Europe Medical Device Warehouse And Logistics Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

9.74 Billion

USD

13.86 Billion

2024

2032

USD

9.74 Billion

USD

13.86 Billion

2024

2032

| 2025 –2032 | |

| USD 9.74 Billion | |

| USD 13.86 Billion | |

|

|

|

|

Segmentação do mercado de logística e depósito de dispositivos médicos na Europa, por ofertas (serviços, hardware e software), temperatura (ambiente, refrigerada, congelada e outras), modo de transporte (logística de frete marítimo, logística de frete aéreo e logística terrestre), aplicação (dispositivos de diagnóstico, dispositivos terapêuticos, dispositivos de monitoramento, dispositivos cirúrgicos e outros dispositivos), uso final (hospitais e clínicas, empresas de dispositivos médicos, institutos acadêmicos e de pesquisa, laboratórios de referência e diagnóstico, empresas de serviços médicos de emergência e outros), canal de distribuição (logística convencional e terceirizada) - tendências e previsões do setor até 2032

Tamanho do mercado de armazenagem e logística de dispositivos médicos na Europa

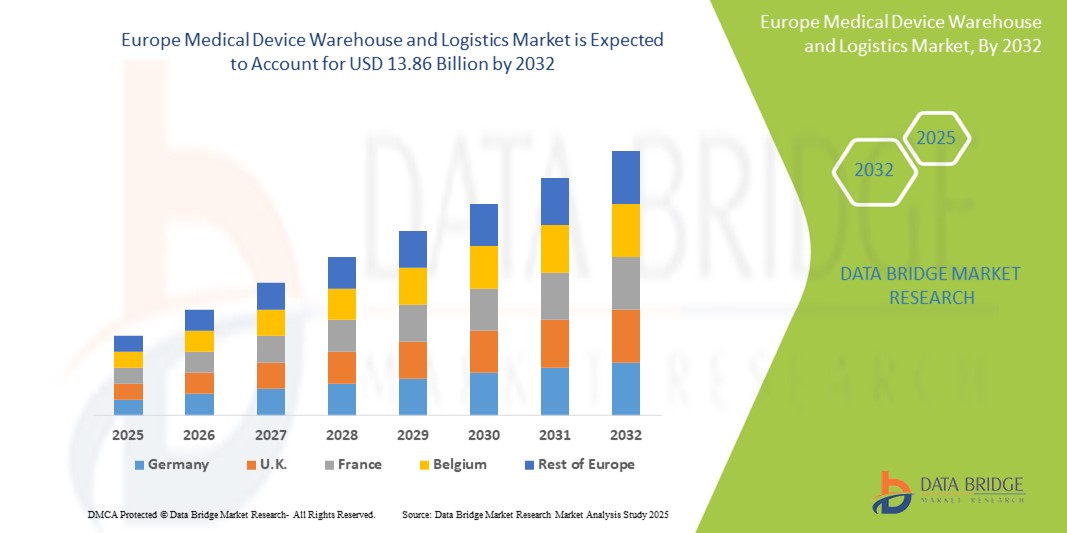

- O tamanho do mercado de armazenagem e logística de dispositivos médicos na Europa foi avaliado em US$ 9,74 bilhões em 2024 e deve atingir US$ 13,86 bilhões até 2032 , com um CAGR de 4,50% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção de tecnologias avançadas de cadeia de suprimentos e pela transformação digital da logística de saúde, levando ao aumento da eficiência no armazenamento e na distribuição de dispositivos médicos em toda a Europa.

- Além disso, a crescente demanda por equipamentos médicos sensíveis à temperatura e de alto valor, aliada à rigorosa conformidade regulatória para rastreabilidade e segurança de dispositivos médicos, está impulsionando a adoção de soluções de armazenagem e logística para dispositivos médicos na Europa. Esses fatores convergentes estão acelerando a adoção de plataformas logísticas com tecnologia avançada, impulsionando significativamente o crescimento do setor.

Análise do Mercado de Armazéns e Logística de Dispositivos Médicos na Europa

- Os serviços de armazenagem e logística de dispositivos médicos são componentes cada vez mais vitais da infraestrutura de saúde da Europa, especialmente em ambientes hospitalares, ambulatoriais e de atendimento domiciliar, devido à crescente demanda por entrega pontual, em conformidade e com temperatura controlada de tecnologias médicas complexas. Esses serviços desempenham um papel crucial para garantir a disponibilidade, a rastreabilidade e o alinhamento regulatório dos dispositivos em toda a região.

- A crescente demanda por logística eficiente de dispositivos médicos na Europa é alimentada principalmente pela crescente base de fabricação de dispositivos médicos, avanços nas tecnologias de cadeia fria, expansão do comércio eletrônico de suprimentos médicos e regulamentações europeias rigorosas, como as diretrizes MDR e GDP.

