North America Automotive Software Market, By Offering (Solutions and Services), Organization Size (Large Scale Organizations, Medium Scale Organization and Small Scale Organization), Software Layer (Operating System, Middleware and Application Software), EV Utility (Charging Management, Battery Management and V2G), Vehicle Type (Passenger Cars, Electric Vehicles, Light Commercial Vehicles and Heavy Duty), End-User (ADAS & Safety Systems, Communication Systems, Infotainment Systems, Body Control & Comfort System, Engine Management & Powertrain, Vehicle Management & Telematics, Autonomous Driving, HMI Application & Others)- Industry Trends and Forecast to 2029.

North America Automotive Software Market Analysis and Size

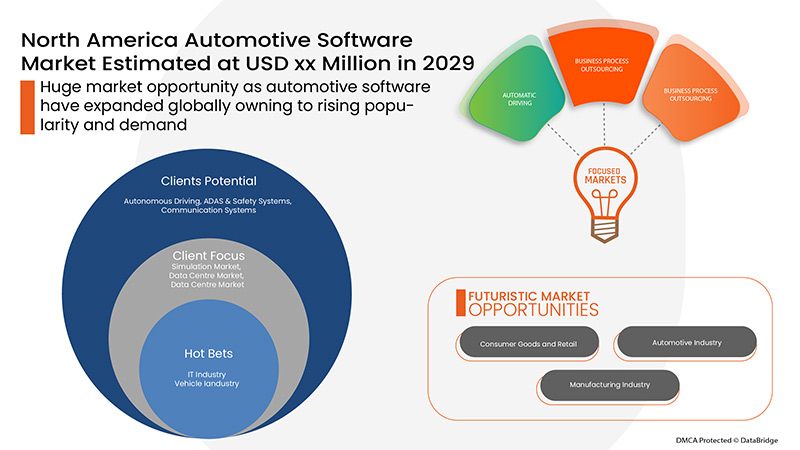

Service providers were continuously trying to find out ways to increase the precision of work, enhanced services, safety and work with growing technology. The requirement for these reasons is being fulfilled through the implementation of the automotive software as they are used to provide enhanced, uninterrupted free, and timely services at the industrial operations. The automotive software in various industries is being used widely due to the rising demand for customer experience. It enables industries to enhance their operations and productivity. Automotive software help end-users by providing better automated solutions without human interference and deliver better driving experience. The North America automotive software market is in the growth phase rapidly due to growing demand for electrifications in vehicles which drives the demand for the automotive software. The companies are even launching new products to gain a larger market share.

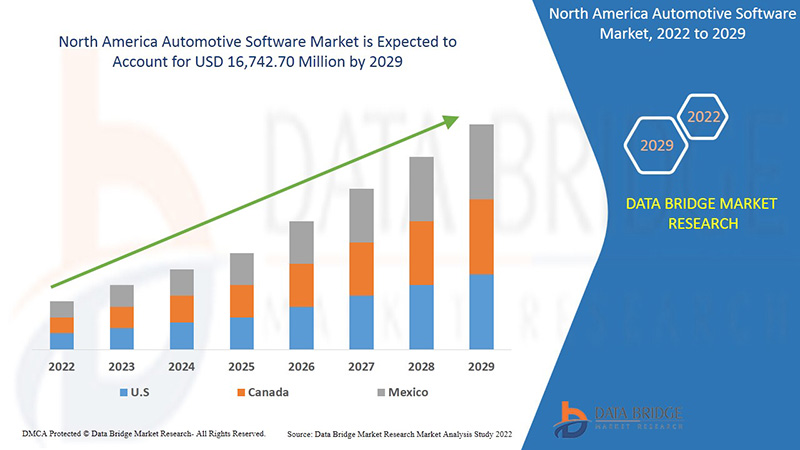

Data Bridge Market Research analyses that the automotive software market is expected to reach the value of USD 16,742.70 million by 2029, at a CAGR of 17.6% during the forecast period. "North America Services" accounts for the largest offering segment in the automotive software market. North America service provides accurate information which is utilized to develop high precision IoT network. The automotive software market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

