Global Truck Scale Market

Taille du marché en milliards USD

TCAC :

%

USD

2.17 Billion

USD

3.17 Billion

2025

2033

USD

2.17 Billion

USD

3.17 Billion

2025

2033

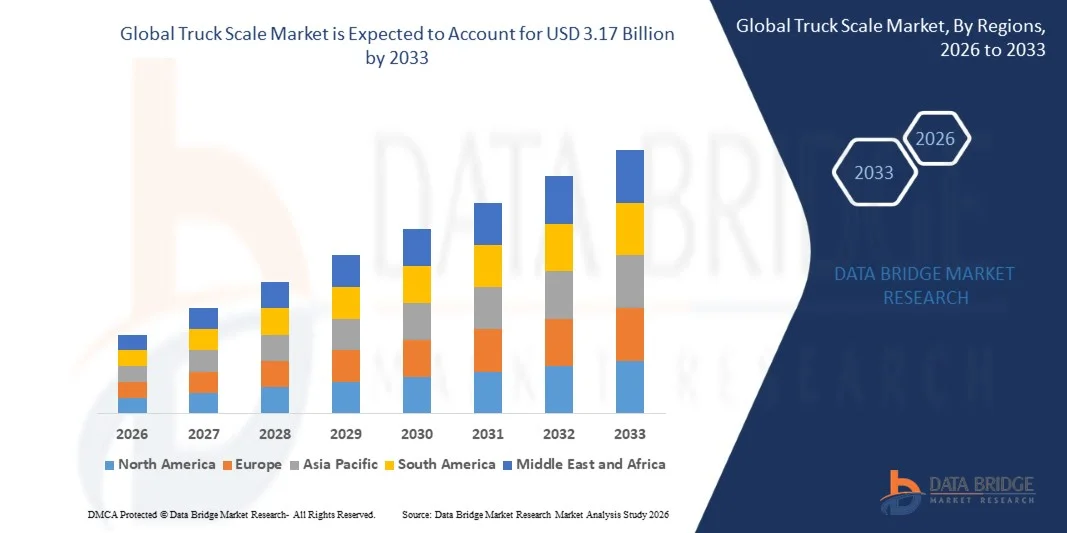

| 2026 –2033 | |

| USD 2.17 Billion | |

| USD 3.17 Billion | |

|

|

|

|

Segmentation du marché mondial des ponts-bascules pour camions, par technologie (ponts-bascules analogiques et numériques), type (ponts-bascules encastrés, ponts-bascules portables, systèmes de pesage par essieu, ponts-bascules et autres), application (transport et logistique, construction et engins lourds, agriculture, mines et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des balances pour camions

- Le marché mondial des ponts-bascules pour camions était évalué à 2,17 milliards de dollars en 2025 et devrait atteindre 3,17 milliards de dollars d'ici 2033 , avec un TCAC de 4,85 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de solutions de pesage précises et efficaces dans les secteurs de la logistique, du transport et de la construction, garantissant ainsi la conformité aux réglementations en matière de chargement et optimisant l'efficacité opérationnelle.

- L'adoption croissante de systèmes de pesage numériques et automatisés avancés, notamment les capteurs de charge sans fil et les ponts-bascules connectés, permet d'améliorer la précision, la surveillance en temps réel et de rationaliser les opérations.

Analyse du marché des ponts-bascules pour camions

- Le marché des ponts-bascules pour camions connaît une adoption croissante des solutions de pesage intelligentes intégrées aux plateformes cloud et logicielles pour l'analyse des données, la gestion de flotte et le reporting.

- Les progrès technologiques, tels que les ponts-bascules modulaires, portables et automatisés, améliorent la flexibilité d'installation, la durabilité et l'efficacité opérationnelle dans divers secteurs d'activité.

- L'Amérique du Nord a dominé le marché des ponts-bascules pour camions en 2025, avec une part de revenus de 38,50 %, portée par la demande croissante de gestion précise du poids des cargaisons, de conformité réglementaire et de modernisation des infrastructures logistiques et de transport.

