Global Laboratory Automation And Smart Reagent Supply Chain Market

Taille du marché en milliards USD

TCAC :

%

USD

1.42 Billion

USD

3.11 Billion

2025

2033

USD

1.42 Billion

USD

3.11 Billion

2025

2033

| 2026 –2033 | |

| USD 1.42 Billion | |

| USD 3.11 Billion | |

|

|

|

|

Segmentation du marché mondial de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents, par type de produit (systèmes automatisés de manipulation de liquides, instruments de préparation et d'analyse d'échantillons), par application (génomique et protéomique, découverte et développement de médicaments) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

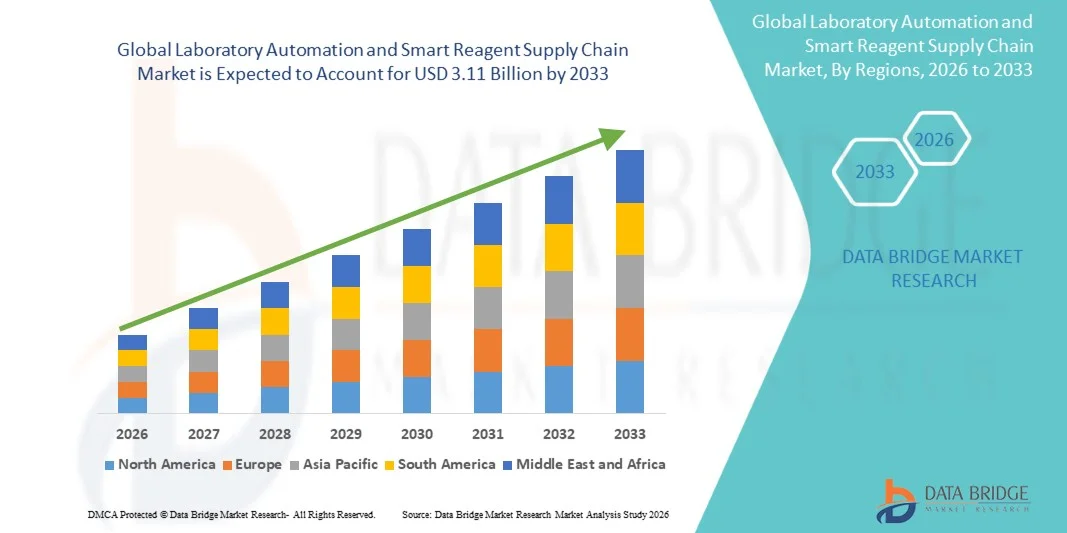

- Le marché mondial de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents était évalué à 1,42 milliard de dollars en 2025 et devrait atteindre 3,11 milliards de dollars d'ici 2033 , avec un TCAC de 10,30 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de processus de laboratoire à haut débit, précis et efficaces, associée aux progrès des technologies d'automatisation et des systèmes intelligents de gestion des réactifs qui rationalisent les flux de travail, réduisent les erreurs humaines et optimisent l'utilisation des ressources.

- Par ailleurs, l'adoption croissante de solutions de laboratoire automatisées dans les secteurs pharmaceutique, biotechnologique et de la recherche, conjuguée à l'importance accrue accordée à la rentabilité et à la reproductibilité des expériences, fait de l'automatisation des laboratoires et des systèmes intelligents d'approvisionnement en réactifs des outils essentiels pour les laboratoires modernes. Ces facteurs convergents accélèrent l'adoption de ces solutions, stimulant ainsi significativement la croissance globale du marché.

Analyse du marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

- L'automatisation des laboratoires et les systèmes intelligents de chaîne d'approvisionnement en réactifs, notamment la manipulation automatisée des liquides, le traitement des échantillons et les plateformes intelligentes de gestion des réactifs, sont de plus en plus essentiels dans les laboratoires modernes en raison de leur capacité à améliorer la précision, la reproductibilité et l'efficacité opérationnelle dans les applications de recherche, cliniques et industrielles.

