Middle East And Africa Japanese Restaurant Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

937.75 Million

USD

1,180.30 Million

2024

2032

USD

937.75 Million

USD

1,180.30 Million

2024

2032

| 2025 –2032 | |

| USD 937.75 Million | |

| USD 1,180.30 Million | |

|

|

|

Middle East and Africa Japanese Restaurant Market Segmentation, By Cuisine Type(Traditional Japanese Cuisine, Specialty Japanese Cuisine, and Modern Japanese Cuisine), Service Type (Quick Service Restaurants (QSR), Full Service Restaurants, and Take-Out Counters/Outlets), Restaurant Category (Standalone Restaurants and Chain/Franchise Model), Restaurant Model (Takeaway, Home Delivery, and Dine-In), Sales Channel (Physical Outlets and Delivery Online Restaurants/Ghost Kitchen) - Industry Trends and Forecast to 2031

Middle East and Africa Japanese Restaurant Market Analysis

Increasing awareness of health benefits related to Japanese food is driving the market growth. Innovation in menu offerings provides opportunities in the market. Moreover, increase in popularity of the dish sushi is driving market growth.

Middle East and Africa Japanese Restaurant Market Size

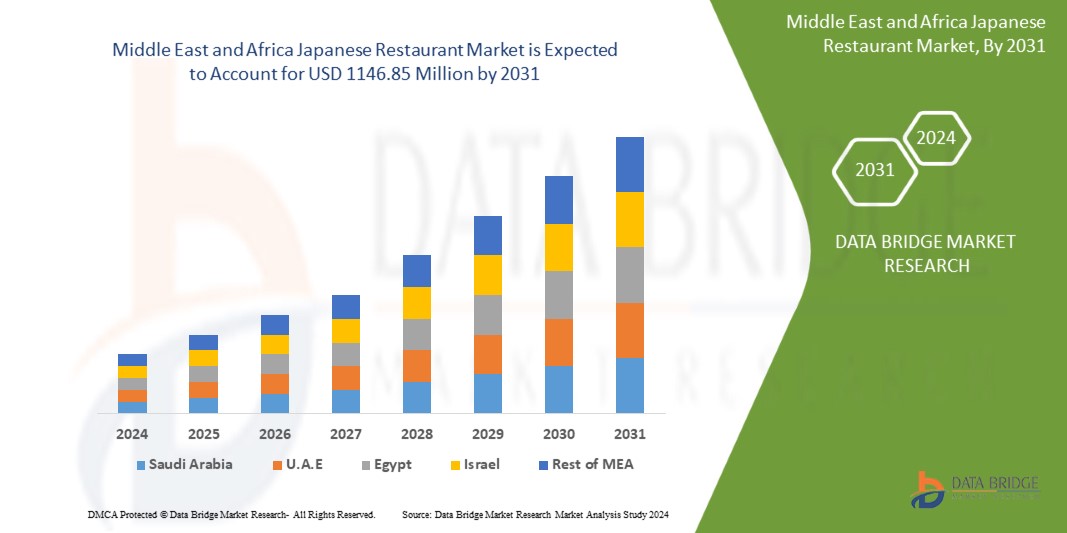

The Middle East and Africa market is expected to reach USD 1146.85 million by 2031 from USD 915.08 million in 2023, growing with a substantial CAGR of 2.92% in the forecast period of 2024 to 2031.

Middle East and Africa Market Trends

“Increasing Awareness of Health Benefits Related to Japanese Food Drives the Middle East and Africa Japanese Restaurant Market”

The Middle East and Africa Japanese restaurant market is experiencing significant growth, driven by the increasing awareness of the health benefits associated with Japanese cuisine. Japanese cuisine, renowned for its emphasis on fresh, high-quality ingredients and balanced nutrition, aligns well with the growing Middle East and Africa focus on health and wellness. Traditional dishes such as sushi, sashimi, and miso soup are not only flavorful but also low in fat and high in essential nutrients. Sushi, for example, features lean proteins like fish and nutrient-rich vegetables, while miso soup provides probiotics beneficial for digestive health. The health benefits of these foods are becoming more widely recognized, leading to a surge in consumer interest. The growing awareness of Japanese cuisine's health benefits also contributes to its appeal in diverse markets. Consumers in various regions are exploring Japanese food not only for its taste but also for its positive impact on overall health. This shift is particularly evident in regions where there is a rising trend of health-oriented eating habits, such as North America and Europe. Japanese restaurants in these areas are seeing increased patronage as they cater to the demand for healthier dining options.

As more people become health-conscious, they are increasingly seeking out dining options that align with their wellness goals. Japanese restaurants are capitalizing on this trend by highlighting the nutritional advantages of their menus. Many establishments like Sushi Gen Enterprises, Sushi Nozawa Group RE&S and others now emphasize their use of fresh, natural ingredients and traditional cooking methods that retain the maximum nutritional value of the food. This focus on health is not just limited to traditional dishes but extends to modern interpretations and fusion cuisines that integrate Japanese principles with other healthy culinary traditions.

