Middle East And Africa Unmanned Ground Vehicle Market

市场规模(十亿美元)

CAGR :

%

USD

182.17 Million

USD

323.62 Million

2025

2033

USD

182.17 Million

USD

323.62 Million

2025

2033

| 2026 –2033 | |

| USD 182.17 Million | |

| USD 323.62 Million | |

|

|

|

|

中東和非洲無人地面車輛市場細分,按尺寸(微型無人地面車輛 (磅))、按系統(有效載荷、控制器單元、動力系統、導航系統、底盤系統、通訊系統、其他)、按移動方式(輪式、履帶式、腿式、混合動力、蛇形/關節式移動)、按推進方式(電動、混合動力、柴油/汽油動力、氫燃料電池無人地面車輛、太陽能輔助無端車輛)、按軍事操作模式(遙控車輛) (小於 50 公斤、中型(50-200 公斤)、重型(200-1,000 公斤)、超重型(1,000 公斤)、產業趨勢及至 2033 年的預測)

中東和非洲無人地面車輛市場規模

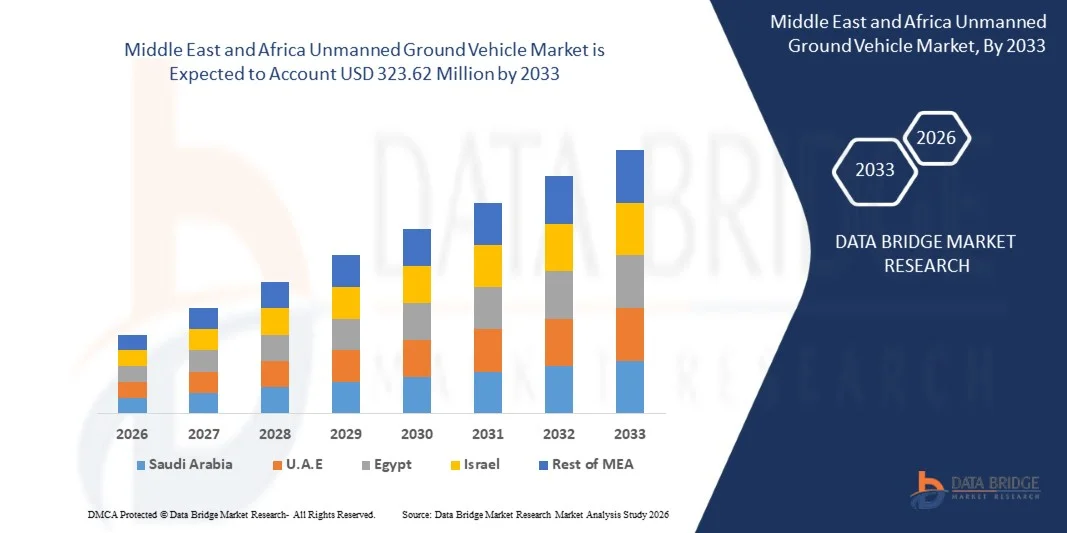

- 2025年中東和非洲無人地面車輛市場規模為1.8217億美元 ,預計 到2033年將達到3.2362億美元,預測期內 複合年增長率為7.9%。

- 中東和非洲無人地面車輛(UGV)市場是指專注於設計、生產和部署無需人員在場即可運行的地面機器人系統的產業。這些車輛廣泛應用於軍事、商業和工業領域,包括監視、物流、爆炸物處理、採礦、農業和基礎設施巡檢。

中東和非洲無人地面車輛市場分析

- 無人地面車輛(UGV)市場是中東和非洲國防、安全和工業自動化領域的重要組成部分,其應用涵蓋軍事行動、邊境安全、執法、採礦、農業和災害應變等諸多面向。 UGV的特徵是可遠端或自主操作、機動性強,並且能夠在危險或難以進入的環境中執行任務。

- 市場成長主要受國防現代化項目推進以及對自主和半自主系統日益增長的需求驅動,這些系統旨在降低作戰、監視和爆炸物處理(EOD)中的人員風險。人工智慧、感測器、導航系統和通訊技術的進步正在加速無人地面車輛(UGV)在國防和商業領域的應用。

- 國防和軍事領域預計仍將是無人地面車輛(UGV)市場的主要終端用戶領域,這得益於偵察、後勤保障和作戰支援車輛領域不斷增長的投資。 UGV 能夠增強態勢感知能力、提高任務效率並在極端條件下持續作戰,這些優勢使軍隊受益匪淺。

- 預計到2025年,沙烏地阿拉伯將以25.77%的市佔率領先中東和非洲無人地面車輛市場,同時預計在預測期內也將維持最快的成長速度。沙烏地阿拉伯的成長得益於不斷增加的國防預算、本土機器人技術的發展以及在國土安全和工業自動化領域的應用範圍擴大。

- 由於輕量化設計、高機動性和成本效益,預計到2025年,小型(10-200磅)無人地面車輛將佔據最大的市場份額,達到35.78%。這些無人地面車輛廣泛應用於監視、偵察、爆炸物處理和巡檢等任務,使其在軍事和商業應用領域都具有極高的通用性。

報告範圍及中東及非洲無人地面車輛市場細分

|

屬性 |

中東和非洲無人地面車輛市場關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

中東和非洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了市場價值、成長率、市場細分、地理覆蓋範圍、市場參與者和市場狀況等市場洞察外,Data Bridge Market Research 團隊精心編制的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 PESTLE 分析。 |

中東和非洲無人地面車輛市場趨勢

“模組化任務有效載荷設計解鎖無人地面車輛的多元化應用領域”

- 模組化任務有效載荷架構使無人地面車輛 (UGV) 能夠快速重新配置,以適應不同的作戰角色——運輸、情報、監視和偵察、傷員撤離、反無人機、爆炸物處理和精確打擊——從而拓展了國防和商業領域的市場。開放式架構的有效載荷介面、標準化的安裝板和軟體抽象化縮短了新功能的部署時間,降低了客戶的整合成本,並使供應商能夠透過任務套件而非客製化車輛來擴展平台系列。

- 2025 年 4 月,Overland AI 發布了 ULTRA 自主戰術車輛,該車輛整合並部署了多個模組化有效載荷(包括無人機系統和破拆工具),展示了模組化有效載荷整合的商業範例,旨在用於戰術地面行動。

