Global Tactical Radios Market

Market Size in USD Billion

CAGR :

%

USD

19.58 Billion

USD

52.80 Billion

2025

2033

USD

19.58 Billion

USD

52.80 Billion

2025

2033

| 2026 –2033 | |

| USD 19.58 Billion | |

| USD 52.80 Billion | |

|

|

|

|

Tactical Radios Market Size

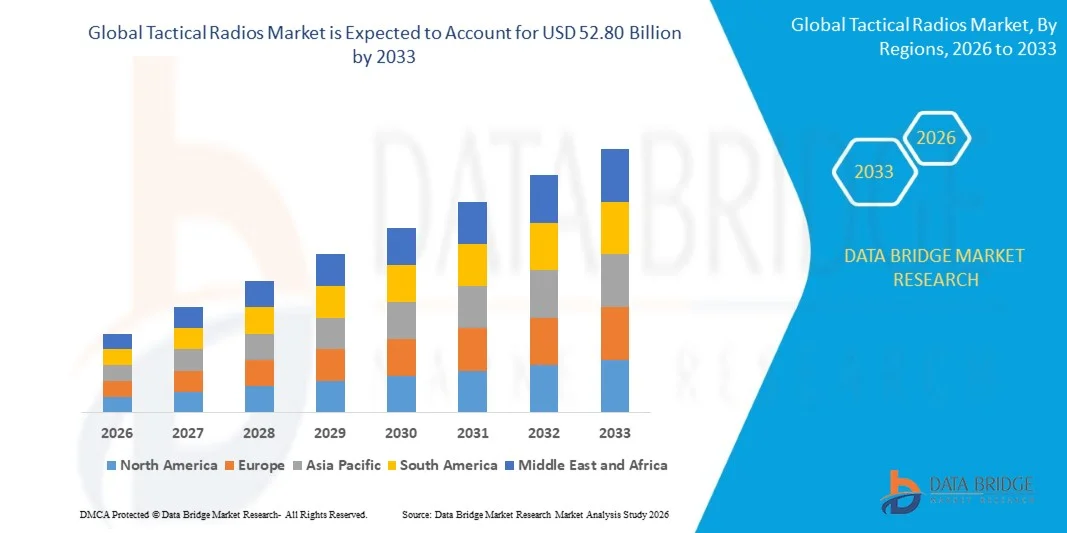

- The global tactical radios market size was valued at USD 19.58 billion in 2025 and is expected to reach USD 52.80 billion by 2033, at a CAGR of 13.20% during the forecast period

- The market growth is largely driven by increasing defense modernization initiatives and the rising need for secure, reliable, and real-time communication systems across military operations, supporting enhanced coordination and situational awareness in complex combat environments

- Furthermore, growing emphasis on network-centric warfare, interoperability among allied forces, and advancements in encryption and software-defined radio technologies are accelerating the adoption of tactical radios, thereby significantly strengthening overall market growth

Tactical Radios Market Analysis

- Tactical radios, enabling secure voice and data communication across land, air, and naval platforms, have become critical components of modern military and defense communication infrastructures due to their resilience, mobility, and encrypted transmission capabilities

- The rising demand for tactical radios is primarily fueled by increasing geopolitical tensions, expanding military operations, and continuous investments in advanced communication systems to improve command, control, and operational effectiveness

- North America dominated the tactical radios market with a share of over 40% in 2025, due to high defense spending, continuous modernization of military communication systems, and strong focus on network-centric warfare

- Asia-Pacific is expected to be the fastest growing region in the tactical radios market during the forecast period due to rising defense expenditures, regional security concerns, and military modernization efforts

- Vehicle mounted segment dominated the market with a market share of 47% in 2025, due to its extensive use in armored vehicles, command vehicles, and logistics fleets for secure and long-range communication. These radios offer higher transmission power, enhanced signal stability, and the ability to integrate with onboard battle management systems, which makes them critical for coordinated military operations. Defense forces prioritize vehicle mounted tactical radios due to their robustness, reliability in harsh terrains, and capability to support continuous communication during prolonged missions. Their compatibility with multiple frequency bands and encryption standards further strengthens their dominance across modern military platforms

Report Scope and Tactical Radios Market Segmentation

|

Attributes |

Tactical Radios Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Tactical Radios Market Trends

