Global Tactical Radios Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

19.58 Billion

USD

52.80 Billion

2025

2033

USD

19.58 Billion

USD

52.80 Billion

2025

2033

| 2026 –2033 | |

| USD 19.58 Billion | |

| USD 52.80 Billion | |

|

|

|

|

Segmentación del mercado global de radios tácticas, por tipo (vehículo, portátil o de mano), tipo de plataforma (terrestre, naval y aérea) y aplicación (ejército, armada, fuerza aérea, terrestre y fuerzas de operaciones especiales [SOP]): tendencias y pronóstico de la industria hasta 2033.

Tamaño del mercado de radios tácticas

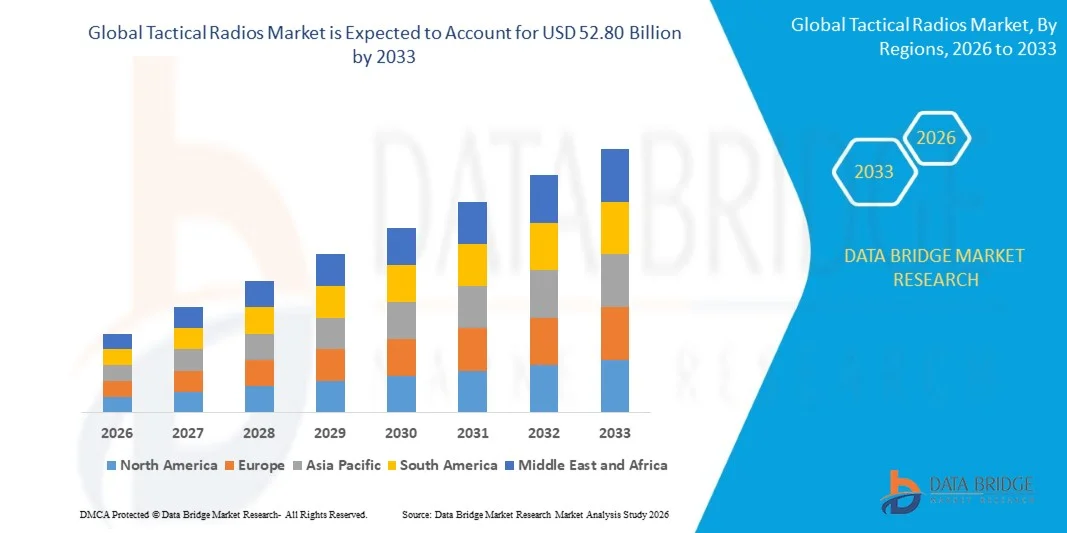

- El tamaño del mercado global de radios tácticas se valoró en USD 19,58 mil millones en 2025 y se espera que alcance los USD 52,80 mil millones para 2033 , con una CAGR del 13,20% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por las crecientes iniciativas de modernización de la defensa y la creciente necesidad de sistemas de comunicación seguros, confiables y en tiempo real en las operaciones militares, que respalden una mejor coordinación y conocimiento de la situación en entornos de combate complejos.

- Además, el creciente énfasis en la guerra centrada en la red, la interoperabilidad entre fuerzas aliadas y los avances en las tecnologías de cifrado y radio definidas por software están acelerando la adopción de radios tácticas, lo que fortalece significativamente el crecimiento general del mercado.

Análisis del mercado de radios tácticas

- Las radios tácticas, que permiten la comunicación segura de voz y datos a través de plataformas terrestres, aéreas y navales, se han convertido en componentes críticos de las infraestructuras de comunicación militares y de defensa modernas debido a su resiliencia, movilidad y capacidades de transmisión cifrada.

- La creciente demanda de radios tácticas se ve impulsada principalmente por el aumento de las tensiones geopolíticas, la expansión de las operaciones militares y las continuas inversiones en sistemas de comunicación avanzados para mejorar el comando, el control y la eficacia operativa.

