Global Truck Scale Market

Market Size in USD Billion

CAGR :

%

USD

2.17 Billion

USD

3.17 Billion

2025

2033

USD

2.17 Billion

USD

3.17 Billion

2025

2033

| 2026 –2033 | |

| USD 2.17 Billion | |

| USD 3.17 Billion | |

|

|

|

|

Truck Scale Market Size

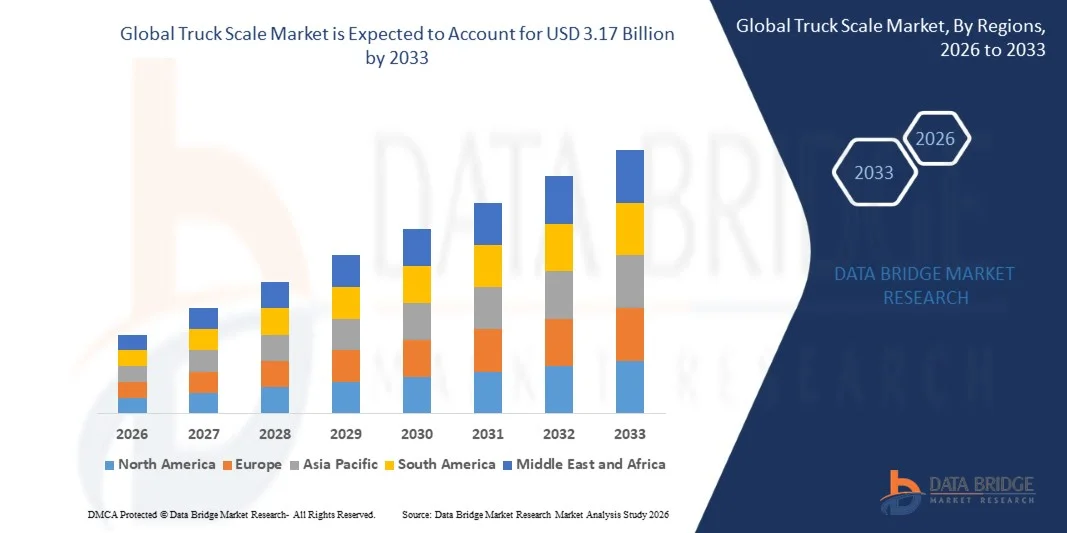

- The global truck scale market size was valued at USD 2.17 billion in 2025 and is expected to reach USD 3.17 billion by 2033, at a CAGR of 4.85% during the forecast period

- The market growth is largely fuelled by the increasing demand for accurate and efficient weighing solutions in logistics, transportation, and construction industries, which ensures compliance with load regulations and optimizes operational efficiency

- Rising adoption of advanced digital and automated weighing systems, including wireless load sensors and IoT-enabled truck scales, is driving improved accuracy, real-time monitoring, and streamlined operations

Truck Scale Market Analysis

- The truck scale market is witnessing increased adoption of smart weighing solutions integrated with cloud and software platforms for data analytics, fleet management, and reporting

- Technological advancements such as modular, portable, and automated truck scales are enhancing installation flexibility, durability, and operational efficiency across various industries

- North America dominated the truck scale market with the largest revenue share of 38.50% in 2025, driven by increasing demand for accurate cargo weight management, regulatory compliance, and modernization of logistics and transportation infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global truck scale market, driven by urbanization, growing demand for construction and mining equipment, rising industrial activities, and increasing adoption of digital and IoT-enabled weighbridge solutions

- The digital truck scales segment held the largest market revenue share in 2025, driven by their high accuracy, real-time data reporting, and seamless integration with cloud-based systems. Digital truck scales enable automated weight capture, reduce human error, and facilitate regulatory compliance, making them a preferred choice for large-scale logistics and industrial operations

Report Scope and Truck Scale Market Segmentation

|

Attributes |

Truck Scale Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Truck Scale Market Trends

“Rise of Smart and Weighbridge-Integrated Truck Scales”