“Rising Adoption of Software-Defined and Interoperable Tactical Radios”

- A major trend shaping the tactical radios market is the growing adoption of software-defined and interoperable radio systems, driven by the increasing need for flexible, upgradeable, and future-ready military communication solutions. These radios allow armed forces to reconfigure frequencies, waveforms, and functionalities through software updates, improving adaptability across diverse mission environments

- For instance, companies such as L3Harris and Thales are actively supplying software-defined tactical radios that support interoperability across allied forces and multiple operational domains. Such solutions enhance coordination during joint missions and ensure compatibility with legacy and next-generation communication networks

- The shift toward multi-domain operations is accelerating demand for interoperable tactical radios that can seamlessly connect land, air, and naval units. This trend is strengthening the role of tactical radios as central elements of network-centric warfare strategies

- Defense forces are increasingly prioritizing radios that support secure data, voice, and video transmission to improve situational awareness and command efficiency. This is reinforcing the adoption of advanced encryption and dynamic spectrum management capabilities within tactical radio systems

- The integration of tactical radios with battlefield management systems and digital command platforms is further amplifying this trend. These integrations enable real-time data sharing and faster decision-making in high-risk combat scenarios

- Overall, the rising emphasis on flexibility, interoperability, and digital battlefield connectivity is positioning software-defined tactical radios as a critical growth driver within modern defense communication architectures

Tactical Radios Market Dynamics

Driver

“Increasing Defense Modernization and Demand for Secure Military Communication”

- The tactical radios market is strongly driven by increasing defense modernization programs aimed at upgrading legacy communication infrastructure across global armed forces. Modern militaries require secure, resilient, and real-time communication systems to support complex and fast-evolving operational environments

- For instance, defense organizations across the U.S., Europe, and Asia-Pacific are investing in encrypted tactical radios to enhance battlefield communication security and prevent signal interception. These investments are accelerating procurement of advanced radio systems with enhanced anti-jamming and secure networking capabilities

- Rising geopolitical tensions and border security concerns are further reinforcing the need for advanced military communication systems. Governments are prioritizing tactical radios as essential tools for improving readiness and response capabilities

- The increasing focus on joint and coalition operations is also driving demand for standardized and interoperable communication solutions. Tactical radios that meet international defense standards are gaining stronger adoption

- Collectively, sustained defense spending and the critical need for secure communication are reinforcing this driver and supporting long-term growth of the tactical radios market

Restraint/Challenge

“High Procurement Costs and Complex System Integration”

- The tactical radios market faces challenges related to the high procurement costs associated with advanced communication systems that incorporate encryption, software-defined architecture, and multi-band capabilities. These cost factors can limit adoption, particularly among countries with constrained defense budgets

- For instance, integrating next-generation tactical radios into existing military communication networks often requires additional investments in infrastructure, training, and system customization. This complexity increases total ownership costs for defense organizations

- System integration challenges arise when aligning new radios with legacy platforms, vehicles, and command systems. Ensuring seamless interoperability without disrupting existing operations adds to deployment difficulty

- Maintenance and lifecycle management costs associated with advanced tactical radios also contribute to budgetary pressures. Upgrading software and ensuring long-term system compatibility demand continuous investment

- As a result, balancing technological advancement with affordability and integration feasibility remains a key challenge influencing purchasing decisions within the tactical radios market

Tactical Radios Market Scope

The market is segmented on the basis of type, platform type, and application.

• By Type

On the basis of type, the tactical radios market is segmented into vehicle mounted and handheld or portable radios. The vehicle mounted segment dominated the market with the largest revenue share of 47% in 2025, driven by its extensive use in armored vehicles, command vehicles, and logistics fleets for secure and long-range communication. These radios offer higher transmission power, enhanced signal stability, and the ability to integrate with onboard battle management systems, which makes them critical for coordinated military operations. Defense forces prioritize vehicle mounted tactical radios due to their robustness, reliability in harsh terrains, and capability to support continuous communication during prolonged missions. Their compatibility with multiple frequency bands and encryption standards further strengthens their dominance across modern military platforms.