- América del Norte dominó el mercado de radios tácticas con una participación de más del 40% en 2025, debido al alto gasto en defensa, la modernización continua de los sistemas de comunicación militar y un fuerte enfoque en la guerra centrada en la red.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento en el mercado de radios tácticas durante el período de pronóstico debido al aumento de los gastos de defensa, las preocupaciones de seguridad regional y los esfuerzos de modernización militar.

- El segmento de radios montados en vehículos dominó el mercado con una cuota de mercado del 47% en 2025, gracias a su amplio uso en vehículos blindados, vehículos de mando y flotas logísticas para comunicaciones seguras y de largo alcance. Estas radios ofrecen mayor potencia de transmisión, mayor estabilidad de señal y la capacidad de integrarse con los sistemas de gestión de batalla a bordo, lo que las hace cruciales para las operaciones militares coordinadas. Las fuerzas de defensa priorizan las radios tácticas montadas en vehículos debido a su robustez, fiabilidad en terrenos difíciles y capacidad para mantener la comunicación continua durante misiones prolongadas. Su compatibilidad con múltiples bandas de frecuencia y estándares de cifrado refuerza aún más su dominio en las plataformas militares modernas.

Alcance del informe y segmentación del mercado de radios tácticas

|

Atributos |

Perspectivas clave del mercado de radios tácticas |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado de radios tácticas

Creciente adopción de radios tácticas interoperables y definidas por software

- Una tendencia importante que define el mercado de radios tácticas es la creciente adopción de sistemas de radio definidos por software e interoperables, impulsada por la creciente necesidad de soluciones de comunicación militar flexibles, actualizables y preparadas para el futuro. Estas radios permiten a las fuerzas armadas reconfigurar frecuencias, formas de onda y funcionalidades mediante actualizaciones de software, mejorando la adaptabilidad en diversos entornos de misión.

- Por ejemplo, empresas como L3Harris y Thales suministran activamente radios tácticas definidas por software que facilitan la interoperabilidad entre fuerzas aliadas y múltiples dominios operativos. Estas soluciones mejoran la coordinación durante misiones conjuntas y garantizan la compatibilidad con redes de comunicación tradicionales y de nueva generación.

- La transición hacia operaciones multidominio está acelerando la demanda de radios tácticas interoperables que puedan conectar sin problemas unidades terrestres, aéreas y navales. Esta tendencia está fortaleciendo el papel de las radios tácticas como elementos centrales de las estrategias de guerra centradas en la red.

- Las fuerzas de defensa priorizan cada vez más las radios que admiten la transmisión segura de datos, voz y video para mejorar el conocimiento de la situación y la eficiencia del mando. Esto refuerza la adopción de capacidades avanzadas de cifrado y gestión dinámica del espectro en los sistemas de radio tácticos.

- La integración de radios tácticas con sistemas de gestión del campo de batalla y plataformas de mando digital está intensificando aún más esta tendencia. Estas integraciones permiten el intercambio de datos en tiempo real y una toma de decisiones más rápida en escenarios de combate de alto riesgo.

- En general, el creciente énfasis en la flexibilidad, la interoperabilidad y la conectividad digital en el campo de batalla está posicionando a las radios tácticas definidas por software como un motor de crecimiento crítico dentro de las arquitecturas de comunicación de defensa modernas.

Dinámica del mercado de radios tácticas

Conductor

“Aumento de la modernización de la defensa y demanda de comunicaciones militares seguras”

- El mercado de radios tácticas está fuertemente impulsado por el aumento de los programas de modernización de defensa, cuyo objetivo es actualizar la infraestructura de comunicaciones heredada en las fuerzas armadas de todo el mundo. Las fuerzas armadas modernas requieren sistemas de comunicación seguros, resilientes y en tiempo real para soportar entornos operativos complejos y en rápida evolución.

