North America Automotive Software Market Analysis and Size

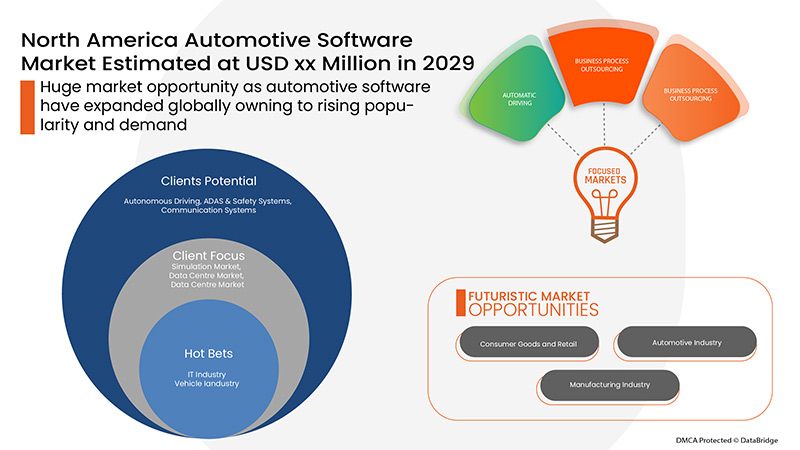

Service providers were continuously trying to find out ways to increase the precision of work, enhanced services, safety and work with growing technology. The requirement for these reasons is being fulfilled through the implementation of the automotive software as they are used to provide enhanced, uninterrupted free, and timely services at the industrial operations. The automotive software in various industries is being used widely due to the rising demand for customer experience. It enables industries to enhance their operations and productivity. Automotive software help end-users by providing better automated solutions without human interference and deliver better driving experience. The North America automotive software market is in the growth phase rapidly due to growing demand for electrifications in vehicles which drives the demand for the automotive software. The companies are even launching new products to gain a larger market share.

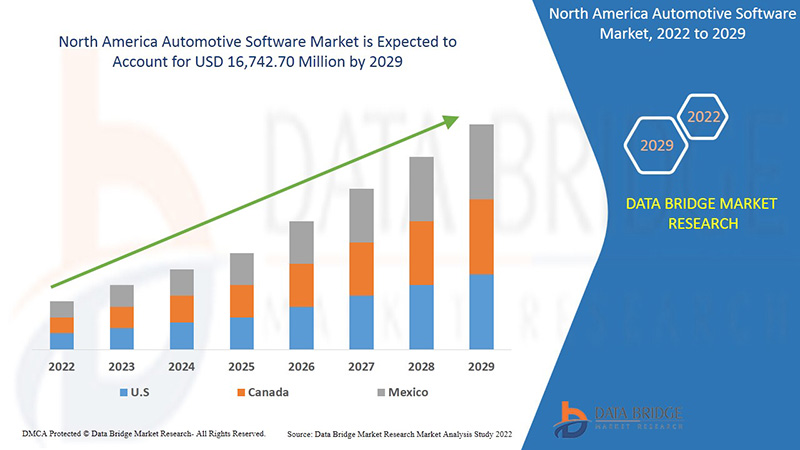

Data Bridge Market Research analyses that the automotive software market is expected to reach the value of USD 16,742.70 million by 2029, at a CAGR of 17.6% during the forecast period. "North America Services" accounts for the largest offering segment in the automotive software market. North America service provides accurate information which is utilized to develop high precision IoT network. The automotive software market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Offering (Solutions and Services), Organization Size (Large Scale Organizations, Medium Scale Organization and Small Scale Organization), Software Layer (Operating System, Middleware and Application Software), EV Utility (Charging Management, Battery Management and V2G), Vehicle Type (Passenger Cars, Electric Vehicles, Light Commercial Vehicles and Heavy Duty), End-User (ADAS & Safety Systems, Communication Systems, Infotainment Systems, Body Control & Comfort System, Engine Management & Powertrain, Vehicle Management & Telematics, Autonomous Driving, HMI Application & Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