• The growing adoption of smart and automated truck scales is transforming the logistics and transportation landscape by enabling accurate, real-time weight measurements. These systems allow immediate verification of cargo weight, reducing overloading, minimizing fines, and improving operational efficiency across supply chains. Integration with cloud-based platforms and mobile apps also allows remote monitoring, predictive analytics, and better fleet management

• Increasing demand for precise weight management in industries such as construction, mining, and agriculture is accelerating the adoption of digital and connected truck scales. These solutions help prevent damage to infrastructure, ensure regulatory compliance, and streamline fleet operations. In addition, smart scales provide historical weight data for trend analysis, resource planning, and optimizing loading practices

• Advances in IoT-enabled weighbridge technology and cloud-based data analytics are improving scalability, accuracy, and monitoring capabilities. Integration with enterprise resource planning (ERP) systems enables data-driven decision-making, inventory management, and optimized logistics planning. Predictive maintenance features and automated alerts further enhance uptime and reduce operational disruptions

• In 2023, Port of Long Beach (U.S.) deployed automated weighbridge systems with RFID and cloud connectivity as part of its digital cargo handling upgrades. The implementation improved cargo handling efficiency, reduced manual errors, and enhanced compliance reporting, while enabling better coordination across transport networks and shortening vessel turnaround times

• While smart truck scale adoption is increasing, sustained impact depends on infrastructure upgrades, consistent technology integration, and workforce training. Manufacturers and operators must focus on scalable deployment, digital monitoring, and predictive maintenance to fully realize market potential. Further, combining AI-driven insights with automated reporting can drive broader adoption across emerging markets

Truck Scale Market Dynamics

Driver

“Increasing Need for Compliance and Efficient Cargo Management”

• Stricter regulatory standards on axle load limits, overloading penalties, and transportation safety are pushing logistics companies and fleet operators to adopt truck scales for accurate weight verification. Compliance ensures safer roads and reduces legal liabilities, while also helping companies avoid penalties and improve reputation. Integration with digital reporting tools further streamlines regulatory documentation and audits

• Growing freight and cargo transport volumes across highways, ports, and industrial zones are driving demand for automated truck weighing solutions. Efficient cargo management reduces operational costs, improves turnaround times, and enhances overall fleet productivity. Real-time weight tracking also allows better scheduling, inventory management, and reduction in fuel consumption

• Integration of truck scales with digital systems, GPS tracking, and enterprise management platforms is enhancing operational visibility and predictive maintenance capabilities. Real-time data capture enables faster decision-making and reduces downtime. In addition, predictive analytics help identify patterns in cargo handling, optimize logistics routes, and prevent equipment overuse

• In 2022, DB Schenker at its German logistics depots implemented IoT‑enabled truck scales integrated with fleet management systems, resulting in improved loading efficiency, reduced vehicle wear and tear, and compliance with transport regulations. The adoption also enabled automated reporting to regulatory authorities and enhanced end‑to‑end visibility across its European supply chain operations

• While regulatory compliance and operational efficiency are supporting market growth, challenges such as infrastructure limitations and technology integration require careful planning and investment. Stakeholders must also focus on cybersecurity, cloud integration, and training programs to maximize benefits from digital truck scale adoption

Restraint/Challenge

“High Installation Costs and Limited Infrastructure in Remote Regions”

• The high capital expenditure for installing advanced truck scales, including automated weighbridges and connected systems, can be prohibitive for small operators and rural transport hubs. Cost remains a major barrier to adoption, and payback periods can extend several years depending on scale and usage. Financial incentives or leasing models may be required to encourage adoption in cost-sensitive markets

• In many developing regions, lack of supporting infrastructure, including reliable power supply and internet connectivity, restricts the deployment of digital truck scales. Manual weighing practices still dominate in such areas, affecting efficiency. Limited local technical support and maintenance personnel further hinder consistent operation and scalability of advanced systems

