Global High Performance Fiber Market

Taille du marché en milliards USD

TCAC :

%

USD

4.04 Billion

USD

6.32 Billion

2024

2032

USD

4.04 Billion

USD

6.32 Billion

2024

2032

| 2025 –2032 | |

| USD 4.04 Billion | |

| USD 6.32 Billion | |

|

|

|

|

Global High Performance Fiber Market, By Type (Carbon Fibers, Polybenzimidazole (PBI), Aramid, Polyphenylene Sulfide Fiber (PPS), Fluoropolymer Fibers, Ceramic Fibers, High-Strength PE Fibers, HDPE Fibers, Melamine Fibers, Glass Fibers, Others), Usage Type (Polymer Composites, Non-Polymer Composites), Distribution Channel (Direct Sales, Distributors), End User (Construction and Building, Electronics and Telecommunication, Aerospace and Defense, Textile, Automotive, Medical, Sporting Goods, Wind Energy, Oil and Gas, Electrical and Electronics, Non-Woven, Filtration, Others) – Industry Trends and Forecast to 2032

High Performance Fibers Market Size

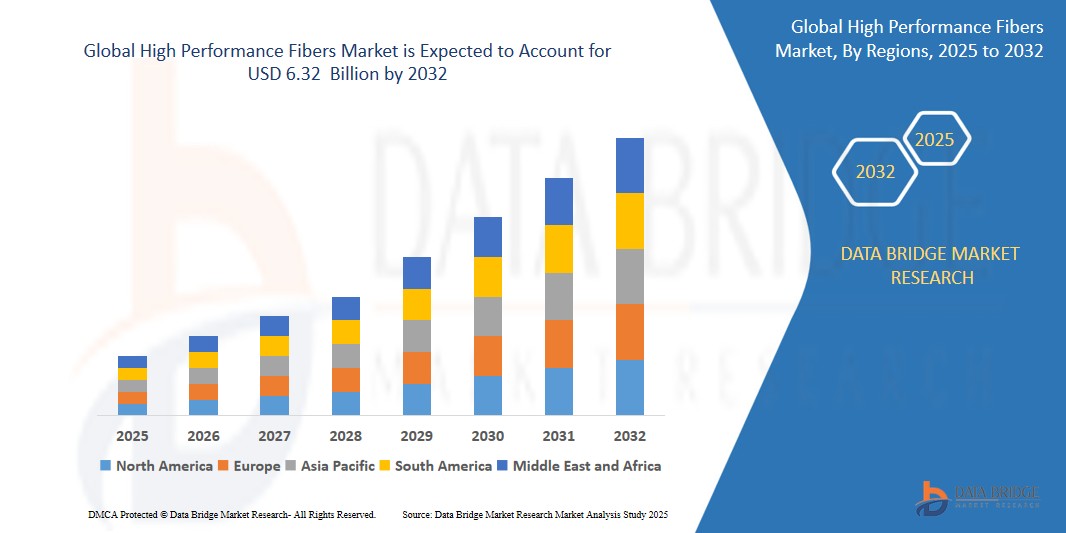

- The global High Performance Fibers market was valued atUSD 4.04 billion in 2024 and is expected to reachUSD 6.32 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 5.74%, primarily driven by the growing consumer awareness regarding health and wellness

- This growth is driven by factors such as busy lifestyles and a growing aging population are fuelling demand for products that enhance health and prevent disease

Global High-Performance Fibers Market Analysis

- High-performance fibers are advanced materials known for their exceptional strength, durability, thermal stability, and chemical resistance. These fibers are engineered to withstand extreme conditions such as high temperatures, mechanical stress, and harsh chemical environments. They are used in a variety of industries, including aerospace, automotive, defense, industrial, and sporting goods. High-performance fibers, such as aramid, carbon, and glass fibers, are commonly utilized in the manufacturing of products like protective clothing, lightweight composites, structural components, and reinforcement materials, which require superior performance and reliability.

- The global high-performance fibers market is witnessing significant growth, driven by the rising demand for lightweight, durable materials in industries that prioritize performance and safety. Innovations in fiber production technologies, such as advancements in carbon fiber manufacturing, and the growing trend toward sustainability and eco-friendly alternatives are also contributing to market expansion. Additionally, increasing applications in the aerospace and automotive industries—driven by the need for fuel efficiency, enhanced safety, and high-performance components—are pushing the demand for high-performance fibers worldwide.