- 2024 年 4 月,DARPA 公開描述了 RACER 第二階段的進展(增加更重的平台並展示車輛間的自主性可移植性)——這項活動透過實現不同 UGV 底盤尺寸的通用自主性和接口,為模組化有效載荷概念奠定了基礎。

中東和非洲無人地面車輛市場動態

司機

國防現代化計畫加速中東和非洲無人地面車輛採購勢頭

- 全球國防現代化計畫透過制定明確的作戰需求、資金來源和加速採購途徑,將試驗成果轉化為正式的備案項目,從而加快了無人地面車輛(UGV)的採購。各國武裝部隊優先考慮將UGV用於後勤保障、道路清障、偵察和部隊防護等任務,這反過來又推動了供應商在平台通用性、開放式架構和模組化任務載荷方面的投資。

- 2025年2月,法國國防採購局(DGA)發布了地面機器人框架協議(DROIDE),建立了一條透過正式框架協議將地面機器人創新技術投入使用的採購途徑,並促進多方合作和產業貢獻。

- 2024 年 9 月,澳洲國防部發布了一項文件,描述了地面無人系統 (GUS) 在情報、監視和偵察任務中的部署和使用情況,展示了澳洲部隊對無人地面車輛 (UGV) 的作戰應用,以及將此類系統整合到日常部隊活動中的意圖。

- 2024 年 4 月,英國國防部發布了一份部長級演講及相關資料,強調軍事機器人和自主系統是採購優先事項,並描述了將為未來無人地面車輛的採購和整合到英國部隊結構中提供資訊的試驗和能力演示。

克制/挑戰

高昂的開發和整合成本限制了更廣泛的部署

- 無人地面車輛(UGV)的高昂研發和整合成本仍然是限制市場擴張的一大因素,因為先進的自主性、堅固耐用的感測器套件、安全的通訊架構以及特定任務的有效載荷都需要在研發、測試和系統認證方面投入大量資金。這些支出限制了無人地面車輛的廣泛應用,尤其是在資金預算有限的機構和商業企業中,並且常常會延緩從原型階段到全面部署的過渡。

- 2024 年 2 月,路透社報道稱,由於經濟和成本壓力,一些機器人領域的投資和採購放緩,並指出由於成本上升和預算收緊減少了近期採購,企業和採購商正在推遲訂單;該報道表明,商業成本敏感性會影響先進機器人平台的採用。

- 2024年7月,英國國防部裝備與保障局(UK MOD / DE&S)發布了2023至2024年度報告和帳目,該報告記錄了地面平台在維護和採購方面面臨的壓力,並重點指出了裝備和支援新技術(包括新型自主系統)所面臨的專案風險和成本不確定性。

中東和非洲無人地面車輛市場範圍

中東和非洲無人地面車輛市場根據尺寸、系統、移動性、推進方式、運行模式、應用和有效載荷等因素細分為七個部分。

•依尺寸

根據尺寸,無人地面車輛市場可細分為微型(<10磅)、小型(10-200磅)、中型(200-500磅)、大型(500-1000磅)、超大型(1000-2000磅)和特大型(>2000磅)。預計到2026年,小型(10-200磅)無人地面車輛將佔據中東和非洲無人地面車輛市場的主導地位,市場份額達35.42%,複合年增長率(CAGR)為6.8%,這主要得益於市場對輕便、便攜式系統的需求不斷增長。由於部署簡單、採購成本低,這些無人地面車輛被廣泛應用於偵察、監視、爆炸物處理和戰術後勤等領域。此外,軍方日益重視快速機動、城市作戰和部隊防護,也進一步推動了該細分市場的成長。

•透過系統

依系統劃分,市場可細分為酬載、控制器單元、動力系統、導航系統、底盤系統、通訊系統及其他。預計到2026年,有效載荷部分將以34.09%的市場份額和6.7%的複合年增長率主導中東和非洲無人地面車輛市場,這主要得益於對模組化任務系統需求的增長。先進感測器、武器站、情報、監視與偵察(ISR)設備和後勤有效載荷的日益普及,使得無人地面車輛能夠支援多樣化的作戰任務。國防部隊對開放式架構和快速重構的重視,進一步加速了對酬載技術的投資。

•透過移動性

根據移動方式,無人地面車輛市場可細分為輪式、履帶式、腿式、混合式和蛇形/鉸接式等多種移動方式。預計到2026年,輪式無人地面車輛將佔據中東和非洲無人地面車輛市場的主導地位,市場份額達到53.78%,複合年增長率(CAGR)為7.8%,這主要得益於其卓越的速度、機動性和更低的維護需求。輪式無人地面車輛廣泛應用於後勤、偵察和巡邏任務,在城市和半結構化地形中具有極高的作業靈活性。對經濟高效、可快速部署的地面系統日益增長的需求也進一步推動了該細分市場的成長。

•透過推進

根據動力方式,無人地面車輛市場可細分為電動、混合動力、柴油/汽油動力、氫燃料電池和太陽能輔助等類型。預計到2026年,電動無人地面車輛將佔據中東和非洲無人地面車輛市場的主導地位,市場份額將達到64.14%,複合年增長率(CAGR)為8.1%,這主要得益於其強大的研發能力、龐大的生產能力和已建立的國防合約。這些公司正大力投資先進的無人地面車輛技術、模組化平台和自主系統,以滿足中東和非洲日益增長的軍事和安全需求。戰略合作和框架協議進一步鞏固了其市場領導地位。

•依運轉模式

依操作模式,無人地面車輛市場可分為遙控式、繫留式和自主式。預計到2026年,遙控式無人地面車輛將佔據中東和非洲無人地面車輛市場的主導地位,市場份額達66.76%,複合年增長率達7.6%,這主要得益於市場對能夠提升操作安全性和精準度的遠端控制系統的需求。這些無人地面車輛廣泛應用於偵察、爆炸物處理和危險環境任務,使人員能夠在安全距離外進行操作。軍事和安全應用的日益增長,以及通訊和控制系統技術的進步,將進一步推動該細分市場的成長。