LUXOFT, A DXC TECHNOLOGY COMPANY, Vector Informatik GmbH, Sigma Software, NVIDIA Corporation, Aptiv, Elektrobit, KPIT, NXP Semiconductors, aiMotive, Siemens, Intellias, Hexagon AB, OXBOTICA, Lynx Software Technologies, Renesas Electronics Corporation, Intel Corporation, Blackberry Limited, Airbiquity Inc., Green Hills Software, Robert Bosch GmbH, Wind River Systems, Inc., Alphabet Inc., Autonet Mobile, Inc, MONTAVISTA SOFTWARE LLC., Microsoft among others. |

Market Definition

The automotive industry comprises a wide range of companies and organizations involved in the design, development, manufacturing, marketing, and selling of motor vehicles. It is one of the world's largest industries by revenue. It is also the industry with the highest spending on Research & Development. NXP offers a broad range of automotive software tools designed to help you to simplify and shorten the time required to build ECUs based on NXP microcontrollers (MCU). This includes run-time and embedded software, software, MATLAB/Simulink-compatible toolboxes, a wide array of drivers, libraries, stacks and boot loader software. NXP also provides MCU initialization tools and auto code generation support to AUTOSAR microcontroller abstraction layers (MCAL) and operating systems (OS).Our dedicated team of professional engineers can extend your capabilities by providing training, consulting, development services and customization on a wide range of application spaces and technologies.

Automotive Software Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Rise in adoption of ADAS features in automobiles

The automobile industry has witnessed huge developments however, advanced driver assistance systems (ADAS) are one of the major developments. This system ensures more safety measures for vehicles because of which demand for ADAS is increasing year over year. This technological innovation for the automotive industry has created a popularity for the safety and benefits involved with the new system which has created the demand for electronics adoptions which is integrated through software applications.

- Rise in the number of connected vehicles

Nowadays connected vehicles seem to be a new norm in the automotive industry which is equipped with smart and convenient features. The vehicles are embedded with SIM cards or chipset with internet access and vehicle application operated through smartphones which allows to remotely operate the functions of a vehicle such as locking/unlocking the door, climate control, locating the vehicle, and many other features.

- Rising demand for electric vehicles

Electric vehicles (EVs) are designed to be a promising technology to achieve sustainable transportation with zero carbon emissions, low noise, and high efficiency. Moreover, electric vehicles were evolve in the 19th century but due to lack of advancement in technology internal combustion engine vehicles had a huge demand compared to electric vehicles.

Electric vehicles are highly embedded with automotive software and have various benefits which are concentrated by various countries and formulating regulations and policies to boost the electric vehicles which help to control carbon emission and avoid North America warming.

- Improper standard protocols for the development of software platforms

The technological advancement is growing year over year resulting evolution of better automotive software without a particular set of standards for software developments which leads to a variety of protocols and user interfaces that can be difficult in integrating the operations leading to restraining the automotive software market.

- Lack of connectivity infrastructures

The investment for developing the connectivity for vehicles includes the infrastructure which is supporting the technology and operation. This includes smart cities and roads that is having vision-based or high-frequency mapping which will help smooth working of autonomous driving equipped with self-driving systems with the requirement of up-to-date information for better navigation of vehicles and connectivity.

- Need for high maintenance of software

The regular update of software enables the development of new software architecture which further leads to changes in the interface, protocols, and technology which might not integrate operations with old mechanical components and resulting in creating issues in the usage which hampers the safety and connectivity facility of the vehicles.

Thus, it is very clear that maintenance of automotive software is limited to a certain level after which the maintenance cost increases rapidly due to maintenance of other related components and devices without which the vehicle can be stated to be unfit and unsafe for usage.

