North America Gastrointestinal Endoscopy Market

Market Size in USD Billion

CAGR :

%

USD

4.71 Billion

USD

7.41 Billion

2024

2032

USD

4.71 Billion

USD

7.41 Billion

2024

2032

| 2025 –2032 | |

| USD 4.71 Billion | |

| USD 7.41 Billion | |

|

|

|

|

Gastrointestinal Endoscopy Market Size

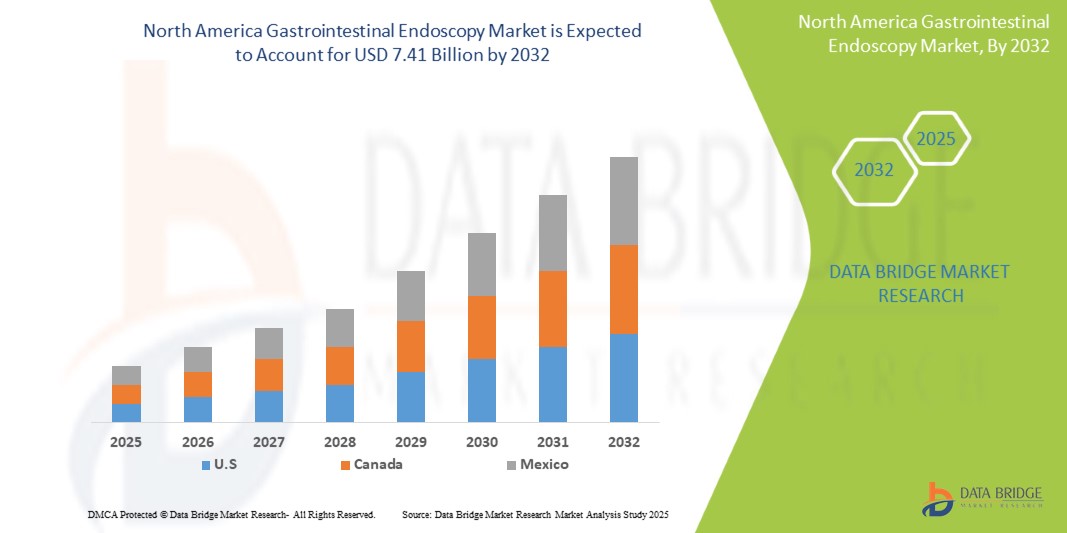

- The North America Gastrointestinal endoscopy market size was valued at USD 4.71 Billion in 2024 and is expected to reach USD 7.41 Billion by 2032, at a CAGR of 5.9% during the forecast period

- The market growth is largely fueled by Rising Prevalence of Gastrointestinal disorders, Technological advancements enhancing GI endoscopy procedures, Rising awareness and expanded screening programs for gastrointestinal endoscopy, and Aging population driving increased demand for GI endoscopy

- Furthermore, the market is expected to witness continued expansion due Growing emphasis on early colorectal cancer detection, Growing adoption of Home-based and capsule endoscopy solutions, and Increasing prevalence and advancements in personalized therapeutic endoscopy

Gastrointestinal Endoscopy Market Analysis

- The global rise in the elderly population is a major contributor to the demand for gastrointestinal endoscopy. Older adults are more susceptible to GI conditions such as diverticulosis, colorectal cancer, and peptic ulcers, increasing the need for regular diagnostic screening and therapeutic interventions

- The global rise in the elderly population is a major contributor to the demand for gastrointestinal endoscopy. Older adults are more susceptible to GI conditions such as diverticulosis, colorectal cancer, and peptic ulcers, increasing the need for regular diagnostic screening and therapeutic interventions

- U.S. gastrointestinal endoscopy market is expected to dominate with the market share of 82.86%. This region is expected to grow with the CAGR of 6.0% in the forecast period of 2025 to 2032 due to Aging population driving increased demand for GI endoscopy, Technological advancements enhancing GI endoscopy procedures