•透過申請

根據應用領域,無人地面車輛市場可細分為商業、軍事、聯邦執法和執法部門。預計到2026年,軍事領域將主導中東和非洲無人地面車輛市場,市場份額將達到45.50%,複合年增長率(CAGR)為8.2%,這主要得益於國防現代化計劃的推進以及對自主和遠程操作系統需求的增長。無人地面車輛廣泛應用於偵察、後勤、部隊防護和作戰支援,從而提高作戰效率並降低人員風險。人工智慧、感測器整合和模組化有效載荷方面的投資不斷增加,進一步加速了無人地面車輛在軍事領域的應用。

•按酬載

根據有效載荷,市場可分為輕型(小於 50 公斤)、中型(50-200 公斤)、重型(200-1000 公斤)和超重型(大於 1000 公斤)。預計到 2025 年,輕型(小於 50 公斤)無人地面車輛市場將佔據主導地位。到 2026 年,輕型(小於 50 公斤)細分市場預計將佔據中東和非洲無人地面車輛市場的 52.96% 份額,複合年增長率 (CAGR) 為 7.5%,這主要得益於市場對高度便攜、易於部署的系統日益增長的需求。這些無人地面車輛非常適合偵察、監視和戰術支援任務,具有快速機動性和降低後勤負擔的優勢。軍方、執法部門和商業用戶越來越多地採用這些車輛以實現靈活、經濟高效的作業,進一步推動了市場成長。

中東和非洲無人地面車輛市場區域分析

沙烏地阿拉伯在中東和非洲無人地面車輛市場佔據主導地位,預計到2026年將佔據25.70%的最大市場份額。沙烏地阿拉伯在中東和非洲無人地面車輛市場的發展主要受國防現代化、邊境安全強化以及「2030願景」計畫的推動。對自主巡邏、偵察和後勤無人地面車輛的投資不斷增加,有助於提升軍事戰備水平,並降低人員在惡劣地形中的風險。

以色列、中東和非洲無人地面車輛市場洞察

預計到2025年,以色列在中東和非洲無人地面車輛市場將佔據該地區超過以色列的市場。以色列在中東和非洲無人地面車輛市場的發展動力主要來自先進的國防研發、持續存在的安全威脅以及強大的國內機器人技術。對自主監視、爆炸物處理和作戰支援型無人地面車輛的高需求推動了國防部隊的快速創新和早期部署。

中東和非洲無人地面車輛市場份額

中東和非洲無人地面車輛市場主要由一些成熟企業主導,其中包括:

- 通用動力陸地系統(美國)

- 萊茵金屬股份公司(德國)

- 埃爾比特系統有限公司(以色列)

- 德事隆系統(美國)

- 泰雷茲(法國)

- 泰萊達因FLIR防務公司(美國)

- 萊昂納多股份公司(義大利)

- QinetiQ(英國)

- 新加坡科技工程公司(ST Engineering (Singapore))

- Peraton(美國)

- AeroVironment公司(美國)

- 韓華集團(韓國)

- 現代ROTEM公司(韓國)

- DOK-ING有限公司(克羅埃西亞)

- Roboteam(以色列)

- 以色列航空航太工業公司(IAI)(以色列)

- Ghost Robotics(美國)

- Milrem AS(愛沙尼亞)

- Edgeforce(英國)

- ASELSAN A.Ş.(土耳其)

中東和非洲無人地面車輛市場最新發展

- 2025 年 12 月,通用動力陸地系統公司 (GDLS) 宣布成功展示了與 AeroVironment 共同開發的 PERCH 巡飛彈發射器,展示了將 Switchblade 300 和 Switchblade 600 巡飛彈集成到裝甲戰車上,以增強超視距監視和殺傷能力。此次演示是在美國陸軍的機械輔助堅固工兵 (MARS) 活動中進行的。

- 2025 年 12 月,泰雷茲推出了 Sonar 76Nano,這是一款新型小型化聲學探測系統,旨在透過擴展先進聲吶功能(包括人工智慧增強探測、海底測繪和低偵測機率訊息傳遞),徹底改變水下戰場態勢感知,使其能夠應用於更廣泛的海上海軍平台,包括無人能航行器,以支援英國及其國盟國的海上安全事項。

- 2025年3月,AV公司透過其子公司Telerob獲得一份重要合同,將向德國聯邦國防軍交付41輛大型先進Telemax™ HT300無人地面車輛(UGV)。首批交付將於2025年夏季開始,後續訂單將持續至2027年。 HT300是在競爭性採購流程中脫穎而出的,專為高風險的爆炸物處理(EOD)和反簡易爆炸裝置(IED)任務而設計,配備先進的機械臂,擁有卓越的牽引力和在復雜多變地形上的機動性。這些系統將在Telerob位於德國奧斯特菲爾登的先進工廠生產,這將鞏固AV公司與德國聯邦國防軍的戰略合作夥伴關係,並提升其在先進UGV解決方案領域的聲譽和市場地位。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 SIZE TIMELINE CURVE

2.8 MARKET APPLICATION COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 CASE STUDY ANALYSIS

4.2.1 CASE STUDY: DEPLOYMENT OF THEMIS UNMANNED GROUND VEHICLE AND ITS IMPACT ON MILITARY LOGISTICS AND COMBAT SUPPORT OPERATIONS

