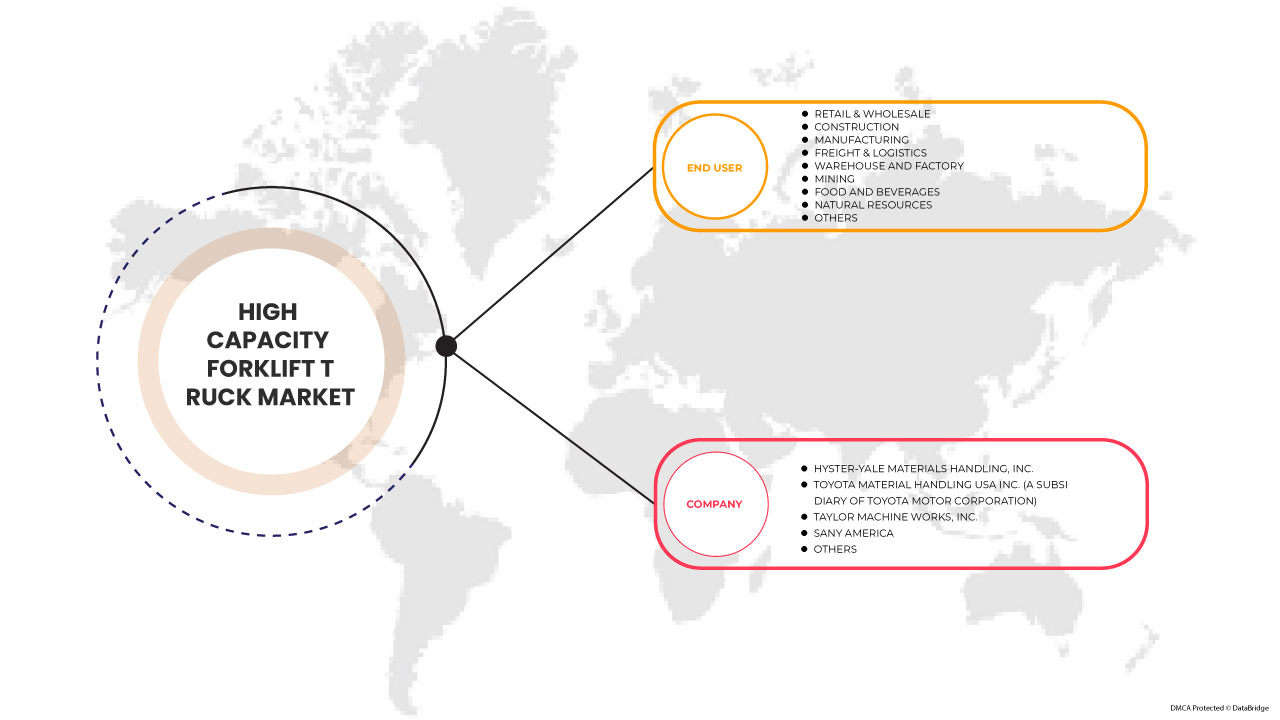

U.S. High Capacity Forklift Truck Market, End User (Retail & Wholesale, Construction, Manufacturing, Freight & Logistics, Warehouse and Factory, Mining, Food and Beverages, Natural Resources, and Others) Industry Trends and Forecast to 2029.

