北米段ボール包装市場の規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

66.68 Million

USD

98.34 Million

2024

2032

USD

66.68 Million

USD

98.34 Million

2024

2032

| 2025 –2032 | |

| USD 66.68 Million | |

| USD 98.34 Million | |

|

|

|

北米段ボール包装市場のセグメンテーション、製品別(レギュラースロットコンテナ(RSC)、ハーフスロットコンテナ(HSC)、オーバーラップスロットコンテナ(OSC)、フルオーバーラップスロットコンテナ(FOL)、センタースペシャルスロットコンテナ(CSSC)、1-2-3ボトムまたはオートロックボトムコンテナ(ALB)、伸縮式ボックス(デザインスタイルトレイ、インフォールドトレイ、アウトフォールドトレイ)、フォルダー、ラップアラウンドブランク)、フルートタイプ(Cフルート、Bフルート、Eフルート、Aフルート、Fフルート、Dフルート)、ボードスタイル(シングルウォール、ダブルウォール、トリプルウォール、シングルフェイス、ライナーボード)、容量(最大100ポンド、100-300ポンド、300ポンド以上)、サイズ(0-10インチ、10-20インチ、20-30インチ、30インチ以上)、印刷タイプ(印刷あり、印刷なし)アプリケーション(電子商取引および小売、食品、電子機器、家電製品、自動車、ヘルスケアおよび医薬品、飲料、ガラス製品および陶磁器、パーソナルケア、ホームケア、農業および園芸、石油およびガス、玩具製品、ベビー用品、その他) - 2032年までの業界動向と予測

段ボール包装市場規模

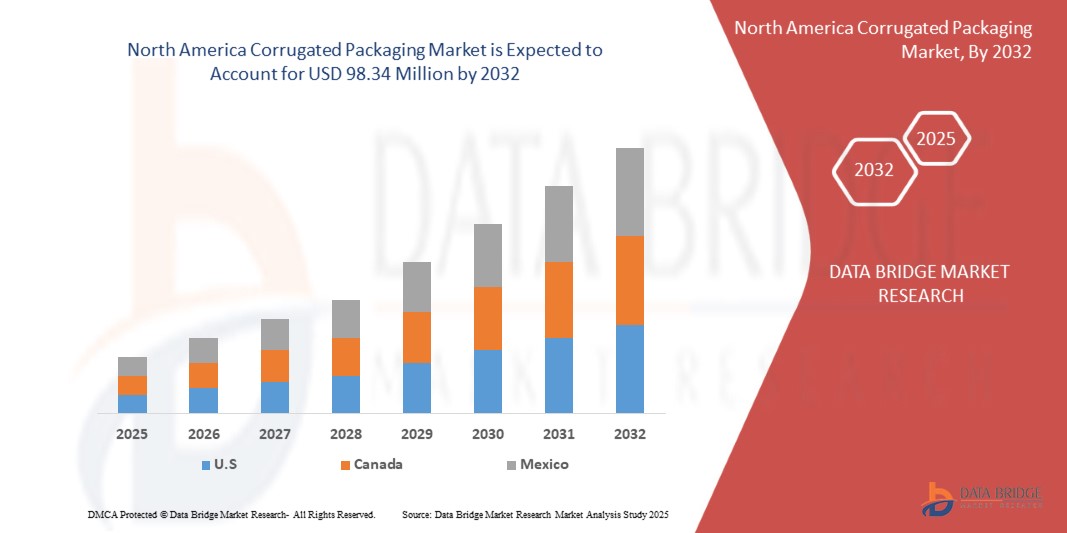

- 北米の段ボール包装市場は2024年に6,668万米ドルと評価され、 2032年までに9,834万米ドルに達すると予想されています。

- 2025年から2032年の予測期間中、市場は主に技術の進歩によって5.1%のCAGRで成長すると予想されます。

- この成長は、製品のカスタマイズ、持続可能な包装、リサイクル可能で再生可能な材料の採用、段ボール包装における電子商取引などの要因によって推進されている。

段ボール包装市場分析

- 段ボール包装は、その耐久性、リサイクル性、そしてコスト効率の良さから、eコマース、食品・飲料、医薬品、消費財などの業界で広く利用されています。輸送中や保管中の優れた保護性能により、北米のサプライチェーンにとって不可欠な存在となっています。

- 持続可能な包装ソリューションへの需要の高まりとeコマースの急増は、段ボール包装市場の拡大を大きく後押ししました。企業がプラスチック廃棄物の削減に注力する中、段ボールは環境に優しい代替品として注目を集めています。