- La demande croissante en solutions d'automatisation des laboratoires et de gestion intelligente des chaînes d'approvisionnement en réactifs est principalement due au besoin accru d'expérimentations à haut débit, de réduction des erreurs humaines et d'optimisation des coûts dans les laboratoires pharmaceutiques, biotechnologiques et de recherche universitaire. L'intégration de l'IA, de l'IoT et de la gestion des stocks dans le cloud accélère encore leur adoption.

- L'Amérique du Nord a dominé le marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents, avec une part de revenus d'environ 37,5 % en 2025. Cette domination s'explique par des infrastructures de laboratoire avancées, des investissements importants en R&D et la forte présence d'acteurs clés du marché. Les États-Unis ont généré la majeure partie des revenus régionaux grâce à une adoption généralisée dans les secteurs pharmaceutique, biotechnologique et universitaire.

- La région Asie-Pacifique devrait connaître la croissance la plus rapide sur le marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents au cours de la période de prévision, avec un TCAC d'environ 8,2 %, sous l'effet de l'augmentation des investissements en R&D, de l'expansion des industries biotechnologiques et pharmaceutiques et de l'adoption croissante des solutions de laboratoire automatisées en Chine, en Inde et au Japon.

- L'application Génomique et Protéomique a dominé le marché en 2025, représentant 48,7 % du chiffre d'affaires.

Portée du rapport et segmentation du marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

|

Attributs |

Automatisation des laboratoires et chaîne d'approvisionnement intelligente en réactifs : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, l'épidémiologie des patients, l'analyse du pipeline, l'analyse des prix et le cadre réglementaire. |

Tendances du marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement intelligente en réactifs

« Progrès en matière d'automatisation des laboratoires et de gestion des réactifs »

- L'adoption croissante de systèmes automatisés pour le traitement des échantillons, la manipulation des réactifs et la gestion des flux de travail constitue une tendance majeure et en pleine accélération sur le marché mondial de l'automatisation des laboratoires et de la chaîne d'approvisionnement intelligente en réactifs. Ces technologies améliorent l'efficacité des laboratoires, réduisent les erreurs humaines et optimisent l'utilisation des réactifs dans les laboratoires de recherche, cliniques et industriels.

- Par exemple, en 2024, Tecan a lancé sa station de travail d'automatisation de laboratoire Fluent, dotée de modules intégrés de gestion des réactifs, permettant un criblage à haut débit et une précision accrue dans la recherche en sciences de la vie.

- L'intégration de la robotique, de la manipulation automatisée des liquides et des systèmes de suivi numérique améliore l'efficacité des flux de travail et permet aux laboratoires de traiter des volumes d'échantillons plus importants avec une intervention manuelle minimale.

- La demande croissante de précision et de reproductibilité dans la recherche pharmaceutique, le diagnostic et les essais cliniques favorise l'adoption des systèmes de laboratoire automatisés.

- La tendance à la mise en place de chaînes d'approvisionnement de réactifs connectées et à une gestion intelligente des stocks permet de réduire le gaspillage, d'assurer un réapprovisionnement en temps voulu et d'améliorer l'efficacité opérationnelle.

Dynamique du marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

Conducteur

« Demande croissante d’efficacité et d’opérations de laboratoire à haut débit »

- La demande croissante de résultats de laboratoire plus rapides et plus fiables, ainsi que l'augmentation de la productivité dans les laboratoires de recherche et de diagnostic, constituent un moteur majeur du marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement intelligente en réactifs.

- Par exemple, en 2023, Roche a étendu ses plateformes d'automatisation de laboratoire dans les laboratoires cliniques européens afin de rationaliser le traitement des échantillons et d'accélérer les tests de diagnostic pendant la période de pointe de la grippe.

- Les laboratoires privilégient de plus en plus l'automatisation pour réduire les erreurs manuelles, minimiser la consommation de réactifs et standardiser les processus sur plusieurs sites.

- Le besoin de flux de travail efficaces dans les tests à grande échelle, la médecine personnalisée et la R&D pharmaceutique stimule davantage la croissance du marché.

