North America Espresso Coffee Market, By Type (Pure Espresso, Double Espresso, Ristretto, Cappuccino, Latte, Mocha Macchiato, Americano, Others), Beans (Coffee Arabica, Coffee Robusta Wild Coffee Beans Brazilian Coffee Beans, Coffee Liberica, Coffee Charrieriana, Coffee Magnistipula, Others), Roast (Light, Medium, Dark, Extra Dark, Others), Distribution Channel (E-Commerce, Super Markets / Hyper Markets, Convenience Stores, Specialty Stores, Others), End-User(Hotels And Restaurants, Offices, Cafes And Bars, Home, Educational Institutes, Hospitals Airports, Others) – Industry Trends and Forecast to 2029

Market Analysis and Size

Espresso coffee has made a significant place in the hot beverage sector around the world. It is being consumed everyday by millions of people in restaurants, office cafeterias, coffee shops and hotels, among others. Manufacturers are working on blending espresso shots with other beverages such as mocha, cappuccino, latte and others.

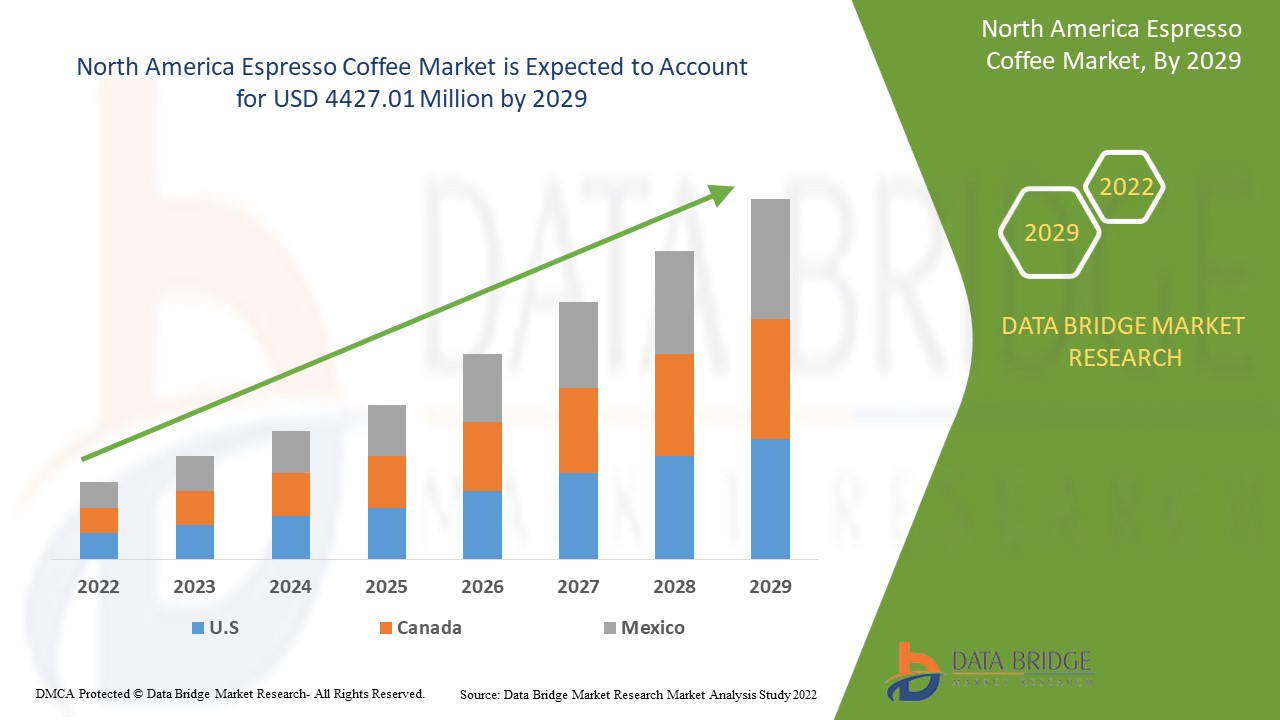

North America Espresso Coffee Market was valued at USD 3161.82 million in 2021 and is expected to reach USD 4427.01 million by 2029, registering a CAGR of 3.70% during the forecast period of 2022-2029. Cafes And Bars account for the largest end-use segment in the respective market owing to the changing consumer lifestyle and preference for coffee houses. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and consumer behaviour.

