North America Gastrointestinal Endoscopy Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.71 Billion

USD

7.41 Billion

2024

2032

USD

4.71 Billion

USD

7.41 Billion

2024

2032

| 2025 –2032 | |

| USD 4.71 Billion | |

| USD 7.41 Billion | |

|

|

|

|

Mercado de endoscopia gastrointestinal na América do Norte, produto (endoscópios e sistemas gastrointestinais e endoterapia gastrointestinal), aplicação (tratamento e diagnóstico), tipo de procedimento (colonoscopia, gastroscopia, duodenoscopia, enteroscopia, sigmoidoscopia e outros), usabilidade (reutilizável e descartável/uso único), usuário final (hospitais, centros cirúrgicos ambulatoriais, clínicas especializadas, laboratórios e outros), canal de distribuição (licitação direta, vendas no varejo e outros) - tendências do setor e previsão até 2032

Tamanho do mercado de endoscopia gastrointestinal

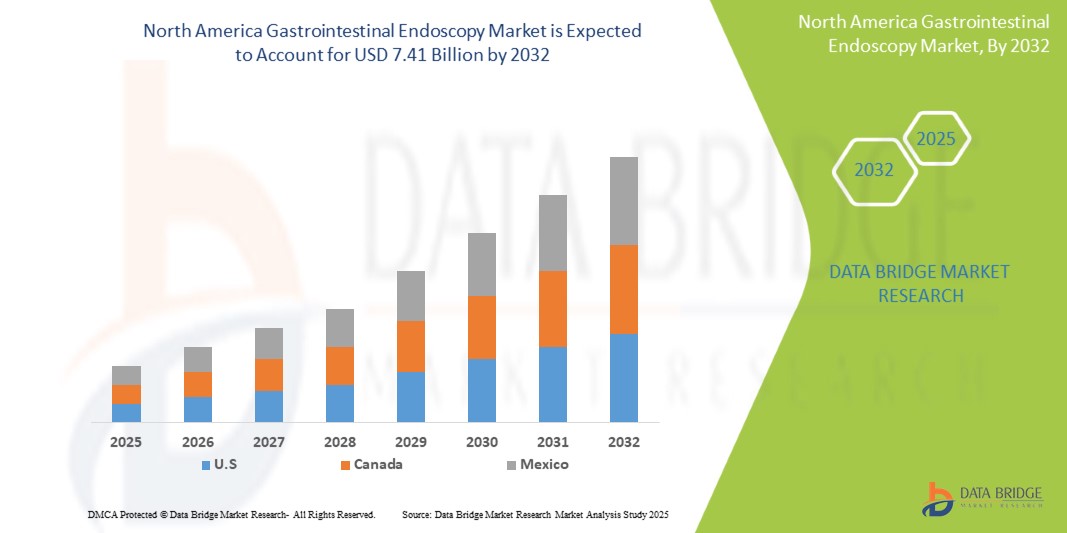

- O tamanho do mercado de endoscopia gastrointestinal na América do Norte foi avaliado em US$ 4,71 bilhões em 2024 e deve atingir US$ 7,41 bilhões até 2032 , com um CAGR de 5,9% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente prevalência de distúrbios gastrointestinais, avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal, conscientização crescente e programas de triagem expandidos para endoscopia gastrointestinal e envelhecimento da população que impulsiona o aumento da demanda por endoscopia gastrointestinal.

- Além disso, espera-se que o mercado testemunhe uma expansão contínua devido à crescente ênfase na detecção precoce do câncer colorretal, à crescente adoção de soluções de endoscopia domiciliar e por cápsula e à crescente prevalência e avanços na endoscopia terapêutica personalizada.

Análise de Mercado de Endoscopia Gastrointestinal

- O aumento global da população idosa contribui significativamente para a demanda por endoscopia gastrointestinal. Idosos são mais suscetíveis a doenças gastrointestinais, como diverticulose, câncer colorretal e úlceras pépticas, aumentando a necessidade de exames diagnósticos e intervenções terapêuticas regulares.

- O aumento global da população idosa contribui significativamente para a demanda por endoscopia gastrointestinal. Idosos são mais suscetíveis a doenças gastrointestinais, como diverticulose, câncer colorretal e úlceras pépticas, aumentando a necessidade de exames diagnósticos e intervenções terapêuticas regulares.