- U.S. is the fastest growing region for North America gastrointestinal endoscopy market fueled by Rising Prevalence of Gastrointestinal disorders, Technological advancements enhancing GI endoscopy procedures

- The Gastrointestinal endoscopes & systems segment is expected to dominate the market with a 58.03% market share, growing with the CAGR of 6.3% in the forecast period of 2025 to 2032. driven by Rising Prevalence of Gastrointestinal disorders, and Technological advancements enhancing GI endoscopy procedures

Report Scope and Gastrointestinal Endoscopy Market Segmentation

|

Attributes |

Gastrointestinal Endoscopy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Gastrointestinal Endoscopy Market Trends

- “Rising Prevalence of gastrointestinal disorders”

- Gastrointestinal (GI) disorders such as colorectal cancer, gastroesophageal reflux disease (GERD), Crohn’s disease, and ulcerative colitis have been rising steadily, becoming a major driver for the gastrointestinal endoscopy market

- These conditions often require early and accurate diagnosis, for which endoscopy remains a primary tool. Colorectal cancer, for instance, ranks among the top causes of cancer-related deaths worldwide, and regular endoscopic screenings like colonoscopies are vital for early detection and prevention

- Chronic GI diseases like Crohn’s and GERD necessitate ongoing endoscopic evaluation for disease management and monitoring. The growing prevalence of these conditions, coupled with improved awareness and accessibility of healthcare services, is leading to a surge in demand for gastrointestinal endoscopic procedures across both developed and emerging economies

- Gastrointestinal (GI) disorders are becoming increasingly common worldwide, prompting a greater reliance on endoscopic procedures for accurate diagnosis and effective disease management. Conditions like Gastroesophageal Reflux Disease (GERD), Crohn’s disease, and colorectal cancer often necessitate timely visual assessment, biopsy, and monitoring, all achievable through endoscopy. With growing awareness, aging populations, and evolving lifestyles, demand for gastrointestinal endoscopy is rising across both developed and emerging regions, positioning it as a cornerstone of modern GI healthcare

Gastrointestinal Endoscopy Market Dynamics

Driver

“Technological Advancements Enhancing GI Endoscopy Procedures”

- Continuous innovation in endoscopic technology has significantly enhanced diagnostic accuracy and procedural efficiency, fueling market growth. The development of capsule endoscopy, high-definition imaging, Narrow-Band Imaging (NBI), and robotic-assisted endoscopy systems has revolutionized GI diagnostics and treatment

- For Instance, In October 2024, according to NYP Holdings, Inc. the demand for advanced diagnostic procedures like gastrointestinal endoscopy continues to rise. Innovations such as remote surgery using robotic systems and magnetic endoscopes enable precise navigation for complex procedures. This technology enhances access to GI diagnostics, particularly for older patients, ensuring accurate treatments and biopsies

- These advanced tools provide clearer visualization, enhanced maneuverability, and improved detection rates, particularly for early-stage lesions. Artificial Intelligence (AI) integration is further enabling real-time detection and characterization of abnormalities. As manufacturers invest heavily in R&D and clinicians adopt these innovations to improve outcomes, the adoption of technologically advanced endoscopic systems continues to expand rapidly across hospitals and specialty centers worldwide

- Additionally, Technological advancements are transforming gastrointestinal endoscopy, improving diagnostic precision and procedural efficiency. Innovations like high-definition imaging, robotic-assisted endoscopy, and AI integration enable clearer visuals and enhanced lesion detection, particularly in complex cases

Restraint/Challenge

“High Cost of Equipment and Procedures”

- The significant capital investment required for gastrointestinal endoscopy systems poses a major barrier to market growth, particularly in resource-limited settings. High-end systems with advanced imaging and AI integration are expensive, with additional costs for maintenance, accessories, and regular software upgrades

- For healthcare providers in developing countries, budget constraints often make procurement of such equipment infeasible

