中東およびアフリカの硫酸市場、原材料別(卑金属製錬所、元素硫黄、黄鉄鉱、その他)、形態別(濃縮、66度ボーメ硫酸、タワー/グローバー酸、チャンバー/肥料酸、バッテリー酸、希硫酸)、製造プロセス別(接触プロセス、鉛チャンバープロセス、湿式硫酸プロセス、メタ重亜硫酸プロセス、その他)、流通チャネル別(オフラインおよびオンライン)、用途別(肥料、化学製造、石油精製、金属加工、自動車、繊維、医薬品製造、パルプおよび紙、工業用、その他)業界動向および2029年までの予測。

中東およびアフリカの硫酸市場の分析と規模

硫酸は、無色、無臭、粘性の液体で、あらゆる濃度で水に溶けます。二酸化硫黄溶液を酸化して作られる強酸で、工業用および実験用試薬として大量に使用されます。硫酸または硫酸は硫酸とも呼ばれ、硫黄、酸素、水素で構成される鉱酸で、分子式は H2SO4、融点は 10 °C、沸点は 337 °C です。

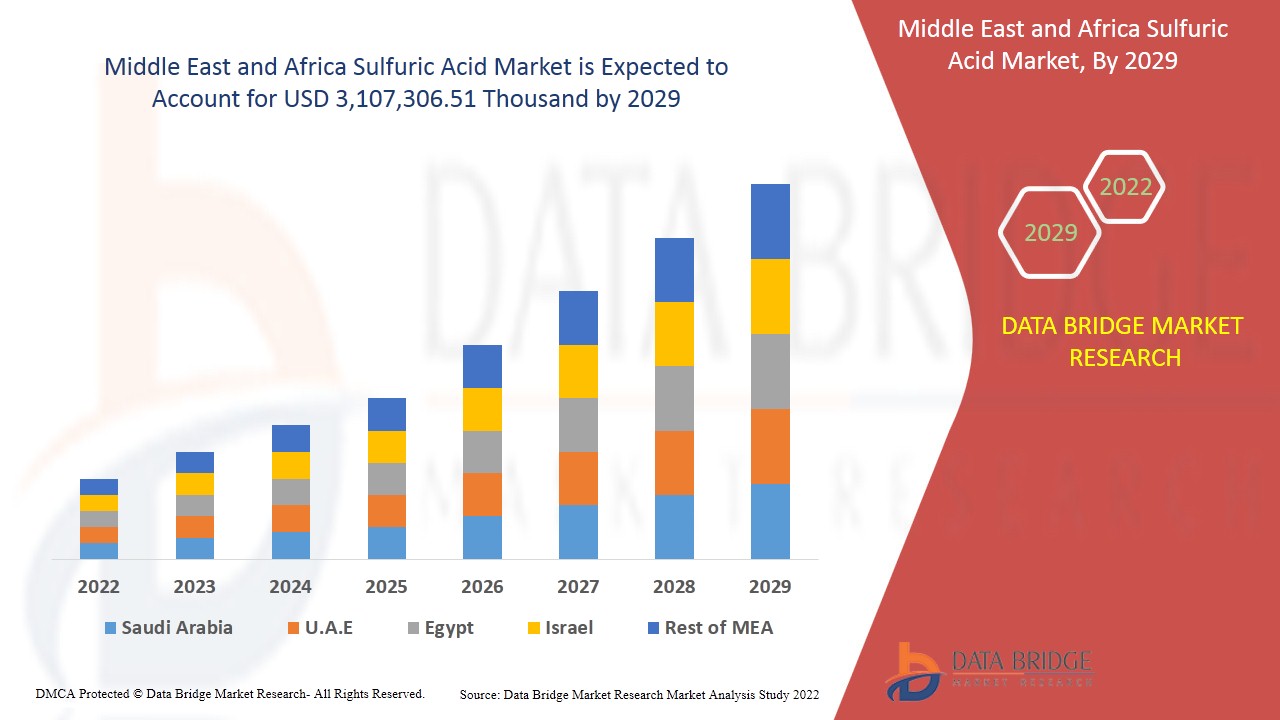

農業産業における肥料需要の増加と、さまざまな産業における硫酸需要の高まりは、市場における硫酸需要を押し上げる原動力の一部です。データブリッジ市場調査は、硫酸市場は予測期間中に3.1%のCAGRで成長し、2029年までに3,107,306.51千米ドルに達すると予測しています。硫黄は世界中で豊富に存在するため、「元素硫黄」はそれぞれ最も重要な原材料セグメントを占めています。データブリッジ市場調査チームがまとめた市場レポートには、詳細な専門家分析、輸入/輸出分析、価格分析、生産消費分析、気候連鎖シナリオが含まれています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高は千米ドル、販売量は千トン、価格は米ドル |

|

対象セグメント |

原材料別(卑金属製錬所、元素硫黄、黄鉄鉱、その他)、形態別(濃縮、66 度ボーメ硫酸、塔/グローバー酸、チャンバー/肥料酸、バッテリー酸、希硫酸)、製造プロセス別(接触プロセス、鉛チャンバープロセス、湿式硫酸プロセス、メタ重亜硫酸プロセス、その他)、流通チャネル別(オフラインおよびオンライン)、用途別(肥料、化学製造、石油精製、金属加工、自動車、繊維、医薬品製造、パルプおよび紙、工業、その他) |

|

対象国 |

南アフリカ、エジプト、サウジアラビア、アラブ首長国連邦、イスラエル、その他の中東およびアフリカの中東およびアフリカ |

