アジア太平洋地域の粘性補充市場、供給源別(動物由来および非動物由来)、年齢層別(高齢者および成人)、注射(単回注射、3回注射、5回注射)、分子量別(中分子量、低分子量、高分子量)、エンドユーザー別(病院、整形外科クリニック、外来ケアセンター、その他)、流通チャネル別(直接入札および小売販売)。

アジア太平洋地域の粘性補充市場の分析と洞察

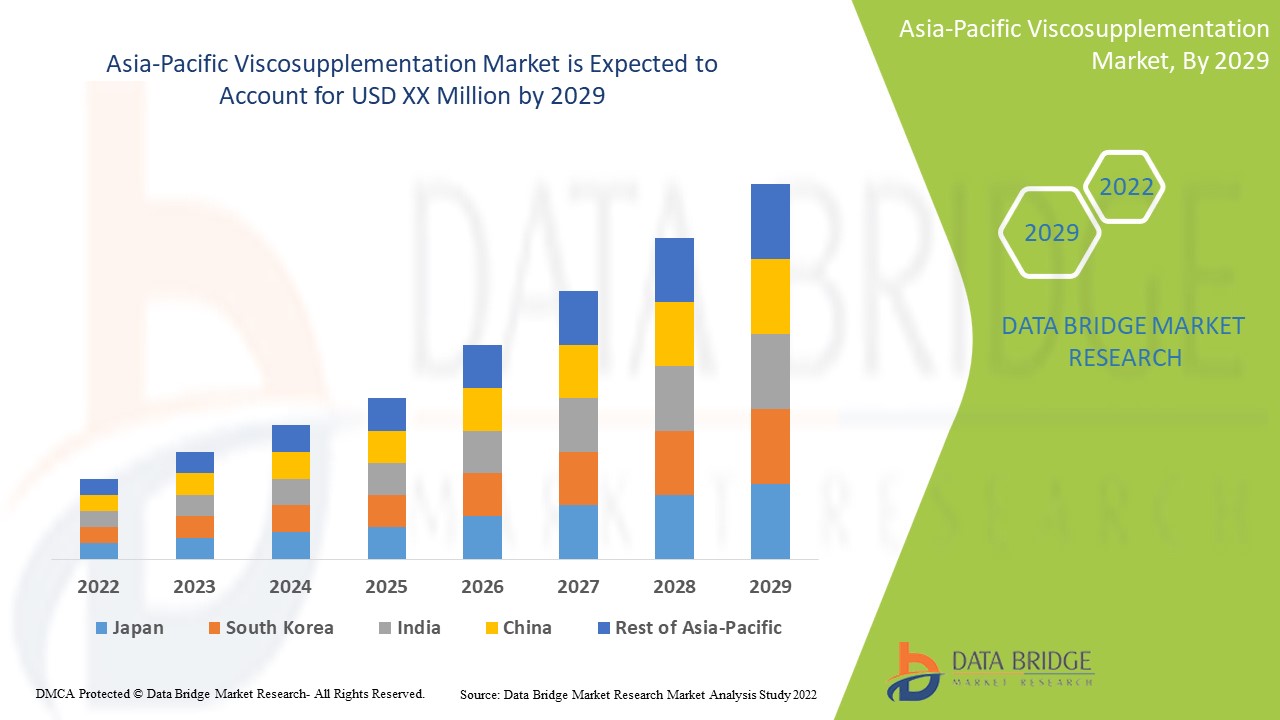

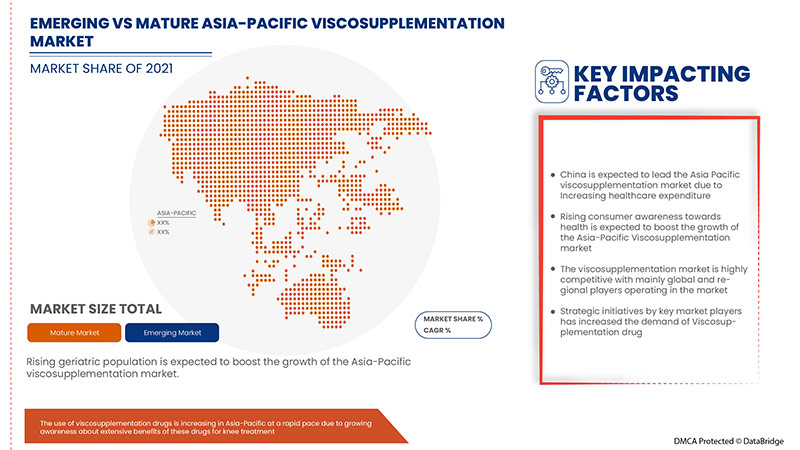

アジア太平洋地域の粘性補充療法市場は、2022年から2029年の予測期間に市場の成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に9.6%のCAGRで成長すると分析しています。ヘルスケア分野における粘性補充療法の技術的進歩の増加は、予測期間におけるアジア太平洋地域の粘性補充療法市場の成長を促進するもう1つの要因です。

しかし、治療に伴う高額な費用と、一時的な注射、注射部位の痛み、腫れ、熱、赤みの消失などの副作用が、市場の成長を抑制します。主要な市場プレーヤーによるパートナーシップや買収などの戦略的提携の採用は、アジア太平洋地域の粘性補充市場の成長の機会となります。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 |

|

定量単位 |

売上高(百万米ドル)、販売数量(単位:台)、価格(米ドル) |

|

対象セグメント |

原料別(動物由来および非動物由来)、年齢層別(高齢者および成人)、注射(単回注射、3回注射、5回注射)、分子量別(中分子量、低分子量、高分子量)、エンドユーザー別(病院、整形外科クリニック、外来診療センター、その他)、流通チャネル別(直接入札および小売販売) |

|

対象国 |

中国、日本、インド、韓国、シンガポール、オーストラリア、タイ、ベトナム、マレーシア、台湾、インドネシア、フィリピン、その他アジア太平洋地域 |

|

対象となる市場プレーヤー |