Por oferta (soluciones y servicios), tamaño de la organización (organizaciones de gran escala, organizaciones de mediana escala y organizaciones de pequeña escala), capa de software (sistema operativo, middleware y software de aplicación), utilidad EV (gestión de carga, gestión de batería y V2G), tipo de vehículo (automóviles de pasajeros, vehículos eléctricos, vehículos comerciales ligeros y pesados), usuario final (ADAS y sistemas de seguridad, sistemas de comunicación, sistemas de infoentretenimiento, control de la carrocería y sistema de confort, gestión del motor y tren motriz, gestión del vehículo y telemática, conducción autónoma, aplicación HMI y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México en América del Norte |

|

Actores del mercado cubiertos |

LUXOFT, UNA EMPRESA DE TECNOLOGÍA DXC, Vector Informatik GmbH, Sigma Software, NVIDIA Corporation, Aptiv, Elektrobit, KPIT, NXP Semiconductors, aiMotive, Siemens, Intellias, Hexagon AB, OXBOTICA, Lynx Software Technologies, Renesas Electronics Corporation, Intel Corporation, Blackberry Limited, Airbiquity Inc., Green Hills Software, Robert Bosch GmbH, Wind River Systems, Inc., Alphabet Inc., Autonet Mobile, Inc, MONTAVISTA SOFTWARE LLC., Microsoft entre otros. |

Definición de mercado

La industria automotriz comprende una amplia gama de empresas y organizaciones involucradas en el diseño, desarrollo, fabricación, comercialización y venta de vehículos motorizados. Es una de las industrias más grandes del mundo en términos de ingresos. También es la industria con el mayor gasto en investigación y desarrollo. NXP ofrece una amplia gama de herramientas de software automotriz diseñadas para ayudarlo a simplificar y acortar el tiempo necesario para construir ECU basadas en microcontroladores (MCU) de NXP. Esto incluye software de tiempo de ejecución e integrado, software, cajas de herramientas compatibles con MATLAB/Simulink, una amplia gama de controladores, bibliotecas, pilas y software de cargador de arranque. NXP también proporciona herramientas de inicialización de MCU y soporte de generación automática de código para capas de abstracción de microcontroladores (MCAL) y sistemas operativos (OS) AUTOSAR. Nuestro equipo dedicado de ingenieros profesionales puede ampliar sus capacidades al brindar capacitación, consultoría, servicios de desarrollo y personalización en una amplia gama de espacios de aplicación y tecnologías.

Dinámica del mercado de software para la industria automotriz

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

- Aumento de la adopción de funciones ADAS en los automóviles

La industria automotriz ha sido testigo de grandes avances, pero los sistemas avanzados de asistencia al conductor (ADAS) son uno de los principales avances. Este sistema garantiza más medidas de seguridad para los vehículos, por lo que la demanda de ADAS aumenta año tras año. Esta innovación tecnológica para la industria automotriz ha creado una popularidad por la seguridad y los beneficios que implica el nuevo sistema, lo que ha creado la demanda de adopciones de electrónica que se integran a través de aplicaciones de software.

- Aumento del número de vehículos conectados

Hoy en día, los vehículos conectados parecen ser la nueva norma en la industria automotriz, ya que están equipados con funciones inteligentes y convenientes. Los vehículos están equipados con tarjetas SIM o chips con acceso a Internet y una aplicación para vehículos que se opera a través de teléfonos inteligentes que permite operar de forma remota las funciones de un vehículo, como bloquear o desbloquear la puerta, controlar el clima, localizar el vehículo y muchas otras funciones.