- Furthermore, for patients without sufficient insurance coverage, the out-of-pocket expenses associated with procedures such as colonoscopies can deter their utilization. These cost challenges limit the adoption of endoscopic technologies and reduce accessibility to critical diagnostic and therapeutic services in both public and private healthcare sectors

- For instance, in November 2022, according to the high cost of gastrointestinal endoscopy procedures and equipment is a major restraint. For example, TNE costs Euro 125.90 per procedure, while oral endoscopy costs Euro 184.10 and MACE costs Euro 407.10. Additionally, equipment maintenance and reprocessing add to the cost, with flexible endoscopes costing around Euro 79,330, making procedures expensive overall

- For Instance, In February 2025, as per science direct the high cost of gastrointestinal endoscopy is evident in various studies, especially for screening and surveillance. For instance, while general population screenings may not be cost-effective in Western regions, targeted surveillance for high-risk groups, such as those with gastric intestinal metaplasia, can still be cost-effective, with ICERs ranging from USD 20,739.1 to 98,402.2 per QALY

- The high cost of gastrointestinal endoscopy procedures and equipment remains a significant challenge to market expansion, particularly in low-resource settings

- Expensive procedures, coupled with ongoing maintenance and repairs, limit accessibility, especially in developing countries. Despite efforts to target high-risk groups for more cost-effective screening, affordability continues to restrict widespread adoption, undermining equitable access to essential diagnostic and therapeutic services

Gastrointestinal Endoscopy Market Scope

The market is segmented on the basis of Product, Application type, Procedure Type, Usability, End User, and Distribution Channel

- By Product

On the basis of Product, the market is segmented into gastrointestinal endoscopes & systems and gastrointestinal endotherapy. In 2024, the gastrointestinal endoscopes & systems segment dominated the market with a 57.74% market share growing with the CAGR of 6.3% in the forecast period 2025 to 2032 driven by rising prevalence of gastrointestinal disorders, and technological advancements enhancing GI endoscopy procedures

- By Application

On the basis of application, the market is segmented into treatment, diagnosis. In 2024, the treatment segment dominated the market with a 56.23% market share growing with the CAGR of 6.0% in the forecast period 2025 to 2032 driven by rising prevalence of gastrointestinal disorders, and rising awareness and expanded screening programs for gastrointestinal endoscopy

- By Procedure Type

On the basis of Procedure type, the market is segmented into colonoscopy, gastroscopy, duodenoscopy, enteroscopy, sigmoidoscopy and others. In 2024, the colonoscopy segment dominated the market with 41.35% market share growing with the CAGR of 5.4% in the forecast period 2025 to 2032 driven by technological advancements enhancing GI endoscopy procedures, and rising awareness and expanded screening programs for gastrointestinal endoscopy

- By Usability

On the basis of usability, the market is segmented into reusable, disposable/ single use. In 2024, the reusable segment dominated the market with 69.53% market share, growing with the CAGR of 5.7% in the forecast period of 2025 to 2032 driven by technological advancements enhancing GI endoscopy procedures

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, specialty clinics, laboratories, others. In 2024, the hospitals segment dominated the market with 53.45% market share and is expected grow with the CAGR of 5.4% in the forecast period of 2025 to 2032 driven by Rising awareness and expanded screening programs for gastrointestinal endoscopy, and Technological advancements enhancing GI endoscopy procedures

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, others. In 2024, the direct tender segment dominated the market with 63.54% market share and is expected grow with the CAGR of 6.0% in the forecast period of 2025 to 2032 driven by rising prevalence of gastrointestinal disorders, rising awareness and expanded screening programs for gastrointestinal endoscopy, and Technological advancements enhancing GI endoscopy procedures

Gastrointestinal Endoscopy Market Regional Analysis

- U.S. gastrointestinal endoscopy market is expected to dominate with the market share of 82.86%. This region is expected to grow with the CAGR of 6.0% in the forecast period of 2025 to 2032 due to Aging population driving increased demand for GI endoscopy, Technological advancements enhancing GI endoscopy procedures

