Global Laboratory Automation And Smart Reagent Supply Chain Market

Market Size in USD Billion

CAGR :

%

USD

1.42 Billion

USD

3.11 Billion

2025

2033

USD

1.42 Billion

USD

3.11 Billion

2025

2033

| 2026 –2033 | |

| USD 1.42 Billion | |

| USD 3.11 Billion | |

|

|

|

|

Laboratory Automation and Smart Reagent Supply Chain Market Size

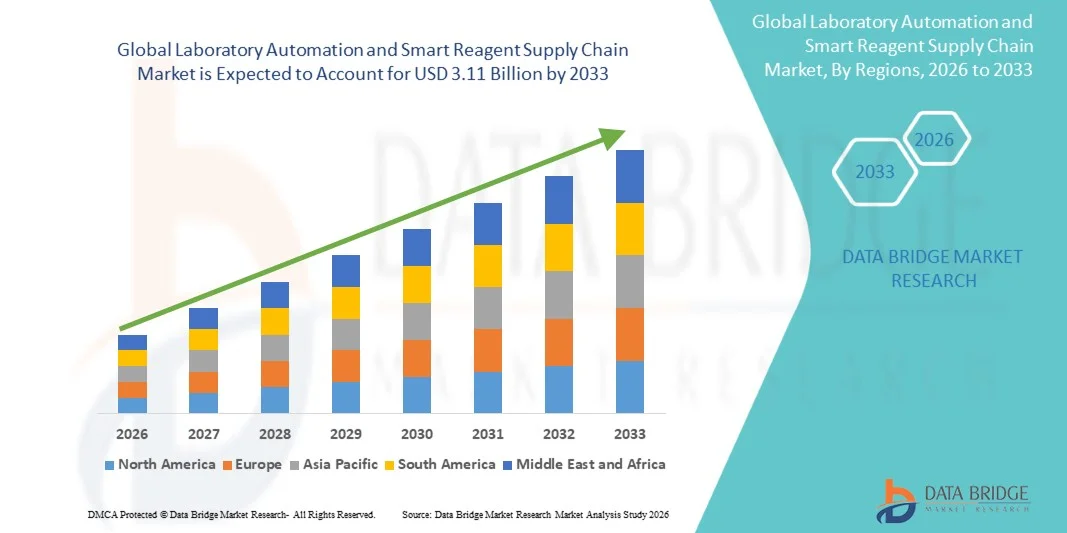

- The global laboratory automation & smart reagent supply chain market size was valued at USD 1.42 billion in 2025 and is expected to reach USD 3.11 billion by 2033, at a CAGR of 10.30% during the forecast period

- The market growth is largely fueled by the increasing demand for high-throughput, accurate, and efficient laboratory processes, coupled with advancements in automation technologies and smart reagent management systems that streamline workflows, reduce human error, and optimize resource utilization

- Furthermore, rising adoption of automated laboratory solutions in pharmaceutical, biotechnology, and research organizations, along with growing emphasis on cost efficiency and reproducibility in experiments, is establishing laboratory automation and smart reagent supply chain systems as critical tools for modern laboratories. These converging factors are accelerating the uptake of laboratory automation & smart reagent supply chain solutions, thereby significantly boosting the overall growth of the market

Laboratory Automation & Smart Reagent Supply Chain Market Analysis

- Laboratory automation and smart reagent supply chain systems, including automated liquid handling, sample processing, and intelligent reagent management platforms, are increasingly vital in modern laboratories due to their ability to enhance accuracy, reproducibility, and operational efficiency across research, clinical, and industrial applications

- The escalating demand for laboratory automation and smart reagent supply chain solutions is primarily driven by the growing need for high-throughput experimentation, reduction of manual errors, and cost optimization in pharmaceutical, biotechnology, and academic research laboratories. Integration with AI, IoT, and cloud-based inventory management further accelerates adoption

- North America dominated the laboratory automation & smart reagent supply chain market with the largest revenue share of approximately 37.5% in 2025, supported by advanced laboratory infrastructure, high R&D investments, and the strong presence of key market players. The U.S. accounted for the majority of regional revenue due to widespread adoption in pharma, biotech, and academic institutions

- Asia-Pacific is expected to be the fastest-growing region in the laboratory automation & smart reagent Supply Chain market during the forecast period, with a CAGR of around 8.2%, driven by increasing R&D investments, expanding biotech and pharmaceutical industries, and growing adoption of automated lab solutions in China, India, and Japan