- 米国地域は、工業化、都市化の進展、オンライン小売業の急成長により、段ボール包装の主要国の一つとして際立っています。

- 北米の段ボール包装は持続可能な包装の選択肢として上位にランクされており、二酸化炭素排出量の削減と効率的な製品輸送の確保に重要な役割を果たし、循環型経済の取り組みをサポートしています。

レポートの範囲と段ボール包装市場のセグメンテーション

|

属性 |

段ボール包装の主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。 |

段ボール包装市場の動向

「持続可能でスマートなパッケージングソリューションへの需要の高まり」

- 北米の段ボール包装市場における顕著な傾向の1つは、環境規制と消費者の嗜好によって推進される持続可能でスマートな包装ソリューションへの移行の増加である。

- 企業は、二酸化炭素排出量を削減し、循環型経済の目標に沿うために、環境に優しく、リサイクル可能で、生分解性の段ボール包装に投資している。

- 例えば、スマーフィット・カッパはマインドフル・シェフと提携し、100%リサイクル可能な段ボール製断熱パックを開発しました。これにより、二酸化炭素排出量は30%削減されました。この持続可能なパッケージは、試験期間中、30時間以上にわたり必要な温度を維持しました。この革新的な技術は、リサイクル不可能な断熱パウチに取って代わり、環境に優しい食品配達に貢献しています。

- RFIDタグ、QRコード、デジタル印刷などのスマートパッケージング技術が段ボール箱に統合され、サプライチェーンの可視性、製品追跡、消費者エンゲージメントが向上しています。

- この傾向は段ボール包装業界を変革し、イノベーション、コスト効率、北米の持続可能性基準への準拠を促進し、最終的には長期的な市場の成長を促進します。

段ボール包装市場の動向

ドライバ

「小売業とFMCG業界の成長が段ボール包装の導入を加速」

- オンラインショッピングの急増により、ブランドは製品の安全性を高め、進化する消費者の期待に応えるために、耐久性があり環境に優しいパッケージを優先しています。

- さらに、リサイクル可能な材料を奨励する政府の規制は、段ボール包装の好まれる傾向の高まりにさらに寄与している。

- 特に白内障は世界中で最も一般的な失明原因の一つであり、高い精度が求められる外科手術が必要となる。

- FMCG企業が製品ラインを拡大し、革新的な包装形態を模索する中で、段ボールシートは汎用性とカスタマイズ性を提供します。食品・飲料からパーソナルケア製品まで、これらのシートは優れた構造強度とブランディングの機会を提供します。

例えば、

- Business Wireによると、2020年2月、SpendEdgeはFMCG企業の戦略的なパッケージ調達アプローチの構築を支援し、年間1,500万米ドルのコスト削減を達成しました。サプライヤーの選定、支出の集約、コスト要因を最適化することで、同社はサプライチェーンの効率性を高め、市場での地位を強化しました。FMCG企業がコスト最適化と業務効率を優先する中、持続可能で費用対効果の高い段ボールパッケージの需要が高まっています。戦略的調達、サプライヤー評価、そして総コスト最適化への重点的な取り組みは、小売およびFMCGセクターにおける段ボールパッケージの導入をさらに促進しています。

- Fresh Plazaの2025年3月の記事では、Klabin社がブラジルにおける段ボール輸送を強化するため、内陸海上輸送を導入し、コスト、配送時間、環境への影響を削減したことが取り上げられました。同社はまた、防湿段ボールにも投資し、eコマース、生鮮食品の輸出、持続可能性への需要に牽引され、成長を続ける小売・FMCGセクターを支援しています。

- 小売業とFMCG(日用消費財)業界の急速な拡大は、段ボール包装の採用拡大を促進する大きな要因となっています。eコマース、持続可能な包装、そして費用対効果の高い物流に対する消費者の需要が高まるにつれ、企業は軽量で耐久性があり、リサイクル可能な段ボールソリューションへと目を向けています。環境に優しい包装への移行と効率的なサプライチェーン管理の必要性も、この傾向をさらに強めています。小売業者とFMCGブランドが持続可能性と製品保護を優先する中で、段ボール包装市場は継続的な成長と革新を遂げると予想されます。

機会

「北米のeコマースの拡大により、軽量で耐久性のある段ボール包装の需要が増加」

- 北米のeコマースの急速な拡大により、輸送中に製品を保護する軽量で耐久性のある梱包材の需要が大幅に増加しています。

- オンライン小売の急増により、強度とリサイクル性に優れた段ボール包装など、信頼性が高く費用対効果の高いソリューションの必要性が高まっています。

- 製造業者は、サプライチェーンの物流を最適化し、損傷率を低減するために、高度な設計を採用するケースが増えています。この傾向は、デジタルコマースの進化に伴い、着実な収益成長と大きな市場ポテンシャルを約束しています。