- U.S. is the fastest growing region for North America gastrointestinal endoscopy market fueled by Rising Prevalence of Gastrointestinal disorders, Technological advancements enhancing GI endoscopy procedures

- In addition, active collaborations between government agencies, research institutions, and biotech companies accelerate innovation and approval of novel therapies, further driving market growth in the region

Canada Gastrointestinal Endoscopy Market Insight

Canada gastrointestinal endoscopy market is expected to dominate with the market share of 10.77%. This region is expected to grow with the CAGR of 5.6% in the forecast period of 2025 to 2032 North America region in 2025, driven by Rising Prevalence of Gastrointestinal disorders, and Rising awareness and expanded screening programs for gastrointestinal endoscopy

Mexico Gastrointestinal Endoscopy Market Insight

Mexico gastrointestinal endoscopy market is expected to dominate with the market share of 6.34%. This region is expected to grow with the CAGR of 5.4% in the forecast period of 2025 to 2032 North America region in 2025, fueled by Rising Prevalence of Gastrointestinal disorders, Technological advancements enhancing GI endoscopy procedures

Gastrointestinal Endoscopy Market Share

The gastrointestinal endoscopy industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Stryker (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- Cook (U.S.)

- CONMED Corporation (U.S.)

- STERIS (U.S.)

- Henry Schein, Inc. (U.S.)

- CapsoVision, Inc. (U.S.)

- Teleflex Incorporated (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- Olympus Corporation (Japan)

- Hoya Corporation (Japan)

- Smith+Nephew (U.K.)

- KLS Martin Group (Germany)

- Laborie (Canada)

Latest Developments in North America Gastrointestinal Endoscopy Market

- In January 2024, AnX Robotica advances gastrointestinal diagnostics with FDA-cleared NaviCam SB Capsule Endoscopy for patients aged 2+, enhanced by ProScan AI-assisted reading. The NaviCam Tether enables esophageal visualization, expanding diagnostic capabilities. With a growing NaviCam platform, including MCCE and colon systems, AnX delivers innovative, non-invasive solutions for comprehensive GI tract evaluation

- In February 2023, AnX Robotica launches the FDA-cleared NaviCam Small Bowel System in the U.S., featuring aspherical lens technology for enhanced imaging and reduced distortion. With faster download and processing times, the system improves diagnostic efficiency for small bowel diseases, supporting timely evaluation of obscure GI bleeding and inflammatory bowel disease (IBD)

- In August 2024, Boston Scientific launched the AXIOS Stent with Electrocautery Enhanced Delivery System for endoscopic gallbladder drainage in acute cholecystitis patients unsuitable for surgery. Using EUS guidance, it enables internal bile drainage, avoiding external drains. Clinical studies show fewer complications and faster recovery compared to traditional methods, offering a minimally invasive option for high-risk patients

- In January 2025, CapsoVision’s CapsoCam Plus has received FDA clearance for pediatric use in patients aged two and above. Offering 360° panoramic imaging without wearable equipment, it provides a stress-free, non-invasive alternative to traditional capsule endoscopy, enhancing diagnostic accuracy and comfort for children while streamlining procedures for healthcare providers through CapsoCloud integration

- In May 2022 , Cook Medical introduced the Evolution Biliary Controlled-Release Stents, designed to provide uniform radial force, optimal flexibility, and conformability. These stents are available in various lengths and are intended to improve outcomes in patients with biliary obstructions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET END USER COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 INDUSTRY INSIGHTS

4.3.1 MICRO AND MACROECONOMIC FACTORS

4.3.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3.3 KEY PRICING STRATEGIES