- La région Asie-Pacifique devrait connaître le taux de croissance le plus élevé sur le marché mondial des ponts-bascules pour camions , sous l'effet de l'urbanisation, de la demande croissante d'équipements de construction et d'exploitation minière, de l'essor des activités industrielles et de l'adoption croissante de solutions de ponts-bascules numériques et connectées à l'Internet des objets (IoT).

- Le segment des ponts-bascules numériques pour camions a représenté la plus grande part de marché en termes de revenus en 2025, grâce à leur haute précision, à la transmission des données en temps réel et à leur intégration fluide avec les systèmes cloud. Ces ponts-bascules numériques permettent une pesée automatisée, réduisent les erreurs humaines et facilitent la conformité réglementaire, ce qui en fait un choix privilégié pour les opérations logistiques et industrielles à grande échelle.

Portée du rapport et segmentation du marché des ponts-bascules

|

Attributs |

Principaux enseignements du marché des ponts-bascules |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur le marché telles que la valeur du marché, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché élaboré par l'équipe de Data Bridge Market Research comprend une analyse approfondie d'experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTEL. |

Tendances du marché des ponts-bascules

« L’essor des ponts-bascules intelligents pour camions »

L'adoption croissante des ponts-bascules intelligents et automatisés transforme le paysage de la logistique et du transport en permettant des mesures de poids précises et en temps réel. Ces systèmes permettent une vérification immédiate du poids du chargement, réduisant ainsi les surcharges, minimisant les amendes et améliorant l'efficacité opérationnelle des chaînes d'approvisionnement. L'intégration avec des plateformes cloud et des applications mobiles permet également la surveillance à distance, l'analyse prédictive et une meilleure gestion de la flotte.

La demande croissante de gestion précise du poids dans des secteurs comme la construction, les mines et l'agriculture accélère l'adoption des ponts-bascules numériques et connectés. Ces solutions contribuent à prévenir les dommages aux infrastructures, à garantir la conformité réglementaire et à optimiser l'exploitation des flottes. De plus, les ponts-bascules intelligents fournissent des données historiques de poids permettant l'analyse des tendances, la planification des ressources et l'optimisation des pratiques de chargement.

Les progrès réalisés dans le domaine des ponts-bascules connectés et de l'analyse de données dans le cloud améliorent l'évolutivité, la précision et les capacités de surveillance. L'intégration aux systèmes de planification des ressources de l'entreprise (ERP) permet une prise de décision basée sur les données, une gestion des stocks optimisée et une planification logistique performante. Les fonctionnalités de maintenance prédictive et les alertes automatisées contribuent à améliorer la disponibilité et à réduire les interruptions d'exploitation.

• In 2023, Port of Long Beach (U.S.) deployed automated weighbridge systems with RFID and cloud connectivity as part of its digital cargo handling upgrades. The implementation improved cargo handling efficiency, reduced manual errors, and enhanced compliance reporting, while enabling better coordination across transport networks and shortening vessel turnaround times

• While smart truck scale adoption is increasing, sustained impact depends on infrastructure upgrades, consistent technology integration, and workforce training. Manufacturers and operators must focus on scalable deployment, digital monitoring, and predictive maintenance to fully realize market potential. Further, combining AI-driven insights with automated reporting can drive broader adoption across emerging markets

Truck Scale Market Dynamics

Driver

“Increasing Need for Compliance and Efficient Cargo Management”

• Stricter regulatory standards on axle load limits, overloading penalties, and transportation safety are pushing logistics companies and fleet operators to adopt truck scales for accurate weight verification. Compliance ensures safer roads and reduces legal liabilities, while also helping companies avoid penalties and improve reputation. Integration with digital reporting tools further streamlines regulatory documentation and audits