Report Scope and Market Segmentation

|

Attributes |

Middle East and Africa Key Market Insights |

|

Segmentation |

By Cuisine Type: Traditional Japanese Cuisine, Specialty Japanese Cuisine, and Modern Japanese Cuisine By Service Type: Quick Service Restaurants (QSR), Full Service Restaurants, and Take-Out Counters/Outlets By Restaurant Category: Standalone Restaurants and Chain/Franchise Model By Restaurant Model: Takeaway, Home Delivery, and Dine-In By Sales Channel: Physical Outlets and Delivery Online Restaurants/Ghost Kitchen |

|

Countries Covered |

U.A.E., Saudi Arabia, South Africa, Israel, Kuwait, and rest of Middle East and Africa |

|

Key Market Players |

Katsu-Ya Group, Inc (U.S.), Wokcano Asian Restaurant & Bar.(U.S.), 893 Ryōtei Berlin (Germany), Chiba Japanese Restaurant (U.S.), Tsujita Artisan Noodle (Japan), Sushi Den (U.S.), Florilège (Japan), Kaiten Zushi (U.S.), Kura Sushi USA (U.S.), Narisawa (Japan), RE&S (Singapore), Sazenka (Japan), Sushi A Go (U.S.), Sushi Gen Enterprises (U.S.), Sushi Nozawa Group (U.S.), Sushiya (India), Takami Sushi & Robata Restaurant (U.S.), Tatsu Ramen LLC (U.S.), Yamashiro Hollywood (U.S.), among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Market Definition

A Japanese restaurant is an establishment that specializes in serving traditional Japanese cuisine, characterized by its emphasis on fresh, high-quality ingredients and meticulous preparation techniques. The menu typically features a variety of dishes, including sushi, sashimi, tempura, ramen, and other items that reflect Japan's diverse culinary heritage. Japanese restaurants often prioritize authenticity, incorporating traditional cooking methods and presentation styles, such as sushi rolls and bento boxes, to deliver a genuine dining experience. The ambiance of these restaurants often reflects Japanese aesthetics, with a focus on simplicity, elegance, and attention to detail. Service in Japanese restaurants is generally attentive and respectful, aiming to enhance the overall dining experience. In recent years, many Japanese restaurants have also embraced modern innovations, such as online ordering and sustainable practices, to meet the evolving preferences of Middle East and Africa consumers.

Middle East and Africa Market Dynamics

Drivers

- The Increase in Popularity of the Dish Sushi

The rising popularity of sushi is a significant factors for the Middle East and Africa Japanese restaurant market, influencing consumer preferences and expanding market reach. Sushi, a staple of Japanese cuisine, has experienced a surge in Middle East and Africa popularity due to its alignment with health trends, versatility, and integration into mainstream food culture. One of the primary factors driving this trend is sushi’s reputation as a healthy and convenient food option. With its emphasis on fresh fish, vegetables, and rice, sushi is often perceived as a nutritious choice. The growing awareness of health and wellness has led many consumers to seek out healthier alternatives to traditional fast food. Sushi’s low-calorie, high-protein, and omega-3-rich profile aligns well with these dietary preferences, making it an attractive option for health-conscious diners. As a result, sushi has become an essential in many diets around the world, driving increased demand for Japanese restaurants. Along with it the rise of sushi's popularity is also supported by its versatility and adaptability. Sushi can be customized to suit various tastes and dietary needs, including vegetarian and gluten-free options. This flexibility allows sushi to cater to a wide range of consumer preferences, further enhancing its appeal. The introduction of innovative sushi rolls and fusion creations has also helped to attract a diverse audience, from traditionalists to those seeking novel culinary experiences. This adaptability has facilitated the expansion of sushi offerings in both traditional Japanese restaurants and new, contemporary dining establishments. In addition the mainstream acceptance of sushi has also played a crucial role in its market influence. Sushi has become a common fixture in cities around the world, from New York and London to Sydney and Tokyo. Its presence in popular media, including television shows, social media, and food blogs, has elevated sushi to a prominent position in Middle East and Africa food culture. This increased visibility has led to a broader acceptance of sushi as a mainstream dining option, attracting customers who may not have previously considered Japanese cuisine.

For Instance,

- In 2024, according to World Metrics, the Middle East and Africa sushi market has experienced substantial growth, with the industry valued at over USD 27 billion. This surge highlights the increasing popularity of sushi, driving a significant rise in the number of Japanese restaurants and contributing to the expansion of Japanese dining experiences worldwide

The Recognition of Japanese Cuisine as a UNESCO Intangible Cultural Heritage

The designation of Japanese cuisine as a UNESCO intangible cultural heritage highlights its traditional practices, unique preparation methods, and cultural significance. This acknowledgment not only elevates the profile of Japanese food but also generates heightened Middle East and Africa interest. Consumers are increasingly drawn to Japanese cuisine due to its rich history, authenticity, and the craftsmanship associated with its preparation. As a result, there is a growing demand for authentic Japanese dining experiences, which directly benefits Japanese restaurants worldwide.