4.3.4 COST ANALYSIS BREAKDOWN

4.3.5 TECHNOLOGY ROADMAP

4.3.6 OPPUTUNITY MAP ANALYSIS

4.3.7 PRICING ANALYSIS

4.3.8 COMPETITOR’S MODEL ANALYSIS

4.3.9 HEALTHCARE ECONOMY

4.3.9.1 HEALTHCARE EXPENDITURE

4.3.9.2 CAPITAL EXPENDITURE

4.3.9.3 CAPEX TRENDS

4.3.9.4 CAPEX ALLOCATION

4.3.9.5 FUNDING SOURCES

4.3.9.6 INDUSTRY BENCHMARKS

4.3.9.7 GDP RATIO IN OVERALL GDP

4.3.9.8 HEALTHCARE SYSTEM STRUCTURE

4.3.9.9 GOVERNMENT POLICIES

4.3.9.10 ECONOMIC DEVELOPMENT

4.4 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.4.1 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.4.2 VENDOR SELECTION CRITERIA DYNAMICS

4.4.3 IMPACT ON SUPPLY CHAIN

4.4.3.1 RAW MATERIAL PROCUREMENT

4.4.3.2 MANUFACTURING AND PRODUCTION

4.4.3.3 LOGISTICS AND DISTRIBUTION

4.4.3.4 PRICE PITCHING AND POSITION OF MARKET

4.4.4 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.4.4.1 SUPPLY CHAIN OPTIMIZATION

4.4.4.2 JOINT VENTURE ESTABLISHMENTS

4.4.5 IMPACT ON PRICES

4.4.6 REGULATORY INCLINATION

4.4.6.1 GEOPOLITICAL SITUATION

4.4.6.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.4.6.3 FREE TRADE AGREEMENTS

4.4.6.4 ALLIANCES ESTABLISHMENTS

4.4.6.5 STATUS ACCREDITATION (INCLUDING MFTN)

4.4.6.6 DOMESTIC COURSE OF CORRECTION

4.4.6.7 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.4.6.8 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

4.4.7 PRICE INDEX

4.5 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.6 SUPPLY CHAIN ECOSYSTEM

4.7 COMPANY EVALUATION QUADRANT

5 REGULATORY COMPLIANCE

5.1 REGULATORY AUTHORITIES

5.2 REGULATORY CLASSIFICATIONS

5.3 REGULATORY SUBMISSIONS

5.4 INTERNATIONAL HARMONIZATION

5.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

5.6 REGULATORY CHALLENGES AND STRATEGIES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF GASTROINTESTINAL DISORDERS

6.1.2 AGING POPULATION DRIVING INCREASED DEMAND FOR GI ENDOSCOPY

6.1.3 TECHNOLOGICAL ADVANCEMENTS ENHANCING GI ENDOSCOPY PROCEDURES

6.1.4 RISING AWARENESS AND EXPANDED SCREENING PROGRAMS FOR GASTROINTESTINAL ENDOSCOPY

6.2 RESTRAINTS

6.2.1 HIGH COST OF EQUIPMENT AND PROCEDURES

6.2.2 RISK OF PROCEDURE-RELATED COMPLICATIONS

6.3 OPPORTUNITIES

6.3.1 GROWING EMPHASIS ON EARLY COLORECTAL CANCER DETECTION

6.3.2 GROWING ADOPTION OF HOME-BASED AND CAPSULE ENDOSCOPY SOLUTIONS

6.3.3 INCREASING PREVALENCE AND ADVANCEMENTS IN PERSONALIZED THERAPEUTIC ENDOSCOPY

6.4 CHALLENGES

6.4.1 LIMITED ACCESS TO GI ENDOSCOPY IN RURAL AREAS

6.4.2 COMPLEXITIES IN ENDOSCOPE REPROCESSING AND STERILIZATION PROCESSES

7 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 GASTROINTESTINAL ENDOSCOPES & SYSTEMS