Market Definition

Espresso is a concentrated form of coffee served in small, strong shots and is the base for several coffee drinks. Espresso coffee is made from various types of coffee beans such as Arabica, robusta among others. Arabica coffee contains a high concentration of caffeine. However, because espresso is typically served in smaller servings than coffee, it has less caffeine per serving.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Pure Espresso, Double Espresso, Ristretto, Cappuccino, Latte, Mocha Macchiato, Americano, Others), Beans (Coffee Arabica, Coffee Robusta Wild Coffee Beans Brazilian Coffee Beans, Coffee Liberica, Coffee Charrieriana, Coffee Magnistipula, Others), Roast (Light, Medium, Dark, Extra Dark, Others), Distribution Channel (E-Commerce, Super Markets / Hyper Markets, Convenience Stores, Specialty Stores, Others), End-User(Hotels And Restaurants, Offices, Cafes And Bars, Home, Educational Institutes, Hospitals Airports, Others) |

|

Countries Covered |

U.S., Canada, Mexico in North America |

|

Market Players Covered |

Starbucks Coffee Company (US), Nestlé (Switzerland), LUIGI LAVAZZA SPA (Italy), La Prima Espresso Company (US), Illycaffè S.p.A. (Italy), Gloria Jean's Gourmet Coffees, Coffee Beanery, Cafe Coffee Day, McDonald's, Massimo Zanetti Beverage procaffé SpA (Italy), Caribou Coffee Operating Company, Inc. (US), Keurig Dr Pepper Inc. (US), ARCO COFFEE COMPANY (US), The J.M. Smucker Company (US), and The Kraft Heinz Company (US), among others |

|

Market Opportunities |

|

North America Espresso Coffee Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Consumption of Tea

The increase in the consumption of espresso coffee as nootropic drinks among students and working-class population acts as one of the major factors driving the growth of bubble tea market. The high consumption of espresso among population who have busy working lifestyle as it is easy to prepare assist in the growth of market.

- Rise in Espresso Coffee

The rise in the popularity of espresso coffee across the region as manufacturers blend espresso shots utilizing other beverages such as latte, cappuccino, and mocha, among others accelerate the market growth.

- Increase in Demand for Cafes

The increase in demand for espresso coffee from hotels, coffee shops office cafeterias, and restaurants in developing economies further influence the market. Increase in consumption of espresso coffee with rise in population around the world assists in the expansion of the market.

Additionally, change in lifestyle, increase in the disposable income and rise in awareness regarding the benefits of the caffeine positively affect the espresso coffee market.

Opportunities

Furthermore, growing focus of manufacturers in providing advanced coffee products extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Also, strategic marketing and promotion endeavours will further expand the market.

Restraints/Challenges

On the other hand, excessive caffeine consumption leading to a variety of cardiovascular problems are expected to obstruct market growth. Also, high calorie level of the product is projected to challenge the espresso coffee market in the forecast period of 2022-2029.

This espresso coffee market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on espresso coffee market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on North America Espresso Coffee Market

The COVID-19 has impacted espresso coffee market. The limited investment costs and lack of employees hampered sales and production of beverages. However, market key players adopted new safety measures for developing the products. The online distribution channel changing the shopping habits of people as it offers benefits such as easy payment methods, availability of a wide range of products, doorstep delivery and heavy discounts assisted in the growth of the market during the pandemic, and will further accelerate the growth during the post-pandemic situation.

Recent Developments

- In February 2019, Nestlé announced the launch of new range of coffee products under the partnership with Starbucks. The new range consists of 24 products, including whole bean and roast and ground, as well as the first-ever Starbucks capsules developed using Nespresso and Nescafé Dolce Gusto proprietary coffee and system technologies. All these products are made with the 100% high-quality Arabica coffee. With this, the company will enhance its offering in the market.

- In May 2019, Café Coffee Day announced the launch of range of innovative flavours of Cappuccinos. The six flavours are the exotic range of coffee flavours that features innovative ingredients such as pea flower extract, Himalayan pink salt, and turmeric, ginger and cinnamon flavours pinch and other flavours. With this, the company has enhanced its portfolio in the market.

