Global Dental Equipment Market

市场规模(十亿美元)

CAGR :

%

USD

7.94 Billion

USD

14.91 Billion

2024

2032

USD

7.94 Billion

USD

14.91 Billion

2024

2032

| 2025 –2032 | |

| USD 7.94 Billion | |

| USD 14.91 Billion | |

|

|

|

|

Global Dental Equipment Market Segmentation, By Product (Dental Radiology Equipment, Dental Systems and Parts, Dental Lasers, Laboratory Machines, and Hygiene Maintenance), Treatment (Orthodontic, Endodontic, Periodontic, and Prosthodontic), End Use (Hospitals, Clinics, Dental Laboratories, and Others) - Industry Trends and Forecast to 2032

Dental Equipment Market Size

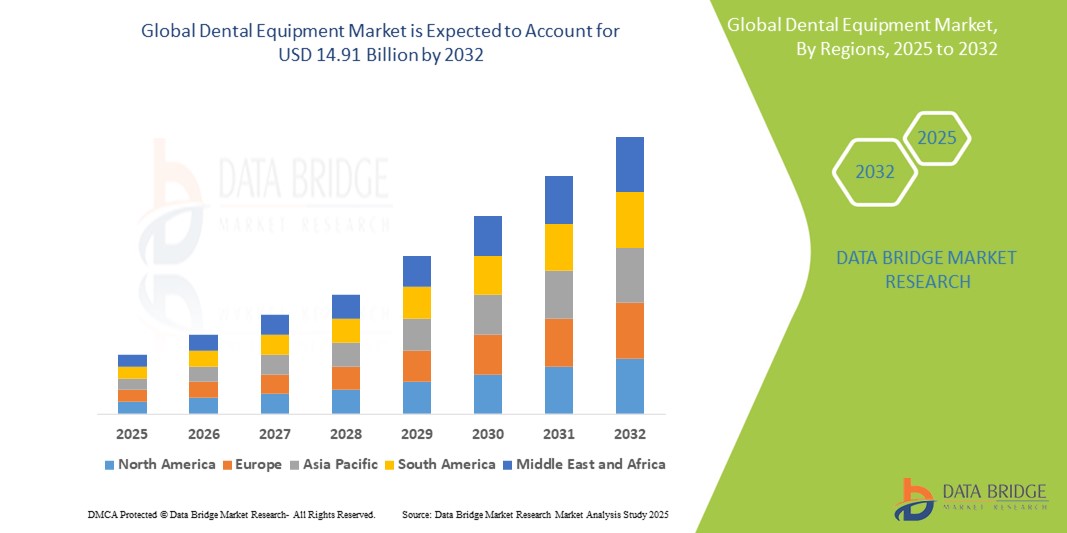

- The global dental equipment market size was valued atUSD 7.94 billion in 2024and is expected to reachUSD 14.91 billion by 2032, at aCAGR of 8.20%during the forecast period

- This growth is driven by factors such as the rising prevalence of dental disorders, increasing demand forcosmetic dentistry, and the adoption of advanced technologies such as digital imaging and CAD/CAM systems

Dental Equipment Market Analysis

- Dental equipment includes devices used for diagnosis, treatment, and prevention of dental disorders, encompassing tools such as dental chairs, radiology equipment, CAD/CAM systems, and lasers

- The market growth is primarily driven by increasing prevalence of dental diseases, rising demand for cosmetic dentistry, and technological advancements such as 3D imaging and AI integration

- North America is expected to dominate the dental equipment market with a market share of 38.9%, due to advanced dental care infrastructure, high expenditure on oral healthcare, and widespread adoption of innovative dental technologies

- Asia-Pacific is expected to be the fastest growing region in the dental equipment market with a market share of 44.1%, during the forecast period due to increasing healthcare investments, rising awareness of oral hygiene, and growing urbanization

- Dental systems and parts segment is expected to dominate the market with a market share of 40.1% due to its essential role in enabling core dental procedures across treatment areas. This segment includes critical components such as CAD/CAM systems, handpieces, and imaging devices, which are vital for diagnostic accuracy and procedural efficiency

