Global Aromatase Inhibitor Drug Class Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

4.73 Billion

USD

7.14 Billion

2025

2033

USD

4.73 Billion

USD

7.14 Billion

2025

2033

| 2026 –2033 | |

| USD 4.73 Billion | |

| USD 7.14 Billion | |

|

|

|

|

Global Aromatase Inhibitor Drug Class Market Segmentation, By Drug (Anastrozole, Letrozole, Exemestane, Formestane, Fadrozole, and Others), Type (Non-Steroidal Aromatase Inhibitors and Steroidal Aromatase Inhibitors), Application (Breast Cancer Treatment, Fertility Treatment, and Other), End User (Hospitals, Specialty Clinics, Homecare, and Others)- Industry Trends and Forecast to 2033

Aromatase Inhibitor Drug Class Market Size

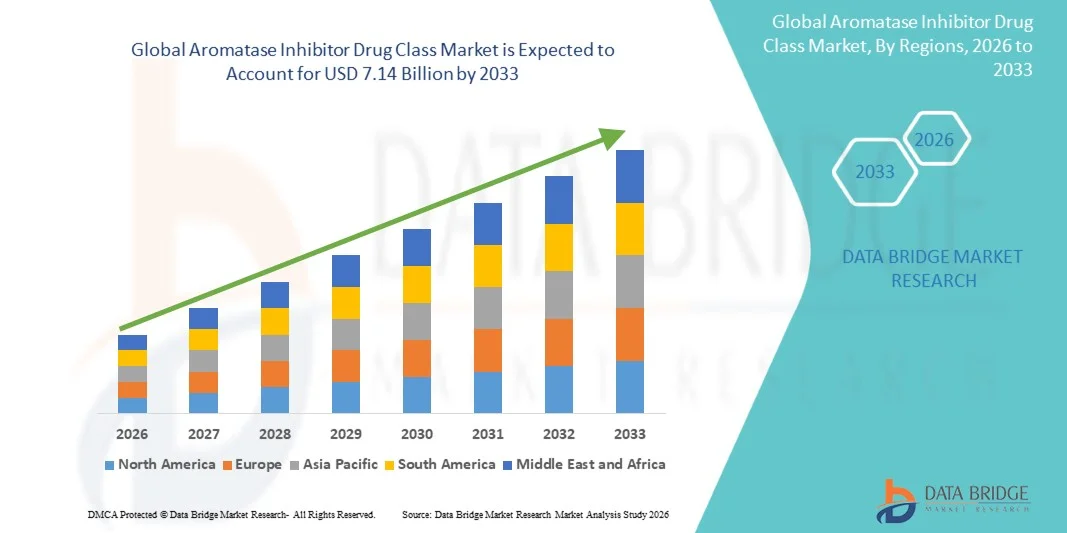

- The global aromatase inhibitor drug class market size was valued at USD 4.73 billion in 2025 and is expected to reach USD 7.14 billion by 2033, at a CAGR of 5.30% during the forecast period

- The market growth is largely driven by the rising prevalence of hormone receptor-positive breast cancer, increasing adoption of targeted hormonal therapies, and expanding use of aromatase inhibitors as first-line and adjuvant treatment options, particularly in post-menopausal women

- Furthermore, growing clinical evidence supporting improved survival outcomes, wider availability of cost-effective generic formulations, and increasing awareness of endocrine-based cancer therapies are strengthening demand for aromatase inhibitors, thereby significantly boosting the overall market growth

Aromatase Inhibitor Drug Class Market Analysis

- Aromatase inhibitors, which suppress estrogen production by inhibiting the aromatase enzyme, are critical components of hormonal therapy for estrogen receptor-positive cancers, particularly breast cancer, and are widely used across hospital, clinic, and outpatient oncology settings

- The increasing demand for aromatase inhibitor drugs is primarily driven by the rising global incidence of breast cancer, growing preference for targeted endocrine therapies over chemotherapy, and expanding use of these agents in both early-stage and metastatic treatment protocols