- La conformité réglementaire, la traçabilité des données et les flux de travail prêts pour l'audit encouragent également l'adoption de systèmes automatisés dans les laboratoires cliniques et industriels.

Retenue/Défi

« Investissement initial et coûts d'entretien élevés »

- Malgré les avantages, le coût élevé de la mise en œuvre des systèmes de laboratoire automatisés et les dépenses de maintenance associées demeurent des défis majeurs, en particulier pour les petits et moyens laboratoires.

- Par exemple, plusieurs instituts de recherche de la région Asie-Pacifique ont signalé des retards dans l'adoption de l'automatisation en raison de contraintes budgétaires et de financements limités pour les systèmes avancés de gestion des réactifs.

- Les problèmes de compatibilité entre les instruments de laboratoire existants et les nouvelles plateformes d'automatisation peuvent également entraver la mise en œuvre.

- Former le personnel à l'exploitation et à la maintenance de systèmes automatisés complexes est essentiel, mais peut s'avérer long et coûteux.

- Surmonter ces défis grâce à des solutions rentables, des plateformes d'automatisation modulaires et des modèles de déploiement évolutifs sera crucial pour une croissance durable du marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement intelligente en réactifs.

Étendue du marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

Le marché est segmenté en fonction du type de produit et de son application.

• Par type de produit

Le marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement intelligente en réactifs est segmenté, selon le type de produit, en systèmes automatisés de manipulation de liquides et en instruments de préparation et d'analyse d'échantillons. Le segment des systèmes automatisés de manipulation de liquides dominait le marché en 2025 avec une part de revenus de 46,5 %, grâce à l'adoption croissante de solutions d'automatisation de laboratoire à haut débit dans les domaines de la génomique, de la protéomique et de la recherche pharmaceutique. Ces systèmes minimisent les erreurs humaines, améliorent la reproductibilité et permettent une manipulation précise de microvolumes de réactifs, un aspect crucial pour les flux de travail modernes à haut débit. La miniaturisation croissante des analyses, associée à l'augmentation des dépenses de R&D dans les secteurs biopharmaceutique et des sciences de la vie, alimente leur forte adoption. Les principaux utilisateurs finaux, notamment les grandes entreprises pharmaceutiques et les laboratoires de recherche universitaires, apprécient ces systèmes pour leur efficacité accrue, la réduction de la consommation de réactifs et leur capacité d'intégration transparente avec d'autres instruments de laboratoire. La demande croissante d'automatisation dans la préparation des échantillons et la standardisation des analyses renforce encore la position dominante de ce segment sur le marché. L'intégration de l'IA et de la surveillance via l'IoT améliore la transparence des flux de travail, l'efficacité opérationnelle et la conformité aux normes réglementaires. Des régions comme l'Amérique du Nord et l'Europe sont en tête de l'adoption grâce à une forte pénétration technologique, des infrastructures robustes et des investissements importants dans la R&D des laboratoires. Ce segment bénéficie également d'un soutien important des fournisseurs, incluant la formation, la maintenance et les services, ce qui le rend très attractif pour les laboratoires établis comme pour les laboratoires émergents.

Le segment des instruments de préparation et d'analyse d'échantillons devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 22,3 %, entre 2026 et 2033, en raison de leur rôle crucial dans la découverte de médicaments, le diagnostic moléculaire et la recherche en protéomique. Cette forte demande est alimentée par le besoin croissant d'analyses d'échantillons rapides, fiables et de haute précision, ce qui accélère les délais de recherche et améliore la reproductibilité. Ces instruments sont de plus en plus intégrés aux flux de travail automatisés afin de rationaliser la préparation des échantillons et les processus analytiques, minimisant ainsi les interventions manuelles. Les marchés émergents d'Asie-Pacifique, notamment la Chine, l'Inde et le Japon, investissent massivement dans les infrastructures de laboratoire, contribuant ainsi à la croissance du marché. L'essor de la recherche en génomique et en médecine personnalisée stimule également l'adoption de ces instruments. Les fabricants innovent constamment pour proposer des instruments multifonctionnels prenant en charge diverses applications et les tests à haut débit, ce qui les rend attractifs pour les laboratoires académiques et industriels. La conformité réglementaire, associée aux progrès réalisés dans le domaine de la microfluidique et des logiciels d'analyse, renforce encore le potentiel du marché. La rentabilité, la réduction du temps de traitement des échantillons et l'intégration avec les plateformes d'analyse de données basées sur le cloud contribuent également à la croissance rapide de ce segment.

