Global Personal Gadget Insurance Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

25.30 Billion

USD

55.03 Billion

2024

2032

USD

25.30 Billion

USD

55.03 Billion

2024

2032

| 2025 –2032 | |

| USD 25.30 Billion | |

| USD 55.03 Billion | |

|

|

|

|

Global Personal Gadget Insurance Market Segmentation, By Insurance Type (Accidental Damage Insurance, Theft Insurance, Liquid Damage Insurance, and Malfunction Insurance), Gadget Type (Smartphones, Tablets, Laptops, and Wearable Devices), Distribution Channel (Online, Retail, and Agent/Broker), Customer Type (Individual Consumers, Business Enterprises, and Educational Institutions) – Industry Trends and Forecast to 2032

Personal Gadget Insurance Market Analysis

The global personal gadget insurance market is witnessing steady growth due to the increasing reliance on electronic gadgets such as smartphones, tablets, laptops, and wearable devices. This market offers coverage against accidental damage, theft, liquid damage, and malfunction, addressing the growing need for protection in a digital-driven world. Rising disposable income, higher gadget penetration, and increasing awareness about insurance are key drivers. Distribution channels such as online platforms, retail stores, and brokers ensure wider accessibility to consumers. Recent developments include innovative insurance plans, tech-driven claim processes, and strategic collaborations among insurers and gadget manufacturers. Major players such as Assurant, AXA, and Allianz are enhancing customer experience with customized policies. The market’s growth is particularly strong in regions such as North America and Asia-Pacific, driven by high gadget adoption and supportive regulatory frameworks. This evolving market is set to expand further, fueled by advancements in technology and growing consumer demand.

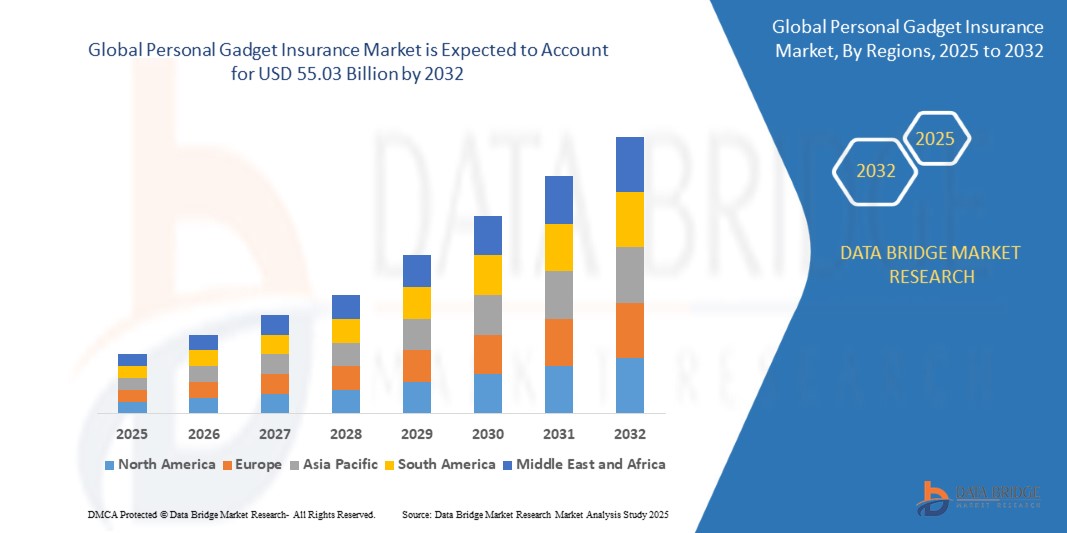

Personal Gadget Insurance Market Size

The global personal gadget insurance market size was valued at USD 25.30 billion in 2024 and is projected to reach USD 55.03 billion by 2032, with a CAGR of 10.20% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Personal Gadget Insurance Market Trends

“Integration of AI-powered Claim Processing”

The global personal gadget insurance market is gaining traction due to the rising dependence on gadgets such as smartphones, laptops, and wearable devices. With growing consumer awareness about protecting their devices, insurers are introducing innovative policies tailored to cover accidental damage, theft, and technical malfunctions. A notable trend is the integration of technology, such as AI-powered claim processing and blockchain for secure transactions, enhancing efficiency and customer satisfaction. In addition, the proliferation of online distribution channels has simplified policy purchases and renewals, catering to tech-savvy consumers. Major players such as AXA and Allianz are leveraging these innovations to stay competitive. As gadget adoption increases globally, particularly in Asia-Pacific and North America, the market continues to witness robust growth opportunities.

Report Scope and Personal Gadget Insurance Market Segmentation

|

Attributes |

Personal Gadget Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

ASSURANT, INC. (U.S.), AXA (France), Zurich (Switzerland), American International Group, Inc. (U.S.), Hiscox Ltd (U.K.), Nationwide Building Society (U.K.), Allianz (Germany), SquareTrade, Inc. (U.S.), Liberty Mutual Insurance (U.S.), The Travelers Indemnity Company (U.S.), MetLife Services and Solutions, LLC (U.S.), Chubb (U.S.), Markel Group Inc. (U.S.), CNA (U.S.), Berkshire Hathaway Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Personal Gadget Insurance Market Definition

Global personal gadget insurance refers to a specialized insurance product designed to provide financial protection for personal electronic devices such as smartphones, laptops, tablets, and wearable gadgets. This coverage typically includes risks such as accidental damage, theft, liquid damage, and malfunction, ensuring that users can repair or replace their devices without significant financial burden. The insurance caters to individual consumers and businesses, offering policies through various distribution channels, including online platforms, retail outlets, and brokers. It addresses the growing need for device protection in an increasingly digital and gadget-reliant world.

