Global Petroleum Coke Market

Market Size in USD Billion

CAGR :

%

USD

7.95 Billion

USD

14.50 Billion

2025

2033

USD

7.95 Billion

USD

14.50 Billion

2025

2033

| 2026 –2033 | |

| USD 7.95 Billion | |

| USD 14.50 Billion | |

|

|

|

|

Petroleum Coke Market Size

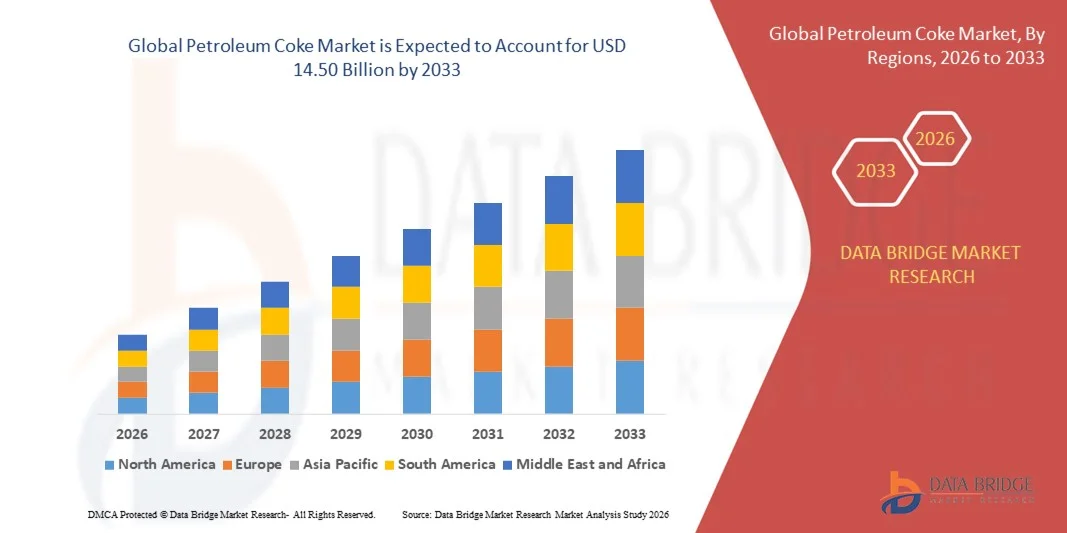

- The global petroleum coke market size was valued at USD 7.95 billion in 2025 and is expected to reach USD 14.50 billion by 2033, at a CAGR of 7.79% during the forecast period

- The market growth is largely fuelled by the increasing demand for energy-efficient and cost-effective fuel alternatives in power generation and industrial applications

- Rising utilization of petroleum coke in cement kilns and metal smelting processes, along with the growing global refinery capacity, is contributing significantly to market expansion

Petroleum Coke Market Analysis

- The petroleum coke market is witnessing robust growth driven by its rising adoption as a carbon material in various industries, such as aluminum and steel manufacturing. Its high calorific value and low cost compared to coal make it a preferred fuel source for energy-intensive operations

- Growing urbanization and industrialization, especially in emerging economies, have accelerated the demand for petroleum coke in power plants and cement production

- North America dominated the petroleum coke market with the largest revenue share in 2025, driven by growing industrialization, high demand from cement and aluminum industries, and abundant refining capacity

- Asia-Pacific region is expected to witness the highest growth rate in the global petroleum coke market, driven by growing industrialization, expanding infrastructure projects, and increasing demand for low-cost, high-calorific fuels across emerging economies

- The fuel grade coke segment held the largest market revenue share in 2025, driven by its widespread use as a low-cost, high-calorific industrial fuel. Fuel grade coke is commonly utilized in power plants, cement kilns, and other high-energy-consuming industries, making it a preferred choice for operators seeking cost-efficient energy solutions

Report Scope and Petroleum Coke Market Segmentation

|

Attributes |

Petroleum Coke Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Petroleum Coke Market Trends