アジア太平洋地域の粘度サプリメント市場で活動している主要企業には、Anika Therapeutics, Inc.、生化学工業株式会社、Bioventus、Fidia Farmaceutici SPA、Ferring BV、sanofi-aventis US LLC、Zimmer Biomet、OrthogenRx, Inc. (AVNS の子会社) があります。 )、アプティッセン、ジョンソン・エンド・ジョンソン・サービシズ社、LG化学、ヴィアトリスInc.、IBSA Institut Biochimique SA、Ortobrand International、TRB CHEMEDICA SA、Teva Pharmaceutical Industries Ltd.、Lifecore (Landec Corporation の子会社)、VIRCHOW BIOTECH、Zuventus HealthCare Ltd. (Emcure Pharmaceuticals の子会社) など。 |

市場の定義

変形性関節症または外傷性関節炎を患うヒトおよび動物の関節の痛みを長期にわたって緩和する治療パラダイムである粘性補充療法の開発は、関節炎状態ではヒアルロン酸の平均分子量と濃度が低下するという発見に基づいています。その結果、滑液の弾性粘性特性が大幅に低下します。粘性補充療法は、病的な滑液または滲出液を関節穿刺によって関節から除去し、病的な関節液の 16 ~ 30 倍の濃度、健康な滑液中のヒアルロン酸の 2 ~ 5 倍の濃度を持つ高度に精製されたヒアルロン酸溶液で置き換える治療プロセスです。今日治療目的で使用されているヒアルロン酸の一部の製剤では、レオロジー特性 (粘度と弾性) が低くなっています。したがって、この液体の弾性粘性は、関節炎の関節から採取した液体の弾性粘性に似ています。世界中の患者が利用できる別の製剤は、ヒアルロン酸溶液よりも弾性粘性が大幅に高いヒアルロン酸誘導体 (ヒラン) で構成されています。この製剤は、若くて健康な人の体内の液体と同等のレオロジー特性を持っています。粘性補充療法の臨床的利点は、関節炎の関節の痛みを長期間緩和できることです。

さらに、変形性関節症の非外科的治療に対する需要の増加、生活習慣に起因する疾患の蔓延、ヒアルロン酸ベースの治療法の開発の進歩などが、市場を牽引すると予想される要因の一部です。

