Global Automotive Front End Module Market

Taille du marché en milliards USD

TCAC :

%

USD

139.20 Billion

USD

226.94 Billion

2024

2032

USD

139.20 Billion

USD

226.94 Billion

2024

2032

| 2025 –2032 | |

| USD 139.20 Billion | |

| USD 226.94 Billion | |

|

|

|

|

Global Automotive Front-End Module Market By Material (Metals, Composites, Plastic, Hybrid), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), Component (Radiator, Motor Fan, Condenser, Internal Air Cooler, Radiator Core Support, Oil Cooler, Headlight, Front Grill, Front Active Grill, Bumper, Horn Assembly, Fenders, Hose Assembly, Bracket Assembly, Automotive Air Quality Sensor, Bumper Beam, Cruise Control Sensor, Crash Sensor, Night Vision Sensor, Park Assist), and Region - Industry Trends and Forecast to 2032

Automotive Front-End Module Market Size

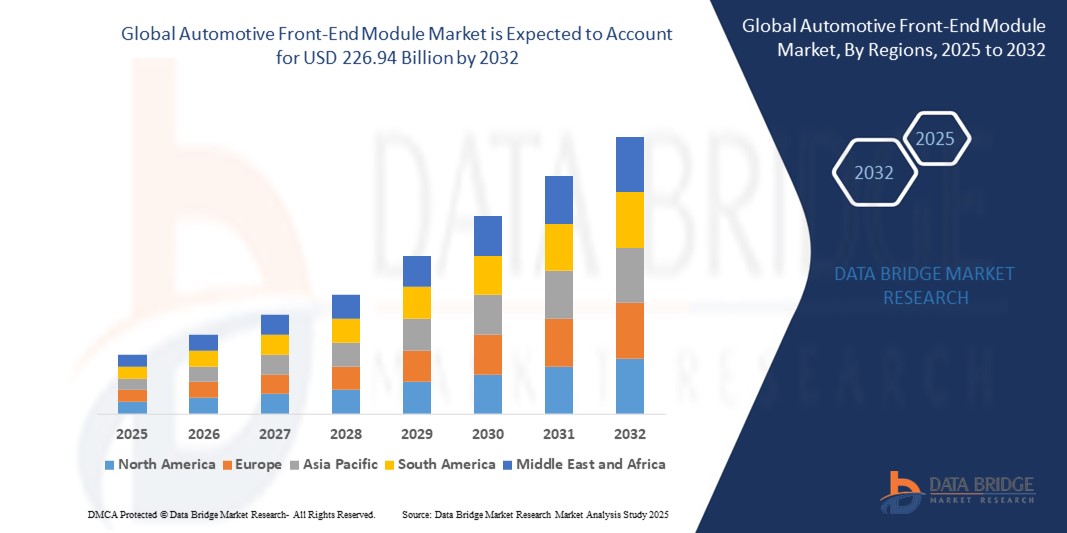

- The Global Automotive Front-End Module Market size was valued at USD 139.2 billion in 2024 and is expected to reach USD 226.94 billion by 2032, at a CAGR of 6.30% during the forecast period.

- This growth is driven by Rising Demand for EVs.

Automotive Front-End Module Market Analysis

- Automakers like BMW and Ford are increasingly adopting composite materials for front-end modules (FEMs) to reduce vehicle weight and enhance fuel efficiency, spurred by regulatory emissions targets.

- The surge in electric vehicle production, led by Tesla and BYD, is driving demand for modular and compact front-end systems optimized for battery and thermal management.

- Asia-Pacific holds a significant market share due to its Advancement in Modular Integration.

- Asia-Pacific is expected to register the fastest growth, fuelled by Growing adoption of advanced driver assistance systems (ADAS) by firms like Bosch has led to increased incorporation of radar and LiDAR sensors into FEMs.

- The Metals segment is projected to account for a significant market share of approximately 32.1% in 2025, driven by Vehicle Light weighting Trends.

Report Scope and Automotive Front-End Module Market Segmentation

|

Attributes |

Machine Safety Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Front-End Module Market Trends

“Advancements in AI, IoT, and Smart Grid Integration”

- The incorporation of Artificial Intelligence (AI) and the Internet of Things (IoT) into automotive front-end modules is enhancing vehicle performance and safety. AI algorithms analyze data from IoT devices to provide real-time insights, enabling predictive maintenance and advanced driver-assistance systems (ADAS). For instance, Ford has shifted its strategy by merging its next-generation and current vehicle software platforms, focusing on centralized software to deliver seamless experiences across its vehicle lineup.

- The adoption of cloud technologies in FEMs offers enhanced scalability, flexibility, and cost-efficiency. Cloud-based solutions allow manufacturers to rapidly adjust resources in response to changing demands, ensuring optimal performance and reliability. This trend is particularly beneficial for industries undergoing rapid digital transformation, such as automotive manufacturing.

- In April 2024, they introduced the Active Air Skirt (AAS) technology, achieving a 2.8% improvement in drag performance during testing on the Genesis GV60 SUV.

- Growth of local automotive industries in India and Southeast Asia is creating new opportunities for FEM localization by companies like Samvardhana Motherson Group.