• Sur demande

En fonction de l'application, le marché est segmenté en génomique et protéomique, et en découverte et développement de médicaments. L'application génomique et protéomique a dominé le marché en 2025, représentant 48,7 % du chiffre d'affaires. Cette domination s'explique par la croissance exponentielle des technologies de séquençage, de l'analyse des protéines et des initiatives de médecine personnalisée. Les laboratoires gérant des projets génomiques et protéomiques à grande échelle s'appuient de plus en plus sur des systèmes automatisés de manipulation de liquides et des chaînes d'approvisionnement intelligentes en réactifs pour garantir précision et évolutivité. Le besoin de résultats reproductibles à haut débit, associé à une réduction des erreurs de manipulation manuelle, est crucial pour les institutions de recherche, les entreprises de biotechnologie et les sociétés pharmaceutiques. Par ailleurs, l'essor de la recherche en protéomique pour la découverte de biomarqueurs et l'analyse des voies pathologiques stimule la demande d'automatisation dans la préparation, le stockage et le suivi des réactifs. L'Amérique du Nord et l'Europe constituent des marchés clés grâce à leurs infrastructures de recherche bien établies, leurs écosystèmes de laboratoires avancés et les financements importants alloués à la recherche en sciences omiques. L'intégration avec les systèmes de gestion de l'information de laboratoire (LIMS) assure une efficacité opérationnelle et une conformité accrues. Les investissements continus du secteur dans l'analyse de données basée sur l'IA et les systèmes compatibles avec l'Internet des objets (IoT) consolident encore davantage sa position de leader sur le marché.

Le segment de la découverte et du développement de médicaments devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 21,8 %, entre 2026 et 2033, sous l'effet du besoin croissant d'accélérer les processus de recherche préclinique et clinique. L'automatisation de la manipulation des échantillons et de la gestion des réactifs réduit les délais, les coûts opérationnels et les erreurs lors du criblage à haut débit et des tests de composés. Les entreprises pharmaceutiques et biotechnologiques adoptent de plus en plus des chaînes d'approvisionnement intelligentes en réactifs afin d'optimiser leurs stocks, de maintenir la stabilité des réactifs et d'assurer leur traçabilité. L'émergence de plateformes de découverte de médicaments assistées par l'IA et de systèmes robotisés intégrés améliore le débit et l'intégrité des données. L'expansion rapide de la R&D pharmaceutique en Asie-Pacifique et en Amérique latine stimule la croissance du marché. Par ailleurs, la demande croissante de produits biologiques, de vaccins et de thérapies personnalisées encourage les investissements dans les infrastructures de laboratoire automatisées. La combinaison d'économies de coûts, de délais d'exécution plus courts et d'une reproductibilité fiable positionne ce segment comme l'application à la croissance la plus rapide au sein du marché de l'automatisation des laboratoires et des chaînes d'approvisionnement intelligentes en réactifs.

Analyse régionale du marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

- L'Amérique du Nord a dominé le marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents, avec la plus grande part de revenus, soit environ 37,5 %, en 2025.

- Soutenue par une infrastructure de laboratoire de pointe, des investissements importants en R&D et la forte présence d'acteurs clés du marché

- L'accent mis par la région sur l'amélioration de l'efficacité des laboratoires, la réduction des erreurs et l'accélération des résultats de la recherche a encore stimulé la croissance du marché.