- A Alemanha dominou o mercado europeu de armazenagem e logística de dispositivos médicos, com a maior participação na receita, de 28,3% em 2024, devido à sua infraestrutura avançada de saúde, centros de distribuição centralizados e liderança na produção e exportação de dispositivos médicos. O investimento do país em automação, rastreamento RFID e armazenagem com temperatura controlada está acelerando a maturidade do mercado, especialmente entre grandes provedores de logística.

- Espera-se que a França seja a região de crescimento mais rápido no mercado de armazenagem e logística de dispositivos médicos durante o período previsto, com um CAGR de 5,8%, apoiado por reformas de saúde apoiadas pelo governo, presença de provedores líderes de serviços de logística, integração de soluções de cadeia fria e crescente demanda por dispositivos de cuidados crônicos.

- O segmento de temperatura ambiente dominou o mercado europeu de armazenagem e logística de dispositivos médicos, com uma participação de mercado de 52,3% em 2024, devido à ampla gama de dispositivos médicos que não requerem controle de temperatura. Sua relação custo-benefício, facilidade de manuseio e compatibilidade com as condições padrão de armazenamento e transporte o tornam a escolha preferida para armazenagem e distribuição de produtos como instrumentos cirúrgicos, kits de diagnóstico e equipamentos médicos duráveis em toda a Europa.

Escopo do Relatório e Segmentação do Mercado de Armazéns e Logística de Dispositivos Médicos na Europa

|

Atributos |

Principais insights de mercado sobre armazenagem e logística de dispositivos médicos na Europa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de logística e armazenagem de dispositivos médicos na Europa

“ Operações simplificadas por meio de automação e rastreamento digital ”

- Uma tendência significativa e crescente no mercado europeu de armazenagem e logística de dispositivos médicos é a adoção de tecnologias avançadas de automação e rastreamento digital. Essas inovações estão melhorando a eficiência operacional, reduzindo erros manuais e permitindo a visibilidade do estoque em tempo real em toda a cadeia de suprimentos.

- Por exemplo, muitos provedores de logística terceirizados (3PLs) estão integrando sistemas digitais de gerenciamento de armazéns (WMS) com tecnologias de RFID e leitura de código de barras para otimizar o armazenamento, a recuperação e a distribuição de dispositivos médicos. Isso garante a conformidade regulatória, minimiza discrepâncias de estoque e acelera o atendimento de pedidos.

- Além disso, a implementação de plataformas de logística baseadas em nuvem está permitindo que as partes interessadas monitorem o status da remessa em tempo real, recebam alertas automatizados e agilizem a documentação alfandegária e regulatória, reduzindo atrasos e aumentando a satisfação do cliente.

- A automação dos sistemas de monitoramento de temperatura e controle de umidade em armazéns é particularmente crucial para dispositivos médicos sensíveis à temperatura e de alto valor, como kits de diagnóstico, dispositivos implantáveis e instrumentos cirúrgicos. Esses sistemas garantem condições ambientais consistentes para manter a integridade do produto.

- A crescente preferência por inventário just-in-time (JIT) e logística orientada pela demanda está incentivando fabricantes e distribuidores a colaborar estreitamente com parceiros de logística que podem oferecer soluções de armazenagem escaláveis e flexíveis

- Consequentemente, os principais intervenientes, como a DB Schenker, a CEVA Logistics e a Kuehne+Nagel, estão a investir em armazéns de dispositivos médicos especialmente concebidos e em conformidade com as normas do RGPD, com infraestruturas especializadas para responder às necessidades em evolução dos fabricantes e prestadores de cuidados de saúde em toda a Europa.

Dinâmica do mercado de logística e armazenagem de dispositivos médicos na Europa

Motorista

“Necessidade crescente devido à crescente demanda por cadeia de frio eficiente e conformidade regulatória”

- A crescente demanda por dispositivos médicos sensíveis à temperatura, juntamente com regulamentações rigorosas para o manuseio e distribuição de dispositivos médicos em toda a Europa, é um importante impulsionador da expansão do mercado de armazenamento e logística de dispositivos médicos na Europa.

- Por exemplo, em abril de 2024, a UPS Healthcare anunciou a expansão de suas capacidades de logística de cadeia fria na Europa para atender à crescente demanda por transporte de dispositivos médicos e biológicos em conformidade e com temperatura regulada. Espera-se que tais investimentos por parte de players importantes impulsionem o crescimento do mercado durante o período previsto.

- À medida que os prestadores de cuidados de saúde priorizam a entrega oportuna e segura de dispositivos diagnósticos e terapêuticos, os parceiros de logística estão aprimorando as capacidades em torno da rastreabilidade, serialização e monitoramento de condições, garantindo a conformidade com as diretrizes MDR e GDP da UE.