• Supply chain and maintenance challenges, including calibration, service access, and spare part availability, can limit the operational reliability of truck scales, particularly in remote locations. Downtime due to malfunction or delays in repairs can impact compliance, scheduling, and overall productivity. Developing regional service hubs and training technicians is critical for long-term adoption

• In 2023, Transnet National Ports Authority (South Africa) reported delays in rolling out automated truck scale systems due to inadequate infrastructure and high installation costs at several container terminals. This affected accurate weight monitoring, led to longer cargo turnaround times, increased vehicle wear due to manual weighing practices, and posed challenges in complying with updated transport regulations

• While technology is advancing, addressing cost, infrastructure, and maintenance challenges is crucial. Market stakeholders must focus on affordable, scalable solutions, regional infrastructure development, and integrated service support to unlock long-term growth potential. Collaboration with local authorities and public-private partnerships can further accelerate adoption in underserved regions

Truck Scale Market Scope

The global truck scale market is segmented into notable segments based on technology, type, and application.

• By Technology

On the basis of technology, the global truck scale market is segmented into analog truck scales and digital truck scales. The digital truck scales segment held the largest market revenue share in 2025, driven by their high accuracy, real-time data reporting, and seamless integration with cloud-based systems. Digital truck scales enable automated weight capture, reduce human error, and facilitate regulatory compliance, making them a preferred choice for large-scale logistics and industrial operations.

The analog truck scales segment is expected to witness the fastest growth rate from 2026 to 2033, driven by their affordability, ease of installation, and minimal maintenance requirements. Analog scales are particularly popular in small-to-medium operations and remote locations where digital infrastructure may be limited, providing reliable weight measurement without dependency on connectivity.

• By Type

On the basis of type, the truck scale market is segmented into in-ground scales, portable scales, axle weighing systems, weighbridge scales, and others. The weighbridge scales segment held the largest market revenue share in 2025, due to their suitability for high-volume cargo weighing and integration with automated logistics systems. Weighbridge scales enable efficient throughput, reduce overloading, and improve overall operational efficiency.

The portable scales segment is expected to witness the fastest growth rate from 2026 to 2033, driven by their flexibility, ease of deployment, and suitability for temporary or remote weighing requirements. Portable scales are increasingly used in construction, agriculture, and mining sectors where mobility and quick installation are essential.

• By Application

On the basis of application, the truck scale market is segmented into transportation & logistics, construction & heavy equipment, agriculture & farming, mining & quarrying, and others. The transportation & logistics segment held the largest market revenue share in 2025, fueled by the need for accurate cargo weight verification, regulatory compliance, and efficient fleet operations.

The construction & heavy equipment segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing demand for precise load management, prevention of infrastructure damage, and enhanced safety during transport of heavy materials. These scales support real-time monitoring, reduce operational risks, and improve workflow efficiency on construction sites.

Truck Scale Market Regional Analysis

• North America dominated the truck scale market with the largest revenue share of 38.50% in 2025, driven by increasing demand for accurate cargo weight management, regulatory compliance, and modernization of logistics and transportation infrastructure

• Fleet operators and port authorities in the region highly value the precision, automation, and integration offered by digital truck scales with ERP and IoT systems, enabling real-time monitoring and efficient cargo handling

• This widespread adoption is further supported by rising freight volumes, advanced infrastructure, and the growing need to prevent overloading and optimize supply chain operations, making truck scales a preferred solution for transportation and industrial sectors

U.S. Truck Scale Market Insight

The U.S. truck scale market captured the largest revenue share in 2025 within North America, fueled by the rapid expansion of logistics, e-commerce, and industrial operations. Companies are increasingly prioritizing automation and real-time weight verification to ensure regulatory compliance and operational efficiency. The rising adoption of IoT-enabled weighbridges, RFID technology, and cloud-based monitoring systems further drives market growth. Moreover, ongoing infrastructure development and government initiatives to enhance transport safety are significantly contributing to market expansion.

