Global Osteoporosis Drug Market

Market Size in USD Million

CAGR :

%

USD

15,576.30 Million

USD

20,332.57 Million

2022

2030

USD

15,576.30 Million

USD

20,332.57 Million

2022

2030

| 2023 –2030 | |

| USD 15,576.30 Million | |

| USD 20,332.57 Million | |

|

|

|

|

Osteoporosis Drug Market Size

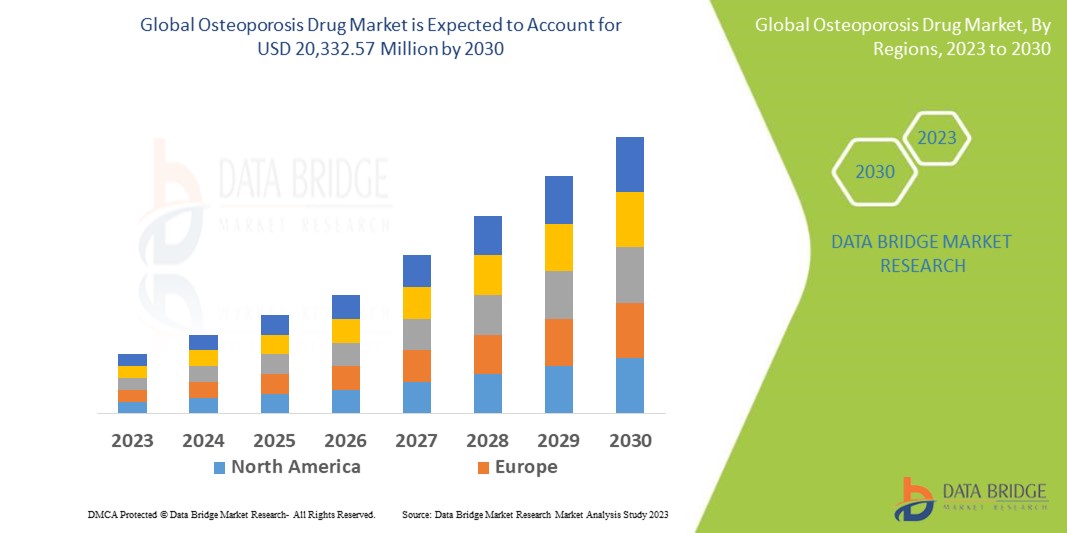

The global osteoporosis drug market is experiencing steady growth driven by factors such as the increasing aging population, rising prevalence of osteoporosis, and growing awareness about bone health. Data Bridge Market Research analyses that the osteoporosis drug market which was USD 15,576.30 million in 2022, would rocket up to USD 20,332.57 million by 2030, and is expected to undergo a CAGR of 4.68% during the forecast period. This indicates that the market value. “Medication” dominates the treatment type segment of the osteoporosis drug market owing to the growing demand for medication treatment due to rise in prevalence of osteoporosis globally. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Osteoporosis Drug Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021(Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Type (Primary Osteoporosis and Secondary Osteoporosis), Therapy Type (Hormone Replacement Therapy and Bisphosphonate Therapy), Treatment Type (Medication and Surgery), Mechanism of Action Type (Bisphosphonates, Selective Estrogen Receptor Modulators and Bone Resorption Inhibitors), Route of Administration Type (Oral, Intravenous, Subcutaneous and Others), End-Users (Hospitals, Homecare, Specialty Clinics and Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