- Além disso, a mudança para dispositivos minimamente invasivos e soluções de assistência médica domiciliar está aumentando a necessidade de entrega de última milha, gerenciamento de estoque eficiente e embalagem especializada, tornando os serviços de depósito e logística um elo crítico na cadeia de suprimentos de dispositivos médicos.

- A crescente prevalência de doenças crônicas e procedimentos cirúrgicos, juntamente com o crescente número de ensaios clínicos e serviços de diagnóstico, acelera ainda mais a necessidade de soluções de armazenagem ágeis e escaláveis, adaptadas às condições específicas de armazenamento e aos tempos de resposta exigidos pelas tecnologias médicas.

Restrição/Desafio

“ Altos custos operacionais e cenário regulatório complexo ”

- O mercado europeu de armazenagem e logística de dispositivos médicos enfrenta desafios devido aos altos custos associados à infraestrutura da cadeia fria, treinamento especializado de pessoal e conformidade regulatória. A construção e a manutenção de instalações e redes de transporte em conformidade com as Boas Práticas de Fabricação (BPD), especialmente para os segmentos de refrigerados e congelados, exigem investimentos significativos.

- Além disso, navegar pelas estruturas regulatórias complexas e em constante evolução em vários países europeus apresenta obstáculos operacionais. Fabricantes e provedores de logística devem se adaptar aos diversos requisitos nacionais, garantindo visibilidade e conformidade centralizadas.

- Por exemplo, atrasos no transporte transfronteiriço devido a erros de documentação ou diferenças nos protocolos alfandegários podem afetar os prazos de entrega e a integridade do produto, especialmente para dispositivos sensíveis à temperatura.

- Além disso, fabricantes de dispositivos médicos de pequeno e médio porte frequentemente enfrentam dificuldades para atender a essas demandas de custo e conformidade, o que os leva a depender fortemente de provedores de logística terceirizada (3PL). Embora isso aumente o alcance, também pode reduzir o controle direto sobre a qualidade e os prazos.

- Para superar essas restrições, as partes interessadas do setor devem investir em automação, sistemas de rastreamento digital e treinamento de pessoal, além de promover uma colaboração mais forte com os órgãos reguladores. A expansão dos centros de armazenagem regionais e a adoção de plataformas digitais padronizadas também serão vitais para otimizar as operações e apoiar o crescimento a longo prazo.

Escopo do mercado de logística e armazenamento de dispositivos médicos na Europa

O mercado é segmentado com base em ofertas, temperatura, modo de transporte, aplicação, uso final e canal de distribuição.

• Por Ofertas

Com base na oferta, o mercado europeu de armazenagem e logística de dispositivos médicos é segmentado em serviços, hardware e software. O segmento de serviços dominou, com a maior participação na receita, de 48,6% em 2024, impulsionado pela crescente terceirização de funções logísticas e pela demanda por manuseio especializado.

Espera-se que o segmento de software testemunhe o CAGR mais rápido de 23,5% durante o período previsto, atribuído ao uso crescente de ferramentas de logística digital, como plataformas WMS e TMS.

• Por temperatura

Com base na temperatura, o mercado europeu de armazenagem e logística de dispositivos médicos é segmentado em temperatura ambiente, refrigerado/refrigerado, congelado e outros. O segmento de temperatura ambiente deteve a maior participação, com 52,3% em 2024, devido à ampla gama de dispositivos que não requerem controle de temperatura.

O segmento refrigerado/refrigerado deverá crescer na mais rápida CAGR de 21,1% entre 2025 e 2032, impulsionado pela crescente demanda por logística de cadeia fria para dispositivos médicos sensíveis.

• Por meio de transporte

Com base no modo de transporte, o mercado europeu de armazenagem e logística de dispositivos médicos é segmentado em logística de frete marítimo, logística de frete aéreo e logística terrestre. O segmento de logística terrestre dominou o mercado, com participação de 45,7% na receita em 2024, devido às redes rodoviárias e ferroviárias bem estabelecidas em toda a Europa.

Espera-se que o segmento de logística de frete aéreo cresça na maior CAGR de 19,4% durante o período previsto, apoiado pela crescente demanda por remessas médicas rápidas e de alto valor.

• Por aplicação

Com base na aplicação, o mercado europeu de armazenagem e logística de dispositivos médicos é segmentado em dispositivos de diagnóstico, dispositivos terapêuticos, dispositivos de monitoramento, dispositivos cirúrgicos e outros dispositivos. O segmento de dispositivos de diagnóstico representou a maior fatia, 34,2%, em 2024, impulsionado pelo alto volume de uso e ciclos recorrentes de reposição.

O segmento de dispositivos cirúrgicos deverá expandir-se a uma CAGR de 20,2% durante o período previsto, apoiado pelo aumento dos volumes de procedimentos e pelos requisitos de manuseio de dispositivos de precisão.

