Global Smart Home Appliances Market

Market Size in USD Billion

CAGR :

%

USD

64.48 Billion

USD

183.96 Billion

2024

2032

USD

64.48 Billion

USD

183.96 Billion

2024

2032

| 2025 –2032 | |

| USD 64.48 Billion | |

| USD 183.96 Billion | |

|

|

|

|

What is the Global Smart Home Appliances Market Size and Growth Rate?

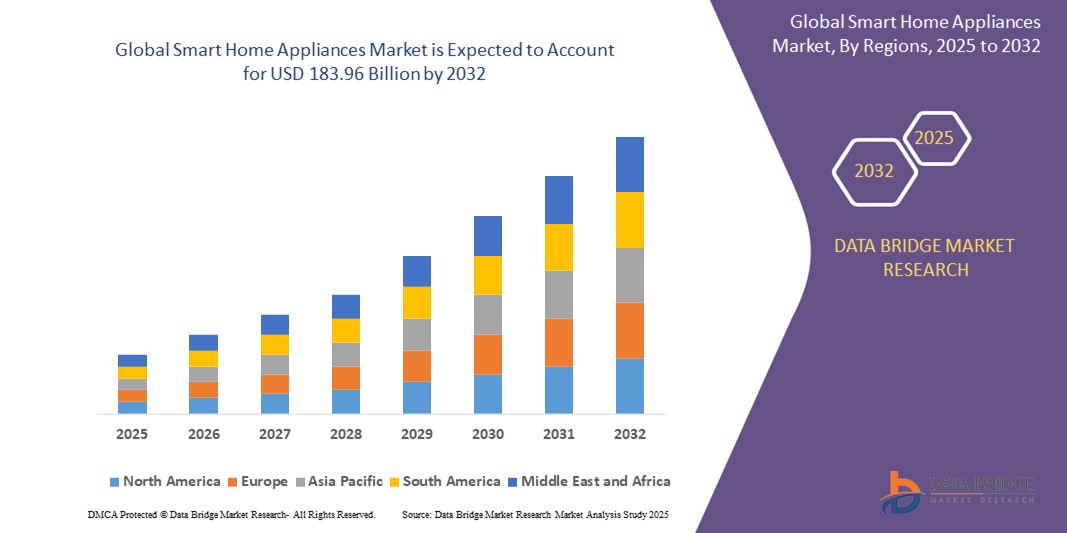

- The global smart home appliances market size was valued at USD 64.48 billion in 2024 and is expected to reach USD 183.96 billion by 2032, at a CAGR of 14.00% during the forecast period

- The smart home appliances market is experiencing robust growth as advancements in technology and increasing consumer demand for convenience and energy efficiency drive innovation and adoption. The market's expansion is largely fueled by the rapid advancement of Internet of Things (IoT) technology, which enables appliances to connect seamlessly with home networks and other smart devices

- Consumers are increasingly seeking appliances that offer enhanced functionality, such as remote control, automation, and integration with smart home ecosystems, which align with the broader trend of home automation and digital connectivity

What are the Major Takeaways of Smart Home Appliances Market?

- The rising consumer demand for convenience is significantly fueling the growth of the smart home appliances market. As lifestyles become increasingly fast-paced, consumers are seeking solutions that simplify their daily routines and enhance their overall quality of life. Smart appliances, which offer features such as remote control, automation, and integration with home automation systems, cater to this demand by providing users with unprecedented levels of convenience

- For instance, smart refrigerators that allow users to check contents remotely, smart ovens that can be preheated via smartphone apps, and voice-controlled lighting systems all contribute to a more streamlined and efficient home environment

- North America led the global smart home appliances market with the largest revenue share of 33.78% in 2024, driven by the growing penetration of connected devices, strong digital infrastructure, and rising demand for convenience and energy-efficient solutions

- Asia-Pacific smart home appliances market is projected to grow at the fastest CAGR of 9.47% between 2025 and 2032, driven by rapid urbanization, rising disposable income, and increasing consumer interest in smart lifestyles

- The smart refrigerators segment dominated the market with the largest market revenue share of 29.8% in 2024, driven by the rising demand for energy-efficient and food-preserving appliances integrated with IoT features

Report Scope and Smart Home Appliances Market Segmentation

|

Attributes |

Smart Home Appliances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Smart Home Appliances Market?