- Creciente demanda de vehículos eléctricos

Los vehículos eléctricos (VE) están diseñados para ser una tecnología prometedora para lograr un transporte sostenible con cero emisiones de carbono, bajo nivel de ruido y alta eficiencia. Además, los vehículos eléctricos evolucionaron en el siglo XIX, pero debido a la falta de avances en la tecnología, los vehículos con motor de combustión interna tuvieron una gran demanda en comparación con los vehículos eléctricos.

Los vehículos eléctricos están altamente integrados con el software automotriz y tienen varios beneficios que se concentran en varios países y se formulan regulaciones y políticas para impulsar los vehículos eléctricos que ayudan a controlar las emisiones de carbono y evitar el calentamiento de América del Norte.

- Protocolos estándar inadecuados para el desarrollo de plataformas de software

El avance tecnológico crece año tras año dando como resultado la evolución de un mejor software automotriz sin un conjunto particular de estándares para el desarrollo de software, lo que conduce a una variedad de protocolos e interfaces de usuario que pueden resultar difíciles de integrar en las operaciones, lo que lleva a restringir el mercado de software automotriz.

- Falta de infraestructuras de conectividad

La inversión para desarrollar la conectividad de los vehículos incluye la infraestructura que respalda la tecnología y el funcionamiento, como las ciudades y carreteras inteligentes que cuentan con mapas de alta frecuencia o basados en visión que ayudarán a que la conducción autónoma funcione sin problemas y que cuenten con sistemas de conducción autónoma que requieran información actualizada para una mejor navegación de los vehículos y conectividad.

- Necesidad de un alto mantenimiento del software

La actualización regular del software permite el desarrollo de una nueva arquitectura de software, lo que a su vez genera cambios en la interfaz, los protocolos y la tecnología que podrían no integrar operaciones con componentes mecánicos antiguos, lo que genera problemas en el uso que obstaculizan la seguridad y la conectividad de los vehículos.

Por lo tanto, está muy claro que el mantenimiento del software automotriz está limitado a un cierto nivel después del cual el costo de mantenimiento aumenta rápidamente debido al mantenimiento de otros componentes y dispositivos relacionados sin los cuales se puede afirmar que el vehículo no es apto ni seguro para su uso.

Impacto del COVID-19 en el mercado de software automotriz

La COVID-19 ha tenido un gran impacto en el mercado de software automotriz, ya que casi todos los países han optado por cerrar todas las instalaciones de producción, excepto las que se dedican a la producción de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de la producción y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más para evitar la propagación de la COVID-19. Las únicas empresas que se enfrentan a esta situación de pandemia son los servicios esenciales a los que se les permite abrir y ejecutar los procesos.

El crecimiento del mercado de software automotriz se debe al aumento del uso de equipos electrónicos en los vehículos y también a la promoción por parte de muchas organizaciones gubernamentales del uso de vehículos eléctricos para reducir las emisiones. Sin embargo, la COVID-19 tuvo un efecto adverso en el mercado de software automotriz, ya que las ventas de vehículos en muchos países se detuvieron y la mayoría de las empresas cerraron sus operaciones temporalmente durante casi meses.

Además, después de la situación de pandemia, los consumidores no estaban dispuestos a comprar vehículos nuevos debido a la economía perturbada en muchos países, lo que afectó directamente el crecimiento de las ventas de automóviles y tuvo un impacto en el crecimiento del mercado de software automotriz.

Desarrollo reciente

- En enero de 2022, Aptiv anunció una colaboración con Sophia Velastegui para acelerar las tecnologías de software de movilidad. Las empresas aprovecharán su experiencia en inteligencia artificial (IA) para el desarrollo de productos. La empresa podrá comercializar y ampliar su cartera de productos con productos mejorados.

- En junio de 2019, Alphabet Inc. anunció la adquisición de Looker por 2600 millones de dólares. Esta adquisición ha ayudado a la empresa a mejorar su oferta de plataformas de inteligencia empresarial, aplicaciones de datos y análisis integrados, lo que ha permitido a los clientes impulsar la transformación digital.