- Espera-se que o mercado de endoscopia gastrointestinal dos EUA domine, com uma participação de mercado de 82,86%. Espera-se que esta região cresça a uma taxa composta de crescimento anual (CAGR) de 6,0% no período previsto de 2025 a 2032, devido ao envelhecimento da população, que impulsiona o aumento da demanda por endoscopia gastrointestinal, e aos avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal.

- Os EUA são a região com crescimento mais rápido no mercado de endoscopia gastrointestinal da América do Norte, impulsionado pela crescente prevalência de distúrbios gastrointestinais e pelos avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal.

- Espera-se que o segmento de endoscópios e sistemas gastrointestinais domine o mercado com uma participação de mercado de 58,03%, crescendo com um CAGR de 6,3% no período previsto de 2025 a 2032, impulsionado pela crescente prevalência de distúrbios gastrointestinais e avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal.

Escopo do Relatório e Segmentação do Mercado de Endoscopia Gastrointestinal

|

Atributos |

Principais insights do mercado de endoscopia gastrointestinal |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de pipeline, análise de preços e estrutura regulatória. |

Tendências do mercado de endoscopia gastrointestinal

- “ Aumento da prevalência de distúrbios gastrointestinais ”

- Distúrbios gastrointestinais (GI), como câncer colorretal, doença do refluxo gastroesofágico (DRGE), doença de Crohn e colite ulcerativa, têm aumentado constantemente, tornando-se um importante impulsionador do mercado de endoscopia gastrointestinal.

- Essas condições frequentemente exigem um diagnóstico precoce e preciso, para o qual a endoscopia continua sendo a principal ferramenta. O câncer colorretal, por exemplo, está entre as principais causas de mortes relacionadas ao câncer em todo o mundo, e exames endoscópicos regulares, como colonoscopias, são vitais para a detecção e prevenção precoces.

- Doenças gastrointestinais crônicas, como a doença de Crohn e a DRGE, exigem avaliação endoscópica contínua para o manejo e monitoramento da doença. A crescente prevalência dessas condições, aliada à maior conscientização e acessibilidade aos serviços de saúde, está levando a um aumento na demanda por procedimentos endoscópicos gastrointestinais em economias desenvolvidas e emergentes.

- Distúrbios gastrointestinais (GI) estão se tornando cada vez mais comuns em todo o mundo, levando a uma maior dependência de procedimentos endoscópicos para diagnóstico preciso e tratamento eficaz da doença. Condições como a Doença do Refluxo Gastroesofágico (DRGE), a doença de Crohn e o câncer colorretal frequentemente exigem avaliação visual, biópsia e monitoramento oportunos, todos possíveis por meio da endoscopia. Com a crescente conscientização, o envelhecimento da população e a evolução dos estilos de vida, a demanda por endoscopia gastrointestinal está aumentando tanto em regiões desenvolvidas quanto em regiões emergentes, posicionando-a como um pilar fundamental da moderna assistência médica gastrointestinal.

Dinâmica do mercado de endoscopia gastrointestinal

Motorista

“Avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal”

- A inovação contínua na tecnologia endoscópica aumentou significativamente a precisão diagnóstica e a eficiência dos procedimentos, impulsionando o crescimento do mercado. O desenvolvimento da endoscopia por cápsula, imagens de alta definição, imagens de banda estreita (NBI) e sistemas de endoscopia assistida por robô revolucionou o diagnóstico e o tratamento gastrointestinal.

- Por exemplo, em outubro de 2024, de acordo com a NYP Holdings, Inc., a demanda por procedimentos diagnósticos avançados, como a endoscopia gastrointestinal, continua a crescer. Inovações como cirurgia remota com sistemas robóticos e endoscópios magnéticos permitem navegação precisa para procedimentos complexos. Essa tecnologia melhora o acesso a diagnósticos gastrointestinais, especialmente para pacientes idosos, garantindo tratamentos e biópsias precisos.

- Essas ferramentas avançadas proporcionam visualização mais clara, maior capacidade de manobra e melhores taxas de detecção, especialmente para lesões em estágio inicial. A integração com Inteligência Artificial (IA) está possibilitando ainda mais a detecção e a caracterização de anormalidades em tempo real. À medida que os fabricantes investem fortemente em P&D e os médicos adotam essas inovações para aprimorar os resultados, a adoção de sistemas endoscópicos tecnologicamente avançados continua a se expandir rapidamente em hospitais e centros especializados em todo o mundo.