Personal Gadget Insurance Market Dynamics

Drivers

- Rising Disposable Income

Higher purchasing power among consumers is a significant driver of the global personal gadget insurance market. As disposable incomes rise, individuals are increasingly able to invest in advanced electronic gadgets such as smartphones, laptops, and wearable devices, which often come with high price tags. This financial capability also extends to purchasing associated insurance plans to safeguard these devices against potential risks such as theft, damage, or malfunction. The willingness to protect these valuable assets reflects growing consumer awareness and confidence in insurance solutions. This trend boosts gadget sales and drives demand for comprehensive insurance policies, fueling market growth.

- Increasing Gadget Penetration

The rapid adoption of smartphones, laptops, tablets, and wearable devices is a key driver for the global personal gadget insurance market. As these gadgets become integral to daily life, their usage has surged across personal, professional, and educational domains. With the increasing dependence on these devices for communication, work, and entertainment, their vulnerability to accidental damage, theft, and malfunctions has grown. This has created a substantial demand for insurance policies that offer financial protection and peace of mind. The rising penetration of gadgets globally, particularly in developing economies, further amplifies this need, driving the growth of gadget insurance solutions.

Opportunities

- Customization of Insurance Plans

The growing demand for tailored insurance policies catering to specific gadget types and individual consumer needs represents a significant market opportunity. Consumers are increasingly seeking personalized solutions that align with their usage patterns, device preferences, and risk profiles. For instance, policies designed exclusively for high-end smartphones, gaming laptops, or fitness wearables offer targeted protection, enhancing their appeal. In addition, flexible options such as pay-per-use plans or coverage for accidental damage only further attract a diverse customer base. This shift toward customization allows insurers to differentiate their offerings, foster customer loyalty, and expand their market reach, driving growth in the global personal gadget insurance market.

- Rising Travel Trends

The rise in international travel is creating a robust opportunity for the global personal gadget insurance market. Travelers rely heavily on electronic gadgets such as smartphones, laptops, and tablets for navigation, communication, and work, making these devices indispensable during trips. However, the risk of theft, accidental damage, or loss increases significantly while traveling. This has driven demand for insurance policies that provide comprehensive coverage, including global protection and on-the-go support. Insurers offering international coverage and streamlined claim processes tailored for frequent travelers are well-positioned to tap into this growing market segment, enhancing their customer base and driving market expansion.

Restraints/Challenges

- Lack of Standardization

The absence of a universal standard for gadget insurance presents a significant challenge in the market. With different insurance providers offering varying coverage, terms, and conditions, consumers often face confusion when selecting the right plan. The lack of standardization can lead to misunderstandings about the scope of coverage, exclusions, and claim processes, leaving consumers uncertain about what they are actually covered for. This inconsistency creates a barrier to informed decision-making and complicates the comparison of policies, hindering market growth. To overcome this challenge, there is a need for greater transparency and uniformity across the industry.

- High Competition in Market

The increasing number of insurance providers in the global personal gadget insurance market presents a significant restraint, as many companies offer similar coverage options. This high level of competition makes it challenging for insurers to stand out and attract customers. Differentiating based on pricing alone is often not enough, as most consumers are looking for added value, such as superior customer service or specialized policies. The pressure to constantly innovate and offer competitive advantages without sacrificing profitability can be daunting for companies. As the market becomes more saturated, distinguishing offerings and maintaining customer loyalty will become increasingly difficult for insurers.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Personal Gadget Insurance Market Scope

The market is segmented on the basis of insurance type, gadget type, distribution channel, and customer type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Insurance Type

- Accidental Damage Insurance

- Theft Insurance

- Liquid Damage Insurance

- Malfunction Insurance

Gadget Type

- Smartphones

- Tablets

- Laptops

- Wearable Devices

Distribution Channel

- Online

- Retail

- Agent/Broker

Customer Type

- Individual Consumers

- Business Enterprises

- Educational Institutions

Personal Gadget Insurance Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, insurance type, gadget type, distribution channel, and customer type as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominate the global personal gadget insurance market, driven by a rise in incidents such as accidental device damage, phone thefts, and device malfunctions. The region's high gadget penetration and increased awareness about insurance protection contributed to its dominance. In addition, growing concerns about cyber threats and virus infections on devices further fueled the demand for gadget insurance in North America.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Personal Gadget Insurance Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Personal Gadget Insurance Market Leaders Operating in the Market Are:

- ASSURANT, INC. (U.S.)

- AXA (France)

- Zurich (Switzerland)

- American International Group, Inc. (U.S.)

- Hiscox Ltd (U.K.)

- Nationwide Building Society (U.K.)

- Allianz (Germany)

- SquareTrade, Inc. (U.S.)

- Liberty Mutual Insurance (U.S.)

- The Travelers Indemnity Company (U.S.)

- MetLife Services and Solutions, LLC (U.S.)

- Chubb (U.S.)

- Markel Group Inc. (U.S.)

- CNA (U.S.)

- Berkshire Hathaway Inc. (U.S.)

Latest Developments in Personal Gadget Insurance Market

- In March 2022, Airtel Payments Bank partnered with ICICI Lombard General Insurance Company to offer smartphone insurance through the Airtel Thanks app. This collaboration enhances Airtel's digital platform, allowing customers to purchase insurance easily through a fast, paperless, and secure process

- In June 2020, Samsung introduced the Samsung Care+ protection plan for Galaxy phone users in India. The service provides extended warranty, screen protection, accidental and liquid damage coverage, as well as protection against technical and mechanical failures, offering comprehensive benefits for Galaxy phone owners

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.