例えば、

- 2024年5月、Baywater Packaging & Supplyが発表した記事によると、2024年のeコマースの急速な成長により、オンラインショッピングの急増に伴い段ボール箱の需要が大幅に増加しました。企業は、増加する出荷量に対応するために、より耐久性があり、軽量で、持続可能な包装を求めていました。消費者の嗜好や規制基準に対応するために、環境に優しい素材やスマートな包装ソリューションの革新が不可欠になりました。物流ネットワークの拡大とサプライチェーンの進化も需要をさらに押し上げました。企業は、進化する市場ニーズに対応するため、生産、リサイクル、効率的な包装設計の最適化に注力しました。

- 2024年3月、モンディはヨーロッパとトルコの消費者6,000人を対象とした調査に基づき、eコマースのパッケージングトレンドに関するレポートを発表しました。この調査では、購買習慣、パッケージングの嗜好、リサイクル行動、そして将来のトレンドについて調査しました。消費者の期待と持続可能性の目標を満たすために、eコマースブランドとパッケージプロバイダーの連携が重要視されました。持続可能なパッケージングの需要が高まる中、eコマースは段ボールパッケージにとって、環境に優しく効率的なソリューションを支える大きなチャンスとなりました。

- 北米におけるeコマースの急速な拡大は、軽量で耐久性のある段ボール包装の需要を大きく押し上げています。オンライン小売販売の継続的な成長に伴い、企業は輸送需要を満たすために革新的で持続可能な包装ソリューションを導入しています。物流、材料科学、スマートパッケージの進歩は、段ボール包装市場をさらに強化し、効率性と環境持続可能性を確保するでしょう。

抑制/挑戦

「原材料価格の変動は生産コストを上昇させ、利益率を圧迫する」

- 原材料価格の変動、特にクラフト紙やリサイクル繊維の価格変動により、段ボール包装業界の生産コストが大幅に上昇し、利益率が圧迫されている。

- パルプと紙の価格変動は財政の不安定化を招き、メーカーにとって予算計画と収益性の維持が困難になる。

- 企業はコスト上昇に対処するため、しばしばコスト削減策を講じますが、これは製品の品質や業務効率に影響を与える可能性があります。多くの企業は、長期供給契約の締結や、効率性の向上と廃棄物の削減を目的とした先進的な製造技術への投資によって、こうした課題を軽減しています。

例えば、

- 2024年7月、ジョンズバーンが発表した記事によると、原材料価格の高騰、労働力不足、輸送費の増加により、eコマースの梱包コストが上昇しました。段ボール包装市場は、需要の急増と持続可能性への期待の高まりにより、課題に直面しました。これらの課題に対処するため、企業は適切なサイズの梱包、費用対効果の高い持続可能な素材の使用、フルフィルメントの自動化、そして商品の品揃えの最適化を導入しました。これらの戦略により、効率性と顧客満足度を維持しながら経費を削減することができました。

- THG PUBLISHING PVT LTD.が発表した記事によると、2024年10月、ケーララ州段ボール箱製造協会(KeCBMA)は、クラフト紙価格の高騰により段ボール箱の価格を15%引き上げました。原材料費の高騰により、メーカーは収益性維持に課題を抱え、段ボール包装市場に影響を与えています。

- 段ボール包装業界は、原材料価格の変動、特にクラフト紙価格の高騰により、依然として大きな課題に直面しています。こうした価格高騰は生産費の増加と利益率の低下を招き、メーカーは自動化や包装の最適化といったコスト削減戦略の導入を余儀なくされています。収益性を維持するため、企業は長期供給契約の締結や代替素材の検討を進めています。こうしたコスト圧力への対応は、市場の安定性と競争力を維持するために依然として重要です。

段ボール包装市場の展望

市場は、製品、フルートタイプ、ボードスタイル、容量、サイズ、印刷タイプ、およびアプリケーションに基づいて分類されています。

|

セグメンテーション |

サブセグメンテーション |

|

製品別 |

|

|

フルートの種類別 |

|

|

ボードスタイル別 |

|

|

容量別 |

|

|

サイズ別 |

|

|

印刷タイプ別

|

|

|

アプリケーション別 |

|

段ボール包装市場の地域分析

「米国は段ボール包装市場における支配的な国である」

- 米国は、電子商取引分野の急成長、急速な工業化、費用対効果が高く持続可能な包装ソリューションへの高い需要に牽引され、段ボール包装市場で優位に立っており、最も急速に成長している国である。