市場の動向

ドライバー

- 高齢化人口の増加

高齢化に伴い、致命的な外傷により入院する高齢患者も増加しています。膝関節症の罹患率の上昇により、診断と治療の需要が高まっています。人口の増加に伴い、医療制度への圧力が高まっています。適切な治療の必要性が高まるにつれて、サルコペニア、骨粗鬆症、骨減少症、その他の合併症などの膝関節症の予防と治療のためのケア、サービス、技術の需要も比例して急増しています。高齢者はこれらの症状にかかりやすく、骨や関節が脆弱になります。このような患者には、身体に関連する即時かつ効率的な効果を提供するために、粘性補充療法が処置に使用されます。

高齢化と変形性関節症の罹患率の上昇に伴い、病気の早期診断の需要も高まっており、世界中の医療システムにおいて治療のための粘性補充療法の必要性が高まっています。

- 骨粗鬆症および変形性関節症のリスク増加

骨粗鬆症は、骨密度や骨量の低下、または骨の質や構造の何らかの変化により進行する骨の病気です。骨粗鬆症は、骨の強度の低下により骨折のリスクを高める可能性があります。男性よりも女性に多く見られます。月経後の女性は、骨粗鬆症が無症状で通常は症状が現れないため、骨折することがよくあります。高齢者は主に骨粗鬆症になりやすい傾向があります。変形性関節症は、関節疾患または関節と周囲の組織の炎症です。このような状態が発生すると、人の運動能力に影響が出ます。

骨粗鬆症や変形性関節症などのサイレント疾患は症状が現れず、人の骨を弱め、脊椎の奇形、骨折、突然の転倒、骨折など、重大な死亡事故につながります。したがって、これらの疾患のリスクが増加すると、そのような疾患による奇形を治療するために必要な粘性補充療法の需要が直接的に高まります。したがって、骨粗鬆症と変形性関節症のリスクの増大は、アジア太平洋地域の粘性補充療法市場の成長を促進すると予想されます。

拘束

- 技術的な専門知識の欠如

優秀な人材を見つけ、引きつけ、雇用することは、エンジニアや技術者の専門チームを構築する第一歩でもあります。最良の状況でも、この手順は困難を極めることがあります。製造業の既存の労働力は急速に高齢化し、退職しています。医療業界では、STEM (科学、技術、工学、数学) スキルが不足しています。製造業では熟練した職人 (技術者) や学部/大学院レベルのスキル (エンジニア) の需要が依然として高いものの、必要なスキルを持つ人の数はわずかになりつつあります。粘性補充療法は訓練を受けた専門家だけが行うべきですが、この手順は複雑なため、この数は世界中ではるかに少なくなっています。

しかし、優れた積層造形 (AM) 人材を育成するには、資格のある候補者を見つけて採用するだけでは不十分です。従業員は、技術が変化し成長しても最新の知識を身につけ、必要なスキルを維持できる資格が必要です。STEM に重点を置いた教育を受けたとしても、新人エンジニアは AM 技術の実地トレーニングを受ける必要があります。これは、新人エンジニアを採用する際の大きな課題の 1 つです。実際、多くの学部工学プログラムでは AM に特化した教育がほとんど提供されておらず、その結果、多くの卒業生は雇用主が求める AM スキルを欠いている可能性があります。

したがって、技術的な専門知識の欠如は、市場の成長の制約となる可能性があります。

機会

-

関節内ヒアルロン酸(IAHA)の安全性と有効性

There are several types of hyaluronic acid injections, also called viscosupplementation, which are used for knee osteoarthritis. They are made from either rooster or chicken combs or are derived from bacteria and are injected directly into the joint. Intra-articular hyaluronic acid is a U.S. Food and Drug Administration-approved treatment for knee osteoarthritis (O.A.). Intra-articular hyaluronic acid (IAHA) injection presents an alternative local treatment option providing symptomatic benefit without the systemic A.E.s associated with I.A. corticosteroids. Numerous RCTs and meta-analyses have sought to assess the efficacy and safety of IAHA, with mixed results and conclusions. IAHA is demonstrated to have a positive effect on pain and joint function. There is also mounting data showing that multiple courses of IAHA can impact long-term outcomes, including a reduction in concomitant analgesia use and a delay in the need for total knee replacement surgery.