Rise of Petroleum Coke Usage in Industrial Applications

- The increasing utilization of petroleum coke (petcoke) as a low-cost, high-calorific fuel is transforming the energy landscape across industries such as cement, power, and aluminum production. Its high carbon content and energy density enable efficient combustion, helping reduce reliance on conventional fuels and lower operational costs. The trend is particularly strong in regions with abundant petroleum refining capacity, while ongoing technological improvements in fuel handling are enhancing operational safety and efficiency. Petcoke is also increasingly considered for co-firing applications in power plants, expanding its market reach

- The demand for petcoke in the aluminum and steel industries is accelerating due to its role as a critical feedstock for calcined coke production, which is essential for producing anodes. Manufacturers are leveraging petcoke for consistent quality and performance, ensuring improved efficiency in metal smelting processes. The trend is further supported by growing industrialization in emerging economies, rising metal demand, and the expansion of large-scale smelting operations, which collectively strengthen petcoke’s strategic importance

- Petcoke’s adoption in power generation and cement kilns is driven by its cost-effectiveness compared to coal and other fossil fuels. Industrial operators benefit from its higher thermal efficiency and longer combustion times, allowing for better energy utilization and reduced fuel consumption. Increasing integration with emission control technologies and blending with alternative fuels is enhancing its sustainability credentials, further solidifying its role in industrial energy management

- For instance, in 2023, several cement plants in India reported enhanced kiln performance and lower fuel expenditure after switching to high-grade calcined petroleum coke sourced from domestic refineries. The improved energy efficiency and reduced operational costs contributed to higher production profitability. Similar adoption trends were observed in Southeast Asia, where plants leveraged petcoke to maintain consistent energy supply while meeting cost targets and regulatory requirements

- While the demand for petroleum coke is growing, its environmental impact and regulatory scrutiny remain critical considerations. Industry players are focusing on cleaner combustion technologies, sulfur reduction methods, and eco-friendly handling practices to maximize market potential. In addition, ongoing R&D on low-sulfur and green coke variants is supporting market expansion in regions with strict environmental regulations

Petroleum Coke Market Dynamics

Driver

Rising Demand from Cement and Aluminum Industries

- The growing industrialization and infrastructure development across Asia-Pacific and Latin America are driving demand for petroleum coke as a fuel and feedstock. Cement and aluminum producers increasingly prefer petcoke due to its cost advantages and consistent energy output. Coupled with supportive government policies and industrial incentives, this trend has fueled investment in long-term supply contracts and strategic refinery partnerships, ensuring steady market growth

- Manufacturers are seeking reliable petcoke supplies to support continuous production in high-capacity facilities. The stability in quality and energy content of petroleum coke ensures operational efficiency and reduces downtime caused by fuel variability. Increasing collaborations between refineries and industrial consumers are also helping maintain supply chain stability, essential for large-scale operations and market confidence

- Expansion in power and cement production facilities is further boosting demand for low-cost fuels such as petroleum coke. The material’s ability to meet high energy requirements at reduced costs has positioned it as an indispensable component of industrial operations. Rising demand in emerging economies, coupled with the expansion of secondary and tertiary recovery projects, is expected to sustain market growth over the forecast period

- For instance, in 2022, several aluminum smelters in China increased their intake of calcined petroleum coke to maintain high anode quality and consistent smelting output, supporting industry growth and operational efficiency. Additional adoption in India and the Middle East highlights the strategic role of petcoke in global industrial supply chains

- As global industrial demand increases, petroleum coke continues to gain traction as a preferred low-cost, high-energy fuel across multiple sectors. The synergy between increasing industrial output and cost-efficient energy sourcing reinforces its long-term market relevance

Restraint/Challenge

Environmental Concerns and Regulatory Restrictions

- The use of petroleum coke is constrained by environmental regulations due to its high sulfur content and CO2 emissions. Industrial combustion of petcoke can contribute to air pollution and greenhouse gas emissions, leading to compliance challenges in many regions. Stringent emission norms and environmental audits are prompting industrial operators to invest in advanced control systems and alternative fuel blends, increasing operational complexity and costs

- Handling, storage, and transportation of petroleum coke pose environmental and safety risks, especially in densely populated or ecologically sensitive areas. Spillage, dust generation, and leachate from storage sites can adversely affect local ecosystems, requiring operators to invest in containment and monitoring systems. Compliance with international standards, such as ISO 14001, is increasingly mandatory, adding additional operational requirements

