North America Departmental Pacs Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

1.91 Billion

USD

3.00 Billion

2024

2032

USD

1.91 Billion

USD

3.00 Billion

2024

2032

| 2025 –2032 | |

| USD 1.91 Billion | |

| USD 3.00 Billion | |

|

|

|

|

North America Departmental Picture Archiving and Communication System (PACS) Market Segmentation, By Type (Radiology PACS, Cardiology PACS, and Others), Components (Services, Software, and Hardware), Application (Computed Tomography, Ultrasound, MRI, C-Arms, Digital Radiography, Nuclear Imaging, and Computed Radiography), Deployments (Web-Based, On-Premise, and Cloud Based), End Users (Hospitals, Clinic Imaging, Dental Practices, Imaging Centers, Diagnostic Centers, Research and Academic Institutes, Ambulatory Surgical Centers, and Others) - Industry Trends and Forecast to 2032

North America Departmental Picture Archiving and Communication System (PACS) Market Size

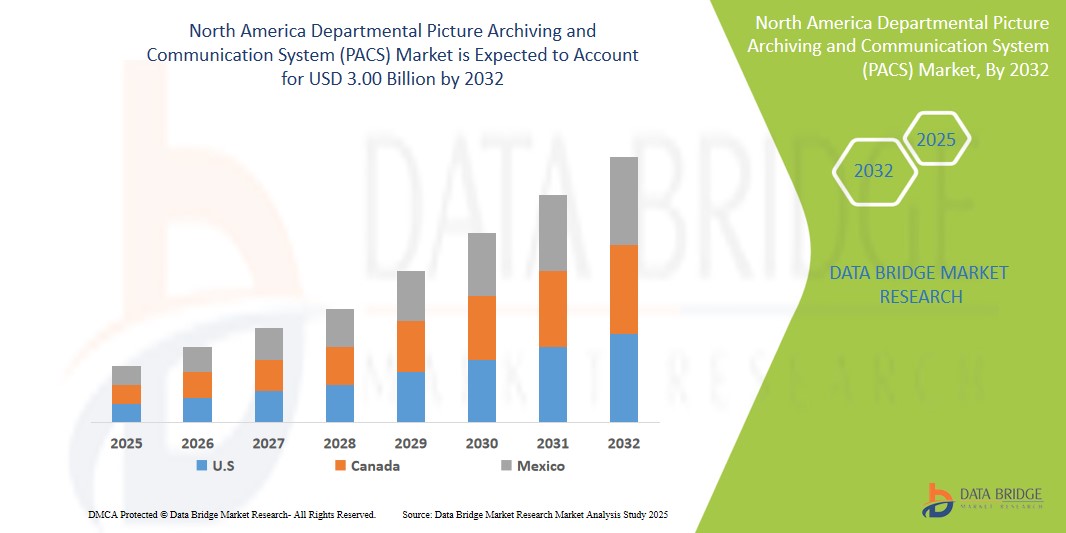

- The departmental picture archiving and communication system (PACS) market size was valued atUSD 1.91 billion in 2024 and is expected to reachUSD 3.00 billion by 2032, at aCAGR of 8.7%during the forecast period

- This growth is attributed to factors such as the ability of PACS to provide centralized storage and quick retrieval of medical images, improving workflow efficiency and patient care coordination. In addition, advancements in imaging technology and partnerships between healthcare providers and technology companies are driving market expansion

North America Departmental Picture Archiving and Communication System (PACS) Market Analysis

- Departmental Picture Archiving and Communication Systems (PACS) are essential tools in medical imaging, enabling healthcare facilities to securely store, retrieve, and share medical images such as X-rays, MRIs, and CT scans

- The demand for PACS is significantly driven by the growing need for efficient healthcare management, the increasing adoption of digital healthcare technologies, and the expansion of healthcare facilities with advanced imaging technologies

- U.S is the dominant country in the PACS market, accounting for approximately 75% of the total market share in North America. This is due to the country’s robust healthcare infrastructure, high adoption of digital health technologies, and large number of healthcare facilities

- Canada is the fastest-growing country in the PACS market, it holds a smaller market share compared to the U.S., estimated at around 20%. However, Canada’s share is expected to increase as the country invests in modernizing healthcare facilities and implementing digital healthcare solutions

- The radiology segment is anticipated to dominate the North American PACS market, with an estimated market share of 45%, driven by the increasing prevalence of chronic diseases and frequent imaging requirements

Report Scope and North America Departmental Picture Archiving and Communication System (PACS) Market Segmentation

|

Attributes |

North America Departmental Picture Archiving and Communication System (PACS)Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Departmental Picture Archiving and Communication System (PACS) Market Trends

“Integration of AI and Machine Learning for Improved Imaging and Diagnosis”