- Além disso, os avanços tecnológicos estão transformando a endoscopia gastrointestinal, melhorando a precisão diagnóstica e a eficiência do procedimento. Inovações como imagens de alta definição, endoscopia assistida por robô e integração com IA permitem imagens mais nítidas e melhor detecção de lesões, especialmente em casos complexos.

Restrição/Desafio

“ Alto Custo de Equipamentos e Procedimentos ”

- O investimento significativo de capital necessário para sistemas de endoscopia gastrointestinal representa uma grande barreira ao crescimento do mercado, especialmente em ambientes com recursos limitados. Sistemas de ponta com imagens avançadas e integração de IA são caros, com custos adicionais de manutenção, acessórios e atualizações regulares de software.

- Para os prestadores de cuidados de saúde nos países em desenvolvimento, as restrições orçamentais tornam frequentemente inviável a aquisição de tais equipamentos.

- Além disso, para pacientes sem cobertura de seguro suficiente, os custos diretos associados a procedimentos como colonoscopias podem inviabilizar sua utilização. Esses desafios de custo limitam a adoção de tecnologias endoscópicas e reduzem o acesso a serviços diagnósticos e terapêuticos essenciais nos setores de saúde público e privado.

- Por exemplo, em novembro de 2022, o alto custo dos procedimentos e equipamentos de endoscopia gastrointestinal representa uma grande limitação. Por exemplo, a endoscopia digestiva alta (TNE) custa 125,90 euros por procedimento, enquanto a endoscopia oral custa 184,10 euros e a endoscopia digestiva alta (MACE) custa 407,10 euros. Além disso, a manutenção e o reprocessamento dos equipamentos aumentam o custo, com endoscópios flexíveis custando cerca de 79.330 euros, tornando os procedimentos caros em geral.

- Por exemplo, em fevereiro de 2025, de acordo com a Science Direct, o alto custo da endoscopia gastrointestinal é evidente em vários estudos, especialmente para triagem e vigilância. Por exemplo, embora as triagens para a população em geral possam não ser custo-efetivas nas regiões ocidentais, a vigilância direcionada para grupos de alto risco, como aqueles com metaplasia intestinal gástrica, ainda pode ser custo-efetiva, com ICERs variando de US$ 20.739,1 a US$ 98.402,2 por QALY.

- O alto custo dos procedimentos e equipamentos de endoscopia gastrointestinal continua sendo um desafio significativo para a expansão do mercado, especialmente em ambientes com poucos recursos

- Procedimentos caros, aliados à manutenção e aos reparos contínuos, limitam a acessibilidade, especialmente em países em desenvolvimento. Apesar dos esforços para direcionar os grupos de alto risco para uma triagem mais econômica, a acessibilidade continua a restringir a adoção generalizada, prejudicando o acesso equitativo a serviços essenciais de diagnóstico e tratamento.

Escopo de mercado da endoscopia gastrointestinal

O mercado é segmentado com base no produto, tipo de aplicação, tipo de procedimento, usabilidade, usuário final e canal de distribuição.

- Por produto

Com base no produto, o mercado é segmentado em endoscópios e sistemas gastrointestinais e endoterapia gastrointestinal. Em 2024, o segmento de endoscópios e sistemas gastrointestinais dominou o mercado, com uma participação de mercado de 57,74%, crescendo com um CAGR de 6,3% no período previsto de 2025 a 2032, impulsionado pela crescente prevalência de distúrbios gastrointestinais e pelos avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal.

- Por aplicação

Com base na aplicação, o mercado é segmentado em tratamento e diagnóstico. Em 2024, o segmento de tratamento dominou o mercado, com uma participação de mercado de 56,23%, crescendo com um CAGR de 6,0% no período previsto de 2025 a 2032, impulsionado pelo aumento da prevalência de distúrbios gastrointestinais e pela crescente conscientização e expansão dos programas de triagem para endoscopia gastrointestinal.

- Por tipo de procedimento

Com base no tipo de procedimento, o mercado é segmentado em colonoscopia, gastroscopia, duodenoscopia, enteroscopia, sigmoidoscopia e outros. Em 2024, o segmento de colonoscopia dominou o mercado, com uma participação de mercado de 41,35%, crescendo com um CAGR de 5,4% no período previsto de 2025 a 2032, impulsionado por avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal e pela crescente conscientização e expansão dos programas de triagem para endoscopia gastrointestinal.