Post COVID-19 Impact on Automotive Software Market

COVID-19 created a major impact on the automotive software market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the automotive software market is because of the increase in the use for electronic equipment in the vehicles and also due to promotion by many government organizations for the use of electric vehicles to reduce the emissions. However, the COVID-19 had an adverse effect on the automotive software market as the sales of the vehicles in many countries was on halt and most of the companies had shut their operations temporarily for nearly about months.

Moreover, after the pandemic situation consumer were not willing to buy new vehicles because of the disrupted economy in many countries which directly affected the sales growth of automotive and resulted impacting the automotive software market growth.

Recent Development

- In January 2022, Aptiv announced collaboration with Sophia Velastegui. The collaboration has been announced for accelerating the technologies of mobility software’s. The companies will leverage its expertise in artificial intelligence (AI) for product development. The company will be able to commercialize and expand its product portfolio with enhanced products.

- In June 2019, Alphabet Inc. announced the acquisition of Looker for USD 2.6 billion. This acquisition has helped the company to improve its platform offerings for business intelligence, data applications and embedded analytics which allowed customers to drive digital transformation.

North America Automotive Software Market Scope

The automotive software market is segmented on the basis of offerings, organization size, software layer, EV utility, vehicle type and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Solutions

- Services

On the basis of offering, the North America automotive software market is segmented into solutions and services.

Organization Size

- Large Scale organizations

- Medium Scale organizations

- Small Scale organizations

On the basis of organization size, the North America automotive software market has been segmented into large scale organizations, medium scale organizations and small scale organizations.

Software Layer

- Operating Systems

- Middleware

- Application Software

On the basis of software layer, the North America automotive software market has been segmented into operating systems, middleware and application software.

Vehicle Type

- Passenger Cars

- Electric Vehicles

- Light Commercial Vehicles

- Heavy Duty Vehicles

On the basis of vehicle type, the North America automotive software market has been segmented into passenger cars, electric vehicles, light commercial vehicles and heavy duty vehicles.

EV Utility

- Charging Management

- Battery Management

- V2G

On the basis of EV utility, the North America automotive software market has been segmented into charging management, battery management and V2G.

End-User

- ADAS & Safety systems

- Communication Systems

- Infotainment Systems

- Engine Management & Powertrain

- Vehicle Management & Telematics

- Body Control & Comfort System

- Autonomous Driving

- HMI Application

- Others

On the basis of end-user, the North America automotive software market has been segmented into ADAS & safety systems, communication systems, infotainment systems, engine management & powertrain, vehicle management & telematics, body control & comfort system, autonomous driving, hmi application and others.

Automotive Software Market Regional Analysis/Insights

The automotive software market is analysed and market size insights and trends are provided by country, offering, vehicle type, software layer, EV utility, organization size and end-use industry as referenced above.

The countries covered in the automotive software market report U.S., Canada and Mexico in North America.

U.S. dominates the North America region due to rise in the autonomous driving system and rise in the development of luxury solutions for the vehicles.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Automotive Software Market Share Analysis

The automotive software market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to automotive software market.

Some of the major players operating in the automotive software market are LUXOFT, A DXC TECHNOLOGY COMPANY, Vector Informatik GmbH, Sigma Software, NVIDIA Corporation, Aptiv, Elektrobit, KPIT, NXP Semiconductors, aiMotive, Siemens, Intellias, Hexagon AB, OXBOTICA, Lynx Software Technologies, Renesas Electronics Corporation, Intel Corporation, Blackberry Limited, Airbiquity Inc., Green Hills Software, Robert Bosch GmbH, Wind River Systems, Inc., Alphabet Inc., Autonet Mobile, Inc, MONTAVISTA SOFTWARE LLC., Microsoft among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP AUTOMOTIVE SOFTWARE COMPANIES

4.1.1 CASE STUDIES-

4.1.2 IDENTIFYING THE PROBLEM:

4.1.3 SOLUTION:

4.1.4 IDENTIFYING THE PROBLEM:

4.1.5 SOLUTIONS:

4.1.6 RND (RESEARCH AND DEVELOPMENT) AND NRE (NON-RECURRING ENGINEERING) STRUCTURES ON VARIED DEVELOPMENT PHASES ON TOP PLAYERS