|

対象となる市場プレーヤー |

LANXESS(ドイツ、ケルン)、Brenntag GmbH(Brenntag SEの子会社)(ドイツ、エッセン)、Boliden Group(スウェーデン、ストックホルム)、Adisseo(フランス、アントニー)、Veolia(フランス、パリ)、Univar Solutions Inc(米国、イリノイ州)、NORAM Engineering & Construction Ltd.(カナダ、バンクーバー)、Nouryon(オランダ、アムステルダム)、International Raw Materials LTD(米国、ペンシルバニア州)、Eti Bakir(トルコ、カスタモヌ)、ACIDEKA SA(スペイン、ビスカヤ)、Airedale Chemical Company Limited.(英国、ノースヨークシャー)、BASF SE(ドイツ、ルートヴィヒスハーフェン)、Aguachem Ltd(英国、レクサム)、Feralco AB(英国、ウィドネス)、Fluorsid(イタリア、ミラノ)、Aurubis AG(ドイツ、ハンブルク)、Nyrstar(オランダ、ブーデル)、Merck KGaA(ドイツ、ダルムシュタット)、Shrieve(テキサス州、 私たち) |

市場の定義

硫酸は、吸湿性と酸化性を備えた強酸です。肥料、化学、合成繊維、顔料業界で使用されています。その他の用途には、電池の製造、金属の酸洗い、その他の工業製造プロセスなどがあります。市場では、硫酸は98%、96.5%、76%、70%、38%などのさまざまな濃度グレードで入手できます。大量の硫酸から硫酸カリウムと肥料が生成されます。農業業界での肥料の需要の増加と、さまざまな業界での硫酸の需要の増加は、市場での硫酸の需要を押し上げる要因の一部です。硫酸の消費が世界的に増加する中、大手企業は市場での存在感を強化するためにさまざまな国で生産能力を拡大しています。

規制の枠組み

- DHHS (1994) および EPA は、三酸化硫黄または硫酸を発がん性物質として分類していません。IARC は、硫酸を含む強力な無機ミストへの職業的暴露は、人体に対して発がん性がある (グループ 1) と見なしています (IARC 1992)。ACGIH は、硫酸を人体に対する発がん性の疑いがある物質 (グループ A2) として分類しています (ACGIH 1998)。