- One prominent trend in the PACS market is the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies to enhance imaging analysis and diagnosis

- These innovations are improving diagnostic accuracy by automating image interpretation, detecting anomalies, and providingpredictive analytics for better decision-making in medical care

- For instance, AI-powered PACS systems are capable of analyzing medical images to identify early signs of diseases such as cancer or neurological disorders, helping doctors provide faster and more accurate diagnoses

- These advancements are revolutionizing medical imaging workflows, improving patient outcomes, and driving demand for next-generation PACS systems that leverage AI and ML for enhanced diagnostic support and efficiency

North America Departmental Picture Archiving and Communication System (PACS) Market Dynamics

Driver

“Growing Need Due to Prevalence of Chronic Diseases and Aging Population”

- The increasing prevalence of chronic diseases such as cardiovascular conditions, diabetes, and cancer is significantly driving the demand for Departmental Picture Archiving and Communication Systems (PACS) in North America

- As the population ages, the incidence of these chronic conditions rises, necessitating frequent diagnostic imaging for monitoring and treatment planning, which in turn boosts the demand for advanced PACS solutions

- Older adults, who are more susceptible to chronic diseases, require frequent imaging to assess the progression of these conditions, further driving PACS adoption in hospitals and healthcare facilities

- For instance, In February 2023, the Centers for Disease Control and Prevention (CDC) reported that over 6 in 10 adults in the U.S. have at least one chronic disease, with cardiovascular diseases being the leading cause of death and disability, thus driving the need for advanced medical imaging solutions

- As a result of the rising prevalence of chronic diseases and the aging population, there is a significant increase in the demand for PACS systems, ensuring more efficient diagnostic workflows and improved patient outcomes

Opportunity

“Advancing Diagnostic Imaging with Artificial Intelligence Integration”

- AI-powered PACS systems have the potential to significantly enhance the capabilities of medical imaging, improving diagnostic accuracy and efficiency across various medical specialties

- AI algorithms can analyze large volumes of imaging data in real-time, assisting healthcare professionals by identifying abnormalities, offering automated image interpretation, and providing predictiveanalytics for disease progression

- These innovations are transforming medical workflows by reducing manual effort, enhancing image quality, and speeding up the diagnostic process, which is critical for timely and accurate patient care

- For instance, In November 2024, Philips Healthcare launched an AI-driven diagnostic imaging platform integrated into its PACS solutions, aimed at improving diagnostic workflows in hospitals. The system utilizes deep learning to automate image analysis, helping clinicians detect and diagnose conditions such as tumors, cardiovascular diseases, and neurological disorders more efficiently

- The integration of AI in PACS systems can lead to better patient outcomes by enabling earlier detection of diseases, streamlining workflows, and enhancing the overall efficiency of healthcare facilities, making it a significant growth opportunity in the North American market

Restraint/Challenge

“High Equipment and Implementation Costs Hindering Market Growth”

- The high cost of Departmental Picture Archiving and Communication Systems (PACS) poses a significant challenge for the market, especially affecting the purchasing decisions of smaller healthcare facilities with limited budgets

- PACS systems, which are essential for managing medical imaging data, can require substantial investments not only in the equipment itself but also in infrastructure, software licenses, and training, leading to high overall implementation costs

- This financial barrier can deter smaller hospitals, clinics, and healthcare providers from adopting PACS or upgrading to more advanced systems, resulting in reliance on outdated solutions or manual image management methods

- For instance, In January 2024, GE Healthcare reported that smaller healthcare providers often face financial challenges when trying to adopt next-generation PACS, as the initial investment and long-term operational costs are prohibitive for many facilities, particularly in rural or underserved regions

- As a result, these high costs can limit the accessibility and affordability of PACS solutions, hindering market penetration and potentially slowing the adoption of advanced diagnostic imaging technologies across North America

Departmental Picture Archiving and Communication System (PACS) Market Scope

The market is segmented on the basis of type, components, application, deployment, and end users.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Component |

|

|

By Application |

|

|

By Deployment |

|

|

By End Users

|

|

In 2025, the radiology segment is projected to dominate the market with a largest share in product type segment

The radiology segment is anticipated to dominate the North American PACS market, with an estimated market share of 45%, driven by the increasing prevalence of chronic diseases and the rising demand for frequent imaging in diagnosis and treatment. As conditions like cardiovascular diseases, cancer, and diabetes become more prevalent, the need for diagnostic imaging systems is expected to rise. In terms of country-specific market share, the U.S. holds a dominant share of around 75-80% of the North American PACS market, while Canada contributes approximately 20%, showing strong growth potential in the region.