The UNESCO recognition also enhances the Middle East and Africa appeal of Japanese cuisine by positioning it as a symbol of cultural sophistication and culinary excellence. This status attracts food enthusiasts and cultural tourists who seek to experience the authentic flavors and traditional techniques that are now internationally celebrated. Japanese restaurants, therefore, benefit from increased foot traffic and consumer interest driven by this prestigious endorsement. Furthermore, the Middle East and Africa focus on preserving intangible cultural heritage aligns with broader trends in cultural tourism and experiential dining. As travelers become more interested in immersing themselves in local traditions and cultural practices, Japanese cuisine’s UNESCO status makes it a compelling choice. Restaurants that offer traditional Japanese dishes and emphasize their heritage connection are likely to attract both international tourists and local consumers who are eager to engage with culturally significant culinary experiences.

For instance,

- In February 2024, according to an article published by the Star Advertiser, the Middle East and Africa interest in Japan’s traditional cuisine, recognized as a UNESCO intangible cultural heritage, continues to rise. The recognition of Japanese cuisine by UNESCO enhances its prestige and appeal, encouraging more diners to explore and appreciate its cultural and historical significance, which in turn fuels the growth and popularity of Japanese dining establishments across the globe

Opportunities

- Innovation in Menu Offerings

Innovation in menu offerings presents a significant opportunity for the Middle East and Africa Japanese restaurant market, possessing growth and capturing new customer segments. As the dining landscape evolves, Japanese restaurants have the chance to differentiate themselves by embracing creative and diverse menu options that appeal to modern consumers. One of the key opportunities lies in the adaptation of traditional Japanese dishes to contemporary tastes and dietary preferences. For example sushi, traditionally consisting of raw fish and rice, has evolved to include a variety of ingredients and styles, such as vegetarian rolls, fusion creations, and even sushi burritos. This innovation allows Japanese restaurants to cater to a broader audience, including those with dietary restrictions or a preference for unique flavor combinations. By offering diverse and inventive menu items, restaurants can attract a wider range of customers and increase their market appeal.

Another opportunity for menu innovation is the integration of Middle East and Africa culinary trends with Japanese cuisine. Japanese restaurants are increasingly incorporating elements from other culinary traditions, resulting in exciting new dishes that blend flavors and techniques. For instance the fusion of Japanese and Mediterranean ingredients can create unique dishes like sushi with hummus or miso-glazed lamb. These cross-cultural innovations not only attract adventurous eaters but also position Japanese restaurants as trendsetters in the Middle East and Africa dining scene.

For instance,

- In 2018, according to the Economic Times, the Japanese restaurant market saw significant innovation with the introduction of sushi doughnuts and sushi burritos. These novel creations, which blend traditional sushi ingredients with new formats, such as a doughnut-shaped sushi or a burrito-style wrap, reflect a growing trend towards inventive menu offerings

Collaboration With local Cultural Events and Festivals

Collaboration with local cultural events and festivals represents a significant opportunity for the Middle East and Africa Japanese restaurant market, fostering growth and expanding market reach. These collaborations allow Japanese restaurants to enhance their visibility, engage with diverse audiences, and strengthen their brand presence in both established and emerging markets.

Participating in cultural events and festivals enables Japanese restaurants to introduce their cuisine to new customer segments. Events such as food festivals, cultural fairs, and community celebrations attract large and varied audiences, providing a platform for restaurants to showcase their offerings. For instance, a Japanese restaurant setting up a booth at a multicultural food festival can reach attendees who may be unfamiliar with Japanese cuisine. By offering sample dishes or special event menus, restaurants can attract potential customers, generate interest, and encourage them to visit the restaurant for a full dining experience. These collaborations help Japanese restaurants build brand recognition and establish a positive reputation within the community. When restaurants align themselves with popular local events, they benefit from the event's promotional efforts, including marketing materials, social media mentions, and local media coverage. This association can boost the restaurant's visibility and credibility, leading to increased interest and foot traffic. For instance, a Japanese restaurant partnering with a prominent local cultural festival may be featured in event advertisements and receive mentions in local news outlets, boosting its profile among potential diners.