Challenge

- Stringent government policies for THE USE OF viscosupplementation

The commercialization of viscosupplementation across the globe by various key market players is facilitated by compliance with the regulatory frameworks established by many countries across the globe. The pre-market approval of various medical devices varies from one country to another. The U.S. Food, Drug, and Cosmetic Act ("FD&C Act") classify medical devices in the U.S. The European Union (E.U.) regulates medical devices in Europe. However, the rapid development of privacy policies and regulations are being made in the Asia-Pacific and EMEA, including India, Russia, China, South Korea, Singapore, Hong Kong, and Australia.

The viscosupplementation is regulated by a structure of laws, rules, and regulations that are extensive and complex to safeguard them from use in any potential harmful treatment.

The viscosupplementation act as a replacement for the damaged, injured, or infected body parts in cases of osteoarthritis conditions or sports accidents among patients, along with maintaining the patient's demand for good body movement. However, any misguidance will affect the patient's safety and body structure.

Therefore, the stringent rules & regulations for the use of viscosupplementation may act as a challenge to the growth of the market.

Post COVID-19 Impact on Asia-Pacific Viscosupplementation Market

COVID-19 has resulted in a substantial increase in demand for medical supplies from healthcare professionals and the general public for precautionary measures. Manufacturers of these items have an opportunity to take advantage of the increased demand for medical supplies by ensuring a steady supply of personal protective equipment on the market. COVID-19 is anticipated to have a big impact on the Asia-Pacific viscosupplementation market.

Asia-Pacific Viscosupplementation Market Scope and Market Size

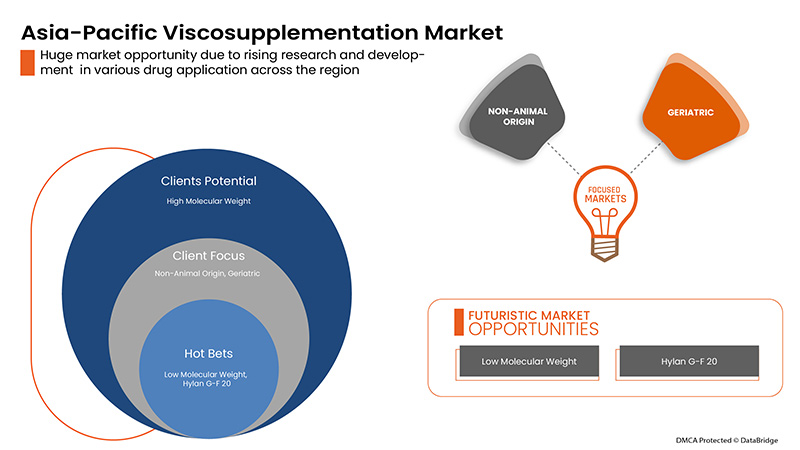

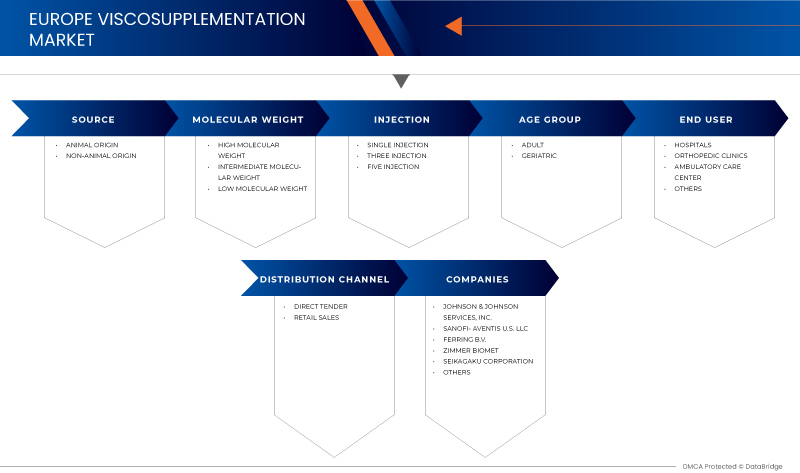

Asia-Pacific viscosupplementation market is segmented on the basis of source, age group, molecular weight, injection, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the Difference in your target markets.