- Por usabilidade

Com base na usabilidade, o mercado é segmentado em reutilizáveis, descartáveis/de uso único. Em 2024, o segmento reutilizável dominaria o mercado, com 69,53% de participação, crescendo com um CAGR de 5,7% no período previsto de 2025 a 2032, impulsionado por avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal.

- Por usuário final

Com base no usuário final, o mercado é segmentado em hospitais, centros cirúrgicos ambulatoriais, clínicas especializadas, laboratórios e outros. Em 2024, o segmento hospitalar dominará o mercado, com 53,45% de participação, e espera-se um crescimento com um CAGR de 5,4% no período previsto de 2025 a 2032, impulsionado pela crescente conscientização e expansão dos programas de triagem para endoscopia gastrointestinal, além dos avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em licitação direta, vendas no varejo e outros. Em 2024, o segmento de licitação direta dominaria o mercado, com 63,54% de participação, e espera-se um crescimento com uma taxa composta de crescimento anual (CAGR) de 6,0% no período previsto de 2025 a 2032, impulsionado pelo aumento da prevalência de distúrbios gastrointestinais, pela conscientização crescente e pela expansão dos programas de triagem para endoscopia gastrointestinal, além dos avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal.

Análise regional do mercado de endoscopia gastrointestinal

- Espera-se que o mercado de endoscopia gastrointestinal dos EUA domine, com uma participação de mercado de 82,86%. Espera-se que esta região cresça a uma taxa composta de crescimento anual (CAGR) de 6,0% no período previsto de 2025 a 2032, devido ao envelhecimento da população, que impulsiona o aumento da demanda por endoscopia gastrointestinal, e aos avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal.

- Os EUA são a região com crescimento mais rápido no mercado de endoscopia gastrointestinal da América do Norte, impulsionado pela crescente prevalência de distúrbios gastrointestinais e pelos avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal.

- Além disso, as colaborações ativas entre agências governamentais, instituições de pesquisa e empresas de biotecnologia aceleram a inovação e a aprovação de novas terapias, impulsionando ainda mais o crescimento do mercado na região.

Visão geral do mercado de endoscopia gastrointestinal no Canadá

Espera-se que o mercado canadense de endoscopia gastrointestinal domine, com uma participação de mercado de 10,77%. Espera-se que esta região cresça com uma taxa composta de crescimento anual (CAGR) de 5,6% no período previsto de 2025 a 2032 na América do Norte em 2025, impulsionada pelo aumento da prevalência de distúrbios gastrointestinais e pela crescente conscientização e expansão dos programas de triagem para endoscopia gastrointestinal.

Visão geral do mercado de endoscopia gastrointestinal no México

Espera-se que o mercado mexicano de endoscopia gastrointestinal domine, com uma participação de mercado de 6,34%. Espera-se que esta região cresça com uma taxa composta de crescimento anual (CAGR) de 5,4% no período previsto de 2025 a 2032 na América do Norte em 2025, impulsionada pelo aumento da prevalência de distúrbios gastrointestinais e pelos avanços tecnológicos que aprimoram os procedimentos de endoscopia gastrointestinal.

Participação no mercado de endoscopia gastrointestinal

O setor de endoscopia gastrointestinal é liderado principalmente por empresas bem estabelecidas, incluindo:

- Medtronic (Irlanda)

- Stryker (EUA)

- Johnson & Johnson Services, Inc. (EUA)

- Boston Scientific Corporation (EUA)

- Cook (EUA)

- CONMED Corporation (EUA)

- STERIS (EUA)

- Henry Schein, Inc. (EUA)

- CapsoVision, Inc. (EUA)

- Teleflex Incorporated (EUA)

- FUJIFILM Holdings Corporation (Japão)

- Olympus Corporation (Japão)

- Hoya Corporation (Japão)

- Smith+Nephew (Reino Unido)

- KLS Martin Group (Alemanha)

- Laborie (Canadá)

Últimos desenvolvimentos no mercado de endoscopia gastrointestinal na América do Norte

- Em janeiro de 2024, a AnX Robotica avança no diagnóstico gastrointestinal com a cápsula endoscópica NaviCam SB, aprovada pela FDA, para pacientes com mais de 2 anos, aprimorada pela leitura assistida por IA ProScan. O NaviCam Tether permite a visualização esofágica, expandindo as capacidades diagnósticas. Com uma plataforma NaviCam em crescimento, incluindo sistemas MCCE e de cólon, a AnX oferece soluções inovadoras e não invasivas para avaliação abrangente do trato gastrointestinal.