Restraints/Challenges

- High Cost of Ingredients for Japanese Cuisine

Japanese cuisine, known for its emphasis on fresh and high-quality ingredients, often relies on specialized items such as premium-grade sushi-grade fish, rare vegetables, and imported condiments. Such as, ingredients like bluefin tuna, used in high-end sushi, and seasonal items such as Matsutake mushrooms, are not only expensive but also subject to fluctuations in availability and price. The high cost of these ingredients impacts the overall cost structure of Japanese restaurants, leading to increased menu prices and potentially reduced consumer demand. The high costs of ingredients can particularly strain smaller or independent Japanese restaurants. These establishments may struggle to absorb the cost increases without significantly raising menu prices, which could discourage budget-conscious customers. Additionally, the volatility in ingredient prices can lead to inconsistent menu pricing and availability. For instance, fluctuations in the Middle East and Africa market for seafood due to overfishing, environmental changes, or supply chain disruptions can cause sudden increases in costs.

The impact of high ingredient costs extends beyond the restaurant level to affect consumer perceptions and behavior. When menu prices rise due to increased ingredient costs, consumers may perceive the restaurant as less affordable or value-for-money. This perception can lead to decreased support and lower overall sales. Moreover, the high cost of authentic Japanese ingredients can limit the ability of restaurants to offer a diverse menu, potentially reducing their appeal to a broader audience.

- Intensa competição da cozinha italiana e chinesa

O mercado de restaurantes japoneses do Médio Oriente e de África enfrenta desafios significativos devido à intensa concorrência das cozinhas italiana e chinesa. As opções gastronómicas italianas e chinesas estão profundamente enraizadas na cultura gastronómica do Médio Oriente e de África, apresentando-se como formidáveis rivais para os restaurantes japoneses na disputa pela atenção do consumidor e pela quota de mercado. Um dos principais desafios é a saturação das cozinhas italiana e chinesa no mercado gastronómico do Médio Oriente e de África. A cozinha italiana, com a sua grande variedade de pratos como massas, pizzas e risotos, e a cozinha chinesa, conhecida pela sua grande variedade, incluindo dim sum, noodles e salteados, estão amplamente disponíveis e profundamente enraizadas em muitos países. Esta ampla disponibilidade cria um elevado nível de concorrência para os restaurantes japoneses, que se devem diferenciar

para captar o interesse do consumidor. A prevalência destas cozinhas significa que os restaurantes japoneses enfrentam a dificuldade de se destacarem num mercado lotado, onde dominam as opções familiares e populares.

A par disto, o custo de entrada e os desafios operacionais associados à manutenção de um restaurante japonês podem ser desafios significativos. Os restaurantes italianos e chineses beneficiam geralmente de economias de escala devido à sua maior presença e às cadeias de abastecimento estabelecidas. Por outro lado, os restaurantes japoneses podem enfrentar custos mais elevados para obter ingredientes autênticos e equipamento especializado, o que pode afetar os seus preços e rentabilidade. Por exemplo, o peixe de alta qualidade para sushi e os molhos de soja premium são caros e requerem um manuseamento cuidadoso, o que pode aumentar os custos operacionais. Esta disparidade na eficiência operacional pode dificultar a vida dos japoneses

restaurantes para competir em preço, especialmente em mercados onde o custo é uma consideração fundamental para os consumidores.

Impacto e cenário atual do mercado de escassez de matéria-prima e atrasos no envio

A Data Bridge Market Research oferece uma análise de alto nível do mercado e fornece informações tendo em conta o impacto e o ambiente atual do mercado de escassez de matérias-primas e atrasos nas remessas. Isto traduz-se em avaliar possibilidades estratégicas, criar planos de ação eficazes e auxiliar as empresas na tomada de decisões importantes.

Além do relatório padrão, também oferecemos uma análise aprofundada do nível de aquisição, desde atrasos previstos de expedição, mapeamento de distribuidores por região, análise de commodities, análise de produção, tendências de mapeamento de preços, sourcing, análise de desempenho de categoria, soluções avançadas de gestão de risco da cadeia de abastecimento.

Impacto esperado da desaceleração económica nos preços e na disponibilidade dos produtos

Quando a atividade económica abranda, as indústrias começam a sofrer. Os efeitos previstos da crise económica nos preços e na acessibilidade dos produtos são tidos em conta nos relatórios de informação de mercado e nos serviços de informações fornecidos pelo DBMR. Com isto, os nossos clientes conseguem geralmente manter-se um passo à frente dos seus concorrentes, projetar as suas vendas e receitas e estimar as suas despesas com lucros e perdas.