BY SOURCE

- ANIMAL ORIGIN

- NON-ANIMAL ORIGIN

On the basis of source, the viscosupplementation market is segmented into the animal origin and non-animal origin.

BY MOLECULAR WEIGHT

- HIGH MOLECULAR WEIGHT

- LOW MOLECULAR WEIGHT

- INTERMEDIATE MOLECULAR WEIGHT

On the basis of molecular weight, the viscosupplementation market is segmented into intermediate molecular weight, low molecular weight, and high molecular weight.

BY INJECTION

- SINGLE INJECTION

- THREE INJECTION

- FIVE INJECTION

On the basis of injection, the viscosupplementation market is segmented into single injection, three injections, and five injections.

BY AGE GROUP

- ADULTS

- GERIATRICS

On the basis of age group, the viscosupplementation market is segmented into geriatric and adults.

END-USER

- HOSPITALS

- ORTHOPEDIC CLINIC

- HOME HEALTHCARE

- OTHERS

On the basis of end-user, the viscosupplementation market is segmented into hospital, orthopedic clinics, ambulatory care centers, and others.

BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

On the basis of distribution channel, the viscosupplementation market is segmented into direct tender and retail sales.

Viscosupplementation Market Country Level Analysis

The viscosupplementation market is analyzed, and market size information is provided by source, age group, molecular weight, injection, end user, and distribution channel.

The countries covered in the viscosupplementation market report are the China, Japan, India, South Korea, Singapore, Australia, Thailand, Vietnam, Malaysia, Taiwan, Indonesia, Philippines, and Rest of Asia-Pacific.

In 2022, China is dominating due to the increasing demand for non-surgical treatments for osteoarthritis with high GDP. China is expected to grow due to the rise in technological advancement in drug treatments.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands impact on sales channels are considered while providing forecast analysis of the country data.

Viscosupplementation market also provides you with a detailed market analysis of every country growth in the healthcare industry. Moreover, it provides detailed information regarding healthcare services and treatments, the impact of regulatory scenarios, and trending parameters regarding the viscosupplementation market.

Competitive Landscape and Asia-Pacific Viscosupplementation Market Share Analysis

Viscosupplementation market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to viscosupplementation treatments.

The major companies which are dealing in the viscosupplementation market are Anika Therapeutics, Inc., SEIKAGAKU CORPORATION, Bioventus, Fidia Farmaceutici S.P.A, Ferring B.V, sanofi-aventis U.S. LLC, Zimmer Biomet, OrthogenRx, Inc. (a subsidiary of AVNS), APTISSEN, Johnson & Johnson Services, Inc., L.G. Chem., Viatris Inc., IBSA Institut Biochimique SA, Ortobrand International, TRB CHEMEDICA SA, Teva Pharmaceutical Industries Ltd., Lifecore (a subsidiary of Landec Corporation), VIRCHOW BIOTECH, Zuventus HealthCare Ltd. (a subsidiary of Emcure Pharmaceuticals), among others

Strategic alliances like mergers, acquisitions, and agreements by the key market players are further expected to accelerate the growth of viscosupplementation treatments.

For instance,

- In May 2022, Fidia Farmaceutici S.p.A. harnesses the regenerative power of hyaluronic acid with its innovative portfolio launched in Spain

Fidia Farmaceutici S.p.A. presented its Aesthetic Care portfolio with a scientific symposium on its innovative ACP (Auto-Crosslinked Polymer) technology at the 20th Aesthetic & Anti-aging Medicine World Congress 2022 (AMWC) in Monte Carlo. The company has launched its complete Hyal System and Hy-Tissue portfolio in Spain. This has helped the company to showcase its research for hyaluronic acid

- In June 2022, Johnson & Johnson announced new data from Phase 3 studies demonstrating patients treated with medicine achieved consistent, long-term efficacy through two years across the domains of active psoriatic arthritis (PsA) – including joint, skin, enthesitis, a dactylitis,b spinal pain, and disease severityc endpoints – irrespective of baseline characteristics. This has helped the company to showcase its progress

- LG化学は2021年11月、次世代の変形性関節症治療薬の開発に向けた臨床開発を開始した。LG化学は、変形性関節症治療薬候補のLG00034053の前臨床結果が良好であったことを受けて、韓国食品医薬品安全処から第1b/2相臨床試験の承認を受けたと発表した。LG化学は、第1相と第2相をリンクさせた臨床試験を設計することで、新薬開発を加速させる計画だ。