“AI-Driven Automation and Voice Integration”

- A major trend in the smart home appliances market is the rapid integration of artificial intelligence (AI) and voice control technology to create more intuitive, responsive, and energy-efficient home environments. AI enables appliances to learn user habits, automate functions, and optimize performance, making homes more intelligent and efficient

- Brands are embedding voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri into devices such as refrigerators, ovens, and washing machines, allowing users to operate them hands-free using voice commands

- For instance, LG’s ThinQ AI platform allows users to remotely control and monitor smart refrigerators, washing machines, and air conditioners using real-time usage data and predictive maintenance features

- These intelligent features enhance user convenience and help optimize energy consumption by adapting to usage patterns, promoting sustainability and lowering utility bills

- As smart living gains popularity, especially in urban households, AI-based automation is becoming a standard expectation. Consumers seek seamless integration across devices, further boosting the demand for interoperable ecosystems

- With the continued rollout of IoT and 5G, AI-powered smart home appliances are reshaping how consumers interact with household devices, making homes smarter, safer, and more efficient

What are the Key Drivers of Smart Home Appliances Market?

- Rising demand for convenience, energy efficiency, and smart connectivity is fueling the adoption of smart home appliances globally. These devices automate daily tasks, offer remote control, and support user customization enhancing lifestyle efficiency

- For instance, Samsung’s Family Hub refrigerator allows users to manage groceries, stream media, and control smart home systems directly from its touchscreen interface

- The increasing penetration of IoT technology and high-speed internet has enabled faster, seamless device interaction and control via smartphones and digital assistants, attracting tech-savvy homeowners

- A growing focus on energy conservation and sustainability is also driving consumers to adopt appliances that minimize electricity and water consumption, supported by smart sensors and real-time tracking features

- Governments in the U.S., Europe, and Asia-Pacific are offering incentives for energy-efficient appliances, further promoting smart technology in residential spaces

- In addition, the surge in urbanization and dual-income households is leading to increased spending on premium home solutions that offer comfort, efficiency, and time-saving capabilities, expanding the market reach

Which Factor is challenging the Growth of the Smart Home Appliances Market?

- One of the major challenges in the smart home appliances market is the high cost of advanced appliances, which limits adoption in price-sensitive regions and among budget-conscious consumers

- While smart appliances offer long-term savings, their initial costs—especially for connected HVAC systems, refrigerators, and laundry machines—remain higher than their conventional counterparts

- For instance, the price difference between a standard washing machine and a Wi-Fi-enabled smart washer can range significantly, deterring middle-income households in emerging markets from switching

- Data privacy and cybersecurity concerns also pose a major barrier. Consumers are increasingly wary of device hacking, data leaks, and lack of control over personal information collected by smart appliances

- Moreover, interoperability issues between devices from different manufacturers often lead to integration failures and a frustrating user experience, especially in households using mixed-brand ecosystems

- To overcome these hurdles, manufacturers must focus on cost optimization, develop unified smart platforms, and implement robust data security frameworks to build consumer trust and encourage widespread adoption

How is the Smart Home Appliances Market Segmented?

The market is segmented on the basis of product, technology, and distribution channel.

- By Product

On the basis of product, the smart home appliances market is segmented into smart refrigerators, smart washing machines, smart air purifiers, smart TVs, and others. The smart refrigerators segment dominated the market with the largest market revenue share of 29.8% in 2024, driven by the rising demand for energy-efficient and food-preserving appliances integrated with IoT features. These refrigerators offer advanced functionalities such as touch screens, voice control, internal cameras, and automatic inventory tracking, which appeal strongly to tech-savvy consumers across North America and Europe.

The smart air purifiers segment is projected to witness the fastest CAGR from 2025 to 2032 due to increasing air pollution levels and heightened awareness of indoor air quality, particularly in urban regions of Asia-Pacific.