North America Espresso Coffee Market Scope and Market Size

The espresso coffee market is segmented on the basis of type, beans, roast, distribution channel and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Pure Espresso

- Double Espresso

- Ristretto

- Cappuccino

- Latte

- Mocha Macchiato

- Americano

- Others

Beans

- Coffee Arabica

- Coffee Robusta Wild Coffee Beans Brazilian Coffee Beans

- Coffee Liberica

- Coffee Charrieriana

- Coffee Magnistipula

- Others

Roast

- Light

- Medium

- Dark

- Extra Dark

- Others

Distribution Channel

- E-Commerce

- Super Markets / Hyper Markets

- Convenience Stores

- Specialty Stores

- Others

End-User

- Hotels and Restaurants

- Offices

- Cafes and Bars

- Home

- Educational Institutes

- Hospitals Airports

- Others

North America Espresso Coffee Market Regional Analysis/Insights

The espresso coffee market is analysed and market size insights and trends are provided by country, type, beans, roast, distribution channel and end user as referenced above.

The countries covered in the espresso coffee market report are U.S., Canada, and Mexico in North America.

The US is dominating the North America espresso coffee market followed by Canada and Mexico. The high consumption of espresso coffee products in the US is the main reason for the dominance while Canada has a huge presence of major companies in the region is driving the growth of the country. Mexico is dominating the market due to growing understanding about health benefits and the good taste of the coffee.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Espresso Coffee Market Share Analysis

The espresso coffee market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to espresso coffee market.

Some of the major players operating in the espresso coffee market are

- Starbucks Coffee Company (US)

- Nestlé (Switzerland)

- LUIGI LAVAZZA SPA (Italy)

- La Prima Espresso Company (US)

- Illycaffè S.p.A. (Italy)

- Gloria Jean's Gourmet Coffees (India)

- Coffee Beanery (US)

- Cafe Coffee Day (India)

- McDonald's (US)

- Massimo Zanetti Beverage procaffé SpA (Italy)

- Caribou Coffee Operating Company, Inc. (US)

- Keurig Dr Pepper Inc. (US)

- ARCO COFFEE COMPANY (US)

- The J.M. Smucker Company (US)

- The Kraft Heinz Company (US)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ESPRESSO COFFEE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 IMPACT OF COVID-19 PANDEMIC ON THE ESPRESSO COFFEE MARKET

5.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA ESPRESSO COFFEE MARKET

5.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE NORTH AMERICA ESPRESSO COFFEE MARKET

5.3 PRICE IMPACT

5.4 IMPACT ON DEMAND

5.5 IMPACT ON SUPPLY CHAIN

5.6 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 ANTIOXIDANT CONTENTS IN ESPRESSO AIDS IN THE ENHANCEMENT OF HEALTH