4.1.7 ALPHABET INC.

4.1.8 NXP SEMICONDUCTORS

4.1.9 MICROSOFT

4.1.10 NVIDIA CORPORATION

4.2 TREND ANALYSIS:

4.2.1 ADVANCED CONNECTIVITY

4.2.2 ARTIFICIAL INTELLIGENCE

4.2.3 AUTONOMOUS DRIVING

4.2.4 SAFETY ENHANCEMENTS

4.2.5 AUGMENTED REALITY

4.2.6 PRICING ANALYSIS

5 PORTER’S FIVE FORCES MODEL

6 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY REGION

6.1 ASIA-PACIFIC

6.2 EUROPE

6.3 NORTH AMERICA

6.4 THE MIDDLE EAST AND AFRICA

6.5 SOUTH AMERICA

7 REGULATORY FRAMEWORK

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISE IN ADOPTION OF ADAS FEATURES IN AUTOMOBILES

8.1.2 RISE IN THE NUMBER OF CONNECTED VEHICLES

8.1.3 RISING DEMAND FOR ELECTRIC VEHICLES

8.2 RESTRAINTS

8.2.1 IMPROPER STANDARD PROTOCOLS FOR THE DEVELOPMENT OF SOFTWARE PLATFORMS

8.2.2 LACK OF CONNECTIVITY INFRASTRUCTURES

8.2.3 NEED FOR HIGH MAINTENANCE OF SOFTWARE

8.3 OPPORTUNITIES

8.3.1 RISE IN THE POTENTIAL FOR ARTIFICIAL INTELLIGENCE

8.3.2 REQUIREMENT OF CONNECTIVITY FOR BETTER FLEET MANAGEMENT

8.3.3 UPSURGE OF ELECTRONIC APPLICATIONS IN VEHICLES

8.4 CHALLENGES

8.4.1 LACK OF QUALITY AND SECURITY CONCERNS

8.4.2 EXPONENTIAL GROWTH OF SOFTWARE COSTS FOR VEHICLES

8.4.3 RISE IN COMPLEXITY FOR THE DEVELOPMENT

9 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING

9.1 OVERVIEW

9.2 SERVICES

9.2.1 INTEGRATION & IMPLEMENTATION

9.2.2 DESIGNING

9.2.3 TESTING

9.2.3.1 UNIT TESTING

9.2.3.2 SYSTEM TESTING

9.2.3.3 INTEGRATION TESTING

9.2.3.4 VALIDATION & VERIFICATION

9.2.4 OTHERS

9.3 SOLUTION

10 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE SCALE ORGANIZATIONS

10.3 MEDIUM SCALE ORGANIZATIONS

10.4 SMALL SCALE ORGANIZATIONS

11 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PASSENGER CARS

11.2.1 HATCHBACK

11.2.2 SEDAN

11.2.3 COMPACT

11.2.4 OTHERS

11.3 ELECTRIC VEHICLES

11.3.1 BATTERY ELECTRIC VEHICLES (BEVS)

11.3.2 HYBRID ELECTRIC VEHICLES (HEVS)

11.3.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

11.4 LIGHT COMMERCIAL VEHICLES

11.4.1 MINIVANS

11.4.2 PICK-UP TRUCKS

11.4.3 AUTORICKSHAWS

11.4.4 OTHERS

11.5 HEAVY DUTY VEHICLES

11.5.1 EXCAVATOR

11.5.2 SUPER LOADER

11.5.3 CRANES

11.5.4 OTHERS

12 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER

12.1 OVERVIEW

12.2 OPERATING SYSTEM

12.3 APPLICATION SOFTWARE

12.4 MIDDLEWARE

13 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY

13.1 OVERVIEW

13.2 CHARGING MANAGEMENT

13.3 BATTERY MANAGEMENT

13.4 V2G

14 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USE

14.1 OVERVIEW

14.2 ADAS & SAFETY SYSTEMS

14.2.1 PASSENGER CARS

14.2.1.1 HATCHBACK

14.2.1.2 SEDAN

14.2.1.3 COMPACT

14.2.1.4 OTHERS

14.2.2 ELECTRIC VEHICLES

14.2.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.2.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.2.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.2.3 LIGHT COMMERCIAL VEHICLES