- Glass fibers held the largest market share due to their wide range of applications, cost-effectiveness, and balanced performance properties, especially in construction, electronics, and automotive components. However, carbon fibers are expected to grow at the highest CAGR during the forecast period, owing to increasing demand for lightweight and high-strength materials in electric vehicles, wind turbines, and aerospace applications.

- North America is expected to remain a key region in the high-performance fibers market, driven by the presence of advanced manufacturing sectors such as aerospace, defense, and automotive. In these regions, the push toward fuel-efficient vehicles, lightweight composites, and advanced materials for aircraft is expected to continue fueling market growth. Furthermore, the rising focus on sustainability and energy efficiency is spurring the adoption of eco-friendly high-performance fibers, particularly in the automotive and construction industries.

- Asia-Pacific is projected to grow at the highest CAGR in the coming years, attributed to rapid industrialization, increasing investment in defense and aerospace, and the expansion of automotive manufacturing in countries like China, India, and South Korea. The region's strengthening focus on renewable energy and infrastructure development is also boosting the adoption of high-performance fibers in emerging economies.

Report Scope andHigh Performance Fibers Market Segmentation

|

Attributes |

High Performance Fibers KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific (APAC)

South America

Middle East and Africa (MEA)

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

High Performance Fibers Market Trends

“Shift Toward Sustainable and Lightweight Materials”

• A key trend in the high-performance fibers market is the increasing demand for sustainable and lightweight materials across various industries. As industries seek to reduce environmental impact, the adoption of eco-friendly fibers, such as bio-based and recyclable high-performance fibers, is growing.

• There is a growing focus on reducing the carbon footprint associated with fiber production, prompting manufacturers to explore renewable raw materials and innovative production processes. Materials such as carbon fibers derived from renewable sources and recyclable glass fibers are gaining popularity in sectors like aerospace, automotive, and construction, where lightweight and strong materials are in high demand.

• This trend is further driven by the rise in regulations and consumer preferences that prioritize sustainability. Companies are now developing new fiber solutions with lower environmental impact while maintaining superior mechanical properties and performance.

• For instance, leading companies like Toray Industries and Teijin are investing in the development of eco-friendly high-performance fibers, enabling them to align with growing sustainability trends while delivering high performance.

High Performance Fibers Market Dynamics

Driver

“Rising Demand from Aerospace and Automotive Sectors”

• The aerospace and automotive industries are significant drivers of the high-performance fibers market. Both sectors require materials that combine lightweight properties with high strength, durability, and heat resistance to meet performance standards and ensure safety.

• In the automotive industry, high-performance fibers are increasingly being used in components such as body panels, fuel systems, and brakes, where high mechanical strength and thermal stability are crucial. In aerospace, these fibers are utilized in structural parts, composites, and advanced materials for aircraft and spacecraft, where strength-to-weight ratios are essential.

• The push for fuel-efficient and lightweight vehicles in the automotive industry, along with the aerospace sector’s demand for improved performance and reduced fuel consumption, is expected to continue driving growth in the high-performance fibers market.

Opportunity

“Expansion of Applications in Wind Energy and Renewable Energy Sectors”

• One of the key opportunities in the high-performance fibers market lies in the increasing use of these fibers in wind energy applications. With the growing demand for renewable energy sources, high-performance fibers are becoming essential in the production of lightweight, durable wind turbine blades.

• Wind energy applications require materials that offer high strength, fatigue resistance, and durability to withstand extreme environmental conditions. High-performance fibers, particularly carbon fibers and aramid fibers, are increasingly being used to enhance the efficiency and longevity of wind turbines.

• Companies are exploring new ways to integrate high-performance fibers into renewable energy technologies, which is driving the expansion of the market in the wind energy sector. As more wind farms are developed globally, the demand for advanced fiber materials is expected to grow.

Restraint/Challenge

“High Cost and Complex Manufacturing Processes”

• One of the significant challenges in the high-performance fibers market is the high cost of production. These fibers require advanced manufacturing techniques and specialized raw materials, which increase the overall production cost.