Report Scope and Dental Equipment Market Segmentation

|

Attributes |

Dental Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Equipment Market Trends

“Integration of Digital Dentistry and AI-Driven Technologies”

- One major trend in the dental equipment market is the increasing adoption of digital dentistry tools and AI-powered technologies across diagnostic and treatment workflows

- These innovations improve clinical accuracy, streamline workflows, and enhance patient experience by enabling faster, more personalized treatments

- For instance, CAD/CAM systems and intraoral scanners allow for same-day restorations, while AI-enabled imaging tools assist in early diagnosis and treatment planning, significantly improving precision and efficiency

- The integration of these advanced technologies is reshaping dental practices globally, boosting procedural efficiency, and driving demand for smart, interconnected dental equipment

Dental Equipment Market Dynamics

Driver

“Rising Burden of Dental Diseases and Demand for Restorative Procedures”

- The increasing global prevalence of dental conditions such as tooth decay, periodontal diseases, and edentulism is a major driver fueling the demand for advanced dental equipment

- Poor oral hygiene, aging populations, high sugar consumption, and tobacco use are contributing to a higher incidence of oral health issues worldwide, necessitating professional dental care and intervention

- As a result, there is growing demand for diagnostic and therapeutic dental devices, including imaging systems, dental chairs, and restorative tools that support high-precision treatment

For instance,

- According to the World Health Organization (2023), oral diseases affect nearly 3.5 billion people globally, with untreated dental caries being the most common condition

- Consequently, the increasing burden of dental diseases and the rising focus on preventive and cosmetic dentistry are significantly boosting the global dental equipment market

Opportunity

“Transforming Dental Care Through Artificial Intelligence and Digital Integration”

- The integration of artificial intelligence (AI) in dental equipment presents a significant growth opportunity by enhancing diagnostic precision, streamlining workflows, and personalizing patient care

- AI-enabled tools can support dentists in identifying early-stage dental diseases, automating treatment planning, and predicting outcomes with greater accuracy, leading to more efficient and effective care delivery

- In addition, AI applications in imaging systems, such as panoramic and cone-beam CT scans, allow real-time data analysis, improving clinical decision-making and reducing diagnostic errors

For instance,

- In February 2024, a study published in Frontiers in Dental Medicine highlighted that AI-powered diagnostic systems achieved over 90% accuracy in detecting early-stage caries and periodontal issues, outperforming traditional visual examinations

- The incorporation of AI and digital solutions into dental equipment not only enhances clinical capabilities but also offers improved patient experiences, faster treatment times, and long-term cost savings, positioning the market for sustained technological growth

Restraint/Challenge

“High Equipment Costs Hindering Widespread Adoption”

- The substantial cost of advanced dental equipment presents a major barrier to market penetration, particularly in low- and middle-income countries where healthcare budgets are constrained

- High-end devices such as CAD/CAM systems, digital imaging tools, and laser-based instruments can cost tens of thousands of dollars, making them unaffordable for smaller clinics and solo dental practices

- This financial burden discourages investment in modern equipment, leading many facilities to continue using outdated or less efficient tools, which can compromise the quality and efficiency of dental care

For instance,

- In September 2024, a report by the Indian Dental Association highlighted that over 60% of private dental clinics in Tier-2 and Tier-3 cities in India still rely on basic, non-digital tools due to the prohibitive cost of upgrading to smart systems

- Consequently, the high equipment cost continues to restrict access to advanced dental technologies, thereby limiting market growth and contributing to inequalities in oral healthcare delivery

Dental Equipment Market Scope

The market is segmented on the basis of product, treatment, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Treatment |

|

|

By End Use |

|

In 2025, the dental system and parts is projected to dominate the market with a largest share in product segment

The dental system and parts segment is expected to dominate the dental equipment market with the largest share of 40.1% in 2025 due to its essential role in enabling core dental procedures across treatment areas. This segment includes critical components such as CAD/CAM systems, handpieces, and imaging devices, which are vital for diagnostic accuracy and procedural efficiency. Growing demand for technologically advanced systems and increasing adoption of digital dentistry further drive this segment’s dominance.