Alcance del mercado de software automotriz en América del Norte

El mercado de software automotriz está segmentado en función de las ofertas, el tamaño de la organización, la capa de software, la utilidad de los vehículos eléctricos, el tipo de vehículo y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Ofrenda

- Soluciones

- Servicios

Sobre la base de la oferta, el mercado de software automotriz de América del Norte está segmentado en soluciones y servicios.

Tamaño de la organización

- Organizaciones de gran escala

- Organizaciones de mediana escala

- Organizaciones de pequeña escala

Sobre la base del tamaño de la organización, el mercado de software automotriz de América del Norte se ha segmentado en organizaciones de gran escala, organizaciones de mediana escala y organizaciones de pequeña escala.

Capa de software

- Sistemas operativos

- Software intermedio

- Software de aplicación

Sobre la base de la capa de software, el mercado de software automotriz de América del Norte se ha segmentado en sistemas operativos, middleware y software de aplicación.

Tipo de vehículo

- Automóviles de pasajeros

- Vehículos eléctricos

- Vehículos comerciales ligeros

- Vehículos pesados

Sobre la base del tipo de vehículo, el mercado de software automotriz de América del Norte se ha segmentado en automóviles de pasajeros, vehículos eléctricos, vehículos comerciales ligeros y vehículos pesados.

Utilidad EV

- Gestión de carga

- Gestión de la batería

- V2G

Sobre la base de la utilidad de los vehículos eléctricos, el mercado de software automotriz de América del Norte se ha segmentado en gestión de carga, gestión de batería y V2G.

Usuario final

- Sistemas ADAS y de seguridad

- Sistemas de comunicación

- Sistemas de infoentretenimiento

- Gestión del motor y tren motriz

- Gestión de vehículos y telemática

- Sistema de control y confort corporal

- Conducción autónoma

- Aplicación HMI

- Otros

Sobre la base del usuario final, el mercado de software automotriz de América del Norte se ha segmentado en sistemas ADAS y de seguridad, sistemas de comunicación, sistemas de información y entretenimiento, gestión de motores y tren motriz, gestión de vehículos y telemática, control de la carrocería y sistema de confort, conducción autónoma, aplicación HMI y otros.

Análisis y perspectivas regionales del mercado de software automotriz

Se analiza el mercado de software automotriz y se proporcionan información y tendencias del tamaño del mercado por país, oferta, tipo de vehículo, capa de software, utilidad EV, tamaño de la organización e industria de uso final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de software automotriz son Estados Unidos, Canadá y México en América del Norte.

Estados Unidos domina la región de América del Norte debido al aumento del sistema de conducción autónoma y al aumento del desarrollo de soluciones de lujo para los vehículos.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del software para la industria automotriz

El panorama competitivo del mercado de software automotriz ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de software automotriz.

Algunos de los principales actores que operan en el mercado de software automotriz son LUXOFT, A DXC TECHNOLOGY COMPANY, Vector Informatik GmbH, Sigma Software, NVIDIA Corporation, Aptiv, Elektrobit, KPIT, NXP Semiconductors, aiMotive, Siemens, Intellias, Hexagon AB, OXBOTICA, Lynx Software Technologies, Renesas Electronics Corporation, Intel Corporation, Blackberry Limited, Airbiquity Inc., Green Hills Software, Robert Bosch GmbH, Wind River Systems, Inc., Alphabet Inc., Autonet Mobile, Inc, MONTAVISTA SOFTWARE LLC., Microsoft entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP AUTOMOTIVE SOFTWARE COMPANIES

4.1.1 CASE STUDIES-

4.1.2 IDENTIFYING THE PROBLEM:

4.1.3 SOLUTION:

4.1.4 IDENTIFYING THE PROBLEM:

4.1.5 SOLUTIONS:

4.1.6 RND (RESEARCH AND DEVELOPMENT) AND NRE (NON-RECURRING ENGINEERING) STRUCTURES ON VARIED DEVELOPMENT PHASES ON TOP PLAYERS

