Global Medical Devices Market

Market Size in USD Billion

CAGR :

%

USD

12.56 Billion

USD

18.98 Billion

2024

2032

USD

12.56 Billion

USD

18.98 Billion

2024

2032

| 2025 –2032 | |

| USD 12.56 Billion | |

| USD 18.98 Billion | |

|

|

|

|

Medical Devices Market Size

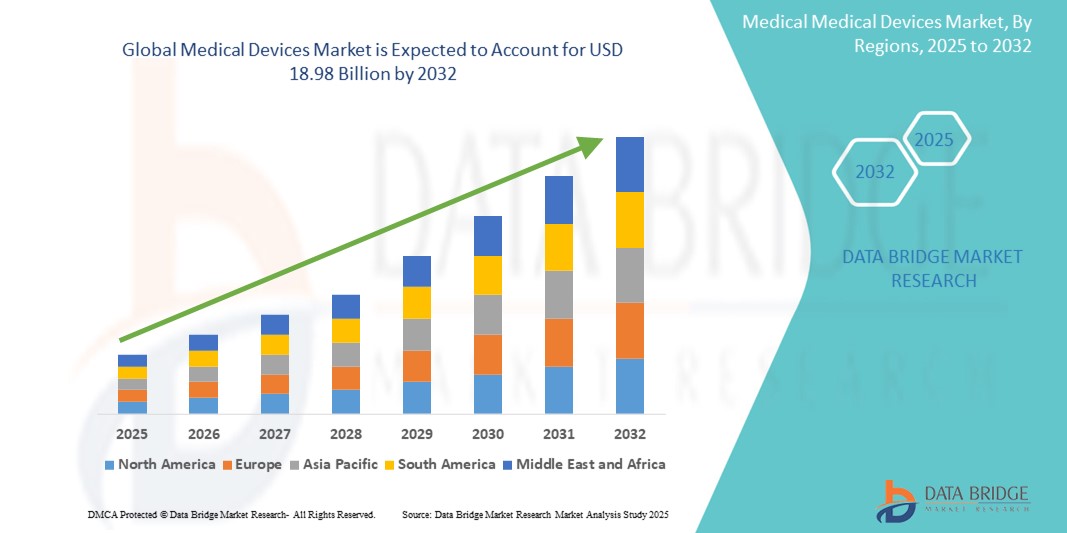

- The global medical devices market size was valued at USD 12.56 billion in 2024 and is expected to reach USD 18.98 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases, rising geriatric population, and technological advancements in diagnostic and therapeutic devices, which are driving widespread adoption across global healthcare systems

- Furthermore, the growing demand for minimally invasive procedures, integration of AI and robotics in medical technologies, and expansion of home healthcare solutions are establishing medical devices as essential tools in modern healthcare delivery. These converging factors are accelerating the uptake of innovative medical devices, thereby significantly boosting the industry's growth

Medical Devices Market Analysis

- Medical devices, encompassing diagnostic, therapeutic, and monitoring instruments, are increasingly vital components of modern healthcare systems in both hospital and homecare settings due to their enhanced precision, remote monitoring capabilities, and seamless integration with digital health ecosystems

- The escalating demand for medical devices is primarily fueled by the growing prevalence of chronic diseases, aging populations, increased healthcare expenditure, and a rising preference for minimally invasive procedures and home-based care solutions

- North America dominated the medical devices market with the largest revenue share of 40.05% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and a strong presence of key industry players. The U.S. has experienced substantial growth in medical device installations, particularly in remote monitoring and robotic-assisted surgery, driven by innovations from both established med-tech companies and digital health startups

- Asia-Pacific is expected to be the fastest growing region in the medical devices market during the forecast period due to increasing urbanization, expanding healthcare infrastructure, and rising disposable incomes across countries such as China and India

- The ventilator segment dominated the medical devices market with a market share of 29.6% in 2024, driven by increased demand in critical care settings, particularly in response to respiratory illness outbreaks and the growing geriatric population requiring advanced respiratory support

Report Scope and Medical Devices Market Segmentation

|

Attributes |

Medical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Devices Market Trends

“Growing Adoption of Connected and User-Centric Healthcare Solutions”

- A significant and accelerating trend in the global medical devices market is the increasing integration of smart technologies and connectivity features that enhance both user experience and operational efficiency across healthcare settings. These advancements are helping providers streamline care delivery while empowering patients to actively manage their health