U.S. High Capacity Forklift Truck Market Analysis and Insights

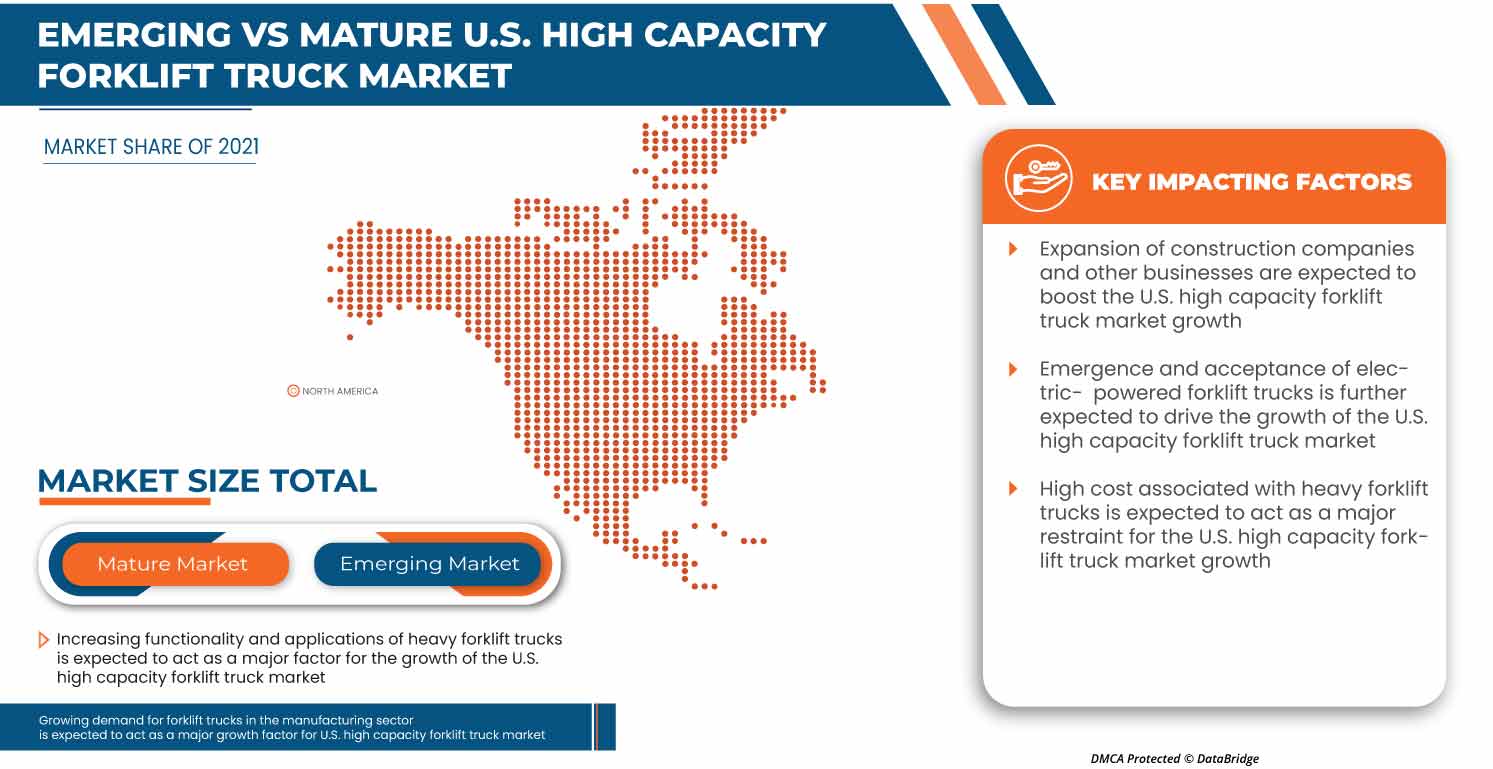

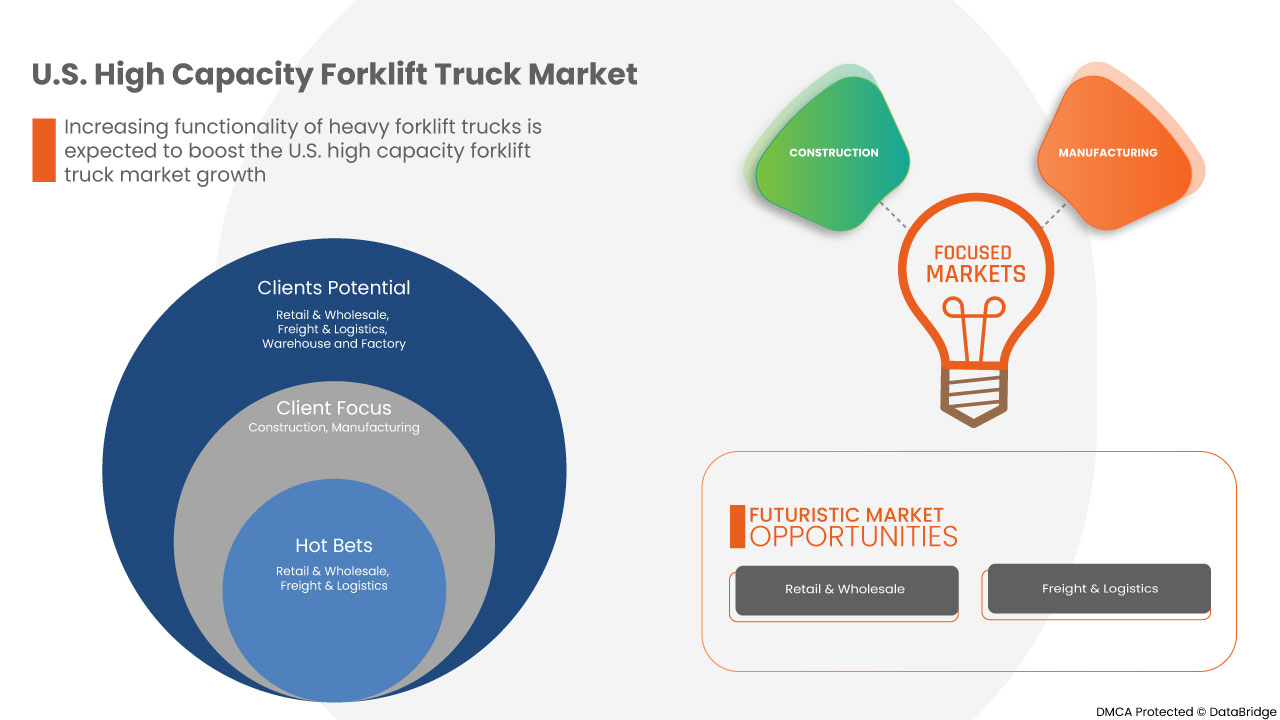

The manufacturers and suppliers in the country offer high-capacity forklift trucks with various specifications and capabilities. The rapid industrialization/expansion of construction companies and growing demand for forklift trucks in the manufacturing sector are estimated to act as major drivers for market growth. Additionally, the emergence and acceptance of electric-powered forklift trucks have further boosted the market. However, the high cost associated with these trucks and the high maintenance cost for multiple fleet owners may impede the market growth. Furthermore, modern forklift trucks are not suitable for the industry environment, and the lack of infrastructure for electric forklift trucks is estimated to challenge the market at present.

Data Bridge Market Research analyses that the U.S. high capacity forklift truck market is expected to reach the value of USD 999.79 million by 2029, at a CAGR of 4.8% during the forecast period. The construction segment accounts for the largest offering segment in the U.S. high capacity forklift truck market. The U.S. high capacity forklift truck market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

End User (Retail & Wholesale, Construction, Manufacturing, Freight & Logistics, Warehouse and Factory, Mining, Food and Beverages, Natural Resources, and Others) |

|

Country Covered |

U.S. |

|

Market Players Covered |

Hyster-Yale Materials Handling, Inc., Toyota Material Handling USA Inc. (A subsidiary of TOYOTA MOTOR CORPORATION), Taylor Machine Works, Inc., SANY AMERICA, Manitou Group, Anhui Heli Co., Ltd., HUBTEX Maschinenbau & Co. KG, and BPR-RICO EQUIPMENT, INC. among others |

Market Definition

High-capacity forklift trucks are high-powered vehicles designed to move or carry heavy objects over a distance and can also place them at a certain height. The adoption of forklift trucks is popular among industries affiliated with loading and unloading goods, such as logistics, manufacturing, and warehouses. These vehicles are commonly used in dockyards, storehouses, and recycling factories among others. These vehicles are used with some attachments, such as platforms and grippers, for efficient handling of goods and are classified based on their weight-bearing capacity. The demand for these trucks is estimated to increase in the U.S. due to factors such as the growth of e-commerce and warehouse management.