Âmbito do mercado de restaurantes japoneses no Médio Oriente e África

O mercado está segmentado em cinco segmentos notáveis com base no tipo de cozinha, tipo de serviço, categoria de restaurante, modelo de restaurante e canal de vendas. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Cozinha tradicional japonesa

- Cozinha tradicional japonesa, por tipo de cozinha

- Sushi

- Sushi, por tipo

- Correia transportadora

- Sem Transportador

- Sushi, por cadeia

- Restaurantes locais

- Cadeia Internacional

- Sushi, Por Estabelecimento

- Serviço rápido

- Restaurantes com serviço completo

- Balcões/pontos de venda para levar

- Sushi, por tipo

- Ramen

- Ramen, por Restaurant Mode

- Levar

- Entrega ao domicílio

- Jantar no local

- Ramen, por estabelecimento

- Serviço rápido

- Restaurantes com serviço completo

- Balcões/pontos de venda para levar

- Ramen, por Restaurant Mode

- Tempura

- Tempura, Por Modo Restaurante

- Levar

- Entrega ao domicílio

- Jantar no local

- Tempura, por estabelecimento

- Serviço rápido

- Restaurantes com serviço completo

- Balcões/pontos de venda para levar

- Tempura, Por Modo Restaurante

- Sashimis

- Sashimi, por Modo Restaurante

- Levar

- Entrega ao domicílio

- Jantar no local

- Sashimi, por estabelecimento

- Serviço rápido

- Restaurantes com serviço completo

- Balcões/pontos de venda para levar

- Sashimi, por Modo Restaurante

- Kaiseki

- Kaiseki, por Modo Restaurante

- Levar

- Entrega ao domicílio

- Jantar no local

- Kaiseki, por estabelecimento

- Serviço rápido

- Restaurantes com serviço completo

- Balcões/pontos de venda para levar

- Kaiseki, por Modo Restaurante

- Udon/Soba

- Udon/Soba, por Restaurant Mode

- Levar

- Entrega ao domicílio

- Jantar no local

- Udon/Soba, por estabelecimento

- Serviço rápido

- Restaurantes com serviço completo

- Balcões/pontos de venda para levar

- Udon/Soba, por Restaurant Mode

- Outros

- Outros, Por Modo Restaurante

- Levar

- Entrega ao domicílio

- Jantar no local

- Outros, por estabelecimento

- Serviço rápido

- Restaurantes com serviço completo

- Balcões/pontos de venda para levar

- Outros, Por Modo Restaurante

- Sushi

Especialidade culinária japonesa

- Especialidade da cozinha japonesa, por tipo

- Yakitori

- Teppanyaki

- Outros

- Especialidade culinária japonesa, por modo de restaurante

- Levar

- Entrega ao domicílio

- Jantar no local

- Especialidade culinária japonesa, por modo de restaurante

- Serviço rápido

- Restaurantes com serviço completo

- Balcões/pontos de venda para levar

- Cozinha Japonesa Moderna

- Cozinha japonesa moderna, por tipo

- Fusão japonesa

- Pratos japoneses contemporâneos

- Cozinha japonesa moderna, por tipo

- Cozinha japonesa moderna, por Restaurant Mode

- Levar

- Entrega ao domicílio

- Jantar no local

- Cozinha japonesa moderna, por estabelecimento

- Serviço rápido

- Restaurantes com serviço completo

- Balcões/pontos de venda para levar

Tipo de serviço

- Restaurantes de serviço rápido (QSR)

- Restaurantes com serviço completo

- Balcões/pontos de venda para levar

Categoria Restaurante

- Restaurantes Independentes

- Modelo de rede/franchising

Modelo de restaurante

- Levar

- Entrega ao domicílio

- Jantar no local

Canal de vendas

- Pontos de venda físicos

- Restaurantes Online de Entrega/Ghost Kitchen

Análise regional do mercado do Médio Oriente e África

O mercado está segmentado em cinco segmentos notáveis com base no tipo de cozinha, tipo de serviço, categoria de restaurante, modelo de restaurante e canal de vendas.

Os países abrangidos pelo mercado são os Emirados Árabes Unidos, a Arábia Saudita, a África do Sul, Israel, o Kuwait e o resto do Médio Oriente e África.

Espera-se que os EAU dominem o mercado e sejam o país com o crescimento mais rápido devido à sua infra-estrutura bem estabelecida, tecnologia de processamento avançada e maiores níveis de investimento no sector em comparação com outras regiões, o que deverá impulsionar ainda mais o crescimento do mercado.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Middle East and Africa Market Leaders Operating in the Market Are:

- Katsu-Ya Group, Inc (U.S.)

- Wokcano Asian Restaurant & Bar.(U.S.),

- 893 Ryōtei Berlin (Germany),

- Chiba Japanese Restaurant (U.S.)

- Tsujita Artisan Noodle (Japan)

- Sushi Den (U.S.)

- Florilège (Japan)

- Kaiten Zushi (U.S.)

- Kura Sushi USA (U.S.)

- Narisawa (Japan)

- RE&S (Singapore)

- Sazenka (Japan)

- Sushi A Go (U.S.)

- Sushi Gen Enterprises (U.S.)

- Sushi Nozawa Group (U.S.)

- Sushiya (India)

- Takami Sushi & Robata Restaurant (U.S.)

- Tatsu Ramen LLC (U.S.)

- Yamashiro Hollywood (U.S.)