- この地域は、製造コストの低さ、強力なサプライチェーン、中国やインドのような大規模な消費者市場の恩恵を受けており、生産と消費の増加を牽引しています。

- さらに、この地域では小売業や食品配達サービスが拡大しており、コスト効率が高く耐久性のある段ボール包装ソリューションの需要が高まっています。

段ボール包装市場シェア

市場競争環境は、競合他社ごとに詳細な情報を提供します。企業概要、財務状況、収益、市場ポテンシャル、研究開発投資、新規市場への取り組み、地域展開、生産拠点・設備、生産能力、強みと弱み、製品投入、製品群の幅広さ、アプリケーションにおける優位性などの詳細が含まれます。上記のデータは、各社の市場への注力分野にのみ関連しています。

市場で活動している主要なマーケットリーダーは次のとおりです。

- スマーフィット・カッパ(アイルランド)

- 王子ホールディングス株式会社(日本)

- インターナショナルペーパー(米国)

- 世界選手権(イギリス)

- ストーラ・エンソ(フィンランド)

- ソノコプロダクツカンパニー(米国)

- ジョージア・パシフィック(米国)

- ウェストロック社(米国)

- パッケージング・コーポレーション・オブ・アメリカ(米国)

- VPKグループNV(ベルギー)

- エルソンズ・インターナショナル(米国)

- レンゴー株式会社(日本)

- プラット・インダストリーズ(米国)

- アメリパック・インダストリーズ(米国)

- SCGパッケージング(タイ)

北米段ボール包装市場の最新動向

- 2025年1月、インターナショナル・ペーパーはDSスミスを買収し、北米における持続可能な包装ソリューションのリーダー企業を目指します。これは、卓越した顧客体験の提供と包装業界におけるイノベーションの促進を目指します。両社の能力を結集することで、より持続可能で効率的かつ革新的な包装ソリューションを提供し、環境に優しい製品への高まる需要に応え、業界におけるリーダーシップを強化していく予定です。

- 2023年5月、Stora Ensoは、冷凍・冷蔵食品包装向けに、リサイクルしやすい新しい包装板紙グレードを導入します。Tambrite Aqua+は、冷凍・冷蔵食品包装用の新しい循環型包装材で、化石燃料由来のプラスチックの使用を減らし、使用後のリサイクル性を向上させます。

- 2024年6月、スマーフィット・カッパはブルガリアのバッグインボックス工場を買収します。この買収により、スマーフィット・カッパは製品ラインナップを拡大し、顧客に持続可能で高品質なソリューションを提供する能力を高めることで、北米の包装市場における地位を強化します。

- 2019年8月、CEOアンドリュー・ジャクソン率いるエルソンズ・インターナショナルは、製造業における雇用機会の拡大に向け、地域社会と積極的に協力しています。同社は、この業界における雇用市場の活性化に向けた取り組みを継続しています。これは、段ボール業界が今回の協力と雇用拡大の恩恵を受けることを意味します。これにより、段ボール製品の製造における労働力と資源の需要が高まり、同分野での雇用創出が促進される可能性が高くなります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CORRUGATED PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL:

4.2.2 ECONOMIC:

4.2.3 SOCIAL:

4.2.4 TECHNOLOGICAL:

4.2.5 LEGAL:

4.2.6 ENVIRONMENTAL:

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4.1 SMART PACKAGING INTEGRATION

4.4.2 MAX LAMINATION TECHNOLOGY

4.4.3 HIGH-PRECISION DIGITAL PRINTING

4.4.4 3 D & AI-DRIVEN PACKAGING DESIGN

4.4.5 AUTOMATED PRODUCTION & ROBOTICS

4.4.6 FLEXO PRINTING AND DIGITAL TECHNOLOGY

4.4.7 FIT-TO-PRODUCT (FTP)

4.5 RAW MATERIAL COVERAGE

4.5.1 CELLULOSE FIBERS

4.5.2 STARCH-BASED ADHESIVES

4.5.3 SPECIALTY COATINGS & ADDITIVES

4.5.4 REINFORCEMENT MATERIALS

4.5.5 RECYCLED MATERIALS & SUSTAINABILITY INNOVATIONS

4.6 IMPORT EXPORT SCENARIO

4.7 SUPPLY CHAIN ANALYSIS

4.8 LOGISTICS COST SCENARIO

4.9 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 CLIMATE CHANGE SCENARIO