• Até o uso final

Com base no uso final, o mercado europeu de armazenagem e logística de dispositivos médicos é segmentado em hospitais e clínicas, empresas de dispositivos médicos, institutos acadêmicos e de pesquisa, laboratórios de referência e diagnóstico, empresas de serviços médicos de emergência e outros. O segmento de hospitais e clínicas deteve a maior participação na receita, 39,6%, em 2024, devido às altas taxas de consumo de dispositivos e à aquisição centralizada.

A previsão é de que o segmento de empresas de dispositivos médicos cresça a uma CAGR mais rápida, de 22,8%, durante o período previsto, à medida que elas terceirizam cada vez mais a logística para provedores terceirizados especializados.

• Por Canal de Distribuição

Com base no canal de distribuição, o mercado europeu de armazenagem e logística de dispositivos médicos é segmentado em logística convencional e logística terceirizada. O segmento de logística terceirizada conquistou a maior fatia, de 61,2%, em 2024, à medida que os fabricantes de dispositivos migram para modelos de distribuição flexíveis e econômicos.

Espera-se que o segmento de logística convencional cresça a uma CAGR mais rápida de 13,9% durante o período previsto, mantendo relevância em regiões com sistemas de distribuição internos ou específicos para regulamentações.

Análise regional do mercado de armazenagem e logística de dispositivos médicos na Europa

- A Europa dominou o mercado de armazenagem e logística de dispositivos médicos com a maior participação de receita de 38,7% em 2024, impulsionada pela infraestrutura de saúde bem estabelecida da região, forte rede de centros logísticos e padrões regulatórios rigorosos que oferecem suporte ao armazenamento e distribuição de dispositivos médicos seguros e em conformidade.

- O foco da região na integridade da cadeia de frio, nos sistemas de rastreamento digital e na sustentabilidade na logística contribuiu significativamente para a demanda por soluções avançadas de armazenagem e distribuição médica.

- A presença de empresas farmacêuticas e de tecnologia médica líderes, combinada com a crescente adoção de automação, robótica e monitoramento de estoque em tempo real nas operações de logística, está impulsionando ainda mais o crescimento do mercado

Visão do mercado de armazenagem e logística de dispositivos médicos na Alemanha

O mercado alemão de armazenagem e logística de dispositivos médicos dominou o mercado europeu, com a maior participação na receita, de 28,3% em 2024, impulsionado por sua infraestrutura avançada de saúde, forte rede logística e ampla adoção da automação no manuseio de dispositivos médicos. A localização estratégica do país na Europa e o foco em conformidade regulatória o tornam um polo preferencial para armazenagem e distribuição.

Visão do mercado de armazenagem e logística de dispositivos médicos na França

A França deverá testemunhar um crescimento constante no mercado de armazenagem e logística de dispositivos médicos durante o período previsto, com um CAGR de 5,8% de 2025 a 2032, apoiado por reformas de saúde apoiadas pelo governo, presença de provedores de serviços de logística líderes, integração de soluções de cadeia fria e crescente demanda por dispositivos de cuidados crônicos.

Visão geral do mercado de armazenagem e logística de dispositivos médicos do Reino Unido

Prevê-se que o mercado de armazenagem e logística de dispositivos médicos do Reino Unido se expanda significativamente, impulsionado por inovações na entrega de última milha, pela reestruturação da cadeia de suprimentos relacionada ao Brexit e pela crescente demanda por dispositivos de diagnóstico. O país está se concentrando em armazenagem digitalizada e soluções logísticas sustentáveis.

Visão geral do mercado de armazenagem e logística de dispositivos médicos na Europa e na Holanda

O mercado holandês de armazenagem e logística de dispositivos médicos está emergindo como um importante polo logístico devido à sua excelente conectividade portuária e aeroportuária. O mercado europeu de armazenagem e logística de dispositivos médicos conta com o apoio de fortes parcerias público-privadas, eficiência alfandegária e alta concentração de fornecedores 3PL.

Participação no mercado de armazenagem e logística de dispositivos médicos na Europa

O setor de armazenagem e logística de dispositivos médicos da Europa é liderado principalmente por empresas bem estabelecidas, incluindo:

- Deutsche Post AG (Alemanha)

- FedEx (EUA)

- United Parcel Service of America, Inc. (EUA)

- Kuehne+Nagel (Reino Unido)

- DB SCHENKER (Alemanha)

- Alloga (Reino Unido)

- CH Robinson Worldwide, Inc. (EUA)

- CEVA (França)

- Dimerco (Taiwan)

- DSV (Dinamarca)

- FM Logística (França)

- Hellmann Worldwide Logistics SE & Co. KG (Alemanha)

- Imperial (África do Sul)

- Movianto (Holanda)

- OIA Global (EUA)

- Omni Logistics, LLC (EUA)