Analyse du marché américain de l'automatisation des laboratoires et de la chaîne d'approvisionnement intelligente en réactifs :

Le marché américain de l'automatisation des laboratoires et de la chaîne d'approvisionnement intelligente en réactifs a capté la majeure partie des revenus en Amérique du Nord en 2025, grâce à l'adoption généralisée des solutions de laboratoire automatisées dans les secteurs pharmaceutique, biotechnologique et de la recherche universitaire. Les investissements importants en R&D, la présence de fournisseurs leaders de solutions d'automatisation de laboratoire et les initiatives visant à améliorer l'efficacité des laboratoires et la conformité aux normes réglementaires sont les principaux facteurs de croissance de ce marché. L'intégration des chaînes d'approvisionnement intelligentes en réactifs aux systèmes de laboratoire robotisés et dotés d'intelligence artificielle optimise davantage les flux de travail et accélère l'adoption de ces solutions aux États-Unis.

Analyse du marché européen de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

Le marché européen de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents devrait connaître une croissance annuelle composée (TCAC) substantielle au cours de la période prévisionnelle, portée par des normes de qualité rigoureuses, une demande croissante de criblage à haut débit et une adoption accrue de l'automatisation dans les laboratoires pharmaceutiques et universitaires. L'Allemagne, la France et le Royaume-Uni sont des acteurs clés de cette croissance, soutenus par d'importantes initiatives gouvernementales visant à moderniser les infrastructures de laboratoire et à accroître l'efficacité de la R&D.

Analyse du marché britannique de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

Le marché britannique de l'automatisation des laboratoires et de la chaîne d'approvisionnement intelligente en réactifs devrait connaître une croissance soutenue au cours de la période de prévision, portée par l'adoption croissante des flux de travail automatisés en laboratoire, l'expansion des secteurs biotechnologique et pharmaceutique, et l'augmentation des investissements en recherche et développement. L'existence de solides réseaux de recherche universitaires et de santé contribue également à accélérer la demande de solutions pour la chaîne d'approvisionnement intelligente en réactifs.

Analyse du marché allemand de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

Le marché allemand devrait connaître une croissance annuelle composée (TCAC) notable au cours de la période de prévision, portée par un secteur industriel solide, la croissance de la recherche en biotechnologie et pharmaceutique, et l'adoption de solutions d'automatisation de laboratoire de pointe. L'accent mis par l'Allemagne sur la précision, l'efficacité et le respect des réglementations strictes favorise l'essor de ce marché.

Analyse du marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents en Asie-Pacifique

Le marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents en Asie-Pacifique devrait connaître la croissance la plus rapide, avec un TCAC d'environ 8,2 % sur la période prévisionnelle. Cette croissance est portée par l'augmentation des investissements en R&D, l'expansion rapide des industries pharmaceutiques et biotechnologiques et l'adoption de solutions de laboratoire automatisées dans des pays comme la Chine, l'Inde et le Japon. Le soutien croissant des gouvernements, le développement de la recherche universitaire et l'externalisation croissante des services de laboratoire contribuent également à l'expansion du marché.

Analyse du marché japonais de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

Le marché japonais de l'automatisation des laboratoires et des chaînes d'approvisionnement intelligentes en réactifs connaît une forte croissance, portée par l'innovation technologique, l'adoption généralisée de l'automatisation des laboratoires et les investissements importants dans la recherche pharmaceutique et biotechnologique. L'intégration de chaînes d'approvisionnement intelligentes en réactifs aux équipements de laboratoire automatisés améliore l'efficacité des flux de travail, réduisant les erreurs manuelles et les délais d'exécution.

Analyse du marché chinois de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

Le marché chinois de l'automatisation des laboratoires et de la chaîne d'approvisionnement intelligente en réactifs a représenté la plus grande part de revenus de la région Asie-Pacifique en 2025, grâce à la croissance rapide de la R&D pharmaceutique et biotechnologique, au développement des infrastructures de laboratoire et aux initiatives gouvernementales de soutien à l'innovation et à l'automatisation. L'accent mis par le pays sur le criblage à haut débit et les solutions de laboratoire économiques favorise l'adoption de systèmes de chaîne d'approvisionnement intelligents en réactifs, tandis que la vigueur des fabricants nationaux soutient l'expansion du marché.