4.2.1.1 BACKGROUND AND STRATEGIC CONTEXT

4.2.1.2 OPERATIONAL CHALLENGES PRIOR TO UGV INTEGRATION

4.2.1.2.1 HIGH PERSONNEL RISK IN FRONTLINE AND SUPPORT MISSIONS

4.2.1.2.2 LOGISTICAL CONSTRAINTS IN CONTESTED AND REMOTE TERRAIN

4.2.1.2.3 DEMAND FOR ENHANCED SITUATIONAL AWARENESS

4.2.1.3 TECHNOLOGICAL AND OPERATIONAL MEASURES INTRODUCED

4.2.1.3.1 MODULAR UGV ARCHITECTURE

4.2.1.3.2 REMOTE AND SEMI-AUTONOMOUS OPERATION

4.2.1.3.3 INTEGRATION WITH EXISTING FORCE STRUCTURES

4.2.1.4 IMPACT ON MILITARY OPERATIONS AND LOGISTICS EFFICIENCY

4.2.1.4.1 IMPROVED LOGISTICS CONTINUITY

4.2.1.4.2 REDUCED EXPOSURE OF HUMAN PERSONNEL

4.2.1.4.3 ENHANCED OPERATIONAL FLEXIBILITY

4.2.1.4.4 SUPPORT FOR MULTI-DOMAIN OPERATIONS

4.2.1.5 LIMITATIONS AND LESSONS LEARNED

4.2.1.5.1 DEPENDENCE ON COMMUNICATIONS AND CONTROL SYSTEMS

4.2.1.5.2 CONSTRAINTS ON FULL AUTONOMY IN COMPLEX ENVIRONMENTS

4.2.2 CASE STUDY: MULTIFUNCTIONAL UNMANNED GROUND VEHICLES IN EMERGENCY RESPONSE AND PUBLIC SAFETY OPERATIONS

4.2.2.1 BACKGROUND AND STRATEGIC CONTEXT

4.2.2.2 OPERATIONAL CHALLENGES BEFORE UGV DEPLOYMENT

4.2.2.2.1 HIGH RISK TO FIRST RESPONDERS

4.2.2.2.2 DELAYS IN INCIDENT ASSESSMENT

4.2.2.3 TECHNOLOGICAL MEASURES INTRODUCED

4.2.2.3.1 INTEGRATED SENSORS AND MANIPULATION TOOLS

4.2.2.3.2 REMOTE COMMAND AND CONTROL OPERATIONS

4.2.2.4 IMPACT ON EMERGENCY RESPONSE EFFECTIVENESS

4.2.2.4.1 IMPROVED RESPONDER SAFETY

4.2.2.4.2 FASTER AND MORE INFORMED DECISION-MAKING

4.3 CONSUMER BUYING BEHAVIOUR

4.4 CONSUMER PURCHASE DECISION PROCESS

4.4.1 PROBLEM RECOGNITION

4.4.2 INFORMATION SEARCH

4.4.3 ALTERNATIVE EVALUATION

4.4.4 PURCHASE DECISION

4.4.5 POST-PURCHASE BEHAVIOR

4.4.6 INFLUENCING FACTORS

4.5 KEY STRATEGIC INITIATIVES

4.5.1 INTEGRATION OF UGVS INTO MULTI-DOMAIN DEFENCE AND SECURITY ARCHITECTURES

4.5.1.1 CONVERGENCE OF LAND, AIR, AND COMMAND-AND-CONTROL SYSTEMS

4.5.1.2 INTEROPERABILITY WITH EXISTING MILITARY AND HOMELAND SECURITY ASSETS

4.5.1.3 Coordination of Multimodal Transport Networks

4.5.2 EMPHASIS ON AUTONOMY, ARTIFICIAL INTELLIGENCE AND ADVANCED SENSING

4.5.2.1 ADVANCEMENT OF SEMI-AUTONOMOUS AND AUTONOMOUS NAVIGATION

4.5.2.2 INTEGRATION OF MULTI-SENSOR AND PERCEPTION SYSTEMS

4.5.3 PLATFORM MODULARITY AND MISSION-SPECIFIC CONFIGURABILITY

4.5.3.1 DEVELOPMENT OF MODULAR PAYLOAD AND CHASSIS DESIGNS

4.5.3.2 SUPPORT FOR DUAL-USE AND CIVIL–MILITARY APPLICATIONS

4.5.4 LOCALISATION, DOMESTIC MANUFACTURING AND SUPPLY CHAIN RESILIENCE

4.5.4.1 ALIGNMENT WITH NATIONAL DEFENCE INDUSTRIAL POLICIES

4.5.4.2 STRENGTHENING OF REGIONAL SUPPLY AND MAINTENANCE ECOSYSTEMS

4.5.5 CYBERSECURITY, RELIABILITY AND OPERATIONAL RESILIENCE

4.5.5.1 INTEGRATION OF SECURE COMMUNICATION AND CYBER HARDENING

4.5.5.2 DESIGN FOR HARSH AND CONTESTED ENVIRONMENTS

4.5.6 EXPANSION OF INTERNATIONAL COLLABORATIONS AND DEFENCE PARTNERSHIPS

4.5.6.1 CROSS-BORDER TECHNOLOGY COLLABORATION AND JOINT PROGRAMS

4.5.6.2 PARTICIPATION IN MIDDLE EAST AND AFRICA DEFENCE MODERNISATION PROGRAMS

4.6 REGIONAL GROWTH OPPORTUNITIES

4.6.1 NORTH AMERICA — ADVANCED DEFENCE DOCTRINE AND TECHNOLOGY LEADERSHIP

4.6.1.1 INSTITUTIONALISATION OF ROBOTIC AND AUTONOMOUS GROUND SYSTEMS