7.2.1 ENDOSCOPES

7.2.1.1 COLONOSCOPES

7.2.1.2 GASTROSCOPES

7.2.1.3 DUODENOSCOPES

7.2.1.4 ENTEROSCOPES

7.2.1.5 SIGMOIDOSCOPES

7.2.1.6 RESECTOSCOPES

7.2.2 FLEXIBLE

7.2.3 RIGID

7.2.4 SEMI RIGID

7.2.4.1 VIDEO

7.2.4.2 FIBRE

7.2.4.3 ULTRASONIC

7.2.5 VISUALIZATION SYSTEMS

7.2.5.1 FLUORESCENCE IMAGING SYSTEMS

7.2.5.1.1 NIR LIGHT FLUORESCENCE IMAGING SYSTEM

7.2.5.1.2 WHITE LIGHT FLUORESCENCE IMAGING SYSTEM

7.2.5.1.3 UV LIGHT FLUORESCENCE IMAGING SYSTEMS

7.2.5.1.4 CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS

7.2.5.1.5 PROBE-BASED CLE (PCLE)

7.2.5.1.6 BUILT-IN DEVICE CLE (ECLE)

7.2.5.2 HIGH DEFINITION (HD) VISUALIZATION SYSTEMS

7.2.5.2.1 2D SYSTEMS

7.2.5.2.2 3D SYSTEMS

7.2.5.3 STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS

7.2.5.3.1 ENDOSCOPIC ULTRASONOGRAPHY SYSTEMS

7.2.5.3.2 CAPSULE ENDOSCOPES

7.2.5.3.3 ULTRASOUND DEVICE

7.3 GASTROINTESTINAL ENDOTHERAPY

7.3.1 ERCP DEVICES

7.3.2 BIOPSY DEVICE

7.3.3 STENTING AND DILATION DEVICE

7.3.4 HOMEOSTASIS DEVICES

7.3.4.1 LIGATION DEVICES

7.3.4.2 PROBES

7.3.4.3 SCLEROTHERAPY NEEDLES

7.3.5 RETRIEVAL DEVICES

7.3.6 CAMERA HEAD

7.3.7 ANTI-REFLUX DEVICES

7.3.7.1 TRANSORAL INCISIONLESS FUNDOPLICATION (TIF) DEVICES

7.3.7.2 TRANSESOPHAGEAL RADIOFREQUENCY (RF) ANTI-REFLUX DEVICES

7.3.8 OTHERS

8 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PROCEDURE TYPE

8.1 OVERVIEW

8.2 COLONOSCOPY

8.3 GASTROSCOPY

8.4 DUODENOSCOPY

8.5 ENTEROSCOPY

8.6 SIGMOIDOSCOPY

8.7 OTHERS

9 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY USABILITY

9.1 OVERVIEW

9.2 REUSABLE

9.3 DISPOSABLE/ SINGLE USE

10 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 TREATMENT

10.3 DIAGNOSIS

11 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 AMBULATORY SURGICAL CENTERS

11.4 SPECIALTY CLINICS

11.5 LABORATORIES

11.6 OTHERS

12 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 OTHERS

13 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 OLYMPUS CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT/NEWS

16.2 FUJIFILM HOLDINGS CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS/NEWS

16.3 MEDTRONIC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS/NEWS

16.4 JOHNSON & JOHNSON SERVICES, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 STRYKER

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 AMBU AS

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS/NEWS

16.7 ANX ROBOTICS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS/NEWS

16.8 BOSTON SCIENTIFIC CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 CAPSOVISION, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS/NEWS

16.1 CONMED CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 COOK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT/NEWS

16.12 DAICHUAN MEDICAL

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 ERBE ELEKTROMEDIZIN GMBH

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GONGJIANG ENDOSCOPY INSTRUMENTS CO., LTD

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 HENRY SCHEIN, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 HOYA CORPORATION.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 INTROMEDIC

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 JIANGSU VEDKANG MEDICAL SCIENCE AND TECHNOLOGY CO., LTD

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 JINSHAN SCIENCE & TECHNOLOGY

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT/NEWS

16.2 KLS MARTIN GROUP

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 LABORIE

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 MECANMEDICAL

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 MICRO-TECH ENDOSCOPY

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 MITRA INDUSTRIES PVT. LTD.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 OVESCO ENDOSCOPY AG