- For instance, next-generation wearable medical devices now offer real-time monitoring and mobile health tracking, allowing patients to share vital data directly with physicians. Remote diagnostic tools and app-based health monitoring solutions are gaining traction, especially among chronic disease patients and elderly populations

- The integration of medical devices with mobile platforms and cloud systems enables features such as personalized data analytics, remote alerts for abnormal readings, and continuous health tracking. This ensures timely intervention and fosters a proactive approach to care, reducing hospital readmissions and improving outcomes

- The seamless synchronization of connected medical devices with telehealth platforms, electronic health records (EHRs), and mobile applications creates an integrated ecosystem where patients and providers can collaborate in real time. This has become especially vital post-pandemic, where remote care and home-based medical solutions are becoming the norm

- This shift toward more user-friendly, interoperable, and data-driven medical devices is reshaping patient expectations and setting new standards for convenience and care personalization. Consequently, leading companies such as Medtronic, Philips, and GE Healthcare are focusing on developing devices that support remote monitoring, self-management, and interoperability with broader healthcare IT systems

- The demand for connected, intelligent, and user-centric medical devices is rapidly growing across both hospital and homecare environments, as patients seek accessible, personalized, and technology-enabled healthcare solutions

Medical Devices Market Dynamics

Driver

“Growing Need Due to Rising Disease Burden and Technological Advancements”

- The increasing prevalence of chronic diseases, aging populations, and rising demand for early and accurate diagnosis are significant drivers fueling the growth of the medical devices market globally

- For instance, in April 2024, Medtronic announced a strategic advancement in its remote monitoring platforms aimed at chronic care management, enabling more precise real-time data capture and patient engagement. Such initiatives by leading companies are expected to drive the medical devices industry's growth during the forecast period

- As patients and providers seek more efficient, less invasive, and cost-effective healthcare solutions, medical devices such as remote monitors, diagnostic wearables, and minimally invasive surgical tools are gaining widespread traction, offering compelling alternatives to conventional methods

- Furthermore, the growing adoption of connected healthcare systems and digital health platforms is making medical devices an integral component of modern healthcare infrastructure. These devices offer seamless integration with electronic health records (EHRs), cloud storage, and telemedicine platforms

- The convenience of real-time health tracking, remote consultations, and early detection capabilities are key factors driving adoption in both hospital and homecare settings. The trend toward personalized medicine, along with the increasing availability of user-friendly, portable, and connected medical devices, is further propelling market growth

Restraint/Challenge

“Concerns Regarding Data Security and High Initial Costs”

- Concerns surrounding the data privacy and cybersecurity vulnerabilities of connected medical devices pose a significant challenge to broader market penetration. As these devices often transmit sensitive patient data via networks, they are susceptible to hacking and unauthorized access, raising concerns about confidentiality and compliance

- For instance, several regulatory agencies, including the FDA and EMA, have issued guidelines addressing cybersecurity risks in medical devices, reflecting the growing urgency of securing healthcare IoT infrastructure

- Addressing these security challenges through end-to-end encryption, secure software architecture, routine firmware updates, and compliance with international data protection standards is critical to building trust among healthcare providers and patients

- In addition, the relatively high initial cost of advanced medical devices—especially those involving robotics, imaging, or real-time monitoring capabilities—can limit adoption, particularly in cost-sensitive or resource-constrained healthcare settings. While economies of scale and increased competition are driving prices down, affordability remains a barrier in certain regions

- Overcoming these challenges through regulatory alignment, greater investment in cybersecurity innovation, provider and patient education, and the development of low-cost medical device alternatives will be essential for sustained market growth across global regions

Medical Devices Market Scope

The market is segmented on the basis of product, mode, application, facility, end user, and distribution channel.

• By Product

On the basis of product, the medical devices market is segmented into ventilators, spirometers, oxygen concentrators, anesthesia machines, and CPAP/BIPAP. The ventilator segment held the largest market revenue share of 29.6% in 2024, driven by increased demand in critical care, especially in response to respiratory illness outbreaks and the growing geriatric population.

The CPAP/BIPAP segment is anticipated to witness the fastest CAGR of 8.9% from 2025 to 2032, owing to the rising incidence of sleep apnea, increased awareness, and the growing preference for home-based respiratory therapies.