これにより、同社は変形性関節症の治療のための新薬の開発を進めることができました。

- 2020年11月、ビアトリス社はマイランNVとファイザーのアップジョン事業の統合に成功しました。これら2つの補完的なレガシー企業を統合することで、ビアトリスは、実績のある規制、医療、アジア太平洋の商業能力を備えた科学、製造、流通の専門知識を持ち、165を超える国と地域の患者に高品質の医薬品を届けることができます。これにより、同社は事業を拡大することができました。

市場プレーヤーによるコラボレーション、製品の発売、事業拡大、賞や表彰、合弁事業、その他の戦略により、アジア太平洋の粘性補充市場における同社の足跡が強化され、組織の利益成長にも貢献します。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、アジア太平洋と地域、ベンダー シェア分析が含まれます。さらに質問がある場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC VISCOSUPPLEMENTATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 INDUSTRIAL INSIGHTS

7 PIPELINE ANALYSIS FOR ASIA PACIFIC VISCOSUPPLEMENTATION MARKET

8 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: REGULATIONS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISING GERIATRIC POPULATION

9.1.2 INCREASING RISK OF OSTEOPOROSIS AND OSTEOARTHRITIS

9.1.3 TECHNOLOGICAL ADVANCEMENT IN VISCOSUPPLEMENTATION

9.1.4 LOW PRODUCTION COST OF VISCOSUPPLEMENTATION PRODUCTS

9.2 RESTRAINTS

9.2.1 LACK OF TECHNICAL EXPERTISE

9.2.2 PRODUCT RECALL PROCEDURES

9.2.3 LIMITED APPLICATIONS OF VISCOSUPPLEMENTATION

9.3 OPPORTUNITIES

9.3.1 SAFETY AND EFFECTIVENESS OF INTRA-ARTICULAR HYALURONIC ACID (IAHA)

9.3.2 RISING HEALTHCARE INFRASTRUCTURE

9.3.3 INCREASE IN DEMAND FOR MINIMALLY INVASIVE PROCEDURES

9.3.4 INCREASING NUMBER OF JOINT REPLACEMENTS AND SPORTS ACCIDENT

9.4 CHALLENGES

9.4.1 STRINGENT GOVERNMENT POLICIES FOR THE USE OF VISCOSUPPLEMENTATION

9.4.2 SIDE-EFFECTS OF VISCOSUPPLEMENTATION

10 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY SOURCE

10.1 OVERVIEW

10.2 NON-ANIMAL ORIGIN

10.2.1 ORTHOVISC

10.2.2 EUFLEXXA

10.2.3 MONOVISC

10.2.4 DUROLANE

10.2.5 GEL-ONE

10.2.6 SUPARTZ

10.2.7 GELSYN-3

10.2.8 CINGAL

10.2.9 SULPLASYN

10.2.10 VISCOSEAL

10.2.11 OSTEONIL

10.2.12 OTHERS

10.3 ANIMAL ORIGIN

10.3.1 HYLAN G-F 20

10.3.2 SYNVIC ONE

10.3.3 SYNVIC

10.3.4 OTHERS

10.3.5 HYALURONANS

10.3.6 HYALGAN

10.3.7 OTHERS

11 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT

11.1 OVERVIEW

11.2 INTERMEDIATE MOLECULAR WEIGHT

11.2.1 ORTHOVISC

11.2.2 EUFLEXXA

11.2.3 MONOVISC

11.2.4 DUROLANE

11.2.5 VISCOSEAL

11.2.6 OSTEONIL

11.2.7 OTHERS

11.3 LOW MOLECULAR WEIGHT

11.3.1 HYLAGAN

11.3.2 SUPARTZ

11.3.3 GELSYN-3

11.3.4 CINGAL

11.3.5 SULPLASYN

11.3.6 OTHERS

11.4 HIGH MOLECULAR WEIGHT

11.4.1 SYNVIC ONE

11.4.2 SYNVIC

11.4.3 OTHERS

12 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY INJECTION

12.1 OVERVIEW

12.2 SINGLE INJECTION

12.3 THREE INJECTION

12.4 FIVE INJECTION

13 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULTS

13.3 GERIATRIC

14 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 ORTHOPEDIC CLINICS

14.4 AMBULATORY CARE CENTERS

14.5 OTHERS

15 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL SALES

15.3 DIRECT TENDER

16 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY REGION

16.1 ASIA-PACIFIC

16.1.1 CHINA

16.1.2 INDIA

16.1.3 JAPAN

16.1.4 AUSTRALIA

16.1.5 MALAYSIA

16.1.6 THAILAND

16.1.7 SINGAPORE

16.1.8 SOUTH KOREA

16.1.9 INDONESIA

16.1.10 PHILIPPINES

16.1.11 TAIWAN

16.1.12 VIETNAM

16.1.13 REST OF ASIA-PACIFIC

17 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 JOHNSON & JOHNSON SERVICES, INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 BIOVENTUS

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 FERRING B.V.

19.3.1 COMPANY SNAPSHOT

19.3.2 COMPANY SHARE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 SANOFI-AVENTIS U.S. LLC

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 ZIMMER BIOMET

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 SEIKAGAKU CORPORATION

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 ANIKA THERAPEUTICS, INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 FIDIA FARMACEUTICI S.P.A

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 APTISSEN

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 IBSA INSTITUT BIOCHIMIQUE SA

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 LG CHEM.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 LIFECORE (A SUBSIDIARY OF LANDEC CORPORATION)

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 ORTHOGENRX, INC. (A SUBSIDIARY OF AVNS)

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENTS

19.14 ORTOBRAND INTERNATIONAL

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 TEVA PHARMACEUTICAL INDUSTRIES LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENTS

19.16 TRB CHEMEDICA SA

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENTS

19.17 VIATRIS INC.

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 VIRCHOW BIOTECH

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 ZUVENTUS HEALTHCARE LTD. (A SUBSIDIARY OF EMCURE PHARMACEUTICALS)