• Growing freight and cargo transport volumes across highways, ports, and industrial zones are driving demand for automated truck weighing solutions. Efficient cargo management reduces operational costs, improves turnaround times, and enhances overall fleet productivity. Real-time weight tracking also allows better scheduling, inventory management, and reduction in fuel consumption

• Integration of truck scales with digital systems, GPS tracking, and enterprise management platforms is enhancing operational visibility and predictive maintenance capabilities. Real-time data capture enables faster decision-making and reduces downtime. In addition, predictive analytics help identify patterns in cargo handling, optimize logistics routes, and prevent equipment overuse

• In 2022, DB Schenker at its German logistics depots implemented IoT‑enabled truck scales integrated with fleet management systems, resulting in improved loading efficiency, reduced vehicle wear and tear, and compliance with transport regulations. The adoption also enabled automated reporting to regulatory authorities and enhanced end‑to‑end visibility across its European supply chain operations

• While regulatory compliance and operational efficiency are supporting market growth, challenges such as infrastructure limitations and technology integration require careful planning and investment. Stakeholders must also focus on cybersecurity, cloud integration, and training programs to maximize benefits from digital truck scale adoption

Restraint/Challenge

“High Installation Costs and Limited Infrastructure in Remote Regions”

• The high capital expenditure for installing advanced truck scales, including automated weighbridges and connected systems, can be prohibitive for small operators and rural transport hubs. Cost remains a major barrier to adoption, and payback periods can extend several years depending on scale and usage. Financial incentives or leasing models may be required to encourage adoption in cost-sensitive markets

• In many developing regions, lack of supporting infrastructure, including reliable power supply and internet connectivity, restricts the deployment of digital truck scales. Manual weighing practices still dominate in such areas, affecting efficiency. Limited local technical support and maintenance personnel further hinder consistent operation and scalability of advanced systems

• Supply chain and maintenance challenges, including calibration, service access, and spare part availability, can limit the operational reliability of truck scales, particularly in remote locations. Downtime due to malfunction or delays in repairs can impact compliance, scheduling, and overall productivity. Developing regional service hubs and training technicians is critical for long-term adoption

• In 2023, Transnet National Ports Authority (South Africa) reported delays in rolling out automated truck scale systems due to inadequate infrastructure and high installation costs at several container terminals. This affected accurate weight monitoring, led to longer cargo turnaround times, increased vehicle wear due to manual weighing practices, and posed challenges in complying with updated transport regulations

• While technology is advancing, addressing cost, infrastructure, and maintenance challenges is crucial. Market stakeholders must focus on affordable, scalable solutions, regional infrastructure development, and integrated service support to unlock long-term growth potential. Collaboration with local authorities and public-private partnerships can further accelerate adoption in underserved regions

Truck Scale Market Scope

The global truck scale market is segmented into notable segments based on technology, type, and application.

• By Technology

On the basis of technology, the global truck scale market is segmented into analog truck scales and digital truck scales. The digital truck scales segment held the largest market revenue share in 2025, driven by their high accuracy, real-time data reporting, and seamless integration with cloud-based systems. Digital truck scales enable automated weight capture, reduce human error, and facilitate regulatory compliance, making them a preferred choice for large-scale logistics and industrial operations.

Le segment des ponts-bascules analogiques pour camions devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à leur prix abordable, leur facilité d'installation et leurs faibles besoins de maintenance. Les ponts-bascules analogiques sont particulièrement appréciés des petites et moyennes entreprises ainsi que dans les zones reculées où l'infrastructure numérique est limitée, car ils offrent une mesure de poids fiable sans dépendre d'une connexion internet.

• Par type

Le marché des ponts-bascules pour camions est segmenté selon le type de système : ponts-bascules encastrés, ponts-bascules portables, systèmes de pesage par essieu, ponts-bascules fixes et autres. En 2025, le segment des ponts-bascules détenait la plus grande part de revenus, grâce à leur capacité à peser des volumes importants de marchandises et à leur intégration aux systèmes logistiques automatisés. Les ponts-bascules permettent un débit optimal, réduisent les surcharges et améliorent l’efficacité opérationnelle globale.