The handheld or portable segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing demand for lightweight and flexible communication systems for dismounted soldiers. These radios support real-time voice and data transmission while allowing greater mobility during patrols, reconnaissance, and special operations. Advancements in battery efficiency, miniaturization, and secure networking features are accelerating adoption, particularly among infantry and special forces units operating in dynamic combat environments.

• By Platform Type

On the basis of platform type, the tactical radios market is segmented into ground-based platform, naval-based platform, and airborne platform. The ground-based platform segment dominated the market in 2025, owing to its widespread deployment across land forces, armored units, and border security operations. Tactical radios on ground platforms enable secure communication between command centers, vehicles, and foot soldiers, ensuring operational coordination and situational awareness. Their scalability, ease of integration with existing military infrastructure, and adaptability to diverse terrains contribute significantly to their large market share.

The airborne platform segment is expected to register the fastest growth rate during the forecast period, driven by rising investments in military aircraft, helicopters, and unmanned aerial vehicles. Airborne tactical radios are critical for maintaining secure air-to-ground and air-to-air communication, especially during surveillance, combat support, and reconnaissance missions. The growing emphasis on network-centric warfare and real-time data exchange is further accelerating demand for advanced airborne communication systems.

• By Application

On the basis of application, the tactical radios market is segmented into army, navy, airforce, land, and special operation force (SOP). The army segment held the dominant market share in 2025 due to the extensive use of tactical radios across infantry units, armored divisions, and ground operations. Armies rely heavily on secure and resilient communication systems to coordinate troop movements, share battlefield intelligence, and maintain command control in hostile environments. Continuous modernization programs and large-scale deployment of tactical communication networks support the segment’s leadership position.

The special operation force (SOP) segment is projected to witness the fastest growth from 2026 to 2033, driven by the increasing focus on counterterrorism, covert missions, and rapid response operations. SOP units require compact, highly secure, and interoperable radios that function reliably in remote and high-risk scenarios. The growing need for encrypted, low-detection communication systems is significantly boosting adoption within this application segment.

Tactical Radios Market Regional Analysis

- North America dominated the tactical radios market with the largest revenue share of over 40% in 2025, driven by high defense spending, continuous modernization of military communication systems, and strong focus on network-centric warfare

- Armed forces in the region emphasize secure, encrypted, and interoperable communication solutions to support joint operations across land, air, and naval platforms

- This dominance is reinforced by advanced defense infrastructure, early adoption of next-generation communication technologies, and ongoing investments in upgrading legacy tactical radio systems for enhanced battlefield connectivity

U.S. Tactical Radios Market Insight

The U.S. tactical radios market accounted for the largest revenue share within North America in 2025, supported by sustained investments from the Department of Defense in advanced communication and command systems. The U.S. military prioritizes resilient, jam-resistant, and encrypted tactical radios to enable seamless coordination across multi-domain operations. The increasing deployment of software-defined radios and integration with battlefield management systems continues to drive market growth. Moreover, strong domestic defense manufacturers and continuous R&D initiatives significantly contribute to the expansion of the tactical radios market in the U.S.

Europe Tactical Radios Market Insight

The Europe tactical radios market is projected to grow at a steady CAGR during the forecast period, driven by rising defense modernization programs and increasing cross-border military cooperation. European nations are investing in secure communication systems to enhance interoperability among allied forces. The growing focus on digital battlefield transformation and secure data transmission is encouraging the adoption of advanced tactical radios across ground, naval, and airborne platforms.

U.K. Tactical Radios Market Insight

The U.K. tactical radios market is expected to register notable growth over the forecast period, supported by defense modernization initiatives and increased emphasis on secure military communications. The U.K. armed forces are upgrading tactical communication networks to improve real-time situational awareness and mission effectiveness. Participation in NATO-led operations and the need for interoperable systems further stimulate demand for advanced tactical radios.

Germany Tactical Radios Market Insight

The Germany tactical radios market is anticipated to expand at a considerable CAGR, driven by increasing defense budgets and modernization of land and joint communication systems. Germany places strong emphasis on secure, reliable, and standardized communication technologies aligned with NATO requirements. The integration of tactical radios with digital command and control platforms is accelerating adoption across military applications.

Asia-Pacific Tactical Radios Market Insight

The Asia-Pacific tactical radios market is expected to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising defense expenditures, regional security concerns, and military modernization efforts. Countries across the region are investing heavily in advanced communication systems to strengthen border security and combat readiness. The expansion of domestic defense manufacturing capabilities further supports market growth in Asia-Pacific.