4.1.7 ALPHABET INC.

4.1.8 NXP SEMICONDUCTORS

4.1.9 MICROSOFT

4.1.10 NVIDIA CORPORATION

4.2 TREND ANALYSIS:

4.2.1 ADVANCED CONNECTIVITY

4.2.2 ARTIFICIAL INTELLIGENCE

4.2.3 AUTONOMOUS DRIVING

4.2.4 SAFETY ENHANCEMENTS

4.2.5 AUGMENTED REALITY

4.2.6 PRICING ANALYSIS

5 PORTER’S FIVE FORCES MODEL

6 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY REGION

6.1 ASIA-PACIFIC

6.2 EUROPE

6.3 NORTH AMERICA

6.4 THE MIDDLE EAST AND AFRICA

6.5 SOUTH AMERICA

7 REGULATORY FRAMEWORK

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISE IN ADOPTION OF ADAS FEATURES IN AUTOMOBILES

8.1.2 RISE IN THE NUMBER OF CONNECTED VEHICLES

8.1.3 RISING DEMAND FOR ELECTRIC VEHICLES

8.2 RESTRAINTS

8.2.1 IMPROPER STANDARD PROTOCOLS FOR THE DEVELOPMENT OF SOFTWARE PLATFORMS

8.2.2 LACK OF CONNECTIVITY INFRASTRUCTURES

8.2.3 NEED FOR HIGH MAINTENANCE OF SOFTWARE

8.3 OPPORTUNITIES

8.3.1 RISE IN THE POTENTIAL FOR ARTIFICIAL INTELLIGENCE

8.3.2 REQUIREMENT OF CONNECTIVITY FOR BETTER FLEET MANAGEMENT

8.3.3 UPSURGE OF ELECTRONIC APPLICATIONS IN VEHICLES

8.4 CHALLENGES

8.4.1 LACK OF QUALITY AND SECURITY CONCERNS

8.4.2 EXPONENTIAL GROWTH OF SOFTWARE COSTS FOR VEHICLES

8.4.3 RISE IN COMPLEXITY FOR THE DEVELOPMENT

9 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING

9.1 OVERVIEW

9.2 SERVICES

9.2.1 INTEGRATION & IMPLEMENTATION

9.2.2 DESIGNING

9.2.3 TESTING

9.2.3.1 UNIT TESTING

9.2.3.2 SYSTEM TESTING

9.2.3.3 INTEGRATION TESTING

9.2.3.4 VALIDATION & VERIFICATION

9.2.4 OTHERS

9.3 SOLUTION

10 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE SCALE ORGANIZATIONS

10.3 MEDIUM SCALE ORGANIZATIONS

10.4 SMALL SCALE ORGANIZATIONS

11 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PASSENGER CARS

11.2.1 HATCHBACK

11.2.2 SEDAN

11.2.3 COMPACT

11.2.4 OTHERS

11.3 ELECTRIC VEHICLES

11.3.1 BATTERY ELECTRIC VEHICLES (BEVS)

11.3.2 HYBRID ELECTRIC VEHICLES (HEVS)

11.3.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

11.4 LIGHT COMMERCIAL VEHICLES

11.4.1 MINIVANS

11.4.2 PICK-UP TRUCKS

11.4.3 AUTORICKSHAWS

11.4.4 OTHERS

11.5 HEAVY DUTY VEHICLES

11.5.1 EXCAVATOR

11.5.2 SUPER LOADER

11.5.3 CRANES

11.5.4 OTHERS

12 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER

12.1 OVERVIEW

12.2 OPERATING SYSTEM

12.3 APPLICATION SOFTWARE

12.4 MIDDLEWARE

13 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY

13.1 OVERVIEW

13.2 CHARGING MANAGEMENT

13.3 BATTERY MANAGEMENT

13.4 V2G

14 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USE

14.1 OVERVIEW

14.2 ADAS & SAFETY SYSTEMS

14.2.1 PASSENGER CARS

14.2.1.1 HATCHBACK

14.2.1.2 SEDAN

14.2.1.3 COMPACT

14.2.1.4 OTHERS

14.2.2 ELECTRIC VEHICLES

14.2.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.2.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.2.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.2.3 LIGHT COMMERCIAL VEHICLES