- puracon GmbH (Alemanha)

- Grupo Rhenus (Alemanha)

- SEKO (EUA)

- TIBA (Espanha)

- Toll Holdings Limited (Austrália)

- XPO, Inc. (EUA)

Últimos desenvolvimentos no mercado europeu de armazenagem e logística de dispositivos médicos

- Em novembro de 2023, a DHL Express inaugurou oficialmente seu Hub expandido para a Ásia Central em Hong Kong, investindo 562 milhões de euros para aprimorar suas capacidades em meio ao crescimento do comércio global. O hub, crucial para conectar a Ásia ao mundo, aumentou sua capacidade de manuseio de remessas de pico em quase 70% e agora consegue gerenciar seis vezes o volume desde sua criação em 2004. Essa expansão reforça o compromisso da DHL em apoiar o crescimento dos clientes e consolidar o status de Hong Kong como um importante hub internacional de aviação.

- Em dezembro de 2022, a DHL Supply Chain anunciou um investimento de US$ 10,93 milhões para expandir sua capacidade de armazenagem no norte de Taiwan, com foco especial nos setores de semicondutores, ciências da vida e saúde. O recém-inaugurado Centro de Distribuição de Taoyuan-Jian Guo adiciona 10.000 metros quadrados à área total de armazenagem da DHL em Taoyuan, aumentando-a para 37.000 metros quadrados. Esta instalação melhora a conectividade para operações logísticas eficientes e apoia a meta da empresa de atingir 200.000 metros quadrados de área total em Taiwan até 2027.

- Em setembro de 2024, a FedEx lançou a plataforma fdx, uma solução de comércio baseada em dados, agora disponível para empresas dos EUA. A plataforma utiliza a rede da FedEx para aprimorar a experiência do cliente, melhorando o crescimento da demanda, as taxas de conversão e a otimização do atendimento. Recursos notáveis incluem estimativas preditivas de entrega, insights de sustentabilidade, rastreamento de pedidos com a marca e processos de devolução simplificados. Raj Subramaniam, CEO da FedEx, destacou o papel da plataforma em cadeias de suprimentos mais inteligentes durante o evento Dreamforce 2024.

- Em março de 2024, a UPS Healthcare lançou o UPS Supply Chain Symphony R, uma plataforma em nuvem projetada para integrar e gerenciar dados da cadeia de suprimentos de saúde de diversos sistemas operacionais. Essa ferramenta oferece aos clientes do setor de saúde visibilidade total de sua logística, capacitando-os a tomar decisões informadas, aprimorar o planejamento e fazer previsões precisas. Ao aprimorar o controle, a eficiência e a transparência, essa plataforma atende à necessidade crítica de cadeias de suprimentos otimizadas na área da saúde. Kate Gutmann enfatizou seu potencial transformador na otimização de operações globais e no atendimento ao paciente.

- Em setembro de 2024, a Kuehne+Nagel, uma importante provedora de logística, inaugurou um novo centro de distribuição com temperatura controlada para a Medtronic em Milton, Ontário, a apenas 50 km de Toronto. Com uma área de 25.000 m², a instalação distribuirá dispositivos médicos para hospitais e abrigará os centros de serviço, reparo e manutenção preventiva da Medtronic para seus equipamentos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRY RIVALRY

4.3 COST ANALYSIS BREAKDOWN

4.4 COST BENCHMARK ANALYSIS

4.4.1 COST METRICS OVERVIEW:

4.4.1.1 AVERAGE WAREHOUSE COST PER SQ FT (USD)

4.4.1.2 AVERAGE WAREHOUSE COST PER ORDER:

4.4.1.3 AVERAGE TRANSPORT COST PER SHIPMENT (USD)

4.5 HEALTHCARE ECONOMY

4.6 INDUSTRY INSIGHT

4.6.1 MICRO AND MACRO ECONOMIC FACTORS

4.6.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.6.3 KEY PRICING STRATEGIES

4.6.4 INTERVIEWS WITH SPECIALISTS

4.6.5 ANALYSIS AND RECOMMENDATIONS

4.7 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.7.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.7.1.1 JOINT VENTURES

4.7.1.2 MERGERS AND ACQUISITIONS

4.7.1.3 LICENSING AND PARTNERSHIP

4.7.1.4 TECHNOLOGY COLLABORATIONS

4.7.1.5 STRATEGIC DIVESTMENTS

4.7.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.7.3 STAGE OF DEVELOPMENT

4.7.4 TIMELINES AND MILESTONES

4.7.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.7.6 RISK ASSESSMENT AND MITIGATION