- Em fevereiro de 2023, a AnX Robotica lança nos EUA o Sistema NaviCam para Intestino Delgado, aprovado pela FDA, com tecnologia de lentes asféricas para imagens aprimoradas e distorção reduzida. Com tempos de download e processamento mais rápidos, o sistema melhora a eficiência diagnóstica de doenças do intestino delgado, auxiliando na avaliação oportuna de sangramento gastrointestinal obscuro e doença inflamatória intestinal (DII).

- Em agosto de 2024, a Boston Scientific lançou o Stent AXIOS com Sistema de Entrega Aprimorado por Eletrocautério para drenagem endoscópica da vesícula biliar em pacientes com colecistite aguda, inadequados para cirurgia. Utilizando a técnica de EUS, ele permite a drenagem biliar interna, evitando drenos externos. Estudos clínicos demonstram menos complicações e recuperação mais rápida em comparação aos métodos tradicionais, oferecendo uma opção minimamente invasiva para pacientes de alto risco.

- Em janeiro de 2025, o CapsoCam Plus da CapsoVision recebeu aprovação da FDA para uso pediátrico em pacientes com dois anos ou mais. Oferecendo imagens panorâmicas de 360° sem equipamento vestível, ele oferece uma alternativa tranquila e não invasiva à endoscopia por cápsula tradicional, aumentando a precisão diagnóstica e o conforto para crianças, ao mesmo tempo em que agiliza os procedimentos para profissionais de saúde por meio da integração com o CapsoCloud.

- Em maio de 2022, a Cook Medical lançou os Stents Biliares de Liberação Controlada Evolution, projetados para fornecer força radial uniforme, flexibilidade e conformabilidade ideais. Esses stents estão disponíveis em vários comprimentos e visam melhorar os resultados em pacientes com obstruções biliares.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET END USER COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 INDUSTRY INSIGHTS

4.3.1 MICRO AND MACROECONOMIC FACTORS

4.3.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3.3 KEY PRICING STRATEGIES

4.3.4 COST ANALYSIS BREAKDOWN

4.3.5 TECHNOLOGY ROADMAP

4.3.6 OPPUTUNITY MAP ANALYSIS

4.3.7 PRICING ANALYSIS

4.3.8 COMPETITOR’S MODEL ANALYSIS

4.3.9 HEALTHCARE ECONOMY

4.3.9.1 HEALTHCARE EXPENDITURE

4.3.9.2 CAPITAL EXPENDITURE

4.3.9.3 CAPEX TRENDS

4.3.9.4 CAPEX ALLOCATION

4.3.9.5 FUNDING SOURCES

4.3.9.6 INDUSTRY BENCHMARKS

4.3.9.7 GDP RATIO IN OVERALL GDP

4.3.9.8 HEALTHCARE SYSTEM STRUCTURE

4.3.9.9 GOVERNMENT POLICIES

4.3.9.10 ECONOMIC DEVELOPMENT

4.4 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.4.1 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.4.2 VENDOR SELECTION CRITERIA DYNAMICS

4.4.3 IMPACT ON SUPPLY CHAIN

4.4.3.1 RAW MATERIAL PROCUREMENT

4.4.3.2 MANUFACTURING AND PRODUCTION

4.4.3.3 LOGISTICS AND DISTRIBUTION

4.4.3.4 PRICE PITCHING AND POSITION OF MARKET

4.4.4 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.4.4.1 SUPPLY CHAIN OPTIMIZATION

4.4.4.2 JOINT VENTURE ESTABLISHMENTS

4.4.5 IMPACT ON PRICES

4.4.6 REGULATORY INCLINATION

4.4.6.1 GEOPOLITICAL SITUATION

4.4.6.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.4.6.3 FREE TRADE AGREEMENTS

4.4.6.4 ALLIANCES ESTABLISHMENTS

4.4.6.5 STATUS ACCREDITATION (INCLUDING MFTN)

4.4.6.6 DOMESTIC COURSE OF CORRECTION

4.4.6.7 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.4.6.8 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

4.4.7 PRICE INDEX

4.5 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.6 SUPPLY CHAIN ECOSYSTEM