- The Genomics & Proteomics application dominated the market in 2025, accounting for 48.7% of revenue

Report Scope and Laboratory Automation & Smart Reagent Supply Chain Market Segmentation

|

Attributes |

Laboratory Automation & Smart Reagent Supply Chain Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Laboratory Automation & Smart Reagent Supply Chain Market Trends

“Advancements in Laboratory Automation and Reagent Management”

- A significant and accelerating trend in the global laboratory automation & smart reagent Supply Chain market is the increasing adoption of automated systems for sample processing, reagent handling, and workflow management. These technologies are enhancing laboratory efficiency, reducing human error, and optimizing reagent usage across research, clinical, and industrial laboratories

- For instance, in 2024, Tecan launched its Fluent Laboratory Automation Workstation with integrated reagent management modules, enabling high-throughput screening and improved accuracy in life sciences research

- Integration of robotics, automated liquid handling, and digital tracking systems is improving workflow efficiency and allowing laboratories to process larger sample volumes with minimal manual intervention

- Growing demand for precision and reproducibility in pharmaceutical research, diagnostics, and clinical trials is driving adoption of automated laboratory systems

- The trend toward connected reagent supply chains and smart inventory management is reducing wastage, ensuring timely replenishment, and enhancing operational efficiency

Laboratory Automation & Smart Reagent Supply Chain Market Dynamics

Driver

“Growing Demand for Efficiency and High-Throughput Laboratory Operations”

- Rising demand for faster, more reliable laboratory results and increased productivity in research and diagnostic laboratories is a major driver for the Laboratory Automation & Smart Reagent Supply Chain market

- For instance, in 2023, Roche expanded its laboratory automation platforms in European clinical laboratories to streamline sample processing and accelerate diagnostic testing during peak influenza season

- Laboratories are increasingly prioritizing automation to reduce manual errors, minimize reagent consumption, and standardize processes across multiple locations

- The need for efficient workflows in high-volume testing, personalized medicine, and pharmaceutical R&D is further driving market growth

- Regulatory compliance, data traceability, and audit-ready workflows also encourage adoption of automated systems in both clinical and industrial laboratories

Restraint/Challenge

“High Initial Investment and Maintenance Costs”

- Despite the benefits, the high cost of implementing automated laboratory systems and the associated maintenance expenses remain key challenges, especially for small and mid-sized laboratories

- For instance, several research institutions in Asia-Pacific reported delays in automation adoption due to budget constraints and limited funding for advanced reagent management systems

- Compatibility issues between existing laboratory instruments and new automation platforms can also hinder implementation

- Training staff to operate and maintain complex automated systems is essential but can be time-consuming and costly

- Overcoming these challenges through cost-effective solutions, modular automation platforms, and scalable deployment models will be crucial for sustained growth in the Laboratory Automation & Smart Reagent Supply Chain market

Laboratory Automation & Smart Reagent Supply Chain Market Scope

The market is segmented on the basis of product type and application.

• By Product Type

On the basis of product type, the Laboratory Automation & Smart Reagent Supply Chain market is segmented into Automated Liquid Handling Systems and Sample Preparation & Analysis Instruments. The Automated Liquid Handling Systems segment dominated the market in 2025 with a revenue share of 46.5%, driven by the increasing adoption of high-throughput laboratory automation solutions in genomics, proteomics, and pharmaceutical research. These systems minimize human error, enhance reproducibility, and allow precise handling of microvolumes of reagents, which is crucial for modern high-throughput workflows. The growing trend toward miniaturization of assays, combined with rising R&D expenditure in biopharma and life sciences, fuels their strong adoption. Key end-users, including large pharmaceutical companies and academic research labs, value these systems for improved efficiency, reduced reagent consumption, and the ability to integrate seamlessly with other laboratory instruments. Increasing demand for automation in sample preparation and assay standardization further reinforces market dominance. The integration of AI and IoT-enabled monitoring enhances workflow transparency, operational efficiency, and compliance with regulatory standards. Geographic regions such as North America and Europe lead adoption due to high technological penetration, robust infrastructure, and significant investment in laboratory R&D. The segment also benefits from strong vendor support, including training, maintenance, and service offerings, making it highly attractive for both established and emerging laboratories.