GlaxoSmithKline plc. (U.K.), F. Hoffmann-La Roche Ltd (Switzerland), Novartis AG (Switzerland), Eli Lilly And Company. (U.S.), Astrazeneca (U.K.), Pfizer Inc. (U.S.), Takeda Pharmaceutical Company Limited. (Japan), Bristol-Myers Squibb Company (U.S.), Sanofi (France), Johnson & Johnson Services, Inc.(U.S.), Bayer AG (Germany), AbbVie Inc. (U.S.), Allergan (Ireland), Merck & Co., Inc. (U.S.), Amgen Inc. (U.S.), Sun Pharmaceutical Industries Ltd. (India), Teva Pharmaceutical Industries Ltd. (Israel), Novo Nordisk A/S (Denmark), DAIICHI SANKYO COMPANY (Japan), LIMITED. and Cipla Inc. (India) |

|

Market Opportunities |

|

Market Definition

Osteoporosis is a condition of bone weakening or bones becomes fragile and likely to break. In other words, osteoporosis is a condition wherein the bone density decreases. This is specially witnessed in old age people. Osteoporosis brings along back pain, stooped posture, bone fracture and tooth loss.

Osteoporosis Drug Market Dynamics

Drivers

- Increasing Prevalence of Osteoporosis

The prevalence of osteoporosis is increasing worldwide mainly due to changing lifestyles, poor diet and sedentary lifestyle. Factors that contribute to osteoporosis, such as reduced physical activity, insufficient intake of calcium and vitamin D and hormonal imbalances. The increasing number of people suffering from osteoporosis is creating a significant demand for osteoporosis drugs

- Increased Awareness and Diagnosis

Awareness of osteoporosis and its consequences has increased significantly among both health professionals and the general public. Initiatives by health organizations, patient advocacy groups, and pharmaceutical companies have played an important role in educating people about osteoporosis prevention, early detection, and available treatment options. As a result, more and more people are diagnosed with osteoporosis, increasing the demand for osteoporosis drugs

- Technological Advances in Drug Development

Technological advances in drug development have made it possible to discover and develop more effective and targeted treatments for osteoporosis. The use of advanced imaging techniques, molecular biology and genomics has provided insight into the pathophysiology of osteoporosis and led to the identification of new drug targets. The development of new drug delivery systems and formulation techniques will also improve the efficacy and patient compliance of osteoporosis medications

- Growing Investment for Healthcare Facilities

Surging focus towards improving the condition of healthcare facilities and improving the overall healthcare infrastructure another important factor fostering the growth of the market. Rising number of partnerships and strategic collaborations between the public and private players pertaining to funding and application of new and improved technology is further creating lucrative market opportunities

Opportunities

- Targeted Therapies and Personalized Medicine

The development of targeted therapies and personalized treatment approaches offers the opportunity to improve the effectiveness and safety of osteoporosis treatment. Advances in genomics, biomarker identification and precision medicine enable specific patient subgroups that may benefit from tailored treatment. By developing innovative treatment methods that meet the individual characteristics and needs of the patient, treatment results can be improved and products can be differentiated in the market

- Research and Development for New Drug Candidates

Ongoing research and development in the field of osteoporosis offers opportunities for the discovery and development of new drug candidates. Exploring new mechanisms of action, identifying innovative drug targets and exploiting advances in drug delivery systems can lead to the development of innovative therapies with greater efficacy and fewer side effects. Companies that invest in RandD to expand their product portfolio can take advantage of these opportunities and gain a competitive advantage in the market

Restraints

- Patent Expiration and Generic Competition

Many osteoporosis drugs have had patent expirations, allowing generic versions to enter the market. Generic drug competition often leads to lower prices, which reduces the revenue potential of originator drug manufacturers. This may affect profitability and hinder the growth of the osteoporosis drug market

- Side Effects and Safety Concerns

Osteoporosis medications, such as all medications, can have potential side effects and safety concerns. Some medications have been associated with rare but serious side effects, such as atypical fractures and osteonecrosis of the jaw. These safety concerns may lead to regulatory actions, warnings, and restrictions affecting the prescribing and marketing of certain osteoporosis drugs

Challenges

- High Development Costs and Long Development Times

Developing and marketing a new osteoporosis drug requires significant research and development costs, including preclinical studies, clinical trials and regulatory notifications. The process can be time-consuming and often takes years from initial discovery to commercialization. In addition, the high failure rate of clinical trials further increases costs and lengthens development schedules. These challenges increase the financial burden on pharmaceutical companies and create uncertainty about the return on invested capital