4.7 COMPANY EVALUATION QUADRANT

5 REGULATORY COMPLIANCE

5.1 REGULATORY AUTHORITIES

5.2 REGULATORY CLASSIFICATIONS

5.3 REGULATORY SUBMISSIONS

5.4 INTERNATIONAL HARMONIZATION

5.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

5.6 REGULATORY CHALLENGES AND STRATEGIES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF GASTROINTESTINAL DISORDERS

6.1.2 AGING POPULATION DRIVING INCREASED DEMAND FOR GI ENDOSCOPY

6.1.3 TECHNOLOGICAL ADVANCEMENTS ENHANCING GI ENDOSCOPY PROCEDURES

6.1.4 RISING AWARENESS AND EXPANDED SCREENING PROGRAMS FOR GASTROINTESTINAL ENDOSCOPY

6.2 RESTRAINTS

6.2.1 HIGH COST OF EQUIPMENT AND PROCEDURES

6.2.2 RISK OF PROCEDURE-RELATED COMPLICATIONS

6.3 OPPORTUNITIES

6.3.1 GROWING EMPHASIS ON EARLY COLORECTAL CANCER DETECTION

6.3.2 GROWING ADOPTION OF HOME-BASED AND CAPSULE ENDOSCOPY SOLUTIONS

6.3.3 INCREASING PREVALENCE AND ADVANCEMENTS IN PERSONALIZED THERAPEUTIC ENDOSCOPY

6.4 CHALLENGES

6.4.1 LIMITED ACCESS TO GI ENDOSCOPY IN RURAL AREAS

6.4.2 COMPLEXITIES IN ENDOSCOPE REPROCESSING AND STERILIZATION PROCESSES

7 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 GASTROINTESTINAL ENDOSCOPES & SYSTEMS

7.2.1 ENDOSCOPES

7.2.1.1 COLONOSCOPES

7.2.1.2 GASTROSCOPES

7.2.1.3 DUODENOSCOPES

7.2.1.4 ENTEROSCOPES

7.2.1.5 SIGMOIDOSCOPES

7.2.1.6 RESECTOSCOPES

7.2.2 FLEXIBLE

7.2.3 RIGID

7.2.4 SEMI RIGID

7.2.4.1 VIDEO

7.2.4.2 FIBRE

7.2.4.3 ULTRASONIC

7.2.5 VISUALIZATION SYSTEMS

7.2.5.1 FLUORESCENCE IMAGING SYSTEMS

7.2.5.1.1 NIR LIGHT FLUORESCENCE IMAGING SYSTEM

7.2.5.1.2 WHITE LIGHT FLUORESCENCE IMAGING SYSTEM

7.2.5.1.3 UV LIGHT FLUORESCENCE IMAGING SYSTEMS

7.2.5.1.4 CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS

7.2.5.1.5 PROBE-BASED CLE (PCLE)

7.2.5.1.6 BUILT-IN DEVICE CLE (ECLE)

7.2.5.2 HIGH DEFINITION (HD) VISUALIZATION SYSTEMS

7.2.5.2.1 2D SYSTEMS

7.2.5.2.2 3D SYSTEMS

7.2.5.3 STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS

7.2.5.3.1 ENDOSCOPIC ULTRASONOGRAPHY SYSTEMS

7.2.5.3.2 CAPSULE ENDOSCOPES

7.2.5.3.3 ULTRASOUND DEVICE

7.3 GASTROINTESTINAL ENDOTHERAPY

7.3.1 ERCP DEVICES

7.3.2 BIOPSY DEVICE

7.3.3 STENTING AND DILATION DEVICE

7.3.4 HOMEOSTASIS DEVICES

7.3.4.1 LIGATION DEVICES

7.3.4.2 PROBES

7.3.4.3 SCLEROTHERAPY NEEDLES

7.3.5 RETRIEVAL DEVICES

7.3.6 CAMERA HEAD

7.3.7 ANTI-REFLUX DEVICES

7.3.7.1 TRANSORAL INCISIONLESS FUNDOPLICATION (TIF) DEVICES

7.3.7.2 TRANSESOPHAGEAL RADIOFREQUENCY (RF) ANTI-REFLUX DEVICES

7.3.8 OTHERS

8 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PROCEDURE TYPE

8.1 OVERVIEW

8.2 COLONOSCOPY

8.3 GASTROSCOPY

8.4 DUODENOSCOPY

8.5 ENTEROSCOPY

8.6 SIGMOIDOSCOPY

8.7 OTHERS

9 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY USABILITY

9.1 OVERVIEW

9.2 REUSABLE

9.3 DISPOSABLE/ SINGLE USE

10 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 TREATMENT

10.3 DIAGNOSIS

11 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 AMBULATORY SURGICAL CENTERS