4.10.1 ENVIRONMENTAL CONCERNS

4.10.2 INDUSTRY RESPONSE

4.10.3 GOVERNMENT’S ROLE

4.11 VENDOR SELECTION CRITERIA

4.11.1 PRODUCT QUALITY & COMPLIANCE

4.11.2 COST & PRICING STRUCTURE

4.11.3 SUSTAINABILITY PRACTICES

4.11.4 PRODUCTION CAPACITY & LEAD TIME

4.11.5 CUSTOMIZATION & DESIGN CAPABILITIES

4.11.6 SUPPLY CHAIN RELIABILITY & LOGISTICS

4.11.7 TECHNOLOGICAL CAPABILITIES & INNOVATION

4.11.8 CUSTOMER SUPPORT & AFTER-SALES SERVICE

4.12 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN RETAIL AND FMCG SECTORS ACCELERATES CORRUGATED PACKAGING ADOPTION

6.1.2 SURGE IN DEMAND FOR PROTECTIVE PACKAGING ENHANCES INNOVATION IN CORRUGATED BOX DESIGNS

6.1.3 GROWING HEALTHCARE & PHARMACEUTICAL SECTOR DRIVES DEMAND FOR STERILE AND SECURE PACKAGING

6.1.4 INNOVATIONS IN DIGITAL PRINTING ENHANCE BRANDING AND CUSTOMIZATION IN CORRUGATED PACKAGING

6.2 RESTRAINTS

6.2.1 LIMITED RECYCLABILITY OF MULTI-LAYERED CORRUGATED PACKAGING HAMPERS SUSTAINABLE ADOPTION AND RAISING ENVIRONMENTAL CONCERNS

6.2.2 LIMITED DURABILITY COMPARED TO RIGID PACKAGING MATERIALS RESTRICTS ADOPTION FOR HEAVY-DUTY APPLICATIONS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR SUSTAINABLE PACKAGING CREATES OPPORTUNITIES FOR CORRUGATED SOLUTIONS

6.3.2 EXPANDING NORTH AMERICA E-COMMERCE BOOSTS DEMAND FOR LIGHTWEIGHT, DURABLE CORRUGATED PACKAGING

6.3.3 ADVANCEMENT IN TECHNOLOGY VIA RFID AND QR CODES BOOSTS SMART PACKAGING TRACEABILITY

6.4 CHALLENGES

6.4.1 FLUCTUATING RAW MATERIAL PRICES ELEVATE PRODUCTION COSTS AND COMPRESS PROFIT MARGINS

6.4.2 INTENSE COMPETITION FROM ALTERNATIVE PACKAGING MATERIALS REDUCES MARKET SHARE AND COMPRESSES PRICING

7 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 REGULAR SLOTTED CONTAINER (RSC)

7.2.1 REGULAR SLOTTED CONTAINER (RSC), BY FLUTE TYPE

7.2.2 REGULAR SLOTTED CONTAINER (RSC), BY BOARD TYPE

7.3 HALF SLOTTED CONTAINER (HSC)

7.3.1 HALF SLOTTED CONTAINER (HSC), BY FLUTE TYPE

7.3.2 HALF SLOTTED CONTAINER (HSC), BY BOARD TYPE

7.4 OVERLAP SLOTTED CONTAINER (OSC)

7.4.1 OVERLAP SLOTTED CONTAINER (OSC), BY FLUTE TYPE

7.4.2 OVERLAP SLOTTED CONTAINER (OSC), BY BOARD TYPE

7.5 FULL OVERLAP SLOTTED CONTAINER (FOL)

7.5.1 FULL OVERLAP SLOTTED CONTAINER (FOL), BY FLUTE TYPE

7.5.2 FULL OVERLAP SLOTTED CONTAINER (FOL), BY BOARD TYPE

7.6 CENTER SPECIAL SLOTTED CONTAINER (CSSC)

7.6.1 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY FLUTE TYPE

7.6.2 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY BOARD TYPE

7.7 CENTER SPECIAL SLOTTED CONTAINER (CSSC)

7.7.1 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY FLUTE TYPE

7.7.2 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY BOARD TYPE

7.8 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB)

7.8.1 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY FLUTE TYPE

7.8.2 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY BOARD TYPE

7.9 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB)