Le segment des balances portables devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à leur flexibilité, leur facilité de déploiement et leur adéquation aux besoins de pesage temporaires ou en zones isolées. Les balances portables sont de plus en plus utilisées dans les secteurs de la construction, de l'agriculture et des mines, où la mobilité et la rapidité d'installation sont essentielles.

• Sur demande

Selon l'application, le marché des ponts-bascules pour camions est segmenté en transport et logistique, construction et engins lourds, agriculture, mines et carrières, et autres. Le segment du transport et de la logistique détenait la plus grande part de revenus en 2025, porté par le besoin de vérification précise du poids des cargaisons, de conformité réglementaire et d'une gestion efficace des flottes.

Le secteur des engins de construction et de chantier devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par la demande croissante de solutions précises pour la gestion des charges, la prévention des dommages aux infrastructures et le renforcement de la sécurité lors du transport de matériaux lourds. Ces balances permettent un suivi en temps réel, réduisent les risques opérationnels et optimisent les flux de travail sur les chantiers.

Analyse régionale du marché des ponts-bascules pour camions

• L’Amérique du Nord a dominé le marché des ponts-bascules pour camions en 2025, avec la plus grande part de revenus (38,50 %), sous l’effet d’une demande croissante de gestion précise du poids des cargaisons, de conformité réglementaire et de modernisation des infrastructures logistiques et de transport.

• Les gestionnaires de flottes et les autorités portuaires de la région apprécient particulièrement la précision, l'automatisation et l'intégration offertes par les ponts-bascules numériques pour camions avec les systèmes ERP et IoT, permettant une surveillance en temps réel et une manutention efficace des marchandises.

Cette adoption généralisée est également favorisée par l'augmentation des volumes de fret, les infrastructures avancées et le besoin croissant de prévenir la surcharge et d'optimiser les opérations de la chaîne d'approvisionnement, faisant des ponts-bascules pour camions une solution privilégiée pour les secteurs du transport et de l'industrie.

Analyse du marché américain des ponts-bascules pour camions

Le marché américain des ponts-bascules pour camions a généré la plus grande part de revenus en Amérique du Nord en 2025, porté par l'expansion rapide des secteurs de la logistique, du e-commerce et des opérations industrielles. Les entreprises privilégient de plus en plus l'automatisation et la vérification du poids en temps réel afin de garantir la conformité réglementaire et l'efficacité opérationnelle. L'adoption croissante des ponts-bascules connectés, de la technologie RFID et des systèmes de surveillance basés sur le cloud stimule davantage la croissance du marché. Par ailleurs, le développement continu des infrastructures et les initiatives gouvernementales visant à améliorer la sécurité des transports contribuent significativement à son expansion.

Analyse du marché européen des ponts-bascules pour camions

Le marché européen des ponts-bascules pour camions devrait connaître la croissance la plus rapide entre 2026 et 2033, principalement sous l'effet de réglementations strictes en matière de charge à l'essieu, de l'augmentation des volumes de transport de marchandises et du besoin croissant de solutions de pesage numériques. L'urbanisation et l'expansion industrielle favorisent l'adoption de ponts-bascules automatisés et intelligents. Les opérateurs européens privilégient les systèmes offrant une intégration avec les logiciels de gestion de flotte, la maintenance prédictive et la production de rapports de conformité en temps réel. La région connaît une croissance dans les ports, les plateformes logistiques et les sites industriels, avec de nouvelles installations et la modernisation des ponts-bascules existants.