硫酸は、「緊急計画およびコミュニティの知る権利に関する法律第 3 条 13 項の対象となる有毒化学物質」(EPA 1998f) の化学物質リストに掲載されています。

硫酸の職業許容暴露限界 (PEL) は 1 mg/m3 です (OSHA 1998)。NIOSH が推奨する暴露限界 (REL) も 1 mg/m3 です (NIOSH 1997)。ACGIH は、閾値限界値時間加重平均 (TLV-TWA) を 1 mg/m3、短期暴露限界 (STEL) を 3 mg/m3 と推奨しています (ACGIH 1998)。

COVID-19は中東およびアフリカの硫酸市場への影響は最小限にとどまった

COVID-19は、職場の閉鎖、サプライチェーンの混乱、輸送の制限につながり、2020年から2021年にかけてさまざまな製造業に影響を及ぼしました。しかし、中東とアフリカの硫酸事業とサプライチェーンには大きな影響が見られましたが、複数の製造施設はまだ稼働しています。サービスプロバイダーは、COVID後のシナリオにおいて衛生および安全対策を講じた上で硫酸の提供を継続しました。

中東およびアフリカの硫酸市場の市場動向は次のとおりです。

- 農業における肥料需要の増加

作物栽培用の高品質肥料の需要増加により、中東およびアフリカの硫酸市場が活性化しています。

- 化学産業の大幅な成長

持続可能性に向けた化学品戦略による欧州地域での化学品生産の増加は、化学産業の成長を強化するグリーンディールの重要な部分であり、危険な化学物質の使用を回避しやすくし、安全で持続可能な代替品の開発に向けたイノベーションを促進します。したがって、化学産業における持続可能性に向けた戦略は、化学産業の大幅な成長を維持し、今後数年間で中東およびアフリカの硫酸市場を推進するのに役立ちます。

- 多様な業界で硫酸の需要が増加

医薬品、繊維、製紙、パルプなどのさまざまな業界における硫酸の需要は、ますます増加すると予想されており、中東およびアフリカの硫酸市場を活性化すると予測されています。

- 自動車産業におけるバッテリー需要の高まり

硫酸を使用して金、銀、鉄、銅などのさまざまな金属を回収する廃棄プリント基板の需要の増加により、中東およびアフリカの硫酸市場が牽引されると予想されます。

- ヘルスケア業界の大幅な成長

自動車や電気自動車のその他の機械における硫酸電池の利点が増大するにつれて、硫酸の需要が増加し、中東およびアフリカの硫酸市場が将来的に活用してより高い成長を記録する機会が生まれます。

- 原料としての硫黄の豊富さ

さらに、硫黄は現在、世界中の石油および天然ガス産業で工業用に生産されており、世界中の硫黄埋蔵量が多いことから、中東およびアフリカの硫酸市場の成長の機会が生まれています。

中東・アフリカの硫酸市場が直面する制約・課題

- 硫酸に関連する健康被害

硫酸を皮膚、目、その他の臓器に使用することによる健康被害が増加しているため、中東およびアフリカの硫酸市場の需要が阻害される可能性があります。

- 硫酸の供給過剰による売上減少

The undersupply of sulfuric acid in the Middle East and Africa sulfuric acid market is the biggest problem being faced by key manufacturers operating in the market, which is directly impacting their sales and profit margins as oversupplied with other producers has led to a decrease in the prices. This is acting as the biggest challenge in the Middle East and Africa sulfuric acid market growth.