7.9.1 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY FLUTE TYPE

7.9.2 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY BOARD TYPE

7.1 TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS)

7.10.1 TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS), BY FLUTE TYPE

7.10.2 TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS), BY BOARD TYPE

7.11 FOLDERS

7.11.1 FOLDERS, BY FLUTE TYPE

7.11.2 FOLDERS, BY BOARD TYPE

7.12 WRAPAROUND BLANK

7.12.1 WRAPAROUND BLANK, BY FLUTE TYPE

7.12.2 WRAPAROUND BLANK, BY BOARD TYPE

8 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE

8.1 OVERVIEW

8.2 C FLUTE

8.3 B FLUTE

8.4 E FLUTE

8.5 A FLUTE

8.6 F FLUTE

8.7 D FLUTE

9 NORTH AMERICA CORRUGATED PACKAGING MARKET, BOARD STYLE

9.1 OVERVIEW

9.2 SINGLE WALL

9.3 DOUBLE WALL

9.4 TRIPLE WALL

9.5 SINGLE FACE

9.6 LINER BOARD

10 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 UPTO 100 LBS

10.3 100-300 LBS

10.4 ABOVE 300 LBS

11 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY SIZE

11.1 OVERVIEW

11.2 0-10 INCHES

11.3 10-20 INCHES

11.4 20-30 INCHES

11.5 ABOVE 30 INCHES

12 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE

12.1 OVERVIEW

12.2 PRINTED

12.3 NON-PRINTED

13 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 E-COMMERCE & RETAIL

13.3 FOOD

13.3.1 FOOD, BY APPLICATION

13.4 ELECTRONICS GOODS

13.4.1 ELECTRIC GOODS, BY APPLICATION

13.4.1.1 CONSUMER ELECTRONICS, BY TYPE

13.4.1.2 COMPUTER AND IT HARDWARE, BY TYPE

13.5 HOME APPLIANCES

13.5.1 HOME APPLIANCES, BY APPLICATION

13.5.1.1 MAJOR HOME APPLIANCES, BY TYPE

13.5.1.2 HEATING AND COOLING DEVICES, BY TYPE

13.5.1.3 SMALL KITCHEN, BY TYPE

13.6 AUTOMOTIVE

13.6.1 AUTOMOTIVE, BY APPLICATION

13.7 HEALTHCARE & PHARMACEUTICALS

13.7.1 HEALTHCARE, BY APPLICATION

13.7.1.1 PHARMACEUTICALS, BY TYPE

13.7.1.2 HEALTHCARE, BY TYPE

13.8 BEVERAGE

13.8.1 BEVERAGE, BY APPLICATION

13.9 GLASSWARE AND CERAMICS

13.9.1 GLASSWARE AND CERAMICS, BY APPLICATION

13.9.1.1 GLASSWARE, BY TYPE

13.9.1.2 CERAMICS, BY TYPE

13.1 PERSONAL CARE

13.10.1 PERSONAL CARE, BY APPLICATION

13.11 HOME CARE

13.11.1 HOME CARE, BY APPLICATION

13.12 AGRICULTURE & HORTICULTURE

13.12.1 AGRICULTURE & HORTICULTURE, BY APPLICATION

13.13 OIL AND GAS

13.13.1 OIL AND GAS, BY APPLICATION

13.14 TOYS

13.14.1 TOYS, BY APPLICATION

13.15 BABY PRODUCTS

13.15.1 BABY PRODUCTS, BY APPLICATION

13.16 OTHERS

14 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA CORRUGATED PACKAGING MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 WESTROCK COMPANY

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT/NEWS

17.2 INTERNATIONAL PAPER

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT/NEWS

17.3 STORA ENSO

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT/NEWS

17.4 SMURFIT KAPPA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT/NEWS

17.5 PACKAGING CORPORATION OF AMERICA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT NEWS

17.6 AMERIPAC INDUSTRIES

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ELSONS INTERNATIONAL

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT/NEWS

17.8 GEORGIA-PACIFIC

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT/NEWS

17.9 MONDI

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT/NEWS

17.1 OJI HOLDINGS CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT/NEWS

17.11 PRATT INDUSTRIES, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 RENGO CO., LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT/NEWS