14.2.3.1 MINIVANS

14.2.3.2 PICK-UP TRUCKS

14.2.3.3 AUTORICKSHAWS

14.2.3.4 OTHERS

14.2.4 HEAVY DUTY VEHICLES

14.2.4.1 EXCAVATOR

14.2.4.2 SUPER LOADER

14.2.4.3 CRANES

14.2.4.4 OTHERS

14.3 COMMUNICATION SYSTEMS

14.3.1 PASSENGER CARS

14.3.1.1 HATCHBACK

14.3.1.2 SEDAN

14.3.1.3 COMPACT

14.3.1.4 OTHERS

14.3.2 ELECTRIC VEHICLES

14.3.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.3.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.3.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.3.3 LIGHT COMMERCIAL VEHICLES

14.3.3.1 MINIVANS

14.3.3.2 PICK-UP TRUCKS

14.3.3.3 AUTORICKSHAWS

14.3.3.4 OTHERS

14.3.4 HEAVY DUTY VEHICLES

14.3.4.1 EXCAVATOR

14.3.4.2 SUPER LOADER

14.3.4.3 CRANES

14.3.4.4 OTHERS

14.4 INFOTAINMENT SYSTEMS

14.4.1 PASSENGER CARS

14.4.1.1 HATCHBACK

14.4.1.2 SEDAN

14.4.1.3 COMPACT

14.4.1.4 OTHERS

14.4.2 ELECTRIC VEHICLES

14.4.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.4.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.4.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.4.3 LIGHT COMMERCIAL VEHICLES

14.4.3.1 MINIVANS

14.4.3.2 PICK-UP TRUCKS

14.4.3.3 AUTORICKSHAWS

14.4.3.4 OTHERS

14.4.4 HEAVY DUTY VEHICLES

14.4.4.1 EXCAVATOR

14.4.4.2 SUPER LOADER

14.4.4.3 CRANES

14.4.4.4 OTHERS

14.5 VEHICLE MANAGEMENT & TELEMATICS SYSTEMS

14.5.1 PASSENGER CARS

14.5.1.1 HATCHBACK

14.5.1.2 SEDAN

14.5.1.3 COMPACT

14.5.1.4 OTHERS

14.5.2 ELECTRIC VEHICLES

14.5.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.5.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.5.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.5.3 LIGHT COMMERCIAL VEHICLES

14.5.3.1 MINIVANS

14.5.3.2 PICK-UP TRUCKS

14.5.3.3 AUTORICKSHAWS

14.5.3.4 OTHERS

14.5.4 HEAVY DUTY VEHICLES

14.5.4.1 EXCAVATOR

14.5.4.2 SUPER LOADER

14.5.4.3 CRANES

14.5.4.4 OTHERS

14.6 ENGINE MANAGEMENT & POWERTRAIN

14.6.1 PASSENGER CARS

14.6.1.1 HATCHBACK

14.6.1.2 SEDAN

14.6.1.3 COMPACT

14.6.1.4 OTHERS

14.6.2 ELECTRIC VEHICLES

14.6.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.6.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.6.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.6.3 LIGHT COMMERCIAL VEHICLES