• By Mode

On the basis of mode, the market is segmented into portable, tabletop, and standalone devices. The portable segment dominated the market with a revenue share of 41.2% in 2024, as healthcare shifts toward homecare and remote patient monitoring. Portability enhances patient compliance and supports long-term therapy outside clinical settings.

The tabletop segment is expected to register the fastest growth rate of 9.3% over the forecast period due to its versatility and growing adoption in small clinics and diagnostic labs.

• By Application

Based on application, the medical devices market is segmented into diagnostic and therapeutic. The diagnostic segment captured the largest revenue share of 54.1% in 2024, driven by rising disease burden and the increasing emphasis on early and accurate diagnosis.

The therapeutic segment is projected to witness the fastest CAGR of 10.1% from 2025 to 2032, fueled by technological advances in treatment devices and growing demand for non-invasive therapeutic solutions.

• By Facility

On the basis of facility, the market is categorized into large, small, and medium facilities. The large facility segment accounted for the highest share of 48.7% in 2024, supported by greater budget allocations, high patient footfall, and investment in advanced equipment.

The small and medium facility segments is expected to witness the fastest CAGR from 2025 to 2032, due to the decentralization of healthcare services and rising investments in diagnostic capabilities in tier-2 and tier-3 regions.

• By End User

On the basis of end user, the medical devices market is segmented into hospitals, ambulatory surgical centres, specialty clinics, long-term care centers, rehabilitation centers, and homecare settings. The hospital segment held the largest share of 37.4% in 2024, driven by high patient intake, surgical procedures, and comprehensive diagnostic capabilities.

The homecare settings segment is projected to grow at the fastest CAGR of 11.6% during 2025–2032, supported by the rising trend of home healthcare and demand for portable, user-friendly devices for chronic disease management.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales and third-party distributors. The direct sales segment dominated with a share of 63.9% in 2024, as major manufacturers increasingly engage in direct selling to healthcare providers and institutions to build long-term relationships and ensure service support.

The third-party distributor segment is expected to witness the fastest CAGR from 2025 to 2032, due to its reach in rural and underpenetrated markets, helping expand access to medical devices globally.

Medical Devices Market Regional Analysis

- North America dominated the medical devices market with the largest revenue share of 40.05% in 2024, driven by strong healthcare infrastructure, high healthcare spending, and the rapid adoption of advanced medical technologies

- The region benefits from the presence of major industry players, growing prevalence of chronic diseases, and favorable reimbursement policies

- Increased investment in digital health, homecare solutions, and remote patient monitoring systems further supports market growth. The push for personalized and preventive care also contributes to strong demand for diagnostic and therapeutic medical devices across the region

U.S. Medical Devices Market Insight

The U.S. medical devices market captured the largest revenue share of 81% in 2024 within North America, fueled by high adoption of innovative technologies, widespread insurance coverage, and a robust regulatory environment that encourages research and development. The rising burden of diseases such as diabetes, cardiovascular conditions, and respiratory disorders has led to the widespread use of monitoring, imaging, and therapeutic devices. Furthermore, the U.S. is a key hub for clinical trials and FDA approvals, which accelerates the availability of next-gen devices in the domestic market.

Europe Medical Devices Market Insight

The Europe medical devices market is projected to grow at a CAGR of 7.2% during the forecast period, supported by aging demographics, government initiatives to digitize healthcare, and stringent medical device regulations driving quality and innovation. High public healthcare expenditure, especially in countries such as Germany, France, and the U.K., enhances access to advanced medical technologies. There is also a rising trend in the adoption of wearable devices and home-based diagnostics, particularly for chronic care and elderly populations.

U.K. Medical Devices Market Insight

The U.K. medical devices market is anticipated to grow at a CAGR of 7.8% during 2025–2032, driven by strong focus on health tech, public-private partnerships, and NHS initiatives to modernize healthcare infrastructure. Increasing health awareness and early diagnosis efforts are fostering demand for imaging, diagnostic, and monitoring tools. The U.K.'s growing med-tech innovation ecosystem and access to AI-integrated solutions are further accelerating market development.

Germany Medical Devices Market Insight

The Germany medical devices market is expected to expand at a CAGR of 7.5% during the forecast period, driven by a well-established healthcare system and a high degree of trust in advanced, precise, and efficient medical technologies. The country leads in the adoption of surgical equipment, respiratory devices, and hospital-based diagnostic tools. A strong manufacturing base and support for healthcare digitization further enhance the market’s position in Europe.