- North America dominated the aromatase inhibitor drug class market with the largest revenue share of 38.6% in 2025, supported by advanced oncology infrastructure, high treatment adoption rates, favorable reimbursement frameworks, and strong presence of branded and generic pharmaceutical manufacturers, with the U.S. accounting for the majority of regional demand

- Asia-Pacific is expected to be the fastest-growing region in the aromatase inhibitor drug class market during the forecast period due to increasing cancer awareness, improving access to oncology care, expanding healthcare expenditure, and rising availability of affordable generic aromatase inhibitors in countries such as China and India

- Non-steroidal aromatase inhibitors segment dominated the market with a share of 61.4% in 2025, driven by their widespread clinical use, strong efficacy profiles, and established role as first-line therapy in hormone receptor-positive breast cancer treatment

Report Scope and Aromatase Inhibitor Drug Class Market Segmentation

|

Attributes |

Aromatase Inhibitor Drug Class Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Aromatase Inhibitor Drug Class Market Trends

“Expanding Use of Aromatase Inhibitors in Personalized and Combination Therapies”

- A prominent and accelerating trend in the global aromatase inhibitor drug class market is the increasing adoption of personalized treatment approaches and combination regimens, particularly in hormone receptor-positive breast cancer management, to improve efficacy and patient outcomes

- For instance, aromatase inhibitors such as letrozole and anastrozole are increasingly prescribed in combination with CDK4/6 inhibitors in advanced and metastatic breast cancer, significantly improving progression-free survival compared to monotherapy

- Advances in biomarker testing and genomic profiling are enabling clinicians to better identify patients who are most likely to benefit from aromatase inhibitor-based therapies, supporting more targeted and optimized treatment decisions

- The growing shift toward extended adjuvant therapy durations, where aromatase inhibitors are used beyond five years in select patients, is further influencing prescribing patterns and long-term demand for these drugs

- The integration of aromatase inhibitors into evolving clinical guidelines and real-world oncology practice is reinforcing their role as cornerstone therapies in hormone-dependent cancers

- Ongoing clinical trials evaluating aromatase inhibitors in earlier disease stages and preventive settings are expanding their therapeutic scope and long-term market potential

- Increasing real-world evidence generation is supporting broader acceptance of aromatase inhibitor-based regimens among oncologists, reinforcing confidence in long-term safety and effectiveness

- This trend toward more tailored, evidence-based, and combination-focused treatment strategies is reshaping therapeutic standards, prompting pharmaceutical companies to invest in lifecycle management and combination-therapy clinical trials

Aromatase Inhibitor Drug Class Market Dynamics

Driver

“Rising Burden of Hormone Receptor-Positive Breast Cancer and Preference for Endocrine Therapy”

- The increasing global incidence of hormone receptor-positive breast cancer, particularly among post-menopausal women, is a major driver fueling demand for aromatase inhibitor therapies

- For instance, in March 2025, several oncology societies reaffirmed aromatase inhibitors as first-line adjuvant therapy in updated clinical practice recommendations for early-stage breast cancer

- Compared to chemotherapy, aromatase inhibitors offer a targeted mechanism of action with improved tolerability, driving physician and patient preference for endocrine-based treatment approaches

- Expanding access to cancer diagnosis, screening programs, and oncology care in emerging economies is increasing the eligible patient pool for aromatase inhibitor treatment

- Government-led cancer awareness initiatives and screening programs are enabling earlier diagnosis, thereby increasing initiation rates of aromatase inhibitor therapy

- Growing physician familiarity with aromatase inhibitor treatment protocols and long-term outcome data is strengthening prescribing confidence across diverse patient populations

- The widespread availability of generic aromatase inhibitors has improved affordability and adherence, further supporting sustained market growth across both developed and developing regions

Restraint/Challenge

“Long-Term Side Effects and Treatment Adherence Concerns”

- Long-term use of aromatase inhibitors is associated with adverse effects such as bone density loss, joint pain, and cardiovascular risks, which can limit patient adherence and persistence with therapy