- Por ejemplo, organizaciones de defensa en EE. UU., Europa y Asia-Pacífico están invirtiendo en radios tácticas encriptadas para mejorar la seguridad de las comunicaciones en el campo de batalla y evitar la interceptación de señales. Estas inversiones están acelerando la adquisición de sistemas de radio avanzados con capacidades mejoradas de antiinterferencias y redes seguras.

- Las crecientes tensiones geopolíticas y la preocupación por la seguridad fronteriza refuerzan la necesidad de sistemas avanzados de comunicación militar. Los gobiernos priorizan las radios tácticas como herramientas esenciales para mejorar la preparación y la capacidad de respuesta.

- El creciente enfoque en operaciones conjuntas y de coalición también impulsa la demanda de soluciones de comunicación estandarizadas e interoperables. Las radios tácticas que cumplen con los estándares internacionales de defensa están ganando cada vez más adeptos.

- En conjunto, el gasto sostenido en defensa y la necesidad crítica de comunicaciones seguras están reforzando este impulsor y apoyando el crecimiento a largo plazo del mercado de radios tácticas.

Restricción/Desafío

“Altos costos de adquisición e integración compleja de sistemas”

- El mercado de radios tácticas se enfrenta a desafíos relacionados con los altos costos de adquisición asociados a los sistemas de comunicación avanzados que incorporan cifrado, arquitectura definida por software y capacidades multibanda. Estos factores de costo pueden limitar su adopción, especialmente en países con presupuestos de defensa limitados.

- Por ejemplo, la integración de radios tácticas de última generación en las redes de comunicación militar existentes suele requerir inversiones adicionales en infraestructura, capacitación y personalización del sistema. Esta complejidad incrementa los costos totales de propiedad para las organizaciones de defensa.

- Los desafíos de integración de sistemas surgen al alinear nuevas radios con plataformas, vehículos y sistemas de comando heredados. Garantizar una interoperabilidad fluida sin interrumpir las operaciones existentes dificulta aún más la implementación.

- Los costos de mantenimiento y gestión del ciclo de vida asociados con las radios tácticas avanzadas también contribuyen a las presiones presupuestarias. Actualizar el software y garantizar la compatibilidad del sistema a largo plazo exige una inversión continua.

- Como resultado, equilibrar el avance tecnológico con la asequibilidad y la viabilidad de la integración sigue siendo un desafío clave que influye en las decisiones de compra dentro del mercado de radios tácticas.

Alcance del mercado de radios tácticas

El mercado está segmentado según el tipo, el tipo de plataforma y la aplicación.

• Por tipo

Según el tipo, el mercado de radios tácticas se segmenta en radios montadas en vehículos y radios portátiles. El segmento de radios montadas en vehículos dominó el mercado con la mayor participación en ingresos, un 47% en 2025, impulsado por su amplio uso en vehículos blindados, vehículos de mando y flotas logísticas para comunicaciones seguras y de largo alcance. Estas radios ofrecen mayor potencia de transmisión, mayor estabilidad de señal y la capacidad de integrarse con sistemas de gestión de batalla a bordo, lo que las hace cruciales para operaciones militares coordinadas. Las fuerzas de defensa priorizan las radios tácticas montadas en vehículos debido a su robustez, fiabilidad en terrenos difíciles y capacidad para mantener la comunicación continua durante misiones prolongadas. Su compatibilidad con múltiples bandas de frecuencia y estándares de cifrado refuerza aún más su dominio en las plataformas militares modernas.

Se prevé que el segmento de dispositivos portátiles experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de sistemas de comunicación ligeros y flexibles para soldados de a pie. Estas radios admiten la transmisión de voz y datos en tiempo real, a la vez que permiten una mayor movilidad durante patrullas, reconocimiento y operaciones especiales. Los avances en la eficiencia de las baterías, la miniaturización y las funciones de red segura están acelerando su adopción, especialmente entre las unidades de infantería y fuerzas especiales que operan en entornos de combate dinámicos.