This sulfuric acid market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the sulfuric acid market contact Data Bridge Market Research for an Analyst Brief, Our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In November 2020, Airedale Chemical Company Limited acquired Alutech, which provides a range of metal treatment solutions, including aluminum brighteners and pre-treatment cleaners. This development helps the company increase the demand for sulfuric acid, which has increased its profits

- In May 2017, BASF SE introduced a new sulfuric acid catalyst preferred due to its unique geometrical shape. This update helps the company to increase production capacity, which generates revenue in the future

Middle East and Africa Sulfuric Acid Market Scope

The Middle East and Africa sulfuric acid market is segmented on the basis of raw material, form, manufacturing process, distribution channel, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Raw Material

- Base Metal Smelters

- Elemental Sulfur

- Pyrite Ore

- Others

On the basis of raw material, the market is segmented into base metal smelters, elemental sulfur, pyrite ore, and others. In 2022, the elemental sulfur segment is expected to dominate due to the abundant availability of sulfur across the globe.

Form

- Concentrated (98%)

- Tower/Glover Acid (77.67%)

- Chamber/Fertilizer Acid (62.8%)

- Battery Acid (33.5%)

- 66 Degree Baume Sulfuric Acid (93%)

- Dilute Sulfuric Acid (10%)

On the basis of form, the market is segmented into concentrated (98%), tower/glover acid (77.67%), chamber/fertilizer acid (62.8%), battery acid (33.5%), 66 degree Baume sulfuric acid (93%) and dilute sulfuric acid (10%).

Manufacturing Process

- Contact Process

- Lead Chamber Process

- Wet Sulfuric Acid Process

- Metabisulfite Process

- Others

Based on manufacturing process, the market is segmented into contact process, lead chamber process, wet sulfuric acid process, metabisulfite process, and others.

Distribution Channel

- Offline

- Online

On the basis of distribution channel, the Middle East and Africa sulfuric acid market is segmented into offline and online.

Application

- Fertilizer,

- Chemical Manufacturing

- Petroleum Refining

- Metal Processing

- Automotive

- Textile

- Drug Manufacturing

- Pulp & Paper

- Industrial

- Others

On the basis of application, the market is segmented into fertilizers, chemical manufacturing, petroleum refining, metal processing, automotive, textile, drug manufacturing, pulp & paper, industrial, and others. The fertilizers are expected to dominate the application segment as the demand for sulfuric fertilizers increases for crop plantation and soil fertility.

Middle East and Africa Sulfuric Acid Regional Analysis/Insights

Middle East and Africa sulfuric acid market is analyzed and market size insights and trends are provided by raw material, form, manufacturing process, distribution channel, and application as referenced above.

The countries covered in the Middle East and Africa sulfuric acid market report are South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel, and Rest of Middle East and Africa.

In Middle East and Africa, United Arab Emirates is dominating in Middle East and Africa sulfuric acid market due to fast growing fertilizer industry in the country. The main use of sulfuric acid is in the manufacture of the basic kinds of fertilizers, such as superphosphate of lime and ammonium sulfate.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Sulfuric Acid Market Share Analysis

The Middle East and Africa sulfuric acid market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Middle East and Africa sulfuric acid market.

殺鼠剤市場で事業を展開している主要企業としては、LANXESS、Brenntag GmbH(Brenntag SEの子会社)、Boliden Group、Adisseo、Veolia、Univar Solutions Inc、NORAM Engineering & Construction Ltd.、Nouryon、International Raw Materials LTD、Eti Bakir、ACIDEKA SA、Airedale Chemical Company Limited.、BASF SE、Aguachem Ltd、Feralco AB、Fluorsid、Aurubis AG、Nyrstar、Merck KGaA、Shrieveなどが挙げられます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AVERAGE ESTIMATED PRICING ANALYSIS

4.2 PRICE TRENDS BY RAW MATERIALS IN NORTH AMERICA

4.3 PRICE TRENDS BY FORM IN NORTH AMERICA

4.4 PRICE TRENDS BY APPLICATION IN NORTH AMERICA

4.5 REGULATORY OVERVIEW:

4.6 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR FERTILIZERS IN AGRICULTURAL INDUSTRY