6.1.2 INCREASING WORK LOAD AND STRESS AMONG CONSUMERS

6.1.3 INCREASING NUMBER OF LOCAL AND FRANCHISED COFFEE SHOPS

6.1.4 BOOSTS MEMORY CONSOLIDATION

6.1.5 INCREASING GROWTH OF COFFEE-BASED PRODUCTS, FAST FOOD AND RESTAURANT CHAINS

6.2 RESTRAINTS

6.2.1 INCREASING RISK OF CARDIOVASCULAR DISEASE DUE TO CONSUMPTION OF HIGH AMOUNT OF CAFFEINE

6.2.2 HIGHER NUMBER OF ALTERNATIVES AVAILABLE

6.2.3 RISE IN LDL CHOLESTEROL LEVELS DUE TO CAFESTOL AND KAHWEOL

6.3 OPPORTUNITIES

6.3.1 GROWING MANUFACTURERS’ FOCUS TOWARDS DEVELOPMENT OF ADVANCED COFFEE PRODUCTS

6.3.2 ESPRESSO INFUSED WITH FLAVOURS

6.4 CHALLENGES

6.4.1 STRICT FOOD-SAFETY AND HYGIENE GUIDELINES

6.4.2 STIFF COMPLETION IN THE MARKET

6.4.3 IMPACT OF COVID-19 ON FOOD SERVICE INDUSTRY

7 NORTH AMERICA ESPRESSO COFFEE MARKET, BY TYPE

7.1 OVERVIEW

7.2 CAPPUCCINO

7.3 LATTE

7.4 MOCHA

7.5 PURE ESPRESSO

7.6 MACCHIATO

7.6.1 SHORT MACCHIATO

7.6.2 LONG MACCHIATO

7.7 AMERICANO

7.8 DOUBLE ESPRESSO

7.9 RISTRETTO

7.1 OTHERS

8 NORTH AMERICA ESPRESSO COFFEE MARKET, BY END-USER

8.1 OVERVIEW

8.2 CAFES AND RESTAURANTS

8.2.1 CAFES AND RESTAURANTS, BY TYPE

8.2.1.1 CAPPUCCINO

8.2.1.2 LATTE

8.2.1.3 MOCHA

8.2.1.4 PURE ESPRESSO

8.2.1.5 MACCHIATO

8.2.1.6 AMERICANO

8.2.1.7 DOUBLE ESPRESSO

8.2.1.8 RISTRETTO

8.2.1.9 OTHERS

8.3 OFFICES

8.3.1 OFFICES, BY TYPE

8.3.1.1 CAPPUCCINO

8.3.1.2 LATTE

8.3.1.3 MOCHA

8.3.1.4 PURE ESPRESSO

8.3.1.5 MACCHIATO

8.3.1.6 AMERICANO

8.3.1.7 DOUBLE ESPRESSO

8.3.1.8 RISTRETTO

8.3.1.9 OTHERS

8.4 AIRPORTS

8.4.1 AIRPORTS, BY TYPE

8.4.1.1 CAPPUCCINO

8.4.1.2 LATTE

8.4.1.3 MOCHA

8.4.1.4 PURE ESPRESSO

8.4.1.5 MACCHIATO

8.4.1.6 AMERICANO

8.4.1.7 DOUBLE ESPRESSO

8.4.1.8 RISTRETTO

8.4.1.9 OTHERS

8.5 HOMES

8.5.1 HOMES, BY TYPE

8.5.1.1 CAPPUCCINO

8.5.1.2 LATTE

8.5.1.3 MOCHA

8.5.1.4 PURE ESPRESSO

8.5.1.5 MACCHIATO

8.5.1.6 AMERICANO

8.5.1.7 DOUBLE ESPRESSO

8.5.1.8 RISTRETTO

8.5.1.9 OTHERS

8.6 HOTELS AND BARS

8.6.1 HOTELS AND BARS , BY TYPE

8.6.1.1 CAPPUCCINO

8.6.1.2 LATTE

8.6.1.3 MOCHA

8.6.1.4 PURE ESPRESSO

8.6.1.5 MACCHIATO

8.6.1.6 AMERICANO

8.6.1.7 DOUBLE ESPRESSO

8.6.1.8 RISTRETTO

8.6.1.9 OTHERS

8.7 EDUCATIONAL INSTITUTES

8.7.1 EDUCATIONAL INSTITUTES , BY TYPE

8.7.1.1 CAPPUCCINO

8.7.1.2 LATTE

8.7.1.3 MOCHA

8.7.1.4 PURE ESPRESSO

8.7.1.5 MACCHIATO

8.7.1.6 AMERICANO

8.7.1.7 DOUBLE ESPRESSO

8.7.1.8 RISTRETTO

8.7.1.9 OTHERS

8.8 HOSPITALS

8.8.1 HOSPITALS, BY TYPE

8.8.1.1 CAPPUCCINO

8.8.1.2 LATTE

8.8.1.3 MOCHA

8.8.1.4 PURE ESPRESSO

8.8.1.5 MACCHIATO

8.8.1.6 AMERICANO

8.8.1.7 DOUBLE ESPRESSO

8.8.1.8 RISTRETTO

8.8.1.9 OTHERS

8.9 OTHERS

8.9.1 OTHERS, BY TYPE

8.9.1.1 CAPPUCCINO

8.9.1.2 LATTE

8.9.1.3 MOCHA

8.9.1.4 PURE ESPRESSO

8.9.1.5 MACCHIATO

8.9.1.6 AMERICANO

8.9.1.7 DOUBLE ESPRESSO

8.9.1.8 RISTRETTO

8.9.1.9 OTHERS

9 NORTH AMERICA ESPRESSO COFFEE MARKET, BY BEANS

9.1 OVERVIEW

9.2 COFFEE ARABICA

9.3 COFFEE ROBUSTA

9.3.1 KOPI LUWAK

9.3.2 KAPÉNG ALAMID

9.3.3 KAHAWA KUBING

9.4 COFFEE LIBERICA

10 NORTH AMERICA ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SPECIALTY STORES

10.3 SUPER MARKETS / HYPER MARKETS

10.4 CONVENIENCE STORES

10.5 E-COMMERCE

10.6 OTHERS

11 NORTH AMERICA ESPRESSO COFFEE MARKET, BY ROAST

11.1 OVERVIEW

11.2 MEDIUM ROAST

11.3 DARK ROAST

11.4 LIGHT ROAST

11.5 OTHERS

12 NORTH AMERICA ESPRESSO COFFEE MARKET, BY COUNTRY

12.1 NORTH AMERICA OVERVIEW

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA ESPRESSO COFFEE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 NESTLÉ

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 MCDONALD'S

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 STARBUCKS COFFEE COMPANY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 THE J.M. SMUCKER COMPANY

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 BRAND PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 LUIGI LAVAZZA SPA