- For instance, real-world clinical studies have reported therapy discontinuation among some patients due to musculoskeletal symptoms associated with prolonged aromatase inhibitor use

- Managing these side effects through supportive therapies, monitoring strategies, and patient education adds to the overall treatment burden and healthcare costs

- While newer dosing strategies and supportive interventions are being explored, concerns around quality of life remain a barrier for extended treatment durations

- Addressing adherence challenges through improved patient management, risk-mitigation strategies, and next-generation endocrine therapies will be essential for sustaining long-term market expansion

- Limited patient awareness regarding the management of aromatase inhibitor-associated side effects can lead to premature discontinuation and suboptimal treatment outcomes

- Variability in reimbursement coverage and access to supportive care services across regions further complicates consistent long-term adherence to aromatase inhibitor therapy

Aromatase Inhibitor Drug Class Market Scope

The market is segmented on the basis of drug, type, application, and end user.

- By Drug

On the basis of drug, the global aromatase inhibitor drug class market is segmented into anastrozole, letrozole, exemestane, formestane, fadrozole, and others. The letrozole segment dominated the market with the largest revenue share in 2025, driven by its widespread use as a first-line therapy in hormone receptor-positive breast cancer and its strong clinical efficacy profile. Letrozole is extensively prescribed in both adjuvant and metastatic settings, supported by robust clinical guidelines and long-term outcome data. Its broad acceptance among oncologists, availability in branded and generic forms, and growing off-label use in fertility treatments further reinforce its dominance. In addition, letrozole benefits from favorable reimbursement coverage in major markets, supporting high treatment adherence and sustained demand.

The exemestane segment is expected to witness the fastest growth during the forecast period, driven by increasing use in patients who develop resistance or intolerance to non-steroidal aromatase inhibitors. As a steroidal inhibitor with a distinct mechanism of action, exemestane is increasingly utilized in sequential and extended endocrine therapy regimens. Growing adoption in combination therapies and rising clinical preference for switching strategies in long-term breast cancer management are fueling its growth. Expanding clinical evidence supporting its role in improving disease-free survival is further accelerating market uptake.

- By Type

On the basis of type, the market is segmented into non-steroidal aromatase inhibitors and steroidal aromatase inhibitors. The non-steroidal aromatase inhibitors segment dominated the market in 2025 with a market share of 61.4%, owing to the extensive use of anastrozole and letrozole as standard-of-care therapies. These drugs are widely recommended in international treatment guidelines due to their proven efficacy, favorable safety profiles, and ease of oral administration. Their strong presence in early-stage and metastatic breast cancer treatment protocols contributes significantly to market dominance. Furthermore, the high availability of generic versions has improved affordability and access, supporting large-scale adoption across both developed and emerging regions.

The steroidal aromatase inhibitors segment is projected to grow at the fastest rate during the forecast period, supported by their increasing use in patients requiring alternative or sequential endocrine therapies. Steroidal inhibitors such as exemestane are gaining traction due to their irreversible binding mechanism, which can offer benefits in cases of disease progression. Rising awareness among clinicians regarding personalized treatment sequencing and resistance management is supporting segment growth. Ongoing clinical trials and extended adjuvant therapy strategies are further strengthening demand for steroidal inhibitors.

- By Application

On the basis of application, the market is segmented into breast cancer treatment, fertility treatment, and other applications. The breast cancer treatment segment dominated the market with the largest revenue share in 2025, driven by the high prevalence of hormone receptor-positive breast cancer globally. Aromatase inhibitors are a cornerstone therapy for post-menopausal women, used across adjuvant, neoadjuvant, and metastatic treatment settings. Strong clinical endorsement, long treatment durations, and increasing survival rates have resulted in sustained and recurring demand. In addition, the integration of aromatase inhibitors into combination regimens with targeted therapies further supports market dominance.