Asia-Pacific Medical Devices Market Insight

The Asia-Pacific medical devices market is projected to grow at the fastest CAGR of 9.6% from 2025 to 2032, fueled by rapid urbanization, expanding middle-class population, and rising healthcare investments across China, India, and Japan. Increasing incidence of lifestyle-related diseases, improving healthcare infrastructure, and supportive government programs (such as India's Ayushman Bharat and China’s Healthy China 2030) are key growth drivers. The region is also becoming a key manufacturing and R&D hub for medical devices, offering cost-effective solutions to both domestic and global markets.

Japan Medical Devices Market Insight

The Japan medical devices market continues to grow steadily, supported by the country’s aging population and its leadership in robotic surgery, diagnostic imaging, and minimally invasive technologies. Increased focus on elderly care and at-home monitoring solutions is driving demand for compact, smart, and user-friendly devices. Regulatory support for innovation and integration of AI and IoT into healthcare is further accelerating the development and adoption of advanced medical technologies.

China Medical Devices Market Insight

The China medical devices market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by its rapidly developing healthcare sector and government efforts to strengthen domestic production and innovation. The country is witnessing substantial growth in areas such as diagnostic imaging, respiratory care, and home-use medical devices due to rising chronic disease prevalence and improved healthcare accessibility. China’s "Made in China 2025" policy has further accelerated the localization of high-end medical device manufacturing, positioning the country as a major global supplier.

Medical Devices Market Share

The medical devices industry is primarily led by well-established companies, including:

- GE Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Medtronic (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- VYAIRE (U.S.)

- Getinge AB (Sweden)

- ndd Medical Technologies (Switzerland)

- ResMed (U.S.)

- Invacare Corporation (U.S.)

- NIDEK MEDICAL PRODUCTS, INC. (Japan)

- O2 CONCEPTS, LLC (U.S.)

- Teijin Limited (Japan)

- GCE Group (U.K.)

- Inogen, Inc. (U.S.)

- Teleflex Incorporated (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- MGC Diagnostics Corporation (U.S.)

- Hill-Rom Holdings, Inc. (U.S.)

- Drive DeVilbiss Healthcare Inc. (U.S.)

- Midmark Corporation (U.S.)

- CAIRE Inc. (U.S.)

- GCE Group (U.K.)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Schiller (Switzerland)

Latest Developments in Global Medical Devices Market

- In March 2025, CMR Surgical, a U.K.-based global surgical robotics innovator, received FDA clearance for its Versius Surgical System, designed for minimal-access gallbladder procedures. This milestone marks CMR’s official entry into the U.S. market, reinforcing its position as a major player in robotic-assisted surgery. By leveraging compact design and modular usability, CMR Surgical is addressing the growing demand for scalable and efficient surgical solutions in the global medical devices market

- In March 2025, Zydus Lifesciences, a leading pharmaceutical and healthcare company based in India, announced the acquisition of an 85.6% stake in France-based Amplitude Surgical for €256.8 million. This strategic move expands Zydus’s footprint into the global orthopedic surgical devices segment, demonstrating its commitment to innovation and international market expansion in the medical devices industry

- In April 2025, the UK Medicines and Healthcare products Regulatory Agency (MHRA) launched its second AI regulatory sandbox pilot, inviting companies with AI-powered medical technologies—especially those in respiratory care and cancer diagnostics—to participate. This initiative emphasizes the growing significance of artificial intelligence in advancing medical device capabilities and ensuring regulatory readiness for next-generation healthcare solutions

- In June 2025, the European Union introduced new restrictions on Chinese medical device manufacturers, limiting their access to public procurement contracts exceeding €5 million unless they meet specific local production criteria. This policy shift is aimed at ensuring reciprocal access and enhancing the competitiveness of European manufacturers, with implications for global market dynamics and supply chains in the medical devices sector

- In February 2025, Bruker Corporation, a key player in life science instrumentation, unveiled plans for the commercial launch of the CosMx Human Whole Transcriptome Panel, integrating spatial multiomics with high-resolution tissue imaging. This development underlines the company's focus on precision diagnostics and personalized medicine, boosting its standing in the global medical devices landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.