11.4 SPECIALTY CLINICS

11.5 LABORATORIES

11.6 OTHERS

12 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 OTHERS

13 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 OLYMPUS CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT/NEWS

16.2 FUJIFILM HOLDINGS CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS/NEWS

16.3 MEDTRONIC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS/NEWS

16.4 JOHNSON & JOHNSON SERVICES, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 STRYKER

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 AMBU AS

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS/NEWS

16.7 ANX ROBOTICS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS/NEWS

16.8 BOSTON SCIENTIFIC CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 CAPSOVISION, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS/NEWS

16.1 CONMED CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 COOK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT/NEWS

16.12 DAICHUAN MEDICAL

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 ERBE ELEKTROMEDIZIN GMBH

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GONGJIANG ENDOSCOPY INSTRUMENTS CO., LTD

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 HENRY SCHEIN, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 HOYA CORPORATION.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 INTROMEDIC

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 JIANGSU VEDKANG MEDICAL SCIENCE AND TECHNOLOGY CO., LTD

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 JINSHAN SCIENCE & TECHNOLOGY

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT/NEWS

16.2 KLS MARTIN GROUP

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 LABORIE

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 MECANMEDICAL

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 MICRO-TECH ENDOSCOPY

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 MITRA INDUSTRIES PVT. LTD.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 OVESCO ENDOSCOPY AG

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 SHAILI ENDOSCOPY

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 SMITH+NEPHEW

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENT

16.28 SONOSCAPE MEDICAL CORP.

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENT/NEWS

16.29 STERIS

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PRODUCT PORTFOLIO

16.29.4 RECENT DEVELOPMENT

16.3 TELEFLEX INCORPORATED.

16.30.1 COMPANY SNAPSHOT

16.30.2 REVENUE ANALYSIS

16.30.3 PRODUCT PORTFOLIO

16.30.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

Lista de Tabela

TABLE 1 TARIFF RATE (S) IN TOP-5 COUNTRY

TABLE 2 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 6 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 7 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 9 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 10 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 12 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (ASP IN USD/UNITS)

TABLE 13 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 15 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (ASP IN USD/UNITS)

TABLE 16 NORTH AMERICA VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 19 NORTH AMERICA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 20 NORTH AMERICA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 22 NORTH AMERICA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 23 NORTH AMERICA VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 26 NORTH AMERICA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 27 NORTH AMERICA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 29 NORTH AMERICA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 30 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 33 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 34 NORTH AMERICA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 36 NORTH AMERICA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 37 NORTH AMERICA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 39 NORTH AMERICA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 40 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PROCEDURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA COLONOSCOPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA GASTROSCOPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA DUODENOSCOPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA ENTEROSCOPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA SIGMOIDOSCOPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA OTHERS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA REUSABLE IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA DISPOSABLE/ SINGLE USE IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA TREATMENT IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA DIAGNOSIS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA HOSPITALS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA SPECIALTY CLINICS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA LABORATORIES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA OTHERS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA DIRECT TENDER IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA RETAIL SALES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA OTHERS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 67 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)..

TABLE 68 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 71 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 73 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (ASP IN USD/UNITS)

TABLE 74 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 76 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (ASP IN USD/UNITS)

TABLE 77 NORTH AMERICA VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 80 NORTH AMERICA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 81 NORTH AMERICA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 83 NORTH AMERICA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 84 NORTH AMERICA VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 87 NORTH AMERICA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 88 NORTH AMERICA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 90 NORTH AMERICA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 91 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 94 NORTH AMERICA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 96 NORTH AMERICA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 97 NORTH AMERICA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 NORTH AMERICA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 99 NORTH AMERICA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 100 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PROCEDURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 105 U.S. GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 106 U.S. GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 U.S. GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 108 U.S. GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 109 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 U.S. GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 112 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 113 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 114 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (ASP IN USD/UNITS)

TABLE 115 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 117 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (ASP IN USD/UNITS)