5.1.2 SIGNIFICANT GROWTH IN CHEMICAL INDUSTRY

5.1.3 GROWING DEMAND FOR SULFURIC ACID ACROSS A DIVERSE RANGE OF INDUSTRIES

5.1.4 RISING USE IN RECOVERY OF WASTE PRINTED CIRCUIT BOARDS

5.2 RESTRAINTS

5.2.1 HEALTH HAZARDS ASSOCIATED WITH SULFURIC ACID

5.2.2 STRINGENT GOVERNMENT REGULATIONS ON USAGE OF SULFURIC ACID

5.2.3 VOLATILITY IN RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR BATTERIES IN AUTOMOTIVE INDUSTRY

5.3.2 ABUNDANCE OF SULFUR AS A RAW MATERIAL

5.4 CHALLENGES

5.4.1 DECLINE IN SALES RESULTING FROM OVERSUPPLY OF SULFURIC ACID

5.4.2 DIFFICULTIES INVOLVED IN TRANSPORTATION AND HANDLING OF SULFURIC ACID

6 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 ELEMENTAL SULFUR

7.3 BASE METAL SMELTERS

7.4 PYRITE ORE

7.5 OTHERS

8 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY FORM

8.1 OVERVIEW

8.2 CHAMBER/FERTILIZER ACID (62.18%)

8.3 CONCENTRATED (98%)

8.4 TOWER/GLOVER ACID (77.67%)

8.5 BATTERY ACID (33.5%)

8.6 DILUTE SULFURIC ACID (10%)

8.7 66 DEGREE BAUME SULFURIC ACID (93%)

9 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS

9.1 OVERVIEW

9.2 CONTACT PROCESS

9.3 LEAD CHAMBER PROCESS

9.4 WET SULFURIC ACID PROCESS

9.5 METABISULFITE PROCESS

9.6 OTHERS

10 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FERTILIZERS

11.2.1 CHAMBER/FERTILIZER ACID (62.18%)

11.2.2 CONCENTRATED (98%)

11.2.3 TOWER/GLOVER ACID (77.67%)

11.2.4 BATTERY ACID (33.5%)

11.2.5 DILUTE SULFURIC ACID (10%)

11.2.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.3 PETROLEUM REFINING

11.3.1 CHAMBER/FERTILIZER ACID (62.18%)

11.3.2 CONCENTRATED (98%)

11.3.3 TOWER/GLOVER ACID (77.67%)

11.3.4 BATTERY ACID (33.5%)

11.3.5 DILUTE SULFURIC ACID (10%)

11.3.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.4 METAL PROCESSING

11.4.1 CHAMBER/FERTILIZER ACID (62.18%)

11.4.2 CONCENTRATED (98%)

11.4.3 TOWER/GLOVER ACID (77.67%)

11.4.4 BATTERY ACID (33.5%)

11.4.5 DILUTE SULFURIC ACID (10%)

11.4.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.5 DRUG MANUFACTURING

11.5.1 CHAMBER/FERTILIZER ACID (62.18%)

11.5.2 CONCENTRATED (98%)

11.5.3 TOWER/GLOVER ACID (77.67%)

11.5.4 BATTERY ACID (33.5%)

11.5.5 DILUTE SULFURIC ACID (10%)

11.5.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.6 CHEMICAL MANUFACTURING