4.6.1.2 BORDER SECURITY, BASE PROTECTION AND HOMELAND APPLICATIONS

4.6.2 EUROPE — MULTINATIONAL COOPERATION AND TERRITORIAL SECURITY

4.6.2.1 COLLECTIVE DEFENCE AND INTEROPERABILITY-DRIVEN DEMAND

4.6.2.2 HEIGHTENED FOCUS ON BORDER SURVEILLANCE AND INFRASTRUCTURE PROTECTION

4.6.3 ASIA–PACIFIC — STRATEGIC TENSIONS AND DUAL-USE EXPANSION

4.6.3.1 BORDER MANAGEMENT AND TERRAIN-INTENSIVE OPERATIONS

4.6.3.2 DISASTER RESPONSE, URBAN SAFETY AND CIVIL APPLICATIONS

4.6.4 MIDDLE EAST — BORDER CONTROL AND CRITICAL ASSET SECURITY

4.6.4.1 PROTECTION OF ENERGY AND STRATEGIC INFRASTRUCTURE

4.6.4.2 LOCAL DEFENCE INDUSTRIAL DEVELOPMENT

4.6.5 CONCLUSION

4.7 TECHNOLOGICAL ADVANCEMENTS

4.7.1 OVERVIEW

4.7.2 AUTONOMOUS NAVIGATION AND ADVANCED SLAM CAPABILITIES

4.7.3 ARTIFICIAL INTELLIGENCE–DRIVEN PERCEPTION AND SENSOR FUSION

4.7.4 EDGE COMPUTING AND ON-BOARD AUTONOMY

4.7.5 SWARMING TECHNOLOGIES AND MULTI-VEHICLE COORDINATION

4.7.6 MODULAR DESIGN AND OPEN-SYSTEM ARCHITECTURES

4.7.7 DIGITAL TWINS, SIMULATION, AND SYNTHETIC TRAINING ENVIRONMENTS

4.7.8 CONCLUSION

4.8 PRICING ANALYSIS

4.9 COMPANY COMPARATIVE ANALYSIS: TOP SELLING MODEL VS PRICE RANGE

4.1 IMPORT EXPORT SCENARIO

4.10.1 COUNTRY-LEVEL PATTERNS

4.10.2 COMPANY-LEVEL TRADE BEHAVIOR

4.11 SUSTAINABILITY INITIATIVES

4.11.1 SUSTAINABILITY DRIVERS IN THE UGV MARKET:

4.11.2 REAL-TIME EXAMPLES: SUSTAINABILITY IN PRACTICE

4.11.2.1 Defense Sector: Hybridization and Fuel Reduction

4.11.2.2 Active Combat Logistics: Resource Optimization

4.11.2.3 Agriculture: Direct Environmental Sustainability Impact

4.11.2.4 Disaster Response & Hazard Mitigation

4.11.3 CROSS-CUTTING SUSTAINABILITY THEMES

4.11.4 STRATEGIC IMPLICATIONS FOR THE UGV MARKET

4.12 TECHNOLOGICAL TRENDS

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 RAW MATERIALS AND FOUNDATIONAL INPUTS

4.13.2 CORE COMPONENT MANUFACTURING

4.13.3 SENSORS, ELECTRONICS, AND SUBSYSTEMS

4.13.4 SOFTWARE, AUTONOMY, AND CONTROL SYSTEMS

4.13.5 SYSTEM INTEGRATION AND FINAL ASSEMBLY

4.13.6 DISTRIBUTION, DEPLOYMENT, AND LIFECYCLE SUPPORT

5 REGULATORY STANDARDS

5.1 DEFENSE AND MILITARY PROCUREMENT FRAMEWORKS

5.1.1 NATIONAL DEFENSE ACQUISITION SYSTEMS

5.1.2 REGULATIONS ON WEAPONIZATION AND AUTONOMOUS ENGAGEMENT

5.2 SAFETY AND OPERATIONAL COMPLIANCE STANDARDS

5.2.1 INTERNATIONAL ROBOTICS AND FUNCTIONAL SAFETY STANDARDS

5.2.2 SECTOR-SPECIFIC OPERATIONAL SAFETY REQUIREMENTS

5.3 COMMUNICATION, SPECTRUM, AND CYBERSECURITY REGULATIONS

5.3.1 RADIOFREQUENCY SPECTRUM GOVERNANCE

5.3.2 CYBERSECURITY AND ENCRYPTION COMPLIANCE

5.4 ARTIFICIAL INTELLIGENCE, AUTONOMY AND ETHICAL GOVERNANCE

5.4.1 INTERNATIONAL AI PRINCIPLES AND HUMAN-CONTROL REQUIREMENTS

5.4.2 NATIONAL AND REGIONAL AI REGULATORY POLICIES

5.5 EXPORT CONTROL AND CROSS-BORDER TRADE REGULATIONS

5.5.1 CONTROL OF DUAL-USE TECHNOLOGIES

5.5.2 SANCTIONS AND MARKET ACCESS LIMITATIONS

5.6 CERTIFICATION, TESTING, AND FIELD DEPLOYMENT STANDARDS

5.6.1 DEFENSE OPERATIONAL TESTING AND EVALUATION

5.6.2 INDUSTRIAL AND COMMERCIAL COMPLIANCE PATHWAYS

5.7 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 DEFENCE MODERNIZATION PROGRAMS ACCELERATING MIDDLE EAST AND AFRICA UGV PROCUREMENT MOMENTUM