- Reimbursement and Pricing Pressures

Osteoporosis drugs, especially the newer biologics, can be expensive. Pricing pressures from health systems, payers and insurance companies can limit the availability and affordability of these drugs. Reimbursement policies, formulary restrictions, and cost containment measures can affect market access, patient affordability, and overall market demand. Pharmaceutical companies must overcome these challenges to secure favourable reimbursement and pricing agreements while demonstrating the value and cost-effectiveness of their products

This osteoporosis drug market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Osteoporosis Drug market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth

Recent Developments

- In August 2021, Enzene Biosciences Ltd received Marketing Authorization (MA) from the Drug Controller General of India (DCGI) for its biosimilar drug, denosumab, indicated for the treatment of osteoporosis in adults

- In January 2021, Theramex, a London-headquartered pharmaceutical company, launched the osteoporosis medicine Livogiva in Europe

Global Osteoporosis Drug Market Scope

The osteoporosis drug market is segmented on the basis of type, therapy type, treatment type, mechanism of action, route of administration and end users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Primary osteoporosis

- Postmenopausal osteoporosis

- Senile osteoporosis

- Idiopathic osteoporosis

- Seocndary osteoporosis

Therapy type

- Hormone Replacement Therapy

- Testosterone Replacement Therapy

- Estrogen Therapy

- Bisphosphonate Therapy

Treatment type

- Medication

- Calcium

- Vitamin D Supplements

- Antacids

- Surgery

- Vertebroplasty

- Kyphoplasty

- Others

Mechanism of Action

- Bisphosphonates

- Alendronate

- Ibandronate

- Risedronate

- Zoledronic

- Selective Estrogen Receptor Modulators

- Raloxifene

- Bone Resorption Inhibitors

- Denosumab

Route of Administration

- Oral

- Intravenous

- Subcutaneous

- Others

End-User

- Hospitals

- Homecare

- Specialty clinics

- Others

Osteoporosis Drug Market Regional Analysis/Insights

The osteoporosis drug market is analysed and market size insights and trends are provided by country, type, therapy type, treatment type, mechanism of action, route of administration and end-users as referenced above.

The countries covered in the osteoporosis drug market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

North America dominates the osteoporosis drug market owing to the easy availability of osteoporosis drugs and rising prevalence of osteoporosis.

Asia-Pacific is projected to score highest growth rate for the forecast period owing to rising expenditure to develop healthcare infrastructure coupled with growth and expansion of life sciences industry.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed Base and New Technology Penetration

The Osteoporosis drug market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for Osteoporosis drug market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the Osteoporosis Drug market. The data is available for historic period from 2021 to 2030.

Competitive Landscape and Osteoporosis Drug Market Share Analysis

The osteoporosis drug market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the company’s focus related to osteoporosis drug market.

Some of the major players operating in the osteoporosis drug market are

- GlaxoSmithKline plc. (U.K.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- Eli Lilly And Company. (U.S.)

- Astrazeneca (U.K.)

- Pfizer Inc. (U.S.)

- Takeda Pharmaceutical Company Limited. (Japan)

- Bristol-Myers Squibb Company (U.S.)

- Sanofi (France)

- Johnson & Johnson Services, Inc.(U.S.)

- Bayer AG (Germany)

- AbbVie Inc. (U.S.)

- Allergan (Ireland)

- Merck & Co., Inc. (U.S.)

- Amgen Inc. (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Novo Nordisk A/S (Denmark)

- DAIICHI SANKYO COMPANY (Japan), LIMITED.