TABLE 118 U.S. VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 119 U.S. FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 U.S. FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 121 U.S. FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 122 U.S. CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 U.S. CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 124 U.S. CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 125 U.S. VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 128 U.S. HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 129 U.S. STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.S. STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 131 U.S. STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 132 U.S. GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 U.S. GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 135 U.S. HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.S. HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 137 U.S. HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 138 U.S. ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 U.S. ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 140 U.S. ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 141 U.S. GASTROINTESTINAL ENDOSCOPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 142 U.S. GASTROINTESTINAL ENDOSCOPY MARKET, BY PROCEDURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.S. GASTROINTESTINAL ENDOSCOPY MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 144 U.S. GASTROINTESTINAL ENDOSCOPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 145 U.S. GASTROINTESTINAL ENDOSCOPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 146 CANADA GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 147 CANADA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 CANADA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 149 CANADA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 150 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 CANADA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 153 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 154 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 155 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (ASP IN USD/UNITS)

TABLE 156 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 157 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 158 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (ASP IN USD/UNITS)

TABLE 159 CANADA VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 160 CANADA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 CANADA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 162 CANADA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 163 CANADA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 165 CANADA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 166 CANADA VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 CANADA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 169 CANADA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 170 CANADA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 172 CANADA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 173 CANADA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 CANADA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 176 CANADA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 178 CANADA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 179 CANADA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 CANADA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 181 CANADA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 182 CANADA GASTROINTESTINAL ENDOSCOPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 183 CANADA GASTROINTESTINAL ENDOSCOPY MARKET, BY PROCEDURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 CANADA GASTROINTESTINAL ENDOSCOPY MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 185 CANADA GASTROINTESTINAL ENDOSCOPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 186 CANADA GASTROINTESTINAL ENDOSCOPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 187 MEXICO GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 188 MEXICO GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 MEXICO GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 190 MEXICO GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 191 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 MEXICO GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 194 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 195 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 196 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (ASP IN USD/UNITS)

TABLE 197 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 198 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 199 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (ASP IN USD/UNITS)

TABLE 200 MEXICO VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 201 MEXICO FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 MEXICO FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 203 MEXICO FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 204 MEXICO CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 MEXICO CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 206 MEXICO CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 207 MEXICO VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 MEXICO HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 MEXICO HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 210 MEXICO HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 211 MEXICO STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 213 MEXICO STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 214 MEXICO GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 217 MEXICO HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MEXICO HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 219 MEXICO HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 220 MEXICO ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 MEXICO ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 222 MEXICO ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 223 MEXICO GASTROINTESTINAL ENDOSCOPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 224 MEXICO GASTROINTESTINAL ENDOSCOPY MARKET, BY PROCEDURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO GASTROINTESTINAL ENDOSCOPY MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO GASTROINTESTINAL ENDOSCOPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO GASTROINTESTINAL ENDOSCOPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT (2024)

FIGURE 12 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING PREVALENCE OF GASTROINTESTINAL DISORDERS IS EXPECTED TO DRIVE THE NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 REUSABLE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET IN THE FORECAST PERIOD OF 2025 & 2032

FIGURE 16 TOTAL NUMBER OF DEALS (YEAR-WISE)

FIGURE 17 TOTAL NUMBER OF DEALS BY TYPE

FIGURE 18 DROC ANALYSIS

FIGURE 19 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PRODUCT, 2024

FIGURE 20 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PRODUCT, 2025-2032 (USD THOUSAND)

FIGURE 21 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 22 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 23 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PROCEDURE TYPE, 2024

FIGURE 24 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PROCEDURE TYPE, 2025-2032 (USD THOUSAND)

FIGURE 25 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PROCEDURE TYPE, CAGR (2025-2032)

FIGURE 26 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PROCEDURE TYPE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY USABILITY, 2024

FIGURE 28 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY USABILITY, 2025-2032 (USD THOUSAND)

FIGURE 29 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY USABILITY, CAGR (2025-2032)

FIGURE 30 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY USABILITY, LIFELINE CURVE

FIGURE 31 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY APPLICATION, 2024

FIGURE 32 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 33 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 34 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 35 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY END USER, 2024

FIGURE 36 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 37 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 38 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY END USER, LIFELINE CURVE

FIGURE 39 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 40 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 41 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 42 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 43 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: SNAPSHOTS (2024)

FIGURE 44 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.