• Por tipo de plataforma

Según el tipo de plataforma, el mercado de radios tácticas se segmenta en plataformas terrestres, navales y aerotransportadas. El segmento de plataformas terrestres dominó el mercado en 2025, gracias a su amplio despliegue en fuerzas terrestres, unidades blindadas y operaciones de seguridad fronteriza. Las radios tácticas en plataformas terrestres permiten una comunicación segura entre centros de mando, vehículos y soldados rasos, garantizando la coordinación operativa y el conocimiento de la situación. Su escalabilidad, fácil integración con la infraestructura militar existente y adaptabilidad a diversos terrenos contribuyen significativamente a su amplia cuota de mercado.

Se espera que el segmento de plataformas aerotransportadas registre la tasa de crecimiento más rápida durante el período de pronóstico, impulsado por el aumento de las inversiones en aeronaves militares, helicópteros y vehículos aéreos no tripulados. Las radios tácticas aerotransportadas son fundamentales para mantener la seguridad de las comunicaciones aire-tierra y aire-aire, especialmente durante misiones de vigilancia, apoyo al combate y reconocimiento. El creciente énfasis en la guerra centrada en la red y el intercambio de datos en tiempo real está acelerando aún más la demanda de sistemas avanzados de comunicación aerotransportada.

• Por aplicación

Según su aplicación, el mercado de radios tácticas se segmenta en ejército, armada, fuerza aérea, tierra y fuerzas de operaciones especiales (SOP). El segmento del ejército mantuvo la cuota de mercado dominante en 2025 debido al amplio uso de radios tácticas en unidades de infantería, divisiones blindadas y operaciones terrestres. Los ejércitos dependen en gran medida de sistemas de comunicación seguros y resilientes para coordinar los movimientos de tropas, compartir inteligencia del campo de batalla y mantener el control del mando en entornos hostiles. Los continuos programas de modernización y el despliegue a gran escala de redes de comunicación táctica respaldan el liderazgo del segmento.

Se proyecta que el segmento de las fuerzas de operaciones especiales (SOP) experimente el mayor crecimiento entre 2026 y 2033, impulsado por el creciente enfoque en la lucha contra el terrorismo, las misiones encubiertas y las operaciones de respuesta rápida. Las unidades SOP requieren radios compactas, altamente seguras e interoperables que funcionen de forma fiable en escenarios remotos y de alto riesgo. La creciente necesidad de sistemas de comunicación cifrados y de baja detección está impulsando significativamente su adopción en este segmento de aplicaciones.

Análisis regional del mercado de radios tácticas

- América del Norte dominó el mercado de radios tácticas con la mayor participación en los ingresos de más del 40 % en 2025, impulsada por el alto gasto en defensa, la modernización continua de los sistemas de comunicación militar y un fuerte enfoque en la guerra centrada en la red.

- Las fuerzas armadas de la región enfatizan soluciones de comunicación seguras, encriptadas e interoperables para apoyar operaciones conjuntas en plataformas terrestres, aéreas y navales.

- Este dominio se ve reforzado por una infraestructura de defensa avanzada, la adopción temprana de tecnologías de comunicación de última generación y las inversiones continuas en la actualización de los sistemas de radio tácticos heredados para una mejor conectividad en el campo de batalla.

Análisis del mercado de radios tácticas de EE. UU.

El mercado estadounidense de radios tácticas representó la mayor participación en los ingresos de Norteamérica en 2025, gracias a las inversiones sostenidas del Departamento de Defensa en sistemas avanzados de comunicación y comando. El ejército estadounidense prioriza las radios tácticas resilientes, resistentes a interferencias y cifradas para facilitar una coordinación fluida en operaciones multidominio. El creciente despliegue de radios definidas por software y la integración con los sistemas de gestión del campo de batalla siguen impulsando el crecimiento del mercado. Además, la solidez de los fabricantes nacionales de defensa y las continuas iniciativas de I+D contribuyen significativamente a la expansión del mercado de radios tácticas en EE. UU.