The Sample Preparation & Analysis Instruments segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, owing to their critical role in drug discovery, molecular diagnostics, and proteomics research. The surge in demand is fueled by the growing need for rapid, reliable, and high-precision sample analysis, which accelerates research timelines and enhances reproducibility. These instruments are increasingly integrated with automated workflows to streamline sample prep and analytical processes, minimizing manual interventions. Emerging markets in Asia-Pacific, particularly China, India, and Japan, are investing heavily in laboratory infrastructure, contributing to growth. The expansion of genomics and personalized medicine research further drives adoption. Manufacturers are continuously innovating to offer multi-functional instruments that support diverse applications and high-throughput testing, making them attractive for both academic and industrial labs. Regulatory compliance, coupled with advancements in microfluidics and analytical software, further enhances market potential. Cost-efficiency, reduced sample processing time, and integration with cloud-based data analytics platforms also boost the segment’s rapid growth.

• By Application

On the basis of application, the market is segmented into Genomics & Proteomics and Drug Discovery & Development. The Genomics & Proteomics application dominated the market in 2025, accounting for 48.7% of revenue. The dominance is attributed to the exponential growth in sequencing technologies, protein analysis, and personalized medicine initiatives. Laboratories handling large-scale genomic and proteomic projects increasingly rely on automated liquid handling systems and smart reagent supply chains for precision and scalability. The need for high-throughput, reproducible results, combined with a reduction in manual handling errors, is critical for research institutions, biotech firms, and pharmaceutical companies. Additionally, the expansion of proteomics research for biomarker discovery and disease pathway analysis is driving the demand for automation in sample preparation, storage, and reagent tracking. North America and Europe are key markets due to well-established research infrastructure, advanced laboratory ecosystems, and significant funding for omics research. Integration with laboratory information management systems (LIMS) ensures enhanced operational efficiency and compliance. The segment’s continued investment in AI-driven analytics and IoT-enabled systems is further cementing its market leadership.

The Drug Discovery & Development segment is expected to register the fastest CAGR of 21.8% from 2026 to 2033, driven by the growing need to accelerate preclinical and clinical research processes. Automation in sample handling and reagent management reduces lead time, operational costs, and errors in high-throughput screening and compound testing. Pharmaceutical and biotech companies increasingly adopt smart reagent supply chains to optimize inventory, maintain reagent stability, and ensure traceability. The emergence of AI-assisted drug discovery platforms and integrated robotic systems enhances throughput and data integrity. Rapid expansion of pharmaceutical R&D in Asia-Pacific and Latin America is boosting market growth. Additionally, rising demand for biologics, vaccines, and personalized therapeutics is driving investment in automated laboratory infrastructure. The combination of cost savings, faster turnaround, and reliable reproducibility positions this segment as the fastest-growing application within the laboratory automation and smart reagent supply chain market.

Laboratory Automation & Smart Reagent Supply Chain Market Regional Analysis

- North America dominated the laboratory automation & smart reagent supply chain market with the largest revenue share of approximately 37.5% in 2025

- Supported by advanced laboratory infrastructure, high R&D investments, and the strong presence of key market players

- The region’s focus on improving laboratory efficiency, reducing errors, and accelerating research outcomes has further driven market growth

U.S. Laboratory Automation & Smart Reagent Supply Chain Market Insight

The U.S. laboratory automation & smart reagent supply chain market captured the majority of North America’s revenue share in 2025, driven by widespread adoption of automated laboratory solutions across pharmaceutical, biotechnology, and academic research institutions. High investments in R&D, the presence of leading laboratory automation solution providers, and initiatives to enhance laboratory efficiency and compliance with regulatory standards are key factors fueling market expansion. The integration of smart reagent supply chains with robotic and AI-enabled laboratory systems is further enhancing workflow optimization and accelerating adoption in the country.

Europe Laboratory Automation & Smart Reagent Supply Chain Market Insight

The Europe laboratory automation & smart reagent supply chain market is projected to grow at a substantial CAGR over the forecast period, driven by stringent quality standards, growing demand for high-throughput screening, and increasing adoption of automation in pharmaceutical and academic laboratories. Germany, France, and the U.K. are key contributors, supported by strong government initiatives to modernize laboratory infrastructure and increase R&D efficiency.

U.K. Laboratory Automation & Smart Reagent Supply Chain Market Insight

The U.K. laboratory automation & smart reagent supply chain market is expected to grow steadily during the forecast period, fueled by rising adoption of automated laboratory workflows, expansion of biotech and pharmaceutical sectors, and increasing investments in research and development. The presence of robust academic and healthcare research networks further accelerates demand for smart reagent supply chain solutions.