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 SHAILI ENDOSCOPY

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 SMITH+NEPHEW

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENT

16.28 SONOSCAPE MEDICAL CORP.

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENT/NEWS

16.29 STERIS

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PRODUCT PORTFOLIO

16.29.4 RECENT DEVELOPMENT

16.3 TELEFLEX INCORPORATED.

16.30.1 COMPANY SNAPSHOT

16.30.2 REVENUE ANALYSIS

16.30.3 PRODUCT PORTFOLIO

16.30.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

List of Table

TABLE 1 TARIFF RATE (S) IN TOP-5 COUNTRY

TABLE 2 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 6 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 7 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 9 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 10 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 12 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (ASP IN USD/UNITS)

TABLE 13 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 15 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (ASP IN USD/UNITS)

TABLE 16 NORTH AMERICA VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 19 NORTH AMERICA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 20 NORTH AMERICA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 22 NORTH AMERICA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 23 NORTH AMERICA VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 26 NORTH AMERICA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 27 NORTH AMERICA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 29 NORTH AMERICA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 30 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 33 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 34 NORTH AMERICA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 36 NORTH AMERICA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 37 NORTH AMERICA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 39 NORTH AMERICA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 40 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PROCEDURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA COLONOSCOPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA GASTROSCOPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA DUODENOSCOPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA ENTEROSCOPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA SIGMOIDOSCOPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA OTHERS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA REUSABLE IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA DISPOSABLE/ SINGLE USE IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA TREATMENT IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA DIAGNOSIS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA HOSPITALS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA SPECIALTY CLINICS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA LABORATORIES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA OTHERS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA DIRECT TENDER IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA RETAIL SALES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA OTHERS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 67 NORTH AMERICA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)..

TABLE 68 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 71 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 73 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (ASP IN USD/UNITS)

TABLE 74 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 76 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (ASP IN USD/UNITS)

TABLE 77 NORTH AMERICA VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 80 NORTH AMERICA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 81 NORTH AMERICA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 83 NORTH AMERICA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 84 NORTH AMERICA VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 87 NORTH AMERICA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 88 NORTH AMERICA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 90 NORTH AMERICA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 91 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 94 NORTH AMERICA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 96 NORTH AMERICA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 97 NORTH AMERICA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 NORTH AMERICA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 99 NORTH AMERICA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 100 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PROCEDURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 105 U.S. GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 106 U.S. GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 U.S. GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 108 U.S. GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 109 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 U.S. GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 112 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 113 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 114 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (ASP IN USD/UNITS)

TABLE 115 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 117 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (ASP IN USD/UNITS)

TABLE 118 U.S. VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 119 U.S. FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 U.S. FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 121 U.S. FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 122 U.S. CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 U.S. CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 124 U.S. CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 125 U.S. VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 128 U.S. HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 129 U.S. STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.S. STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 131 U.S. STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 132 U.S. GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 U.S. GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.S. ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 135 U.S. HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.S. HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 137 U.S. HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 138 U.S. ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 U.S. ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 140 U.S. ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 141 U.S. GASTROINTESTINAL ENDOSCOPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 142 U.S. GASTROINTESTINAL ENDOSCOPY MARKET, BY PROCEDURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.S. GASTROINTESTINAL ENDOSCOPY MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 144 U.S. GASTROINTESTINAL ENDOSCOPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 145 U.S. GASTROINTESTINAL ENDOSCOPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 146 CANADA GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 147 CANADA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 CANADA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 149 CANADA GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 150 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 CANADA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 153 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 154 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 155 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (ASP IN USD/UNITS)

TABLE 156 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 157 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 158 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (ASP IN USD/UNITS)