- By Technology

On the basis of technology, the smart home appliances market is segmented into Wi-Fi, Radio Frequency Identification (RFID), ZigBee, cellular technology, Bluetooth, and others. The Wi-Fi segment held the largest market share of 37.2% in 2024, attributed to its widespread adoption in smart homes and seamless integration with home automation systems. Wi-Fi-enabled appliances enable remote monitoring, diagnostics, and control through mobile apps and voice assistants.

The ZigBee segment is anticipated to grow at the fastest CAGR from 2025 to 2032, owing to its low-power consumption, mesh networking capabilities, and growing adoption in connected home environments, particularly for HVAC and lighting systems.

- By Distribution Channel

On the basis of distribution channel, the smart home appliances market is segmented into offline and online channels. The offline segment, which includes specialty electronic stores, retail chains, and brand outlets, dominated the market with the largest revenue share of 54.6% in 2024, due to consumers’ preference for in-person product demonstrations and physical evaluation before purchase.

The online segment is expected to witness the fastest CAGR during the forecast period, driven by the convenience of doorstep delivery, increased smartphone usage, availability of deals and discounts, and rising trust in e-commerce platforms such as Amazon, Flipkart, and Best Buy.

Which Region Holds the Largest Share of the Smart Home Appliances Market?

- North America led the global smart home appliances market with the largest revenue share of 33.78% in 2024, driven by the growing penetration of connected devices, strong digital infrastructure, and rising demand for convenience and energy-efficient solutions

- Consumers across the U.S. and Canada are increasingly adopting smart appliances such as refrigerators, washing machines, and TVs that integrate with home automation systems and voice assistants

- The region’s growth is also supported by high disposable income, a tech-savvy population, and the presence of leading smart appliance manufacturers focusing on innovation and product diversification

U.S. Smart Home Appliances Market Insight

The U.S. smart home appliances market captured the largest revenue share in 2024 within North America, fueled by the rising popularity of home automation, increased adoption of IoT, and growing awareness of smart energy management. Consumers are investing in advanced appliances that offer remote access, real-time monitoring, and energy-saving features through mobile apps or AI-based systems. Key players are launching AI-enabled smart devices that integrate seamlessly with digital ecosystems such as Amazon Alexa and Google Assistant. The increasing prevalence of smart homes, combined with efficient after-sales service networks and strong online retail channels, is further boosting the U.S. market’s dominance.

Europe Smart Home Appliances Market Insight

The Europe smart home appliances market is projected to register significant growth over the forecast period, driven by the growing preference for sustainable living, energy-efficient appliances, and digital home solutions. Consumers are leaning toward appliances that help reduce electricity consumption while offering comfort and automation. Smart refrigerators, washing machines, and dishwashers with IoT capabilities are gaining popularity. The region’s strict energy regulations, eco-conscious population, and rapid smart grid development are fostering market expansion. Moreover, European manufacturers are increasingly focusing on product design, energy labels, and seamless connectivity to align with environmental goals and consumer demands for innovation.

U.K. Smart Home Appliances Market Insight

The U.K. smart home appliances market is anticipated to expand at a notable CAGR during the forecast period, bolstered by rising digital literacy, increasing smartphone penetration, and consumer interest in connected living. Smart kitchen appliances, TVs, and laundry solutions are particularly gaining ground due to their ability to enhance convenience and reduce time spent on household chores. Government initiatives promoting energy efficiency and sustainability further drive adoption. Retailers and brands are also leveraging e-commerce, smart home showrooms, and influencer marketing to expand reach. The growing popularity of voice-assisted control and app integration is setting the pace for rapid U.K. market growth.

Germany Smart Home Appliances Market Insight

Germany's smart home appliances market is poised for robust expansion, supported by a technologically advanced manufacturing sector and growing awareness of smart energy solutions. German consumers favor high-performance, durable, and environmentally friendly products integrated with smart features. Appliances offering predictive maintenance, remote diagnostics, and AI-powered automation are increasingly sought after. The country’s focus on the Internet of Things and industrial automation complements the rising adoption of smart home products. In addition, collaboration between domestic tech companies and appliance manufacturers is encouraging the development of smart ecosystems tailored to the evolving needs of modern German households.

