Global Massive Open Online Courses (MOOCS) Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

12.70 Billion

USD

29.69 Billion

2024

2032

USD

12.70 Billion

USD

29.69 Billion

2024

2032

| 2025 –2032 | |

| USD 12.70 Billion | |

| USD 29.69 Billion | |

|

|

|

|

Global Massive Open Online Courses (MOOCS) Market Segmentation, By Component (Platform and Services), Subjects (Technology, Business Management, Computer Science and Programming, Engineering, Science, Sociology and Philosophy, Humanities, Education and Training, Healthcare and Medicine, Arts and Design, Mathematics, Foreign Language Learning, and Others), Customer (Individual MOOCs, Enterprise / Corporate MOOCs, MOOCs for Small Enterprise, MOOCs for Medium Sized Enterprise, MOOCs for Large Enterprise, and MOOCs for Educational Institutes), Objective (MOOCs for Reskilling and Online Certification, MOOCs for Language and Casual Learning, MOOCs for Supplemental Education, MOOCs for Higher Education, and MOOCs for Test Preparation), Program (Certificate and Professional Program MOOCs, Degree and Master Programs MOOCs, and Other MOOC Programs), Application (Education, Research and Study, and Others), End User (Students and Professionals) - Industry Trends and Forecast to 2032

Massive Open Online Courses (MOOCS) Market Size

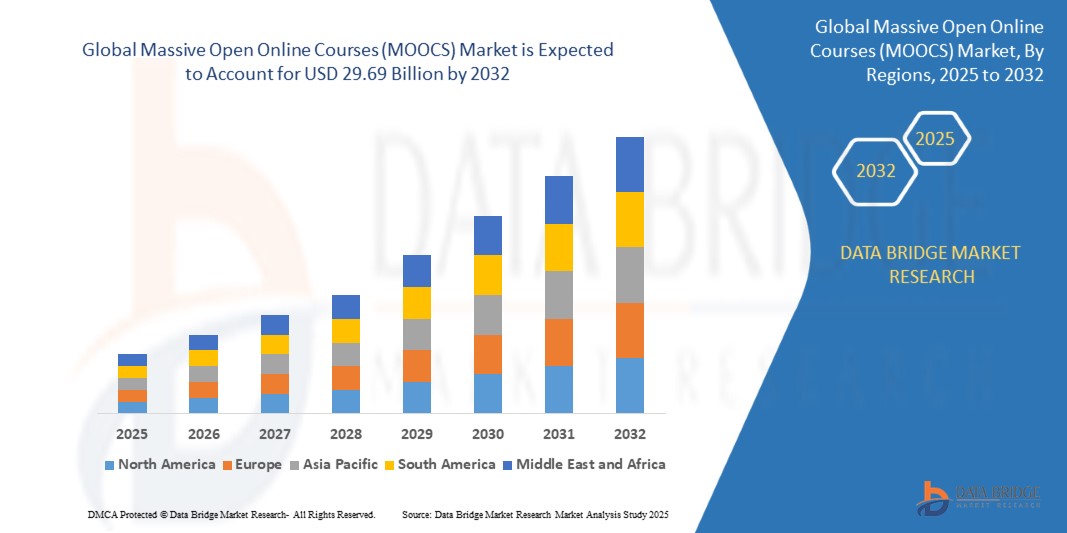

- The global massive open online courses (MOOCS) market size was valued atUSD 12.70 billion in 2024and is expected to reachUSD 29.69 billion by 2032, at aCAGR of 11.20%during the forecast period

- This growth is driven by growing corporate demand for continuous learning increases the demand for MOOCs

Massive Open Online Courses (MOOCS) Market Analysis

- Massive Open Online Courses (MOOCs) are transforming the education sector by offering accessible, affordable, and flexible learning opportunities to a global audience, breaking traditional barriers of time, cost, and geography

- The growing demand for MOOCs is fueled by the increasing need for upskilling, reskilling, and continuous learning in a rapidly evolving job market, alongside the expansion of digital infrastructure and widespread internet access