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

表のリスト

TABLE 1 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC NON-ANIMAL IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 5 ASIA PACIFIC ANIMAL IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 9 ASIA PACIFIC HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 11 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC SINGLE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC THREE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC FIVE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC ADULT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC GERIATRIC IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC HOSPITALS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ORTHOPEADIC CLINICS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC AMBULATORY CARE CENTERS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC OTHERS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC RETAIL SALES IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC DIRECT TENDER IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 37 ASIA-PACIFIC ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 40 ASIA-PACIFIC HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 42 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 CHINA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 51 CHINA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 52 CHINA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 53 CHINA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 54 CHINA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CHINA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 56 CHINA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 57 CHINA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 58 CHINA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 59 CHINA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 60 CHINA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 61 CHINA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 62 CHINA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 63 CHINA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 64 CHINA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 CHINA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 INDIA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 67 INDIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 68 INDIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 69 INDIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 70 INDIA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 INDIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 72 INDIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 73 INDIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 74 INDIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 75 INDIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 76 INDIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 77 INDIA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 78 INDIA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 79 INDIA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 80 INDIA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 81 INDIA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 82 INDIA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 83 INDIA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 INDIA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 JAPAN VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 86 JAPAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 87 JAPAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 88 JAPAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 89 JAPAN ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 JAPAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 91 JAPAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 92 JAPAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 93 JAPAN VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 94 JAPAN INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 95 JAPAN HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 96 JAPAN VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 97 JAPAN VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 98 JAPAN VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 JAPAN VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 103 AUSTRALIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 104 AUSTRALIA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 AUSTRALIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 107 AUSTRALIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 108 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 113 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 114 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 117 MALAYSIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 118 MALAYSIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 119 MALAYSIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 120 MALAYSIA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 123 MALAYSIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 124 MALAYSIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 126 MALAYSIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 127 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 130 MALAYSIA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 131 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 132 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 133 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 134 MALAYSIA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 135 THAILAND VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 136 THAILAND NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 137 THAILAND NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 138 THAILAND NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 139 THAILAND ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 THAILAND HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 141 THAILAND HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 142 THAILAND HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 143 THAILAND HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 144 THAILAND HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 145 THAILAND HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 146 THAILAND VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 147 THAILAND INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 148 THAILAND LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 149 THAILAND HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 150 THAILAND VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 151 THAILAND VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 152 THAILAND VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 THAILAND VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 155 SINGAPORE NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 156 SINGAPORE NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 157 SINGAPORE NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 158 SINGAPORE ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 SINGAPORE HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 160 SINGAPORE HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 161 SINGAPORE HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 162 SINGAPORE HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 163 SINGAPORE HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 164 SINGAPORE HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 165 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 166 SINGAPORE INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 167 SINGAPORE LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 168 