17.13 SCG PACKAGING

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT/NEWS

17.14 SONOCO PRODUCTS COMPANY

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT/NEWS

17.15 TGIPACKAGING.IN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 VPK GROUP NV

17.16.1 COMPANY SNAPSHOT

17.16.2 1.1.4 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT/NEWS

18 QUESTIONNAIRE

19 RELATED REPORTS

表のリスト

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 GREENHOUSE GAS EMISSIONS FOR COMMON BOX SIZES

TABLE 3 FIBERBOARD PERFORMANCE STANDARDS

TABLE 4 TIME TAKEN FOR GARBAGE TO DECOMPOSE IN THE ENVIRONMENT

TABLE 5 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 7 NORTH AMERICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 12 NORTH AMERICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 NORTH AMERICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 41 NORTH AMERICA C FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA B FLUTE IN CORRUGATED PACKAGING MARKETMARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA E FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA A FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA F FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA D FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA SINGLE WALL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA DOUBLE WALL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA TRIPLE WALL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA SINGLE FACE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA LINER BOARD IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA UPTO 100 LBS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA 100-300 LBS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA ABOVE 300 LBS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA 0-10 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 59 NORTH AMERICA 10-20 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 60 NORTH AMERICA 20-30 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 61 NORTH AMERICA ABOVE 30 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 62 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 63 NORTH AMERICA PRINTED IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 64 NORTH AMERICA NON-PRINTED IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 65 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 66 NORTH AMERICA E-COMMERCE & RETAIL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 67 NORTH AMERICA FOOD IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 68 NORTH AMERICA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 69 NORTH AMERICA ELECTRONICS GOODS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 70 NORTH AMERICA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 71 NORTH AMERICA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 NORTH AMERICA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 73 NORTH AMERICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 74 NORTH AMERICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 75 NORTH AMERICA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 NORTH AMERICA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 NORTH AMERICA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 NORTH AMERICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 79 NORTH AMERICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 80 NORTH AMERICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 81 NORTH AMERICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 82 NORTH AMERICA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 NORTH AMERICA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 84 NORTH AMERICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 85 NORTH AMERICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 86 NORTH AMERICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 87 NORTH AMERICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 88 NORTH AMERICA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 89 NORTH AMERICA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 NORTH AMERICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 91 NORTH AMERICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 92 NORTH AMERICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 93 NORTH AMERICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 94 NORTH AMERICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 95 NORTH AMERICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 96 NORTH AMERICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 97 NORTH AMERICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 98 NORTH AMERICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 99 NORTH AMERICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 100 NORTH AMERICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 101 NORTH AMERICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 102 NORTH AMERICA OTHERS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 103 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 104 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 105 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 106 NORTH AMERICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 107 NORTH AMERICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 108 NORTH AMERICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 109 NORTH AMERICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 110 NORTH AMERICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 111 NORTH AMERICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 112 NORTH AMERICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 113 NORTH AMERICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 114 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 115 NORTH AMERICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 116 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 117 NORTH AMERICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 118 NORTH AMERICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 119 NORTH AMERICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 120 NORTH AMERICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 121 NORTH AMERICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 122 NORTH AMERICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 123 NORTH AMERICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 124 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 125 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 126 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 127 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 128 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 129 NORTH AMERICA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 130 NORTH AMERICA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 131 NORTH AMERICA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 132 NORTH AMERICA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 133 NORTH AMERICA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 134 NORTH AMERICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 135 NORTH AMERICA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 136 NORTH AMERICA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 137 NORTH AMERICA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 138 NORTH AMERICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 139 NORTH AMERICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 140 NORTH AMERICA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 141 NORTH AMERICA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 142 NORTH AMERICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 143 NORTH AMERICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 144 NORTH AMERICA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 145 NORTH AMERICA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 146 NORTH AMERICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 147 NORTH AMERICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 148 NORTH AMERICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 149 NORTH AMERICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 150 NORTH AMERICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 151 NORTH AMERICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 152 U.S. CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 153 U.S. CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 154 U.S. REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 155 U.S. REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 156 U.S. HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 157 U.S. HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 158 U.S. OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 159 U.S. OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 160 U.S. FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 161 U.S. FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 162 U.S. CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 163 U.S. CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 164 U.S. 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 165 U.S. 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 166 U.S. TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 167 U.S. TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 168 U.S. FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 169 U.S. FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 170 U.S. WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 171 U.S. WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 172 U.S. CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 173 U.S. CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 174 U.S. CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 175 U.S. CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 176 U.S. CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 177 U.S. CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 178 U.S. FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 179 U.S. ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 180 U.S. CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 181 U.S. COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 182 U.S. HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 183 U.S. MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 184 U.S. HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 185 U.S. SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 U.S. AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 187 U.S. HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 188 U.S. PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 189 U.S. HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 190 U.S. BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 191 U.S. GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 192 U.S. GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 U.S. CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 U.S. PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 195 U.S. HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 196 U.S. AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 197 U.S. OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 U.S. TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 199 U.S. BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 200 CANADA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 201 CANADA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 202 CANADA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 203 CANADA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 204 CANADA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 205 CANADA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 206 CANADA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 207 CANADA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 208 CANADA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 209 CANADA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 210 CANADA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 211 CANADA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 212 CANADA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 213 CANADA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 214 CANADA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 215 CANADA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 216 CANADA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 217 CANADA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 218 CANADA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 219 CANADA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 220 CANADA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 221 CANADA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 222 CANADA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 223 CANADA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 224 CANADA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 225 CANADA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 226 CANADA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 227 CANADA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 228 CANADA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 229 CANADA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 230 CANADA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 231 CANADA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 232 CANADA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 233 CANADA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 234 CANADA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 235 CANADA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 236 CANADA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 237 CANADA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 238 CANADA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 239 CANADA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 240 CANADA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 241 CANADA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 242 CANADA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 243 CANADA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 244 CANADA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 245 CANADA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 246 CANADA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 247 CANADA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 248 MEXICO CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 249 MEXICO CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 250 MEXICO REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 251 MEXICO REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 252 MEXICO HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 253 MEXICO HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 254 MEXICO OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 255 MEXICO OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 256 MEXICO FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 257 MEXICO FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 258 MEXICO CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 259 MEXICO CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 260 MEXICO 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 261 MEXICO 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 262 MEXICO TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 263 MEXICO TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 264 MEXICO FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 265 MEXICO FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 266 MEXICO WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 267 MEXICO WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 268 MEXICO CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 269 MEXICO CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 270 MEXICO CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 271 MEXICO CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 272 MEXICO CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 273 MEXICO CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 274 MEXICO FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 275 MEXICO ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 276 MEXICO CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 277 MEXICO COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 278 MEXICO HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 279 MEXICO MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 280 MEXICO HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 281 MEXICO SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 282 MEXICO AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 283 MEXICO HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 284 MEXICO PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 285 MEXICO HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 286 MEXICO BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 287 MEXICO GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 288 MEXICO GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 289 MEXICO CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 290 MEXICO PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 291 MEXICO HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 292 MEXICO AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 293 MEXICO OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 294 MEXICO TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 295 MEXICO BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA CORRUGATED PACKAGING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CORRUGATED PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CORRUGATED PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CORRUGATED PACKAGING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CORRUGATED PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CORRUGATED PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CORRUGATED PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CORRUGATED PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA CORRUGATED PACKAGING MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA CORRUGATED PACKAGING MARKET: PRODUCT TIMELINE CURVE