Automotive Front-End Module Market Dynamics

Driver

“Increasing Vehicle Production”

- The rising demand for vehicles globally is a significant driver for the FEM market. As individuals seek simpler and safer mobility solutions, the need for automobiles increases, subsequently driving up the demand for automotive front-end modules.

- Continuous innovations in materials and manufacturing processes are enhancing the functionality and efficiency of FEMs. The integration of lightweight materials and advanced technologies contributes to improved fuel efficiency and vehicle performance.

- For instance, In April 2021, introduced PixCell LED, an intelligent headlight system featuring an adaptive driving beam (ADB) system, enhancing driver visibility and safety.

- The surge in electric vehicle production, led by Tesla and BYD, is driving demand for modular and compact front-end systems optimized for battery and thermal management.

Opportunity

“Vehicle electrification”

- Rapid industrialization and urbanization in regions like Asia-Pacific present significant opportunities for the FEM market. The increasing focus on vehicle electrification and the adoption of international safety standards are driving market growth in these areas.

- The incorporation of analytics capabilities such as predictive analytics and data mining into FEMs enables manufacturers to derive actionable insights from vast datasets. This integration supports data-driven decision-making, allowing businesses to adapt their products proactively.

- For instance, In November 2023, patented innovative inflatable bumper technology for large SUVs and trucks, enhancing pedestrian protection systems.

- Tier 1 suppliers like Magna International and Valeo are offering FEMs that integrate multiple components (radiators, headlamps, sensors), cutting assembly time and costs for OEMs.

Restraint/Challenge

“Reluctance in adopting modern technologies”

- Some organizations exhibit reluctance in adopting modern technologies due to concerns over complexity, required training, and potential disruptions to existing workflows. This resistance can hinder the implementation and effectiveness of FEM solutions.

- The initial investment required for advanced FEMs, including software, hardware, and professional services, can be substantial. This financial barrier may deter small and medium-sized enterprises (SMEs) from adopting FEMs, despite the long-term benefits.

- For instance, Fluctuations in the cost of plastics and aluminum, especially during 2021–2023 supply chain disruptions, strained profitability for suppliers like Denso and Mahle.

- Developing modular front-end platforms requires significant upfront investment, limiting adoption among smaller OEMs.

Automotive Front-End Module Market Scope

The market is segmented based on Material, Vehicle Type, Component.

|

Segmentation |

Sub-Segmentation |

|

By Material |

|

|

By Vehicle Type |

|

|

By Component |

|

In 2025, Radiator segment is projected to dominate the component segment

The Radiator segment is expected to hold a market share of approximately 16.1% in 2025, driven by Vehicle Light weighting Trends.

The Passenger Cars Vehicle Type segment is expected to account for the largest share during the forecast period in the application market

In 2025, the Passenger Cars Vehicle Type segment is projected to account for a market share of 45.1%, driven by Advancement in Modular Integration.

“Asia Pacific Holds the Largest Share in the Machine Safety Market”

- Asia Pacific dominates the market due to Tier 1 suppliers like Magna International and Valeo are offering FEMs that integrate multiple components (radiators, headlamps, sensors), cutting assembly time and costs for OEMs.

- The China holds a significant share, driven by Advancement in Modular Integration.

- The globe benefits from Global Production Recovery Post-COVID.

“Europe is Projected to Register the Highest CAGR in the Machine Safety Market”

- Europe’s growth is driven by ADAS and Sensor Integration.

- Germany is projected to exhibit the highest CAGR due to its increasing investments in automobile industry.

- Growing adoption of advanced driver assistance systems (ADAS) by firms like Bosch has led to increased incorporation of radar and LiDAR sensors into FEMs.

Automotive Front-End Module Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DENSO CORPORATION,

- MAHLE GmbH,

- Faurecia,

- Calsonic Kansei Corporation,

- Magna International Inc.,

- HYUNDAI MOBIS,

- Plastic Omnium,

- SMRPBV,

- SL Corporation,

- Valeo, Montaplast GmbH,

- WHEEL MOVERS (INDIA) PVT. LTD,

- Batsons Industries,

- Inteva Products,

- Minda Vast Access Systems Pvt. Ltd,

- Hanon Systems,

- Applus+,

- Arkal Automotive,

- CHASSIX, Gestamp,

- AGS Automotive Systems,

- Continental AG.

Latest Developments in Global Automotive Front-End Module Market

- In August 2022, BMW Group & HBIS Group established a sustainable steel supply chain agreement, introducing low-carbon steel with a 10-30% smaller carbon footprint than conventional steel.

- In April 2024, Hyundai & Kia introduced the Active Air Skirt (AAS) technology, achieving a 2.8% improvement in drag performance during testing on the Genesis GV60 SUV.

- In April 2021, Samsung introduced PixCell LED, an intelligent headlight system featuring an adaptive driving beam (ADB) system, enhancing driver visibility and safety.

- January 2025: Schneider Electric Announced a partnership with a prominent pharmaceutical manufacturer to design and implement machine safety systems in new production lines, integrating safety modules and emergency stop devices.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.