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ARCO COFFEE COMPANY

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 CAFE COFFEE DAY

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 CARIBOU COFFEE OPERATING COMPANY, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 COFFEE BEANERY

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 GLORIA JEAN'S GOURMET COFFEES

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 THE KRAFT HEINZ COMPANY

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 BRAND PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 ILLYCAFFÈ S.P.A.

15.12.1 COMPANY SNAPSHOT

15.12.2 BRAND PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 KEURIG DR PEPPER INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 BRAND PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 LA PRIMA ESPRESSO COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MASSIMO ZANETTI BEVERAGE GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 BRAND PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 PEET'S COFFEE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

LIST OF TABLES

TABLE 1 IMPORT DATA OF COFFEE, WHETHER OR NOT ROASTED OR DECAFFEINATED; COFFEE HUSKS AND SKINS; COFFEE SUBSTITUTES, HS CODE - 0901 USD (THOUSAND)

TABLE 2 MINERAL CONTENT IN GROUND COFFEE BEANS

TABLE 3 NORTH AMERICA ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 4 NORTH AMERICA MACCHIATO IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 5 NORTH AMERICA ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 6 NORTH AMERICA CAFES AND RESTAURANTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 7 NORTH AMERICA OFFICES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 8 NORTH AMERICA AIRPORTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 9 NORTH AMERICA HOMES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 10 NORTH AMERICA HOTELS AND BARS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 11 NORTH AMERICA EDUCATIONAL INSTITUTES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 12 NORTH AMERICA HOSPITALS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 13 NORTH AMERICA OTHERS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION )

TABLE 14 NORTH AMERICA ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION )

TABLE 15 NORTH AMERICA COFFEE ROBUSTA IN ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION )

TABLE 16 NORTH AMERICA ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL, 2018– 2027 (USD MILLION)

TABLE 17 NORTH AMERICA ESPRESSO COFFEE MARKET, BY ROAST, 2018– 2027 (USD MILLION)

TABLE 18 NORTH AMERICA ESPRESSO COFFEE MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA MACCHIATO IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA ROBUSTA IN ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA ESPRESSO COFFEE MARKET, BY ROAST, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA ESPRESSO COFFEE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA CAFES AND RESTAURANTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 27 NORTH AMERICA OFFICES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA HOTELS AND BARS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 29 NORTH AMERICA HOMES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA EDUCATIONAL INSTITUTES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA HOSPITALS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 32 NORTH AMERICA AIRPORTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 34 U.S.ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 35 U.S.MACCHIATO IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 36 U.S.ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 37 U.S.ROBUSTA IN ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 38 U.S.ESPRESSO COFFEE MARKET, BY ROAST, 2018-2027 (USD MILLION)