14.2.3.1 MINIVANS

14.2.3.2 PICK-UP TRUCKS

14.2.3.3 AUTORICKSHAWS

14.2.3.4 OTHERS

14.2.4 HEAVY DUTY VEHICLES

14.2.4.1 EXCAVATOR

14.2.4.2 SUPER LOADER

14.2.4.3 CRANES

14.2.4.4 OTHERS

14.3 COMMUNICATION SYSTEMS

14.3.1 PASSENGER CARS

14.3.1.1 HATCHBACK

14.3.1.2 SEDAN

14.3.1.3 COMPACT

14.3.1.4 OTHERS

14.3.2 ELECTRIC VEHICLES

14.3.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.3.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.3.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.3.3 LIGHT COMMERCIAL VEHICLES

14.3.3.1 MINIVANS

14.3.3.2 PICK-UP TRUCKS

14.3.3.3 AUTORICKSHAWS

14.3.3.4 OTHERS

14.3.4 HEAVY DUTY VEHICLES

14.3.4.1 EXCAVATOR

14.3.4.2 SUPER LOADER

14.3.4.3 CRANES

14.3.4.4 OTHERS

14.4 INFOTAINMENT SYSTEMS

14.4.1 PASSENGER CARS

14.4.1.1 HATCHBACK

14.4.1.2 SEDAN

14.4.1.3 COMPACT

14.4.1.4 OTHERS

14.4.2 ELECTRIC VEHICLES

14.4.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.4.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.4.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.4.3 LIGHT COMMERCIAL VEHICLES

14.4.3.1 MINIVANS

14.4.3.2 PICK-UP TRUCKS

14.4.3.3 AUTORICKSHAWS

14.4.3.4 OTHERS

14.4.4 HEAVY DUTY VEHICLES

14.4.4.1 EXCAVATOR

14.4.4.2 SUPER LOADER

14.4.4.3 CRANES

14.4.4.4 OTHERS

14.5 VEHICLE MANAGEMENT & TELEMATICS SYSTEMS

14.5.1 PASSENGER CARS

14.5.1.1 HATCHBACK

14.5.1.2 SEDAN

14.5.1.3 COMPACT

14.5.1.4 OTHERS

14.5.2 ELECTRIC VEHICLES

14.5.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.5.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.5.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.5.3 LIGHT COMMERCIAL VEHICLES

14.5.3.1 MINIVANS

14.5.3.2 PICK-UP TRUCKS

14.5.3.3 AUTORICKSHAWS

14.5.3.4 OTHERS

14.5.4 HEAVY DUTY VEHICLES

14.5.4.1 EXCAVATOR

14.5.4.2 SUPER LOADER

14.5.4.3 CRANES

14.5.4.4 OTHERS

14.6 ENGINE MANAGEMENT & POWERTRAIN

14.6.1 PASSENGER CARS

14.6.1.1 HATCHBACK

14.6.1.2 SEDAN

14.6.1.3 COMPACT

14.6.1.4 OTHERS

14.6.2 ELECTRIC VEHICLES

14.6.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.6.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.6.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.6.3 LIGHT COMMERCIAL VEHICLES