4.7.7 FUTURE OUTLOOK

4.7.8 CONCLUSION

4.8 OPPORTUNITY MAP ANALYSIS

4.9 REIMBURSEMENT FRAMEWORK

4.1 TECHNOLOGICAL ROADMAP

4.11 VALUE CHAIN ANALYSIS

5 REGULATORY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR MEDICAL DEVICES

6.1.2 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN MEDICAL TECHNOLOGY

6.1.3 INCREASED SPENDING ON HEALTHCARE INFRASTRUCTURE BY GOVERNMENTS AND PRIVATE SECTORS

6.2 RESTRAINTS

6.2.1 SUPPLY CHAIN DISRUPTIONS

6.2.2 HIGH OPERATIONAL COSTS OF MEDICAL DEVICE LOGISTICS AND WAREHOUSING

6.3 OPPORTUNITIES

6.3.1 ADOPTION OF ADVANCED TECHNOLOGIES IN LOGISTICS MANAGEMENT

6.3.2 STRATEGIC PARTNERSHIPS AND MERGERS BETWEEN MEDICAL DEVICE MANUFACTURERS AND LOGISTICS AND E-COMMERCE COMPANIES

6.4 CHALLENGES

6.4.1 COMPLEX REGULATORY REQUIREMENTS FOR LOGISTICS PROVIDERS TO ENSURE COMPLIANCE

6.4.2 SHORTAGE OF SKILLED LABOR IN LOGISTICS AND WAREHOUSE OPERATIONS CAN CREATE INEFFICIENCIES AND DELAYS

7 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS

7.1 OVERVIEW

7.2 SERVICES

7.3 HARDWARE

7.4 SOFTWARE

8 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION

8.1 OVERVIEW

8.2 SEA FREIGHT LOGISTICS

8.3 AIR FREIGHT LOGISTICS

8.4 OVERLAND LOGISTICS

9 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE

9.1 OVERVIEW

9.2 AMBIENT

9.3 CHILLED/REFRIGERATED

9.4 FROZEN

9.5 OTHERS

10 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DIAGNOSTIC DEVICES

10.3 THERAPEUTIC DEVICES

10.4 MONITORING DEVICES

10.5 SURGICAL DEVICES

10.6 OTHERS DEVICES

11 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE

11.1 OVERVIEW

11.2 HOSPITALS & CLINICS

11.3 MEDICAL DEVICES COMPANIES

11.4 ACADEMIC & RESEARCH INSTITUTES

11.5 REFERENCE & DIAGNOSTIC LABORATORIES

11.6 EMERGENCY MEDICAL SERVICES COMPANIES

11.7 OTHERS

12 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 CONVENTIONAL LOGISTICS

12.3 THIRD PARTY

13 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 FRANCE

13.1.4 SPAIN

13.1.5 SWITZERLAND

13.1.6 NETHERLANDS

13.1.7 RUSSIA

13.1.8 BELGIUM

13.1.9 FINLAND

13.1.10 DENMARK

13.1.11 POLAND

13.1.12 NORWAY

13.1.13 HUNGARY

13.1.14 SWEDEN

13.1.15 REST OF EUROPE

14 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 DEUTSCHE POST AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 SERVICE PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 FEDEX

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SERVICE PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 UNITED PARCEL SERVICE OF AMERICA, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SERVICE PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 KUEHNE+NAGEL

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 SERVICE PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 DB SCHENKER

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 SERVICE PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ALLOGA

16.6.1 COMPANY SNAPSHOT

16.6.2 SERVICE PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AWL INDIA PRIVATE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 SERVICE PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 C.H. ROBINSON WORLDWIDE, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 SERVICE PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 CAVALIER LOGISTICS

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 CEVA

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 CROWN LSP GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 SERVICE PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 DIMERCO

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 SERVICE PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 DSV

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 FM LOGISTIC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SERVICE PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 HANSA INTERNATIONAL