TABLE 39 U.S.ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 40 U.S.ESPRESSO COFFEE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 41 U.S.CAFES AND RESTAURANTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 42 U.S.OFFICES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 43 U.S.HOTELS AND BARS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 44 U.S.HOMES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 45 U.S.EDUCATIONAL INSTITUTES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 46 U.S.HOSPITALS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 47 U.S.AIRPORTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 48 U.S.OTHERS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 49 CANADA ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 50 CANADA MACCHIATO IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 51 CANADA ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 52 CANADA ROBUSTA IN ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 53 CANADA ESPRESSO COFFEE MARKET, BY ROAST, 2018-2027 (USD MILLION)

TABLE 54 CANADA ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 55 CANADA ESPRESSO COFFEE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 56 CANADA CAFES AND RESTAURANTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 57 CANADA OFFICES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 58 CANADA HOTELS AND BARS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 59 CANADA HOMES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 60 CANADA EDUCATIONAL INSTITUTES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 61 CANADA HOSPITALS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 CANADA AIRPORTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 63 CANADA OTHERS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 64 MEXICO ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 65 MEXICO MACCHIATO IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 66 MEXICO ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 67 MEXICO ROBUSTA IN ESPRESSO COFFEE MARKET, BY BEANS, 2018-2027 (USD MILLION)

TABLE 68 MEXICO ESPRESSO COFFEE MARKET, BY ROAST, 2018-2027 (USD MILLION)

TABLE 69 MEXICO ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 70 MEXICO ESPRESSO COFFEE MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 71 MEXICO CAFES AND RESTAURANTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 MEXICO OFFICES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 73 MEXICO HOTELS AND BARS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 74 MEXICO HOMES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 75 MEXICO EDUCATIONAL INSTITUTES IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 76 MEXICO HOSPITALS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 77 MEXICO AIRPORTS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 78 MEXICO OTHERS IN ESPRESSO COFFEE MARKET, BY TYPE, 2018-2027 (USD MILLION)

Lista de Figura

LIST OF FIGURES

FIGURE 1 NORTH AMERICA ESPRESSO COFFEE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ESPRESSO COFFEE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ESPRESSO COFFEE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ESPRESSO COFFEE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ESPRESSO COFFEE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ESPRESSO COFFEE MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA ESPRESSO COFFEE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA ESPRESSO COFFEE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA ESPRESSO COFFEE MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA ESPRESSO COFFEE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA ESPRESSO COFFEE MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA ESPRESSO COFFEE MARKET: SEGMENTATION

FIGURE 13 ANTIOXIDANTS CONTENTS IN ESPRESSO AID IN THE ENHANCEMENT OF HEALTH HELPS BOOST THE IMMUNE SYSTEM IS DRIVING THE NORTH AMERICA ESPRESSO COFFEE MARKET IN THE FORECAST PERIOD 2020 TO 2027

FIGURE 14 CAPPUCCINO SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ESPRESSO COFFEE MARKET IN 2020 & 2027

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA ESPRESSO COFFEE MARKET

FIGURE 16 NORTH AMERICA ESPRESSO COFFEE MARKET: BY TYPE, 2019

FIGURE 17 NORTH AMERICA ESPRESSO COFFEE MARKET: BY END-USER, 2019

FIGURE 18 NORTH AMERICA ESPRESSO COFFEE MARKET: BY BEANS, 2019

FIGURE 19 NORTH AMERICA ESPRESSO COFFEE MARKET, BY DISTRIBUTION CHANNEL , 2019

FIGURE 20 NORTH AMERICA ESPRESSO COFFEE MARKET, BY ROAST , 2019

FIGURE 21 NORTH AMERICA ESPRESSO COFFEE MARKET: SNAPSHOT (2019)

FIGURE 22 NORTH AMERICA ESPRESSO COFFEE MARKET: BY COUNTRY (2019)

FIGURE 23 NORTH AMERICA ESPRESSO COFFEE MARKET: BY COUNTRY(2020& 2027)

FIGURE 24 NORTH AMERICA ESPRESSO COFFEE MARKET: BY COUNTRY (2019& 2027)

FIGURE 25 NORTH AMERICA ESPRESSO COFFEE MARKET: BY TYPE(2020-2027)

FIGURE 26 NORTH AMERICA ESPRESSO COFFEE MARKET: COMPANY SHARE 2019 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.