Análisis del mercado europeo de radios tácticas

Se proyecta que el mercado europeo de radios tácticas crecerá a una tasa de crecimiento anual compuesta (TCAC) constante durante el período de pronóstico, impulsado por el aumento de los programas de modernización de la defensa y la creciente cooperación militar transfronteriza. Las naciones europeas están invirtiendo en sistemas de comunicación seguros para mejorar la interoperabilidad entre las fuerzas aliadas. El creciente enfoque en la transformación digital del campo de batalla y la transmisión segura de datos está fomentando la adopción de radios tácticas avanzadas en plataformas terrestres, navales y aéreas.

Análisis del mercado de radios tácticas del Reino Unido

Se espera que el mercado británico de radios tácticas registre un crecimiento notable durante el período de pronóstico, impulsado por las iniciativas de modernización de la defensa y un mayor énfasis en la seguridad de las comunicaciones militares. Las fuerzas armadas británicas están modernizando sus redes de comunicación táctica para mejorar el conocimiento de la situación en tiempo real y la eficacia de las misiones. La participación en operaciones lideradas por la OTAN y la necesidad de sistemas interoperables impulsan aún más la demanda de radios tácticas avanzadas.

Análisis del mercado de radios tácticas en Alemania

Se prevé que el mercado alemán de radios tácticas se expanda a una tasa de crecimiento anual compuesta (TCAC) considerable, impulsado por el aumento de los presupuestos de defensa y la modernización de los sistemas de comunicación terrestres y conjuntos. Alemania prioriza las tecnologías de comunicación seguras, fiables y estandarizadas, alineadas con los requisitos de la OTAN. La integración de radios tácticas con plataformas digitales de mando y control está acelerando su adopción en aplicaciones militares.

Análisis del mercado de radios tácticas de Asia-Pacífico

Se espera que el mercado de radios tácticas de Asia-Pacífico crezca a su tasa de crecimiento anual compuesta (TCAC) más alta durante el período de pronóstico de 2026 a 2033, impulsado por el aumento del gasto en defensa, las preocupaciones sobre la seguridad regional y los esfuerzos de modernización militar. Los países de la región están invirtiendo fuertemente en sistemas de comunicación avanzados para fortalecer la seguridad fronteriza y la preparación para el combate. La expansión de la capacidad nacional de fabricación de defensa impulsa aún más el crecimiento del mercado en Asia-Pacífico.

Análisis del mercado de radios tácticas japonesas

El mercado japonés de radios tácticas experimenta un crecimiento constante, impulsado por un mayor enfoque en la preparación para la defensa y una infraestructura de comunicación avanzada. Japón prioriza sistemas de comunicación táctica seguros y fiables para mejorar la coordinación entre las fuerzas de defensa terrestres, marítimas y aéreas. La adopción de radios tecnológicamente avanzados, alineados con las estrategias de defensa modernas, continúa impulsando la expansión del mercado.

Análisis del mercado de radios tácticas de China

El mercado chino de radios tácticas registró la mayor participación en ingresos en Asia-Pacífico en 2025, impulsado por programas de modernización militar a gran escala e importantes inversiones en tecnologías de defensa autóctonas. El enfoque de China en fortalecer las redes de comunicación seguras en todas las ramas militares está impulsando la demanda de radios tácticas avanzadas. La presencia de importantes fabricantes nacionales y el creciente énfasis en sistemas de defensa autónomos impulsan aún más el crecimiento del mercado.

Cuota de mercado de radios tácticas

La industria de las radios tácticas está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- RTX Corporation (EE. UU.)

- General Dynamics Corporation (EE. UU.)

- Northrop Grumman Corporation (EE. UU.)

- 3M (EE. UU.)

- BAE Systems plc (Reino Unido)

- Grupo Thales (Francia)

- L3Harris Technologies Inc. (EE. UU.)