- North America is expected to dominate the MOOCs market with the largest market share of 34.62%, due to the strong presence of key providers such as Coursera, edX, and Udacity, supported by high adoption rates among universities and working professionals seeking career advancement

- Asia-Pacific is projected to be the fastest-growing region in the MOOCs market during the forecast period, driven by rising student populations, increasedsmartphonepenetration, and government-led digital learning initiatives in countries such as India, China, and Indonesia

- The XMOOC segment is expected to dominate the market with the largest market share of 61.27% due to its integration with formal degree programs is becoming increasingly common. Platforms such as Coursera and EDX provide credit-bearing courses, enabling learners to accumulate credentials that can be applied towards earning a full degree

Report Scope and Massive Open Online Courses (MOOCS) Market Segmentation

|

Attributes |

Massive Open Online Courses (MOOCS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Massive Open Online Courses (MOOCS) Market Trends

“Integration of Microlearning and Modular Courses”

- A growing trend in the MOOCs market is the increasing adoption of microlearning formats, where learners consume content in short, focused segments that cater to limited attention spans and busy schedules

- MOOCs platforms are now offering modular courses that allow learners to build personalized learning paths by stacking credentials toward professional certifications or degrees

- The flexibility, affordability, and targeted approach of microlearning are attracting both individual learners and corporate clients seeking to upskill employees quickly

- For instance, in September 2024, Coursera launched “SkillSets,” a modular course offering tailored to job roles, allowing learners to gain job-relevant skills faster

- This trend is expected to reshapedigital educationby making learning more adaptive, efficient, and outcome-driven, enhancing MOOCs’ value across global education and enterprise sectors

Massive Open Online Courses (MOOCS) Market Dynamics

Driver

“Surge in Demand for Workforce Reskilling and Upskilling”

- The rapid evolution of job roles due to automation and digital transformation has created a strong demand for continuous learning and workforce reskilling.

- MOOCs offer scalable, accessible, and affordable solutions for individuals and organizations to keep pace with changing skill requirements.

- Governments and companies are actively partnering with MOOCs providers to offer training programs aligned with market demand

- For instance, in 2023, the Singapore government partnered with edX and LinkedIn Learning to subsidize MOOCs for digital skills development under its SkillsFuture initiative

- This rising demand is expected to continue driving the adoption of MOOCs as a key tool in global workforce development strategies

Opportunity

“Expansion of Multilingual and Regional Content”

- One major opportunity lies in offering localized and multilingual MOOCs that cater to non-English-speaking learners in emerging markets

- By expanding language options and regional content, platforms can unlock access to massive untapped learner populations across Asia, Africa, and Latin America

- MOOCs providers are increasingly partnering with regional universities and institutions to co-create culturally relevant and language-specific content

- For instance, in 2024, edX partnered with Universidad Nacional Autónoma de México (UNAM) to launch Spanish-language MOOCs tailored to Latin American learners

- This localization strategy is expected to fuel MOOCs adoption in diverse global markets, broadening reach and engagement

Restraint/Challenge

“Low Completion Rates and Learner Engagement”

- A persistent challenge in the MOOCs market is the low course completion rate, with many learners dropping out due to lack of motivation, poor course structure, or limited interaction

- Limited one-on-one engagement, absence of real-time feedback, and a lack of accountability mechanisms make it difficult for learners to stay committed

- These challenges are especially critical for long-term or certification-based courses that require sustained learner attention and discipline

- For instance, a 2023 MIT study found that average completion rates for MOOCs were below 10%, signaling the need for better engagement strategies

- If left unaddressed, this issue could hinder MOOCs' effectiveness and impact, prompting providers to invest in gamification, peer support, and mentor-led models

Massive Open Online Courses (MOOCS) Market Scope

The market is segmented on the basis of component, subjects, customer, objective, program, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Subjects |

|

|

By Customer |

|

|

By Objective |

|

|

By Program |

|

|

By Application |

|

|

By End User |

|

In 2025, the XMOOC is projected to dominate the market with a largest share in component segment

The XMOOC segment is expected to dominate the massive open online courses (MOOCS) market with the largest market share of 61.27% in 2025 due to its integration with formal degree programs is becoming increasingly common. Platforms such as Coursera and EDX provide credit-bearing courses, enabling learners to accumulate credentials that can be applied towards earning a full degree.