- Fluctuating crude oil refining outputs and quality inconsistencies of petcoke can also impact availability and pricing, limiting its adoption in industries with strict quality requirements. Supply chain disruptions due to geopolitical tensions or refinery maintenance further exacerbate uncertainty, necessitating strategic stockpiling and long-term procurement agreements to ensure continuous operations

- For instance, in 2023, several power plants in Europe had to reduce petroleum coke usage due to tightened emission regulations and high sulfur content, prompting a shift to blended fuels or alternative energy sources. Similar restrictions in North America and East Asia are encouraging adoption of low-sulfur variants and emission mitigation measures, impacting market dynamics

- To address these challenges, industry participants are focusing on cleaner combustion technologies, desulfurization processes, and eco-friendly supply chain management to ensure sustainable growth in the petroleum coke market. Increased R&D on environmental compliance and process optimization is expected to drive both market expansion and responsible usage across industrial sectors

Petroleum Coke Market Scope

The petroleum coke market is segmented on the basis of type, product type, and application.

- By Type

On the basis of type, the petroleum coke market is segmented into fuel grade coke and calcined coke. The fuel grade coke segment held the largest market revenue share in 2025, driven by its widespread use as a low-cost, high-calorific industrial fuel. Fuel grade coke is commonly utilized in power plants, cement kilns, and other high-energy-consuming industries, making it a preferred choice for operators seeking cost-efficient energy solutions.

The calcined coke segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its critical role in aluminum and steel production. Calcined coke is valued for its consistent quality, low moisture content, and suitability for anode production, ensuring enhanced efficiency and product performance in metal smelting applications. The increasing industrialization and expansion of large-scale smelting facilities are further propelling its adoption.

- By Product Type

On the basis of product type, the petroleum coke market is segmented into needle coke, sponge coke, catalyst coke, shot coke, and purge coke. The needle coke segment held the largest market revenue share in 2025, fueled by its high demand in graphite electrode manufacturing for steel and aluminum industries. Needle coke’s superior carbon content and low impurity levels make it essential for efficient smelting processes, supporting consistent output and reduced operational costs.

The catalyst coke segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its increasing utilization in petroleum refining and chemical industries. Catalyst coke is critical in cracking processes and other refinery operations, ensuring enhanced efficiency and improved product yields, which is propelling its adoption in emerging markets.

- By Application

On the basis of application, the petroleum coke market is segmented into power plants, cement industry, steel industry, aluminum industry, and others. The power plant segment held the largest market revenue share in 2025, driven by the cost-effectiveness and high energy output of petroleum coke. Operators in energy-intensive industries benefit from its high calorific value, reducing fuel expenses and improving operational efficiency.

The aluminum industry segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising demand for calcined coke in anode production. Aluminum manufacturers prefer petroleum coke for its consistent quality and performance, ensuring smoother smelting operations and enhanced production efficiency.

Petroleum Coke Market Regional Analysis

- North America dominated the petroleum coke market with the largest revenue share in 2025, driven by growing industrialization, high demand from cement and aluminum industries, and abundant refining capacity

- The region’s established manufacturing base and availability of low-cost petroleum coke make it a preferred choice for industrial operators seeking efficient and reliable energy sources

- Widespread adoption is further supported by favorable regulations, strong infrastructure, and the presence of major cement, steel, and aluminum producers, establishing petroleum coke as a key industrial fuel

U.S. Petroleum Coke Market Insight

The U.S. petroleum coke market captured the largest revenue share in 2025 within North America, fueled by the extensive use of fuel-grade and calcined coke in power generation, cement, and aluminum production. Industrial operators are increasingly leveraging petroleum coke for its cost-effectiveness and high-calorific value, ensuring consistent energy output and operational efficiency. The availability of domestic refining capacity, combined with strategic supply chains and long-term supply contracts, further drives the market. Moreover, U.S. investments in cleaner combustion technologies and desulfurization processes are enabling sustainable usage of petroleum coke across industries.