11.6.1 BY FORM

11.6.1.1 CHAMBER/FERTILIZER ACID (62.18%)

11.6.1.2 CONCENTRATED (98%)

11.6.1.3 TOWER/GLOVER ACID (77.67%)

11.6.1.4 BATTERY ACID (33.5%)

11.6.1.5 DILUTE SULFURIC ACID (10%)

11.6.1.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.6.2 BY APPLICATION

11.6.2.1 AGRICULTURE CHEMICALS

11.6.2.2 HYDROCHLORIC ACID

11.6.2.3 NITRIC ACID

11.6.2.4 DYES AND PIGMENTS

11.6.2.5 SULFATE SALTS

11.6.2.6 SYNTHETIC DETERGENTS

11.6.2.7 OTHERS

11.7 TEXTILE

11.7.1 CHAMBER/FERTILIZER ACID (62.18%)

11.7.2 CONCENTRATED (98%)

11.7.3 TOWER/GLOVER ACID (77.67%)

11.7.4 BATTERY ACID (33.5%)

11.7.5 DILUTE SULFURIC ACID (10%)

11.7.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.8 INDUSTRIAL

11.8.1 CHAMBER/FERTILIZER ACID (62.18%)

11.8.2 CONCENTRATED (98%)

11.8.3 TOWER/GLOVER ACID (77.67%)

11.8.4 BATTERY ACID (33.5%)

11.8.5 DILUTE SULFURIC ACID (10%)

11.8.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.9 AUTOMOTIVE

11.9.1 CHAMBER/FERTILIZER ACID (62.18%)

11.9.2 CONCENTRATED (98%)

11.9.3 TOWER/GLOVER ACID (77.67%)

11.9.4 BATTERY ACID (33.5%)

11.9.5 DILUTE SULFURIC ACID (10%)

11.9.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.1 PULP & PAPER

11.10.1 CHAMBER/FERTILIZER ACID (62.18%)

11.10.2 CONCENTRATED (98%)

11.10.3 TOWER/GLOVER ACID (77.67%)

11.10.4 BATTERY ACID (33.5%)

11.10.5 DILUTE SULFURIC ACID (10%)

11.10.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.11 OTHERS

11.11.1 CHAMBER/FERTILIZER ACID (62.18%)

11.11.2 CONCENTRATED (98%)

11.11.3 TOWER/GLOVER ACID (77.67%)

11.11.4 BATTERY ACID (33.5%)

11.11.5 DILUTE SULFURIC ACID (10%)

11.11.6 66 DEGREE BAUME SULFURIC ACID (93%)

12 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 U.A.E.

12.1.2 SAUDI ARABIA

12.1.3 SOUTH AFRICA

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13.2 MERGERS & ACQUISITIONS

13.3 EXPANSIONS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 VEOLIA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 AURUBIS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 MERCK KGAA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATE

15.4 UNIVAR SOLUTIONS INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 BASF SE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT UPDATES

15.6 ACIDEKA S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATE

15.7 ADISSEO

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATE

15.8 AGUACHEM LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

15.9 AIREDALE CHEMICAL COMPANY LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 BOLIDEN GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATE

15.11 BRENNTAG GMBH (A SUBSIDARY OF BRENNTAG SE)

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATE

15.12 ETI BAKIR

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 FERALCO AB

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATES

15.14 FLUORSID

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT UPDATE

15.15 INTERNATIONAL RAW MATERIALS LTD

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATE

15.16 LANXESS

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 NORAM ENGINEERS AND CONSTRUCTORS LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT UPDATES

15.18 NOURYON

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT UPDATES

15.19 NYRSTAR

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 SHRIEVE

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF SULFURIC ACID; OLEUM; HS CODE - 2807 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SULFURIC ACID; OLEUM; HS CODE - 2807 (USD THOUSAND)

TABLE 3 EMISSION STANDARDS SULFURIC ACID PLANT (CPCB- INDIA)

TABLE 4 DEMAND FOR FERTILIZER NUTRIENT USE IN THE WORLD, 2016-2022 (THOUSAND TONES)

TABLE 5 NEWLY LAUNCHED AND EXPECTED LAUNCH MODELS OF ELECTRICAL CARS

TABLE 6 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 8 MIDDLE EAST & AFRICA ELEMENTAL SULFUR IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA ELEMENTAL SULFUR IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 10 MIDDLE EAST & AFRICA BASE METAL SMELTERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA BASE METAL SMELTERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 12 MIDDLE EAST & AFRICA PYRITE ORE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA PYRITE ORE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 16 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA CHAMBER/FERTILIZER ACID (62.18%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA CONCENTRATED (98%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA TOWER/GLOVER ACID (77.67%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA BATTERY ACID (33.5%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA DILUTE SULFURIC ACID (10%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA 66 DEGREE BAUME SULFURIC ACID (93%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA CONTACT PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA LEAD CHAMBER PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA WET SULFURIC ACID PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA METABISULFITE PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA OFFLINE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA ONLINE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA TEXTILE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY COUNTRY, 2020-2029 (THOUSAND TONNE)