The prosthodontic is expected to account for the largest share during the forecast period in treatment market

In 2025, the prosthodontic segment is expected to dominate the market with the largest market share of 32.9% due to its rising demand for restorative dental procedures such as crowns, bridges, dentures, and implants. The increasing prevalence of tooth loss, especially among the aging population, drives the need for prosthodontic solutions. Technological advancements in dental materials and digital workflows also enhance treatment outcomes and efficiency, further boosting segment growth.

Dental Equipment Market Regional Analysis

“North America Holds the Largest Share in the Dental Equipment Market”

- North America dominates the dental equipment market with a market share of estimated 38.9%, driven, by advanced dental care infrastructure, high expenditure on oral healthcare, and widespread adoption of innovative dental technologies

- U.S. holds a market share of 33.3%, due to a strong presence of major market players, increasing demand for cosmetic and restorative dentistry, and a growing elderly population requiring frequent dental interventions

- The favorable reimbursement policies for dental procedures and the integration of digital technologies such as CAD/CAM and AI-powered diagnostics further strengthen North America's leading position in the market

- In addition, the growing number of dental service organizations (DSOs) and the trend toward multi-specialty clinics are supporting the regional growth by making advanced dental services more accessible

“Asia-Pacific is Projected to Register the Highest CAGR in the Dental Equipment Market”

- Asia-Pacific is expected to witness the highest growth rate in the dental equipment market with a market share of 44.1%, driven by increasing healthcare investments, rising awareness of oral hygiene, and growing urbanization

- Countries such as China, India, and Japan are emerging as key contributors due to large populations, rising middle-class income, and an increasing burden of dental diseases

- Japan remains a leader in the adoption of digital dentistry tools and advanced diagnostic equipment, supported by its tech-savvy population and strong healthcare infrastructure

- India is projected to register the highest CAGR within the region, fueled by expanding dental tourism, an increasing number of dental clinics, and a growing focus on cosmetic dentistry and orthodontic procedures

Dental Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Zimmer Biomet(U.S.)

- 3M(U.S.)

- Danaher Corporation (U.S.)

- Young Innovations, Inc. (U.S.)

- GC International AG(Japan)

- Institut Straumann AG (Switzerland)

- Dentsply Sirona (U.S.)

- Patterson Companies, Inc. (U.S.)

- Henry Schein, Inc. (U.S.)

- Midmark Corporation (U.S.)

- PLANMECA OY (Finland)

- BIOLASE, Inc. (U.S.)

- Carestream Health (U.S.)

- A-dec Inc. (U.S.)

- Aseptico, Inc. (U.S.)

- Chromadent (U.S.)

- Crosstex International, Inc. (U.S.).

- Midmark Corporation (U.S.)

- NSK / Nakanishi inc. (Japan)

- Henry Schein, Inc. (U.S.)

Latest Developments in Global Dental Equipment Market

- In March 2025, Planmeca introduced its latest line of dental units at the International Dental Show (IDS) 2025. These units feature advanced ergonomic designs, enhanced digital integration, and improved patient comfort. The new models aim to streamline dental procedures and enhance the overall patient experience

- In February 2025, Dentsply Sirona announced the release of its new AI-powered imaging systems. These systems utilize artificial intelligence to provide real-time diagnostics, improving accuracy in detecting dental pathologies and aiding in treatment planning

- In January 2025, Straumann Group unveiled its latest CAD/CAM solutions designed to enhance digital workflows in dental practices. The new systems offer faster processing times and higher precision in prosthetic manufacturing, aiming to improve efficiency and patient outcomes

- In January 2025, Benco Dental, the largest independent distributor of oral healthcare technology and supplies in the U.S., announced a new distribution agreement with A-dec, a global leader in dental solutions. This partnership enables Benco Dental customers across the U.S. to access A-dec's comprehensive product line, including dental chairs, delivery systems, and cabinetry. This collaboration aims to streamline the procurement process for dental practices, offering integrated solutions that enhance clinical efficiency and patient care

- In April 2025, 3Shape launched an updated version of its popular intraoral scanner. The new model boasts improved scanning speed, higher accuracy, and enhanced patient comfort, facilitating better digital impressions for various dental procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。