Part de marché de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

Le secteur de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents est principalement dominé par des entreprises bien établies, notamment :

- Tecan Group Ltd. (Suisse)

- Hamilton Company (États-Unis)

- Beckman Coulter, Inc. (États-Unis)

- Agilent Technologies, Inc. (États-Unis)

- Thermo Fisher Scientific, Inc. (États-Unis)

- PerkinElmer, Inc. (États-Unis)

- Illumina, Inc. (États-Unis)

- Eppendorf AG (Allemagne)

- Sartorius AG (Allemagne)

- Laboratoires Bio-Rad, Inc. (États-Unis)

- Corning Incorporated (États-Unis)

- Danaher Corporation (États-Unis)

- Mettler-Toledo International Inc. (Suisse)

- Hitachi High-Tech Corporation (Japon)

Dernières évolutions du marché mondial de l'automatisation des laboratoires et de la chaîne d'approvisionnement en réactifs intelligents

- En mai 2023, Opentrons, une entreprise américaine spécialisée dans l'automatisation des laboratoires, a lancé sa plateforme robotique Flex afin d'étendre les solutions d'automatisation avancées pour les chercheurs en sciences de la vie du monde entier. Ce système robotique flexible permet de réaliser un large éventail d'expériences, notamment la préparation d'échantillons et la manipulation de réactifs. Conçu pour être programmable et compatible avec les flux de travail existants en laboratoire, le robot Flex améliore le débit, réduit les interventions manuelles et accroît la reproductibilité, reflétant ainsi l'évolution du secteur vers des systèmes d'automatisation plus accessibles et modulaires.

- En décembre 2023, Hudson Robotics, Inc. a fait l'acquisition de Tomtec Inc., fournisseur de solutions d'automatisation de laboratoire, dans le cadre d'une démarche stratégique visant à renforcer son portefeuille d'automatisation et à élargir son offre en matière de manipulation de réactifs à haut débit et de systèmes automatisés de manipulation de liquides. Cette acquisition a permis de réunir des technologies complémentaires afin de prendre en charge des flux de travail automatisés de bout en bout et d'améliorer l'efficacité de la chaîne d'approvisionnement en réactifs pour les clients des secteurs de la biotechnologie, de la pharmacie et de la recherche académique.

- En juillet 2024, Inpeco a dévoilé FlexLab X, un système d'automatisation de laboratoire complet, lors du salon ADLM 2024 à Chicago. Cette plateforme d'automatisation modulaire est conçue pour intégrer des analyseurs de différents fournisseurs via une interface unifiée, simplifiant considérablement les opérations de laboratoire et améliorant la manipulation des réactifs, le suivi des échantillons et l'intégration des données au sein des flux de travail automatisés. Le système FlexLab X a été développé pour répondre au besoin croissant de solutions d'automatisation évolutives et flexibles dans les laboratoires cliniques et de recherche à haut débit.

- En mai 2024, Abbott a déployé la solution d'automatisation GLP Systems Track dans plusieurs laboratoires de diagnostic en Inde. Cette plateforme, conçue pour optimiser les flux de travail des laboratoires à haut volume, automatise le traitement des échantillons et réduit jusqu'à 80 % les étapes manuelles. Ce déploiement a permis aux laboratoires d'améliorer leurs performances, de réduire les erreurs et d'optimiser l'utilisation et le suivi des réactifs, répondant ainsi à la demande croissante de tests de diagnostic sur l'un des marchés à la croissance la plus rapide d'Asie.

- En janvier 2025, Agilent Technologies a présenté de nouvelles solutions d'automatisation des flux de travail lors du congrès SLAS2025 à San Diego. L'événement a mis en lumière des outils d'automatisation améliorés pour la préparation, l'autodilution, l'acheminement et le lavage des échantillons, couvrant des applications en génomique, protéomique et analyse des biomolécules. Ce lancement, largement médiatisé, a démontré l'importance cruciale des technologies d'automatisation pour optimiser l'efficacité des laboratoires, le débit et la gestion de la chaîne d'approvisionnement en réactifs, tant en recherche clinique qu'en milieu hospitalier.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.