Europe Petroleum Coke Market Insight

The Europe petroleum coke market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing industrial demand in the cement and aluminum sectors and the need for low-cost, high-energy fuels. Regulatory incentives for energy efficiency and emission reduction are encouraging the adoption of calcined petroleum coke in industrial processes. European manufacturers are focusing on integrating petroleum coke into sustainable energy strategies while balancing cost-effectiveness and environmental compliance, supporting market expansion.

U.K. Petroleum Coke Market Insight

The U.K. petroleum coke market is expected to witness significant growth from 2026 to 2033, driven by industrial modernization and rising demand for cost-efficient fuel in cement and power plants. Increasing focus on energy-intensive industries and sustainable operations is encouraging the adoption of cleaner-grade petroleum coke. The U.K.’s strong industrial infrastructure, coupled with technological advancements in fuel handling and combustion efficiency, is expected to further stimulate market growth.

Germany Petroleum Coke Market Insight

The Germany petroleum coke market is expected to witness substantial growth from 2026 to 2033, fueled by rising industrial production in cement, steel, and aluminum sectors and increasing investments in energy efficiency. Germany’s emphasis on eco-conscious industrial practices and innovation in calcined coke applications supports the adoption of petroleum coke. Integration of advanced processing technologies and emission-reduction measures ensures compliance with stringent environmental standards while maintaining operational cost benefits.

Asia-Pacific Petroleum Coke Market Insight

The Asia-Pacific petroleum coke market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, rising urbanization, and strong growth in cement, aluminum, and steel production in countries such as China, India, and Japan. The region benefits from abundant petroleum refining capacity and low-cost availability of petcoke, making it a preferred choice for energy-intensive industries. Furthermore, government initiatives promoting industrial growth and infrastructure development are encouraging the adoption of petroleum coke as a reliable and cost-effective fuel.

Japan Petroleum Coke Market Insight

The Japan petroleum coke market is expected to witness notable growth from 2026 to 2033 due to the country’s high demand for energy-efficient fuels in aluminum and steel production. Japan’s emphasis on industrial automation, clean energy practices, and consistent fuel quality is driving the adoption of both fuel-grade and calcined petroleum coke. In addition, integration with advanced combustion and emission-control technologies is supporting sustainable industrial operations, ensuring market growth.

China Petroleum Coke Market Insight

The China petroleum coke market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapid industrialization, expansion of cement and aluminum industries, and high domestic refining capacity. China stands as one of the largest consumers of petroleum coke, using it extensively in power plants, cement kilns, and metal smelting facilities. Government initiatives supporting energy efficiency, combined with the availability of low-cost petcoke and robust domestic manufacturing capabilities, are key factors driving the market’s growth.

Petroleum Coke Market Share

The Petroleum Coke industry is primarily led by well-established companies, including:

- Exxon Mobil Corporation (U.S.)

- Oxbow Corporation (U.S.)

- Royal Dutch Shell (U.K./Netherlands)

- Aramco Trading (Saudi Arabia)

- bp America (U.S.)

- Essar (India)

- Reliance Industries Limited (India)

- Chevron Corporation (U.S.)

- Valero (U.S.)

- Indian Oil Corporation Ltd (India)

- Trammo, Inc. (U.S.)

- Phillips 66 Company (U.S.)

- Marathon Petroleum Corporation (U.S.)

- AMINCO RESOURCES LLC. (U.S.)

- HPCL-Mittal Energy Limited (HMEL) (India)

- Bharat Petroleum Corporation Limited (India)

- Shamokin Carbons (U.S.)

- Husky Energy Inc. (Canada)

- Rain Carbon Inc. (U.S.)

- Carbograf Industrial S.A. de C.V. (Mexico)

Latest Developments in Global Petroleum Coke Market

- In July 2023, Venezuela’s state-owned oil company, PDVSA, signed two new export contracts with Latif Petrol (Turkey) and Reussi Trading (St. Vincent and the Grenadines) for up to 1.6 million metric tons of petroleum coke. The agreements aim to expand PDVSA’s international distribution network and increase sales of petcoke to global markets. This development is expected to enhance revenue generation for the company while meeting growing industrial demand for low-cost, high-calorific fuels. The contracts also strengthen trade ties with key international partners and support the overall growth of the petroleum coke market by improving supply availability and market penetration

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Petroleum Coke Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Petroleum Coke Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Petroleum Coke Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.