U.S. High Capacity Forklift Truck Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

-

Rapid industrialization/expansion of construction companies

An industrial vehicle with a front-powered platform is called a forklift. It has a fork that can be lifted or lowered and inserted underneath a load for lifting and moving purposes. Combustion engines or electrical batteries can power forklifts.

Some forklift models let the driver sit while operating the machine, while others demand that the driver stand (stand-up forklifts). In general, forklifts are used to transfer materials and things.

-

Growing demand for forklift trucks in the manufacturing sector

Material handling requirements vary widely in the manufacturing industry, such as order pickers are required to pick parts, tuggers are required to move them throughout the factory, and forklifts are required to move product pallets.

During the Industrial Revolution in the 18th and 19th centuries, the manufacturing industries underwent a significant transformation that increased the demand for appropriate material handling. Since then, there have been numerous changes made to material handling procedures.

Opportunity

-

Growing demand for forklift trucks in warehouse management

The warehouse is a building where raw materials or manufactured goods may be stored before their distribution for sale. Warehouses are used by all different types of businesses that need to temporarily store products in bulk before either shipping them to other locations or individually to end consumers. For instance, many e-commerce businesses; purchase products in bulk from their suppliers, who ship them to their warehouses for storage. When an end customer places an order from the e-commerce site, the business or its third-party fulfilment provider; picks and packs the product from the warehouse and ships it directly to the customer. As there is constant growth in the e-commerce segment across the U.S., the number of warehouses is also increasing. In return, this positively affects the market as these trucks are used in the warehouse to store heavy goods and efficiently use the warehouse space. Thus, the growing warehouse number across the U.S. is increasing the demand for forklift trucks for its management. This is expected to be an opportunity for the U.S. high capacity forklift truck market.

Restraint/Challenge

- High maintenance cost for multiple fleet owners

Every 200–250 hours of operation, or every six weeks, forklifts must be completely serviced and maintained. Any forklift used on a job site should go through a daily inspection. Forklift maintenance not only keeps your machine in peak shape but also aids in reducing safety risks. The Occupational Safety and Health Administration (OSHA) fines businesses that don't do enough forklift maintenance because regular maintenance is crucial.

The term "forklift maintenance" is intentionally wide. The amount and kind of maintenance your forklift requires may fluctuate depending on the type of power it uses. Regular cleaning, testing safety features, and replacing damaged equipment are all included in maintenance. Companies ensure the greatest return on investment by staying on top of maintenance.

COVID-19 Impact on U.S. High Capacity Forklift Truck Market

COVID-19 significantly impacted various industries as almost every country has opted for the shutdown for every facility except those in the essential goods segment. The government has taken some strict actions, such as shutting facilities and selling non-essential goods, blocking international trade, and many more to prevent the spread of COVID-19. This boosted the U.S. high capacity forklift truck market with the emergence and acceptance of electric-powered forklift trucks.