16.15.1 COMPANY SNAPSHOT

16.15.2 SERVICE PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 HELLMANN WORLDWIDE LOGISTICS SE & CO. KG

16.16.1 COMPANY SNAPSHOT

16.16.2 SERVICE PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 IMPERIAL

16.17.1 COMPANY SNAPSHOT

16.17.2 SERVICE PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 MERCURY BUSINESS SERVICES

16.18.1 COMPANY SNAPSHOT

16.18.2 SERVICE PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 MOVIANTO

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 MURPHY LOGISTICS

16.20.1 COMPANY SNAPSHOT

16.20.2 SERVICE PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 OIA EUROPE

16.21.1 COMPANY SNAPSHOT

16.21.2 SERVICE PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 OMNI LOGISTICS, LLC

16.22.1 COMPANY SNAPSHOT

16.22.2 SERVICE PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 PURACON GMBH

16.23.1 COMPANY SNAPSHOT

16.23.2 SERVICE PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 RHENUS GROUP

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 SEKO

16.25.1 COMPANY SNAPSHOT

16.25.2 SERVICE PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 TIBA

16.26.1 COMPANY SNAPSHOT

16.26.2 SERVICE PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

16.27 TOLL HOLDINGS LIMITED

16.27.1 COMPANY SNAPSHOT

16.27.2 SERVICE PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

16.28 WAREHOUSE ANYWHERE

16.28.1 COMPANY SNAPSHOT

16.28.2 SERVICE PORTFOLIO

16.28.3 RECENT DEVELOPMENTS

16.29 XPO, INC.

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 SERVICE PORTFOLIO

16.29.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 2 EUROPE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 3 EUROPE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 4 EUROPE LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 5 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 6 EUROPE STORAGE AND WAREHOUSE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 EUROPE STORAGE AND WAREHOUSE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 8 EUROPE PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 EUROPE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 EUROPE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 EUROPE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 EUROPE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 14 EUROPE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 EUROPE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 EUROPE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 18 EUROPE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 EUROPE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 EUROPE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 24 EUROPE AMBIENT IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 EUROPE CHILLED/REFRIGERATED IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 26 EUROPE FROZEN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 27 EUROPE OTHERS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 28 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 29 EUROPE DIAGNOSTIC DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 30 EUROPE THERAPEUTIC DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 EUROPE MONITORING DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 32 EUROPE SURGICAL DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 EUROPE OTHERS DEVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY END USE, 2022-2031 (USD THOUSAND)

TABLE 35 EUROPE HOSPITALS & CLINICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 EUROPE MEDICAL DEVICES COMPANIES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 EUROPE ACADEMIC & RESEARCH INSTITUTES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 38 EUROPE REFERENCE & DIAGNOSTIC LABORATORIES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 EUROPE EMERGENCY MEDICAL SERVICES COMPANIES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 40 EUROPE OTHERS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 41 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY END USE, 2022-2031 (USD THOUSAND)

TABLE 42 EUROPE CONVENTIONAL LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 EUROPE THIRD PARTY IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 44 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 45 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 46 EUROPE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 EUROPE LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 EUROPE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 EUROPE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 EUROPE PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 52 EUROPE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 EUROPE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 55 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 56 EUROPE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 EUROPE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 59 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 60 EUROPE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 61 EUROPE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 63 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 64 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 65 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 66 GERMANY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 GERMANY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 GERMANY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 GERMANY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 71 GERMANY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 GERMANY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 GERMANY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 75 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 76 GERMANY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 GERMANY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 GERMANY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 GERMANY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 83 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 84 GERMANY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 85 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 86 U.K. SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 U.K. LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 U.K. STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 90 U.K. STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 U.K. PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 U.K. HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 U.K. SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 95 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 96 U.K. SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 U.K. AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 99 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 100 U.K. OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 U.K. COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 103 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 104 U.K. MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 105 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 106 FRANCE SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 FRANCE LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 108 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 109 FRANCE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 FRANCE STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 FRANCE PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 FRANCE HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 FRANCE SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 115 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 116 FRANCE SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 117 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 FRANCE AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 119 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 FRANCE OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 FRANCE COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 123 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 124 FRANCE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 125 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 126 ITALY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 ITALY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 128 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 129 ITALY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 ITALY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 131 ITALY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 ITALY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 ITALY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 135 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 136 ITALY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 138 ITALY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 139 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 140 ITALY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 141 ITALY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 142 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 143 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 144 ITALY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 145 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 146 SPAIN SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 147 SPAIN LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 148 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 SPAIN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 SPAIN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 151 SPAIN PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 SPAIN HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 SPAIN SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 155 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 156 SPAIN SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 157 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 158 SPAIN AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 SPAIN OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 161 SPAIN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 163 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 164 SPAIN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 165 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 166 SWITZERLAND SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 167 SWITZERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 168 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 169 SWITZERLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 170 SWITZERLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 171 SWITZERLAND PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 172 SWITZERLAND HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 173 SWITZERLAND SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 174 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 175 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 176 SWITZERLAND SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 177 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 178 SWITZERLAND AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 179 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 180 SWITZERLAND OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 181 SWITZERLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 183 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 184 SWITZERLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 185 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 186 NETHERLANDS SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 187 NETHERLANDS LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 188 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 189 NETHERLANDS STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 190 NETHERLANDS STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 191 NETHERLANDS PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 192 NETHERLANDS HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 193 NETHERLANDS SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 194 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 195 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 196 NETHERLANDS SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 197 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 198 NETHERLANDS AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 199 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 200 NETHERLANDS OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 201 NETHERLANDS COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 202 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 203 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 204 NETHERLANDS MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 205 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 206 RUSSIA SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 207 RUSSIA LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 208 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 209 RUSSIA STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 210 RUSSIA STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 211 RUSSIA PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 212 RUSSIA HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 213 RUSSIA SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 214 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 215 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 216 RUSSIA SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 218 RUSSIA AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 219 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 220 RUSSIA OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 221 RUSSIA COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 222 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 223 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 224 RUSSIA MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 225 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 226 BELGIUM SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 227 BELGIUM LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 228 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 229 BELGIUM STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 230 BELGIUM STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 231 BELGIUM PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 232 BELGIUM HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 233 BELGIUM SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 234 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 235 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 236 BELGIUM SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 237 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 238 BELGIUM AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 239 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 240 BELGIUM OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 241 BELGIUM COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 242 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 243 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 244 BELGIUM MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 245 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 246 FINLAND SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 247 FINLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 248 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 249 FINLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 250 FINLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 251 FINLAND PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 252 FINLAND HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 253 FINLAND SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 254 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 255 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 256 FINLAND SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 257 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 258 FINLAND AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 259 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 260 FINLAND OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 261 FINLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 262 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 263 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 264 FINLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 265 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 266 DENMARK SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 267 DENMARK LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 268 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 269 DENMARK STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 270 DENMARK STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 271 DENMARK PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 272 DENMARK HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 273 DENMARK SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 274 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 275 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 276 DENMARK SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 277 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 278 DENMARK AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 279 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 280 DENMARK OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 281 DENMARK COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 282 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 283 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 284 DENMARK MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 285 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 286 POLAND SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 287 POLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 288 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 289 POLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 290 POLAND STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 291 POLAND PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 292 POLAND HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 293 POLAND SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 294 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 295 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 296 POLAND SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 297 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 298 POLAND AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 299 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 300 POLAND OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 301 POLAND COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 302 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 303 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 304 POLAND MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 305 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 306 NORWAY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 307 NORWAY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 308 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 309 NORWAY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 310 NORWAY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 311 NORWAY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 312 NORWAY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 313 NORWAY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 314 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 315 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 316 NORWAY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 317 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 318 NORWAY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 319 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 320 NORWAY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 321 NORWAY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 322 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 323 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 324 NORWAY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 325 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 326 HUNGARY SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 327 HUNGARY LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 328 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 329 HUNGARY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 330 HUNGARY STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 331 HUNGARY PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 332 HUNGARY HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 333 HUNGARY SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 334 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 335 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 336 HUNGARY SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 337 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 338 HUNGARY AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 339 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 340 HUNGARY OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 341 HUNGARY COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 342 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 343 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 344 HUNGARY MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 345 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

