North America Orthopedic Prosthetics Market

市场规模(十亿美元)

CAGR :

%

USD

1.60 Billion

USD

2.70 Billion

2024

2032

USD

1.60 Billion

USD

2.70 Billion

2024

2032

| 2025 –2032 | |

| USD 1.60 Billion | |

| USD 2.70 Billion | |

|

|

|

|

North America Orthopedic Prosthetics Market, by Product Type (Upper Extremity, Prosthetics, Lower Extremity Prosthetics, Liners, Sockets and Modular Components), Technology Type (Conventional, Electric Powered and Hybrid Prosthetics), End User Type (Hospitals, Prosthetic Clinics, Rehabilitation Centers, and Others)- Industry Trends and Forecast to 2032

Orthopedic Prosthetics Market Size

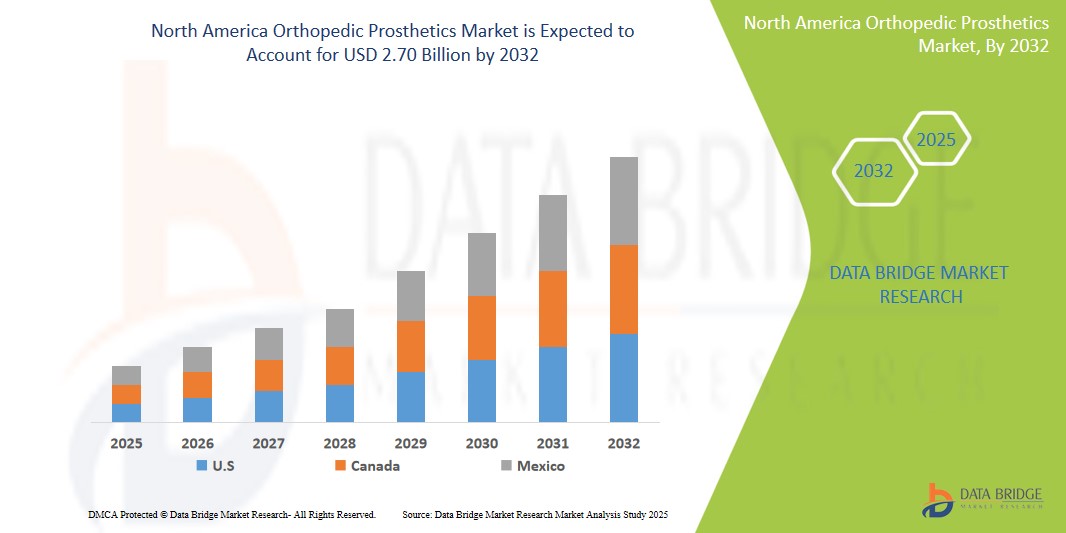

- The North America Orthopedic Prosthetics Market was valued atUSD1.6 Billion in 2024 and is expected to reachUSD2.70 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 6.8%primarily driven by the anticipated launch of therapies

- The drivers of the Orthopedic Prosthetics Market include growing geriatric population, increasing incidence of diabetes and vascular diseases, rising sports injuries and accidents, and technological advancements like smart prosthetics and 3D-printed limbs.

North America Orthopedic Prosthetics Market Analysis

- Orthopedic prosthetics are external medical devices designed to replace missing body parts, enhance mobility, and improve quality of life for individuals with limb loss or deformities.

- Rising prevalence of conditions like vascular diseases, diabetes-related amputations, cancer, and road accidents is significantly driving demand for orthopedic prosthetics across North America.

- Furthermore, technological innovations such as myoelectric prosthetics, 3D-printed prosthetic limbs, and bionic devices have enhanced functionality, comfort, and customization, encouraging higher adoption rates.

- For instance, According to the Amputee Coalition, approximately 2.1 million people are living with limb loss in the U.S., and this number is expected to double by 2050 due to rising chronic diseases and trauma injuries.

- In North America, orthopedic prosthetics, including artificial limbs and supportive devices, are increasingly in demand due to rising cases of limb loss from diabetes, trauma, and vascular diseases. Advancements in material science, healthcare reforms, and growing awareness of rehabilitation technologies are improving access, affordability, and patient outcomes across the region

Report Scope Orthopedic Prosthetics Market Segmentation

|

Attributes |

Orthopedic ProstheticsKey Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Orthopedic Prosthetics Market Trends

“Increased Adoption of Technologically Advanced Prosthetic Solutions”

- Rising preference for advanced orthopedic prosthetics, such as microprocessor-controlled knees and myoelectric arms, is growing across North America. Patients are opting for lightweight, durable, and highly functional prosthetics that improve mobility and quality of life, supported by innovations in materials, robotics, and design technologies.