The degree and master programs MOOCs is expected to account for the largest share during the forecast period in program segment

In 2025, the degree and master programs MOOCs segment is expected to dominate the market with the largest market share of 57.01% because universities are increasingly adopting and expanding their hybrid online learning models to better meet students' needs. For instance, in February 2023, Pepperdine University partnered with EDX to launch the MicroMasters program, offering comprehensive knowledge and a flexible pathway toward earning a master's degree.

Massive Open Online Courses (MOOCS) Market Regional Analysis

“North America Holds the Largest Share in the Massive Open Online Courses (MOOCS) Market”

- North America is expected to dominate the MOOCs market, with the largest market share of 34.62%, driven by the presence of major online learning platforms, strong digital infrastructure, and a high demand for flexible, accessible education options.

- The U.S. stands as the key player in the region, supported by a robust educational ecosystem and a growing trend of lifelong learning among professionals.

- The region benefits from increasing adoption of online courses by both individuals and institutions, driven by the demand for upskilling, reskilling, and continued professional development

“Asia-Pacific is projected to register the Highest CAGR in the Massive Open Online Courses (MOOCS) Market”

- Asia-Pacific is expected to witness the fastest growth in the massive open online courses (MOOCs) market due to rising internet penetration, increasing smartphone usage, and a growing emphasis on digital education across countries such as India, China, Japan, and Australia

- Supportive government initiatives such as India's SWAYAM platform, China's Smart Education initiative, and strong public-private partnerships are driving widespread adoption of MOOCs in schools, universities, and corporate learning environments

- The expansion of edtech startups and localized course content in regional languages have made MOOCs more accessible to a broader learner base, especially in underserved and rural areas

- This exponential growth makes Asia-Pacific a key driver of the global MOOCs market, with ample opportunities for platform providers, content developers, and investors aiming to scale digital learning across diverse demographics

Massive Open Online Courses (MOOCS) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Coursera Inc. (U.S.)

- edX LLC(U.S.)

- Pluralsight LLC. (U.S.)

- Alison(Ireland)

- Udacity, Inc. (U.S.)

- Udemy, Inc.(U.S.)

- Miríadax (Spain)

- Jigsaw Academy Education Pvt. Ltd. (India)

- Simplilearn Solutions (U.S.)

- iversity Learning Solutions GmbH (Germany)

- INTELLIPAAT (India)

- FutureLearn (U.K.)

- LinkedIn (U.S.)

- NovoEd, Inc (U.S.)

- Open2Study (Australia)

- WizIQ (India)

- Skillshare, Inc (U.S.)

- XuetangX (China)

Latest Developments in Global Massive Open Online Courses (MOOCS) Market

- In July 2024, the Electronic Multimedia Research Centre (EMRC) department of Devi Ahilya, India, developed six new courses for MOOCs, making them accessible on the SWAYAM platform. This initiative aims to expand digital learning resources for students nationwide

- In June 2024, UNESCO and LG AI Research partnered to launch a global MOOC on the Ethics of Artificial Intelligence (AI), fostering ethical innovation and responsible AI adoption worldwide. This collaboration seeks to build a global community committed to ethical AI practices

- In June 2024, UNESCO and LG AI Research collaborated to introduce an AI ethics-focused MOOC, promoting responsible development and deployment of AI technologies. The course is designed to encourage ethical standards in AI innovation

- In May 2024, Pepperdine University’s edtech arm and 2U Inc. strengthened their partnership, announcing six new online degree programs in licensure-based fields, including education and speech-language pathology. This expansion enhances professional upskilling opportunities in critical sectors

- In March 2024, Accenture acquired Udacity to strengthen its foothold in AI education while unveiling a USD 1 billion investment in its new learning platform, LearnVantage. This move underscores Accenture’s commitment to advancing tech education globally

- In August 2023, the Andhra Pradesh (AP) government signed an MoU with edX to improve digital learning and skill development for students statewide. This partnership aims to bridge educational gaps and support workforce readiness

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。