14.6.3.1 MINIVANS

14.6.3.2 PICK-UP TRUCKS

14.6.3.3 AUTORICKSHAWS

14.6.3.4 OTHERS

14.6.4 HEAVY DUTY VEHICLES

14.6.4.1 EXCAVATOR

14.6.4.2 SUPER LOADER

14.6.4.3 CRANES

14.6.4.4 OTHERS

14.7 BODY CONTROL & COMFORT SYSTEM

14.7.1 PASSENGER CARS

14.7.1.1 HATCHBACK

14.7.1.2 SEDAN

14.7.1.3 COMPACT

14.7.1.4 OTHERS

14.7.2 ELECTRIC VEHICLES

14.7.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.7.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.7.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.7.3 LIGHT COMMERCIAL VEHICLES

14.7.3.1 MINIVANS

14.7.3.2 PICK-UP TRUCKS

14.7.3.3 AUTORICKSHAWS

14.7.3.4 OTHERS

14.7.4 HEAVY DUTY VEHICLES

14.7.4.1 EXCAVATOR

14.7.4.2 SUPER LOADER

14.7.4.3 CRANES

14.7.4.4 OTHERS

14.8 HMI APPLICATION

14.8.1 PASSENGER CARS

14.8.1.1 HATCHBACK

14.8.1.2 SEDAN

14.8.1.3 COMPACT

14.8.1.4 OTHERS

14.8.2 6.2.2 ELECTRIC VEHICLES

14.8.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.8.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.8.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.8.3 LIGHT COMMERCIAL VEHICLES

14.8.3.1 MINIVANS

14.8.3.2 PICK-UP TRUCKS

14.8.3.3 AUTORICKSHAWS

14.8.3.4 OTHERS

14.8.4 HEAVY DUTY VEHICLES

14.8.4.1 EXCAVATOR

14.8.4.2 SUPER LOADER

14.8.4.3 CRANES

14.8.4.4 OTHERS

14.9 AUTONOMOUS DRIVING

14.9.1 PASSENGER CARS

14.9.1.1 HATCHBACK

14.9.1.2 SEDAN

14.9.1.3 COMPACT

14.9.1.4 OTHERS

14.9.2 ELECTRIC VEHICLES

14.9.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.9.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.9.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.9.3 LIGHT COMMERCIAL VEHICLES

14.9.3.1 MINIVANS

14.9.3.2 PICK-UP TRUCKS

14.9.3.3 AUTORICKSHAWS

14.9.3.4 OTHERS

14.9.4 HEAVY DUTY VEHICLES

14.9.4.1 EXCAVATOR

14.9.4.2 SUPER LOADER

14.9.4.3 CRANES

14.9.4.4 OTHERS

14.1 OTHERS

14.10.1 PASSENGER CARS

14.10.1.1 HATCHBACK

14.10.1.2 SEDAN

14.10.1.3 COMPACT

14.10.1.4 OTHERS

14.10.2 ELECTRIC VEHICLES

14.10.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.10.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.10.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.10.3 LIGHT COMMERCIAL VEHICLES

14.10.3.1 MINIVANS

14.10.3.2 PICK-UP TRUCKS

14.10.3.3 AUTORICKSHAWS

14.10.3.4 OTHERS

14.10.4 HEAVY DUTY VEHICLES

14.10.4.1 EXCAVATOR

14.10.4.2 SUPER LOADER

14.10.4.3 CRANES

14.10.4.4 OTHERS

15 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 APTIV

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 ALPHABET INC.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 NXP SEMICONDUCTORS.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 MICROSOFT

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 NVIDIA CORPORATION.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 AIMOTIVE

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 AIRBIQUITY INC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 AUTONET MOBILE, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 BLACKBERRY LIMITED

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 ELEKTROBIT

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 GREEN HILLS SOFTWARE

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HEXAGON AB

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 INTEL CORPORATION

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 INTELLIAS

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 KPIT

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 LUXOFT, A DXC TECHNOLOGY COMPANY

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 LYNX SOFTWARE TECHNOLOGIES

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 1.1RECENT DEVELOPMENT

18.18 MONTAVISTA SOFTWARE, LLC.

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 OXBOTICA

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 RENESAS ELECTRONICS CORPORATION