- Cipla Inc. (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL OSTEOPOROSIS DRUG MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL OSTEOPOROSIS DRUG MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL OSTEOPOROSIS DRUG MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 PATENT ANALYSIS

6.1.1 PATENT LANDSCAPE

6.1.2 USPTO NUMBER

6.1.3 PATENT EXPIRY

6.1.4 EPIO NUMBER

6.1.5 PATENT STRENGTH AND QUALITY

6.1.6 PATENT CLAIMS

6.1.7 PATENT CITATIONS

6.1.8 PATENT LITIGATION AND LICENSING

6.1.9 FILE OF PATENT

6.1.10 PATENT RECEIVED CONTRIES

6.1.11 TECHNOLOGY BACKGROUND

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH SPECIALIST

6.8 OTHER KOL SNAPSHOTS

7 EPIDEMIOLOGY

7.1 INCIDENCE OF ALL BY GENDER

7.2 TREATMENT RATE

7.3 MORTALITY RATE

7.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

7.5 PATIENT TREATMENT SUCCESS RATES

8 MERGERS AND ACQUISITION

8.1 LICENSING

8.2 COMMERCIALIZATION AGREEMENTS

9 REGULATORY FRAMEWORK

9.1 REGULATORY APPROVAL PROCESS

9.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

9.3 REGULATORY APPROVAL PATHWAYS

9.4 LICENSING AND REGISTRATION

9.5 POST-MARKETING SURVEILLANCE

9.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

10 PIPELINE ANALYSIS

10.1 CLINICAL TRIALS AND PHASE ANALYSIS

10.2 DRUG THERAPY PIPELINE

10.3 PHASE III CANDIDATES

10.4 PHASE II CANDIDATES

10.5 PHASE I CANDIDATES

10.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 COLOMBIA CLINICAL TRIAL MARKET FOR XX

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yest Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