SINGAPORE HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 169 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 170 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 171 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 SINGAPORE VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 174 SOUTH KOREA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 175 SOUTH KOREA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 176 SOUTH KOREA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 177 SOUTH KOREA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 SOUTH KOREA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 179 SOUTH KOREA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 180 SOUTH KOREA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 181 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 182 SOUTH KOREA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 183 SOUTH KOREA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 184 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 185 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 186 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 187 SOUTH KOREA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 189 INDONESIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 191 INDONESIA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 192 INDONESIA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 INDONESIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 194 INDONESIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 195 INDONESIA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 196 INDONESIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 197 INDONESIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 198 INDONESIA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 199 INDONESIA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 200 INDONESIA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 201 INDONESIA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 202 INDONESIA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 203 INDONESIA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 204 INDONESIA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 205 INDONESIA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 206 INDONESIA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 207 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 208 PHILIPPINES NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 209 PHILIPPINES NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 210 PHILIPPINES NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 211 PHILIPPINES ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 PHILIPPINES HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 213 PHILIPPINES HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 214 PHILIPPINES HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 215 PHILIPPINES HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 216 PHILIPPINES HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 217 PHILIPPINES HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 218 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 219 PHILIPPINES INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 220 PHILIPPINES LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 221 PHILIPPINES HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 222 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 223 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 224 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 225 PHILIPPINES VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 226 TAIWAN VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 227 TAIWAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 228 TAIWAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 229 TAIWAN NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 230 TAIWAN ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 TAIWAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 232 TAIWAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 233 TAIWAN HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 234 TAIWAN HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 235 TAIWAN HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 236 TAIWAN HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 237 TAIWAN VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 238 TAIWAN INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 239 TAIWAN LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 240 TAIWAN HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 241 TAIWAN VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 242 TAIWAN VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 243 TAIWAN VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 244 TAIWAN VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 245 VIETNAM VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 246 VIETNAM NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 247 VIETNAM NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 248 VIETNAM NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 249 VIETNAM ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 VIETNAM HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 251 VIETNAM HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 252 VIETNAM HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, VOLUME, 2020-2029 (ASP, USD)

TABLE 253 VIETNAM HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 254 VIETNAM HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 255 VIETNAM HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 256 VIETNAM VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 257 VIETNAM INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 258 VIETNAM LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 259 VIETNAM HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 260 VIETNAM VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 261 VIETNAM VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 262 VIETNAM VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 263 VIETNAM VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 264 REST OF ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC VISCOSUPPLEMENTATION MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 THE INCREASING DEMAND FOR NON-SURGICAL TREATMENTS FOR OSTEOARTHRITIS AND ADVANCEMENTS IN THE DEVELOPMENT OF HYALURONIC ACID-BASED THERAPIES IS EXPECTED TO DRIVE THE ASIA PACIFIC VISCOSUPPLEMENTATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 NON-ANIMAL ORIGIN IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC VISCOSUPPLEMENTATION MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC VISCOSUPPLEMENTATION MARKET

FIGURE 15 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE, 2021

FIGURE 16 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE, 2022-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, 2021

FIGURE 20 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY INJECTION, 2021

FIGURE 24 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY INJECTION, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY INJECTION, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY INJECTION, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, 2021

FIGURE 28 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY END USER, 2021

FIGURE 32 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 36 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: SNAPSHOT (2021)

FIGURE 40 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2021)

FIGURE 41 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 ASIA-PACIFIC VISCOSUPPLEMENTATION MARKET: BY SOURCE (2022-2029)

FIGURE 44 ASIA PACIFIC VISCOSUPPLEMENTATION MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。