Latest Developments in Middle East and Africa Japanese Restaurant Market

- In May 2024, Sushi Den has announced the relaunch of its highly anticipated lunch service. In addition, OTOTO, a latest addition to the Sushi Den and Izakaya Den, has launched a delightful Sunday Brunch starting from 11:00 AM to 2:00 PM. The company look forward to sharing this new chapter with their customer’s and enjoying the season’s fresh offerings together

- In May 2024, Kura Sushi USA launched a Dragon Ball Super-themed Bikkura Pon promotion from May 1 to June 30, 2024. The collaboration featured exclusive Dragon Ball Super prizes, including limited-edition acrylic stand keychains and enamel pins. A rare glow-in-the-dark Goku keychain was available in limited quantities. From June 5-9, Rewards Members received a Dragon Ball Super graphic tee with a $70 in-restaurant spend. A Dragon Ball Super Bottle Set with a straw and lanyard was available for $16.00 starting June 1. The Bikkura Pon Prize System rewarded diners with Dragon Ball Super-themed prizes for every 15 plates enjoyed

- In December 2023, Kura Sushi USA, Inc. has introduced ecopon, the world’s first plastic-free, biodegradable paper capsule, for its Bikkura Pon prizes. Developed by K2 Station Co., Ltd., Rengo Co., Ltd., and Daiho Industrial Co., Ltd., ecopon capsules are made from starch and paper pulp, reducing CO2 emissions by a third compared to polypropylene. The new capsules will debut with a Peanuts® Bikkura Pon collaboration from Dec. 1, 2024, to Jan. 31, 2025. This initiative reflects Kura Sushi’s commitment to sustainability, following their transition to paper straws and other eco-friendly practices. For more information, visit kurasushi.com/sustainability

- In October 2023, Kura Sushi USA, Inc. has partnered with Peanuts Worldwide LLC for a special Bikkura Pon promotion running from Dec. 1, 2024, to Jan. 31, 2025. Diners can enjoy exclusive Peanuts-themed prizes, including figurine keychains, can badges, and microfiber cloths featuring characters like Snoopy and Charlie Brown. For every 15 sushi plates, guests will receive a Peanuts x Kura Sushi prize, with a rare Snoopy Figurine Keychain available only through the prize system. Rewards Members spending $70 from Jan. 3-7, 2024, will get a Peanuts-inspired cup set. Kura Sushi is also using ecopon’s biodegradable capsules for this promotion

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 RAW MATERIAL SOURCING

4.1.2 PROCESSING & PACKAGING

4.1.3 LOGISTICS & DISTRIBUTION

4.1.4 RESTAURANT OPERATIONS

4.1.5 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS FOR THE MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET

4.2 VENDOR SELECTION CRITERIA

4.2.1 INGREDIENT QUALITY AND AUTHENTICITY

4.2.2 RELIABILITY AND SUPPLY CHAIN EFFICIENCY

4.2.3 COMPLIANCE WITH FOOD SAFETY AND REGULATORY STANDARDS

4.2.4 COST COMPETITIVENESS AND PRICING STABILITY

4.2.5 SUSTAINABILITY AND ETHICAL SOURCING PRACTICES

4.2.6 TECHNOLOGICAL INTEGRATION AND ORDERING EFFICIENCY

4.3 FACTORS INFLUENCING PURCHASING DECISION OF END USERS IN THE MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET

4.3.1 AUTHENTICITY AND CULTURAL EXPERIENCE

4.3.2 QUALITY AND FRESHNESS OF INGREDIENTS

4.3.3 MENU VARIETY AND DIETARY PREFERENCES

4.3.4 PRICING AND VALUE FOR MONEY

4.3.5 AMBIENCE AND RESTAURANT DESIGN

4.3.6 BRAND REPUTATION AND REVIEWS

4.3.7 CONVENIENCE AND ACCESSIBILITY

4.3.8 CUSTOMER SERVICE AND HOSPITALITY

4.3.9 HEALTH AND SAFETY CONCERNS

4.3.10 CULTURAL TRENDS AND POPULARITY

4.3.11 CONCLUSION

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS IN THE MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET

4.4.1 EXPANSION THROUGH FRANCHISING

4.4.2 MENU INNOVATION AND DIVERSIFICATION

4.4.3 DIGITAL TRANSFORMATION AND ONLINE PRESENCE

4.4.4 STRATEGIC PARTNERSHIPS AND COLLABORATIONS

4.4.5 SUSTAINABLE PRACTICES AND ETHICAL SOURCING

4.4.6 PREMIUMIZATION AND FINE DINING CONCEPTS

4.4.7 GEOGRAPHIC EXPANSION INTO EMERGING MARKETS

4.4.8 LOYALTY PROGRAMS AND CUSTOMER ENGAGEMENT

4.4.9 TECHNOLOGY-DRIVEN EFFICIENCY

4.4.10 HEALTH AND WELLNESS-FOCUSED OFFERINGS

4.4.11 CONCLUSION

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF THE MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET

4.5.1 RISING POPULARITY OF AUTHENTIC AND REGIONAL JAPANESE CUISINE

4.5.2 GROWTH OF FAST-CASUAL AND TAKEAWAY CONCEPTS

4.5.3 INCREASED FOCUS ON SUSTAINABILITY AND ETHICAL SOURCING

4.5.4 DIGITAL TRANSFORMATION AND SMART RESTAURANT TECHNOLOGY

4.5.5 EXPANSION INTO EMERGING MARKETS

4.5.6 HEALTH AND WELLNESS-DRIVEN MENUS

4.5.7 INFLUENCE OF JAPANESE POP CULTURE ON FOOD TRENDS

4.5.8 PERSONALIZATION AND CUSTOMIZATION

4.5.9 ALCOHOL PAIRING AND SAKE CULTURE EXPANSION

4.5.10 FUTURE OUTLOOK: THE EVOLUTION OF THE JAPANESE RESTAURANT MARKET

4.5.11 CONCLUSION

4.6 TECHNOLOGICAL ADVANCEMENT OF THE MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET

4.6.1 AUTOMATION AND ROBOTICS

4.6.2 AI AND SMART ORDERING SYSTEMS

4.6.3 DIGITAL PAYMENT AND CONTACTLESS SOLUTIONS

4.6.4 SMART KITCHENS AND IOT INTEGRATION

4.6.5 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.6.6 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING AWARENESS OF HEALTH BENEFITS

6.1.2 THE INCREASE IN POPULARITY OF THE DISH SUSHI

6.1.3 JAPANESE CUISINE, RECOGNIZED AS A UNESCO INTANGIBLE CULTURAL HERITAGE, INCREASES THE MIDDLE EAST AND AFRICA CONSUMER INTEREST FOR JAPANESE CUISINE

6.2 RESTRAINTS

6.2.1 FOOD CONTAMINATION, RISKING THE SAFETY, AND QUALITY OF THE PRODUCT

6.2.2 HIGH COSTS OF INGREDIENTS FOR JAPANESE CUISINE

6.3 OPPORTUNITIES

6.3.1 INNOVATION IN MENU OFFERINGS

6.3.2 COLLABORATION WITH LOCAL CULTURAL EVENTS AND FESTIVALS

6.4 CHALLENGES

6.4.1 INTENSE COMPETITION FROM ITALIAN AND CHINESE CUISINES

6.4.2 MAINTAINING AUTHENTICITY AND LABOR SHORTAGES

7 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE

7.1 OVERVIEW

7.2 TRADITIONAL JAPANESE CUISINE

7.2.1 SUSHI

7.2.2 RAMEN

7.2.3 TEMPURA

7.2.4 SASHIMI

7.2.5 KAISEKI

7.2.6 UDON/SOBA

7.2.7 OTHERS

7.3 SPECIALTY JAPANESE CUISINE

7.4 MODERN JAPANESE CUISINE

8 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE

8.1 OVERVIEW

8.2 QUICK SERVICE RESTAURANTS (QSR)

8.3 FULL SERVICE RESTAURANTS

8.4 TAKE-OUT COUNTERS/OUTLETS

9 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY

9.1 OVERVIEW

9.2 STANDALONE RESTAURANT

9.3 CHAIN/FRANCHISE MODEL

10 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL

10.1 OVERVIEW

10.2 TAKEAWAY

10.3 HOME DELIVERY

10.4 DINE-IN

11 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 PHYSICAL OUTLETS

11.3 DELIVERY ONLINE RESTAURANTS/GHOST KITCHEN

12 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 U.A.E.

12.1.2 SAUDI ARABIA

12.1.3 SOUTH AFRICA

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 KATSU-YA GROUP, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 WOKCANO ASIAN RESTAURANT & BAR.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 893 RYŌTEI BERLIN

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 CHIBA JAPANESE RESTAURANT

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 TSUJITA ARTISAN NOODLE.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 FLORILÈGE

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 KAITEN ZUSHI

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 KURA SUSHI USA

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 MY CONCIERGE JAPAN

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 NARISAWA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 RE&S

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 BRAND PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 SAZENKA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 SEZZANE

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT NEWS

15.14 SUSHI A GO GO

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SUSHI DEN

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 SUSHI GEN ENTERPRISES

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SUSHI NOZAWA GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SUSHIYA

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 TAKAMI SUSHI & ROBATA RESTAURANT

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TATSU RAMEN LLC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 YAMASHIRO HOLLYWOOD