- Motorola Solutions Inc. (EE. UU.)

- Elbit Systems Ltd. (Israel)

- Bose Corporation (EE. UU.)

- Leonardo DRS Inc. (EE. UU.)

- Corporación Curtiss-Wright (EE. UU.)

- Viasat Inc. (EE. UU.)

- Rohde & Schwarz GmbH KG & Co (Alemania)

- Cobham Limited (Reino Unido)

- ASELSAN AS (Turquía)

- Iridium Communications Inc. (EE. UU.)

- Sepura Limited (Reino Unido)

- Codan Limited (Australia)

- Savox Communications Ltd. (Finlandia)

- Compañía de Telecomunicaciones Thuraya (EAU)

- Silynx Communications Inc. (EE. UU.)

- Radmor SA (Polonia)

- Rolta India Limited (India)

- Television Equipment Associates Inc. (EE. UU.)

Últimos avances en el mercado global de radios tácticas

- En octubre de 2025, BAE Systems (Reino Unido) anunció la expansión de su portafolio de comunicaciones tácticas mediante el lanzamiento de una avanzada plataforma de radio definida por software, diseñada para operaciones conjuntas y de coalición. Este desarrollo fortalece la posición de BAE Systems en el mercado de radios tácticas al abordar la creciente demanda de soluciones de comunicación interoperables y actualizables. Esta medida mejora la capacidad de la compañía para satisfacer las necesidades de guerra centradas en la red, reforzando su competitividad entre las fuerzas de defensa que buscan sistemas de comunicación preparados para el futuro.

- En septiembre de 2025, L3Harris Technologies (EE. UU.) presentó una nueva gama de radios tácticas diseñadas para apoyar operaciones multidominio en los ámbitos terrestre, aéreo, marítimo, espacial y cibernético. Este lanzamiento impacta significativamente el mercado al abordar la creciente necesidad de una interoperabilidad fluida entre las fuerzas aliadas. Al alinear su estrategia de producto con los requisitos de la guerra moderna, L3Harris refuerza su liderazgo y amplía su presencia en el mercado de soluciones avanzadas de comunicación táctica.

- En agosto de 2025, el Grupo Thales (FR) firmó una alianza estratégica con un importante proveedor de telecomunicaciones para desarrollar conjuntamente sistemas de comunicación táctica de próxima generación. Esta colaboración fortalece la posición de Thales en el mercado al impulsar la innovación y facilitar la entrega de soluciones de comunicación más integradas y resilientes. La alianza destaca la creciente importancia de la colaboración intersectorial para satisfacer las cambiantes necesidades de comunicación militar y ampliar el alcance del mercado global.

- En julio de 2025, General Dynamics (EE. UU.) finalizó la adquisición de una empresa tecnológica especializada en sistemas de comunicación basados en inteligencia artificial. Esta adquisición fortalece la competitividad de General Dynamics al permitir una mayor integración de las capacidades de IA en las radios tácticas. Este desarrollo refleja una transición más amplia del mercado hacia soluciones de comunicación inteligentes y adaptativas que mejoran la eficacia operativa y la diferenciación a largo plazo en el mercado de las radios tácticas.

- En agosto de 2022, Motorola Solutions (EE. UU.) adquirió Barrett Communications (Australia), proveedor de comunicaciones de radio especializadas de alta y muy alta frecuencia. Esta adquisición estratégica enriquece la cartera de Motorola al integrar los sistemas de comunicación independientes de la infraestructura de Barrett, ideales para operaciones de seguridad, mantenimiento de la paz y humanitarias. Esta operación amplía el alcance global de Motorola, especialmente en la región Asia-Pacífico, y fortalece su posición en comunicaciones de misión crítica. Con la incorporación de las capacidades de Barrett, Motorola busca respaldar operaciones especializadas y esfuerzos de respuesta ante desastres, en línea con su compromiso con la innovación y el liderazgo en seguridad pública y empresarial.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.