Germany Laboratory Automation & Smart Reagent Supply Chain Market Insight

Germany’s market is anticipated to expand at a notable CAGR during the forecast period, driven by a strong industrial base, growing biotech and pharmaceutical research, and adoption of cutting-edge laboratory automation solutions. Germany’s focus on precision, efficiency, and compliance with strict regulatory frameworks is promoting market uptake.

Asia-Pacific Laboratory Automation & Smart Reagent Supply Chain Market Insight

Asia-Pacific laboratory automation & smart reagent supply chain market is expected to be the fastest-growing region in the Laboratory Automation & Smart Reagent Supply Chain market, with a CAGR of around 8.2% during the forecast period. Growth is driven by increasing R&D investments, rapid expansion of pharmaceutical and biotechnology industries, and the adoption of automated lab solutions in countries such as China, India, and Japan. Rising government support, growing academic research initiatives, and increasing outsourcing of laboratory services are further fueling market expansion.

Japan Laboratory Automation & Smart Reagent Supply Chain Market Insight

Japan’s laboratory automation & smart reagent supply chain market is gaining momentum due to strong focus on technological innovation, widespread adoption of laboratory automation, and high investments in pharmaceutical and biotech research. Integration of smart reagent supply chains with automated laboratory equipment enhances workflow efficiency, reducing manual errors and turnaround times.

China Laboratory Automation & Smart Reagent Supply Chain Market Insight

China laboratory automation & smart reagent supply chain market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid growth in pharmaceutical and biotech R&D, increasing laboratory infrastructure, and government initiatives to support innovation and automation. The country’s focus on high-throughput screening and cost-efficient laboratory solutions is driving the adoption of smart reagent supply chain systems, with strong domestic manufacturers supporting market expansion.

Laboratory Automation & Smart Reagent Supply Chain Market Share

The Laboratory Automation & Smart Reagent Supply Chain industry is primarily led by well-established companies, including:

- Tecan Group Ltd. (Switzerland)

- Hamilton Company (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Thermo Fisher Scientific, Inc. (U.S.)

- PerkinElmer, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Eppendorf AG (Germany)

- Sartorius AG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Corning Incorporated (U.S.)

- Danaher Corporation (U.S.)

- Mettler-Toledo International Inc. (Switzerland)

- Hitachi High-Tech Corporation (Japan)

Latest Developments in Global Laboratory Automation & Smart Reagent Supply Chain Market

- In May 2023, Opentrons, a U.S.‑based lab automation company, launched its Flex robot platform to expand advanced lab automation solutions for life scientists worldwide, providing researchers with a flexible robotic system capable of performing a wide range of experiments including sample preparation and reagent handling. The Flex robot was developed to be programmable and compatible with existing lab workflows, enabling improved throughput, reduced manual intervention, and increased reproducibility, reflecting the industry’s shift toward more accessible and modular automation systems

- In December 2023, Hudson Robotics, Inc. acquired Tomtec Inc., a laboratory automation solutions provider, in a strategic move to strengthen its automation portfolio and expand offerings in high‑throughput reagent handling and automated liquid handling systems. This acquisition brought together complementary technologies to support end‑to‑end automated workflows and enhance reagent supply chain efficiency for customers in biotech, pharmaceutical, and academic research sectors

- In July 2024, Inpeco unveiled the FlexLab X total lab automation system at ADLM 2024 in Chicago, a modular automation platform designed to integrate analyzers from multiple vendors via a unified interface, significantly streamlining laboratory operations and enhancing reagent handling, sample tracking, and data integration across automated workflows. The FlexLab X system was introduced to address the growing need for scalable and flexible automation solutions in clinical and high‑throughput research laboratories

- In May 2024, Abbott introduced the GLP Systems Track automation solution at multiple diagnostic laboratories in India, a platform designed to support high‑volume laboratory workflows by automating sample processing and reducing up to 80% of manual steps. This deployment helped labs increase performance, reduce errors, and optimize reagent use and tracking, addressing rising diagnostic testing demand in one of Asia’s fastest‑growing markets

- In January 2025, Agilent Technologies showcased new automated workflow solutions at SLAS2025 in San Diego, highlighting enhanced automation tools for sample preparation, auto‑dilution, sample delivery, and washout processes covering applications in genomics, proteomics, and biomolecule analysis. This high‑visibility launch demonstrated how automation technologies are crucial for improving laboratory efficiency, throughput, and reagent supply chain management across research and clinical settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.