Europe Truck Scale Market Insight

The Europe truck scale market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent axle load regulations, rising cargo transport volumes, and the increasing need for digital weighing solutions. Urbanization and industrial expansion are fostering the adoption of automated and smart truck scales. European operators are drawn to systems that offer integration with fleet management software, predictive maintenance, and real-time compliance reporting. The region is witnessing growth across ports, logistics hubs, and industrial facilities, with both new installations and retrofitting of existing weighbridges.

U.K. Truck Scale Market Insight

The U.K. truck scale market is expected to witness the fastest growth rate from 2026 to 2033, driven by modernization of logistics infrastructure and the demand for efficient cargo management. Concerns regarding overloading penalties, safety regulations, and infrastructure protection are encouraging fleet operators to adopt digital truck scales. The UK’s advanced transport and industrial systems, along with government incentives for smart weighing solutions, are expected to continue stimulating market growth.

Germany Truck Scale Market Insight

The Germany truck scale market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of digital weighing technologies and regulatory enforcement on cargo loads. Germany’s well-developed transport infrastructure, coupled with a focus on efficiency and sustainability, promotes the adoption of automated truck scales across industrial and logistics sectors. Integration with ERP and IoT systems is becoming increasingly prevalent, allowing operators to optimize operations and reduce maintenance costs while ensuring compliance with transport regulations.

Asia-Pacific Truck Scale Market Insight

The Asia-Pacific truck scale market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing industrialization, rising trade volumes, and technological advancements in countries such as China, Japan, and India. The region's growing logistics sector, supported by government initiatives to improve transport infrastructure and promote digitalization, is driving the adoption of smart truck scales. In addition, as APAC becomes a manufacturing hub for weighbridge components, affordability and accessibility of truck scales are expanding to a wider range of operators and industrial users.

Japan Truck Scale Market Insight

The Japan truck scale market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high industrial activity, advanced logistics systems, and emphasis on transport safety. Japanese operators prioritize real-time weight monitoring and integration with automated fleet management systems. The adoption of IoT-enabled digital truck scales and cloud-based data platforms is enhancing operational efficiency and compliance reporting. Moreover, the need for precise cargo handling in ports and construction sectors is likely to spur further market growth.

China Truck Scale Market Insight

The China truck scale market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid industrialization, expanding logistics networks, and increasing demand for compliance with axle load regulations. China represents one of the largest markets for weighbridge solutions, with adoption spanning transportation hubs, ports, mining, and agriculture sectors. The government’s push toward smart cities and infrastructure modernization, along with strong domestic manufacturers, is driving market expansion and wider accessibility of automated truck scale systems.

Truck Scale Market Share

The Truck Scale industry is primarily led by well-established companies, including:

- Avery Weigh-Tronix (U.S.)

- METTLER TOLEDO (U.S.)

- Cardinal / Detecto Scale (U.S.)

- Rice Lake Weighing Systems (U.S.)

- Walz Scale & Scanner Weighing Solutions (U.S.)

- B-TEK Scales LLC (U.S.)

- Fairbanks Scales (U.S.)

- PRECIA MOLEN (France)

- Essae Digitronic Pvt. (India)

- JFE Advantech Co., Ltd. (Japan)

Latest Developments in Global Truck Scale Market

- In April 2025, Avery Weigh-Tronix, achieved UKAS accreditation for calibrating high-capacity non-automatic weighing machines up to 50,000 kilograms, enhancing the precision and reliability of its calibration services. This development allows the company to serve a broader range of industrial clients requiring accurate weight measurements for heavy-duty applications, strengthening its market reputation and supporting industry compliance with international standards

- In January 2025, Rice Lake Weighing Systems, launched the SURVIVOR OTR-IMS in-motion truck scale system to optimize operational efficiency at high-traffic facilities. The system enables Legal-for-Trade single-draft weighing without stopping trucks, reducing idle time, emissions, and queues. Its integration with existing and new SURVIVOR OTR scales enhances throughput, safety, and overall fleet productivity, positively impacting logistics and transportation operations globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.