- Increasing demand for customized prosthetic solutions is driving the market. 3D printing technology enables faster production, better fit, and personalized designs that enhance patient comfort and functionality. This shift is revolutionizing the prosthetics field, particularly for individuals with unique anatomical needs.

Orthopedic Prosthetics Market Dynamics

Driver

“High Awareness and Access to Advanced Prosthetic Care”

- Growing awareness about advanced rehabilitation technologies and the critical importance of mobility restoration is significantly driving the North America orthopedic prosthetics market. Federal and state-level healthcare programs in the U.S. and Canada are playing a vital role by expanding access to specialized prosthetic services through public insurance schemes such as Medicare, Medicaid, and various veteran support programs

- Organizations like the Amputee Coalition in the U.S. are also actively advocating for amputee rights, increasing visibility, and promoting early adoption of prosthetic solutions.

- The focus on early intervention, rehabilitation, and mobility improvement has led to higher adoption rates of cutting-edge orthopedic prosthetics, such as myoelectric and bionic limbs, which offer enhanced functionality and patient independence.

- For instance, In March 2024, the Canadian Prosthetics and Orthotics Association (CPOA) launched a new national initiative to integrate prosthetic care more closely with rehabilitation and occupational therapy services. This multidisciplinary approach is improving patient outcomes and is expected to increase the demand for sophisticated prosthetic devices throughout Canada.

- Simultaneously, the growing presence of prosthetic clinics, rehabilitation centers, and tele-rehabilitation services across urban and rural regions is improving access for underserved populations. Retail expansion and e-commerce platforms are further streamlining the purchase of standard prosthetic components, orthotic devices, and replacement parts, making prosthetic care more accessible and affordable.

Opportunity

“Technological Advancements and Telehealth Expansion”

- Advanced prosthetics are increasingly integrating smart technologies such as sensors, microprocessors, AI, and IoT connectivity. Modern prosthetic limbs can now adapt to different terrains, user movements, and activities through real-time data processing.

- Under the Affordable Care Act and various state-level healthcare reforms, policies are expanding insurance coverage for durable medical equipment (DME), including prosthetic devices. Medicaid, Medicare, and private insurers increasingly cover prosthetic fitting, replacements, and related services, reducing out-of-pocket expenses for patients. This regulatory environment is encouraging higher prosthetic uptake across different socioeconomic groups.

- Emerging prosthetics are being paired with wearable health devices (such as smartwatches and mobile apps) that track gait, posture, and prosthetic use efficiency. This integration supports better patient outcomes through data-driven adjustments and personalized therapy plans, offering new opportunities for companies to provide bundled smart health solutions

- For instance, In February 2024, Ottobock North America launched a remote prosthetic adjustment service platform, allowing users to connect with clinicians via mobile apps and receive real-time limb fitting guidance, without needing repeated clinic visits. This innovation is expected to significantly increase prosthetic adoption among underserved populations.

- Consequently, the growing integration of digital health solutions is expected to improve contraceptive accessibility, reduce disparities, and significantly drive market growth across the region

Restraint/Challenge

“Cultural Sensitivities and Access Inequities”

- In various communities, deep-rooted cultural beliefs and religious values influence attitudes toward the use of assistive devices, including prosthetics. Some populations may perceive prosthetic adoption as a stigma or may resist advanced technological solutions due to traditional preferences for natural healing or alternative therapies. These societal barriers slow the acceptance of innovative prosthetic technologies, particularly in conservative or marginalized groups.

- In rural areas across Canada and the United States, the scarcity of certified prosthetists, rehabilitation centers, and telehealth capabilities limits early intervention and ongoing prosthetic care. Delays in fittings, repairs, and rehabilitation services compromise patient outcomes and lead to lower satisfaction and acceptance rates.

- For instance, In January 2024, a study published by the American Orthotic and Prosthetic Association (AOPA) revealed that uninsured individuals in North America were 40% less likely to receive timely prosthetic interventions following limb loss, leading to prolonged disability and reduced quality of life

- Consequently, without targeted policy efforts, investment in rural healthcare infrastructure, and culturally sensitive outreach initiatives, these disparities could continue to inhibit the full potential growth of the North America Orthopedic Prosthetics Market over the coming years

Orthopedic Prosthetics Market Scope

The market is segmented on the basis, product type, technology, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Technology |

|

|

By End User |

|

In 2025, the Upper Extremity Prosthetics is projected to dominate the market with a largest share in product type segment

The Upper Extremity Prosthetics segment is expected to dominate the Orthopedic Prosthetics market with the largest share in 2025, driven by advancements in prosthetic technology and increasing demand for customized solutions to restore functionality and quality of life for individuals with limb loss. The segment is expected to dominate the market due to the rising number of amputations, traumatic injuries, congenital conditions, and the growing aging population in North America..