6.1.2 ADVANCEMENTS IN AI AND SENSORS ENABLING HIGHER-AUTONOMY CAPABILITIES

6.1.3 EXPANDING COMMERCIAL ADOPTION ACROSS MINING, AGRICULTURE, AND LOGISTICS

6.1.4 GROWING USAGE OF UNMANNED GROUND VEHICLES IN AREAS AFFECTED BY CBRN ATTACKS

6.2 RESTRAINT

6.2.1 HIGH DEVELOPMENT AND INTEGRATION COSTS LIMITING WIDER DEPLOYMENT

6.2.2 EXPORT CONTROLS AND POLICY RESTRICTIONS CONSTRAINING MIDDLE EAST AND AFRICA SALES

6.3 OPPORTUNITIES

6.3.1 MODULAR MISSION-PAYLOAD DESIGNS UNLOCKING DIVERSIFIED APPLICATION SEGMENTS OF UGV

6.3.2 EXPANDING ROLE OF UNMANNED SYSTEMS IN MULTI-DOMAIN OPERATIONS

6.3.3 AFTERMARKET SERVICE AND SOFTWARE EXPANDING UGV PROFITABILITY POTENTIAL

6.4 CHALLENGES

6.4.1 CYBERSECURITY VULNERABILITIES CREATING OPERATIONAL AND SAFETY RISKS

6.4.2 RELIABILITY ISSUES IN HARSH, CONTESTED, AND REMOTE ENVIRONMENTS

7 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE

7.1 OVERVIEW

7.2 MICRO UGVS (<10 LBS)

7.3 SMALL (10 - 200 LBS)

7.4 MEDIUM (200 - 500 LBS)

7.5 LARGE (500 – 1,000 LBS)

7.6 VERY LARGE (1,000 – 2,000 LBS)

7.7 EXTREMELY LARGE (>2,000 LBS)

7.8 MIDDLE EAST AND AFRICA MICRO UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.8.1 ASIA-PACIFIC

7.8.2 EUROPE

7.8.3 NORTH AMERICA

7.8.4 SOUTH AMERICA

7.8.5 MIDDLE EAST & AFRICA

7.9 MIDDLE EAST AND AFRICA SMALL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.9.1 ASIA-PACIFIC

7.9.2 EUROPE

7.9.3 NORTH AMERICA

7.9.4 SOUTH AMERICA

7.9.5 MIDDLE EAST & AFRICA

7.1 MIDDLE EAST AND AFRICA MEDIUM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.10.1 ASIA-PACIFIC

7.10.2 EUROPE

7.10.3 NORTH AMERICA

7.10.4 SOUTH AMERICA

7.10.5 MIDDLE EAST & AFRICA

7.11 MIDDLE EAST AND AFRICA LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.11.1 ASIA-PACIFIC

7.11.2 EUROPE

7.11.3 NORTH AMERICA

7.11.4 SOUTH AMERICA

7.11.5 MIDDLE EAST & AFRICA

7.12 MIDDLE EAST AND AFRICA VERY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.12.1 ASIA-PACIFIC

7.12.2 EUROPE

7.12.3 NORTH AMERICA

7.12.4 SOUTH AMERICA

7.12.5 MIDDLE EAST & AFRICA

7.13 MIDDLE EAST AND AFRICA EXTREMELY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.13.1 ASIA-PACIFIC

7.13.2 EUROPE

7.13.3 NORTH AMERICA

7.13.4 SOUTH AMERICA

7.13.5 MIDDLE EAST & AFRICA

8 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM

8.1 OVERVIEW

8.2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

8.2.1 PAYLOADS

8.2.2 CONTROLLER UNITS

8.2.3 POWER SYSTEM

8.2.4 NAVIGATION SYSTEM

8.2.5 CHASSIS SYSTEM

8.2.6 COMMUNICATION SYSTEM

8.2.7 OTHERS

8.3 MIDDLE EAST AND AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.3.1 CAMERAS

8.3.2 SENSORS

8.3.3 GPS ANTENNAS

8.3.4 LASERS

8.3.5 RADARS

8.3.6 MOTOR ENCODERS

8.3.7 ARTICULATED ARMS

8.3.8 OTHERS

8.4 MIDDLE EAST AND AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 EUROPE

8.4.3 NORTH AMERICA

8.4.4 SOUTH AMERICA

8.4.5 MIDDLE EAST & AFRICA

8.5 MIDDLE EAST AND AFRICA CONTROLLER IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.5.1 ASIA-PACIFIC

8.5.2 EUROPE

8.5.3 NORTH AMERICA

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST & AFRICA

8.6 MIDDLE EAST AND AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.6.1 ELECTRIC NON SOLAR RECHARGEABLE BATTERY

8.6.2 SOLAR RECHARGEABLE BATTERY

8.7 MIDDLE EAST AND AFRICA ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.7.1 LITHIUM ION

8.7.2 LEAD ACID

8.7.3 NICKEL METAL HYDRIDE

8.7.4 NICKEL CADMIUM

8.8 MIDDLE EAST AND AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.8.1 ASIA-PACIFIC

8.8.2 EUROPE

8.8.3 NORTH AMERICA

8.8.4 SOUTH AMERICA

8.8.5 MIDDLE EAST & AFRICA

8.9 MIDDLE EAST AND AFRICA NAVIGATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.9.1 ASIA-PACIFIC

8.9.2 EUROPE

8.9.3 NORTH AMERICA

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 MIDDLE EAST AND AFRICA CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.10.1 MOTOR