The acquire and manage DICOM content is expected to account for the largest share during the forecast period in service segments

The “acquire and manage DICOM content” service is expected to dominate the North American PACS market, accounting for the largest share of approximately 35-40%. This growth is driven by the increasing need for seamless integration and efficient management of medical images across healthcare platforms. In addition, services like “Structured Report Normalized Interface” and “Encounter-Based Imaging” are gaining traction, with “Mobile Image and Video Capture” seeing significant expansion due to the rise in mobile device use for real-time sharing. In terms of country-specific market share, the United States dominates with around 75-80%, while Canada holds approximately 20%.

Departmental Picture Archiving and Communication System (PACS) Market Regional Analysis

“U.S Holds the Largest Share in the Departmental Picture Archiving and Communication System (PACS) Market”

- The U.S. benefits from a robust healthcare system with cutting-edge medical technologies, contributing to its dominance in the PACS market, holding approximately 75-80% of the North American market share

- The rapid adoption of electronic health records (EHR) across U.S. healthcare facilities supports seamless integration of PACS systems, enhancing diagnostic accuracy and efficiency

- The increasing prevalence of chronic diseases and the growing need for diagnostic imaging systems lead to a high demand for PACS solutions in the U.S.

- Well-established reimbursement policies and substantial investments in research and development by leading U.S. healthcare companies further reinforce its leadership in the PACS market

“Canada is Projected to Register the Highest CAGR in the Departmental Picture Archiving and Communication System (PACS) Market”

- Canada’s strong emphasis on digital transformation in healthcare is driving the adoption of PACS solutions, contributing to its expected market growth, with an estimated market share of 15% in North America

- Government-backed initiatives to modernize healthcare facilities and improve the efficiency of medical image management systems are accelerating the adoption of PACS in the country

- The growing need for efficient healthcare management, especially in remote areas, is fostering demand for PACS solutions in Canada

- Ongoing investments in healthcare technologies by both public and private sectors are supporting the rapid expansion of PACS systems across Canada

Departmental Picture Archiving and Communication System (PACS) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- INFINITT Healthcare Co., Ltd. (Korea)

- Hyland Software, Inc. (U.S.)

- BridgeHead Software Ltd (U.K.)

- Carestream Health (U.S.)

- UltraLinQ (U.S.)

- Voyager Imaging (Australia)

- Visaris (Serbia)

- SinoVision (China)

- JPIHealthcareSolution (U.S.)

- Fujifilm Corporation (Japan)

- Siemens Healthcare GmbH (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Agfa-Gevaert Group (Belgium)

- BMD Software (Portugal)

- Epic Systems Corporation (U.S.)

- General Electric Company (U.S.)

- McKesson Corporation (U.S.)

- Sectra AB (Sweden)

Latest Developments in Global Departmental Picture Archiving and Communication System (PACS) Market

- In November 2022, SEJONG Telecom, Inc. partnered with IRM Co., Ltd. and Pusan National University Hospital to create a blockchain-based platform for managing medical data. This initiative focuses on enhancing the security and accessibility of healthcare systems by leveraging blockchain technology. The project aims to improve the safety and utilization of medical data, transitioning existing PACS (Picture Archiving and Communication Systems) onto a blockchain framework. In addition, the platform will support NFT issuance for medical image data, ensuring transparent ownership and usage

- In October 2022, the Agfa-Gevaert Group partnered with Atos to enhance its internal IT operations, aiming to strengthen product development and expand its market presence. This collaboration focuses on driving digital transformation by utilizing Atos's expertise in innovative IT solutions. The partnership is part of Agfa's broader strategy to modernize its IT infrastructure, streamline operations, and improve efficiency across its global network. By leveraging Atos's advanced technologies, Agfa seeks to create a more agile and future-ready digital organization

- In October 2022, Visaris organized an exhibition showcasing the development and modern applications of X-ray technology among Serbs. The event highlighted the pioneering contributions of Nikola Tesla and Mihajlo Pupin to radiology, tracing its evolution from the discovery of X-rays to contemporary advancements. The exhibition aimed to celebrate the achievements of Serbian scientists and innovators in the field, emphasizing their impact on global radiology practices. It also explored the integration of digital transformation in X-ray technology, reflecting the ongoing progress in medical imaging

- In March 2022, Tata Capital Healthcare Fund made its first investment in the health technology sector by contributing $10 million to DeepTek, a Pune-based startup specializing in AI-powered radiology imaging solutions. DeepTek offers a cloud-based PACS platform designed to enhance workflow automation and improve diagnostic accuracy through advanced AI integration. This funding aims to support DeepTek's global expansion and secure regulatory approvals, furthering its mission to transform radiology operations. The investment highlights Tata Capital Healthcare Fund's commitment to fostering innovation in healthcare technology

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.