Recent Developments

- In July 2022, Toyota Material Handling announced that the company had acquired PennWest Toyota Lift, a Pennsylvania-based forklift dealership located in Mount Pleasant, Pittsburgh, and Erie, Pennsylvania. Through this acquisition, the company has increased its market reachability in the U.S. and has aimed to increase its market share in the market

- In November 2021, Hyster-Yale Materials Handling, Inc. announced that the company is participating in Baird Virtual Global Industrial Conference. This participation has allowed the company to increase its influence in the industrial sector with its offered product portfolio in the market

U.S. High Capacity Forklift Truck Market Scope

The U.S. high capacity forklift truck market is segmented based on end user. The growth amongst these segments will help you analyse meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By End User

- Retail & Wholesale

- Construction

- Manufacturing

- Freight & Logistics

- Warehouse and Factory

- Mining

- Food and Beverages

- Natural Resources

- Others

On the basis of end user, the U.S. high capacity forklift truck market is segmented into retail & wholesale, construction, manufacturing, freight & logistics, warehouse and factory, mining, food and beverages, natural resources, and others.

Competitive Landscape and U.S. High Capacity Forklift Truck Market Share Analysis

The U.S. high capacity forklift truck market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the U.S. high capacity forklift truck market.

Some of the major players operating in the U.S. high capacity forklift truck market are Hyster-Yale Materials Handling, Inc., Toyota Material Handling USA Inc. (A subsidiary of TOYOTA MOTOR CORPORATION), Taylor Machine Works, Inc., SANY AMERICA, Manitou Group, Anhui Heli Co., Ltd., HUBTEX Maschinenbau & Co. KG, and BPR-RICO EQUIPMENT, INC. among others.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MARKET END-USER COVERAGE GRID

2.8 MULTIVARIATE MODELLING

2.9 PRODUCT TYPE CURVE

2.1 CHALLENGE MATRIX

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS ANALYSIS

4.2 LIST OF END USER COMPANIES (DOCKYARDS, PORTS, AND RECYCLING)

4.3 U.S. SAFETY DEPARTMENT CONTACT LIST

4.4 OSHA FORKLIFT RULES AND REGULATIONS

4.5 TECHNOLOGICAL TRENDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RAPID EXPANSION OF CONSTRUCTION COMPANIES

5.1.2 GROWING DEMAND FOR FORKLIFT TRUCKS IN THE MANUFACTURING SECTOR

5.1.3 EMERGENCE AND ACCEPTANCE OF ELECTRIC-POWERED FORKLIFT TRUCKS

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH HEAVY FORKLIFT TRUCKS

5.2.2 HIGH MAINTENANCE COST FOR MULTIPLE FLEET OWNERS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR FORKLIFT TRUCKS IN WAREHOUSE MANAGEMENT