14.6.3.1 MINIVANS

14.6.3.2 PICK-UP TRUCKS

14.6.3.3 AUTORICKSHAWS

14.6.3.4 OTHERS

14.6.4 HEAVY DUTY VEHICLES

14.6.4.1 EXCAVATOR

14.6.4.2 SUPER LOADER

14.6.4.3 CRANES

14.6.4.4 OTHERS

14.7 BODY CONTROL & COMFORT SYSTEM

14.7.1 PASSENGER CARS

14.7.1.1 HATCHBACK

14.7.1.2 SEDAN

14.7.1.3 COMPACT

14.7.1.4 OTHERS

14.7.2 ELECTRIC VEHICLES

14.7.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.7.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.7.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.7.3 LIGHT COMMERCIAL VEHICLES

14.7.3.1 MINIVANS

14.7.3.2 PICK-UP TRUCKS

14.7.3.3 AUTORICKSHAWS

14.7.3.4 OTHERS

14.7.4 HEAVY DUTY VEHICLES

14.7.4.1 EXCAVATOR

14.7.4.2 SUPER LOADER

14.7.4.3 CRANES

14.7.4.4 OTHERS

14.8 HMI APPLICATION

14.8.1 PASSENGER CARS

14.8.1.1 HATCHBACK

14.8.1.2 SEDAN

14.8.1.3 COMPACT

14.8.1.4 OTHERS

14.8.2 6.2.2 ELECTRIC VEHICLES

14.8.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.8.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.8.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.8.3 LIGHT COMMERCIAL VEHICLES

14.8.3.1 MINIVANS

14.8.3.2 PICK-UP TRUCKS

14.8.3.3 AUTORICKSHAWS

14.8.3.4 OTHERS

14.8.4 HEAVY DUTY VEHICLES

14.8.4.1 EXCAVATOR

14.8.4.2 SUPER LOADER

14.8.4.3 CRANES

14.8.4.4 OTHERS

14.9 AUTONOMOUS DRIVING

14.9.1 PASSENGER CARS

14.9.1.1 HATCHBACK

14.9.1.2 SEDAN

14.9.1.3 COMPACT

14.9.1.4 OTHERS

14.9.2 ELECTRIC VEHICLES

14.9.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.9.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.9.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.9.3 LIGHT COMMERCIAL VEHICLES

14.9.3.1 MINIVANS

14.9.3.2 PICK-UP TRUCKS

14.9.3.3 AUTORICKSHAWS

14.9.3.4 OTHERS

14.9.4 HEAVY DUTY VEHICLES

14.9.4.1 EXCAVATOR

14.9.4.2 SUPER LOADER

14.9.4.3 CRANES

14.9.4.4 OTHERS

14.1 OTHERS

14.10.1 PASSENGER CARS

14.10.1.1 HATCHBACK

14.10.1.2 SEDAN

14.10.1.3 COMPACT

14.10.1.4 OTHERS

14.10.2 ELECTRIC VEHICLES

14.10.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.10.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.10.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.10.3 LIGHT COMMERCIAL VEHICLES

14.10.3.1 MINIVANS

14.10.3.2 PICK-UP TRUCKS

14.10.3.3 AUTORICKSHAWS

14.10.3.4 OTHERS

14.10.4 HEAVY DUTY VEHICLES

14.10.4.1 EXCAVATOR

14.10.4.2 SUPER LOADER

14.10.4.3 CRANES

14.10.4.4 OTHERS

15 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 APTIV

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 ALPHABET INC.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 NXP SEMICONDUCTORS.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 MICROSOFT

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 NVIDIA CORPORATION.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 AIMOTIVE

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 AIRBIQUITY INC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 AUTONET MOBILE, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 BLACKBERRY LIMITED

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 ELEKTROBIT

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 GREEN HILLS SOFTWARE

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HEXAGON AB

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 INTEL CORPORATION

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 INTELLIAS

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 KPIT

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 LUXOFT, A DXC TECHNOLOGY COMPANY

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 LYNX SOFTWARE TECHNOLOGIES

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 1.1RECENT DEVELOPMENT

18.18 MONTAVISTA SOFTWARE, LLC.

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 OXBOTICA

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 RENESAS ELECTRONICS CORPORATION