• The intricate processes required to produce high-performance fibers, such as carbon fiber processing and the use of advanced resins and polymers, add to the complexity and cost of production. As a result, these fibers are often more expensive than traditional fibers, which may limit their adoption in price-sensitive industries.

• To address this challenge, manufacturers are focusing on reducing costs by improving production efficiency and exploring new raw materials. However, the high initial investment and specialized manufacturing requirements may continue to pose challenges in the widespread adoption of high-performance fibers, especially in developing markets.

High Performance Fibers Market Scope

The market is segmented on the basis type, Usage Type, Distribution Channel, and End-User Industry

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Usage Type |

|

|

By Distribution Channel |

|

|

By End-User Industry |

|

High Performance Fibers Market Regional Analysis

“North America to Lead the High-Performance Fibers Market”

- North America is anticipated to dominate the high-performance fibers market, owing to the strong presence of key end-use industries such as defense, aerospace, and industrial manufacturing. The U.S., in particular, accounts for a substantial market share due to high government investment in defense and homeland security, where high-performance fibers are extensively used in ballistic protection, body armor, and aerospace components.

- The increasing use of high-performance fibers like aramid and carbon fibers in automotive lightweighting and structural applications to meet regulatory emission norms further supports regional demand. Moreover, the presence of leading fiber manufacturers, coupled with consistent innovation in composite material technologies, reinforces North America's market leadership.

“Asia-Pacific to Register Strong Growth in the High-Performance Fibers Market”

- The Asia-Pacific region is projected to witness the fastest growth in the high-performance fibers market, driven by the booming automotive, construction, and electronics industries. Rapid urbanization and infrastructure development in countries like China, India, and Southeast Asia are creating robust demand for high-strength, durable materials, including high-performance fibers.

- China is emerging as a major producer and consumer of carbon and aramid fibers, supported by growing aerospace capabilities and domestic defense programs. Additionally, the expanding renewable energy sector, particularly wind energy, is driving demand for high-performance fibers in turbine blade manufacturing.

- Increasing investments in R&D, along with favorable government policies supporting local manufacturing and the use of advanced materials, are further accelerating market growth across the Asia-Pacific region. The rising focus on energy efficiency, electric mobility, and sustainable construction practices is also propelling the adoption of high-performance fibers.

High Performance Fibers Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SGL Carbon (Germany)

- Solvay (Belgium)

- Hexcel Corporation (U.S.)

- Axiom Materials, Inc. (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Honeywell International Inc. (U.S.)

- DuPont (U.S.)

- DSM (Netherlands)

- TORAY INDUSTRIES, INC. (Japan)

- W. L. Gore & Associates, Inc. (U.S.)

- KUREHA CORPORATION (Japan)

- Teijin Carbon Europe GmbH (Germany)

- Sarla Performance Fibers Limited (India)

- JEC Group (France)

- AGY (U.S.)

- Owens Corning (U.S.)

- Braj Binani Group (India)

- ZOLTEK (U.S.)

- ZHONGFU SHENYING CARBON FIBER CO., LTD. (China)

- Bally Ribbon Mills (U.S.)

Latest Developments in Global High Performance Fibers Market

- In October 2023, Toray Industries, Inc. introduced TORAYCA™ T1200 carbon fiber, achieving a world-record tensile strength of 1,160 Ksi. This advancement enables the production of lighter carbon-fiber-reinforced plastic components, benefiting applications in aerospace, defense, alternative energy, and consumer products by enhancing performance while reducing environmental impact.

- In August 2024, HFCL unveiled a new range of high-performance cable solutions at ISE EXPO 2024 in Dallas, Texas. Notably, the company introduced high-density single-jacket, single-armor Intermittently Bonded Ribbon (IBR) cables comprising 144–1728 fibers. This innovation earned HFCL the ISE Innovators Award, highlighting its commitment to advancing fiber optic technologies.

- In July 2024, China launched the world's first passenger train constructed entirely from carbon fiber, marking a significant milestone in high-speed rail technology. This development underscores China's leadership in adopting advanced materials to enhance transportation efficiency and sustainability.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.