FIGURE 11 NORTH AMERICA CORRUGATED PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA CORRUGATED PACKAGING MARKET: SEGMENTATION

FIGURE 13 NINE SEGMENTS COMPRISE THE NORTH AMERICA CORRUGATED PACKAGING MARKET, BY PRODUCT (2024)

FIGURE 14 NORTH AMERICA CORRUGATED PACKAGING MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 GROWTH IN RETAIL AND FMCG SECTORS ACCELERATES CORRUGATED PACKAGING ADOPTION IS EXPECTED TO DRIVE THE NORTH AMERICA CORRUGATED PACKAGING MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 REGULAR SLOTTED CONTAINER (RSC) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CORRUGATED PACKAGING MARKET IN 2025 & 2032

FIGURE 18 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 19 HIGHEST RECEIVERS OF PACKAGING EXPORTS (DOLLAR)

FIGURE 20 SUPPLY CHAIN ANALYSIS FOR THE NORTH AMERICA CORRUGATED PACKAGING MARKET

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 MARKET OVERVIEW

FIGURE 23 OVERALL RETAIL MARKET GROWTH IN INDIA (FY 18-FY 24)

FIGURE 24 DEMAND FOR CORRUGATED BOXES

FIGURE 25 SHARE OF ONLINE RETAIL TRANSACTIONS OVER THE YEARS

FIGURE 26 GROWTH IN RETAIL E-COMMERCE SALES GLOBALLY OVER THE YEARS

FIGURE 27 NORTH AMERICA CORRUGATED PACKAGING MARKET: BY PRODUCT, 2024

FIGURE 28 NORTH AMERICA CORRUGATED PACKAGING MARKET: BY FLUTE TYPE, 2024

FIGURE 29 NORTH AMERICA CORRUGATED PACKAGING MARKET: BOARD STYLE, 2024

FIGURE 30 NORTH AMERICA CORRUGATED PACKAGING MARKET: BY CAPACITY, 2024

FIGURE 31 NORTH AMERICA CORRUGATED PACKAGING MARKET: BY SIZE, 2024

FIGURE 32 NORTH AMERICA CORRUGATED PACKAGING MARKET: BY PRINT TYPE, 2024

FIGURE 33 NORTH AMERICA CORRUGATED PACKAGING MARKET: BY APPLICATION, 2024

FIGURE 34 NORTH AMERICA CORRUGATED PACKAGING MARKET SNAPSHOT

FIGURE 35 NORTH AMERICA CORRUGATED PACKAGING MARKET: COMPANY SHARE 2024 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。