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

18.21 ROBERT BOSCH GMBH

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 SIEMENS

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 SIGMA SOFTWARE

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 VECTOR INFORMATIK GMBH

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENTS

18.25 WIND RIVER SYSTEMS, INC.

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 THE BELOW TABLE CLEARLY SHOWS THE OEM INVESTING SOFTWARE RESEARCH AND DEVELOPMENT AND ACCORDINGLY, THE COMPANIES FACE DISRUPTION IN COMPETING WITH THE MARKET PLAYERS.

TABLE 2 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SOLUTION IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA LARGE SCALE ORGANIZATIONS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MEDIUM SCALE ORGANIZATIONS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SMALL SCALE ORGANIZATIONS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE , 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OPERATING SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA APPLICATION SOFTWARE IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA MIDDLEWARE IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA CHARGING MANAGEMENT IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA BATTERY MANAGEMENT IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA V2G IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USER , 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA VEHICLE MANAGEMENT & TELEMATICS SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VEHICLE MANAGEMENT & TELEMATICS SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA ENGINE MANAGEMENT & POWERTRAIN SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA ENGINE MANAGEMENT & POWERTRAIN SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BODY CONTROL & COMFORT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 93 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 95 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 97 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 NORTH AMERICA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 NORTH AMERICA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 107 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 NORTH AMERICA VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 112 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 NORTH AMERICA ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 117 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 NORTH AMERICA BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 122 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 NORTH AMERICA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 127 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 NORTH AMERICA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 132 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 NORTH AMERICA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 137 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 U.S. AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 142 U.S. SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 U.S. TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 U.S. AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 145 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 U.S. ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 U.S. LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 U.S. AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 150 U.S. AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 151 U.S. AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 152 U.S. AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 U.S. ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 154 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 U.S. LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 U.S. COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 159 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 U.S. INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 164 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 U.S. VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 169 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 U.S. ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 174 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 U.S. BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 179 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 U.S. HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 184 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 U.S. AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 189 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 U.S. OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 194 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 CANADA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 199 CANADA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 CANADA TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 CANADA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 202 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 CANADA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 CANADA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 CANADA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 207 CANADA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 208 CANADA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 209 CANADA AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 210 CANADA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 211 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 CANADA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 CANADA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 216 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 220 CANADA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 221 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 CANADA VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 226 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 CANADA ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 231 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 CANADA BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 236 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 CANADA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 241 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 CANADA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 246 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 247 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 CANADA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 251 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 256 MEXICO SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 MEXICO TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 259 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 MEXICO ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 MEXICO LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 263 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 264 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 265 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 266 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 267 MEXICO ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 268 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 270 MEXICO LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 MEXICO COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 273 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 277 MEXICO INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 278 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 MEXICO VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 283 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 284 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 285 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 MEXICO ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 288 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 289 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 292 MEXICO BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 293 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 294 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 295 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 296 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 297 MEXICO HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 298 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 300 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 MEXICO AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 303 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 304 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 305 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 306 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 307 MEXICO OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 308 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 309 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 310 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 311 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: SEGMENTATION

FIGURE 11 RISE IN ADOPTION OF ADAS FEATURES IN AUTOMOBILES IS EXPECTED TO DRIVE NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 OFFERING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 15 AUTOMOTIVE AI MARKET SIZE

FIGURE 16 WORLDWIDE ELECTRONIC SYSTEM CAGR (IN %)

FIGURE 17 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY OFFERING, 2021

FIGURE 18 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 19 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY VEHICLE TYPE, 2021

FIGURE 20 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY SOFTWARE LAYER, 2021

FIGURE 21 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY EV UTILITY, 2021

FIGURE 22 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USER

FIGURE 23 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY OFFERING (2022-2029)

FIGURE 28 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.