Analyse du marché britannique des ponts-bascules pour camions

Le marché britannique des ponts-bascules pour camions devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par la modernisation des infrastructures logistiques et la demande croissante de solutions de gestion du fret performantes. Les préoccupations liées aux amendes pour surcharge, aux réglementations en matière de sécurité et à la protection des infrastructures incitent les exploitants de flottes à adopter les ponts-bascules numériques. Les systèmes de transport et industriels de pointe du Royaume-Uni, ainsi que les incitations gouvernementales en faveur des solutions de pesage intelligentes, devraient continuer à stimuler la croissance du marché.

Analyse du marché allemand des ponts-bascules pour camions

Le marché allemand des ponts-bascules pour camions devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par une sensibilisation accrue aux technologies de pesage numérique et par le renforcement de la réglementation relative au chargement des marchandises. L'infrastructure de transport performante de l'Allemagne, associée à une priorité accordée à l'efficacité et au développement durable, favorise l'adoption des ponts-bascules automatisés dans les secteurs industriels et logistiques. L'intégration aux systèmes ERP et IoT se généralise, permettant aux opérateurs d'optimiser leurs opérations et de réduire leurs coûts de maintenance, tout en garantissant la conformité aux réglementations en vigueur.

Analyse du marché des ponts-bascules pour camions en Asie-Pacifique

The Asia-Pacific truck scale market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing industrialization, rising trade volumes, and technological advancements in countries such as China, Japan, and India. The region's growing logistics sector, supported by government initiatives to improve transport infrastructure and promote digitalization, is driving the adoption of smart truck scales. In addition, as APAC becomes a manufacturing hub for weighbridge components, affordability and accessibility of truck scales are expanding to a wider range of operators and industrial users.

Japan Truck Scale Market Insight

The Japan truck scale market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high industrial activity, advanced logistics systems, and emphasis on transport safety. Japanese operators prioritize real-time weight monitoring and integration with automated fleet management systems. The adoption of IoT-enabled digital truck scales and cloud-based data platforms is enhancing operational efficiency and compliance reporting. Moreover, the need for precise cargo handling in ports and construction sectors is likely to spur further market growth.

China Truck Scale Market Insight

The China truck scale market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid industrialization, expanding logistics networks, and increasing demand for compliance with axle load regulations. China represents one of the largest markets for weighbridge solutions, with adoption spanning transportation hubs, ports, mining, and agriculture sectors. The government’s push toward smart cities and infrastructure modernization, along with strong domestic manufacturers, is driving market expansion and wider accessibility of automated truck scale systems.

Truck Scale Market Share

The Truck Scale industry is primarily led by well-established companies, including:

- Avery Weigh-Tronix (U.S.)

- METTLER TOLEDO (U.S.)

- Cardinal / Detecto Scale (U.S.)

- Rice Lake Weighing Systems (U.S.)

- Walz Scale & Scanner Weighing Solutions (U.S.)

- B-TEK Scales LLC (U.S.)

- Fairbanks Scales (U.S.)

- PRECIA MOLEN (France)

- Essae Digitronic Pvt. (India)

- JFE Advantech Co., Ltd. (Japan)

Latest Developments in Global Truck Scale Market

- In April 2025, Avery Weigh-Tronix, achieved UKAS accreditation for calibrating high-capacity non-automatic weighing machines up to 50,000 kilograms, enhancing the precision and reliability of its calibration services. This development allows the company to serve a broader range of industrial clients requiring accurate weight measurements for heavy-duty applications, strengthening its market reputation and supporting industry compliance with international standards

- En janvier 2025, Rice Lake Weighing Systems a lancé le système de pesage en mouvement SURVIVOR OTR-IMS afin d'optimiser l'efficacité opérationnelle des installations à fort trafic. Ce système permet un pesage en une seule étape conforme à la réglementation, sans arrêt des camions, réduisant ainsi les temps d'attente, les émissions et les files d'attente. Son intégration avec les balances SURVIVOR OTR existantes et nouvelles améliore le débit, la sécurité et la productivité globale des flottes, ayant un impact positif sur les opérations logistiques et de transport à l'échelle mondiale.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.