The Conventional is expected to account for the largest share during the forecast period in technology market

n 2025, the Conventional segment is expected to maintain its dominant position in the North American Orthopedic Prosthetics Market, capturing the largest market share. This dominance is driven by the simplicity, cost-effectiveness, and reliability of conventional prosthetic devices, which continue to be widely preferred for individuals requiring orthopedic solutions for limb loss or dysfunction. Conventional prosthetics, including basic socket-based systems and mechanical joints, are known for their accessibility and straightforward design, making them a practical option for many patients, particularly in regions with varied access to advanced healthcare technologies.

Orthopedic Prosthetics Market Regional Analysis

“U.S. is the Dominant Country in the Orthopedic Prosthetics Market”

- North America is expected to continue leading the global Orthopedic Prosthetics market in 2025, with the United States holding a substantial share of the market. The U.S. benefits from a highly developed healthcare infrastructure, which facilitates access to cutting-edge prosthetic solutions, including advanced upper and lower extremity prosthetics. Additionally, the presence of major industry players such as Össur, Hanger Clinic, and Stryker ensures that the latest innovations in materials, technology, and prosthetic design are readily available to U.S. patients.

- The U.S. boasts a robust healthcare system with well-established rehabilitation centers, prosthetics clinics, and specialized healthcare providers, ensuring access to both conventional and advanced prosthetic devices.

- The integration of advanced prosthetic technologies, such as myoelectric limbs and bionic devices, has made the U.S. a leader in providing highly functional and customized prosthetic solutions, enhancing the quality of life for individuals with limb loss or impairment.

- Insurance policies, including those under Medicare and private health insurers, often cover the cost of prosthetic devices, making them more accessible to a larger portion of the population. Government policies, such as the Affordable Care Act (ACA), which mandates insurance coverage for medically necessary prosthetics, further support adoption

“Canada is Projected to Register the Highest Growth Rate”

- Canada is projected to experience one of the highest growth rates in the North American orthopedic prosthetics market. The country benefits from a universal healthcare system, which provides equitable access to healthcare services, including prosthetic devices. Government initiatives aimed at promoting rehabilitation, accessibility, and quality of life for individuals with limb loss are accelerating the adoption of orthopedic prosthetic.

- Canada’s publicly funded healthcare system ensures that orthopedic prosthetics are accessible to a broad population, including those in remote areas where private insurance might be limited.

- anadian government initiatives focused on improving rehabilitation and prosthetic access, such as funding for amputee rehabilitation programs and partial coverage for prosthetic devices, are fueling market growth.

- Increased awareness of the benefits of modern prosthetic technologies and improved sexual and reproductive health education has also contributed to a rise in demand for advanced orthopedic prosthetics

Orthopedic Prosthetics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Össur (Iceland)

- Ottobock (Germany)

- Hanger, Inc. (U.S.

- Blatchford Limited (U.K.)

- Fillauer LLC (U.S.

- Steeper Group (U.K.)

- WillowWood Global LLC (U.S.)

Latest Developments in North America Orthopedic Prosthetics Market

- In May 2024, Medical technology firm Ottobock introduced an advanced mechanical prosthetic foot to the global market. The Evanto foot balances dynamics, flexibility, and stability for the first time, marking a significant prosthetic breakthrough.

- In March 2024, NIPPON EXPRESS HOLDINGS, INC. announced that it had invested in Instalimb, Inc., a company growing its 3D-printed prosthetics operations internationally in the Philippines, India, and other locations. This acquisition occurred as part of the NX Global Innovation Fund in February 2024.

- In June 2023, Fillauer launched the Myo/One Electrode system, designed in partnership with Coapt. It is a streamlined, waterproof solution with one preamplifier providing two EMG signal channels for myoelectric devices and replaces fabrication aids, sealing rings, cables, and other devices with a cable.

- In May 2023, WillowWood announced the release of the Alpha Control Liner System, an innovative prosthetic liner with embedded electronics, in partnership with Coapt. The system is of advantage to people using a myoelectric prosthesis, as it enables a more consistent and comfortable electrode contact with the skin, leading to enhanced functional control. Coapt’s Complete Control system leverages machine learning to understand user intentions and control prosthesis actions.

- In March 2023, Steeper Group announced that it had joined the Eqwal Group, with the latter acquiring 100% of the shares in Steeper Group. The Eqwal Group has its headquarters in Toulouse, France, and is a global patient care services provider in prosthetics and orthotics. Through this development, Steeper Group aims to strengthen its clinical offerings in the United Kingdom and deliver innovative products and services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。