Japan Tactical Radios Market Insight

The Japan tactical radios market is witnessing steady growth, supported by increasing focus on defense preparedness and advanced communication infrastructure. Japan emphasizes secure and reliable tactical communication systems to enhance coordination among ground, maritime, and air defense forces. The adoption of technologically advanced radios aligned with modern defense strategies continues to fuel market expansion.

China Tactical Radios Market Insight

The China tactical radios market held the largest revenue share within Asia-Pacific in 2025, driven by large-scale military modernization programs and significant investments in indigenous defense technologies. China’s focus on strengthening secure communication networks across all military branches is boosting demand for advanced tactical radios. The presence of strong domestic manufacturers and increasing emphasis on self-reliant defense systems further propel market growth.

Tactical Radios Market Share

The tactical radios industry is primarily led by well-established companies, including:

- RTX Corporation (U.S.)

- General Dynamics Corporation (U.S.)

- Northrop Grumman Corporation (U.S.)

- 3M (U.S.)

- BAE Systems plc (U.K.)

- Thales Group (France)

- L3Harris Technologies Inc. (U.S.)

- Motorola Solutions Inc. (U.S.)

- Elbit Systems Ltd. (Israel)

- Bose Corporation (U.S.)

- Leonardo DRS Inc. (U.S.)

- Curtiss-Wright Corporation (U.S.)

- Viasat Inc. (U.S.)

- Rohde & Schwarz GmbH KG & Co (Germany)

- Cobham Limited (U.K.)

- ASELSAN A.S. (Turkey)

- Iridium Communications Inc. (U.S.)

- Sepura Limited (U.K.)

- Codan Limited (Australia)

- Savox Communications Ltd. (Finland)

- Thuraya Telecommunications Company (UAE)

- Silynx Communications Inc. (U.S.)

- Radmor S.A. (Poland)

- Rolta India Limited (India)

- Television Equipment Associates Inc. (U.S.)

Latest Developments in Global Tactical Radios Market

- In October 2025, BAE Systems (U.K.) announced the expansion of its tactical communications portfolio through the launch of an advanced software-defined radio platform tailored for joint and coalition operations. This development strengthens BAE Systems’ position in the tactical radios market by addressing the rising demand for interoperable and upgradeable communication solutions. The move enhances the company’s ability to support network-centric warfare requirements, reinforcing its competitiveness among defense forces seeking future-ready communication systems

- In September 2025, L3Harris Technologies (U.S.) introduced a new range of tactical radios engineered to support multi-domain operations across land, air, sea, space, and cyber domains. This launch significantly impacts the market by addressing the growing need for seamless interoperability among allied forces. By aligning its product strategy with modern warfare requirements, L3Harris reinforces its leadership position and expands its market presence in advanced tactical communication solutions

- In August 2025, Thales Group (FR) entered into a strategic partnership with a major telecommunications provider to co-develop next-generation tactical communication systems. This collaboration enhances Thales’s market position by accelerating innovation and enabling the delivery of more integrated and resilient communication solutions. The partnership highlights the increasing importance of cross-industry collaboration in meeting evolving military communication needs and expanding global market reach

- In July 2025, General Dynamics (U.S.) finalized the acquisition of a niche technology firm specializing in artificial intelligence-driven communication systems. This acquisition strengthens General Dynamics’ competitive standing by enabling deeper integration of AI capabilities into tactical radios. The development reflects a broader market shift toward intelligent, adaptive communication solutions that enhance operational effectiveness and long-term differentiation in the tactical radios market

- In August 2022, Motorola Solutions (U.S.) acquired Barrett Communications (Australia), a provider of specialized high-frequency and very high-frequency radio communications. This strategic acquisition enhances Motorola's portfolio by integrating Barrett's infrastructure-independent communication systems, ideal for security, peacekeeping, and humanitarian operations. The move extends Motorola's global reach, particularly in the Asia-Pacific region, and strengthens its position in mission-critical communications. By adding Barrett's capabilities, Motorola aims to support specialized operations and disaster response efforts, aligning with its commitment to innovation and leadership in public safety and enterprise security

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.