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

18.21 ROBERT BOSCH GMBH

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 SIEMENS

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 SIGMA SOFTWARE

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 VECTOR INFORMATIK GMBH

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENTS

18.25 WIND RIVER SYSTEMS, INC.

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 THE BELOW TABLE CLEARLY SHOWS THE OEM INVESTING SOFTWARE RESEARCH AND DEVELOPMENT AND ACCORDINGLY, THE COMPANIES FACE DISRUPTION IN COMPETING WITH THE MARKET PLAYERS.

TABLE 2 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SOLUTION IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA LARGE SCALE ORGANIZATIONS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MEDIUM SCALE ORGANIZATIONS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SMALL SCALE ORGANIZATIONS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE , 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OPERATING SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA APPLICATION SOFTWARE IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA MIDDLEWARE IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA CHARGING MANAGEMENT IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA BATTERY MANAGEMENT IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA V2G IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USER , 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA VEHICLE MANAGEMENT & TELEMATICS SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VEHICLE MANAGEMENT & TELEMATICS SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA ENGINE MANAGEMENT & POWERTRAIN SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA ENGINE MANAGEMENT & POWERTRAIN SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BODY CONTROL & COMFORT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 93 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 95 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 97 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 NORTH AMERICA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 NORTH AMERICA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 107 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 NORTH AMERICA VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 112 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 NORTH AMERICA ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 117 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 NORTH AMERICA BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 122 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 NORTH AMERICA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 127 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 NORTH AMERICA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 132 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 NORTH AMERICA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 137 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 U.S. AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 142 U.S. SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 U.S. TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 U.S. AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 145 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 U.S. ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 U.S. LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 U.S. AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 150 U.S. AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 151 U.S. AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 152 U.S. AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 U.S. ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 154 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 U.S. LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 U.S. COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 159 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 U.S. INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 164 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 U.S. VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 169 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 U.S. ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 174 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 U.S. BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 179 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 U.S. HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 184 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 U.S. AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 189 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 U.S. OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 194 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 CANADA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 199 CANADA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 CANADA TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 CANADA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 202 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 CANADA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 CANADA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 CANADA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 207 CANADA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 208 CANADA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 209 CANADA AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 210 CANADA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 211 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 CANADA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 CANADA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 216 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 220 CANADA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 221 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 CANADA VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 226 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 CANADA ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 231 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 CANADA BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 236 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 CANADA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 241 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 CANADA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 246 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 247 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 CANADA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 251 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 256 MEXICO SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 MEXICO TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 259 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 MEXICO ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 MEXICO LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 263 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 264 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 265 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 266 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 267 MEXICO ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 268 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 270 MEXICO LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 MEXICO COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 273 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 277 MEXICO INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 278 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 MEXICO VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 283 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 284 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 285 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 MEXICO ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 288 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 289 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 292 MEXICO BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 293 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 294 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 295 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 296 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 297 MEXICO HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 298 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 300 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 MEXICO AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 303 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 304 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 305 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 306 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 307 MEXICO OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 308 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 309 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 310 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 311 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: SEGMENTATION

FIGURE 11 RISE IN ADOPTION OF ADAS FEATURES IN AUTOMOBILES IS EXPECTED TO DRIVE NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 OFFERING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 15 AUTOMOTIVE AI MARKET SIZE

FIGURE 16 WORLDWIDE ELECTRONIC SYSTEM CAGR (IN %)

FIGURE 17 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY OFFERING, 2021

FIGURE 18 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 19 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY VEHICLE TYPE, 2021

FIGURE 20 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY SOFTWARE LAYER, 2021

FIGURE 21 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY EV UTILITY, 2021

FIGURE 22 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USER

FIGURE 23 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY OFFERING (2022-2029)

FIGURE 28 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.