Global Aquafeed Additives Market Scope

The aquafeed additives market is segmented on the basis of ingredient, additive, species, form and lifecycle. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Ingredient

- Soybean

- Soybean meal

- Soy oil

- Soy lecithin

- Fishmeal

- Corn

- Corn gluten meal

- Corn gluten feed

- Corn oil

- Fish Oil

- Additive

- Others

Additives

- Amino Acids

- Vitamins & Minerals

- Probiotics & Prebiotics

- Enzymes

- Antibiotics

- Antioxidants

- Others

Species

- Fish

- Tilapia

- Salmon

- Carp

- Trout

- Crustaceans

- Shrimp

- Crabs

- Krill

- Mollusks

- Oysters

- Mussels

- Others

Form

- Dry

- Wet

- Moist

Lifecycle

- Grower Feed

- Finisher Feed

- Starter Feed

- Brooder Feed

Aquafeed Additives Market Regional Analysis/Insights

The aquafeed additives market is analysed and market size insights and trends are provided by country ingredient, additive, species, form and lifecycle as referenced above.

The countries covered in the aquafeed additives market report are U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Global (APAC) in the Global (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific will dominate the aquafeed additives market from 2022 to 2029, owing to the region's rising demand for processed seafood, increased urbanization, and diet diversification.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Aquafeed Additives Market Share Analysis

The aquafeed additives market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to aquafeed additives market.

Some of the major players operating in the aquafeed additives market are:

- Darling Ingredients Inc. (U.S.)

- The Lauridsen Group Inc. (U.S.)

- SARIA Group (Germany)

- Sera Scandia (Denmark)

- Lican Food (Chile)

- Puretein Agri LLC. (U.S.)

- Veos Group (Belgium)

- Kraeber & Co Gmbh (Germany)

- Rocky Mountain Biologicals (U.S.)

- Lihme Protein Solutions (Denmark)

- EcooFeed LLC (U.S.)

- FeedWorks (Australia)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。