TABLE 56 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 58 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 70 MIDDLE EAST & AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 73 U.A.E. SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 74 U.A.E. SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 75 U.A.E. SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 76 U.A.E. SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 77 U.A.E. SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 78 U.A.E. SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 U.A.E. FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 80 U.A.E. PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 81 U.A.E. METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 82 U.A.E. DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 83 U.A.E. CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 84 U.A.E. CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 U.A.E. TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 86 U.A.E. INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 87 U.A.E. AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 88 U.A.E. PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 89 U.A.E. OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 90 SAUDI ARABIA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 91 SAUDI ARABIA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 92 SAUDI ARABIA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 93 SAUDI ARABIA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 94 SAUDI ARABIA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 95 SAUDI ARABIA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 SAUDI ARABIA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 97 SAUDI ARABIA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 98 SAUDI ARABIA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 99 SAUDI ARABIA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 100 SAUDI ARABIA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 101 SAUDI ARABIA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 SAUDI ARABIA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 103 SAUDI ARABIA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 104 SAUDI ARABIA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 SAUDI ARABIA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 106 SAUDI ARABIA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 107 SOUTH AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 108 SOUTH AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 109 SOUTH AFRICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 110 SOUTH AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 111 SOUTH AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 112 SOUTH AFRICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 SOUTH AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 114 SOUTH AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 115 SOUTH AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 116 SOUTH AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 117 SOUTH AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 118 SOUTH AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 SOUTH AFRICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 120 SOUTH AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 121 SOUTH AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 122 SOUTH AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 123 SOUTH AFRICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 124 ISRAEL SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 125 ISRAEL SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 126 ISRAEL SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 127 ISRAEL SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 128 ISRAEL SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 129 ISRAEL SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 ISRAEL FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 131 ISRAEL PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 132 ISRAEL METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 133 ISRAEL DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 134 ISRAEL CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 135 ISRAEL CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 ISRAEL TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 137 ISRAEL INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 138 ISRAEL AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 139 ISRAEL PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 140 ISRAEL OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 141 EGYPT SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 142 EGYPT SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 143 EGYPT SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 144 EGYPT SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 145 EGYPT SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 146 EGYPT SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 EGYPT FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 148 EGYPT PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 149 EGYPT METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 150 EGYPT DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 151 EGYPT CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 152 EGYPT CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 EGYPT TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 154 EGYPT INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 155 EGYPT AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 156 EGYPT PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 157 EGYPT OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 158 REST OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 159 REST OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: RAW MATERIAL LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SIGNIFICANT GROWTH IN THE CHEMICAL INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 ELEMENTAL SULFUR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET IN 2022 & 2029

FIGURE 17 AVERAGE ESTIMATED PRICING ANALYSIS OF SULFURIC ACID

FIGURE 18 PRICE OF 98% SULFURIC ACID

FIGURE 19 VALUE CHAIN ANALYSIS OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET

FIGURE 21 FERTILIZER CONSUMPTION IN VARIOUS COUNTRIES (2019) (KILOGRAMS PER HECTARE OF LAND)

FIGURE 22 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY RAW MATERIAL, 2021

FIGURE 23 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY FORM, 2021

FIGURE 24 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY MANUFACTURING PROCESS, 2021

FIGURE 25 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY APPLICATION, 2021

FIGURE 27 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: SNAPSHOT (2021)

FIGURE 28 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY COUNTRY (2021)

FIGURE 29 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY RAW MATERIAL (2022-2029)

FIGURE 32 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。