Which Region is the Fastest Growing in the Smart Home Appliances Market?

Asia-Pacific smart home appliances market is projected to grow at the fastest CAGR of 9.47% between 2025 and 2032, driven by rapid urbanization, rising disposable income, and increasing consumer interest in smart lifestyles. Countries such as China, Japan, South Korea, and India are witnessing a surge in smart home installations supported by strong smartphone usage and government smart city initiatives. Affordable internet, aggressive marketing by brands, and growing awareness of energy efficiency are influencing buying behavior. Local and global brands are offering budget-friendly smart appliances with cutting-edge technology, making them accessible to a wider population across diverse income groups.

Japan Smart Home Appliances Market Insight

Japan's smart home appliances market is experiencing steady growth due to the country's aging population, advanced electronics industry, and focus on compact, multifunctional home solutions. Japanese consumers value convenience, space-saving designs, and energy efficiency, prompting high demand for smart air purifiers, compact refrigerators, and washing machines with app-based controls. Integration with robotics and AI, such as voice-enabled appliances and motion-sensing technologies, reflects Japan’s leadership in smart innovation. Moreover, the popularity of smart kitchen appliances and health-monitoring functionalities is increasing. With smart living becoming a cultural norm, Japan continues to see growing demand for intuitive, automated home solutions.

China Smart Home Appliances Market Insight

The China smart home appliances market accounted for the largest revenue share in Asia-Pacific in 2024, backed by robust digital infrastructure, a thriving middle class, and rising consumer demand for intelligent living spaces. The market is driven by domestic giants such as Haier, Midea, and Xiaomi, offering integrated solutions at competitive prices. Chinese consumers prefer appliances that sync with smartphones, voice assistants, and smart platforms such as HarmonyOS or MIJIA. E-commerce platforms such as JD.com and Tmall play a vital role in shaping buying patterns, offering smart appliance bundles and seasonal deals. Strong government backing for smart city development further propels demand.

Which are the Top Companies in Smart Home Appliances Market?

The smart home appliances industry is primarily led by well-established companies, including:

- SAMSUNG (South Korea)

- BSH Home Appliances (Germany)

- General Electric Company (U.S.)

- Whirlpool Corporation (U.S.)

- LG Electronics (South Korea)

- AB Electrolux (Sweden)

- Panasonic Corporation (Japan)

- Miele & Cie. KG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- IRobot India (India)

- ECOVACS (China)

- Neato Robotics, Inc. (U.S.)

- ABB (Switzerland)

- Midea Group (China)

- Legrand (France)

- Siemens (Germany)

- Haier Group (China)

- Emerson Electric Co. (U.S.)

- Google LLC (U.S.)

- Robert Bosch GmbH (Germany)

What are the Recent Developments in Global Smart Home Appliances Market?

- In June 2023, GE Profile introduced the UltraFast Combo, a cutting-edge all-in-one laundry appliance that integrates ventless heat pump technology to simplify the washing and drying process. By eliminating the need to manually shift clothes between two separate machines, this innovation offers users a highly efficient and seamless laundry experience. This launch reflects GE’s commitment to modernizing home appliances with convenience-driven solutions

- In June 2023, SmartThings rolled out enhanced features for its SmartThings Energy platform, designed to empower users to monitor and manage their energy usage more effectively. These updates help users cut costs, earn rewards, and contribute to sustainability goals. This move aligns with SmartThings' vision of fostering eco-conscious smart home environments

- In April 2023, Samsung Electronics Co., Ltd. unveiled the SmartThings Station, a budget-friendly smart home hub combined with a fast-charging pad. The device enables users to automate various home functions with ease and supports a wide array of smart devices. This launch strengthens Samsung’s position as a leader in accessible and integrated smart home ecosystems

- In January 2023, the Home Connectivity Alliance (HCA) revealed the HCA 1.0 interface specification during CES in Las Vegas, allowing users to link any device with any app, promoting greater device interoperability. This standard also supports the development of more energy-efficient home systems. This initiative paves the way for enhanced cross-brand compatibility and sustainability in smart home technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.