The fertility treatment segment is expected to be the fastest growing during forecast period, driven by rising use of letrozole for ovulation induction and management of polycystic ovary syndrome (PCOS). Increasing infertility rates, delayed pregnancies, and growing acceptance of pharmacological fertility treatments are fueling demand. Letrozole is increasingly preferred over traditional therapies due to improved pregnancy outcomes and lower risk profiles. Expanding fertility clinics and greater awareness of off-label applications in emerging markets are accelerating growth in this segment.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty clinics, homecare, and others. The hospitals segment dominated the market in 2025, supported by the centralized delivery of oncology care, access to specialized diagnostic facilities, and multidisciplinary treatment approaches. Hospitals serve as primary centers for cancer diagnosis, initiation of therapy, and management of advanced disease stages. Higher patient volumes, structured treatment protocols, and strong reimbursement frameworks contribute to the segment’s leading revenue share. In addition, hospitals play a key role in administering combination therapies and monitoring long-term treatment outcomes.

The homecare segment is anticipated to witness the fastest growth during the forecast period, driven by the oral nature of aromatase inhibitor therapies and the shift toward outpatient and home-based cancer management. Improved patient education, digital health monitoring, and increasing emphasis on quality of life are supporting this trend. Homecare settings enable long-term therapy adherence with reduced healthcare costs and hospital visits. The growing elderly population and rising preference for convenient, patient-centric care models are further accelerating growth in this segment

Aromatase Inhibitor Drug Class Market Regional Analysis

- North America dominated the aromatase inhibitor drug class market with the largest revenue share of 38.6% in 2025, supported by advanced oncology infrastructure, high treatment adoption rates, favorable reimbursement frameworks, and strong presence of branded and generic pharmaceutical manufacturers, with the U.S. accounting for the majority of regional demand

- Patients and healthcare providers in the region strongly prefer aromatase inhibitors due to their proven clinical efficacy, availability of both branded and generic options, and strong inclusion in standard treatment guidelines for breast cancer management

- This widespread adoption is further supported by favorable reimbursement policies, early access to advanced cancer diagnostics, and high awareness of endocrine therapies, establishing aromatase inhibitors as a cornerstone treatment across hospital and outpatient oncology settings

U.S. Aromatase Inhibitor Drug Class Market Insight

The U.S. aromatase inhibitor drug class market captured the largest revenue share within North America in 2025, driven by the high incidence of hormone receptor-positive breast cancer and early adoption of advanced endocrine therapies. Physicians in the U.S. increasingly prioritize aromatase inhibitors due to their strong clinical efficacy, long-term survival benefits, and inclusion as first-line treatment in national oncology guidelines. The widespread availability of branded and generic drugs, coupled with favorable reimbursement policies, further supports market growth. Moreover, strong participation in clinical trials and rapid uptake of combination regimens with targeted therapies continue to propel market expansion.

Europe Aromatase Inhibitor Drug Class Market Insight

The Europe aromatase inhibitor drug class market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising cancer prevalence and well-established public healthcare systems. Increasing emphasis on early cancer diagnosis and standardized treatment protocols across European countries is fostering consistent demand for aromatase inhibitors. European healthcare providers favor these therapies for their cost-effectiveness and strong long-term clinical evidence. Growth is observed across both hospital and outpatient settings, supported by increasing use of generics and expanding access to endocrine therapies.

U.K. Aromatase Inhibitor Drug Class Market Insight

The U.K. aromatase inhibitor drug class market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong adoption of guideline-driven breast cancer treatment within the National Health Service. Rising awareness of hormone receptor-positive breast cancer and increased screening initiatives are contributing to earlier diagnosis and higher treatment initiation rates. The preference for cost-effective generic aromatase inhibitors further supports sustained demand. In addition, ongoing research activity and real-world outcome studies in the U.K. continue to reinforce physician confidence in long-term endocrine therapy use.

Germany Aromatase Inhibitor Drug Class Market Insight

The Germany aromatase inhibitor drug class market is expected to expand at a considerable CAGR, fueled by advanced oncology infrastructure and a strong emphasis on evidence-based treatment. German clinicians widely adopt aromatase inhibitors due to their proven efficacy and favorable safety profiles. The country’s robust pharmaceutical manufacturing base and strong reimbursement environment enhance access to both branded and generic therapies. Increasing focus on personalized medicine and sequential endocrine treatment strategies is further driving market growth in Germany.