TABLE 346 SWEDEN SERVICES IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 347 SWEDEN LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 348 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 349 SWEDEN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 350 SWEDEN STORAGE AND WAREHOUSING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 351 SWEDEN PACKAGING IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DEVICE TYPE, 2022-2031 (USD THOUSAND)

TABLE 352 SWEDEN HARDWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 353 SWEDEN SOFTWARE IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 354 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE, 2022-2031 (USD THOUSAND)

TABLE 355 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY MODE OF TRANSPORTATION, 2022-2031 (USD THOUSAND)

TABLE 356 SWEDEN SEA FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 357 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 358 SWEDEN AIR FREIGHT LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 359 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 360 SWEDEN OVERLAND LOGISTICS IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY LOGISTIC TYPE, 2022-2031 (USD THOUSAND)

TABLE 361 SWEDEN COLD CHAIN IN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY TEMPERATURE TYPE, 2022-2031 (USD THOUSAND)

TABLE 362 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 363 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY END USE, 2022-2031 (USD THOUSAND)

TABLE 364 SWEDEN MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 365 REST OF EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS, 2022-2031 (USD THOUSAND)

Lista de Figura

FIGURE 1 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET

FIGURE 2 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: SEGMENTATION

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 THREE SEGMENTS COMPRISE THE EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET, BY OFFERINGS

FIGURE 14 EXECUTIVE SUMMARY

FIGURE 15 RISING DEMAND FOR MEDICAL DEVICES IS EXPECTED TO DRIVE THE EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET IN THE FORECAST PERIOD

FIGURE 16 THE SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET IN 2024 AND 2031

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET

FIGURE 20 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY OFFERINGS, 2023

FIGURE 21 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY OFFERINGS, 2024-2031

FIGURE 22 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY OFFERINGS, CAGR (2024-2031)

FIGURE 23 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY OFFERINGS, LIFELINE CURVE

FIGURE 24 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY MODE OF TRANSPORTATION, 2023

FIGURE 25 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY MODE OF TRANSPORTATION, 2024-2031

FIGURE 26 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY MODE OF TRANSPORTATION, CAGR (2024-2031)

FIGURE 27 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY MODE OF TRANSPORTATION, LIFELINE CURVE

FIGURE 28 EUROPE MEDICAL DEVICE WAREHOUSE AND LOGISTICS MARKET: BY TEMPERATURE, 2023