5.3.2 INCREASING FUNCTIONALITY OF HEAVY FORKLIFT TRUCKS

5.3.3 INCREASING PARTNERSHIP AND ACQUISITION AMONG MARKET PLAYERS

5.4 CHALLENGES

5.4.1 MODERN FORKLIFT TRUCKS ARE UNSUITABLE FOR THE INDUSTRY ENVIRONMENT

5.4.2 LACK OF INFRASTRUCTURE FOR ELECTRIC FORKLIFT TRUCKS

6 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET, BY END USER

6.1 OVERVIEW

6.2 CONSTRUCTION

6.2.1 INTERNAL COMBUSTION ENGINE POWERED

6.2.1.1 DIESEL

6.2.1.2 LPG/GASOLINE

6.2.2 ELECTRIC POWERED

6.3 FREIGHT & LOGISTICS

6.3.1 INTERNAL COMBUSTION ENGINE POWERED

6.3.1.1 DIESEL

6.3.1.2 LPG/GASOLINE

6.3.2 ELECTRIC POWERED

6.4 MANUFACTURING

6.4.1 INTERNAL COMBUSTION ENGINE POWERED

6.4.1.1 DIESEL

6.4.1.2 LPG/GASOLINE

6.4.2 ELECTRIC POWERED

6.5 NATURAL RESOURCES

6.5.1 INTERNAL COMBUSTION ENGINE POWERED

6.5.1.1 DIESEL

6.5.1.2 LPG/GASOLINE

6.5.2 ELECTRIC POWERED

6.6 WAREHOUSE & FACTORY

6.6.1 INTERNAL COMBUSTION ENGINE POWERED

6.6.1.1 DIESEL

6.6.1.2 LPG/GASOLINE

6.6.2 ELECTRIC POWERED

6.7 MINING

6.7.1 INTERNAL COMBUSTION ENGINE POWERED

6.7.1.1 DIESEL

6.7.1.2 LPG/GASOLINE

6.7.2 ELECTRIC POWERED

6.8 FOOD & BEVERAGES

6.8.1 INTERNAL COMBUSTION ENGINE POWERED

6.8.1.1 DIESEL

6.8.1.2 LPG/GASOLINE

6.8.2 ELECTRIC POWERED

6.9 RETAIL & WHOLESALE

6.9.1 INTERNAL COMBUSTION ENGINE POWERED

6.9.1.1 DIESEL

6.9.1.2 LPG/GASOLINE

6.9.2 ELECTRIC POWERED

6.1 OTHERS

7 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET, COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: U.S.

8 SWOT ANALYSIS

9 COMPANY PROFILE

9.1 HYSTER-YALE MATERIALS HANDLING, INC.

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 BRAND PORTFOLIO

9.1.4 RECENT DEVELOPMENTS

9.2 TOYOTA MATERIAL HANDLING (A SUBSIDIARY OF TOYOTA MOTOR CORPORATION)

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENTS

9.3 TAYLOR MACHINE WORKS, INC

9.3.1 COMPANY SNAPSHOT

9.3.2 PRODUCT PORTFOLIO

9.3.3 RECENT DEVELOPMENTS

9.4 MANITOU GROUP

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENT

9.5 ANHUI HELI CO.

9.5.1 COMPANY SNAPSHOT

9.5.2 PRODUCT PORTFOLIO

9.5.3 RECENT DEVELOPMENT

9.6 BPR-RICO EQUIPMENT, INC.

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENT

9.7 HUBTEX MASCHINENBAU & CO. KG

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENTS

9.8 SANY AMERICA

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

표 목록

TABLE 1 SUMMARY TABLE ON USE OF INDUSTRIAL TRUCKS IN VARIOUS LOCATIONS

TABLE 2 SUMMARY TABLE ON USE OF INDUSTRIAL TRUCKS IN VARIOUS LOCATIONS - CONTINUED

TABLE 3 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 4 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET, BY END USER, 2020-2029 (VOLUME IN THOUSAND)

TABLE 5 U.S. CONSTRUCTION IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 6 U.S. CONSTRUCTION IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 7 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 8 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 9 U.S. FREIGHT & LOGISTICS IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 10 U.S. FREIGHT & LOGISTICS IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 11 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 12 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 13 U.S. MANUFACTURING IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 14 U.S. MANUFACTURING IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 15 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 16 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 17 U.S. NATURAL RESOURCES IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 18 U.S. NATURAL RESOURCES IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 19 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 21 U.S. WAREHOUSE & FACTORY IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 22 U.S. WAREHOUSE & FACTORY IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 23 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 24 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 25 U.S. MINING IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 26 U.S. MINING IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 27 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 29 U.S. FOOD & BEVERAGES IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 30 U.S. FOOD & BEVERAGES IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 31 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 33 U.S. RETAIL & WHOLESALE IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 34 U.S. RETAIL & WHOLESALE IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 35 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 36 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

그림 목록

FIGURE 1 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: SEGMENTATION

FIGURE 2 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: DATA TRIANGULATION

FIGURE 3 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: DROC ANALYSIS

FIGURE 4 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: SEGMENTATION

FIGURE 10 RAPID INDUSTRIALIZATION/EXPANSION OF CONSTRUCTION COMPANIES IS THE MAJOR FACTOR BOOSTING THE GROWTH TO BE A KEY DRIVER FOR U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET IN THE FORECAST PERIOD

FIGURE 11 CONSTRUCTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET FROM 2022 TO 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET

FIGURE 13 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: BY END USER, 2021

FIGURE 14 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.