8.10.2 ACTUATOR

8.11 MIDDLE EAST AND AFRICA CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.11.1 ASIA-PACIFIC

8.11.2 EUROPE

8.11.3 NORTH AMERICA

8.11.4 SOUTH AMERICA

8.11.5 MIDDLE EAST & AFRICA

8.12 MIDDLE EAST AND AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.12.1 RF COMMUNICATION

8.12.2 SATELLITE COMMUNICATION

8.12.3 4G/5G COMMUNICATION

8.13 MIDDLE EAST AND AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.13.1 ASIA-PACIFIC

8.13.2 EUROPE

8.13.3 NORTH AMERICA

8.13.4 SOUTH AMERICA

8.13.5 MIDDLE EAST & AFRICA

8.14 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

9 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY

9.1 OVERVIEW

9.2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

9.2.1 WHEELED

9.2.2 TRACKED

9.2.3 LEGGED

9.2.4 HYBRID

9.2.5 SNAKE/ARTICULATED MOBILITY

9.3 MIDDLE EAST AND AFRICA WHEELED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.3.1 ASIA-PACIFIC

9.3.2 EUROPE

9.3.3 NORTH AMERICA

9.3.4 SOUTH AMERICA

9.3.5 MIDDLE EAST & AFRICA

9.4 MIDDLE EAST AND AFRICA TRACKED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.4.1 ASIA-PACIFIC

9.4.2 EUROPE

9.4.3 NORTH AMERICA

9.4.4 SOUTH AMERICA

9.4.5 MIDDLE EAST & AFRICA

9.5 MIDDLE EAST AND AFRICA LEGGED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 EUROPE

9.5.3 NORTH AMERICA

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST & AFRICA

9.6 MIDDLE EAST AND AFRICA HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.6.1 ASIA-PACIFIC

9.6.2 EUROPE

9.6.3 NORTH AMERICA

9.6.4 SOUTH AMERICA

9.6.5 MIDDLE EAST & AFRICA

9.7 MIDDLE EAST AND AFRICA SNAKE/ARTICULATED MOBILITY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

10 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION

10.1 OVERVIEW

10.2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

10.2.1 TELEOPERATED

10.2.2 TETHERED

10.2.3 AUTONOMOUS

10.3 MIDDLE EAST AND AFRICA TELEOPERATED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 EUROPE

10.3.3 NORTH AMERICA

10.3.4 SOUTH AMERICA

10.3.5 MIDDLE EAST & AFRICA

10.4 MIDDLE EAST AND AFRICA TETHERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.4.1 ASIA-PACIFIC

10.4.2 EUROPE

10.4.3 NORTH AMERICA

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST & AFRICA

10.5 MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

10.5.1 SEMI-AUTONOMOUS

10.5.2 FULLY AUTONOMOUS

10.6 MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 EUROPE

10.6.3 NORTH AMERICA

10.6.4 SOUTH AMERICA

10.6.5 MIDDLE EAST & AFRICA

11 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD

11.1 OVERVIEW

11.2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

11.2.1 LIGHT DUTY (LESS THAN 50 KG

11.2.2 MEDIUM DUTY (50–200 KG)

11.2.3 HEAVY DUTY (200–1,000 KG)

11.2.4 ULTRA-HEAVY DUTY (>1,000 KG)

11.3 MIDDLE EAST AND AFRICA LIGHT DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.3.1 ASIA-PACIFIC

11.3.2 EUROPE

11.3.3 NORTH AMERICA

11.3.4 SOUTH AMERICA

11.3.5 MIDDLE EAST & AFRICA

11.4 MIDDLE EAST AND AFRICA MEDIUM DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.4.1 ASIA-PACIFIC

11.4.2 EUROPE

11.4.3 NORTH AMERICA

11.4.4 SOUTH AMERICA

11.4.5 MIDDLE EAST & AFRICA

11.5 MIDDLE EAST AND AFRICA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 EUROPE

11.5.3 NORTH AMERICA

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

11.6 MIDDLE EAST AND AFRICA ULTRA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.6.1 ASIA-PACIFIC

11.6.2 EUROPE

11.6.3 NORTH AMERICA

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST & AFRICA

12 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION

12.1 OVERVIEW

12.2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

12.2.1 ELECTRIC

12.2.2 HYBRID

12.2.3 DIESEL/GASOLINE POWERED

12.2.4 HYDROGEN FUEL CELL UGVS

12.2.5 SOLAR-ASSISTED UGVS

12.3 MIDDLE EAST AND AFRICA ELECTRIC IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.3.1 ASIA-PACIFIC

12.3.2 EUROPE

12.3.3 NORTH AMERICA

12.3.4 SOUTH AMERICA

12.3.5 MIDDLE EAST & AFRICA

12.4 MIDDLE EAST AND AFRICA HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.4.1 ASIA-PACIFIC

12.4.2 EUROPE

12.4.3 NORTH AMERICA

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST & AFRICA

12.5 MIDDLE EAST AND AFRICA DIESEL/GASOLINE POWERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.5.1 ASIA-PACIFIC

12.5.2 EUROPE

12.5.3 NORTH AMERICA

12.5.4 SOUTH AMERICA

12.5.5 MIDDLE EAST & AFRICA

12.6 MIDDLE EAST AND AFRICA HYDROGEN FUEL CELL UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.6.1 ASIA-PACIFIC

12.6.2 EUROPE

12.6.3 NORTH AMERICA

12.6.4 SOUTH AMERICA

12.6.5 MIDDLE EAST & AFRICA

12.7 MIDDLE EAST AND AFRICA SOLAR ASSISTED UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.7.1 ASIA-PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

13.2.1 COMMERCIAL

13.2.2 MILITARY

13.2.3 FEDERAL LAW ENFORCEMENT

13.2.4 LAW ENFORCEMENT

13.3 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.3.1 FIREFIGHTING

13.3.2 AUTONOMOUS DELIVERY

13.3.3 CBRN

13.3.4 PHYSICAL SECURITY

13.3.5 AGRICULTURE

13.3.6 DOMESTIC

13.3.7 OIL & GAS

13.3.8 WAREHOUSE & LOGISTICS

13.3.9 OTHERS

13.4 MIDDLE EAST AND AFRICA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.4.1 SPRAYING

13.4.2 MOWING

13.4.3 TILLING

13.5 MIDDLE EAST AND AFRICA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.5.1 INSPECTION

13.5.2 HAULAGE

13.6 MIDDLE EAST AND AFRICA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.6.1 SORTING ROBOTS

13.6.2 PALLET MOVERS

13.7 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.7.1 ASIA-PACIFIC

13.7.2 EUROPE

13.7.3 NORTH AMERICA

13.7.4 SOUTH AMERICA

13.7.5 MIDDLE EAST & AFRICA

13.8 MIDDLE EAST AND AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.8.1 TRANSPORTATION

13.8.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

13.8.3 EXPLOSIVE ORDNANCE DISPOSAL

13.8.4 SEARCH & RESCUE

13.8.5 FIREFIGHTING

13.8.6 COMBAT SUPPORT

13.8.7 MINE CLEARANCE

13.8.8 OTHERS

13.9 MIDDLE EAST AND AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.9.1 ASIA-PACIFIC

13.9.2 EUROPE

13.9.3 NORTH AMERICA

13.9.4 SOUTH AMERICA

13.9.5 MIDDLE EAST & AFRICA

13.1 MIDDLE EAST AND AFRICA FEDERAL LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.10.1 ASIA-PACIFIC

13.10.2 EUROPE

13.10.3 NORTH AMERICA

13.10.4 SOUTH AMERICA

13.10.5 MIDDLE EAST & AFRICA

13.11 MIDDLE EAST AND AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.11.1 BOMB DISPOSAL UNITS

13.11.2 RIOT CONTROL ROBOTS

13.11.3 URBAN SURVEILLANCE ROBOTS

13.12 MIDDLE EAST AND AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.12.1 ASIA-PACIFIC

13.12.2 EUROPE

13.12.3 NORTH AMERICA

13.12.4 SOUTH AMERICA

13.12.5 MIDDLE EAST & AFRICA

14 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 ISRAEL

14.1.3 UNITED ARAB EMIRATES

14.1.4 EGYPT

14.1.5 SOUTH AFRICA

14.1.6 KUWAIT

14.1.7 OMAN

14.1.8 QATAR

14.1.9 BAHRAIN

14.1.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GENERAL DYNAMICS LAND SYSTEMS

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 RHEINMETALL AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ELBIT SYSTEMS LTD.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 TEXTRON SYSTEMS

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 THALES

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AEROVIRONMENT, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ASELSAN A.Ş.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 DOK-ING

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 EDGEFORCE

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 GHOSTROBOTICS.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 HANWHA AEROSPACE

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 HYUNDAI ROTEM COMPANY.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 IAI

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 LEONARDO S.P.A.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 MILREM AS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PERATON

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 QINETIQ

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 ROBOTEAM

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ST ENGINEERING

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 TELEDYNE FLIR DEFENSE INC.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 TECHNOLOGICAL DEVELOPMENT

TABLE 3 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA MICRO UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA SMALL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA MEDIUM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA VERY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA EXTREMELY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CONTROLLER IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA NAVIGATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA WHEELED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA TRACKED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA LEGGED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA SNAKE/ARTICULATED MOBILITY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA TELEOPERATED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA TETHERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA LIGHT DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA MEDIUM DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA ULTRA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA ELECTRIC IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA DIESEL/GASOLINE POWERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA HYDROGEN FUEL CELL UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA SOLAR ASSISTED UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA FEDERAL LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY COUNTRY, 2019-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY COUNTRY, 2019-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA

TABLE 59 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 78 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 79 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 80 SAUDI ARABIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 81 SAUDI ARABIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 82 SAUDI ARABIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 83 SAUDI ARABIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 84 SAUDI ARABIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 85 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 86 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 87 SAUDI ARABIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 88 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 89 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 90 SAUDI ARABIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 91 SAUDI ARABIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 92 SAUDI ARABIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 93 SAUDI ARABIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 94 SAUDI ARABIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 95 SAUDI ARABIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 96 SAUDI ARABIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 97 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 98 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 99 ISRAEL PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 100 ISRAEL POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 101 ISRAEL ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 102 ISRAEL CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 103 ISRAEL COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 104 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 105 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 106 ISRAEL AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 107 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 108 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 109 ISRAEL UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 110 ISRAEL COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 111 ISRAEL AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 112 ISRAEL OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 113 ISRAEL WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 114 ISRAEL MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 115 ISRAEL LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 116 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 117 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 118 UNITED ARAB EMIRATESPAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 119 UNITED ARAB EMIRATESPOWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 120 UNITED ARAB EMIRATESELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 121 UNITED ARAB EMIRATESCHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 122 UNITED ARAB EMIRATESCOMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 123 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 124 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 125 UNITED ARAB EMIRATESAUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 126 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 127 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 128 UNITED ARAB EMIRATESUNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 129 UNITED ARAB EMIRATESCOMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 130 UNITED ARAB EMIRATESAGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 131 UNITED ARAB EMIRATESOIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 132 UNITED ARAB EMIRATESWAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 133 UNITED ARAB EMIRATESMILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 134 UNITED ARAB EMIRATESLAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 135 EGYPT UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 136 EGYPT UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 137 EGYPT PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 138 EGYPT POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 139 EGYPT ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 140 EGYPT CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 141 EGYPT COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 142 EGYPT UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 143 EGYPT UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 144 EGYPT AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 145 EGYPT UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 146 EGYPT UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 147 EGYPT UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 148 EGYPT COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 149 EGYPT AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 150 EGYPT OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 151 EGYPT WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 152 EGYPT MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 153 EGYPT LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 154 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 155 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 156 SOUTH AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 157 SOUTH AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 158 SOUTH AFRICA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 159 SOUTH AFRICA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 160 SOUTH AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 161 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 162 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 163 SOUTH AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 164 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 165 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 166 SOUTH AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 167 SOUTH AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 168 SOUTH AFRICA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 169 SOUTH AFRICA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 170 SOUTH AFRICA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 171 SOUTH AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 172 SOUTH AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 173 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 174 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 175 KUWAIT PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 176 KUWAIT POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 177 KUWAIT ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 178 KUWAIT CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 179 KUWAIT COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 180 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 181 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 182 KUWAIT AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 183 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 184 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 185 KUWAIT UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 186 KUWAIT COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 187 KUWAIT AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 188 KUWAIT OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 189 KUWAIT WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 190 KUWAIT MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 191 KUWAIT LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 192 OMAN UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 193 OMAN UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 194 OMAN PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 195 OMAN POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 196 OMAN ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 197 OMAN CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 198 OMAN COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 199 OMAN UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 200 OMAN UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 201 OMAN AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 202 OMAN UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 203 OMAN UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 204 OMAN UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 205 OMAN COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 206 OMAN AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 207 OMAN OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 208 OMAN WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 209 OMAN MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 210 OMAN LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 211 QATAR UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 212 QATAR UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 213 QATAR PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 214 QATAR POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 215 QATAR ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 216 QATAR CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 217 QATAR COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 218 QATAR UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 219 QATAR UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 220 QATAR AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 221 QATAR UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 222 QATAR UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 223 QATAR UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 224 QATAR COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 225 QATAR AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 226 QATAR OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 227 QATAR WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 228 QATAR MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 229 QATAR LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 230 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 231 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 232 BAHRAIN PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 233 BAHRAIN POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 234 BAHRAIN ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 235 BAHRAIN CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 236 BAHRAIN COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 237 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 238 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 239 BAHRAIN AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 240 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 241 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 242 BAHRAIN UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 243 BAHRAIN COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 244 BAHRAIN AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 245 BAHRAIN OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 246 BAHRAIN WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 247 BAHRAIN MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 248 BAHRAIN LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 249 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 250 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 251 REST OF MIDDLE EAST AND AFRICA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 252 REST OF MIDDLE EAST AND AFRICA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 253 REST OF MIDDLE EAST AND AFRICA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 254 REST OF MIDDLE EAST AND AFRICA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 255 REST OF MIDDLE EAST AND AFRICA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 256 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 257 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 258 REST OF MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 259 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 260 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 261 REST OF MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 262 REST OF MIDDLE EAST AND AFRICA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 263 REST OF MIDDLE EAST AND AFRICA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 264 REST OF MIDDLE EAST AND AFRICA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 265 REST OF MIDDLE EAST AND AFRICA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 266 REST OF MIDDLE EAST AND AFRICA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 267 REST OF MIDDLE EAST AND AFRICA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

图片列表

FIGURE 1 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET

FIGURE 2 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: MULTIVARIATE MODELLING

FIGURE 7 UNMANNED GROUND VEHICLE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: SEGMENTATION

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 SIX SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE

FIGURE 15 ASIA-PACIFIC IS EXPECTED TO BE THE DOMINANT AND FASTEST GROWING REGION IN THE MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 16 DEFENSE MODERNIZATION PROGRAMS ACCELERATING MIDDLE EAST AND AFRICA UGV PROCUREMENT MOMENTUM IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 17 SMALL (10 - 200 LBS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET IN 2026 & 2033

FIGURE 18 ASIA-PACIFIC IS THE FASTEST-GROWING REGION FOR THE MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 19 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, 2025-2033, AVERAGE SELLING PRICE (USD PER UNIT)

FIGURE 20 SWOT ANALYSIS

FIGURE 21 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2025

FIGURE 22 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2025

FIGURE 23 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2025

FIGURE 24 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2025

FIGURE 25 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2025

FIGURE 26 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2025

FIGURE 27 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2025

FIGURE 28 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET, SNAPSHOT (2025)

FIGURE 29 MIDDLE EAST AND AFRICA UNMANNED GROUND VEHICLE MARKET: COMPANY SHARE 2025 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。