TABLE 159 CANADA VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 160 CANADA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 CANADA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 162 CANADA FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 163 CANADA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 165 CANADA CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 166 CANADA VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 CANADA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 169 CANADA HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 170 CANADA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 172 CANADA STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 173 CANADA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 CANADA GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 176 CANADA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 178 CANADA HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 179 CANADA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 CANADA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 181 CANADA ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 182 CANADA GASTROINTESTINAL ENDOSCOPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 183 CANADA GASTROINTESTINAL ENDOSCOPY MARKET, BY PROCEDURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 CANADA GASTROINTESTINAL ENDOSCOPY MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 185 CANADA GASTROINTESTINAL ENDOSCOPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 186 CANADA GASTROINTESTINAL ENDOSCOPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 187 MEXICO GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 188 MEXICO GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 MEXICO GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 190 MEXICO GASTROINTESTINAL ENDOSCOPES & SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 191 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 MEXICO GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 194 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 195 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 196 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY MODALITY, 2018-2032 (ASP IN USD/UNITS)

TABLE 197 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 198 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 199 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNIQUES, 2018-2032 (ASP IN USD/UNITS)

TABLE 200 MEXICO VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 201 MEXICO FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 MEXICO FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 203 MEXICO FLUORESCENCE IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 204 MEXICO CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 MEXICO CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 206 MEXICO CONFOCAL LASER ENDOSCOPY IMAGING SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 207 MEXICO VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 MEXICO HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 MEXICO HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 210 MEXICO HIGH DEFINITION (HD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 211 MEXICO STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 213 MEXICO STANDARD DEFINITION (SD) VISUALIZATION SYSTEMS IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 214 MEXICO GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO GASTROINTESTINAL ENDOTHERAPY IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 MEXICO ENDOSCOPES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 217 MEXICO HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MEXICO HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 219 MEXICO HOMEOSTASIS DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 220 MEXICO ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 MEXICO ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 222 MEXICO ANTI-REFLUX DEVICES IN GASTROINTESTINAL ENDOSCOPY MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 223 MEXICO GASTROINTESTINAL ENDOSCOPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 224 MEXICO GASTROINTESTINAL ENDOSCOPY MARKET, BY PROCEDURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO GASTROINTESTINAL ENDOSCOPY MARKET, BY USABILITY, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO GASTROINTESTINAL ENDOSCOPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO GASTROINTESTINAL ENDOSCOPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, BY PRODUCT (2024)

FIGURE 12 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING PREVALENCE OF GASTROINTESTINAL DISORDERS IS EXPECTED TO DRIVE THE NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET, IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 REUSABLE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET IN THE FORECAST PERIOD OF 2025 & 2032

FIGURE 16 TOTAL NUMBER OF DEALS (YEAR-WISE)

FIGURE 17 TOTAL NUMBER OF DEALS BY TYPE

FIGURE 18 DROC ANALYSIS

FIGURE 19 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PRODUCT, 2024

FIGURE 20 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PRODUCT, 2025-2032 (USD THOUSAND)

FIGURE 21 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 22 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 23 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PROCEDURE TYPE, 2024

FIGURE 24 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PROCEDURE TYPE, 2025-2032 (USD THOUSAND)

FIGURE 25 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PROCEDURE TYPE, CAGR (2025-2032)

FIGURE 26 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY PROCEDURE TYPE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY USABILITY, 2024

FIGURE 28 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY USABILITY, 2025-2032 (USD THOUSAND)

FIGURE 29 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY USABILITY, CAGR (2025-2032)

FIGURE 30 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY USABILITY, LIFELINE CURVE

FIGURE 31 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY APPLICATION, 2024

FIGURE 32 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 33 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 34 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 35 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY END USER, 2024

FIGURE 36 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 37 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 38 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY END USER, LIFELINE CURVE

FIGURE 39 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 40 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 41 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 42 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 43 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: SNAPSHOTS (2024)

FIGURE 44 NORTH AMERICA GASTROINTESTINAL ENDOSCOPY MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.