11 MARKETED DRUG ANALYSIS

11.1 DRUG

11.1.1 BRAND NAME

11.1.2 GENERICS NAME

11.2 THERAPEUTIC INDIACTION

11.3 PHARACOLOGICAL CLASS OD THE DRUG

11.4 DRUG PRIMARY INDICATION

11.5 MARKET STATUS

11.6 MEDICATION TYPE

11.7 DRUG DOSAGES FORM

11.8 DOSAGES AVAILABILITY

11.9 PACKAGING TYPE

11.1 DRUG ROUTE OF ADMINISTRATION

11.11 DOSING FREQUENCY

11.12 DRUG INSIGHT

11.13 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

11.13.1 FORECAST MARKET OUTLOOK

11.13.2 CROSS COMPETITION

11.13.3 THERAPEUTIC PORTFOLIO

11.13.4 CURRENT DEVELOPMENT SCENARIO

12 MARKET ACCESS

12.1 10-YEAR MARKET FORECAST

12.2 CLINICAL TRIAL RECENT UPDATES

12.3 ANNUAL NEW FDA APPROVED DRUGS

12.4 DRUGS MANUFACTURER AND DEALS

12.5 MAJOR DRUG UPTAKE

12.6 CURRENT TREATMENT PRACTICES

12.7 IMPACT OF UPCOMING THERAPY

13 R & D ANALYSIS

13.1 COMPARATIVE ANALYSIS

13.2 DRUG DEVELOPMENTAL LANDSCAPE

13.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

13.4 THERAPEUTIC ASSESSMENT

13.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

14 MARKET OVERVIEW

14.1 DRIVERS

14.2 RESTRAINTS

14.3 OPPORTUNITIES

14.4 CHALLENGES

15 GLOBAL OSTEOPOROSIS DRUGS MARKET, BY TYPE

15.1 OVERVIEW

15.2 PRIMARY OSTEOPOROSIS

15.3 SECONDARY OSTEOPOROSIS

16 GLOBAL OSTEOPOROSIS DRUGS MARKET, BY THERAPY TYPE

16.1 OVERVIEW

16.2 BISPHOSPHONATES

16.2.1 ALENDRONATE

16.2.2 IBANDRONATE

16.2.3 RISEDRONATE

16.2.4 ZOLEDRONIC ACID

16.2.5 OTHERS

16.3 HORMONE THERAPY

16.3.1 PARATHYROID HORMONE

16.3.1.1. ABALOPARATIDE

16.3.1.2. TERIPARATIDE

16.3.1.3. OTHERS

16.3.2 ESTROGEN

16.3.2.1. CONJUGATED ESTROGENS

16.3.2.2. ESTERIFIED ESTROGENS

16.3.2.3. ESTROPIPATE

16.3.2.4. SELECTIVE ESTROGEN RECEPTOR MODULATORS

16.3.3 CALCITONIN

16.3.4 OTHERS

16.4 OTHERS

17 GLOBAL OSTEOPOROSIS DRUGS MARKET, BY DRUG TYPE

17.1 OVERVIEW

17.2 BRANDED

17.2.1 FOSAMAX

17.2.2 FORTEO

17.2.3 ACTONEL

17.2.4 RECLAST

17.2.5 ACLASTA

17.2.6 EVENITY

17.2.7 PROLIA

17.2.8 BINOSTO

17.2.9 OTHERS

17.3 BIOSIMILARS

17.3.1 DENOSUMAB

17.3.2 TERROSA

17.3.3 OTHERS

17.4 GENERICS

18 GLOBAL OSTEOPOROSIS DRUGS MARKET, BY MECHANISM OF ACTION

18.1 OVERVIEW

18.2 BISPHOSPHONATES

18.3 SELECTIVE ESTROGEN RECEPTOR MODULATORS

18.4 BONE RESORPTION INHIBITORS

18.5 OTHERS

19 GLOBAL OSTEOPOROSIS DRUGS MARKET, BY ROUTE OF ADMINISTRATION

19.1 OVERVIEW

19.2 ORAL

19.2.1 TABLETS

19.2.2 CAPSULES

19.2.3 OTHERS

19.3 INJECTABLE

19.4 SUBCUTANEOUS

19.5 OTHERS

20 GLOBAL OSTEOPOROSIS DRUGS MARKET, BY GENDER

20.1 OVERVIEW

20.2 MALE

20.2.1 PEDIATRIC

20.2.2 ADULTS

20.3 FEMALE

20.3.1 PEDIATRIC

20.3.2 ADULTS

21 GLOBAL OSTEOPOROSIS DRUGS MARKET, BY END USER

21.1 OVERVIEW

21.2 HOSPITALS

21.3 HOMECARE

21.4 SPECIALTY CLINICS

21.5 OTHERS

22 GLOBAL OSTEOPOROSIS DRUGS MARKET, BY DISTRIBUTION CHANNEL

22.1 OVERVIEW

22.2 DIRECT TENDER

22.3 RETAILS SALES

22.3.1 PHARMACY STORES

22.3.2 ONLINE RETAIL CHANNELS

22.3.3 OTHERS

22.4 OTHERS

23 GLOBAL OSTEOPOROSIS DRUG MARKET, SWOT AND DBMR ANALYSIS

24 GLOBAL OSTEOPOROSIS DRUG MARKET, COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: GLOBAL

24.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.3 COMPANY SHARE ANALYSIS: EUROPE