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA MODERN JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA QUICK SERVICE RESTAURANTS (QSR) IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA FULL SERVICE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA TAKE-OUT COUNTERS/OUTLETS IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA STANDALONE RESTAURANT IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA CHAIN/FRANCHISE MODEL IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA TAKEAWAY IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA HOME DELIVERY IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA DINE-IN IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA PHYSICAL OUTLETS IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA DELIVERY ONLINE RESTAURANTS/GHOST KITCHEN IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 U.A.E JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.A.E TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.A.E SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.A.E SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 76 U.A.E SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 77 U.A.E SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 78 U.A.E RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 79 U.A.E RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 80 U.A.E TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 81 U.A.E TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 82 U.A.E SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 83 U.A.E SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 84 U.A.E KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 85 U.A.E KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 86 U.A.E UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 87 U.A.E UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 88 U.A.E OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 89 U.A.E OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 90 U.A.E SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 U.A.E SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 92 U.A.E SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 93 U.A.E MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 U.A.E MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 95 U.A.E MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 96 U.A.E JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 U.A.E JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 98 U.A.E JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 99 U.A.E JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 100 SAUDI ARABIA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SAUDI ARABIA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SAUDI ARABIA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SAUDI ARABIA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 104 SAUDI ARABIA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 105 SAUDI ARABIA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 106 SAUDI ARABIA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 107 SAUDI ARABIA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 108 SAUDI ARABIA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 109 SAUDI ARABIA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 110 SAUDI ARABIA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 111 SAUDI ARABIA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 112 SAUDI ARABIA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 113 SAUDI ARABIA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 114 SAUDI ARABIA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 115 SAUDI ARABIA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 116 SAUDI ARABIA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 117 SAUDI ARABIA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 118 SAUDI ARABIA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 SAUDI ARABIA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 121 SAUDI ARABIA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 123 SAUDI ARABIA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH AFRICA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SOUTH AFRICA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH AFRICA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 SOUTH AFRICA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH AFRICA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH AFRICA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH AFRICA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH AFRICA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 136 SOUTH AFRICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 137 SOUTH AFRICA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 138 SOUTH AFRICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 139 SOUTH AFRICA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 140 SOUTH AFRICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 141 SOUTH AFRICA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 142 SOUTH AFRICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 143 SOUTH AFRICA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 144 SOUTH AFRICA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 145 SOUTH AFRICA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 146 SOUTH AFRICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SOUTH AFRICA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 148 SOUTH AFRICA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 149 SOUTH AFRICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SOUTH AFRICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 151 SOUTH AFRICA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 152 SOUTH AFRICA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SOUTH AFRICA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 154 SOUTH AFRICA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 155 SOUTH AFRICA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 156 ISRAEL JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 ISRAEL TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 ISRAEL SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 ISRAEL SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 160 ISRAEL SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 161 ISRAEL SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 162 ISRAEL RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 163 ISRAEL RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 164 ISRAEL TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 165 ISRAEL TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 166 ISRAEL SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 167 ISRAEL SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 168 ISRAEL KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 169 ISRAEL KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 170 ISRAEL UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 171 ISRAEL UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 172 ISRAEL OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 173 ISRAEL OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 174 ISRAEL SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 ISRAEL SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 176 ISRAEL SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 177 ISRAEL MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 ISRAEL MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 179 ISRAEL MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 180 ISRAEL JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 ISRAEL JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 182 ISRAEL JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 183 ISRAEL JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 184 EGYPT JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 EGYPT TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 EGYPT SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 EGYPT SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 188 EGYPT SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 189 EGYPT SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 190 EGYPT RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 191 EGYPT RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 192 EGYPT TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 193 EGYPT TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 194 EGYPT SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 195 EGYPT SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 196 EGYPT KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 197 EGYPT KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 198 EGYPT UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 199 EGYPT UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 200 EGYPT OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 201 EGYPT OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 202 EGYPT SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 EGYPT SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 204 EGYPT SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 205 EGYPT MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 EGYPT MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 207 EGYPT MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 208 EGYPT JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 EGYPT JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 210 EGYPT JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 211 EGYPT JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 212 REST OF MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET

FIGURE 2 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: BY CUISINE TYPE, 2024

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INCREASING AWARENESS OF HEALTH BENEFITS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET IN THE FORECAST PERIOD

FIGURE 15 TRADITIONAL JAPANESE CUISINE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET IN 2025 AND 2032

FIGURE 16 SUPPLY CHAIN ANALYSIS- MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET

FIGURE 19 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: BY CUISINE TYPE, 2024

FIGURE 20 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: BY SERVICE TYPE, 2024

FIGURE 21 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: BY RESTAURANT CATEGORY, 2024

FIGURE 22 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: BY RESTAURANT MODEL, 2024

FIGURE 23 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: BY SALES CHANNEL, 2024

FIGURE 24 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: SNAPSHOT, 2024

FIGURE 25 MIDDLE EAST AND AFRICA JAPANESE RESTAURANT MARKET: COMPANY SHARE, 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.