Asia-Pacific Aromatase Inhibitor Drug Class Market Insight

The Asia-Pacific aromatase inhibitor drug class market is poised to grow at the fastest CAGR during the forecast period, driven by rising cancer incidence, improving healthcare access, and growing awareness of hormonal therapies. Rapid urbanization, expanding oncology infrastructure, and increasing government healthcare investments in countries such as China, Japan, and India are boosting treatment adoption. The growing availability of low-cost generics is significantly improving patient access. In addition, increasing participation in global clinical trials is supporting broader acceptance of aromatase inhibitor therapies across the region.

Japan Aromatase Inhibitor Drug Class Market Insight

The Japan aromatase inhibitor drug class market is gaining momentum due to an aging population and a high prevalence of breast cancer among post-menopausal women. The Japanese healthcare system places strong emphasis on early diagnosis and long-term disease management, supporting sustained use of endocrine therapies. Aromatase inhibitors are widely prescribed due to their favorable benefit-risk profile. Furthermore, strong physician adherence to clinical guidelines and increasing adoption of combination therapies are contributing to steady market growth.

India Aromatase Inhibitor Drug Class Market Insight

The India aromatase inhibitor drug class market accounted for a significant revenue share in Asia-Pacific in 2025, driven by increasing cancer burden, expanding diagnostic capabilities, and rising healthcare awareness. India’s strong generic pharmaceutical industry ensures wide availability of affordable aromatase inhibitors, improving treatment access across urban and semi-urban areas. Government-led cancer programs and growing penetration of private oncology centers are further supporting market expansion. In addition, increasing acceptance of long-term endocrine therapy is contributing to sustained growth in the Indian market.

Aromatase Inhibitor Drug Class Market Share

The Aromatase Inhibitor Drug Class industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- AstraZeneca (U.K.)

- Novartis AG (Switzerland)

- Sanofi (France)

- Bayer AG (Germany)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sandoz International GmbH (Switzerland)

- Apotex Inc. (Canada)

- Sun Pharmaceutical Industries Ltd. (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Cipla Limited (India)

- Hetero Drugs Limited (India)

- Zydus Lifesciences Limited (India)

- Lupin Limited (India)

- Amneal Pharmaceuticals, Inc. (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- ANI Pharmaceuticals, Inc. (U.S.)

- Fresenius Kabi AG (Germany)

- Mayne Pharma Group Limited (Australia)

What are the Recent Developments in Global Aromatase Inhibitor Drug Class Market?

- In August 2025, research published showed that a new class of compounds called polyisoprenylated cysteinyl amide inhibitors (PCAIs) demonstrated potent activity against aromatase inhibitor-resistant breast cancer cells, pointing toward novel strategies to overcome resistance in AI therapy

- In July 2025, a Phase 2 trial was launched to evaluate leflutrozole, a first-in-class aromatase inhibitor, for the treatment of male infertility due to low testosterone, indicating potential expansion of AI therapeutic applications beyond oncology

- In January 2025, a clinical study reported that combining metronomic capecitabine with an aromatase inhibitor significantly increased progression-free survival and overall survival in HR+ breast cancer patients compared to aromatase inhibitor alone, suggesting combination strategies may improve therapeutic outcomes

- In December 2024, the European Commission granted approval for ribociclib plus an aromatase inhibitor as an adjuvant therapy for HR+/HER2-negative early breast cancer, aligning European regulatory policy with U.S. indications and broadening access across EU member states

- In September 2024, the U.S. Food and Drug Administration (FDA) approved ribociclib (Kisqali) in combination with an aromatase inhibitor for the adjuvant treatment of adults with hormone receptor-positive (HR+)/HER2-negative early breast cancer at high risk of recurrence, expanding the role of aromatase inhibitors beyond metastatic use into earlier stages based on data from the NATALEE phase III trial

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.