24.4 COMPANY SHARE ANALYSIS: SOUTH AMERICA

24.5 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

24.6 MERGERS & ACQUISITIONS

24.7 NEW PRODUCT DEVELOPMENT & APPROVALS

24.8 EXPANSIONS

24.9 REGULATORY CHANGES

24.1 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

25 GLOBAL OSTEOPOROSIS DRUG MARKET, BY REGION, 2022-2031, (USD MILLION)

GLOBAL OSTEOPOROSIS DRUG MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

25.1 OVERVIEW

25.2 NORTH AMERICA

25.2.1 U.S.

25.2.2 CANADA

25.2.3 MEXICO

25.3 EUROPE

25.3.1 GERMANY

25.3.2 U.K.

25.3.3 ITALY

25.3.4 FRANCE

25.3.5 SPAIN

25.3.6 SWITZERLAND

25.3.7 RUSSIA

25.3.8 TURKEY

25.3.9 BELGIUM

25.3.10 NETHERLANDS

25.3.11 REST OF EUROPE

25.4 ASIA-PACIFIC

25.4.1 JAPAN

25.4.2 CHINA

25.4.3 SOUTH KOREA

25.4.4 INDIA

25.4.5 AUSTRALIA & NEW ZEALAND

25.4.6 SINGAPORE

25.4.7 THAILAND

25.4.8 INDONESIA

25.4.9 MALAYSIA

25.4.10 PHILIPPINES

25.4.11 REST OF ASIA-PACIFIC

25.5 SOUTH AMERICA

25.5.1 BRAZIL

25.5.2 ARGENTINA

25.5.3 REST OF SOUTH AMERICA

25.6 MIDDLE EAST AND AFRICA

25.6.1 SOUTH AFRICA

25.6.2 EGYPT

25.6.3 SAUDI ARABIA

25.6.4 UNITED ARAB EMIRATES

25.6.5 ISRAEL

25.6.6 REST OF MIDDLE EAST AND AFRICA

26 GLOBAL OSTEOPOROSIS DRUG MARKET, COMPANY PROFILE

26.1 AMGEN INC

26.1.1 COMPANY OVERVIEW

26.1.2 REVENUE ANALYSIS

26.1.3 GEOGRAPHIC PRESENCE

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPMENTS

26.2 NOVARTIS AG

26.2.1 COMPANY OVERVIEW

26.2.2 REVENUE ANALYSIS

26.2.3 GEOGRAPHIC PRESENCE

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPMENTS

26.3 AUROBINDO PHARMA

26.3.1 COMPANY OVERVIEW

26.3.2 REVENUE ANALYSIS

26.3.3 GEOGRAPHIC PRESENCE

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPMENTS

26.4 GLENMARK PHARMACEUTICALS LTD

26.4.1 COMPANY OVERVIEW

26.4.2 REVENUE ANALYSIS

26.4.3 GEOGRAPHIC PRESENCE

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPMENTS

26.5 SANOFI-AVENTIS

26.5.1 COMPANY OVERVIEW

26.5.2 REVENUE ANALYSIS

26.5.3 GEOGRAPHIC PRESENCE

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPMENTS

26.6 APOTEX INC.

26.6.1 COMPANY OVERVIEW

26.6.2 REVENUE ANALYSIS

26.6.3 GEOGRAPHIC PRESENCE

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPMENTS

26.7 PFIZER INC.

26.7.1 COMPANY OVERVIEW

26.7.2 REVENUE ANALYSIS

26.7.3 GEOGRAPHIC PRESENCE

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPMENTS

26.8 DR. REDDY’S LABORATORIES LTD.

26.8.1 COMPANY OVERVIEW

26.8.2 REVENUE ANALYSIS

26.8.3 GEOGRAPHIC PRESENCE

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPMENTS

26.9 MERCK & CO., INC

26.9.1 COMPANY OVERVIEW

26.9.2 REVENUE ANALYSIS

26.9.3 GEOGRAPHIC PRESENCE

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPMENTS

26.1 ELI LILLY AND COMPANY

26.10.1 COMPANY OVERVIEW

26.10.2 REVENUE ANALYSIS

26.10.3 GEOGRAPHIC PRESENCE

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPMENTS

26.11 THE MENARINI GROUP

26.11.1 COMPANY OVERVIEW

26.11.2 REVENUE ANALYSIS

26.11.3 GEOGRAPHIC PRESENCE

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPMENTS

26.12 ALVOGEN

26.12.1 COMPANY OVERVIEW

26.12.2 REVENUE ANALYSIS

26.12.3 GEOGRAPHIC PRESENCE

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPMENTS

26.13 TABUK PHARMACEUTICA

26.13.1 COMPANY OVERVIEW

26.13.2 REVENUE ANALYSIS

26.13.3 GEOGRAPHIC PRESENCE

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPMENTS

26.14 SPIMACO

26.14.1 COMPANY OVERVIEW

26.14.2 REVENUE ANALYSIS

26.14.3 GEOGRAPHIC PRESENCE

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPMENTS

26.15 SUDAIR PHARMA

26.15.1 COMPANY OVERVIEW

26.15.2 REVENUE ANALYSIS

26.15.3 GEOGRAPHIC PRESENCE

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPMENTS

26.16 LUPIN

26.16.1 COMPANY OVERVIEW

26.16.2 REVENUE ANALYSIS

26.16.3 GEOGRAPHIC PRESENCE

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPMENTS

26.17 SUN PHARMA

26.17.1 COMPANY OVERVIEW

26.17.2 REVENUE ANALYSIS

26.17.3 GEOGRAPHIC PRESENCE

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPMENTS

26.18 GLAXOSMITHKLINE

26.18.1 COMPANY OVERVIEW

26.18.2 REVENUE ANALYSIS

26.18.3 GEOGRAPHIC PRESENCE

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPMENTS

26.19 TEVA PHARMACEUTICAL INDUSTRIES LTD

26.19.1 COMPANY OVERVIEW

26.19.2 REVENUE ANALYSIS

26.19.3 GEOGRAPHIC PRESENCE

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPMENTS

26.2 ALKEM LABORATORIES LTD

26.20.1 COMPANY OVERVIEW

26.20.2 REVENUE ANALYSIS

26.20.3 GEOGRAPHIC PRESENCE

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPMENTS

26.21 CIPLA

26.21.1 COMPANY OVERVIEW

26.21.2 REVENUE ANALYSIS

26.21.3 GEOGRAPHIC PRESENCE

26.21.4 PRODUCT PORTFOLIO

26.21.5 RECENT DEVELOPMENTS

26.22 ABBVIE INC.

26.22.1 COMPANY OVERVIEW

26.22.2 REVENUE ANALYSIS

26.22.3 GEOGRAPHIC PRESENCE

26.22.4 PRODUCT PORTFOLIO

26.22.5 RECENT DEVELOPMENTS

26.23 BAYER AG

26.23.1 COMPANY OVERVIEW

26.23.2 REVENUE ANALYSIS

26.23.3 GEOGRAPHIC PRESENCE

26.23.4 PRODUCT PORTFOLIO

26.23.5 RECENT DEVELOPMENTS

26.24 RADIUS HEALTH, INC.

26.24.1 COMPANY OVERVIEW

26.24.2 REVENUE ANALYSIS

26.24.3 GEOGRAPHIC PRESENCE

26.24.4 PRODUCT PORTFOLIO

26.24.5 RECENT DEVELOPMENTS

26.25 UCB S.A.

26.25.1 COMPANY OVERVIEW

26.25.2 REVENUE ANALYSIS

26.25.3 GEOGRAPHIC PRESENCE

26.25.4 PRODUCT PORTFOLIO

26.25.5 RECENT DEVELOPMENTS

26.26 DAIICHI SANKYO COMPANY

26.26.1 COMPANY OVERVIEW

26.26.2 REVENUE ANALYSIS

26.26.3 GEOGRAPHIC PRESENCE

26.26.4 PRODUCT PORTFOLIO

26.26.5 RECENT DEVELOPMENTS

26.27 VIATRIS INC.

26.27.1 COMPANY OVERVIEW

26.27.2 REVENUE ANALYSIS

26.27.3 GEOGRAPHIC PRESENCE

26.27.4 PRODUCT PORTFOLIO

26.27.5 RECENT DEVELOPMENTS

26.28 F. HOFFMANN-LA ROCHE LTD

26.28.1 COMPANY OVERVIEW

26.28.2 REVENUE ANALYSIS

26.28.3 GEOGRAPHIC PRESENCE

26.28.4 PRODUCT PORTFOLIO

26.28.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

27 RELATED REPORTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.